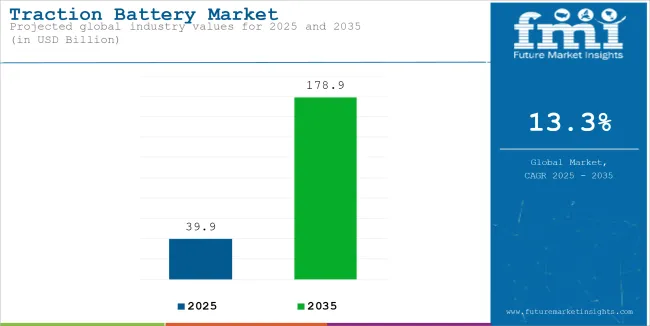

Global sales of the traction battery market were reported at USD 27.5 billion in 2020. Demand for traction batteries is anticipated to reach USD 39.9 billion in 2025. Over the assessment period (2025 to 2035), the market is projected to expand at a CAGR of 13.3% and attain a value of USD 178.9 billion by the end of 2035.

Battery traction refers to batteries used as power sources for electric vehicles (EVs), industrial equipment, and mobility solutions, providing energy for propulsion and enabling efficient, emission-free transportation and operations.

Traction batteries, also known as electric vehicle batteries, refer to an assembly of accumulators constituting the energy storage for powering the traction motors of vehicles. These batteries are gaining immense traction across the automotive sector, owing to their favorable attributes such as high tolerance to overcharging, large current capability, reliability, and rechargeability.

Because of such attributes, they are increasingly adopted in different types of vehicles, such as pure electric cars, motorcycles, and hybrid cars. Traction batteries are also used across non-electric automotive vehicles to power lighting, push-button ignition, horns, infotainment systems, and other accessories.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 39.9 billion |

| Market Value, 2035 | USD 178.9 billion |

| Value CAGR (2025 to 2035) | 13.3% |

These batteries have massive storage capacity and provide power over a longer period of time than conventional batteries. Hence, they are finding a wide range of applications across heavy industrial, commercial vehicles such as electric tractors, electric forklift trucks, and others, which is, in turn, propelling the demand for traction batteries in the market. In addition, the rising introduction of advanced traction batteries, such as valve-regulated lead-acid (VRLA) batteries, is anticipated to further favor the growth in the market.

Battery traction operates by converting stored chemical energy in rechargeable batteries into electrical energy to power electric motors for propulsion. This system is widely used in electric vehicles (EVs), industrial equipment, and railways. As the primary energy source, the battery supplies power to an electric motor through a controller, which regulates power flow and motor speed.

During operation, the motor converts electrical energy into mechanical energy, enabling motion. Batteries used for traction, such as lead-acid, lithium-ion, and nickel-based batteries, are designed for high energy density, durability, and repeated charging cycles. The system’s efficiency lies in minimal energy loss during conversion, making it ideal for eco-friendly and energy-efficient transportation and operations.

Traction batteries are commonly applied in EVs, forklifts, cranes, trains, and even marine vehicles, offering clean and silent operation compared to traditional combustion engines. Challenges persist while they provide significant advantages like emission-free mobility, low noise, and high energy efficiency.

These include limited battery life, high initial costs, and dependence on charging infrastructure. However, advancements in battery technology and growing investments in EV infrastructure continue to drive the adoption of traction battery systems, supporting global efforts toward sustainable and emission-free energy solutions.

The table below highlights the annual growth rates of the global traction battery market from 2025 to 2035. With 2024 as the base year, the report examines how the market’s growth evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This detailed analysis provides stakeholders with a clear understanding of the industry’s performance, focusing on critical advancements and market dynamics that are likely to influence future growth.

The traction battery market is projected to grow at a CAGR of 13.3% from 2025 to 2035, driven by rising demand for electric vehicles (EVs) and industrial automation. In H2, the growth rate is expected to see a slight increase compared to H1.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 12.8% (2024 to 2034) |

| H2 2024 | 13.0% (2024 to 2034) |

| H1 2025 | 13.2% (2025 to 2035) |

| H2 2025 | 13.4% (2025 to 2035) |

From H1 2025 to H2 2025, the CAGR is anticipated to increase modestly from 13.2% to 13.4%, representing a 40 BPS rise in both halves. This growth reflects the impact of increasing investments in EV infrastructure, the adoption of high-performance batteries, and shifting towards sustainable and efficient energy solutions across industries.

Lead Acid Battery Composition Preferred Owing to Cost-Effectiveness and Reliability

Lead-acid batteries are driving the traction batteries market due to their affordability, reliability, and suitability for industrial applications. They are widely used in forklifts, locomotives, and other traction systems, owing to their ability to handle high power demands efficiently. The global recycling rate of lead-acid batteries exceeds 95%, making them an environmentally sustainable option.

Companies like Exide Technologies and Clarios are leveraging this demand by investing in advanced technologies and expanding their portfolios. For instance, Exide has developed batteries with extended cycle life and reduced maintenance, ensuring their continued relevance in industrial applications. Similarly, Clarios is enhancing production capacities to meet the rising demand across sectors.

The mature infrastructure for manufacturing and recycling lead-acid batteries ensures their cost competitiveness and widespread availability, reinforcing their critical role in driving the traction batteries market forward.

Rising Demand for High Energy Density and Lightweight Design Drives Lithium-Ion Adoption in the Traction Battery market

Lithium-ion batteries are emerging as a dominant force in the traction batteries market, driven by their superior energy density and lightweight design. These attributes enable longer travel ranges and improved energy efficiency, making them ideal for electric vehicles (EVs), metros, and trains. For instance, lithium-ion batteries provide 3-4 times higher energy density than lead-acid batteries, significantly enhancing vehicle performance.

Their lightweight structure further reduces the overall weight of traction systems, boosting operational efficiency and lowering energy consumption. This has prompted leading companies like CATL, LG Energy Solution, and Tesla to invest heavily in research and development. CATL, for example, has developed high-energy-density LFP batteries tailored for heavy-duty EVs.

The rising adoption of EVs globally, with sales surpassing 10 million units in 2022, underscores the growing preference for lithium-ion technology. Moreover, government incentives and subsidies for green energy transitions further propel the market, ensuring steady growth for lithium-ion traction batteries.

Increasing Usage in Material Handling Equipment Fuels the Demand for Traction Batteries Market

The rising demand for material handling equipment is a significant driver for the traction batteries market. Material handling systems such as forklifts, pallet jacks, and automated guided vehicles (AGVs) are widely used across warehousing, logistics, and manufacturing industries. With the growing focus on sustainability, these industries are transitioning to battery-powered equipment to reduce carbon emissions and operational costs.

Advancements in battery technologies, such as lithium-ion batteries, have enhanced traction systems' efficiency, durability, and charging speed, making them more suitable for material handling applications. For instance, major players like Toyota Material Handling and Jungheinrich AG are integrating advanced battery systems into their equipment.

According to industry reports, the global warehousing and logistics sector witnessed a 15% surge in material handling equipment adoption in 2023, reflecting the rising preference for battery-powered solutions. This trend is reshaping the traction batteries landscape, driving innovation and growth.

Growing Adoption of Electric Vehicles Boost Traction Batteries Market

The rapid adoption of electric vehicles (EVs) is significantly driving the demand for traction battery systems, as these batteries serve as the core power source for EV propulsion. According to the International Energy Agency (IEA), global EV sales exceeded 10 million units in 2023, a growth of over 55% from 2022, showcasing the accelerating transition toward cleaner transportation.

Government incentives, such as European subsidies and tax rebates in the USA, have made EVs more accessible, further boosting adoption. Additionally, in many countries, stringent emission norms like Euro 7 standards and bans on internal combustion engine (ICE) vehicles by 2035 have pushed automakers to invest heavily in EVs.

Advanced traction battery systems, particularly lithium-ion and solid-state technologies, are crucial for meeting the increasing demand for EVs. They offer longer range and faster charging, thus fueling the growth of the traction battery market.

From 2020 to 2024, the global traction batteries market experienced significant growth, driven by the rising adoption of electric vehicles (EVs) and advancements in industrial automation. The increasing demand for efficient and durable energy storage solutions in EVs, forklifts, and railways fueled the development of traction batteries with higher energy densities, faster charging capabilities, and extended lifespans.

Innovations in lithium-ion technology, including improvements in thermal management and power output, played a pivotal role in addressing performance requirements. Additionally, the push for cleaner transportation and the expansion of EV infrastructure further accelerated market growth, supported by government incentives and investments in renewable energy integration.

Looking ahead to 2025 to 2035, the traction battery market is poised for rapid expansion, underpinned by technological advancements and increasing demand for sustainable energy solutions. The shift towards high-capacity, lightweight batteries with enhanced energy efficiency and safety features will shape the industry’s growth trajectory. Emerging markets with growing EV adoption and industrial automation will be key in driving demand.

Furthermore, innovations such as solid-state batteries and advanced recycling technologies will likely address sustainability and supply chain constraints challenges, ensuring the traction batteries market continues to thrive in the coming decade.

Tier-1 companies account for around 50-55% of the overall market, with product revenue from the traction batteries market of more than USD 150 million. These include Unik Batteries Pvt. Ltd., EXIDE INDUSTRIES LTD., Bater, and other players.

Tier-2 and other companies, such as UBT Batteries Pvt. Ltd., Akkuteam Energietechnik GmbH, and other players, are projected to account for 40-60% of the overall market, with estimated revenue under USD 150 million through traction batteries.

The section below covers the industry analysis for traction batteries in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 14.0% |

| The USA | 13.5% |

| South Korea | 11.5% |

| Japan | 11.0% |

| Germany | 10.5% |

China's domestic EV giants, such as BYD and CATL, are driving significant growth in the traction battery market through their expanding operations. BYD, a leader in the global EV market, produced 1.8 million electric vehicles in 2023, a staggering 40% increase compared to 2022, demonstrating the robust demand for traction batteries. CATL, China’s largest battery producer, held over 37% of the global EV battery market share in 2023, supplying batteries to major automakers, including Tesla, NIO, and Xpeng.

The company has expanded production capacity with new facilities, such as the "super battery plant" in Fujian, to meet increasing domestic and global demand. With strong government support, including incentives for EV adoption and investments in manufacturing, the scaling operations of these giants have solidified China's position as the leader in traction battery technology and production.

The rapid expansion of battery gigafactories in the USA is a key driver for the traction battery market, ensuring a robust supply chain for electric vehicles (EVs) and other traction battery applications. Tesla's Gigafactory in Nevada, one of the largest in the world, has been instrumental in reducing battery costs through economies of scale, producing batteries for over 500,000 EVs annually.

Similarly, LG Energy Solution and Panasonic have partnered with automakers like General Motors and Ford to build battery plants, enhancing domestic production capabilities. For instance, LG Energy's Ultium Cells facility in Ohio has ramped up production to meet the growing demand for EVs.

These gigafactories reduce dependence on imports and support advancements in battery technology, including higher energy density and faster charging solutions, which are crucial for traction battery systems. Moreover, the Inflation Reduction Act (IRA) has allocated significant funding to incentivize local manufacturing, further fueling investments in gigafactories.

By ensuring a steady supply of high-quality traction batteries, these facilities are driving the growth of the USA traction batteries market and supporting the transition to sustainable transportation.

Strategic collaborations between domestic battery manufacturers and global automakers significantly fuel South Korea's traction batteries market. LG Energy Solution’s partnership with General Motors for Ultium Cells has led to establishing multiple battery plants in the USA, increasing demand for South Korean-produced traction batteries.

Similarly, SK On and Hyundai Motor Group have collaborated on advanced battery solutions for EVs. Hyundai targets sales of 1.87 million EVs annually by 2030. Samsung SDI’s agreements with Stellantis to supply high-capacity batteries further underscore the global reliance on South Korean innovations.

These partnerships have driven substantial R&D investment, enabling the development of next-generation battery technologies with higher energy density and faster charging capabilities. By integrating cutting-edge solutions into global EV platforms, these collaborations directly contribute to South Korea's traction batteries market growth.

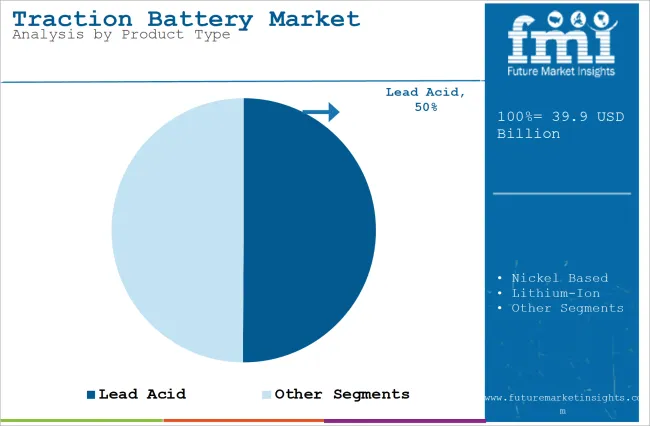

The section explains the growth of the leading segments in the industry. In terms of product type, lead-acid will likely dominate and generate a share of around 50.1% in 2024.

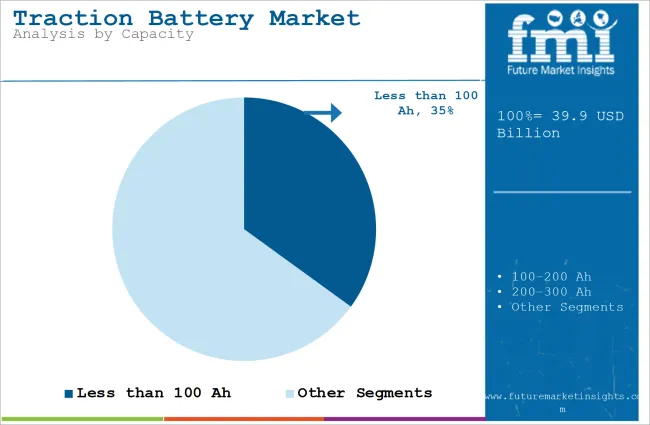

Based on the capacity, less than 100 Ah is projected to hold a major share of 35% in 2024. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Lead-acid ( Product Type) |

|---|---|

| Value Share (2024) | 50.1% |

Lead-acid batteries remain widely used in traction battery applications due to their reliable performance and low maintenance requirements. These batteries excel in delivering high power output for short bursts, making them ideal for heavy equipment like forklifts and material handling machinery. Their ability to handle frequent charge-discharge cycles without significant performance degradation further enhances their appeal in industrial settings.

Modern advancements, such as sealed maintenance-free lead-acid batteries, have reduced the need for regular upkeep, making them more convenient and cost-effective for users. Additionally, the well-established global infrastructure for lead-acid battery recycling supports their sustainability and cost competitiveness.

Their affordability compared to lithium-ion alternatives ensures their continued dominance in applications where cost sensitivity and durability are critical. These combined attributes make lead-acid batteries a preferred choice in the traction batteries market.

| Segment | Less than 100 Ah (Capacity) |

|---|---|

| Value Share (2024) | 35% |

Less than 100Ah batteries dominate the traction batteries market due to their efficiency and adaptability across various applications. These batteries are compact and lightweight, making them ideal for equipment like pallet trucks, low-speed electric vehicles, and material handling systems where space and weight are critical constraints. Their lower capacity ensures fast charging cycles, reducing downtime and enhancing operational efficiency in industries such as warehousing and logistics.

Advancements in lead-acid and lithium-ion technologies have further improved the performance of sub-100Ah batteries, offering higher energy density and extended life cycles. Additionally, their cost-effectiveness compared to higher-capacity alternatives makes them an attractive choice for small-scale operations and emerging markets. As industries increasingly adopt electrified solutions, the demand for versatile and efficient sub-100Ah batteries continues to grow, reinforcing their dominance in the traction batteries market.

Technological advancements in the traction battery market are enhancing performance, efficiency, and sustainability. The development of high-energy-density batteries, particularly lithium-ion and solid-state technologies, is gaining prominence to meet the growing demand for longer ranges in electric vehicles (EVs).

Improved thermal management systems and advanced battery chemistries increase durability and safety, ensuring optimal performance under extreme conditions. Fast-charging technologies, such as silicon-anode batteries, significantly reduce charging times, supporting widespread EV adoption. Innovations in battery pack designs, including modular and lightweight structures, enhance energy efficiency and adaptability to various vehicle types.

Coating technologies, like ceramic or polymer coatings, extend battery lifespan by improving heat resistance and preventing electrode degradation. Additionally, integrating smart battery management systems (BMS) with real-time monitoring capabilities optimizes energy use and ensures safety during operation. These advancements position traction battery systems as a cornerstone of modern electric mobility, meeting the demands of a rapidly evolving transportation landscape.

Recent Industry Developments

The product type is further categorized into lead acid, nickel based, lithium-ion, and others.

The application is classified into electric vehicle (EV), battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), hybrid electric vehicle (HEV), industrial, forklift and others.

The capacity is classified into less than 100 Ah, 100-200 Ah, 200 Ah-300 Ah, 300-400 Ah.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The traction batteries was valued at USD 35.3 billion in 2024.

The demand for traction batteries is set to reach USD 39.9 billion in 2025.

The traction batteries is driven by rising demand for electric vehicles, advancements in battery technologies, government incentives, environmental concerns, and the push for renewable energy solutions in transportation.

The traction batteries demand is projected to reach USD 178.9 billion in 2035.

The lead-acid expected to lead during the forecasted period due to cost-effectiveness, reliability, established technology, and suitability for high-power applications in various industries.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Traction Battery Market Size and Share Forecast Outlook 2025 to 2035

Traction Motors Market Growth - Trends & Forecast 2025 to 2035

Traction Inverter Market

Traction Transformer Market

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

Skin Traction Kits Market

Rail Traction Transformers Market

Data Extraction Software Market

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Traction Motor Market Growth – Trends & Forecast 2025 to 2035

Railway Traction Inverter Market Growth - Trends & Forecast 2025 to 2035

Tissue Extraction System Market Size and Share Forecast Outlook 2025 to 2035

Carpet Extraction Cleaner Market Analysis- Trends, Growth & Forecast 2025 to 2035

Electric Traction Motor Market Share, Trends & Forecast 2024-2034

Faecal Extraction System Market

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA