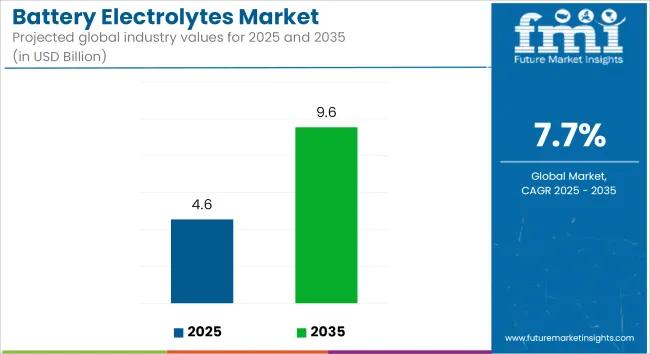

The global battery electrolytes market is projected to grow from USD 4.55 Billion in 2025 to USD 9.55 Billion by 2035, advancing at a CAGR of 7.7% during the forecast period. Market expansion is being shaped by increased electric vehicle (EV) penetration, accelerated deployment of grid-scale energy storage, and ongoing innovation in electrolyte formulations across battery technologies.

Electrolytes are utilized as ion transport media within batteries and play a critical role in determining charge-discharge efficiency, thermal stability, and cycle life. Across lithium-ion chemistries, heightened performance expectations have led to the adoption of purified solvents and salt compositions designed to operate under elevated voltages and variable temperatures.

Additives are being incorporated to reduce gas formation, improve interfacial stability, and limit electrolyte decomposition, especially under fast-charging conditions.

Supportive regulatory policies and targeted funding initiatives have prompted large-scale capacity expansions in both developed and emerging markets. Several battery manufacturers have undertaken investments in electrolyte synthesis and supply chain localization to reduce import dependency and ensure quality consistency.

With the rise in cell-to-pack designs and increased emphasis on thermal control, electrolyte formulations are being customized for specific use cases, including high-energy-density pouch cells and cylindrical cells for commercial EV platforms.

Solid-state electrolytes are undergoing active pilot-scale validation, with multiple projects focused on sulfide-based and oxide-based chemistries. These alternatives are being evaluated for safety advantages, higher electrochemical stability windows, and the potential to enable lithium metal anodes. While full commercial adoption is not expected before 2028, prototype deployments are being trialed in premium mobility and aerospace systems.

Polymer-based and gel electrolytes are also being pursued as transitional technologies due to their ability to balance safety and ionic conductivity. Hybrid electrolytes, incorporating ceramic reinforcements, are being developed to improve mechanical strength and interface compatibility.

Volatility in lithium salt pricing and concerns over fluorinated solvent availability have increased interest in closed-loop electrolyte recovery and reuse. Research efforts are being directed toward electrolyte regeneration methods compatible with existing battery recycling infrastructure, supporting broader circular economy goals.

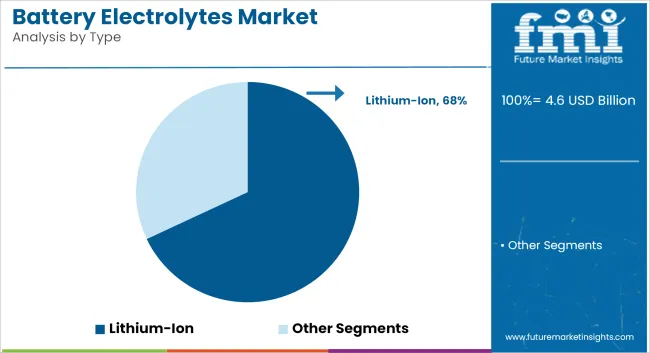

The lithium-ion segment is projected to hold approximately 68% of the global battery electrolyte market share in 2025 and is expected to grow at a CAGR of 8.1% through 2035. These electrolytes typically consist of lithium salts such as LiPF₆ dissolved in organic solvents and are critical for ionic conductivity within the battery. Advancements in electrolyte chemistry-including solid-state, gel-based, and fluorinated formulations-are being pursued to enhance thermal stability, voltage tolerance, and cycle life.

With the rapid electrification of mobility and energy storage systems, lithium-ion technology continues to lead battery innovation. Demand for safer, higher-capacity batteries across EVs, grid storage, and high-performance consumer electronics is expected to sustain growth in this segment.

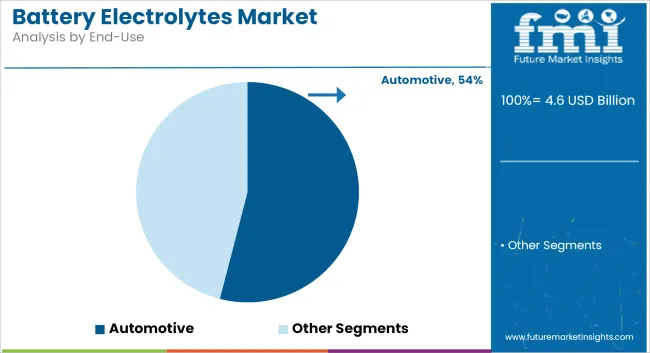

The automotive segment is estimated to account for approximately 54% of the global battery electrolyte market share in 2025 and is expected to grow at a CAGR of 8.0% through 2035. Battery electrolytes are essential components in both lead-acid and lithium-ion batteries used in electric vehicles, hybrid electric vehicles, and traditional internal combustion engine vehicles.

Government incentives, emission mandates, and OEM investments in electric drivetrains are accelerating the deployment of lithium-ion battery packs across passenger and commercial fleets. Additionally, demand for battery-powered systems in vehicle electronics, ADAS, and auxiliary power units continues to rise. As automotive battery chemistries evolve, the need for advanced and thermally stable electrolytes will remain central to performance and safety optimization.

A new study by Future Market Insights (FMI) surveyed key stakeholders such as battery producers, raw material producers, and final consumers. A notable 78% of respondents pointed out an increasing demand for high-performance electrolytes due to the push for longer battery life and faster charging. Solid-state electrolytes were another area of interest, where 65% of industry specialists indicated commercial scalability in the next five years.

Supply chain constraints remain a significant challenge, with more than 60% of respondents citing raw material price fluctuations and sourcing difficulties. Stakeholders highlighted the importance of increased investment in recycling batteries and alternative electrolyte chemistries to decrease reliance on limited resources such as lithium and cobalt. Further, 50% of respondents stated that regulatory policies will have a defining influence on the industry, with a focus on sustainability mandates and standards for battery safety.

When questioned about the future, almost 70% of industry leaders anticipate a boom in strategic partnerships among battery makers, automakers, and energy storage companies to drive innovation. Industry players also highlighted the increasing importance of localized production to counter geopolitical threats and supply chain disruptions.

| Countries | Regulations & Certifications |

|---|---|

| United States | Local battery manufacturing has been incentivized by the Bipartisan Infrastructure Law and the Inflation Reduction Act (IRA). Battery safety standards such as UL 2580 and SAE J2464 guide industry compliance, while the Department of Energy (DOE) continues to push for supply chain localization. |

| United Kingdom | The UK Battery Strategy promotes local production. Industrial batteries need to conform to the UK Battery Regulations (equivalent in the EU) and BS EN 62619. Legislation for Extended Producer Responsibility (EPR) also plays a role. |

| France | France has now instituted the Battery Regulation Act, which has very strict guidelines around recycling once batteries reach end-of-life. A business is consequently required to meet standards for CE marking and the EU Battery Directive (2013/56/EU) to acquire environmental and security standards. |

| Germany | Tight adherence to the BattG (Battery Act) and the EU Battery Passport under the Green Deal For high-energy battery systems, the VDE-AR-E 2510-50 standard is necessary. The standard necessitates the reporting of battery parts' carbon footprint. |

| Italy | The EU Battery Directive applies, and other local recycling rules do. Each battery must pass CE certification, and ECO-Design standards influence electrolyte content for sustainability. |

| South Korea | The K-Battery Strategy focuses on localized production. Main Battery Safety Regulations Battery Safety The KC Certification (KATS) is mandatory for batteries in South Korea according to the Safety Control Act, which includes testing for the safety and performance of battery functions. The government subsidizes R&D on solid-state batteries. |

| Japan | The METI (Ministry of Economy, Trade and Industry) governs battery manufacturing under the PSE (Product Safety Electrical Appliance & Materials) Act. Lithium-ion batteries are subject to JIS C 8712 compliance for the purpose of safety. |

| China | Note that the GB/T 31467 series establishes national standards for EV batteries. There are mandatory recycling laws, and manufacturers must implement China Compulsory Certification (CCC) standards. The Made in China 2025 initiative undergirds domestic battery supply chains. |

| Australia & New Zealand | Recycling is required under the Australian Battery Stewardship Scheme. Batteries will need to conform with AS/NZS 62133 safety standards. Government policies encourage local processing of lithium under the premise of self-sufficiency. |

| India | Producer responsibility for recycling is mandated under the Battery Waste Management Rules, 2022. Safety standards also include BIS (Bureau of Indian Standards) IS 16046. |

The USA battery electrolytes industry will expand at a CAGR of 8.2% over the 2025 to 2035 period, higher than the global average, largely due to an increase in domestic battery manufacturing in the country and the rising adoption of electric vehicles (EVs).

Increased demand for electrolyte manufacturing in North America is driven through tax credits under the Inflation Reduction Act (IRA) for EV batteries produced in the region. Moreover, the industry is witnessing an increase in investments in solid-state battery technology, with Tesla, Quantum Scape, and Solid Power leading the way.

The country is also imposing stricter recycling demands, with the Department of Energy (DOE) supporting efforts to reduce reliance on China-controlled lithium supply chains. Hence, American battery manufacturers increasingly source lithium, nickel, and cobalt from nearby and allied sources, which will ensure long-term stability in the industry for battery electrolytes.

The period of 2025 to 2035 is forecast to show significant growth with a CAGR of 7.5% in the battery electrolyte industry in the UK, primarily due to the desire of the government for localized battery production along with net-zero goals.

The country has committed £1 billion to plans for driving the industrialization of the battery sector, concentrating on lithium refining and advanced electrolyte research. Important regulations, like the UK Battery Strategy and BS EN 62619 safety standards, are impacting the industry by imposing sustainability requirements. Demand for high-performance electrolytes is growing thanks to the likes of gigafactories such as British volt and Envision AESC.

Also helping is the UK government’s 2035 ban on new petrol and diesel cars driving investment into future-generation battery chemistries such as solid-state and sodium-ion batteries, placing the nation as a forerunner in the European industry.

From 2025 to 2035, the use of battery electrolytes is expected to grow at a 7.6% compound annual growth rate in France, owing to battery production plans supported by the government and strict green policies. Compliance with the French Battery Regulation Act and the EU Battery Directive pushes battery makers to focus on eco-friendly electrolyte compositions.

TotalEnergies' Saft and Verkor are investing heavily in lithium-ion and sodium-ion batteries to align with anticipated advancements in performance and electrolyte chemistry. Moreover, France's quest for energy self-sufficiency will only fuel home-refined lithium facilities, reducing reliance on Asian supply chains.

Tax incentives are also being used to encourage behaviors that support a circular economy, while battery electrolyte producers are also being made to incorporate recycling and material recovery into their production lines.

The battery electrolyte industry in Germany is projected to grow at a CAGR of 7.9% over 2025 to 2035, one of the fastest-growing battery electrolyte industries in Europe. Germany’s strong automobile sector, represented by Volkswagen, BMW, and Mercedes-Benz, is helping support demand for high-performance electrolytes. Germany has passed regulations for the EU Battery Passport, requiring traceability and carbon footprint reporting on battery materials.

The National Battery Innovation Strategy also promotes R&D on solid-state and silicon-based electrolytes; BASF and SGL Carbon have made significant progress. Gigafactories like CATL and Northvolt, along with Tesla's Berlin plant in Germany, are driving the demand for electrolytes. Germany is set to become a European hub for next-generation battery electrolytes, with increasing government incentives driving EV battery production.

From 2025 to 2035, the Italian battery electrolytes industry is forecasted to grow at a CAGR of 7.3%, owing to growing demand for EVs and energy storage systems (ESS). Italy has The EU Battery Directive conforms to strict sustainability regulation of battery constituents. The EU Battery Directive provides incentives and allocates grants for domestic battery production, prompting companies like FAAM Energy to invest in high-performance electrolyte solutions.

And Italy’s growing solar sector is boosting demand for grid-scale energy storage, which further encourages the industry. The country is also focusing on recycling batteries, with legislation setting ambitions to boost the recovery rates of lithium, nickel, and cobalt. Overall, Italy is gradually establishing its unique position within the European battery electrolyte value chain.

It is one of the most lucrative industries in the world, with battery electrolyte industries in South Korea projected to witness a healthy pump of 8.5% CAGR during the forecast period from 2025 to 2035. Major players similar to this in South Korea are LG Energy Solution, Samsung SDI, and SK Innovation, leading the way in both lithium-ion and solid-state battery development.

The K-Battery Strategy focuses on local electrolyte manufacturing, thereby reducing China's reliance on imports. The KC Certification (KATS) ensures battery parts are safe and high performing. The government is also pouring substantial investments into lithium refining technology and electrolyte recycling, which could further bolster South Korea as a world battery powerhouse.

Japan's battery electrolytes industry is to capture 7.8% CAGR between 2025 and 2035, owing to advancements in solid-state battery technology and next-gen lithium-ion chemistry. Japan's Ministry of Economy, Trade and Industry (METI) is funnelling money into next-generation battery R&D as part of its push to support cutting-edge companies, including Panasonic, Toyota, and Mitsubishi Chemical.

Moreover, the country has been pursuing the development of safer, non-combustible electrolyte solutions to further extend battery life and prevent thermal runaway risk. With government-sponsored ventures and partnerships with automakers and energy storage companies, Japan is expected to emerge as a global leader in battery innovation.

From 2025 to 2035, China's battery electrolyte industry is likely to grow at a CAGR (compound annual growth rate) of 9.0%, the highest rate in the world, thanks to favourable government policies, large-scale production capacity, and dominant lithium refining capacity.

The Made in China 2025 initiative promotes the development of battery supply chains within China, while the GB/T 31467 standards govern the properties of electrolytes, including quality, safety, and energy density development. The industry leaders in battery-related electrolyte production are CATL, BYD, and Gotion High-Tech, which are all making significant investments in solid-state and high-energy-density lithium-ion batteries.

China is the world’s largest producer of lithium, cobalt, and nickel, enabling a cost-competitive supply chain with reduced reliance on imports. In addition, China is at the forefront of battery recycling and second-life applications, providing a circular economy. With the rise of EVs and energy storage projects, China’s place as an international battery giant will become even clearer.

In Australia and New Zealand, the region's battery electrolytes industry will grow at a compound annual growth rate (CAGR) of 7.1% during 2025 to 2035, driven by increased lithium mining activity, battery recycling programs, and growing energy storage adoption. With a significant lithium supply, large-scale mining in Western Australia underpins global electrolyte and battery manufacturing.

Battery recycling in Australia is registered under the Battery Stewardship Scheme to promote sustainable recovery and proper disposal of battery materials. The same applies to domestic lithium refineries, which aim to establish domestic supply chains and reduce reliance on Chinese processing plants. If the government strengthens support for clean energy policies and local manufacturing of processing capacity, the battery electrolytes industry in Australia and New Zealand is set for steady growth.

The Indian battery electrolyte industry is also anticipated to grow at a CAGR of 8.4% during 2025 to 2035 on account of favorable government incentives, the exponentially emerging electric vehicle industry, and increasing investments in energy storage.

The introduction of the Production Linked Incentive (PLI) scheme is significantly boosting indigenous battery production, with many of the leading international players setting up bases in India to cater to the local requirement through manufacturing factories. The Battery Waste Management Rules (2022), which include strict recycling measures, should also encourage the development of sustainable electrolytes and promote a circular economy.

The rise in solar and wind power projects in India is driving demand for grid-scale battery storage and high-performance electrolytes. Government initiatives and increasing private investments are positioning India as an emerging global competitor in the battery electrolytes industry.

The battery electrolyte market is focusing on enhancing safety and performance through technological advancements and local supply chain development. The scaling up of electrolyte production in key regions is supporting the demand for diverse battery chemistries, aligned with energy security goals. Innovations such as polymer-based electrolytes designed to prevent thermal runaway are improving the safety and stability of lithium-ion systems, particularly for electric vehicles and grid storage.

The industry is segmented into lead-acid, lithium-ion and others

It is segmented into automotive, consumer electronics and others

The sector is fragmented among North American, Latin America, Europe, Asia Pacific, Middle East and Africa

Increased EV adoption, energy storage growth, and the development of high-performance batteries are prime drivers.

Companies are creating non-flammable, solid-state, and high-voltage-stable electrolytes to minimize risks and maximize performance.

Automotive, consumer electronics, and renewable energy storage industries dominate use.

Domestic production is supported by regulations, recycling requirements, and research and development grants for next-generation battery chemistries.

Yes, bio-based, water-based, and recyclable electrolyte solutions are on the horizon as environmentally friendly alternatives.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Competitive Breakdown of Battery Management System Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA