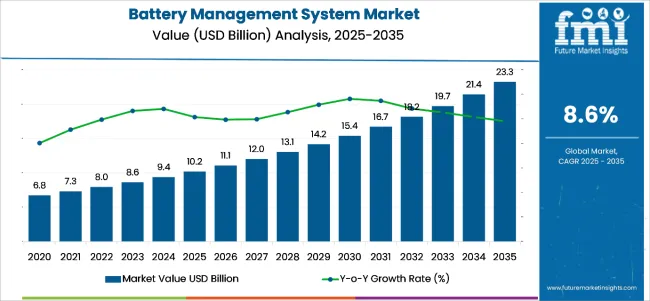

The global sales of battery management systems are estimated to be worth USD 10.2 billion in 2025, and are anticipated to reach USD 23.3 billion by 2035. Sales are projected to increase at a compound annual growth rate (CAGR) of 8.6% over the forecast period from 2025 to 2035. The revenue generated by the battery management system in 2024 was USD 8.7 billion.

In particular, battery management systems (BMS) offer key capabilities like cell monitoring, balancing, and thermal management, which can help optimize battery performance and safety. Measuring voltage, current, and temperature ensures maximum performance and prevents overcharging or deep discharge. Balancing functions (either passive or active) will equalize the charge levels between the cells so that the battery lasts longer.

Their protection mechanisms perform overvoltage, undervoltage, overcurrent, short-circuit, and thermal protections, eliminate failures through regular operations and fault detection by providing right conditions, and therefore, enhance the reliability of entire systems where they are mounted.

There is support for real-time communication interface (CAN, Modbus, SMBus) with energy storage and electric vehicle (EV) systems. Advanced BMS utilizes sustainment analytics, state-of-charge (SOC), and state-of-health (SOH) estimation to enhance battery performance and service life.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 10.2 billion |

| Projected Size, 2035 | USD 23.3 billion |

| Value-based CAGR (2025 to 2035) | 8.6% |

BMS use cases cover all sectors. In this case, BMS helps improve the safety of electric vehicles, which increases their range and enables efficient energy management. BMS is utilized in renewable energy storage systems, such as solar and wind farms, where maintaining battery balance and allocating energy are in high demand. For consumer electronics, such as smartphones, laptops, and wearables, BMS enhances battery life and prevents overheating.

Commercial power backup systems, such as those used in data centers and UPS, are employed in industrial applications. In medical devices, in BMS, battery performance is maintained by devices like portable oxygen concentrators and defibrillators. BMS for aerospace & marine applications are primarily for the safety and longevity of lithium-ion battery packs in aircraft, submarines, and various marine applications. As battery technology improves, so does the BMS itself, incorporating AI, cloud analytics, and improving efficiency, predictive maintenance, and overall energy management across sectors.

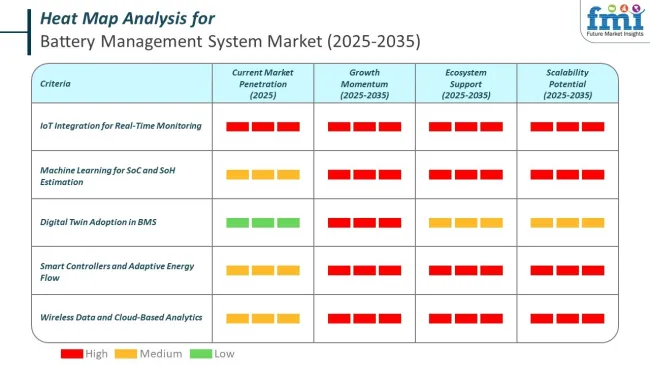

Smart technology plays a critical role in enhancing the accuracy, efficiency, and lifespan of modern battery management systems. With increasing adoption in electric vehicles, renewable energy storage, and portable electronics, BMS solutions now rely heavily on AI, IoT, and advanced data analytics for real-time performance control, safety, and diagnostics.

These technologies enable precise control over charging, discharging, cell balancing, and thermal regulation. As battery packs become larger and more complex, smart systems ensure safety, extend battery life, and reduce maintenance downtime across industrial and consumer applications.

Leading battery and EV manufacturers are integrating AI, IoT, and ML technologies into their battery management systems to improve accuracy, safety, and lifecycle performance. These systems are essential in electric vehicles, grid storage, and smart electronics where predictive analytics and real-time control offer a major competitive advantage.

These smart BMS platforms support features such as wireless data transmission, state-of-health modeling, temperature control, and cloud-based diagnostics. Many global players are collaborating with semiconductor and AI firms to accelerate innovation.

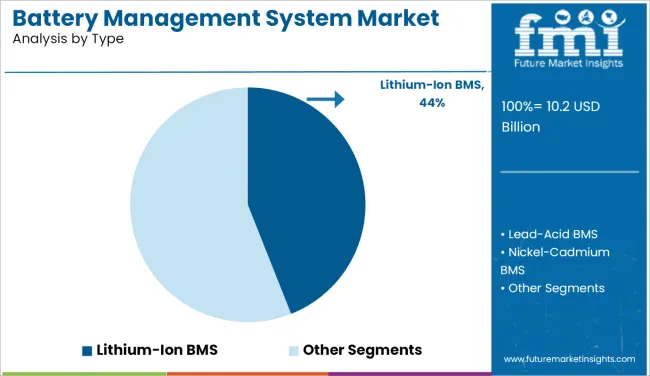

| Type | Value Share (2025) |

|---|---|

| Lithium-Ion BMS | 44.0% |

Lithium-ion batteries accounted for more than 80% of deployed energy storage systems in 2022, according to FMI. Owing to the high demand of reliable and effective grid-scale storage solutions. Meanwhile, there was a more than 57% increase in the deployment of those residential solar storage systems, which use lithium-ion batteries. This increase was due to the BMS capabilities of enhancing safety and battery longevity.

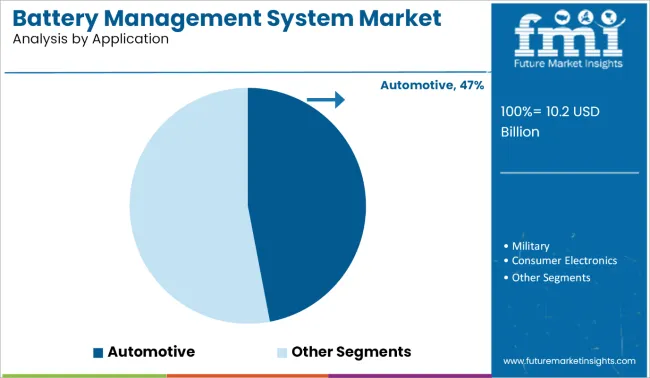

| Application | CAGR (2025 to 2035) |

|---|---|

| Automotive | 7.4% |

The global electric vehicles (EVs) grew more than 55% in 2022 compared to the previous year, as per the International Energy Agency (IEA). This rapid rise generated the imminent need for BMS solutions. While Tesla deployed advanced BMS in its 2022 Model vehicles, featuring improved battery monitoring capabilities to optimize range and battery life; Ford also introduced its next-generation BMS in its F-150 Lightning.

The table below presents the predicted compound annual growth rate (CAGR) for the Global battery management system market across various semi-annual periods from 2024 to 2034. In the first half H1 of the year 2024 to 2034 the business is anticipated to grow at a CAGR of 8.7%, followed in the second half H2 of the year with a slightly lower growth rate of 8.3%.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 8.7% (2024 to 2034) |

| H2, 2024 | 8.3% (2024 to 2034) |

| H1, 2025 | 9.0% (2025 to 2035) |

| H2, 2025 | 8.2% (2025 to 2035) |

The CAGR, however, increases slightly as we move into the subsequent period H1 2025-H2 2035, which stands at 9.0% annually in the first half from 2025 to 2035 before dropping moderately to 8.2% in the second half of 2025 to 2035. The market experienced an increase of 30 BPS in the first half of 2025 to 2035, and the H2 2025 to 2035 saw a decrease of 10 BPS.

Growing industrial automation and reliance on battery-powered machinery drive the need for an advanced battery management system.

The industrial landscape is inherently plentiful with increasing automation and an increase in battery-powered equipment. As technology advances and demand increases for enhanced performance and productivity, we are witnessing a shift towards greater automation. The demand for advanced battery management systems (BMS) has skyrocketed as a result.

Industrial automation involves the integration of advanced control systems and information technology to manage processes and machinery with minimal human intervention. This is particularly evident in manufacturing, logistics, and other heavy industries, where automated structures, battery-powered robots, and automated guided vehicles (AGVs) are becoming increasingly common. These machines heavily rely on batteries to operate, making battery management crucial to maintaining operational continuity and efficiency.

The surging worldwide demand for electric vehicles (EVs) signifies a great shift closer to a sustainable transportation solution. This transformation is fueled by developing environmental concerns and advancements in battery technology. However, the full-scale adoption and success of EVs hinge on the efficiency and reliability of battery management systems (BMS). These structures are constructed from crucial hardware components that ensure the protection, overall performance, and sturdiness of the batteries powering electric vehicles.

At the heart of each EV lies the battery pack, the primary power source of the car. Unlike conventional fuel-powered engines, EVs rely completely at the capacity and efficiency of their batteries. Battery Management System act as an intelligent control center, constantly monitoring and dealing with the battery's health and performance through specialized components.

This component include voltage and temperature sensors, and these sensors constantly measure individual cellular voltages and ordinary battery temperature, providing real-time statistics for control and safety capabilities.

Initial implementation costs pose a significant barrier in the battery management system (BMS) market. A battery management system requires a variety of sophisticated sensors, including voltage, temperature, and current sensors, to monitor individual battery cell health and performance accurately. Moreover, microcontrollers and data acquisition units (DAQs) are crucial for efficiently processing sensor data and executing control algorithms.

These components are technologically complex, demanding high accuracy and reliability, which often results in premium price tags. Procuring these specialized components can be challenging due to limited suppliers for high-performance sensors and specialized battery packs, leading to potential bottlenecks and inflated costs.

Integration of these components necessitates engineers with specialized knowledge to ensure compatibility and optimal system performance. Depending on complexity and demand, some components may have extended lead times, impacting production schedules and project timelines.

Battery management system can reduce the complexities and space requirements of battery systems by eliminating the need of extensive wiring. This reduction would be able to simplify manufacturing and assembly processes, at the same time improving the reliability of the system by reducing the physical connectors, resulting in minimized potential failure points. With the extensive use of wireless battery management system, the chances for innovative battery pack designs are quite high.

Meanwhile, the battery management system would be able to enhance its efficient maintenance and diagnostics capabilities. The remote monitoring will also allow the operators to identify and fix issues quickly. This will result in reduced downtime and improved system performance.

Between 2020 and 2025, the global battery management system (BMS) market experienced considerable growth. While EV adoption became a major driver, another factor propelling BMS demand was the growth of renewable energy projects.

The expansion of renewable power integrations, which include solar and wind energy, surged during these years, necessitating BMS solution for grid-scale electricity storage systems. These structures required advanced BMS technologies to optimize the performance and longevity of battery packs utilized in power storage applications.

From 2025 to 2035, the worldwide shift towards sustainable solutions, combined with increasing consumer awareness of environmental effects, will fuel the demand for efficient BMS technology across various packages. Innovations in BMS capabilities, consisting of greater electricity control, predictive maintenance, and integration with smart grid technology, are expected to grow the market. This will provide new opportunities for industry players to innovate and meet evolving market needs.

Tier 1 vendors are characterized with their tremendous global presence, sizable marketplace percentage, and broaden product portfolio. These vendors typically lead in technological innovation, large-scale production capabilities, and strategic partnerships with key stakeholders across various industries.

Tier 2 providers within the BMS market are characterized by their product applications and significant regional presence. These companies serve specific segments within the automotive, consumer electronics, or renewable power sectors, supplying tailor-made solutions to fulfill industry needs. The vendors in this tier include Renesas Electronics, Toshiba Corporation, Samsung SDI, among others.

Tier 3 companies within the BMS market represent small to medium-sized organizations (SMEs), startups, and specialized companies that offer niche BMS solutions, often specializing in unique battery or emerging technologies. These companies play a vital role in fostering innovation and addressing specific marketplace demands with agile and customizable solutions. Vendors in this tier include LG Chem., Eberspaecher Vecture Inc., Robert Bosch GmbH among others.

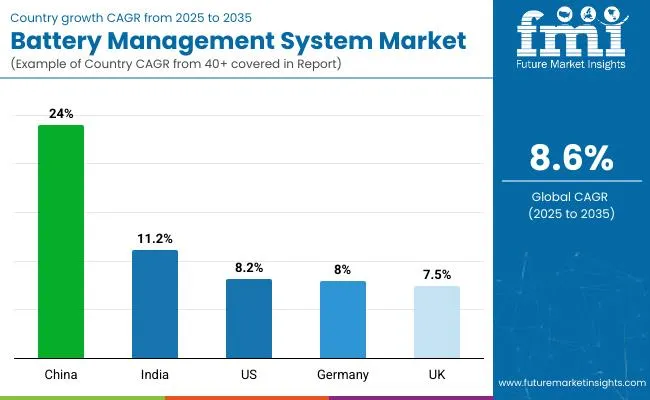

This section below covers the industry analysis for the battery management system market for different countries in the regions, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Asia.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 24% |

| India | 11.2% |

| USA | 8.2% |

| Germany | 8% |

| UK | 7.5% |

The growing defense budgets and modernization applications in the United States have substantially extended the adoption of advanced battery management systems (BMS) in navy applications. This approach is driven by using several critical factors that underscore the importance of a reliable and efficient BMS for enhancing the operational abilities and safety of military equipment.

USA Military's heightened awareness on modernization ranging from strategic shifts and evolving geopolitical threats, necessitating advanced technological solutions to keep navy superiority. Battery-powered equipment plays a crucial role in modern warfare, encompassing unmanned aerial vehicles (UAVs), ground vehicles, portable communication devices, and soldier-worn systems. These structures require a strong BMS for necessary operations in tough environments, consisting of excessive temperatures and prolonged missions.

The investment and R&D activities in the BMS market for military applications reflect substantial growth opportunities. For instance, recent defense budget allocations have allocated significant funds for technology upgrades, including battery systems, expected to enhance military capabilities.

With the heavy implementation of 5G technology, Germany has expanded their telecom networks. There is also a push for renewable energy integration with telecom networks in the country. These factors have highlighted the need for effective battery management systems for telecommunication backup systems.

For instance, Deutsche Telekom began expanding its 5G network coverage across urban and rural areas in 2022. This expansion increased the demand for reliable backup power solutions to ensure network resilience. Thus, Modern BMS technology is now being integrated into telekom backup systems to optimize battery performance.

The need for advanced battery management systems in China is now critical as the country is becoming leading hub for medical devices manufacturing. These devices include portable ventilators, insulin pumps and wearable health monitors. The rise in the adoption of BMS technology is owing to the increased production of wearable health devices like smartwatches and glucose monitors.

For instance, Mindray medical international reported 30% increase in the production of portable medical devices in 2022. These BMS systems are crucial as they offer precise battery health monitoring and ensure uninterrupted patient care operations.

Key players operating in the battery management system market are investing in advanced technologies and also entering into partnerships. Key Battery Management System providers have also been acquiring smaller players to grow their presence to penetrate the market across multiple regions further.

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 10.2 billion |

| Projected Market Size (2035) | USD 23.3 billion |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/ Volume in million units |

| Segments by Type | Lithium-ion BMS, Lead-acid BMS, Nickel-cadmium BMS, Nickel-metal Hydride BMS, Others |

| Segments by Topology | Centralized, Modular, Distributed |

| Segments by Application | Automotive, Military, Consumer Electronics, Telecom, Energy, Others |

| Key Regions | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa (MEA) |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | Texas Instruments, Toshiba Corporation, Infineon Technologies, STMicroelectronics, NXP Semiconductors, Analog Devices, Denso Corporation, Robert Bosch GmbH, Continental AG, Eaton Corporation, Renesas Electronics, LG Chem, Panasonic Corporation, Samsung SDI, L&T Technology Services, Sensata Technologies |

| Additional Attributes | Growth driven by electric vehicle expansion, grid integration of renewables, and safety compliance |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of type, the industry is divided into lithium-ion BMS, lead-acid BMS, nickel-cadmium BMS, nickel-metal hydride BMS and others.

In terms of topologies, the industry is segregated into centralized, modular and distributed.

The application is classified by automotive, military, consumer electronics, telecom, energy and others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa (MEA) have been covered in the report.

The industry is projected to witness CAGR of 8.6% between 2025 and 2035.

The global battery management system industry stood at USD 8.7 billion in 2024.

The global battery management system industry is anticipated to reach USD 23.3 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.5% in the assessment period.

The key players operating in the industry include Texas Instruments, Analog Devices, NXP Semiconductor, Toshiba Corporation, L&T Technology Services, Navitas System, LLC, Sensata Technologies among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Components, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Components, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Components, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Components, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Components, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Components, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Components, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Topologies, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Topologies, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Components, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Components, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Components, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Battery Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Topologies, 2023 to 2033

Figure 28: Global Market Attractiveness by Components, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Components, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Battery Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Topologies, 2023 to 2033

Figure 58: North America Market Attractiveness by Components, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Components, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Battery Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Topologies, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Components, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Battery Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Topologies, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Components, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Components, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Battery Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Topologies, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Components, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Components, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Battery Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Topologies, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Components, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Components, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Battery Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Topologies, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Components, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Topologies, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Components, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Topologies, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Topologies, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Topologies, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Topologies, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Components, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Components, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Components, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Components, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Battery Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Topologies, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Components, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Battery Management System Providers

Japan Battery Management System Market Growth – Trends & Forecast 2023-2033

Korea Battery Management System Market Growth – Trends & Forecast 2023-2033

Demand for Battery Management System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Battery Management System in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Battery Management System Market Growth - Trends & Forecast 2025 to 2035

Western Europe Battery Management System Market Growth – Trends & Forecast 2023-2033

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

Crowd Management System Market

Asset Management System Market

Dealer Management System Market Size and Share Forecast Outlook 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA