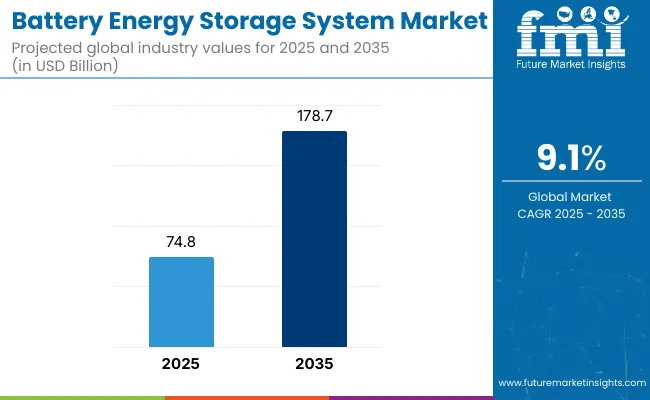

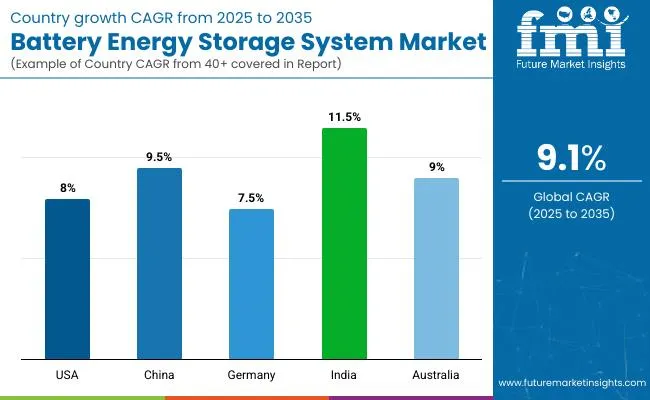

The global battery energy storage system market is anticipated to report a valuation of USD 74.8 billion in 2025 and is projected to reach USD 178.7 billion by 2035, expanding at a compound annual growth rate (CAGR) of 9.1% during the forecast period. Growth in this market is being positively influenced by rising decarbonization goals, increased investments in resilient grid infrastructure, and the need for effective integration of intermittent renewable energy sources.

| Attributes | Key Insights |

|---|---|

| Estimated Market Value, 2025 | USD 74.8 billion |

| Projected Market Value, 2035 | USD 178.7 billion |

| Market Value CAGR (2025 to 2035) | 9.1% |

The shift toward cleaner energy portfolios by governments and utilities is driving widespread deployment of battery storage systems to balance supply-demand fluctuations and ensure grid stability. Battery storage is increasingly being used to smooth load curves, provide frequency regulation, and offer backup power during outages, particularly as solar and wind generation expands globally.

Spending on grid modernization, especially in advanced economies across North America, Europe, and East Asia, has created demand for scalable and modular storage systems that enhance grid flexibility. In emerging economies, distributed energy storage is enabling rural electrification and reducing dependency on diesel generators, supporting sustainability and energy access goals.

The declining cost of lithium-ion batteries, advancements in alternative chemistries like sodium-ion and solid-state batteries, and supportive policy frameworks are further accelerating commercial adoption. Incentive programs, capacity payment models, and energy arbitrage opportunities are helping utilities, commercial entities, and industrial users to deploy battery energy storage as a cost-saving and reliability-enhancing solution.

Battery energy storage systems are becoming a strategic asset in energy transition strategies, offering value not only in grid-connected applications but also in microgrids, electric vehicle charging infrastructure, and behind-the-meter storage for commercial and residential users. Continued innovation in battery management systems (BMS), thermal control, and digital energy platforms is expected to enhance performance, safety, and return on investment for storage assets over the next decade.

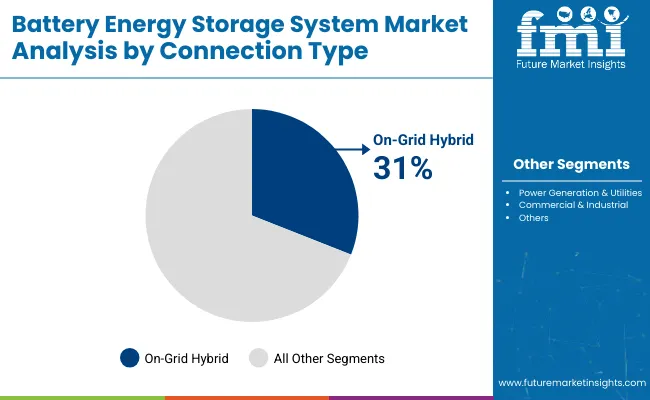

Hybrid renewable systems under the on-grid (front-of-the-meter) category are projected to hold a 31% share of the connection type segment in 2025, expanding at a CAGR of 9.8% through 2035. This segment involves battery energy storage systems coupled with solar PV or wind farms to ensure firm power delivery to the grid.

These integrated deployments are being prioritized in power purchase agreements, supported by renewable portfolio standards and utility procurement programs. Asia-Pacific and the USA are leading deployment in this category with rapidly growing utility-scale hybrid storage capacity.

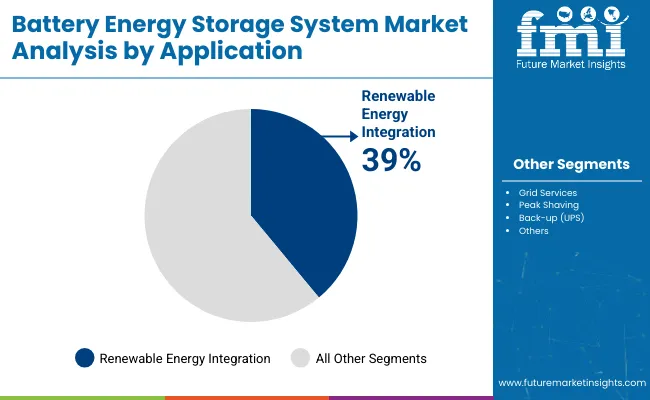

Renewable energy integration is projected to represent 39% share of the application segment in 2025 and is expected to grow at a CAGR of 9.7% through 2035. Energy storage systems are being increasingly co-located with solar and wind installations to mitigate intermittency and support dispatchable clean power.

Regulatory mandates to increase renewable share in the energy mix and reduce curtailment are further accelerating adoption. Integration use cases range from short-duration firming to long-duration storage for time-shifting and grid balancing.

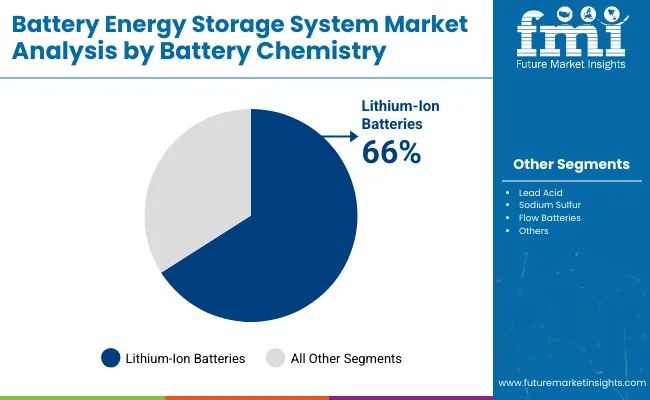

Lithium-ion batteries are expected to hold a 66% share of the battery chemistry segment in 2025 and are projected to grow at a CAGR of 9.4% during the forecast period. Their dominance is underpinned by continued price declines, mature supply chains, and proven use across both stationary and mobile energy storage applications.

Enhanced energy density, long cycle life, and adaptability across all capacity ranges support the segment’s broad deployment across residential, commercial, and utility-scale storage projects. Advances in LFP and NMC chemistries are further consolidating lithium-ion’s market position.

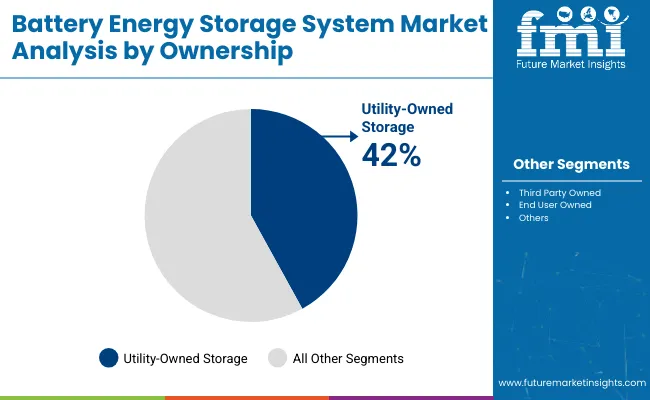

Utility-owned projects are estimated to capture 42% share of the ownership segment in 2025 and are forecast to grow at a CAGR of 9.0% through 2035. This trend reflects the increasing involvement of regulated and municipal utilities in long-duration storage deployment to enhance reliability, defer infrastructure upgrades, and support decarbonization mandates.

Direct access to capital and regulatory incentives allow utilities to scale grid-connected energy storage faster, particularly in North America and Europe.

The 1,000.1 to 10,000 kWh segment is projected to account for 34% share of the total battery energy storage market in 2025, expanding at a CAGR of 9.6% through 2035. This range supports the majority of commercial and industrial deployments requiring multi-hour storage durations.

Demand is being driven by utility-scale front-of-meter projects and microgrid systems, where mid-scale storage balances cost and operational flexibility. This category has become critical in locations with intermittent renewable penetration, enabling grid stabilization and peak demand response.

FMI Survey Findings: Battery Energy Storage System (BESS) industry trends According to Stakeholder Views

(Surveyed Q4 2024, n=500 stakeholders-manufacturers, utilities, project developers, and policymakers - distributed evenly across North America, Europe, Asia-Pacific, and the Middle East & Africa)

Global Consensus:

Regional Variance:

High Variance in Tech Adoption:

ROI Outlooks:

Consensus:

Regional Variance:

Shared Challenges:

Regional Variations:

Manufacturers:

Utilities/Developers:

Alignment:

Divergence:

Global Consensus:

Key Variances:

Strategic Insight:

| Country/Region | Key Policies, Regulations & Mandatory Certifications |

|---|---|

| United States |

|

| Canada |

|

| European Union |

|

| China |

|

| India |

|

| Japan |

|

| South Korea |

|

Secure Supply Chains & Diversify Battery Chemistries

Action: Invest in local raw material sourcing (lithium, cobalt substitutes) and dual-supply techniques to counter geopolitical threats. Give top priority to R&D in sodium-ion, solid-state, and LFP batteries to lower cost and reliance on key minerals.

Position Ourselves with Policy-Driven Demand Hotspots

Action: Target industries with robust regulatory tailwinds (USA IRA tax incentives, EU Battery Passport, China's storage requirements). Create policy-savvy product strategies, like recyclable batteries for Europe or low-cost storage for new Asia.

Construct Hybrid Solutions & Energy-as-a-Service Models

Action: Partner with renewable developers, utilities, and tech companies to provide solar storage microgrids, virtual power plants (VPPs), and leasing models. Make software/AI startup acquisitions to advance grid optimization and battery life cycle management.

| Risk | Probability/Impact |

|---|---|

| Geopolitical Supply Chain Disruptions (e.g., lithium/cobalt shortages, trade restrictions) | High/Severe - Could delay projects, inflate costs, and force abrupt chemistry shifts. |

| Regulatory Uncertainty (e.g., shifting subsidies, slow permitting, safety standards) | Medium-High/High - May stall deployments in key players (EU, USA) or invalidate existing designs. |

| Technology Displacement (e.g., rapid rise of sodium-ion/solid-state outcompeting lithium-ion) | Medium/High - Could strand assets or erode margins for lagging players. |

| Priority | Immediate Action |

|---|---|

| Secure Alternative Battery Material Supply | Finalize contracts with 2+ sodium-ion or LFP battery suppliers to diversify away from lithium dependence. |

| Align with IRA/EU Subsidy Deadlines | Launch a dedicated task force to fast-track 3 USA or EU storage projects eligible for 2024 tax credits. |

| Pilot Energy-as-a-Service Model | Partner with 1 regional utility to test leased storage/VPP solutions (launch within 6 months). |

To stay ahead, companies must leverage the USD 65B battery storage boom, we suggest an immediate shift to policy-driven industries (USA/EU subsidies) hedging supply chain bets through dual sourcing (sodium-ion + LFP). Within 12 months, begin at least one Energy-as-a-Service pilot (e.g., storage leasing with a renewable developer) securing sticky revenue before commoditization. This insight requires restyling your 2025 roadmap to focus on:

Localized production (to access IRA/EU incentives),

R&D collaborations on non-lithium chemistries, and

M&A of grid-edge software companies to support VPPs.

Differentiator: While others pursue lithium-ion scale, this strategy makes you the nimble, policy-aware leader in command of both margins and industries. Act quickly-regulatory windows and first-maker benefits are shutting rapidly.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.0% |

| China | 9.5% |

| Germany | 7.5% |

| India | 11.5% |

| Australia | 9.0% |

CAGR (2025 to 2035): ~8.0%

The USA has the largest and most developed BESS industry, fueled by the Inflation Reduction Act (IRA) that includes 30-50% tax credits for storage systems produced in the country. Leaders in deployments are states such as California, Texas, and New York, with utility-scale plants reigning supreme (80% of installed capacity).

The market is turning towards 4-hour storage systems to enable solar integration, while behind-the-meter (BTM) commercial storage expands through demand charge management.

CAGR (2025 to 2035): ~7.5% (EU leader in distributed storage)

Germany leads Europe in residential/commercial BESS, with 800,000+ home batteries installed (2024). The KfW subsidies and solar-storage requirements fuel adoption. Utility-scale storage lags but expands through grid-balancing tenders.

CAGR (2025 to 2035): ~9.5% (Global leader in volume, but low margins)

China leads BESS manufacturing (70% world capacity) and is converting to sodium-ion batteries to reduce lithium dependency. State Grid Corporation is rolling out 200+ GW of storage by 2030.

Companies are strengthening their market positions through acquisitions and innovative service models. Acquiring energy storage projects is helping expand regional presence and enhance grid resilience. Meanwhile, international expansion into new markets with large-scale projects is intensifying competition. The industry is increasingly focused on scalable, sustainable solutions that facilitate the transition to cleaner energy while maintaining grid stability.

Lithium-ion batteries prevail because of high efficiency and declining costs.

Grid stability requirements and renewable energy integration are primary drivers.

Germany, Australia, and the USA are the leaders in home battery installations.

They present lower costs and minimize dependence on key minerals.

Subsidies and mandates drive adoption in the USA, EU, and China.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Battery Manufacturing Machines Market

Battery Separators Film Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA