The nucleic acid extraction kit market is experiencing consistent expansion driven by advancements in molecular biology, rising demand for accurate genetic analysis, and growing applications in clinical diagnostics and research. Current market conditions reflect strong utilization in laboratories and hospitals, supported by increasing adoption of automated extraction systems that enhance throughput and reproducibility. The demand for high-purity nucleic acids from varied biological matrices is accelerating innovation in reagent chemistry and kit design.

Continuous investment in life science research and the growing emphasis on precision medicine are further propelling market growth. The future outlook remains positive as emerging economies expand their research capabilities and diagnostic testing infrastructure.

Growth rationale is anchored on the widespread use of these kits in genomics, infectious disease testing, and biotechnology applications The combination of technological improvements, regulatory compliance, and user-friendly formats is expected to sustain steady revenue growth and broaden global adoption across healthcare and research sectors.

| Metric | Value |

|---|---|

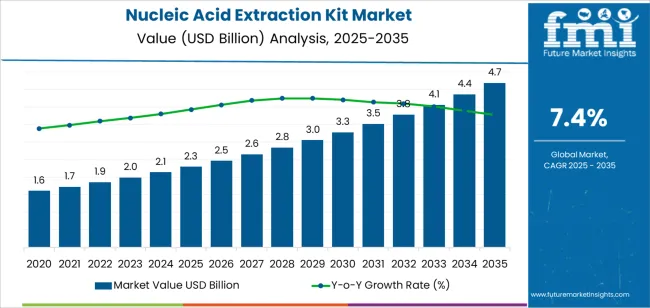

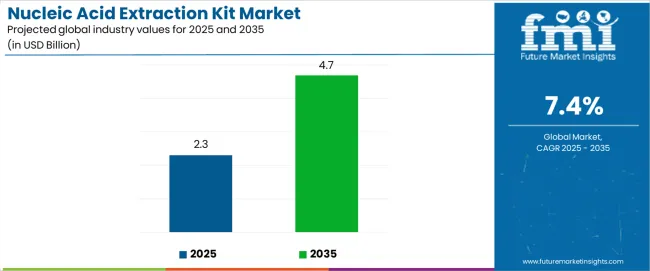

| Nucleic Acid Extraction Kit Market Estimated Value in (2025 E) | USD 2.3 billion |

| Nucleic Acid Extraction Kit Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

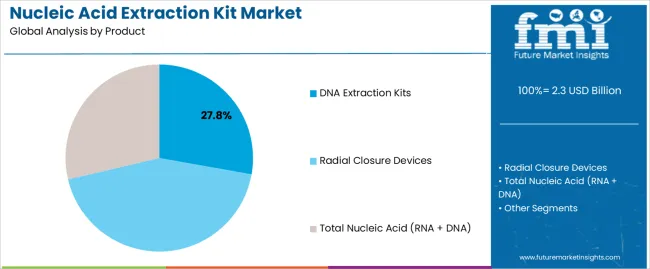

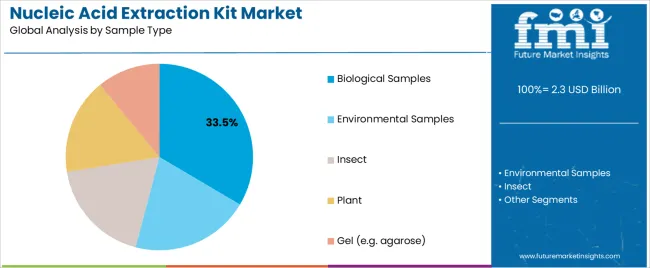

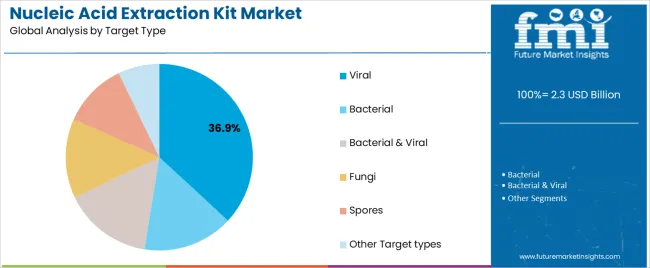

The market is segmented by Product, Sample Type, Target Type, Format, Purpose, Application, and End User and region. By Product, the market is divided into DNA Extraction Kits, Radial Closure Devices, and Total Nucleic Acid (RNA + DNA). In terms of Sample Type, the market is classified into Biological Samples, Environmental Samples, Insect, Plant, Gel (e.g. agarose), PCR Clean-Up (post-PCR amplification product extraction), and Other Sample Types. Based on Target Type, the market is segmented into Viral, Bacterial, Bacterial & Viral, Fungi, Spores, and Other Target types. By Format, the market is divided into Magnetic Beads (Automatable), Columns, 96-Well Plate, and Other Format. By Purpose, the market is segmented into Clinical Use and Research Use Only (RUO). By Application, the market is segmented into Disease Diagnosis, Drug Diagnosis, Cancer Research, cDNA library, Environmental DNA (eDNA) Studies, Food Safety Testing, GMO Detection, and Other Applications. By End User, the market is segmented into Diagnostic Laboratories, Hospitals, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Clinical Research Organizations, Forensic Labs, Food Testing Laboratories, and Agricultural and Environmental Research Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The DNA extraction kits segment, accounting for 27.80% of the product category, has emerged as the leading segment due to its extensive application in molecular diagnostics, genetic testing, and academic research. Its dominance is supported by the ability to yield high-quality DNA suitable for downstream applications such as PCR, sequencing, and cloning.

Technological enhancements in silica membrane and magnetic bead-based purification methods have improved efficiency, purity, and scalability. Market growth is further strengthened by automation compatibility and reduced processing times, making these kits highly preferred in both research and clinical settings.

Consistent product innovation, combined with the availability of standardized protocols, has enhanced reproducibility and reliability As molecular testing continues to expand globally, the DNA extraction kits segment is expected to maintain its leadership, driven by increasing laboratory throughput and continuous advances in extraction technologies.

The biological samples segment, representing 33.50% of the sample type category, leads the market owing to its broad applicability across clinical, forensic, and research laboratories. Its dominance stems from the versatility of biological matrices such as blood, tissue, and saliva, which serve as key sources for nucleic acid extraction.

Continuous improvements in sample lysis and purification chemistry have optimized yield and integrity, allowing for higher diagnostic sensitivity. Adoption is being accelerated by the need for reliable sample processing in infectious disease testing and genetic research.

The segment’s share is also supported by the widespread availability of compatible automation platforms that simplify workflow and minimize contamination risks As diagnostic networks expand and personalized medicine initiatives progress, demand for efficient nucleic acid extraction from biological samples is projected to rise steadily, reinforcing this segment’s leading position.

The viral target segment, holding 36.90% of the target type category, has achieved leadership due to growing testing volumes for viral pathogens and the expanding role of molecular assays in infectious disease management. The COVID-19 pandemic accelerated the adoption of viral extraction kits, and ongoing surveillance for emerging viruses continues to sustain demand.

Advancements in viral RNA and DNA purification protocols have improved sensitivity and reproducibility, ensuring accurate downstream analysis. Regulatory alignment and validated kit performance have strengthened end-user confidence, particularly in clinical diagnostics and public health laboratories.

Manufacturers are focusing on scalable solutions compatible with high-throughput systems to meet testing surges efficiently The segment’s outlook remains strong as global health agencies prioritize early detection and genomic monitoring of viral diseases, ensuring that viral extraction kits continue to dominate within the nucleic acid extraction kit market.

Global sales of nucleic acid extraction kits recorded a CAGR of 6.1% from 2020 to 2025. The nucleic acid extraction kit market accounted for around 16.3% of the global molecular diagnostics kit market, valued at USD 11,134.3 million.

Over the forecast period, the global nucleic acid extraction kit industry is set to expand at 7.1% CAGR. It will likely total a valuation of USD 4,285.08 million by 2035, driven by factors like rising prevalence of chronic disease and growing demand for molecular diagnostics.

In the past few years, government agencies in the Asia-Pacific and Middle East regions have effectively motivated manufacturers to contribute to the expansion of the healthcare and biopharmacy sectors. Major companies have the opportunity to capitalize on this encouragement to enhance their standing in the market.

Countries in the Asia-Pacific region, particularly developing ones like India, have removed export restrictions on diagnostic kits and reagents. This includes equipment like nucleic acid extraction kits and systems used for detecting coronavirus infections.

The below table shows the estimated growth rates of the top countries. China, India, and the United Kingdom are set to record higher CAGRs of 13.0%, 8.5%, and 8.6% respectively, through 2035.

Market Growth Outlook by Key Countries

| Countries | Projected Nucleic Acid Extraction Kit Market CAGR |

|---|---|

| United States | 4.1% |

| Germany | 6.0% |

| United Kingdom | 8.6% |

| Japan | 7.9% |

| China | 13.0% |

| India | 8.5% |

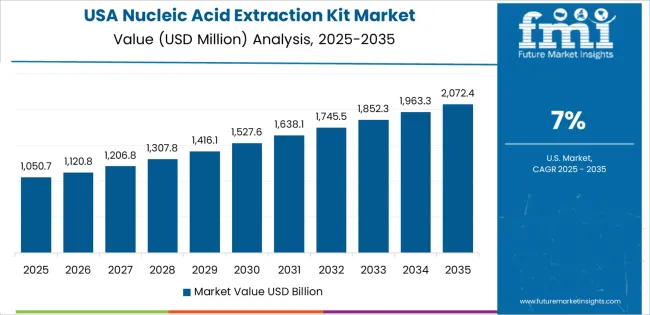

The United States nucleic acid extraction kit market is estimated to be valued at USD 2.3 million in 2025. It will likely exhibit steady growth, with overall demand for nucleic acid extraction kits rising at 4.1% CAGR through 2035. This can be attributed to factors like:

The United States is a frontrunner in the nucleic acid extraction kit market due to several factors. Firstly, the nation boasts a robust research infrastructure with well-established laboratories and academic institutions that conduct extensive genomic research.

Institutions such as the National Institutes of Health (NIH) and leading universities contribute significantly to the demand for nucleic acid extraction kits. Similarly, rising trend of personalized medicine will likely propel nucleic acid extraction kits demand in the nation.

The United States has a well-established healthcare system that emphasizes precision medicine and personalized treatments. This will continue to create a steady demand for nucleic acid extraction kits in clinical diagnostics and research.

China is anticipated to emerge as the hotbed for nucleic acid extraction kit manufacturers during the forecast period. The latest report predicts China nucleic acid extraction kit market to thrive at 13.0% CAGR during the forecast period. Some of the key drivers/trends include:

China's expansion in the nucleic acid extraction kit market is notable, driven by advancements in biotechnology and molecular diagnostics. The country's robust investment in research and development, coupled with a burgeoning healthcare sector, is propelling demand for nucleic acid extraction kits.

Growing awareness and adoption of molecular testing techniques in various applications, including academic research and clinical diagnostics, contribute to rapid market growth. Subsequently, development of innovative nucleic acid kits is set to support market expansion.

Sales of nucleic acid extraction kits in India are poised to grow at a CAGR of 8.5% throughout the forecast period. Accordingly, the nucleic acid extraction kit market in India is estimated to be valued at USD 102.05 million, driven by factors like:

India is making significant strides in the nucleic acid extraction kit market, showcasing positive growth trends. The nation's advancements in biotechnology and molecular research are contributing to a notable improvement in this sector.

Increasing investment in research and development, coupled with a growing emphasis on healthcare infrastructure, are set to boost market growth in India. The nation is poised to make valuable contributions to the field, reflecting its commitment to advancing biotechnological capabilities and fostering innovation in nucleic acid extraction technologies.

The table section offers detailed insights into top segments in the nucleic acid extraction kit industry. This information will likely allow players to frame their strategies accordingly to boost revenue and stay ahead of the competition.

Market Growth Outlook by Key Products

| Products | Value CAGR |

|---|---|

| DNA Extraction Kits | 6.2% |

| Radial Closure Devices | 8.0% |

| Total Nucleic Acid (RNA + DNA) | 9.6% |

As per the latest analysis, the DNA extraction kits segment is expected to dominate the global market, holding a revenue share of 49.1% in 2025. Over the forecast period, demand for DNA extraction kits is set to increase at 6.2% CAGR.

Market Growth Outlook by Key Samples

| Sample Type | Value CAGR |

|---|---|

| Biological Samples | 5.4% |

| Environmental Samples | 7.0% |

| Insect | 9.8% |

| Plant | 7.1% |

| Gel (e.g. agarose) | 8.5% |

| PCR Clean-up (post-PCR amplification product extraction) | 12.1% |

Based on sample type, the biological samples segment is poised to grow at 5.4% CAGR during the assessment period. It will likely hold a market share of 45.2% in 2025.

Market Growth Outlook by Key Target Type

| Target Type | Value CAGR |

|---|---|

| Bacterial | 5.6% |

| Viral | 7.0% |

| Bacterial & Viral | 7.9% |

| Fungi | 8.6% |

| Spores | 9.8% |

| Other Target types | 10.7% |

The bacterial segment is expected to retain its market dominance, holding a market share of 31.5% in 2025. Further, it will likely record a CAGR of 5.6% throughout the assessment period.

Market Growth Outlook by Key Format

| Format | Value CAGR |

|---|---|

| Columns | 9.5% |

| 96-Well Plate | 5.4% |

| Magnetic Beads (Automatable) | 7.1% |

| Other Format | 10.0% |

Based on format, the 96-well plate segment is set to lead the global market, with a share of 37.9% in 2025. It will also exhibit a CAGR of 5.4% between 2025 and 2035.

Market Growth Outlook by Key Purpose

| Purpose | Value CAGR |

|---|---|

| Research Use Only (RUO) | 6.4% |

| Clinical Use | 9.2% |

As per the latest report, nucleic acid extraction kit consumption remains high in research projects. The target segment will likely grow at 6.4% CAGR during the forecast period, holding a value share of 65.3% in 2025.

Market Growth Outlook by Key Application

| Application | Value CAGR |

|---|---|

| Disease Diagnosis | 4.6% |

| Drug Diagnosis | 6.4% |

| Cancer Research | 7.1% |

| cDNA library | 7.8% |

| Environmental DNA (eDNA) Studies | 8.7% |

| Food Safety Testing | 9.7% |

| GMO Detection | 10.0% |

| Other Applications | 11.0% |

| Disease Diagnosis | 4.6% |

Based on application, the disease diagnosis segment is projected to generate significant revenue for the market. As per the latest analysis, the target segment will likely progress at 4.6% CAGR during the forecast period, totaling revenue worth USD 482.28 million in 2025.

Market Growth Outlook by Key End User

| End User | Value CAGR |

|---|---|

| Hospitals | 5.4% |

| Academic & Research Institutes | 9.4% |

| Pharmaceutical & Biotechnology Companies | 8.4% |

| Clinical Research Organizations | 6.4% |

| Diagnostic Laboratories | 4.6% |

| Forensic Labs | 10.5% |

| Food Testing Laboratories | 10.1% |

| Agricultural and Environmental Research Institutes | 12.3% |

Diagnostic laboratories are expected to remain leading end users of nucleic acid extraction kits during the forecast period. The target segment will likely exhibit a 4.6% CAGR, holding a market share of 24.4% in 2025.

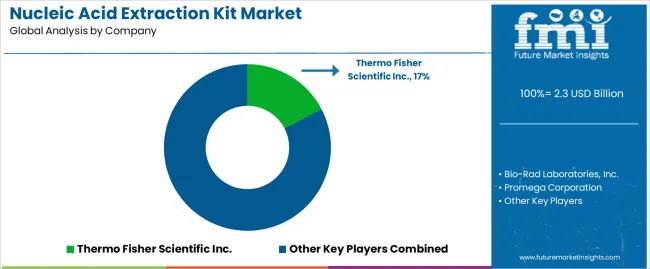

Key manufacturers of nucleic acid extraction kits are increasingly investing in research and development to advance in nucleic acid extraction technology. They are continuously introducing new kits and other solutions, as well as implementing strategies acquisitions, mergers, and partnerships to stay ahead of the competition.

Recent Developments in the Nucleic Acid Extraction Kit Market

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 2.3 billion |

| Projected Market Size (2035) | USD 4.7 billion |

| Expected Growth Rate (2025 to 2035) | 7.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; and Middle East & Africa |

| Key Countries Covered | United States, Canada, Mexico, Brazil, Chile, China, Japan, South Korea, India, ASEAN Countries, Australia & New Zealand, Germany, Italy, France, United Kingdom, Spain, BENELUX, Nordic Countries, Russia, Hungary, Poland, Saudi Arabia, Türkiye, South Africa, Other African Union. |

| Key Market Segments Covered | Product Type, Sample Type, Target Type, Format, Purpose, Application, End User, and Region |

| Key Companies Profiled | Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific Inc.; Promega Corporation; Agilent Technologies, Inc.; Merck KGaA; Bioneer Corporation; PerkinElmer Inc.; LGC Biosearch Technologies; QIAGEN; GeneBio Systems, Inc.; Takara Bio Inc.; F. Hoffmann-La Roche Ltd; GeneReach Biotechnology Corp.; Akonni Biosystems, Inc.; Primerdesign Ltd; ProtonDx; GVS S.p.A.; TRIVITRON HEALTHCARE PVT. LTD.; Almanac Life Science India; New England Biolabs.; RBC Bioscience Corp.; Zymo Research Corporation.; Omega Bio-tek, Inc.; Molzym GmbH & Co. KG |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global nucleic acid extraction kit market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the nucleic acid extraction kit market is projected to reach USD 4.7 billion by 2035.

The nucleic acid extraction kit market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in nucleic acid extraction kit market are dna extraction kits, _sequence-specific dna, _cell-free dna (cfdna), _tissue dna extraction kits, radial closure devices, _total rna, _purified rnas, _viral rna, _sequence-specific rna and total nucleic acid (rna + dna).

In terms of sample type, biological samples segment to command 33.5% share in the nucleic acid extraction kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nucleic Acid and Gene Therapies in Neuromuscular Disorders Market Size and Share Forecast Outlook 2025 to 2035

Nucleic Acid Isolation and Purification Market Analysis by DNA Extraction and Purification Kits and RNA Extraction and Purification Kits Through 2035

Nucleic Acid Testing Market is segmented by product, indication and end user from 2025 to 2035

Nucleic acid electrophoresis and blotting market

Nucleic Acid Test Kits for Pets Market Size and Share Forecast Outlook 2025 to 2035

Automated Nucleic Acid Extraction Systems Market Analysis – Growth, Trends & Forecast 2024-2034

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA