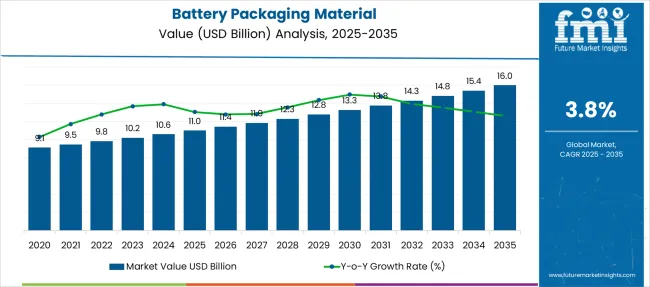

The Battery Packaging Material Market is estimated to be valued at USD 11.0 billion in 2025 and is projected to reach USD 16.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. The battery packaging material market is set to expand from USD 9.1 billion in 2020 to USD 16.0 billion by 2035, generating an absolute increase of USD 6.9 billion at a CAGR of 3.8%. Although growth is moderate, the sector holds strong strategic significance driven by the global electrification wave and the shift toward safer, high-density energy storage systems. The market shows incremental demand for thermal-resistant films, corrosion-protective casings, and lightweight enclosures, particularly as EV adoption accelerates and stationary energy storage becomes mainstream.

The white space lies in advanced multi-layer composites and smart packaging with integrated thermal sensors to improve safety and predictive maintenance. Opportunities are significant in solid-state battery packaging as OEMs transition from traditional lithium-ion cells, creating demand for entirely new material categories. Moreover, regional clusters in Asia-Pacific will dominate, supported by high-volume EV battery manufacturing and recycling infrastructure.

Future growth pivots on localized sourcing strategies, ensuring compliance with stringent safety certifications and reducing dependency on imported materials. Players investing in customizable modular packaging solutions and eco-compliant alternatives such as recyclable aluminum laminates can gain a competitive edge as regulatory mandates for green battery ecosystems intensify.

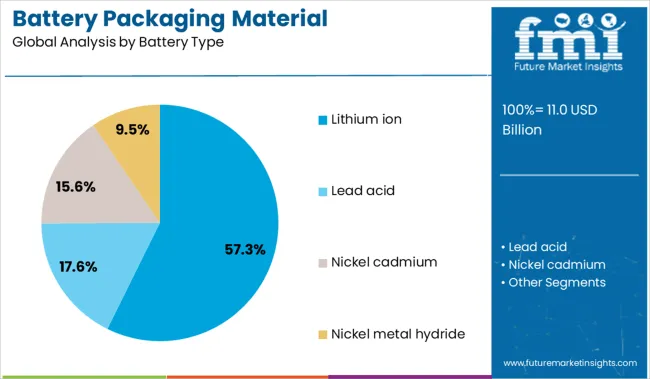

Moderate growth is tied to the global electrification wave, where safe and compliant battery transport is becoming as critical as the cells themselves. Demand is largely concentrated in the lithium-ion segment, which accounts for 57.3% share, owing to its dominance in electric vehicles, grid storage, and consumer electronics.

The sector’s complexity lies in balancing structural integrity, thermal resistance, and regulatory compliance for hazardous goods. Asia-Pacific leads due to large-scale EV manufacturing and robust battery supply chains in China, South Korea, and Japan. North America follows with strong adoption in energy storage systems and OEM-driven packaging standards, while Europe emphasizes safety and recycling frameworks in alignment with its battery directive.

Future innovation will pivot toward lightweight, flame-retardant composites, smart packaging with embedded sensors for temperature and impact monitoring, and reusable solutions that reduce logistics costs.

| Metric | Value |

|---|---|

| Battery Packaging Material Market Estimated Value in (2025 E) | USD 11.0 billion |

| Battery Packaging Material Market Forecast Value in (2035 F) | USD 16.0 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The battery packaging material market is advancing steadily as the demand for safe, sustainable, and efficient packaging solutions rises alongside global battery production. The growth is being shaped by increasing adoption of electric vehicles, renewable energy storage, and consumer electronics, which require robust packaging to ensure safety during transportation and storage.

Industry trends indicate that manufacturers are prioritizing materials that not only meet regulatory standards for hazardous goods but also align with environmental sustainability goals. Future growth is expected to be propelled by innovations in lightweight and recyclable materials, improved supply chain logistics, and heightened awareness of safe handling practices.

Investments in production capacity expansion and collaborations between battery producers and packaging suppliers are further paving the way for scalable, cost-effective, and compliant solutions that meet the evolving demands of the energy storage sector.

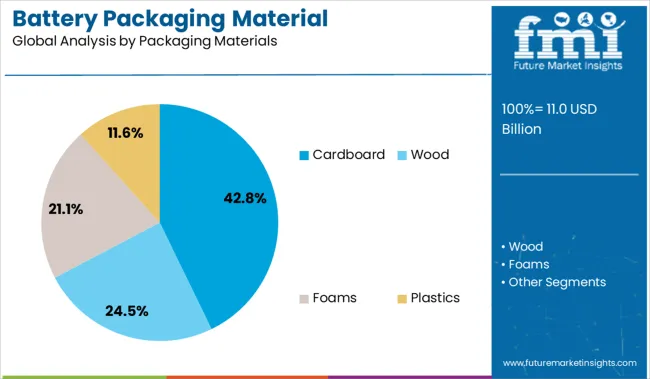

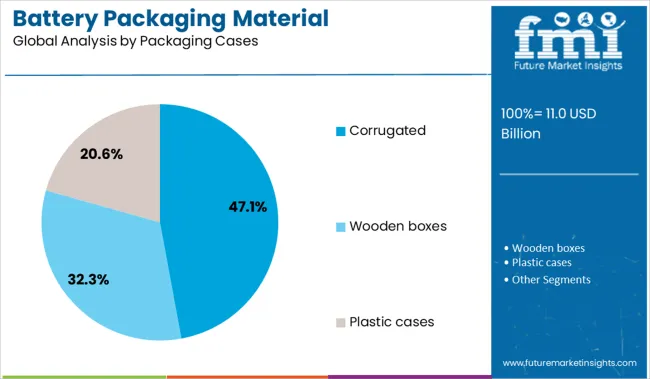

The battery packaging material market is segmented by battery type, packaging materials, packaging cases, and region. By battery type, it includes lithium-ion, lead-acid, nickel-cadmium, and nickel-metal hydride, addressing different energy storage technologies. In terms of packaging materials, the segmentation covers cardboard, wood, foams, plastics, polyethylene terephthalate (PET), HDPE, polypropylene, PVC, and others such as LDPE and polystyrene, ensuring durability and safety. Based on packaging cases, the market comprises corrugated boxes, wooden boxes, and plastic cases, providing multiple options for transport and storage. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

When segmented by battery type, the lithium ion segment is expected to hold 57.3% of the total market revenue in 2025, establishing itself as the dominant battery type. This leadership is supported by the widespread application of lithium ion batteries across electric vehicles, portable electronics, and grid storage systems, all of which necessitate secure and compliant packaging.

The segment’s growth has been reinforced by stringent international transport regulations that mandate robust packaging for lithium ion cells due to their hazardous nature. Packaging designs have been adapted to meet these requirements while optimizing space utilization and reducing costs.

The rising scale of lithium ion battery production and the associated logistics challenges have driven investment in packaging that ensures product integrity, operational efficiency, and compliance, contributing to this segment’s commanding market position.

In terms of packaging materials, cardboard is projected to account for 42.8% of the market revenue in 2025, ranking as the leading material segment. This dominance is attributed to cardboard’s versatility, recyclability, and cost efficiency, which have made it a preferred choice for battery packaging.

Manufacturers have adopted high-strength, engineered cardboard solutions that offer protection against impact and vibration while remaining lightweight and easy to handle. The material’s alignment with sustainability initiatives and its ability to meet regulatory compliance for hazardous goods transportation have further reinforced its appeal.

The widespread availability of recyclable cardboard and its adaptability to various battery sizes and configurations have supported its continued growth as a practical and environmentally conscious packaging material.

When analyzed by packaging cases, the corrugated segment is anticipated to capture 47.1% of the market revenue in 2025, securing its position as the top segment. This leadership is driven by the superior strength, durability, and cushioning properties of corrugated cases, which have proven essential for the safe transport of batteries.

Corrugated designs have evolved to accommodate both small cells and large battery packs, providing structural integrity and minimizing damage risks during handling and transit. The ability to customize corrugated cases for specific battery dimensions and regulatory labeling has enhanced operational efficiency and compliance.

The combination of performance, cost effectiveness, and sustainability credentials has solidified corrugated cases as the preferred choice in scenarios demanding high protection and logistical efficiency.

Battery packaging materials are evolving alongside developments in electric vehicles, consumer electronics, and industrial power systems. Corrugated fibreboard, engineered plastics like PETG and HDPE, and metal-laminated foils are being widely adopted due to their strength, moisture resistance, and compatibility with thermal control layers. The growing complexity of battery formats, ranging from cylindrical and prismatic to pouch cells is encouraging the use of modular packaging. Market traction is increasing for lightweight, sensor-integrated materials that support secure transport, real-time diagnostics, and pack-level customization.

The rise in lithium-ion battery use across multiple industries has driven demand for advanced packaging materials designed to ensure mechanical stability and hazard protection. Lithium batteries require packaging that resists impact, prevents moisture ingress, and controls temperature exposure during transport and storage. Materials such as PETG sheets, HDPE inserts, and multi-layer foams are increasingly favored to meet these conditions. Corrugated structures are often used in multi-cell packaging for their balance of shock absorption and cost-effectiveness. Metal-foil laminates offer enhanced thermal insulation in high-capacity battery modules. The classification of lithium batteries as hazardous goods has also led manufacturers to adopt tamper-evident designs and traceable packaging systems. Integration of RFID tags, temperature monitoring strips, and anti-shock indicators is helping logistics teams reduce risk, ensure compliance, and maintain battery integrity throughout the supply chain.

Packaging innovation is moving toward lighter, form-adaptive solutions to match emerging battery geometries such as pouch and curved-format cells. Engineered films and thermoformable plastics are gaining relevance due to their ability to protect battery units without adding excess bulk. Growth in solid-state and sodium-ion batteries is further reshaping material requirements, favoring packaging that withstands internal pressure variations and isolates sensitive cell chemistries. Another opportunity lies in smart packaging integration, battery packs are increasingly being housed in enclosures equipped with embedded sensors and color-changing labels that signal overheating or structural shifts. Reusable modular trays and multi-use enclosures are being piloted across OEM and aftermarket channels to streamline logistics.

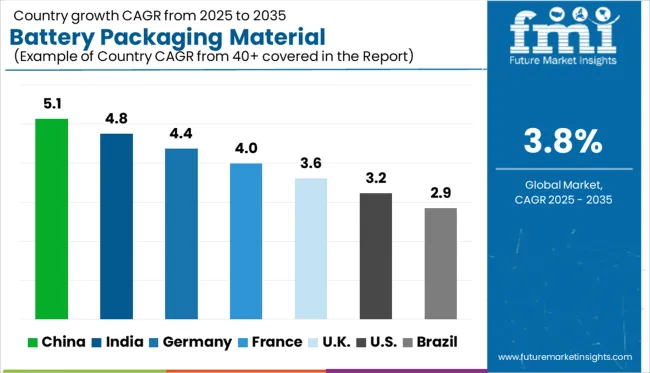

| Countries | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

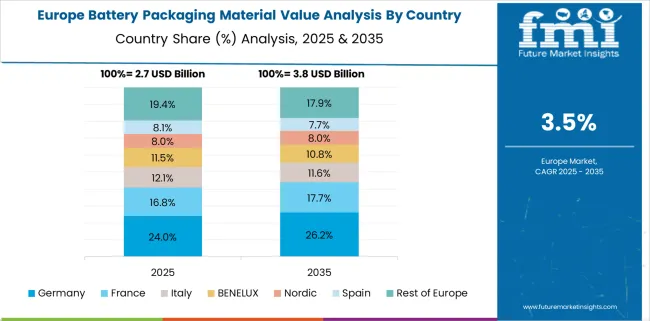

The global battery packaging material market is projected to grow at a CAGR of 3.8% between 2025 and 2035. Demand is being shaped by rising deployment of electric vehicles, stationary battery systems, and lithium-ion cell exports. China leads with a 5.1% CAGR, driven by EV production hubs and government support for domestic packaging value chains. India follows at 4.8%, led by energy storage incentives and mid-cap manufacturing expansion.

Germany, a core OECD member, posts 4.4%, with growth influenced by automotive battery recycling and material innovation. France records growth at 4% CAGR, supported by fire-resistant packaging solutions. The United Kingdom grows at 3.6%, with demand channeled through OEM alliances and battery-grade foil development. The report includes analysis of over 40 countries, with five profiled below for reference.

Adoption of battery packaging material in China is projected to rise at a CAGR of 5.1% through 2035. Aluminum-laminated film manufacturers are expanding capacity to meet the surge in cylindrical and prismatic cell demand. Policies favoring domestic sourcing are encouraging bulk procurement of multi-layer packaging from certified Chinese converters.

Efforts are also being made to harmonize standards for pouch-type and rigid casing applications to improve recyclability and export compliance. State-backed energy storage projects are fueling material validation cycles across battery production lines. Innovation is aligning with both performance safety testing and volume scaling.

Sales for battery packaging material in India are projected to grow at a CAGR of 4.8% between 2025 and 2035. Indian startups are co-developing leak-resistant wraps and heat-tolerant films compatible with local climatic conditions. Government-linked R&D centers are advancing product testing standards under Make in India initiatives.

Regional hubs in Maharashtra and Tamil Nadu are attracting mid-scale converters aiming to supply cell module casings to Tier 2 and Tier 3 EV brands. Strategic alliances are being formed between foil fabricators and battery enclosure assemblers to localize production. The sector is showing preference for protective multi-layer formats with recyclability attributes.

Demand for battery packaging material in Germany is forecast to grow at a CAGR of 4.4% from 2025 to 2035. Technical innovation is occurring across protective films, insulation sheets, venting membranes, and casing laminates with EM shielding capabilities. Automakers and battery integrators are trialing advanced barrier layers to meet EU battery directive standards.

Fire safety tests, pressure tolerance validations, and puncture resistance trials are being used to pre-qualify packaging formats. Academic institutions are collaborating with OEMs on circular material design compatible with extended product life and modular pack reuse. Innovation is also surfacing in form factors optimized for underbody installations in passenger cars.

Sales of battery packaging material in France are expected to grow at a CAGR of 4.0% through 2035. Packaging producers are investing in lightweight film conversion units to supply reinforced pouches for thin-form cell structures. French regulations around electrical hazard prevention and enclosure integrity are shaping the specifications for pack layers.

Local firms are working on integrating sensors and temperature labels into packaging foils to facilitate smart tracking. The country’s import substitution policies are encouraging homegrown suppliers to enter the laminated pouch film segment. Product development cycles are focusing on shock resistance, fire mitigation, and sealing consistency.

Demand for battery packaging material in the United Kingdom are projected to expand at a CAGR of 3.6% between 2025 and 2035. Domestic converters are ramping up capabilities in adhesive barrier films, vent layers, and high-elongation insulation sheets. Market expansion is being enabled through OEM collaborations with packaging designers and composite material labs.

Demand is strongest for formats compatible with pack assembly automation and rapid heat dispersion. Industry bodies are facilitating data-sharing between vehicle manufacturers and packaging suppliers to improve performance benchmarking. Lightweight and low-shrinkage packaging options are receiving preference in UK-based pilot production lines.

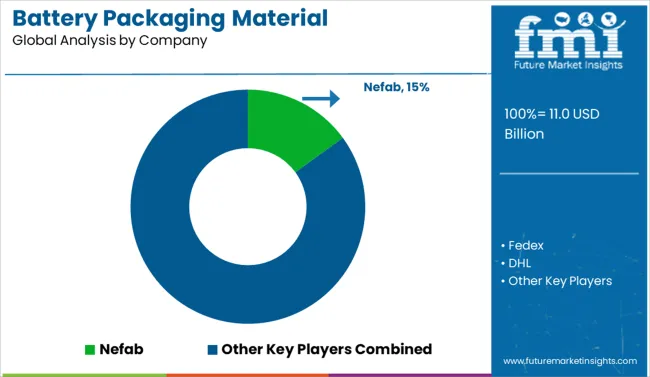

Nefab leads the battery packaging material industry, holding a significant market share due to its specialization in sustainable, shock-resistant packaging for lithium-ion batteries across automotive and electronics sectors. FedEx, UPS, and DHL contribute through logistics-integrated packaging solutions that meet international hazmat transport standards, especially for EV battery shipments.

Rogers Corporation focuses on engineered materials such as thermal insulation and flame-retardant layers within battery enclosures. Umicore supports safe battery logistics through its recycling-oriented transport packaging, aligning with closed-loop material handling.

Zarges offers aluminum-based protective cases for air and maritime transit of high-energy battery modules. Competitive dynamics are now driven by regulatory compliance, heat dispersion performance, and reusable packaging systems that align with safety and global transportation mandates.

Key Developments in the Battery Packaging Material Market

| Item | Value |

|---|---|

| Quantitative Units | USD 11.0 Billion |

| Battery Type | Lithium ion, Lead acid, Nickel cadmium, and Nickel metal hydride |

| Packaging Materials | Cardboard, Wood, Foams, Plastics, Polyethylene Terephthalate, HDPE, Polypropylene, PVC, and Others (LDPE, Polystyrene etc.) |

| Packaging Cases | Corrugated, Wooden boxes, and Plastic cases |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nefab, Fedex, DHL, Rogers Corporation, United Parcel Service (UPS), Umicore, and Zarges |

| Additional Attributes | Dollar sales are segmented by cell packaging format including pouch, prismatic, and cylindrical, with laminated pouches capturing increasing market share due to their lightweight and flexible structure. Material types include aluminum laminates, polymer composites, and coated steel, with rising demand for thermal stability and flame retardancy. OEMs and contract manufacturers offer turnkey packaging solutions. Asia-Pacific and Europe lead adoption, supported by the expansion of electric vehicles and stationary energy storage systems. |

The global battery packaging material market is estimated to be valued at USD 11.0 billion in 2025.

The market size for the battery packaging material market is projected to reach USD 16.0 billion by 2035.

The battery packaging material market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in battery packaging material market are lithium ion, lead acid, nickel cadmium and nickel metal hydride.

In terms of packaging materials, cardboard segment to command 42.8% share in the battery packaging material market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Battery Manufacturing Machines Market

Battery Separators Film Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA