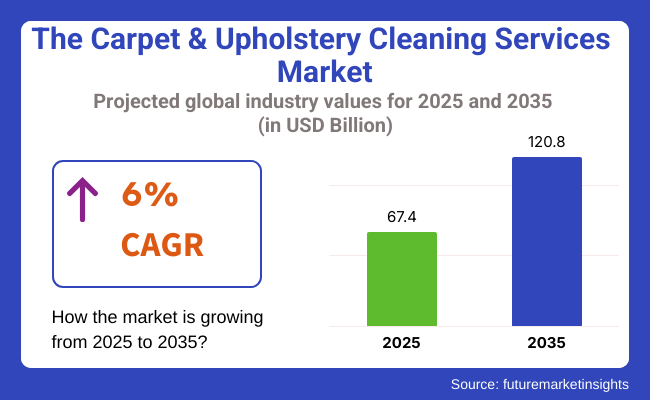

The value of the carpet & upholstery cleaning services market was USD 67.4 billion in 2025 and is expected to grow at a 6% CAGR during the period from 2025 to 2035. The carpet & upholstery cleaning services industry is expected to reach USD 120.8 billion by 2035.

Increased emphasis on indoor air cleanliness and hygiene in residential and commercial settings is one of the key drivers for the growth, fueled by post-pandemic consciousness and evolving cleanliness norms. Increased urbanization and development in the hospitality, corporate, and healthcare sectors have bolstered demand for scheduled and professional cleaning services significantly.

Carpets and upholstered furniture act as reservoirs for dust mites, allergens, and microbial dirt and hence need frequent maintenance. Property owners now began opting for deep cleaning services not just for hygiene but also to enhance the lifespan of interior assets and aesthetic appeal.

Technological advances in steam cleaning, low-moisture extraction, and environmentally friendly detergents are transforming the industry with improved service efficiency and shorter drying times. Equipment manufacturers are providing automation and sound-reduction capabilities to enhance operator productivity in heavy-traffic and sensitive environments like offices and hospitals. The innovations are making services more accessible and improving customer loyalty.

Also, the trend of outsourcing facility management in commercial spaces is driving recurring service contracts with professional cleaning staff. Businesses require frequent, certified service providers able to cater to green building standards and infection control procedures.

Domestic consumers, meanwhile, are strongly attracted to subscription cleaning plans offering convenience, affordability, and assurance.During the forecast period, the industry will be influenced by smart cleaning technology, real-time scheduling platforms, and artificial intelligence-based logistics for route optimization. Providers that adopt sustainable operations, transparent pricing, and high-touch customer service models will have ample space to grow.

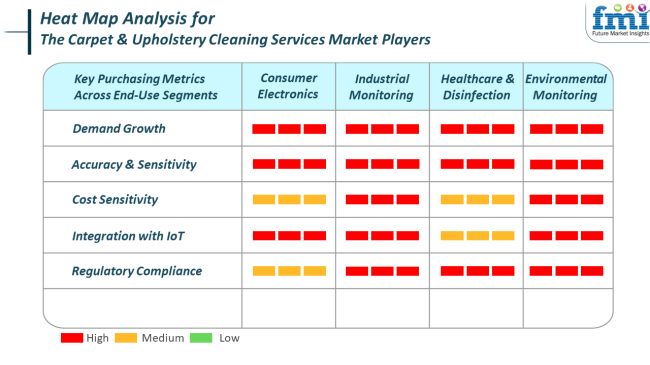

Consumer expectations in the carpet & upholstery cleaning services industry are increasingly influenced by their experiences in other high-tech or regulated industries. In consumer electronics-sensitive homes, cleaning providers need to show precision and safety, particularly when operating around integrated AV systems or smart home configurations. The need for non-disruptive, accurate and residue-free solutions is growing.

Commercial and healthcare settings reflect industrial and disinfection standards, where accuracy and compliance are not negotiable. In these settings, service providers have to provide stringent standards that encompass infection control, indoor air quality objectives, and sustainability reporting. The industry gets aligned with monitoring standards, where results are quantified and regulated.

Environmental factors are at the forefront of purchasing choices, particularly as consumers become increasingly environmentally aware. Services that employ biodegradable materials, water-saving equipment and energy-efficient cleaning processes are increasingly sought after. Clients of all levels appreciate cleaning as it boosts well-being without sacrificing ecological duty, staying in line with overall environmental monitoring expectations.

One of the key risks facing the carpet & upholstery cleaning services industry is economic variability. As a largely discretionary service, particularly in residential settings, demand tends to contract during periods of economic downturn or uncertainty. Pressure gets put on companies to maintain customer loyalty and service value while adjusting pricing models to remain competitive.

Dependence on labor is yet another serious issue. The trade is people-oriented, and personnel shortages or lack of skills threaten the quality of service and operational scalability. There is a need for training and holding onto trained technicians capable of handling both old and new equipment, particularly where services penetrate critical environments such as hospitals or upscale interiors.

Tightening regulations regarding chemical use, water discharge, and waste management pose a constant compliance challenge. Operators need to be ahead of environmental laws or risk operational restrictions and reputational damage. Small operators could find themselves challenged by the capital costs involved in upgrading to eco-compliant systems and practices.

Between 2020 and 2024, the carpet & upholstery cleaning services industry experienced steady growth, driven by increasing awareness of hygiene among consumers, particularly in residential and commercial settings. The COVID-19 pandemic also boosted focus on hygiene, and the demand for professional cleaning services boomed.

Advances in technology related to cleaning equipment and environment-friendly cleaning agents increased in popularity, with the scale for sustainability rising in demand. The ease of accessibility of online shopping websites also made it easier to find cleaning services, and thereby, the industry grew.

In the future, from 2025 to 2035, the industry is projected to undergo radical changes. Artificial intelligence (AI) and automation will be used to make life simpler, with enhanced efficiency of service and customer satisfaction. Sustainability will continue to stay in focus with more applications of biodegradable products and water-saving technology.

Electric and autonomous vehicles can create new service needs, and the industry will react by developing new services. In addition, digital ecosystems and subscription-based models will transform customer engagement and service delivery, enabling personalized and seamless experiences for customers.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for protection by law enforcers, the military, and security agencies. | Convergence of automation and AI, EV saturation, and green service demand. |

| Utilization of green cleaning chemicals and mobile service centers. | Utilization of AI-based diagnostics, automated cleaning equipment, and digital service centers. |

| Historical single-service packages and mobile detailer vans. | Subscription models, on-demand services, and converging to digital platforms. |

| Quality focus, convenience, and affordability emphasis. | Call for customized services, environmentally friendly practices, and easy-to-use digital experiences. |

| Compliance with local environmental conservation and safety regulations. | Compliance with international sustainability demands and the ability to adapt to new automotive technology. |

| Local competition and price sensitivity. | Need for continuous innovation, technology investment, and sensitivity to evolving customer needs. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

| UK | 5.2% |

| France | 4.9% |

| Germany | 5.1% |

| Italy | 4.7% |

| South Korea | 5.4% |

| Japan | 4.6% |

| China | 6.1% |

| Australia-NZ | 4.8% |

The USA is anticipated to develop at a 5.7% CAGR over the forecast period. Rising hygiene consciousness, urbanization, and a thriving commercial real estate industry are driving demand for carpet and upholstery cleaning solutions in the USA Strong home ownership culture and focus on indoor aesthetics are also driving residential demand.

Companies, especially in the corporate office and hospitality industries, are also giving high priority to professional cleaning services to ensure cleanliness levels and enhance customer satisfaction. Regular cleaning requirements in schools, healthcare facilities, and entertainment centers add strength to a year-round service commitment.

Technology implementation is a major driver in the USA, with service providers utilizing green products, steam cleaning, and online scheduling systems to attract environmentally aware and convenience-oriented consumers.

Increasing health awareness is also driving demand for allergen-free, deep-cleaning products. Franchise models are growing, backed by national marketing and uniform service standards. Moreover, increasing disposable income and time-starved lifestyles are likely to drive professional cleaning demand in suburban and urban homes. Industry consolidation and the emergence of tech-based startups are improving service efficiency and competitive pricing, making the industry more dynamic.

The UK will grow at 5.2% CAGR throughout the study. Expansion in the UK carpet & upholstery cleaning services market is driven by increasing demand for specialist cleaning products from households and companies alike. Growing emphasis on cleanliness inside homes due to health and safety regulations, particularly in the wake of post-pandemic hygiene standards, has boosted demand.

The hospitality industry, with high guest turnovers and aesthetic maintenance needs, is a major driver of recurring cleaning demands. The residential segment has an expanding rental base and fuels growth in end-of-tenancy cleaning services. UK consumers are increasingly looking for green and sustainable cleaning services.

Accordingly, providers of environmentally friendly products and low-water-consumption processes are gaining competitive ground. The move to online booking sites and customer review-driven choices is forcing service providers to be more transparent and ensure quality.

Small and medium-sized businesses control the fragmented industry, with some consolidation likely as demand stabilizes. Also, government incentives for small service firms and public-private partnerships for sanitation initiatives are making professional cleaning services more visible and accessible.

France is anticipated to advance at 4.9% CAGR during the forecast period. Urbanization patterns, stringent hospitality industry standards, and increased sensitivity to allergens and indoor air quality are driving the demand for carpet and upholstery cleaning in France.

Residential apartment buildings and urban inhabitants alike are turning towards outsourced expert cleaning services owing to lifestyle issues. Hotels, restaurants, and co-working places are an important customer base where consistent maintenance of fabric surfaces is deemed necessary to ensure brand reputation and customer comfort.

Service differentiation is emerging in the hospitality industry with the incorporation of non-toxic, biodegradable cleaning chemicals and sophisticated machinery that reduces drying time. In France, increased environmental consciousness is compelling companies towards eco-friendly certifications and prudent waste disposal in their practice.

Franchise expansion models are picking up, empowering small operators with the advantage of wider brand credibility and support infrastructures. Implementing customer feedback mechanisms and pay-per-use or subscription-based models enhances retention and revenue predictability. Service providers are also embracing digital platforms to facilitate smooth appointment scheduling and payment as preferences among consumers transition toward convenience and reliability.

Germany is anticipated to grow at 5.1% CAGR over the study period. Increasing focus on hygiene standards in residential and commercial properties is driving growth. Offices, retail chains, and public places like libraries and auditoriums are following rigorous cleanliness schedules, which generates a steady demand for professional service providers. Germany's robust middle-class sector is also a major contributor to residential service adoption, especially for biannual deep-clean cycles and seasonal overhauls.

Equipment innovation, such as dry-cleaning technologies and sound-dampening equipment, responds to German consumers' interest in efficiency and discretion. A steady increase in pet ownership is also impacting the industry, raising demand for odor and stain elimination services in residences and automobiles.

The demand is continuously growing because of the popularity of ridesharing and used car sales. A soundly established regulatory environment and stringent consumer expectations have prompted service providers to focus on reliability, timeliness, and compliance with health protocols. Digitalization of operations, such as mobile scheduling and real-time tracking of services, is also gaining traction.

Italy will grow at 4.7% CAGR throughout the study. The country's hospitality and tourism sectors are driving Italy's carpet & upholstery cleaning services market. Due to the need for regular cleaning and fabric care in hotels, resorts, and rental units, there is increasingly greater dependence on outsourced professional services. Also, older interior structures and high-end furniture items need specialized, soft cleaning methods, which is generating demand for trained service providers with sophisticated equipment and suitable solvents.

Increasing consciousness regarding allergen control and indoor air quality among urban residential consumers is opening opportunities for subscription-based residential cleaning services. Italy's fashion-aware consumers are also becoming more concerned with home looks, which generates occasional deep cleaning of carpets, sofas, and curtains.

Italy provides plenty of room for franchisors and new entrants looking to bring standardized service models into the industry. Mobile app integration for scheduling services and customer interaction is assisting providers in gaining popularity among young, technologically oriented customers. Sustainability certification and reliance on low-emission cleaning products are becoming key differentiators.

South Korea is anticipated to expand at a 5.4% CAGR throughout analysis. South Korea's high population density urban areas and high-rise residential setups mean that there will be a growing need for outsourced cleaning services such as carpet and upholstery cleaning. A clean culture, with growing dual-income households, lays a solid ground for professional service growth.

Hospitality, driven by tourism and regular business trips, also generates repeated cleaning needs for seating materials, floor coverings, and guestroom furnishings. Clearing service innovations such as AI-assisted customer support, online check-in platforms, and robotic cleaning assistants are enabling South Korean suppliers to deliver high-quality, responsive services.

Consumers are especially vigilant about hygiene, favoring deep cleaning and anti-bacterial treatment for allergen-intensive surfaces. Demand is also increasing in schools, hospitals, and public transportation systems, where fabric cleanliness is a prime component of environmental cleanliness.

Government support towards digitization in small businesses and the accessibility of micro-loans for service startups are urging new entrants into the industry. Eco-friendly cleaning products are gaining strength as a component of larger environmental sustainability objectives.

Japan will increase at 4.6% CAGR throughout the research period. Cleanliness values, extended possession longevity, and simplicity determine the demand for carpet & upholstery cleaning services in Japan. Much focus on maintaining interior homes and offices has resulted in relentless demand for professional and fastidious cleaning services. Compact, multi-functional furniture in Japanese residential and commercial establishments frequently features textiles that need regular deep cleaning for hygiene and aesthetic purposes.

The aging population in Japan and the increase in one-person households are compelling the demand for outsourced cleaning services on account of constrained time or mobility. Demand from hospitals, aged care facilities, and traditional hospitality establishments like ryokans is also considerable, especially for the upkeep of fabric-based interiors on a regular basis.

The industry benefits from Japan's technological superiority, as providers employ silent machinery, sophisticated filtration systems, and allergen-eliminating agents to satisfy rigorous user requirements. Environmental certification and chemical safety are dominant purchasing requirements. Mobile scheduling, package home care services, and price models based on loyalty are increasingly being used by residential as well as commercial users.

China will grow at 6.1% CAGR throughout the study. Accelerating urbanization, rising disposable incomes, and expanding middle class are key drivers of China's growing demand for carpet & upholstery cleaning services. As more individuals, households, and enterprises move toward fabric-based interiors and high-end furnishings, the demand for routine and emergency cleaning has accelerated.

Malls, cinemas, and restaurants provide steady demand for clean, odor-free seating facilities. The industry is changing with the incorporation of mobile applications, real-time tracking of services, and AI-powered chat assistants that enhance customer engagement and retention.

China's robust digital payment infrastructure allows for fast ordering of services and repeated bookings. Special cleaning is becoming popular in rental residences where turnover is heavy, and property owners look for speed restoration services.

Growing awareness of air quality and allergen exposure is promoting intensive cleaning cycles through water-efficient and chemical-free processes. Demand is particularly strong in tier-one and tier-two cities. In contrast, development in rural areas is expected through the franchise model and government initiative towards the growth of the services industry.

The Australia-New Zealand region is expected to expand at 4.8% CAGR through the duration of this study. The Australian and New Zealand region is fueled by increasing environmental cleanliness awareness, enhanced hospitality standards, and a flourishing real estate industry. The wide prevalence of carpets and fabric furniture in residences and business spaces has resulted in a strong demand for professional cleaning.

Hygiene practices post-pandemic are underpinning demand, particularly in common residential places and vacation rentals. Both nations have consumer inclinations towards non-toxic and biodegradable cleaning practices that guarantee family and pet safety.

Childcare centers, nursing homes, and office buildings are important adopters because of cleaning regulation needs. Technological adoption is equally robust, with cloud booking systems, customer feedback applications, and IoT-connected equipment facilitating smooth operations.

A tough competition is forcing service providers to provide flexible pricing, seasonal packages, and same-day service options. Government programs promoting small service enterprises are likely to increase further regional participation in the industry.

Carpet cleaning services have the largest industry share, at an estimated 70-75% of the entire industry. Periodic maintenance requirements in heavy-traffic commercial environments such as offices, hotels, and medical facilities drive growth.

Key companies such as Stanley Steemer, COIT and Chem-Dry are dominant players in scalable, professional-level services that serve residential and commercial clients. Technological advancements in steam cleaning and dry extraction are also improving efficiency, with green products becoming increasingly popular.

Commercial usage is a greater percentage based on trends between 2022 and 2024, particularly in regions like North America and Europe, where facility maintenance standards are high. Between 2025 to 2035, this segment is expected to grow at a CAGR of 4.8% owing to corporate sustainability initiatives and post-COVID hygiene requirements. Upholstery cleaning services, while smaller in scale, are acquiring increasing significance with an increased focus on indoor air quality and allergen control.

The sub-segment commands about 25-30% of the industry. Home consumers and hospitality businesses constitute the main customer base, requiring deep-clean treatments for leather and fabric furnishings. Key players such as Sears Home Services, ServiceMaster Clean, and Oxi Fresh are also actively targeting this segment by promoting upholstery cleaning with carpet.

Growth is also being driven by rising furniture sales and urban population density, especially in the Asia-Pacific and Latin American markets. During 2025 to 2035, upholstery cleaning will report a slightly increased CAGR of 5.6% through its increasing demand in middle-income homes and boutique hospitality properties.

Commercial applications dominate the market and account for nearly 65% of total demand. Herein, commercial spaces, hospitality, healthcare, aviation, government and institutional complexes are the principal verticals. Heavy office, hotel and hospital usage on an everyday, high-traffic level necessitates regular carpet and upholstery cleaning to maintain hygienic levels and extend asset life.

Routine schedule contracted or bundled cleaning is offered by vendors like ABM Industries, Jani-King, and ISS Facility Services. Institutional and government clients like schools, airports, and administrative buildings buy services through public bids with contractors like Aramark and Sodexo. Whereas commercial growth is steady (projected CAGR: 5.2%), public sector transactions grow at a more moderate pace (CAGR: ~4.2%) due to fiscal restraints and procurement cycles, but both generate steady, long-term cash flows for providers.

Residential cleaning applications are approximately 30% of the total market, fueled by growing urbanization, busier lifestyles, and the proliferation of home service platforms like Handy, Thumbtack and HomeAdvisor. Home residents, particularly middle-income segments in urban areas, more and more outsource upholstery and carpet care quarterly or annually. It expands most vigorously in Europe and North America and is increasing most in Asia-Pacific.

Specialized residential services-such as pet odor removal, allergen control, and post-renovation cleaning-are a niche but lucrative sub-segment. Specialized companies like Zerorez and Green Choice target these niches through high-end, green products and services. Residential services are projected to grow at a CAGR of 5.8%, with niche segments growing marginally higher (approximately 6.2%) based on increased awareness of health and hygiene in homes in the post-pandemic period.

The global carpet & upholstery cleaning services market is moderately fragmented, with an integrated facility management firm and specialized commercial cleaning service providers combining the lion's share of the industry share. Such prominent players as ServiceMaster Global Holdings Inc., ABM Industries Inc., Jani-King International Inc., CleanNet USA Inc., and Anago Cleaning Systems Inc. enhance their competitive position using an extensive franchise network, comprehensive service portfolios, and technology integration for scalable delivery across varying locales.

ServiceMaster remains dominant with its ServiceMaster Clean and Merry Maids divisions, capitalizing on an extensive USA network and unified branding. The company has increased its efforts to maintain various software and environmentally conformable products in order to sustain its contracts with the government and commercial sectors.

ABM Industries leverages a bundled service strategy in which carpet and upholstery care are part of broader facility services, especially attractive to large healthcare, aviation, and educational clients. Jani-King and CleanNet USA differ in their ability to grant franchisees a measure of autonomy in local operations while maintaining strict quality control at the regional level. Both advanced in their digital scheduling, reporting, and client management systems, fostering transparency and a higher level of service satisfaction.

The Anago Cleaning Systems model has grown, mainly in the last few years, as a regional master franchisor scheme concentrating mostly in North America and is now beginning to walk toward hospitality and entertainment venues. On the European side, the competition includes the likes of Sodexo and Crest Commercial Cleaning, which are maintaining local trust through compliance with regulations and culturally oriented cleaning procedures.

The increasing stakes of smaller players through specialized upholstery cleaning, using green-certified chemicals, and offering on-demand digital booking solutions are indicative of an industry metamorphosing in one direction: from standardization to personalization of services.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| ServiceMaster Global Holdings Inc. | 14-18% |

| ABM Industries Inc. | 11-14% |

| Jani-King International Inc. | 9-12% |

| CleanNet USA Inc. | 7-10% |

| Anago Cleaning Systems Inc. | 6-9% |

| Other Players | 37-45% |

| Company Name | Offerings & Activities |

|---|---|

| ServiceMaster Global Holdings Inc. | Comprehensive cleaning through ServiceMaster Clean; expanded digital operations platform. |

| ABM Industries Inc. | Bundled facility services, including carpet/upholstery; focus on long-term contracts. |

| Jani-King International Inc. | Franchise-led growth; quality-controlled cleaning services across multiple verticals. |

| CleanNet USA Inc. | Commercial carpet care with a strong focus on compliance and eco-certifications. |

| Anago Cleaning Systems Inc. | Franchise-based model with flexible packages for hospitality and retail sectors. |

Key Company Insights

ServiceMaster Global Holdings Inc. (14-18%)

A dominant USA-based player offering standardized, tech-enabled carpet and upholstery services with scalable commercial operations.

ABM Industries Inc. (11-14%)

Leverages integrated facility management to deliver efficient, large-scale cleaning across healthcare, aviation, and education sectors.

Jani-King International Inc. (9-12%)

Strong national and regional franchise presence with robust quality assurance frameworks and brand consistency.

CleanNet USA Inc. (7-10%)

Emphasizes green-cleaning protocols and real-time job tracking, gaining traction with environmentally conscious clients.

Anago Cleaning Systems Inc. (6-9%)

Expanding footprint in North America using a master franchisor model, with services increasingly tailored to high-footfall venues.

Other Key Players

The carpet & upholstery cleaning services market is segmented into carpet cleaning services and upholstery cleaning services.

The application segment includes commercial and residential sectors. The commercial segment is further broken down into aviation, commercial spaces, healthcare facilities, hospitality, government, institutional, and others. The residential segment includes household carpet and upholstery cleaning.

The regional analysis covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is slated to reach USD 67.4 billion in 2025.

The industry is predicted to reach a size of USD 120.8 billion by 2035.

Key companies include ServiceMaster Global Holdings Inc., ABM Industries Inc., Jani-King International Inc., CleanNet USA Inc., Anago Cleaning Systems Inc., Crest Commercial Cleaning Ltd., DuraClean, Eco Group Services, Pritchard Industries Inc., Stratus Building Solutions, and Sodexo.

China, slated to grow at 6.1% CAGR during the forecast period, is poised for the fastest growth.

Carpet cleaning services are being widely used.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 6: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 9: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 12: Western Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 21: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ million) Forecast by Service, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Service, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Service, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ million) by Service, 2023 to 2033

Figure 17: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 25: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Service, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ million) by Service, 2023 to 2033

Figure 32: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Service, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ million) by Service, 2023 to 2033

Figure 47: Western Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 55: Western Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Service, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ million) by Service, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Service, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ million) by Service, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Service, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ million) by Service, 2023 to 2033

Figure 92: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Service, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ million) by Service, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ million) Analysis by Service, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Service, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carpet Extraction Cleaner Market Analysis- Trends, Growth & Forecast 2025 to 2035

Carpet and Rug Shampoo Market Analysis – Trends, Growth & Forecast 2025-2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA