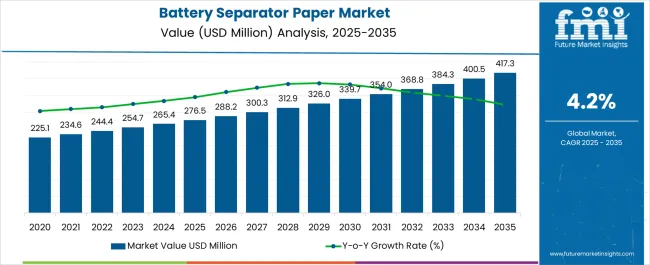

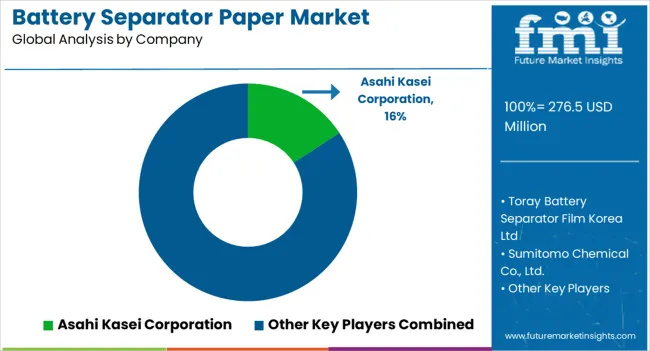

The Battery Separator Paper Market is estimated to be valued at USD 276.5 million in 2025 and is projected to reach USD 417.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Battery Separator Paper Market Estimated Value in (2025 E) | USD 276.5 million |

| Battery Separator Paper Market Forecast Value in (2035 F) | USD 417.3 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The battery separator paper market is recording notable growth as demand for energy storage solutions intensifies across multiple sectors. Increasing adoption of electric mobility, expanding renewable energy integration, and rising production of consumer electronics are driving consumption. Current dynamics are shaped by innovations in separator materials, improvements in durability and thermal stability, and a shift toward lightweight designs that enhance overall battery performance.

Regulatory emphasis on safety and efficiency has further reinforced the use of advanced separator papers. The future outlook is marked by accelerating electric vehicle penetration, government incentives for clean energy adoption, and growing investment in next-generation battery technologies.

Supply chain consolidation and technological collaborations are expected to optimize cost structures and product availability Growth rationale is anchored on the increasing role of battery separator papers in ensuring safety, extending cycle life, and improving energy density, which positions the market for sustained expansion across global automotive, industrial, and electronics applications.

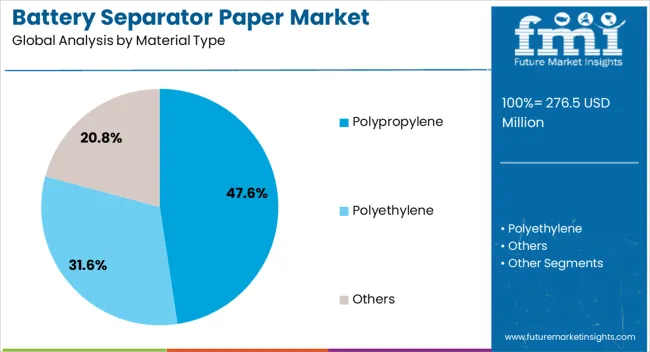

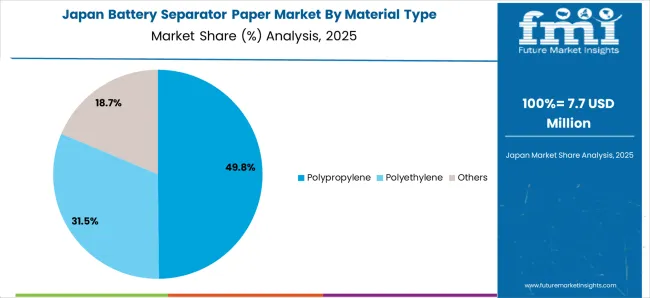

The polypropylene segment, accounting for 47.60% of the material type category, has been leading due to its high mechanical strength, chemical resistance, and thermal stability that make it well suited for battery applications. Its adoption has been reinforced by the growing need for reliable separator materials in both conventional and advanced batteries.

Manufacturing efficiencies, combined with scalable production technologies, have supported consistent supply and cost competitiveness. Market confidence has been strengthened by compliance with stringent safety standards, ensuring dependable performance across varying operational conditions.

Demand growth has also been influenced by rising consumption of lithium-ion batteries, where polypropylene-based separators remain integral to meeting performance benchmarks Continued innovation in microporous film technology and surface treatment methods is expected to sustain the segment’s dominance and support expansion into next-generation battery designs.

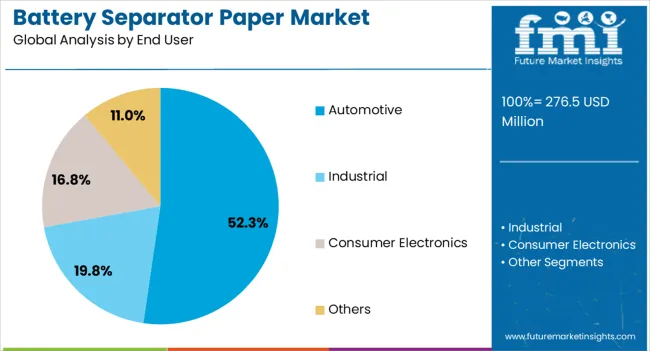

The automotive segment, holding 52.30% of the end-user category, has emerged as the dominant consumer of battery separator paper due to the accelerating adoption of electric and hybrid vehicles. Demand has been driven by large-scale investments from automakers in electrification strategies and the increasing need for high-performance batteries that ensure safety and longevity.

The segment has benefited from favorable policy frameworks and emission reduction targets that are pushing widespread adoption of alternative propulsion systems. Battery separator papers in this sector have been favored for their role in enhancing thermal management, durability, and consistent charge-discharge performance.

Supply chain integration with leading automotive OEMs has further reinforced demand stability Future growth is expected to be fueled by global expansion of EV infrastructure, cost reductions in battery manufacturing, and scaling of production capacities, ensuring that the automotive sector continues to anchor the market’s growth trajectory.

Steady Growth in the Battery Separator Paper Market from 2020 to 2025

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 227.9 million |

| Market Value for 2025 | USD 255.2 million |

| Market CAGR from 2020 to 2025 | 2.9% |

Competitive Landscape Evolution in Battery Separator Paper from 2025 to 2035

The segmented battery separator paper market analysis is included in the following subsection. Based on comprehensive studies, the polypropylene (PP) battery separator paper sector is leading the material type category, and the automotive segment is commanding the end-use category.

| Leading Segment | Polypropylene (PP) Battery Separator Paper |

|---|---|

| Segment Share | 54.70% |

| Leading Segment | Automotive |

|---|---|

| Segment Share | 49.20% |

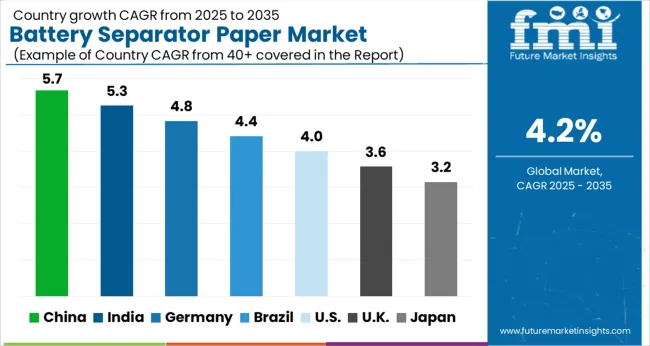

The battery separator paper market can be observed in the subsequent tables, which focus on the leading economies in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous opportunities due to its resilient manufacturers.

India Market Outlook

China Market Outlook

| Attributes | Details |

|---|---|

| India Market CAGR | 6.9% |

| China Market CAGR | 5.3% |

| Japan Market CAGR | 5.0% |

| Australia Market CAGR | 2.0% |

Japan Market Outlook

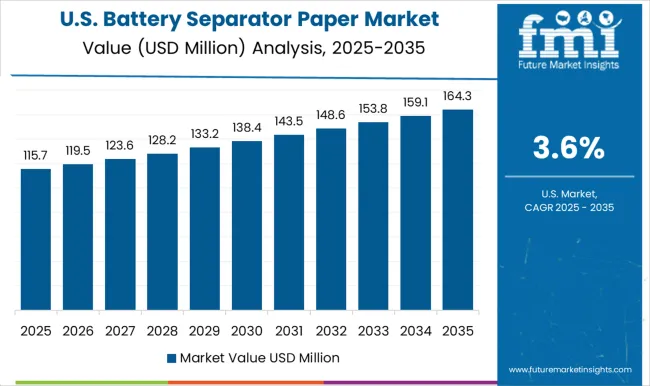

The United States Market Outlook

| Attributes | Details |

|---|---|

| North America Market Share | 16.0% |

| United States Market CAGR | 4.00% |

Canada Market Outlook

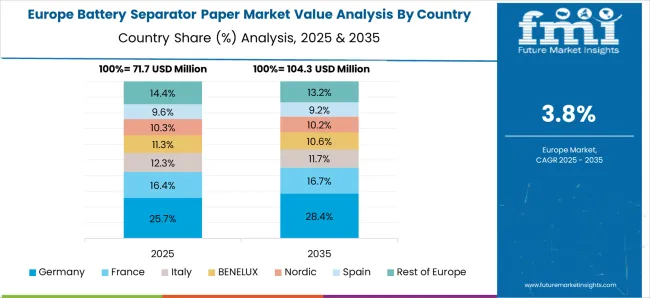

Germany Market Outlook

| Attributes | Details |

|---|---|

| Europe Market Share | 14.5% |

| Germany Market CAGR | 3.3% |

| United Kingdom Market CAGR | 3.2% |

The United Kingdom Market Outlook

There is fierce competition among many significant market players in battery separator paper, including both well-established businesses and recently emerged ones. The battery separator paper manufacturers always emphasize innovation, efficient production, and international expansion. The battery separator paper market is growing because of technological developments and sustainability concerns, which create a dynamic environment where businesses work to improve product performance and environmental credentials.

Raw material availability, consumer preferences, and regulatory standards influence the competitive landscape. While niche players look for chances in specialized segments to establish their presence, battery separator paper vendors use partnerships, mergers, acquisitions, and research and development investments to hold onto their market share.

Notable Innovations

| Company | Details |

|---|---|

| United States Department of Energy's Battery Materials Processing and Battery Manufacturing | In November 2025, the United States Department of Energy's Battery Materials Processing and Battery Manufacturing division declared that it would work with General Motors and Microvast to invest US$ 0.2 billion toward developing customized battery separators for electric vehicles. |

| ENTEK | To satisfy the growing demand for lithium-ion battery separators, ENTEK announced in April 2025 that it would expand in the United States. It is anticipated that ENTEK may finish its first phase of expansion by 2025 and continue to grow until 2035, producing 1.4 billion square meters in total, enough material for the separator to power about 1.4 billion electric vehicles. |

| ENTEK | Adaptive Engineering and Fabrication, a producer of material handling equipment, was purchased by Entek Manufacturing, a reputable manufacturer of separators for lead and lithium-ion batteries, in January 2025. Entek Adaptive, the rebranded company, has become the most recent product line for all material handling businesses owing to this acquisition. |

| Asahi Kasei | Leading manufacturer of LIB separators worldwide, Asahi Kasei, plans to boost Hipore Li-ion battery separator output at its Miyazaki, Japan, facility in March 2024. With production facilities for both wet and dry processes located in the United States and Japan, the company has been actively concentrating on growing its LIB separator business. |

The global battery separator paper market is estimated to be valued at USD 276.5 million in 2025.

The market size for the battery separator paper market is projected to reach USD 417.3 million by 2035.

The battery separator paper market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in battery separator paper market are polypropylene, polyethylene and others.

In terms of end user, automotive segment to command 52.3% share in the battery separator paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA