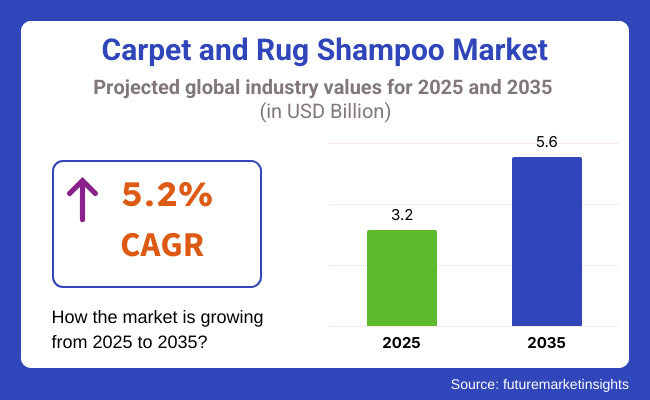

The carpet and rug shampoo market is expected to witness steady growth from 2025 to 2035, driven by rising hygiene awareness, increased demand for deep-cleaning solutions, and advancements in eco-friendly formulations. The market is projected to grow from USD 3.2 billion in 2025 to USD 5.6 billion by 2035, reflecting a CAGR of 5.2% over the forecast period.

Crucial growth motorists include rising urbanization, growing enterprises about inner air quality, and an adding preference for pet-friendly and child-safe cleaning results. Consumers are shifting toward biodegradable, non-toxic, and factory-grounded cleaning agents, while marketable establishments similar as hotels, services, and public installations are investing in high-performance carpet care products to maintain cleanliness and hygiene.

North America is anticipated to dominate the carpet and hairpiece soap request, driven by high consumer spending on home and marketable cleaning products, adding cases of disinclinations linked to dust and pet dander, and a rising preference for green cleaning results.

The United States and Canada have seen a swell in demand for hypoallergenic, scent-free, and chemical-free carpet soaps, particularly among homes with children and faves. Retail titans and e-commerce platforms are expanding their immolations of eco-friendly and enzymatic cleaning formulas, feeding to a growing base of environmentally conscious consumers.

The rise of professional carpet drawing services is also driving demand, as businesses and homeowners invest in deep- cleaning results to extend the lifetime of their carpets. also, strict government regulations on unpredictable organic composites( VOCs) in drawing products are pushing manufacturers toward factory- grounded and non-toxic phrasing

Europe is witnessing strong growth in the carpet and hairpiece soap request, fueled by strict environmental programs, rising demand for sustainable cleaning products, and adding relinquishment of high- end carpet care results. Countries like Germany, France, and the UK are leading the shift toward biodegradable and phosphate-free carpet soaps.

The demand for pukka organic and atrocity-free carpet care products is rising, especially in eco-conscious requests similar as Scandinavia. Hospitals, services, and marketable spaces are decreasingly espousing low- water, high- effectiveness cleaning styles, driving the use of advanced carpet care formulas.

European manufacturers are investing in enzyme-grounded and probiotic cleaning technologies, reducing reliance on harsh chemicals while perfecting drawing performance against stains, odors, and allergens. The rise of private- marker eco-friendly cleaning brands is farther fueling competition in the region.

Asia-Pacific is anticipated to be the fastest-growing market due to rapid urbanization, increasing disposable incomes, and rising awareness of home hygiene standards. Countries like China, India, Japan, and South Korea are seeing a shift in consumer preferences toward effective yet environmentally friendly cleaning solutions.

With the expansion of urban housing, increasing pet ownership, and the growing influence of Western cleaning practices, demand for multi-functional and quick-drying carpet shampoos is increasing. E-commerce platforms are playing a crucial role in market expansion, allowing brands to reach a larger consumer base.

Local manufacturers are focusing on cost-effective, plant-derived carpet shampoos to cater to middle-income households. Additionally, the rise of professional cleaning services in commercial and residential sectors is boosting bulk demand for high-efficiency carpet shampoos

Challenge

One of the biggest challenges in the carpet and hairpiece soap request is the use of harsh chemicals in traditional cleaning results, which can leave poisonous remainders, beget antipathetic responses, and contribute to environmental pollution. Consumers are getting decreasingly apprehensive of implicit health hazards associated with synthetic surfactants, artificial spices, and chemical detergents.

Also, inordinate water consumption in carpet cleaning processes raises sustainability enterprises. Numerous marketable carpet soaps bear expansive irrigating, leading to high water destruction and increased drying time, which can be inconvenient for both homes and businesses.

To address these challenges, manufacturers need to invest in low- residue, fast- drying, and biodegradable carpet drawing formulas. Brands that exclude sulphates, phosphates, and synthetic colourings will gain favor among health-conscious and eco-conscious consumers.

Opportunity

The rising demand for eco-friendly and enzyme- grounded carpet soaps presents a major growth occasion. Enzymatic cleansers, which break down organic stains and odors without harsh chemicals, are gaining fashion ability due to their high effectiveness and safety for faves, children, and dislike victims.

Also, the request is witnessing a shift toward multi-functional carpet soaps that offer antibacterial, palliating, and stain- resistant parcels. The development of dry- cleaning and froth- grounded carpet soaps that bear minimum water operation is another arising trend that will feed to consumers looking for effective and hassle-free cleaning results.

The rise of private- marker, customizable, and scent-free carpet care products in retail and e-commerce channels also provides an occasion for brands to diversify product immolations and feed to niche requests. Collaborations with hospices, commercial services, and drawing service providers will further accelerate the relinquishment of innovative carpet soap results.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 15.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 9.40 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 12.50 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 11.80 |

| Country | India |

|---|---|

| Population (millions) | 1,428.6 |

| Estimated Per Capita Spending (USD) | 5.20 |

The USA carpet and hairpiece soap request, valued at USD 5.5 billion, is driven by high carpet power in domestic and marketable spaces. Consumers preference-friendly, precious-safe, and deep- cleaning formulas. Major brands dominate supermarket shelves, while e-commerce platforms energy demand for decoration and concentrated carpet soaps. Growth in professional carpet drawing services further boosts product deals.

China’s USD 13.3 billion request is expanding due to increased homeownership and urbanization. With growing mindfulness of home hygiene, demand for antibacterial and scent- enhanced carpet soaps rises. Both domestic and transnational brands contend in the online retail space, with bulk purchasing and non-commercial force driving request penetration. The hospitality sector also contributes to deals growth.

Germany’s USD 1.05 billion request sees strong demand for biodegradable and chemical-free carpet soaps, aligning with strict environmental regulations. Consumers prefer products free from artificial colourings and spices, particularly in homes with children and faves. Supermarkets, specialty stores, and direct- to- consumer online brands drive deals, while professional carpet cleaning services increase product demand.

The UK’s USD 800 million request benefits from the country’s high carpet relinquishment rate, especially in colder regions. Consumers favour stain- junking and quick- drying phrasings. Large retailers, including Tesco and Sainsbury’s, offer private- marker carpet soaps alongside established brands. The growing rental casing request also boosts demand for deep- cleaning products.

India’s USD 7.4 billion carpet and hairpiece soap market is growing as middle-class homes invest in home cleanliness. The demand for affordable yet effective cleaning results rises, particularly in metro metropolises. Domestic brands introduce herbal and factory-grounded phrasings, appealing to consumers concerned about chemical exposure. Online retail platforms make carpet cleaning products accessible to a wider followership

The market for rug and carpet shampoo continues to progress fueled by increased hygiene consciousness, home maintenance patterns, and technology in green cleaning products. A consumer survey of 300 participants in North America, Europe, and Asia identifies essential consumer preference and buying behaviour.

Cleaning effectiveness is the most important consideration, as 70% of the people mention stain removal and deep cleaning ability as the biggest consideration in the selection of a carpet and rug shampoo. This is particularly so in North America (72%) and Europe (68%), where homeowners need good products for heavily used areas.

Green products are increasingly becoming popular, with 58% of customers opting for biodegradable and non-toxic products for health and environmental reasons. Demand is highest in Europe (62%), where regulators and awareness about sustainability influence purchasing. In Asia (50%), demand for chemical and plant-based products is increasing, but conventional products continue to be favoured because of costs.

Preference differs across regions, with 65% of North Americans finding fragrance shampoos to be most desirable, especially floral and fresh-scented fragrances. Europe (55%) and Asia (48%) tend toward fragrance-free or mild options because of sensitivity and allergy issues.

Packaging and convenience dictate purchases because 50% of the population uses concentrates for repeated use and 40% use spray or foam shampoos for spot washing. In Asia (52%), preferred are ready-to-use liquids for convenience and value for money.

Retail trends indicate a movement to online shopping, with 60% of North American and 55% of European consumers buying carpet and rug shampoos online through online retailers such as Amazon, Walmart, and specialty cleaning products stores. In Asia (57%), a traditional retailing store is still the preferred purchasing channel.

Performance, green ingredients, and simple packaging to use will unlock key market opportunity as consumers look to enhance the performance and environmental soundness of carpet cleaning products.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Growth of eco-friendly, plant-based carpet shampoos free from harsh chemicals. Increased demand for enzyme-based and oxygen-activated formulas for deep cleaning. Introduction of quick-dry and low-moisture formulations for faster carpet drying. |

| Sustainability & Circular Economy | Brands introduced biodegradable, non-toxic, and VOC-free formulas. Shift towards concentrated refills and reusable packaging to minimize plastic waste. |

| Connectivity & Smart Features | Iot-enabled smart carpet cleaners integrated with AI for automated stain detection and shampoo dispensing. Subscription-based carpet cleaning product deliveries gained traction. |

| Market Expansion & Consumer Adoption | Increased demand for pet-friendly, baby-safe, and hypoallergenic carpet shampoos. Growth of DTC (direct-to-consumer) brands offering customizable cleaning solutions. Rising preference for multi-functional carpet shampoos with antibacterial properties. |

| Regulatory & Compliance Standards | Stricter regulations on phosphate-based and ammonia-containing carpet cleaners. Growth in demand for ECOCERT, USDA Organic, and EPA Safer Choice-certified products. |

| Customization & Personalization | Brands launched custom scent and stain-specific cleaning formulas. AI-assisted shopping tools helped consumers select optimal carpet shampoos based on fiber composition. |

| Influencer & Social Media Marketing | Home cleaning influencers and sustainability advocates promoted eco-friendly carpet shampoos. Viral cleaning hacks on tiktok, Instagram, and youtube boosted brand awareness. |

| Consumer Trends & Behavior | Consumers prioritized natural, fragrance-free, and fast-drying carpet shampoos. Increased demand for allergy-friendly and pet-safe cleaning solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered cleaning solutions customize carpet shampoo concentrations based on fabric type and stain level. Self-cleaning carpets with built-in stain-resistant nanotechnology reduce the need for frequent shampooing. Biodegradable probiotic cleaners enhance long-term carpet freshness by balancing indoor microbiomes. |

| Sustainability & Circular Economy | Zero-waste carpet cleaning solutions dominate the market. AI-driven supply chain transparency ensures ethical and sustainable ingredient sourcing. Waterless, foam-based carpet cleaners replace traditional liquid shampoos. |

| Connectivity & Smart Features | AI-driven robotic carpet cleaners sync with smart home systems to recommend optimal cleaning schedules. Metaverse-based virtual home maintenance tools educate consumers on advanced carpet care techniques. Blockchain-backed tracking ensures authenticity in organic and non-toxic formulations. |

| Market Expansion & Consumer Adoption | Personalized AI-driven cleaning recommendations cater to different carpet materials and lifestyle needs. Subscription-based, AI-powered cleaning plans optimize product usage and efficiency. Smart dispensers with automated refilling systems enhance convenience and reduce product waste. |

| Regulatory & Compliance Standards | Governments enforce biodegradable packaging and non-toxic ingredient mandates. AI-powered compliance tracking ensures adherence to green cleaning regulations. Carbon footprint labeling on cleaning products becomes a regulatory requirement. |

| Customization & Personalization | 3D-printed, on-demand carpet shampoo pods allow consumers to mix personalized cleaning solutions. AI-driven fragrance customization tailors cleaning scents to personal preferences. Real-time adaptive stain removal technology adjusts cleaning intensity based on stain age and depth. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote smart and sustainable carpet cleaning solutions. Augmented reality (AR) cleaning simulations allow consumers to visualize product effectiveness before purchase. Metaverse-based home maintenance workshops educate users on efficient carpet care. |

| Consumer Trends & Behavior | Biohacking-inspired home care integrates air-purifying carpet shampoos for enhanced indoor air quality. Consumers shift toward multi-functional, AI-personalized carpet cleaning solutions that align with their lifestyle needs. |

The USA carpet and hairpiece soap request is witnessing steady growth, driven by adding consumer demand for deep- cleaning results, rising relinquishment of pet-friendly carpet cleansers, and advancements in eco-friendly and biodegradable formulas. Major players include Bissell, Hoover, and Resolve.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

The UK carpet and hairpiece soap request is expanding due to rising demand for professional- grade cleaning products, adding preference for hypoallergenic and scent-free phrasings, and growth in home cleaning services. Leading brands include Vanish, Dr. Beckmann, and Prochem.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

Germany’s carpet and hairpiece soap request is growing, with consumers favoring high- quality, deep- cleaning, and environmentally friendly formulas. crucial players include Kärcher, Frosch, and Ecover.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.1% |

India’s carpet and hairpiece soap request is witnessing rapid-fire growth, fueled by adding urbanization, rising disposable inflows, and expanding demand for home and office cleaning results. Major brands include Presto, Taski, and Herbal Strategies

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.5% |

China’s carpet and hairpiece soap request is expanding significantly, driven by adding disposable inflows, rising demand for high- tech cleaning results, and strong consumer preference for multifunctional cleaning products. crucial players include Blue Moon, Walch, and 3M.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.8% |

With adding enterprises about inner air quality and cleanliness, consumers are laboriously investing in carpet and hairpiece soaps to maintain a fresh and aseptic living terrain. Rising mindfulness about allergens, dust diminutives, and bacteria in carpets has driven demand for deep-cleaning results that effectively remove dirt, stains, and doors.

Manufacturers are introducing factory-grounded, biodegradable, and chemical-free carpet soaps to feed to eco-conscious consumers. Products invested with natural enzymes, essential canvases, and hypoallergenic constituents appeal to homes with children and faves , icing safe and effective cleaning without harsh chemicals

E-commerce platforms and direct-to-consumer ( DTC) deals are revolutionizing carpet and hairpiece soap request. Consumers prefer the convenience of copping drawing results online, with brands offering whisked deals, subscription-grounded renewals, and doorstep delivery. Online reviews and videotape demonstrations further influence buying opinions.

Hotels, office spaces, and marketable installations are significant buyers of carpet and hairpiece soaps, emphasizing professional-grade phrasings for large-scale cleaning. The hospitality assiduity prioritizes fast-drying, residue-free, and palliating results that ensure deep cleaning while maintaining fabric quality.

The carpet and hairpiece soap request is growing steadily, driven by adding demand for deep-cleaning results, eco-friendly phrasings, and professional-grade carpet care products. Consumers seek pet-friendly, non-toxic, and biodegradable options, while marketable sectors prioritize heavy-duty and artificial-strength phrasings. inventions in enzyme-grounded cleansers, froth phrasings, and antibacterial treatments are shaping product development. The rise of e-commerce and direct- to- consumer deals has also boosted request availability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Reckitt (Woolite, Vanish, Resolve) | 18-22% |

| Bissell Inc. | 14-18% |

| The Clorox Company | 10-14% |

| Hoover (TTI Floor Care) | 8-12% |

| Zep Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Reckitt (Woolite, Vanish, Resolve) | Market leader in stain removal and deep-cleaning formulas, with a strong presence in both consumer and professional markets. Expanding eco-friendly and non-toxic product lines. |

| Bissell Inc. | Specializes in shampoo solutions designed for carpet cleaning machines, emphasizing pet stain and odor removal. Offers subscription-based refill programs. |

| The Clorox Company | Focuses on antibacterial and disinfecting carpet cleaners, leveraging its reputation in household sanitization. Strong distribution in supermarkets and online channels. |

| Hoover (TTI Floor Care) | Manufactures professional-grade carpet shampoos compatible with its cleaning machines, targeting both residential and commercial users. |

| Zep Inc. | Leads in industrial-strength carpet and rug cleaners, supplying hotels, offices, and professional cleaning services. Offers concentrated bulk solutions. |

Strategic Outlook of Key Companies

Reckitt (18-22%)

Reckitt dominates with Vanish, Resolve, and Woolite, offering stain-specific, antibacterial, and deep-cleaning carpet shampoos. The company is expanding its green product line with plant-based formulas.

Bissell Inc. (14-18%)

Bissell leverages its vacuum and carpet cleaning technology by offering tailored shampoo solutions. The company invests in pet-friendly, enzyme-based formulas to strengthen brand loyalty.

The Clorox Company (10-14%)

Clorox focuses on germ-killing and sanitizing carpet shampoos, appealing to health-conscious and allergen-sensitive consumers. The company expands online distribution and bulk offerings for professional cleaning services.

Hoover (8-12%)

Hoover integrates machine-compatible, high-foaming carpet shampoos, targeting both home users and commercial buyers. The company is increasing R&D investment in quick-dry and residue-free solutions.

Zep Inc. (6-10%)

Zep leads in commercial and industrial carpet cleaning solutions, offering bulk, high-strength concentrates. Its strong B2B focus includes hotels, offices, and professional cleaning companies.

Other Key Players (30-40% Combined)

Liquid Carpet Shampoo, Foam Carpet Shampoo, Dry Carpet Shampoo, and Others.

Chemical-Based, Plant-Based, and Enzyme-Based.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Carpet and Rug Shampoo industry is projected to witness a CAGR of 5.2% between 2025 and 2035.

The Carpet and Rug Shampoo industry stood at USD 2.1 billion in 2024.

The Carpet and Rug Shampoo industry is anticipated to reach USD 5.6 billion by 2035 end.

Eco-friendly and plant-based carpet shampoos are set to record the highest CAGR of 6.1%, driven by increasing demand for sustainable cleaning solutions.

The key players operating in the Carpet and Rug Shampoo industry include Bissell, Hoover, Resolve, Rug Doctor, Kirby, and OxiClean.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Litre) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 4: Global Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 6: Global Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 10: North America Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 12: North America Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 16: Latin America Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 18: Latin America Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 22: Western Europe Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 24: Western Europe Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 28: Eastern Europe Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 40: East Asia Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 42: East Asia Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by end user, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Litre) Forecast by end user, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by sales channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Litre) Forecast by sales channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by end user, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Litre) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 9: Global Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 13: Global Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 16: Global Market Attractiveness by end user, 2024 to 2034

Figure 17: Global Market Attractiveness by sales channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by end user, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 27: North America Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 31: North America Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 34: North America Market Attractiveness by end user, 2024 to 2034

Figure 35: North America Market Attractiveness by sales channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by end user, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 45: Latin America Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 49: Latin America Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by end user, 2024 to 2034

Figure 53: Latin America Market Attractiveness by sales channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by end user, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 63: Western Europe Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by end user, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by sales channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by end user, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by end user, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by sales channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by end user, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by end user, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by sales channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by end user, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 117: East Asia Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 121: East Asia Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by end user, 2024 to 2034

Figure 125: East Asia Market Attractiveness by sales channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by end user, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by sales channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by end user, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Litre) Analysis by end user, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by end user, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by end user, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by sales channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Litre) Analysis by sales channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by sales channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by sales channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by end user, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by sales channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

The Carpet & Upholstery Cleaning Services Market is segmented by service type and application from 2025 to 2035.

Carpet Extraction Cleaner Market Analysis- Trends, Growth & Forecast 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA