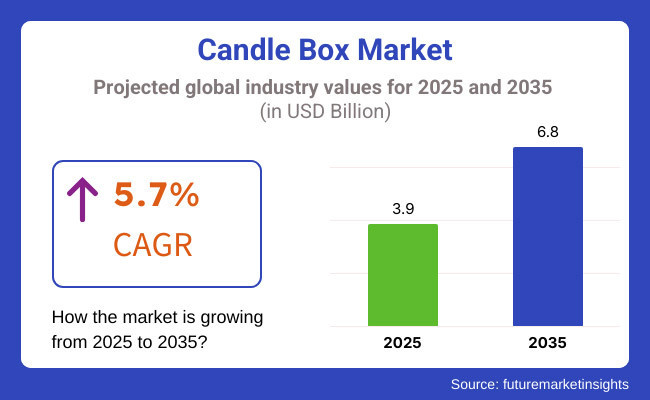

The candle box market is projected to grow from USD 3.9 billion in 2025 to USD 6.8 billion by 2035, registering a CAGR of 5.7% during the forecast period. Sales in 2024 reached USD 3.6 billion, reflecting the sector's resilience in the premium packaging landscape. This growth is driven by increasing consumer demand for aesthetically appealing and eco-friendly packaging solutions in the candle industry.

The surge in luxury candle sales and gifting trends has led brands to focus on premium, customized, and sustainable candle box designs. Additionally, the rising awareness regarding eco-friendly packaging materials, such as recyclable cardboard and biodegradable coatings, is prompting manufacturers to innovate and enhance the sustainability of candle boxes.

A significant shift is being observed in material preferences within the industry. Manufacturers are increasingly adopting sustainable materials like recycled cardboard and biodegradable plastics to meet consumer demand for environmentally responsible products. Modern design elements, such as two-piece candle boxes and those with windows, are gaining popularity, allowing consumers to view the candle before purchase. Custom candle labels are also becoming more common, enabling brands to add a personal touch to their products and stand out in a competitive market.

In April 2024, International Paper announced a recommended all-share combination with DS Smith, aiming to create a global leader in sustainable packaging solutions. Mark S. Sutton, Chairman and Chief Executive Officer of International Paper, stated, “Combining with DS Smith is a logical next step in International Paper's strategy to drive profitable growth by strengthening our global packaging business.” This strategic move is expected to enhance International Paper's capabilities in Europe and North America, providing a broader range of sustainable packaging solutions to customers.

The market's expansion is also supported by the surge in demand for candles used in home décor and aromatherapy, which has led to higher demand for aesthetically pleasing and functional packaging. The rise in consumer preferences for luxury and personalized candles has spurred innovation in candle box designs, incorporating various materials and finishes that enhance the unboxing experience.

Additionally, the trend towards sustainable and eco-friendly packaging solutions is gaining traction, with manufacturers focusing on recyclable and biodegradable materials to meet consumer demand for environmentally responsible products.

Moreover, the candle box market is expected to deliver an incremental opportunity worth USD 2.9 billion through 2035, as global brands and local manufacturers increasingly invest in differentiated packaging formats to improve product appeal and sustainability. With its ability to enhance branding and meet environmental goals, custom candle boxes are positioned as a strategic component in the premiumization of product lines across industries.

Lock bottom boxes are projected to capture approximately 33.8% of the candle box market by product type in 2025, owing to their structural strength, assembly stability, and high compatibility with heavier candle formats. These boxes are designed with interlocking bottom flaps that securely lock into place, offering superior weight-bearing capacity compared to tuck-in or crash bottom styles. This makes them particularly well-suited for large-sized jar candles, multi-wick candles, and container candles packaged in glass or ceramic vessels.

The lock bottom format ensures the base remains tightly sealed without the need for adhesives, minimizing packaging failures during transport or display. Candle manufacturers favor this box style for its ease of flat shipping, quick assembly in fulfillment centers, and ability to accommodate custom inserts or padding for added protection.

From a branding perspective, the box’s clean panels support high-quality printing for logos, scent profiles, and decorative elements, making them ideal for both retail display and e-commerce. As functional reliability and efficiency remain top priorities for brands operating in high-volume segments, lock bottom boxes will continue to dominate as the go-to solution for stable, protective, and visually flexible candle packaging.

Mass candle boxes are expected to account for 64.1% of the type-based segmentation by 2025, reflecting their dominant role in meeting the packaging needs of budget-friendly and widely distributed candle products. Typically manufactured using lightweight paperboard or corrugated material, mass boxes are optimized for high-speed production, bulk shipping, and shelf-ready display across supermarkets, discount stores, and general retailers. These boxes focus on delivering functional protection and brand visibility at the lowest possible unit cost.

Their design tends to favor efficient die cuts, standardized dimensions, and minimal embellishments, supporting large-scale automation in packing facilities. Despite their low-cost positioning, many mass candle boxes are now incorporating basic sustainable features such as soy-based inks, recyclable board, and simplified branding aligned with eco-conscious consumer preferences. Additionally, they can be adapted to seasonal product lines or promotional bundles without incurring high design or tooling costs.

As global candle consumption continues to expand beyond premium and artisanal niches into everyday utility and fragrance segments, mass boxes remain the preferred packaging solution for brands prioritizing scalability, affordability, and operational efficiency across wide retail networks.

Challenge: Sustainability and Waste Management

Sustainability and wastage are threatening the sector of the candle boxes market, and packaging sectors are urged to make effort to minimize the ecological impact. Packaging waste with plastic coatings, metallic foil, and candle boxes that are impossible to recycle. This has led to stringent regulations being put in place by international regulatory bodies for sustainable packaging, which has propelled manufacturers toward adopting green alternatives. However, the transition to sustainable materials is often more expensive, which poses challenges to businesses that are active in cost-sensitive market segments.

Opportunity: Customization and Smart Packaging Trends

The emerging trend of customized and intelligent packaging is a big opportunity in the candle box market. Consumers are increasingly looking for distinctive and beautiful packaging that complements the overall candle-purchasing experience. Brands are using new printing technologies, embossing, and digital personalization to produce striking candle boxes that showcase their personality. The use of QR codes and augmented reality features in packages also enables brands to provide interactive experiences, for example, storytelling about the fragrances of candles, the origin of ingredients, and how to use them. As e-commerce keeps growing, the need for new and protective candle packaging increases, leading to increased market growth.

The USA candle box industry is witnessing consistent growth because of rising consumer demand for high-end and customized candle packaging, growth in e-commerce sales, and the increasing popularity of candles as lifestyle and home décor items. The move toward sustainable and eco-friendly packaging solutions is influencing innovations in biodegradable and recyclable candle boxes. Moreover, luxury and premium candle companies are spending on premium and visually good-looking packaging to improve product attractiveness, again driving market demand.

The rising expansion of subscription box services and online platforms has also helped drive the demand for personalization of candle boxes. As consumers seek personalized and gift-worthy packaging, producers are concentrating on robust, good-looking, and environmentally friendly materials to stand out from the competition.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

Drivers of UK Candle Box Market Growing trend of home fragrance products, rising sales of eco-friendly packaging materials, and high sales of premium candles drive the UK candle box market. Rising demand for sustainable and plastic-free materials, driven by regulations relating to the environment, is compelling manufacturers to develop paper-based and biodegradable packaging products.

Additionally, the digital gifting culture and the emergence of niche candle brands are fueling the demand for alluring personalized candle boxes. They focus on premium printing, embossing, and unique box layouts to entice consumers, as the trend for minimalism and luxury packaging becomes more popular.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

Growing need for lightweight and functional packaging, growing use of candles, and rise in the premium home fragrances market are driving the candle boxes market in the European Union. Germany, France and Italy are also among the leading nations with consumers preferring premium and sustainable solutions.

EU directives on packaging waste have increased the application of compostable, recyclable, and FSC-approved materials to manufacture candle boxes. Moreover, the increasing demand for luxury candle brands and specialization of boutique gift packaging is also projecting the demand for custom and beautiful packaging designs. Growth in seasonal and festive candle collections is also propelling the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

Japan's market for candle boxes is expanding based on growing interest in aromatherapy candles, increased demand for sleek and sophisticated packaging, and high consumer demand for environmental-friendly materials. Consumers in Japan prefer simple, sophisticated, and premium packaging design, with this prompting brands to spend money on high-end materials like textured paper, wooden boxes, and beautiful printing methods.

The market is also being supported by an increasing demand for meditation and traditional candles, which is fueling demand for customized and culturally relevant candle boxes. With regulations on packaging wastage, manufacturers are turning towards biodegradable and recyclable candle box formats, aiding sustained market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

South Korea's market for candle boxes is growing driven by the trend of growing usage of scented and therapeutic candles, growing e-commerce retailing, and premium consumer demand for innovative and fashion-forward packaging. South Korea's thriving K-beauty and home lifestyle markets are shaping candle package trends, and companies are now emphasizing stylish, compact, and sustainable box packs.

Personal and limited-edition packaging demand is also growing as brands provide season and festival-inspired candle collections. Moreover, sustainable packaging trends compel manufacturers to opt for recyclable and biodegradable materials with government support towards reducing packaging waste.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The market for Candle Box is witnessing substantial growth because of the escalating need for decorative and eco-friendly candle packaging solutions. With growing consumer demand for premium and customized candle packaging, producers are concentrating on innovative materials, green alternatives, and customization.

The growth of the home decor and gifting business and the development of e-commerce is also adding to the demand for the market. Top firms are concentrating on product differentiation, ruggedness, and branding to stay ahead in the competition.

McKenzieCrest Inc. (15-20%)

One of the most recognized luxury candle packaging companies, McKenzieCrest Inc. is famous for its luxury, eco-friendly designs. The company invests in high-quality materials and sustainable production to address the increasing need for environmentally friendly products.

ICM Custom Packaging (12-16%)

With a specialization in fully customizable packaging, ICM Custom Packaging concentrates on innovative branding and eco-friendly designs. The business partners with candle brands to develop unique and functional packaging.

Craft Candles Manufacturer (10-14%)

Being one of the leaders in handcrafted and artisan packages, Craft Candles Manufacturer provides customized packaging for boutique candle brands. The business combines innovative design elements with high-quality materials.

BlueBox Packaging (8-12%)

A maker of sturdy and rigid candle boxes, BlueBox Packaging prioritizes product safety alongside an upscale appearance. The business caters to mass-market as well as luxury brands.

ClipnBox (6-10%)

With emphasis on price affordability and innovation, ClipnBox offers diverse designs for candle boxes appealing to value-seekers and small companies.

Elite Custom Box (5-9%)

Renowned for high-end and aesthetically pleasing candle boxes, Elite Custom Box provides exquisite printing, finish, and brand solutions for candles seeking to differentiate themselves.

Other Key Players (30-40% Combined)

The candle box market is also supported by regional and emerging companies, including:

The market is estimated to reach a value of USD 3.9 billion by the end of 2025.

The market is projected to exhibit a CAGR of 5.7% over the assessment period.

The market is expected to clock revenue of USD 6.8 billion by end of 2035.

Key companies in the Candle Box Market include McKenzieCrest Inc., ICM Custom Packaging, Craft Candles Manufacturer, BlueBox Packaging, ClipnBox.

On the basis of type, premium box to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Shape, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Shape, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Shape, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Shape, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Shape, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Shape, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Shape, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Shape, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Shape, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Shape, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Shape, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Shape, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Shape, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Shape, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Shape, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Shape, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Shape, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Shape, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Shape, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Shape, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Shape, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Shape, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Shape, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Competitive Breakdown of Box Pouch Providers

Market Share Insights of Boxboard Packaging Providers

Box Latch Market Positioning & Competitive Analysis

Industry Share Analysis for Box Liners Companies

Candle Jar Market Growth & Industry Forecast 2025 to 2035

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Carboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA