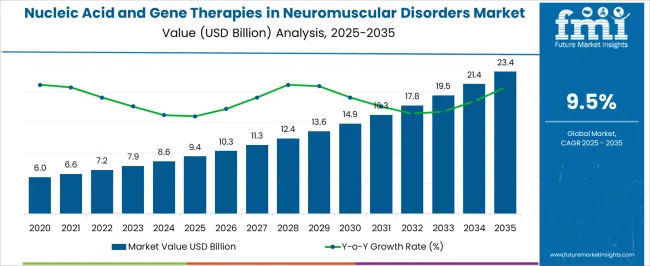

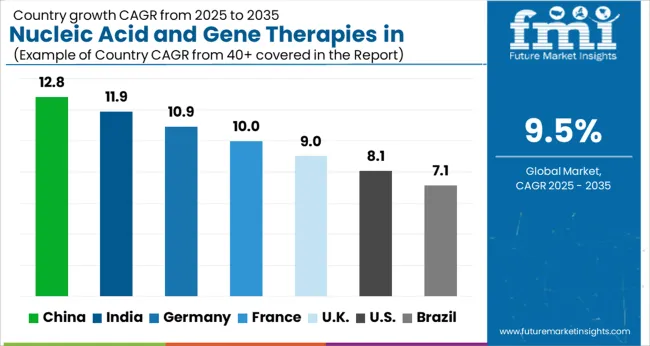

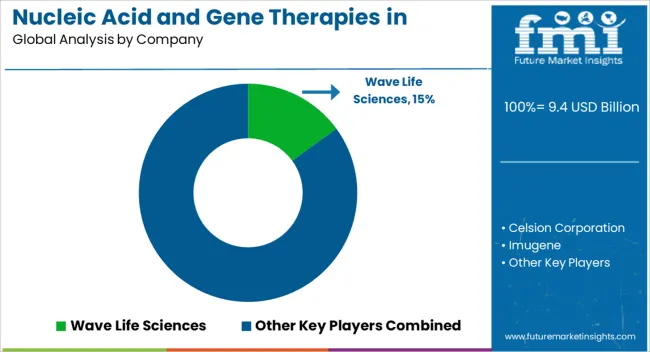

The Nucleic Acid and Gene Therapies in Neuromuscular Disorders Market is estimated to be valued at USD 9.4 billion in 2025 and is projected to reach USD 23.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Nucleic Acid and Gene Therapies in Neuromuscular Disorders Market Estimated Value in (2025 E) | USD 9.4 billion |

| Nucleic Acid and Gene Therapies in Neuromuscular Disorders Market Forecast Value in (2035 F) | USD 23.4 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The Nucleic Acid and Gene Therapies in Neuromuscular Disorders market is experiencing significant momentum, driven by the increasing prevalence of genetically linked neuromuscular conditions and the expanding application of precision medicine. The current market landscape is defined by advancements in viral vector delivery systems, growing regulatory support for orphan drug development, and a rising pipeline of clinical-stage gene therapies targeting rare disorders.

Strategic collaborations between biotechnology firms and academic institutions are accelerating innovation in this space, particularly in addressing previously untreatable diseases. Insights from industry publications and corporate press releases indicate that increasing patient advocacy and supportive policy environments are contributing to faster clinical adoption.

The future outlook remains promising, with transformative therapies receiving accelerated approvals and expanded access programs being rolled out across multiple regions As clinical outcomes continue to demonstrate improved functionality and quality of life for affected individuals, investment in this field is expected to intensify, ensuring sustained growth in both research and commercial deployment globally.

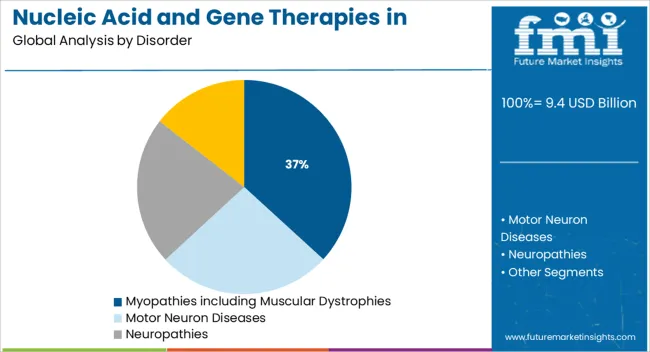

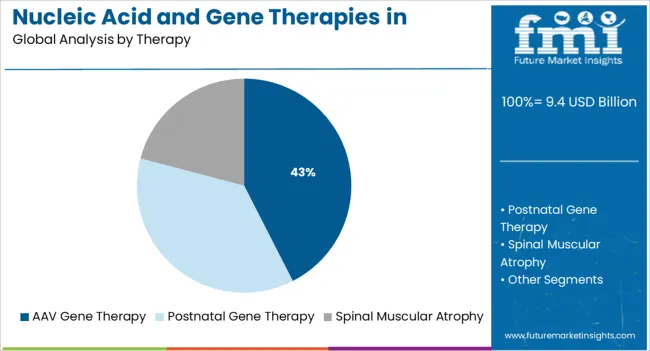

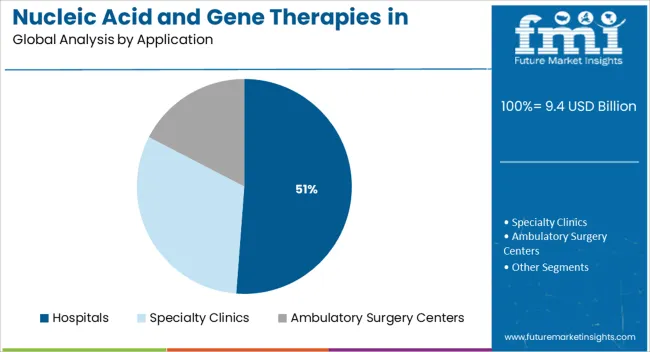

The market is segmented by Disorder, Therapy, and Application and region. By Disorder, the market is divided into Myopathies including Muscular Dystrophies, Motor Neuron Diseases, Neuropathies, and Neuromuscular Junction Disorders. In terms of Therapy, the market is classified into AAV Gene Therapy, Postnatal Gene Therapy, and Spinal Muscular Atrophy. Based on Application, the market is segmented into Hospitals, Specialty Clinics, and Ambulatory Surgery Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The myopathies including muscular dystrophies segment is projected to account for 36.8% of the Nucleic Acid and Gene Therapies in Neuromuscular Disorders market revenue share in 2025, making it the leading disorder segment. This leadership is being driven by the high genetic burden and clinical severity associated with muscular dystrophies, which have historically lacked curative options.

Significant attention from biotechnology developers has been focused on Duchenne and Becker muscular dystrophies, leading to rapid advances in nucleic acid and gene therapies. Hospital case studies and medical journals have emphasized the increasing availability of targeted therapeutic solutions aimed at correcting or compensating for genetic mutations at the molecular level.

Regulatory incentives for rare disease treatments, including fast-track designations and breakthrough therapy status, have further accelerated progress The segment’s dominant share is also being reinforced by strong patient advocacy networks and growing participation in clinical trials, which are helping to validate and expand access to these therapies.

The AAV gene therapy segment is expected to contribute 42.5% of the total market revenue share in 2025, making it the leading therapy segment. This dominance is being supported by the proven safety profile and delivery efficiency of adeno-associated virus vectors in gene therapy applications.

As highlighted in clinical research updates and biotech investor communications, AAV vectors have become the preferred modality for delivering genetic material into target cells with high specificity and minimal immune response. The segment’s growth has been propelled by the successful approval and commercialization of several AAV-based therapies in neuromuscular disorders, which has increased industry confidence and attracted substantial R&D investment.

Additionally, scalable manufacturing processes and ongoing innovations in capsid engineering are enabling broader therapeutic applications These factors, combined with increasing support from regulatory authorities and long-term durability of treatment effects, have positioned AAV gene therapy as a foundational platform in the neuromuscular therapeutics landscape.

The hospitals segment is forecasted to hold 51.2% of the market revenue share in 2025, making it the leading application segment. This dominance is attributed to the centralized infrastructure and specialized clinical expertise available in hospital settings, which are essential for the administration of advanced gene and nucleic acid therapies. As reported in healthcare system briefings and clinical practice updates, hospitals serve as primary centers for the infusion, monitoring, and post-treatment care of patients receiving high-cost, precision-based therapies.

These institutions are also equipped with the necessary diagnostic and genomic screening tools that support patient selection and treatment customization. Furthermore, hospitals often participate in clinical trials and early-access programs, giving them a pivotal role in driving adoption and enabling real-world evidence collection.

The segment’s prominence is also being sustained by reimbursement frameworks that prioritize treatment delivery through accredited centers of excellence This centralized approach ensures safety, compliance, and optimal therapeutic outcomes, further reinforcing the hospital segment’s leadership in this evolving market.

The global demand for Nucleic Acid And Gene Therapies In Neuromuscular Disorders is projected to increase at a CAGR of 9.5% during the forecast period between 2025 and 2035, reaching a total of USD 23.4 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 3.5%.

According to Future Market Insights, a market research and competitive intelligence provider, the Nucleic Acid And Gene Therapies In the Neuromuscular Disorders market were valued at USD 9.4 Billion in 2025.

Factors including a surge in government initiatives to ensure early diagnosis, an increase in awareness about genetic disorders, enhanced healthcare infrastructure, and a rise in research and development activities are anticipated to propel the growth of nucleic acid and gene therapies in the neuromuscular disorders market during the forecast period.

According to a study conducted in 2014, the prevalence rate of neuromuscular disorders was between 1 and 10 per 100,000, except for multifocal motor neuropathy, Lambert-Eaton myasthenic syndrome, Emery-Dreifuss dystrophy, oculopharyngeal muscular dystrophy, and congenital muscular dystrophies, which was <1/100,000. Post-polio syndrome and Charcot-Marie-Tooth disease had a prevalence of >10/100,000.

Diagnosis of neuromuscular disorders is performed through physical examination as well as certain diagnostic tests. A physician runs a complete medical history assessment, in order to assess the condition of a patient to determine if any family member had previously had symptoms of neuromuscular disorders. Currently, there is no cure for neuromuscular disorders. However, research is being done on genetic therapies and new medications to develop a cure. These are lifelong disorders and cannot be cured completely, but can be managed to help individuals to maximize their capabilities.

Rise in R&D Activities to Fuel the Market Growth

Neuromuscular diseases are a broad category of disorders that cause progressive motor function impairment. Motor neurons, skeletal muscle, or their synaptic connection, the neuromuscular junction, are the most common Neuromuscular Disorders. MNs [e.g., amyotrophic lateral sclerosis caused by direct loss or retrograde degeneration of MNs], muscle [e.g., Duchenne muscular dystrophy or myotonic dystrophy], NMJs [e.g., myasthenia gravis or congenital myasthenic syndromes], or a combination of these [e.g. (e.g., Pompe disease).

Moreover, regardless of its source, the structural and functional deficit in a targeted tissue will resonate throughout the motor unit, resulting in multiple shared symptoms among different Neuromuscular Disorders.

Methods to differentiate hiPSCs into neuronal cells have advanced rapidly in the last decade, because of an increased understanding of early neural development and the commitment of neuro progenitor cells to highly specialized neural subtypes, including MNs. The MNs are found throughout the CNS and are divided into upper MNs (UMNs) and lower MNs (LMNs), which are developmentally and genetically distinct despite their shared nomenclature. Different NMDs can target UMNs and LMNs, making their distinction important when modeling NMDs. The cerebral cortex's pre-motor and primary motor regions are where UMNs originate. As a result, many recent breakthroughs in neuromuscular disease therapy development have been made.

There are approximately 200 products in the pipeline for neuromuscular disorders, with a roughly 50:50 ratio of preclinical to clinical development. Most target amyotrophic lateral sclerosis (ALS) and Duchenne's muscular dystrophy (DMD). Recent technological advancements have aided the development of several different types of therapies. In 2020, small molecules (targeting receptor modulation, epigenetic reprogramming, redox metabolism, and other mechanisms), gene therapy, and antisense oligonucleotides accounted for nearly half of the nearly 200 potential therapies for neuromuscular diseases under development (Aitken et al., 2020). The US Food and Drug Administration recently approved ASO and gene therapy. Thus, these factors are anticipated to fuel market growth in the forthcoming years.

Novel Drug Approvals to Accelerate the Market Growth

Novel drug approvals are one of the key factors that are projected to augment the growth of nucleic acid and gene therapies in the neuromuscular disorders market. There has been an increase in drug approvals in the market for treating various neuromuscular indications in recent years. This is attributed to the advanced research being conducted on highly morbid and progressive indications.

Spinal muscular atrophy is one of the major neuromuscular diseases for which the market has witnessed therapeutic approvals. Spinal muscular atrophy is morbid and rapidly progressive neuromuscular. It is caused by the death of a type of nerve cell, called motor neurons, in the spinal cord. Treatments using drugs are not effective and do not stop the disease progression due to the rapidly progressive nature of the disease.

To overcome this challenge, various vendors are conducting research on the development of novel gene therapies and antisense therapies that can stop the progression of the disease and increase the life expectancy of patients. Hence, these factors are expected to accelerate the growth of the market growth during the forecast period.

Exorbitant Treatment Costs to Restrain the Market Growth

Regardless of the increasing prevalence of chronic disorders such as SMA and cancer, the treatment method for neuromuscular disorders is extremely expensive. The method is majorly advertised as a single-dose treatment regime that reverses the genetic dysfunction in the patient’s body. As per Novartis AG, a single dose of Kymriah, the therapy cancer drug costs a whopping USD 475,000. The same drug is priced at USD 306,000 in Japan.

This expensive therapy has also encouraged reluctance to reimburse the treatment method by some insurance companies. This is one of the major factors that is expected to hinder the growth of nucleic acid and gene therapies in the neuromuscular disorders market during the forecast period.

Additionally, low awareness in developing countries and a lack of diagnostic facilities are other factors that will hamper market growth in the near future.

Side Effects Associated with Neuromuscular Therapeutics to Limit the Market Growth

Myasthenia gravis (MG) is a neuromuscular junction disorder that causes varying degrees of weakness in the body's skeletal muscles. Although there is currently no cure for MG, traditional therapies such as acetylcholinesterase inhibitors as well as immunomodulating therapies (corticosteroids, azathioprine, and mycophenolate mofetil) enable most patients to live productive lives with an average life expectancy.

However, these therapies are associated with side effects such as nausea, vomiting, gastrointestinal (GI) upset, increased infection risk, weight gain, and liver damage, which can deter patients from using the medications.

Additionally, poor adherence is also a result of unsatisfactory treatment outcomes with traditional MG therapies, with 23 percent of patients reporting poor treatment compliance. Despite this, patient-reported information on the exact nature, duration, and severity of these side effects is scarce. Moreover, stringent regulations imposed by governments are another major factor that is expected to impede market growth over the analysis period.

Better Healthcare Infrastructure in the Region to Fuel the Market Growth

The Nucleic Acid And Gene Therapies In Neuromuscular Disorders Market in North America is expected to accumulate the highest market share of 46% in 2025.

Factors such as the increasing patient population, presence of major market players in North America, and better healthcare infrastructure are projected to boost the regional market growth during the forecast period. Moreover, increasing approvals of novel nucleic acid treatments and the availability of nucleic acid extraction technology are other factors that are expected to accelerate the market growth in the region. For instance, neuromuscular diseases (NMDs) are a broad category of disorders that affect an estimated 250,000 people in the United States.

In addition, in December 2024, Vyvgart (efgartigimod) received approval from the US Food and Drug Administration for the treatment of generalized myasthenia gravis (gMG) in adults who test positive for the anti-acetylcholine receptor (AChR) antibody. The region is expected to hold the highest CAGR of 9.4% during the forecast period.

Increasing Population in the Region to Fuel the Market Growth

The Nucleic Acid And Gene Therapies In Neuromuscular Disorders Market in Asia Pacific are expected to accumulate the highest market share of 44% in 2025.

The Asia Pacific hypophosphatasia market is anticipated to register significant growth during the analysis period, attributed to factors such as an increase in population, high acceptance of new treatment methodologies, as well as improvement in healthcare infrastructure in countries such as India. Furthermore, the rise in focus of major market players in Asia Pacific is another major factor that will propel the revenue share of the regional market during the forecast period.

An increase in investment, strong collaboration among research institutes and private players, and high awareness regarding the treatment are other factors that are anticipated to escalate the growth of the market in the region in the near future. The region is expected to hold the highest CAGR of 9.3% during the forecast period.

Spinal Muscular Atrophy Segment to Drive the Nucleic Acid And Gene Therapies In Neuromuscular Disorders Market

Based on the Therapy, the Spinal Muscular Atrophy segment is expected to witness a significant growth of 46% in 2025, and the trend is expected to continue during the forecast period, expanding at a rapid rate of 9.4% CAGR over the analysis period.

The segment’s growth is attributed to the SMA being a good example of a monogenic disease that currently has an AAV9-based vector gene therapy as a therapeutic option. In addition, the rise in the incidence of cancer and other target diseases, the availability of reimbursement policies, as well as the increase in funding for gene therapy research are other major factors escalating the growth of the segment.

Hospitals Segment to Drive the Nucleic Acid And Gene Therapies In Neuromuscular Disorders Market

Based on the Application, the hospital's segment is expected to witness a significant growth of 45% in 2025, and the trend is expected to continue during the forecast period, expanding at a rapid rate of 9.3% CAGR over the analysis period.

In terms of application, the hospital segment is expected to have the highest share of the market during the forecast period. The dominance is attributed to the high availability as well as the accessibility of the treatment methods in such facilities.

Nucleic Acid And Gene Therapies In Neuromuscular Disorders Market startup players are adopting various marketing strategies such as new product launches, geographical expansion, mergers and acquisitions, partnerships, and collaboration to identify the interest of potential patients and create a larger customer base. For instance,

Prominent players in the Nucleic Acid And Gene Therapies In Neuromuscular Disorders market are Pfizer, Inc., F. Hoffmann-La Roche Ltd., UCB Pharma, Biogen, Astellas Pharma, Inc., Novartis AG, Abbott Laboratories, Inc., and Sanofi, among others.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.5% from 2025 to 2035 |

| Market Value in 2025 | USD 9.4 billion |

| Market Value in 2035 | USD 23.4 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Disorder, Therapy, Application, Region |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

| Key Countries Profiled | The US, Canada, Brazil, Mexico, Germany, The UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Pfizer, Inc.; F. Hoffmann-La Roche Ltd.; UCB Pharma; Biogen; Astellas Pharma, Inc.; Novartis AG; Abbott Laboratories, Inc.; Sanofi |

The global nucleic acid and gene therapies in neuromuscular disorders market is estimated to be valued at USD 9.4 billion in 2025.

The market size for the nucleic acid and gene therapies in neuromuscular disorders market is projected to reach USD 23.4 billion by 2035.

The nucleic acid and gene therapies in neuromuscular disorders market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in nucleic acid and gene therapies in neuromuscular disorders market are myopathies including muscular dystrophies, motor neuron diseases, neuropathies and neuromuscular junction disorders.

In terms of therapy, aav gene therapy segment to command 42.5% share in the nucleic acid and gene therapies in neuromuscular disorders market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nucleic Acid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Nucleic Acid Test Kits for Pets Market Size and Share Forecast Outlook 2025 to 2035

Nucleic Acid Testing Market is segmented by product, indication and end user from 2025 to 2035

Nucleic Acid Isolation and Purification Market Analysis by DNA Extraction and Purification Kits and RNA Extraction and Purification Kits Through 2035

Nucleic acid electrophoresis and blotting market

Automated Nucleic Acid Extraction Systems Market Analysis – Growth, Trends & Forecast 2024-2034

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Acid Proof Lining Market Trends 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA