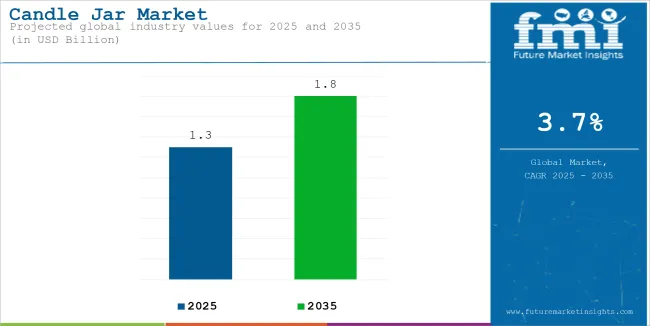

The global Candle Jar market is estimated to account for USD 1.3 billion in 2025. It is anticipated to grow at a CAGR of 3.7% during the assessment period and reach a value of USD 1.8 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Candle Jar Market Size (2025E) | USD 1.3 billion |

| Projected Global Candle Jar Market Value (2035F) | USD 1.8 billion |

| Value-based CAGR (2025 to 2035) | 3.7% |

A candle jar is a type of container made specifically for candles. Most candle jars are made of materials such as glass, ceramic, or concrete suitable for various shapes and sizes of candles. In order to provide the best lighting experience, the design of candles, and jars should be considered. Candle jars contain melted wax and wick but enable safe burning and effective scent diffusion.

Commonly made from glass, ceramic, or metal, these jars enhance the visual presentation of the candle while helping to ensure good performance by providing the best conditions for burning and the release of fragrance. The design of candle jars is essential because it affects the candle aesthetics.

| Attributes | Details |

|---|---|

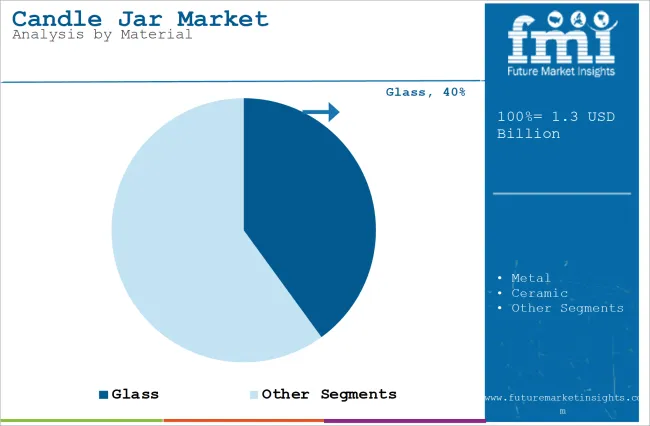

| Top Material | Glass |

| Market Share in 2025 | 40% |

Based on material, the market is divided into Glass, Metal, and Ceramic. The glass segment is expected to account for a 40% share in 2025. One of the key reasons that glass candle jars are so highly recommended is because of their attractive, sophisticated design.

Glass enables a customer to visualize the bright colors and different textures on the candle. This transparency also reflects the glow of the flickering flame creating a cozy ambiance in the given space. The aesthetic versatility of glass jars allows them to be perfectly suited to different décor styles, making them a favorite among consumers looking to elevate their home interiors.

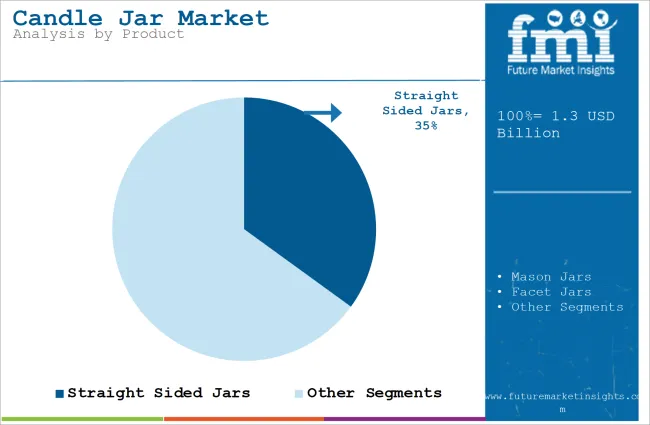

| Top Product | Straight Sided Jars |

|---|---|

| Market Share in 2025 | 35% |

Based on product, the market is divided into Mason Jars, Straight Sided Jars, and Facet Jars. The Straight-Sided Jars segment is expected to account for a 35% share in 2025. Straight-sided candle jars are rapidly gaining popularity within the candle market for several reasons enhancing their functionality as well as aesthetics.

The primary advantage of straight-sided candle jars is that they are space-efficient. The straight walls allow maximum fill capacity, as more wax can be poured into the jar compared to tapered or curved designs.

This feature is particularly beneficial for manufacturers, as it enables them to produce larger candles without increasing the overall footprint of the product. This helps in easy stacking and storage, which makes logistics easier during shipping and retail display, Straight-sided jars also provide considerable aesthetic flexibility.

Smooth lines and minimal ornamentation allow for use with very popular interior design schemes from modern to rustic. This allows candle manufacturers to appeal to the preferences of many consumer’s tastes and changes in interior designs.

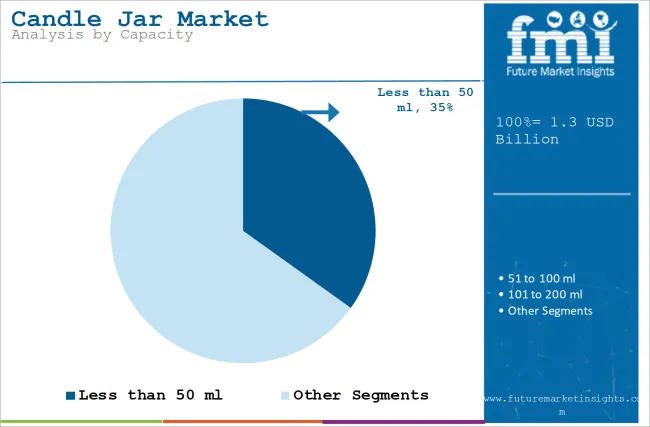

Based on capacity, the market is divided into Less than 50 ml, 51 to 100 ml, 101 to 200 ml, and Above 200 ml. The 101 to 200 ml candle jars fall perfectly in size, which also happens to make them highly practicable. It is at the same time not too bulky, which goes a long way in making the candy usable and practical for every day. Consumers include the durability of this candle because they can enjoy their fragrance for a long time without having to replace it frequently.

Growing Interest in Home Décor

The primary driver of the candle jar market is growing consumer interest in home décor. Consumers seek to create an inviting and visually pleasing living space, and candles have become a popular decorative item to enhance ambiance.

The trend toward personalization in home design has led consumers to choose candles not only for their functional use but also as stylish accessories that complement various interior styles. The rise in interest in home aesthetics has led to an increased demand for decorative candle jars, which are both useful containers and beautiful décor pieces.

Rise of Wellness and Aromatherapy Trends

Another driving factor for growth in the market for candle jars is the increasing interest in wellness and self-care practices, with aromatherapy being a growing area of awareness. Consumers increasingly use scented candles as an avenue to de-stress and relax, seeking products infused with essential oils and fragrances associated with wellness.

This trend is aligned with a broader cultural shift toward holistic health, where individuals focus on mental and emotional wellness. Therefore, candle jars designed for aromatherapy purposes are gaining popularity, thus driving demand as consumers seek to enhance their personal spaces with calming scents and soothing experiences.

Seasonal and Festive Demand

Seasonal and festivals also generate massive demand within the candle jar market. With their association of celebrating and observing the rituals for candles, the online marketplace experiences greater volumes during seasons such as Christmas, Diwali, and Halloween.

Consumers commonly purchase candle jars as decorations and presents during festivals and holidays. The continuous demand allows manufacturers to produce a wide array of themed candle jars for particular occasions, which drives the market upward throughout the year.

Expansion of Online Retail Channels

Online retail channels have dramatically changed the candle jar market because they make the products available to a large audience. Through e-commerce, consumers can browse through different candle jar products from the comfort of their homes and compare and purchase them easily.

The trend of online shopping has been expedited by the advancement of technology and changing consumer behaviour. With more consumers shopping online, the candle jar market is expected to grow as brands capitalize on digital marketing channels to reach potential customers effectively.

Safety Concerns

The most significant restraint in the candle jar market is the persistent safety problems as directly related to candle use. The fire hazards involved in using candles make them hazardous if left unattended or near flammable materials. Such safety concerns have led to stringent safety regulations and guidelines that manufacturers must observe, which can raise production costs and complicate design.

In addition, consumer’s knowledge of safety concerns and, decision to choose alternative home fragrances without any open flame as essential oil diffusers and electric wax warmers. This shift in consumer preference limits the candle jar market from growing to its full potential

Sustainability and Eco-Friendly Designs

The most notable trend in candle jars, however, is on sustainability and eco-friendly designs. With increasingly conscious consumers about the environment, there is a need for sustainable and eco-friendly candle jars made of recycled glass, biodegradable plastics, and even natural components such as wood. This reflects a trend that has led to waste minimization and reduced environmental impact.

Personalization and Customization

Personalization and customization have emerged as another standout trend in the candle jar market. Consumers are moving more towards unique choices shaped by their tastes and preferences. Brands emphasize the consumer choices’ by providing engraved or customized candle jars, in which the name, special dates, or special messages are put. Personalization turns candles into treasures on special occasions such as weddings, anniversaries, or birthdays, making them cherished gifts and keepsakes.

Emphasis on Wellness and Self-Care

A major mega-consumer trend in the candle jar market is the growing emphasis on wellness and self-care. As people increasingly emphasize mental health and well-being, candles have become a popular tool for creating calming environments. Scented candles are often associated with aromatherapy practices that promote relaxation and stress relief.

Consumers are looking to buy products that enhance their surroundings and contribute toward a soothing ambiance, thus enhancing the demand for candle jars mainly designed for that purpose. This trend is also supported by the growing mindfulness practices and self-care habits, where lighting a candle is one of the most evident simple ways to promote calmness and provide a better self.

Additionally, the growth trends aligned, manufacturers are concentrating on producing candles that consist of natural elements, such as essential oils and eco-friendly waxes to cater to health-conscious consumers.

USA candle jar industry is expected to continue growing at a CAGR of 2.3 % during 2035. As wellness and self-care practices become increasingly popular, the users seek out the aroma of candles used for aromatherapy and relaxation. Consumers are using candles more as a way to improve their mental well-being, create a peaceful ambiance, and reduce stress.

India is expected to achieve a CAGR of 5.1 % in the forecast period. The candle jar market in India has grown significantly due to the multiple interconnected factors indicating shifts in consumers’ behavior and culture. Firstly, the candles scented kind have become very popular as such products are often associated with wellness and self-care practices.

China is poised to witness a CAGR of 4.9 % in the forecast period. The candle jar industry in China is highly growing and is being powdered by several interrelated factors, which reflect changing consumer preferences and market dynamics. Among the most recognized due to their use in aromatherapy and enhancing home ambiance. As consumers attempt to acquire products that promote relaxation and well-being, candles have become an essential household item. This fits the broader cultural change towards wellness and self-care; people are striving to add more comfort to the home environment.

UK is poised to attain a CAGR of 1.9 % from 2025 to 2035. The UK candle jar market is experiencing growth, explained by a combination of factors that reflect changing consumer preferences and the overall trends of lifestyle. As there’s growth in scented candles, they are mainly used to decorate homes and create relaxing environments. Consumers have begun making significant investments in their living spaces, and candles have become requisite decorative elements that enforce ambiance and contribute to home aesthetics in general.

The candle jar market in Germany is growing at around 5.3% CAGR till 2035 due to cultural, economic, and lifestyle factors changing consumer preferences. One of the significant driver is the rapidly increasing popularity of scented and decorative candles to enhance home ambiance and create a cozy atmosphere.

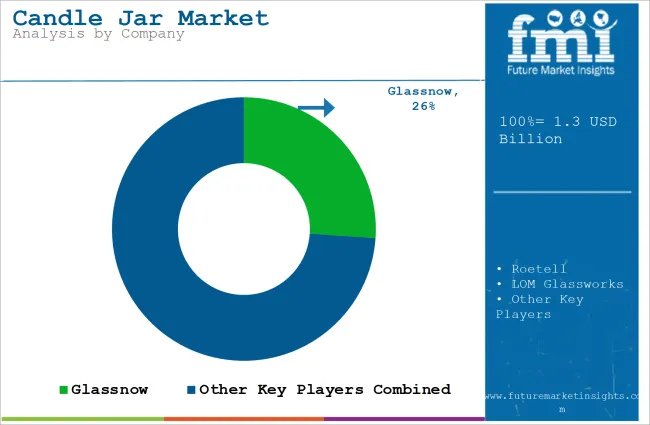

The competitive landscape of the candle jar market is dominated by established companies along with new innovators who have been fueling growth through diverse strategies. Established companies such as Roetell, Glassnow, and TricorBraun are the market leaders who have succeeded in the quality and diversity of their products.

For example, Roetell is famous for its very intricate designs on glassware, and durability has been achieved to meet wholesale as well as retail markets. The growth strategy has emphasized the enlargement of the product line by having unique as well as custom-made candle jars to attract mass-market appeal.

Similarly, Glassnow uses green-friendly practices by including recycled materials in their production. This way, they are attracting the environment-conscious consumer and, at the same time, remain cost-effective. Besides these big companies, Welburn Candles, a new company, is making a good presence in the market by providing options for customization and better craftsmanship.

Several startups have managed to gain ground in the candle jar market through innovative approaches to differentiate and keep up with the changing demands of consumers. A few such examples are listed below:

Boho Ivy is a startup producing handprinted candles with unique design options that the competition cannot find elsewhere. These handmade candles set the business up in a better way than the others by providing its consumers with a true, artistic view of candlemaking. Its development plan includes securing an online reputation on e-commerce platforms to appeal to a higher range of users and showcase this new unique product.

P.F. Candle Co. produces a soy-based candle with unique fragrance blends and emphasizes the narrative of sustainability while promoting its quality production. It will be on social media storytelling in terms of making candles and how this enhances the human lifestyle.

Frostbeard Studio offers themed candles inspired by literature and pop culture. Their growth strategy includes creating limited-edition scents that resonate with specific fandoms, which not only attracts niche audiences but also encourages repeat purchases from loyal customers. Frostbeard Studio effectively utilizes social media marketing to promote its products and engage with fans, further solidifying its brand identity.

In terms of material, the market is segmented into Glass, Metal, and Ceramic.

In terms of product, the market is segmented into Mason Jars, Straight Sided Jars, and Facet Jars.

In terms of capacity, the market is segmented into Less than 50 ml, 51 to 100 ml, 101 to 200 ml, and Above 200 ml.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, and Middle-East and Africa.

The market is predicted to reach USD 1.3 billion by 2025.

The market is predicted to reach USD 1.8 billion by 2035.

The prominent companies in the candle jar market include LOM Glassworks, JL Glass Co. Ltd., EAP Innovations, and others.

Germany is likely to create lucrative opportunities for the candle jar market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Material, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Material, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Material, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Material, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 21: Global Market Attractiveness by Material, 2024 to 2034

Figure 22: Global Market Attractiveness by Capacity, 2024 to 2034

Figure 23: Global Market Attractiveness by Product, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 45: North America Market Attractiveness by Material, 2024 to 2034

Figure 46: North America Market Attractiveness by Capacity, 2024 to 2034

Figure 47: North America Market Attractiveness by Product, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Capacity, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Capacity, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Capacity, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Capacity, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Capacity, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Capacity, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Candle Box Market Size, Share & Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Scented Candle Market

Scented Candlе Industry Outlook

Market Share Distribution Among Eco-Friendly Candle Manufacturers

Eco-friendly Candle Market Report – Demand & Trends 2024-2034

Mosquito Repellent Candles Market Analysis – Trends, Growth & Forecast 2025 to 2035

Jars Market Analysis - Growth & Demand 2025 to 2035

PET Jars Market

Mason Jars & Canning Supplies Market Trends - Growth & Forecast 2025 to 2035

Oblong Jar Market

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Plastic Jar Packaging Companies

Canning Jars Market

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Hermetic Jars Industry

Competitive Overview of Cosmetic Jars Market Share

Hermetic Jars Market Analysis – Trends & Growth Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA