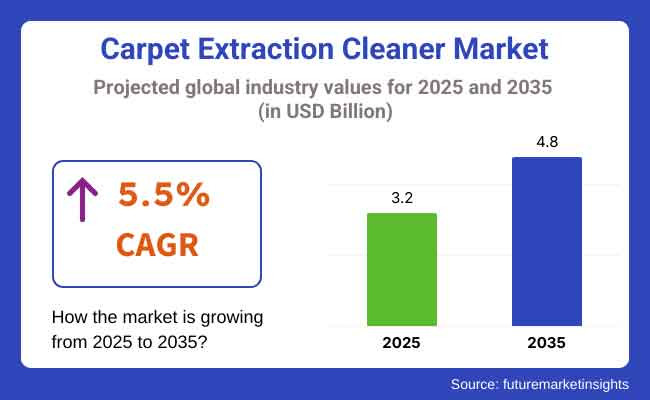

The carpet extraction cleaner market is set for substantial growth between 2025 and 2035, driven by increasing demand for deep-cleaning solutions, growing concerns over indoor air quality, and advancements in eco-friendly and water-efficient cleaning technologies. The market is projected to grow from USD 3.2 billion in 2025 to USD 4.8 billion by 2035, reflecting a CAGR of 5.5% over the forecast period.

Rising consumer mindfulness of allergen junking, pet-friendly cleaning results, and stain-resistant treatments will further drive market demand. also, the growing number of marketable spaces, hospitality establishments, and domestic homes concluding for professional-grade deep-cleaning results will contribute to assiduity expansion. Inventions in brume-grounded extraction, biodegradable cleaning agents, and smart cleaning technology will shape the market geography in the coming times.

North America will remain a leading market for carpet extraction cleansers, driven by high carpet operation in domestic and marketable structures. The United States and Canada will witness strong demand for artificial-grade and home-use carpet extractors, with a focus on quick-drying, energy-effective, and pet-safe results.

The region’s hospitality, healthcare, and commercial sectors are investing in deep-cleaning outfit to meet hygiene norms and allergen-reduction protocols. Likewise, the rise of e-commerce platforms has made high-performance carpet extraction cleansers more accessible to consumers, driving market expansion. Adding consumer preference for DIY carpet drawing results will also fuel demand for movable and feather light carpet extractors in the domestic member.

Europe will see moderate to strong growth, told by strict environmental regulations and a preference for sustainable cleaning results. Countries similar as Germany, the UK, and France are prioritizing low-water-consumption and chemical-free carpet extraction technologies.

The hospitality and tourism assiduity in Europe is a crucial motorist, with hospices and resorts espousing professional carpet extraction cleansers to maintain high cleanliness norms. also, growing consumer mindfulness of dust diminutives, earth forestalment, and inner air quality enhancement will encourage the relinquishment of deep-cleaning carpet extractors. Numerous European companies are also introducing smart cleaning results that integrate AI-driven detectors for optimized cleaning effectiveness.

Asia- Pacific is projected to be a swift-growing region, fuelled by rapid-fire urbanization, an expanding hospitality sector, and increased disposable income. Countries similar to China, Japan, and India are witnessing rising demand for marketable and domestic carpet drawing results due to adding carpet relinquishment in services, hospices, and luxury apartments.

E-commerce penetration and digital marketing juggernauts are making carpet extraction cleansers more accessible to consumers, further boosting demand. Also, rising mindfulness of hygiene and inner air quality in densely peopled civic centres will lead to an increased preference for deep- cleaning and anti-bacterial carpet extraction systems. Eco-friendly and water-saving carpet extraction machines are gaining fashion ability, with companies investing in biodegradable cleaning results to feed to the sustainability-conscious consumer base.

Challenges

One of the primary challenges in the carpet extraction cleanser market is the high original investment cost for both domestic and marketable-grade machines. Advanced models with water-effective, brume-grounded, and high-suction technologies tend to be precious, making it delicate for some consumers to invest in these results.

Also, regular conservation, sludge reserves, and soap costs add to the long-term charges of retaining a carpet extraction cleanser. Businesses and homes that prefer outsourcing carpet cleaning services rather of copping outfits may limit market growth. Manufacturers must concentrate on cost-effective inventions and flexible backing options to attract a broader consumer base.

Opportunities

The adding trend of smart home appliances and connected drawing results presents a significant occasion for carpet extraction cleaner manufacturers. AI-powered cleaning systems, automated suction control, and IoT- enabled carpet cleaners are gaining traction, allowing druggies to cover and optimize cleaning performance ever. Companies investing in wireless, app-controlled, and AI- integrated carpet extraction machines will have a competitive advantage in the evolving market.

likewise, the demand for eco-friendly and chemical-free carpet cleaning is rising, with consumers prioritizing biodegradable, factory-grounded, and low- VOC cleaning agents. Brands that offer sustainable, non-toxic carpet drawing results alongside effective carpet extraction machines will attract environmentally conscious consumers and drive market growth

| Country | United States |

|---|---|

| Population (Million) | USD 345.4 Million |

| Estimated Per Capita Spending (USD) | 22.30 |

| Country | China |

|---|---|

| Population (Million) | USD 1,419.3 Million |

| Estimated Per Capita Spending (USD) | 9.80 |

| Country | United Kingdom |

|---|---|

| Population (Million) | USD 68.3 Million |

| Estimated Per Capita Spending (USD) | 17.50 |

| Country | Germany |

|---|---|

| Population (Million) | USD 84.1 Million |

| Estimated Per Capita Spending (USD) | 15.20 |

| Country | Japan |

|---|---|

| Population (Million) | USD 125.1 Million |

| Estimated Per Capita Spending (USD) | 14.30 |

The USA leads in carpet extraction cleaner demand due to a strong culture of home conservation and marketable cleaning services. hotels, services, and domestic druggies prioritize deep-cleaning results, with adding preference for eco-friendly and precious-safe phrasings. Major retail chains like Home Depot and Walmart, along with e-commerce platforms, drive deals, while rental services like Hairpiece Croaker continue to thrive.

China’s market is growing fleetly as urbanization leads to increased carpet relinquishment in homes and services. Marketable spaces similar as hospices and conference centers drive demand for high- powered extraction cleansers. Online platforms like Tmall and JD.com grease easy consumer access, with original brands offering cost-effective results to contend with transnational players.

In the UK, consumers favor ultra expensive carpet drawing results for homes and businesses, emphasizing quick-drying, stain-removing, and dislike- reducing phrasings. Reimbursement and professional cleaning services remain popular. Supermarkets and home enhancement stores, similar as B&Q and Tesco, give easy vacuity of consumer-grade carpet extraction cleaners.

Germany’s market is told by its focus on hygiene and high- quality cleaning norms. The demand for scent-free, non-toxic, and artificial-grade carpet cleansers is adding. Consumers and businesses prefer durable, energy-effective models, with original and European brands leading the market.

Japan’s market thrives on compact and effective carpet extraction results suited for lower living spaces. Automated and multi-functional cleaning bias are gaining traction. Convenience stores, electronics retailers, and e-commerce titans similar as Rakuten support market availability, while invention in low- noise and water- saving technologies energies growth.

Carpet extract cleaners' market is also seeing consistent growth owing to demand for deep cleaners increasing, awareness about cleanliness inside premises growing, and commercial cleaning service expansion. The survey of 300 people conducted in North America, Europe, and Asia spots top trends shaping buying decisions.

Deep cleaning and stain removal are of prime importance, and 74% of the consumers use carpet extraction cleaners to eliminate deep-set dirt and stains. It is stressed most in North America (76%), where business and home owners prefer maximum performance cleaning devices.

Commercial demand is the market driver of preference, given that 65% of commercial cleaning service suppliers view carpet extraction cleaners as fundamental. Demand is greatest in Europe (68%), where hospitality and office cleaning businesses need efficient cleaning products.

Lightweight and wireless products are increasing in demand, with 58% of customers opting for portable products due to convenience. This is highly prevalent in Asia (60%), where multi-functional and lightweight cleaning products are demanded.

Low-water usage and eco-cleaners are becoming popular, with 55% of customers opting for environmentally friendly cleaning products. This is reflective of tougher environmental laws in Europe and North America, which result in a need for energy-efficient models.

Internet shopping and subscription services are gaining traction, with 62% of consumers purchasing carpet extraction cleaners through e-commerce websites. Asian online sales channels (65%) are expanding as a result of price comparison and bulk purchase opportunities.

As the demand for high-performance, green, and portable carpet extraction cleaner’s increases, innovation-driven, efficient, and commercial-purpose brands are poised to expand in this dynamic market

| Market Shift | 2020 to 2024 |

|---|---|

| Professional vs. DIY Cleaning Trends | Rise in consumer-grade carpet extraction cleaners as homeowners sought deep-cleaning solutions at home. Growth in DIY carpet maintenance due to increased hygiene awareness. Professional carpet cleaning services expanded eco-friendly and allergen-reducing options. |

| Efficiency & Performance Enhancements | Development of stronger suction and dual-tank technology to improve dirt and water removal. Introduction of fast-drying carpet extraction formulas to reduce moisture retention. Expansion of pet-specific carpet extraction cleaners with odor-neutralizing properties. |

| Sustainability & Green Cleaning | Increased demand for biodegradable, non-toxic, and plant-based extraction detergents. Growth in low-water extraction cleaning solutions to reduce environmental impact. Expansion of eco-friendly, VOC-free carpet cleaning products. |

| Commercial & Industrial Market Growth | Expansion of high-traffic commercial carpet extraction systems in hotels, offices, and public spaces. Increased use of anti-bacterial and anti-viral cleaning solutions for sanitation compliance. |

| Advanced Stain & Odor Removal | Increased use of enzymatic carpet extraction formulas to break down organic stains (e.g., pet urine, wine, coffee). Brands introduced activated oxygen and probiotic-based carpet cleaners for long-term freshness. |

| Smart Home Integration & Automation | Development of IoT-connected carpet extractors with app-based controls and scheduling. Rise in self-adjusting suction technology to protect delicate carpet fibers. |

| Ergonomics & Portability | Demand for lightweight, compact carpet extractors increased for apartment dwellers and small-space users. Rise of cordless, rechargeable carpet cleaners for convenience. |

| Market Shift | 2025 to 2035 |

|---|---|

| Professional vs. DIY Cleaning Trends | On-demand, app-based carpet extraction rental services become widespread. Hybrid cleaning models allow consumers to use AI-assisted home extractors and schedule professional cleanings when needed. Subscription-based deep-cleaning plans provide periodic automated services. |

| Efficiency & Performance Enhancements | AI-powered cleaning intensity adjustments optimize water and detergent use based on stain type and carpet fiber. Self-healing carpet treatments integrate protective coatings that repel future dirt and spills. Robotic, self-operating extraction cleaners automate entire carpet deep-cleaning cycles. |

| Sustainability & Green Cleaning | Waterless, enzyme-based carpet extraction cleaners become mainstream. AI-optimized detergent formulations provide deep cleaning with minimal environmental impact. Reusable, compostable carpet pads and filtration systems replace disposable parts. |

| Commercial & Industrial Market Growth | AI-driven smart cleaning systems track carpet usage and recommend real-time extraction schedules for businesses. Energy-efficient, low-noise industrial carpet extractors dominate commercial markets. Blockchain-backed cleaning verification systems provide proof of sanitation for regulatory compliance. |

| Advanced Stain & Odor Removal | Smart stain-detection technology allows extraction cleaners to identify and adjust formulas for specific stain types. Self-repairing carpet protection films prevent stains from bonding to fibers. AI-powered odor removal systems neutralize smells at a molecular level. |

| Smart Home Integration & Automation | Voice-controlled carpet extractors integrate with smart home assistants (Alexa, Google Home). Automated carpet mapping systems identify high-traffic areas for targeted deep-cleaning cycles. AI-driven surface recognition optimizes extraction settings per carpet type. |

| Ergonomics & Portability | Wearable, hands-free carpet extraction devices reduce strain for users. Collapsible and foldable extraction units offer compact storage. 3D-printed, customizable ergonomic handles improve ease of use. |

The USA carpet extraction cleanser market is witnessing steady growth, driven by adding demand for deep-cleaning results in homes and marketable spaces, rising pet power, and advancements in eco-friendly and biodegradable cleaning formulas. Major players include Bissell, Rug Doctor, and Hoover.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The UK carpet extraction cleanser market is expanding due to adding preference for allergen- removing and pet-friendly cleaning results, growing marketable cleaning assiduity, and rising demand for compact and easy- to- use carpet cleansers. Leading brands include Vax, Kärcher, and Numatic.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

Germany’s carpet extraction cleanser market is growing, with consumers favoring high-quality, durable, and high-suction cleaning outfits for home and marketable use. crucial players include Kärcher, SEBO, and Cleanfix.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.4% |

India’s carpet extraction cleaner market is witnessing rapid growth, fuelled by increasing urbanization, rising disposable incomes, and expanding awareness of deep-cleaning benefits in both residential and commercial spaces. Major brands include Eureka Forbes, Karcher India, and Inalsa.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.8% |

China’s carpet extraction cleanser market is expanding significantly, driven by adding disposable inflows, growing demand for high- tech and robotic cleaning results, and strong marketable sector relinquishment. Crucial players include Haier, Xiaomi, and Ecovacs.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

The demand for carpet extraction cleansers is rising as consumers seek effective deep-drawing results for home and marketable use. These cleansers give superior dirt and stain junking, making them a favoured choice for maintaining carpets in high-business areas similar as services, hospices, and homes. The shift towards hygiene-conscious living further drives market growth.

The hospitality, healthcare, and commercial sectors significantly contribute to the carpet extraction cleanser market. Hotels and hospitals prioritize deep cleaning to maintain hygiene norms, while office spaces use extraction cleansers to ensure well-maintained carpets. The rise in demand for rental cleaning services also boosts market relinquishment.

Online retail platforms and home enhancement stores play a vital part in expanding market reach. Consumers profit from a wide range of options, product comparisons, and competitive pricing through e-commerce channels. Also, rental services for carpet extraction cleaners are gaining traction, making professional- grade outfit accessible to homes.

Manufacturers are introducing carpet extraction cleansers with enhanced features, similar as faster drying times, water-effective technology, and eco-friendly cleaning results. The rise of movable and cordless models offers convenience, while inventions in biodegradable and chemical-free cleaning agents align with growing environmental enterprises.

The carpet extraction cleanser market is growing steadily due to adding consumer and marketable demand for deep-cleaning results that effectively remove dirt, stains, and allergens. The rise in hygiene mindfulness, expansion of the hospitality sector, and advancements in drawing technologies are driving market growth. Companies are fastening on eco-friendly phrasings, faster drying times, and professional- grade performance to feed to both domestic and artificial druggies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| BISSELL | 20-25% |

| Hoover (TTI Floor Care) | 15-20% |

| Rug Doctor | 12-16% |

| Kärcher | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BISSELL | Market leader offering a wide range of carpet extraction cleaners for residential and commercial use. The brand is known for its Heatwave Technology, pet-focused cleaning solutions, and eco-friendly formulas. |

| Hoover (TTI Floor Care) | Specializes in advanced carpet cleaning machines with deep-cleaning power and dual-tank technology. Offers portable, upright, and professional-grade models with Quick Dry features. |

| Rug Doctor | Focuses on rental and consumer-grade carpet extractors with powerful suction and professional cleaning capabilities. Expanding into retail sales with compact and pet-friendly models. |

| Kärcher | European leader in industrial and commercial carpet extraction cleaning equipment, known for robust build quality and eco-friendly steam cleaning technology. |

Strategic Outlook of Key Companies

BISSELL (20-25%)

BISSELL maintains a strong market position by continuously instituting in deep- cleaning technology. The company is expanding its range of carpet extraction cleansers with advanced water extraction, heat-supported drying, and enhanced pet stain junking results. Sustainability is a crucial focus, with biodegradable cleaning formulas and machines made from recycled accoutrements. BISSELL is also using smart connectivity features to give automated drawing results for consumers.

Hoover (TTI Floor Care) (15-20%)

Hoover strengthens its position in the market by offering high-performance and cost-effective carpet extraction cleaners. The company is fastening on featherlight, movable models for domestic druggies while developing heavy-duty results for marketable settings. Hoover's advanced spin-mite and automatic soap mixing features insure effective deep cleaning, making it a top choice for consumers seeking important yet affordable cleaning machines.

Rug Doctor (12-16%)

Rug Doctor continues to dominate the rental carpet cleaner market while expanding its direct-to-consumer product range. The company is developing more compact and user-friendly machines, catering to pet owners and households with frequent carpet cleaning needs. With a growing focus on eco-friendly cleaning solutions, Rug Doctor is increasing its line of plant-based and non-toxic carpet shampoos.

Kärcher (8-12%)

Kärcher remains a leading provider of artificial and marketable carpet drawing systems, fastening on energy-effective, high- suction extraction cleansers. The company is introducing smart detector technology for automatic cleaning adaptations, perfecting ease of use for businesses. Kärcher is also expanding itseco-label product line, icing reduced water and chemical consumption without compromising performance.

Other Key Players (30-40% Combined)

Several emerging and established brands contribute to the carpet extraction cleaner market, focusing on innovative, budget-friendly, and specialized solutions:

Hot Water Extraction Cleaners, Cold Water Extraction Cleaners, Portable Extraction Cleaners, Truck-Mounted Extraction Cleaners, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

Residential, Commercial (Hotels, Offices, Restaurants), and Industrial.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Carpet Extraction Cleaner industry is projected to witness a CAGR of 5.5% between 2025 and 2035.

The Carpet Extraction Cleaner industry stood at USD 2.4 billion in 2024.

The Carpet Extraction Cleaner industry is anticipated to reach USD 4.8 billion by 2035 end.

Commercial and industrial carpet extractors are set to record the highest CAGR of 6.3%, driven by increasing demand from hotels, offices, and public spaces.

The key players operating in the Carpet Extraction Cleaner industry include Bissell, Rug Doctor, Hoover, Kärcher, Tennant Company, and Nilfisk Group.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Power Source, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Power Source, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Power Source, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Power Source, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Power Source, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Power Source, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Power Source, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Power Source, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Power Source, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Power Source, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Power Source, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Power Source, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Power Source, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Power Source, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Power Source, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

The Carpet & Upholstery Cleaning Services Market is segmented by service type and application from 2025 to 2035.

Carpet and Rug Shampoo Market Analysis – Trends, Growth & Forecast 2025-2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Extraction Software Market

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tissue Extraction System Market Size and Share Forecast Outlook 2025 to 2035

Faecal Extraction System Market

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

Viral RNA Extraction Kit Market - Trends & Forecast 2025 to 2035

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Nucleic Acid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Welding Fume Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Kidney Stone Extraction Balloon Market Size and Share Forecast Outlook 2025 to 2035

Commercial Oil Extraction Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA