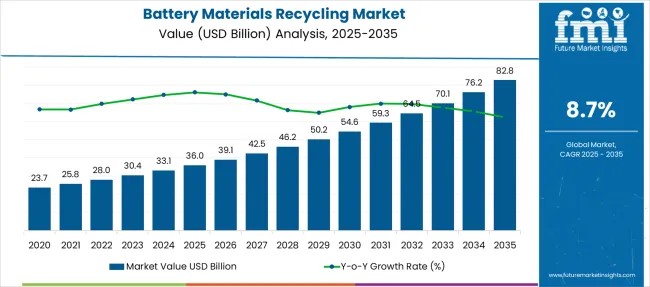

The Battery Materials Recycling Market is estimated to be valued at USD 36.0 billion in 2025 and is projected to reach USD 82.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Battery Materials Recycling Market Estimated Value in (2025 E) | USD 36.0 billion |

| Battery Materials Recycling Market Forecast Value in (2035 F) | USD 82.8 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The battery materials recycling market is undergoing significant expansion as global industries shift toward resource efficiency, sustainability mandates, and reduced dependence on raw material extraction. Rising volumes of end-of-life batteries from electric vehicles, consumer electronics, and industrial energy storage systems are prompting rapid advancements in mechanical and hydrometallurgical recycling techniques.

Governments and regulatory bodies across North America, Europe, and Asia are enforcing stricter e-waste and extended producer responsibility frameworks, accelerating the demand for scalable battery recycling infrastructure. Furthermore, the increasing volatility in critical raw material prices and geopolitical constraints on mining operations are compelling battery manufacturers to invest in closed-loop supply chains.

Innovations in chemical separation and automation are enabling higher material recovery rates and improved cost efficiency. As the transition to electric mobility and renewable energy storage accelerates, battery recycling is expected to emerge as a strategic pillar for circular economy integration and supply chain resilience.

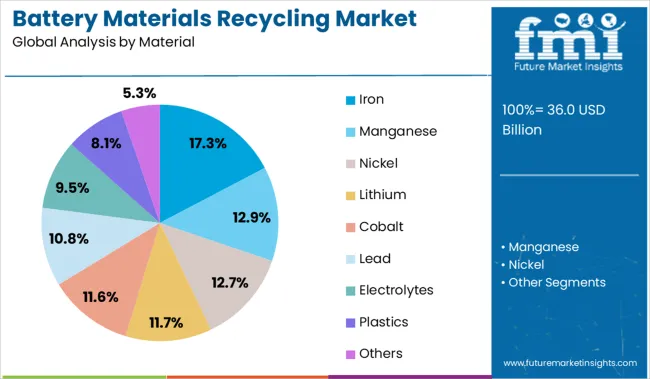

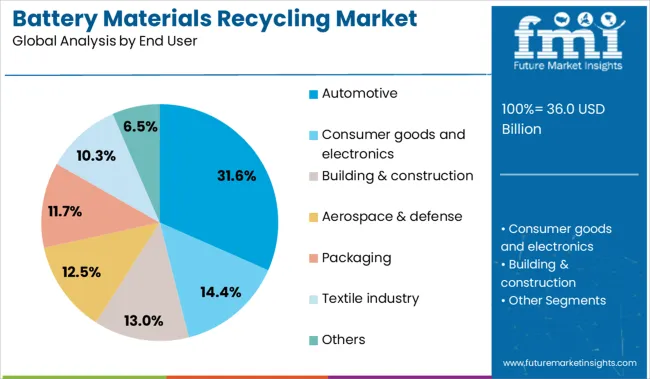

The market is segmented by Material and End User and region. By Material, the market is divided into Iron, Manganese, Nickel, Lithium, Cobalt, Lead, Electrolytes, Plastics, and Others. In terms of End User, the market is classified into Automotive, Consumer goods and electronics, Building & construction, Aerospace & defense, Packaging, Textile industry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Iron is anticipated to account for 17.3% of total market revenue by 2025 within the material category, making it a prominent segment in the battery materials recycling ecosystem. This share is being driven by the high volume presence of iron-based components across lithium-ion and nickel-metal hydride battery types.

The ability to efficiently recover iron during recycling processes through magnetic separation and mechanical methods contributes to cost-effective and environmentally favorable operations. Iron’s established secondary market demand in industries such as construction and manufacturing has further supported its recovery prioritization.

Its recyclability without significant degradation and relatively lower processing complexity compared to critical minerals have positioned iron as a stable contributor to revenue generation within battery recycling value chains. As industrial battery usage grows, the volume of recyclable iron-rich content is also expected to increase, reinforcing its share in the segment.

The automotive sector is projected to lead the battery materials recycling market with a 31.6% share of total revenue by 2025 under the end user category. This dominance is being fueled by the global transition toward electric mobility, which is generating a substantial influx of used electric vehicle batteries.

Regulatory directives requiring automakers to manage battery end-of-life through take-back schemes and circular supply strategies are compelling manufacturers to invest in recycling partnerships and internal infrastructure. The significant volume, weight, and material value of automotive batteries make them a high-impact source for recyclers seeking critical elements like lithium, cobalt, nickel, and iron.

Additionally, advancements in battery health diagnostics and second-life repurposing are streamlining the collection and processing of these batteries for recovery. As the EV market expands and vehicle lifecycles mature, the automotive sector is expected to remain the largest and most influential end user in battery materials recycling.

Lithium-ion battery waste from EVs, grid storage, and electronics has increased demand for recycling infrastructure focused on extracting lithium, cobalt, nickel, and manganese. Hydrometallurgical and direct recycling processes are being adopted due to efficiency and lower emissions.

Regulatory mandates, OEM partnerships, and closed-loop supply strategies are driving investment in localized recovery plants. As high-nickel and solid-state chemistries emerge, adaptable processing systems and modular facilities are being prioritized across key EV production and battery assembly regions.

The rapid increase in electric vehicle deployment has accelerated the generation of end-of-life battery packs, necessitating structured recycling infrastructure. Governments in the EU, US, and China have mandated safe disposal, reuse benchmarks, and material recovery targets for battery systems. Lithium-ion modules are being dismantled and processed to recover high-value metals through scalable techniques like hydrometallurgy and mechanical shredding.

Waste classification regulations, along with producer responsibility mandates, have made battery collection networks more robust and traceable. Original equipment manufacturers are collaborating with recycling firms to create closed-loop systems, minimizing reliance on virgin mining and reducing raw material price volatility.

Additionally, safety standards for hazardous battery handling have encouraged investment in automated sorting and disassembly units to limit exposure and contamination risks during processing

Opportunities are expanding for localized recycling facilities integrated into EV manufacturing zones and battery gig factory corridors. Closed-loop recovery systems where black mass is processed into high-purity precursor materials are being adopted to reduce external sourcing risks and ensure traceable feedstock. Emerging regions are deploying micro-recycling hubs to support regional collection and downstream refinement.

Companies are piloting direct recycling techniques that retain cathode structure, minimizing reprocessing cost and environmental impact. High-nickel chemistries and solid-state batteries present future demand for adaptable recovery lines.

Strategic partnerships between automakers, energy storage integrators, and metal refiners are being formed to build multi-metal recovery plants with modular throughput. Fiscal incentives, feed-in contracts, and green finance tools are facilitating plant deployment in jurisdictions with active clean energy policies and raw material import exposure.

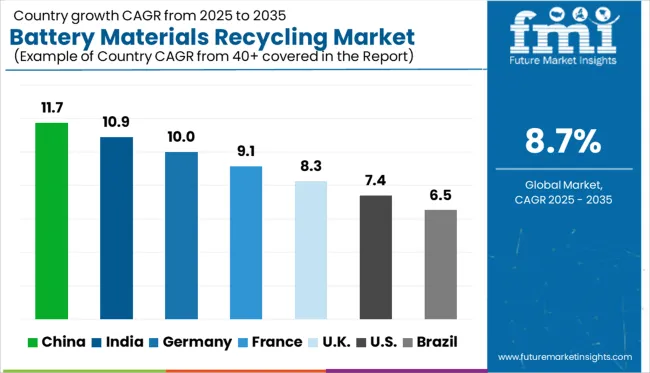

| Country | CAGR |

|---|---|

| China | 11.7% |

| India | 10.9% |

| Germany | 10.0% |

| France | 9.1% |

| UK | 8.3% |

| USA | 7.4% |

| Brazil | 6.5% |

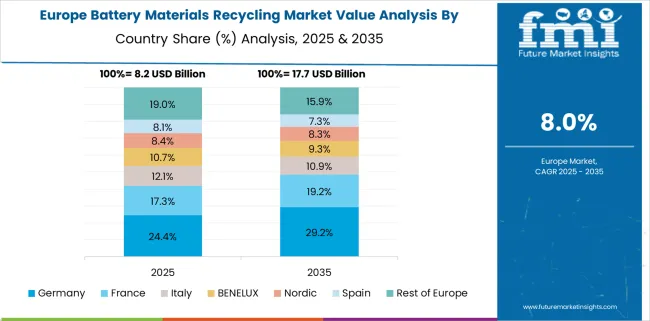

The global battery materials recycling market is projected to expand at a CAGR of 8.7% from 2025 to 2035, driven by rising EV battery retirement volumes, tightening resource circularity regulations, and improved recovery technologies for lithium, cobalt, and nickel. China leads with an 11.7% CAGR, supported by regional hub development, pyro metallurgical facility upgrades, and integration with gigafactory supply loops.

India follows at 10.9%, driven by end-of-life battery mandates, investment in hydrometallurgical processes, and aggregation of spent battery cells through organized collection systems. Germany grows at 10.0%, backed by cathode-to-cathode recovery models and regulatory stimulus for EU-compliant secondary material streams.

France posts 9.1%, shaped by automotive battery lifecycle legislation and state-backed recovery corridors. The United Kingdom, at 8.3%, is investing in high-yield separation lines and reverse logistics optimization. These five markets demonstrate a mix of infrastructure expansion, recycling innovation, and policy-induced recovery demand across a 40+ country assessment.

The battery materials recycling market in China is forecast to grow at a CAGR of 11.7%, driven by scale-oriented recovery hubs, EV battery disposal mandates, and integration of recycling lines into domestic gigafactory clusters. Pyro metallurgical and hydrometallurgical techniques have been adopted to extract high-purity cobalt, lithium, and nickel.

National targets have emphasized secondary material recirculation as a buffer against global price volatility. Recovery facilities are increasingly collocated with battery cell manufacturing to close the materials loop. State subsidies and regional partnerships have accelerated investment in automated dismantling, black mass processing, and purification technologies. China is being positioned as a dominant recycler not only for domestic feedstock but also for imported scrap.

Demand for the battery materials recycling in India is projected to grow at a CAGR of 10.9%, fueled by rapid EV deployment, policy-led battery waste regulation, and investments in modular hydrometallurgical plants. Informal recycling networks are being replaced by formal collection channels, supported by digital traceability and reverse logistics.

Companies are adopting selective leaching and solvent extraction for material recovery from lithium-ion chemistries. Collection from telecom, mobility, and solar storage sectors is expanding feedstock access. Public-private models are being adopted to co-develop battery recovery parks, with land and power incentives provided by state governments. Recycling volumes are expected to accelerate as battery leasing and swapping platforms mature.

The battery materials recycling market in Germany is expected to grow at a CAGR of 10.0%, supported by legislative push for EU-critical raw material security, OEM-backed pilot facilities, and process innovation. Cathode-to-cathode recycling is being prioritized by auto suppliers seeking lower carbon footprint inputs for EV battery manufacturing.

Closed-loop recycling chains are being constructed within existing OEM ecosystems. Mechanical pre-processing and aqueous leaching are used to maximize nickel and cobalt purity. Funding from EU Green Deal programs has accelerated development of pilot-scale refining plants focused on spent battery modules from cars and power tools. Battery passports and digital traceability platforms are being implemented to track secondary material flows.

The battery materials recycling market in France is forecast to expand at a CAGR of 9.1%, shaped by lifecycle accountability mandates, utility-grade storage retirement, and regionally coordinated dismantling centers. National law requires producers to participate in end-of-life battery processing frameworks.

Lithium iron phosphate and nickel-manganese-cobalt cells are being disassembled and sorted using semi-automated lines. Partnerships between recyclers and automakers have led to joint research initiatives targeting black mass yield improvements and reagent reuse.

France is aligning recycling capacities with future gigafactory construction in northern and western zones. Integration with regional logistics hubs ensures lower collection costs and faster turnaround for recovered materials.

The United Kingdom battery materials recycling market is projected to grow at a CAGR of 8.3%, driven by rising battery waste volumes, decarbonization mandates, and process line localization. High-yield separation technologies are being installed to recover cobalt, manganese, and lithium from EV and consumer electronics batteries.

Mechanical shredding, inert atmosphere processing, and closed-loop purification methods are being refined through academic-industry collaboration. The UK market is focusing on reverse logistics optimization through vehicle depots, battery leasing firms, and energy storage system integrators. Process standardization is being prioritized to align with EU-adjacent compliance expectations, even post-Brexit.

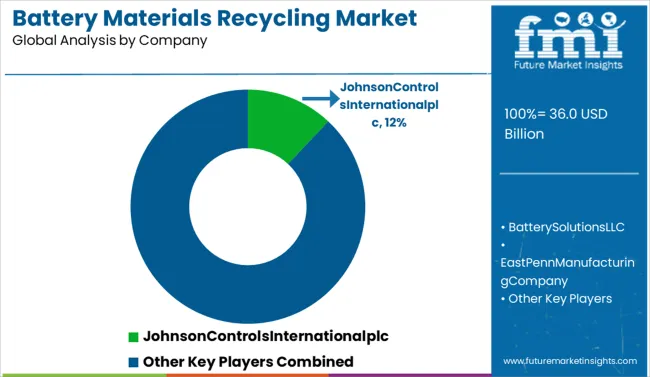

The battery materials recycling industry is led by Johnson Controls International plc, holding a 12.0% market share, driven by its closed-loop recycling model and large-scale lead-acid battery recovery systems. East Penn Manufacturing, EnerSys, and Exide Industries maintain vertically integrated operations that support both battery production and end-of-life material recovery.

Retriev Technologies and Umicore NV focus on lithium-ion recycling, offering advanced separation technologies for cobalt, nickel, and lithium recovery. Gravita India Ltd. and Aqua Metals are expanding cost-efficient and eco-friendly recycling capacities in Asia and North America.

Call2Recycle and Battery Solutions LLC provide logistics and compliance services for consumer battery take-back programs. Market competition now centers on yield recovery rates, scalability of lithium-focused processes, and alignment with EV and grid storage circular supply chains.

In November 2024, Belgian recycler Umicore announced it is pausing construction of a new battery materials plant in Loyalist, Ontario, along with delaying its European recycling investment. The strategic shift aims to optimize capital and serve North American customers from Korea.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.0 Billion |

| Material | Iron, Manganese, Nickel, Lithium, Cobalt, Lead, Electrolytes, Plastics, and Others |

| End User | Automotive, Consumer goods and electronics, Building & construction, Aerospace & defense, Packaging, Textile industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | JohnsonControlsInternationalplc, BatterySolutionsLLC, EastPennManufacturingCompany, Ecobattechnlogies, GPBatteries, RetrievTechnologiesInc., UmicoreNV, Exideindustries, EnerSys, Call2RecycleInc., GravitaIndiaLtd., AquaMetals, GopherResource, TerrapureEnvironmental, and RSRCorporation |

| Additional Attributes | Dollar sales span recycling processes such as hydrometallurgical, pyro metallurgical, and direct recycling, with hydrometallurgy gaining share due to cost efficiency and recovery rates. Growing demand is fueled by EV battery proliferation and circular‑economy mandates. CDMOs and EPC providers support turnkey recycling plants. Asia‑Pacific and Europe lead adoption, driven by regulatory pressure and material value recovery. |

The global battery materials recycling market is estimated to be valued at USD 36.0 billion in 2025.

The market size for the battery materials recycling market is projected to reach USD 82.8 billion by 2035.

The battery materials recycling market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in battery materials recycling market are iron, manganese, nickel, lithium, cobalt, lead, electrolytes, plastics and others.

In terms of end user, automotive segment to command 31.6% share in the battery materials recycling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Battery Manufacturing Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA