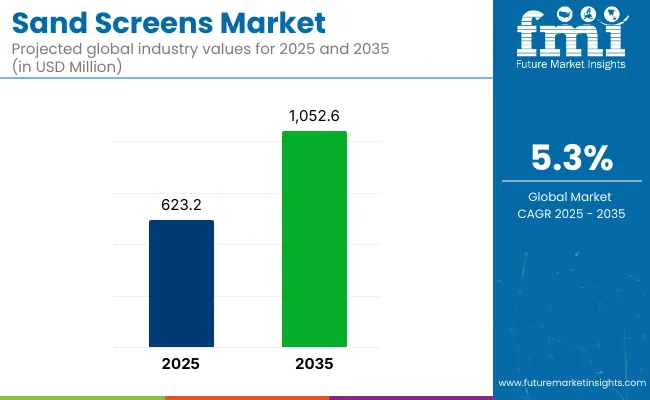

The global sand screens market is valued at USD 623.2 million in 2025 and is expected to reach USD 1,052.6 million by 2035, reflecting a CAGR of 5.3%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 623.2 million |

| Projected value (2035) | USD 1,052.6 million |

| CAGR (2025-2035) | 5.3% |

Growth will be driven by the rising need for effective sand control in mature and unconventional oil and gas reservoirs, along with technological advancements in corrosion-resistant alloys and environment-friendly composite materials. Increasing drilling activities in shale formations and expanding offshore exploration projects are also expected to support market expansion during the forecast period.

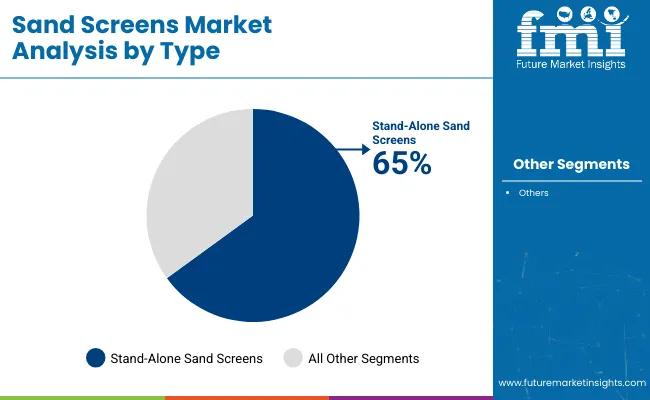

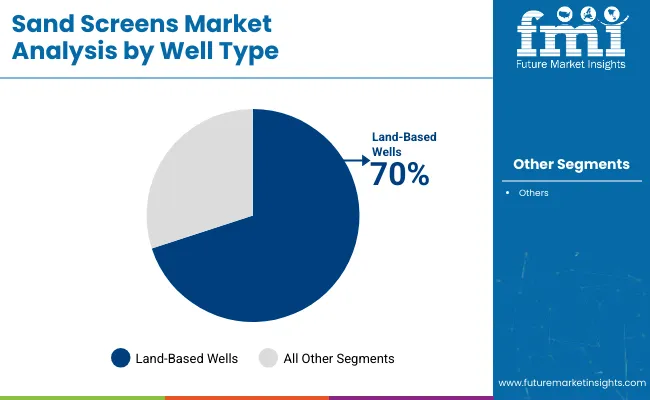

In 2025, the USA is expected to remain the largest market for sand screens due to strong oil and gas exploration, expanding rapidly at a CAGR of 10.0% through 2035. On the other hand, the UK is also experiencing steady growth at a CAGR of 5.0%. Stand-alone sand screens by type are likely to maintain a significant market share of around 65%, whereas land-based well screens by well type are expected to account for nearly 70% of the market share in 2025.

During the assessment period, companies such as Schlumberger and Halliburton are likely to see significant profits owing to their diversified sand control solutions portfolios. However, manufacturers in Asia-Pacific might face challenges due to price sensitivity and limited adoption of advanced technologies, even as investments increase.

Government regulations in Western Europe mandating eco-friendly materials and low-carbon manufacturing are expected to drive the development of sustainable sand screens, while stricter environmental standards in the USA will enforce innovation in low-impact technologies.

Sand screens hold approximately 35% to 40% share in the sand control systems market, as they are essential components in preventing formation sand intrusion during oil and gas production. In the well completion equipment market, they account for around 18% to 22%, supporting efficient reservoir inflow management.

Within the downhole tools market, sand screens contribute roughly 10% to 12%, primarily used in horizontal and high-pressure wells. In the broader oilfield equipment market, their share is about 6% to 8%. Their role in reservoir management and drilling and production equipment markets is smaller, estimated between 4% to 6%, supporting zonal isolation and productivity.

The sand screens market has been segmented into type, well type, and region. By type, it includes stand-alone and remedial or artificial lift protection. By well type, it is segmented into land and offshore. By region, it covers North America, Latin America, Western Europe, Eastern Europe, South Asia and the Pacific, East Asia, the Middle East and Africa.

Stand-alone sand screens are projected to remain the dominant type, accounting for approximately 65% market share through 2035. Their widespread use in unconsolidated formations, particularly for open-hole completions, is driving growth. These screens are preferred for their cost efficiency and operational simplicity compared to remedial or artificial lift protection screens. Adoption is further supported by their ability to control sand production without the need for complex gravel packing, reducing installation time and overall operational costs.

Land-based wells are expected to maintain dominance with an estimated 70% market share by 2035. The segment benefits from the sheer scale of onshore drilling globally, particularly in shale plays and heavy oil reservoirs. Cost efficiency, ease of access, and the rise of unconventional resource development contribute to segment growth. Land wells are preferred for their lower operational costs and scalability in countries such as the USA, China, and India, where large onshore reserves are actively exploited.

Recent Trends in the Sand Screens Market

Challenges in the Sand Screens Market

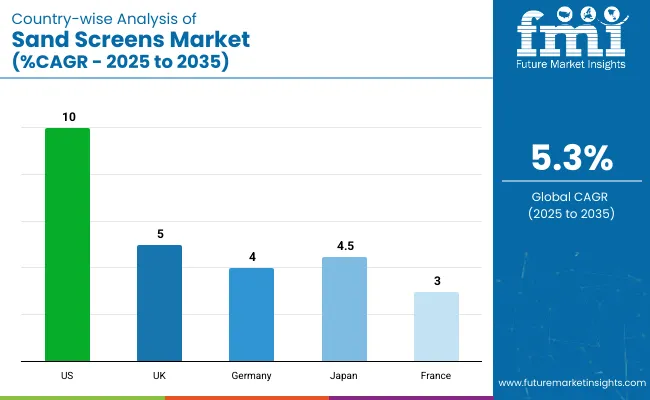

The USA leads the sand screens market with a robust 10.0% CAGR (2025 to 2035), fueled by shale gas activities and smart sand control adoption. The UK follows with a 5.0% CAGR, supported by North Sea asset optimization and improved recovery methods. Japan, growing at 4.5%, leverages its strong manufacturing and offshore supply chain role.

Germany, at 4.0% CAGR, benefits from its export-focused, precision-engineering strength despite minimal domestic production. France lags with a 3.0% CAGR due to its renewable energy focus, yet remains active in global oilfield ventures. Across these countries, innovation, offshore development, and advanced drilling drive varying growth levels.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The sand screens demand in the USA is projected to grow at a CAGR of 10.0% from 2025 to 2035. Growth will be driven by robust shale gas exploration and production activities, especially in the Permian Basin and Eagle Ford Shale regions. Adoption of advanced hydraulic fracturing and horizontal drilling technologies has been creating strong demand for effective sand control solutions. Additionally, a well-established oilfield services ecosystem is supporting market expansion.

The sand screens revenue in the UK is anticipated to register a CAGR of 5.0% from 2025 to 2035. Growth will be supported by efforts to maximize recovery from mature North Sea fields and government initiatives encouraging exploration and production investments. Adoption of improved oil recovery methods and focus on extending the life of existing offshore assets will continue to drive demand for advanced sand control screens.

The sales of sand screens in Germany are forecast to grow at a CAGR of 4.0% from 2025 to 2035. Growth prospects stem from the country’s strong engineering and equipment manufacturing base, which supplies high-grade sand control technologies globally. Despite limited domestic oil and gas production, German manufacturers are well-positioned to export precision-engineered sand screens to international oilfield markets.

The sand screens revenue in France is expected to expand at a CAGR of 3.0% from 2025 to 2035. Growth remains moderate due to limited domestic oil and gas production and a national focus on renewable energy. However, participation in cross-border oil and gas ventures and advancements in sand control technologies by French firms are supporting their international market presence.

The sand screens market in Japan is projected to grow at a CAGR of 4.5% from 2025 to 2035. Growth is attributed to its strong manufacturing capabilities and focus on high-quality, technologically advanced sand control solutions. Japanese firms are well integrated into the global oil and gas supply chain, supplying premium products for offshore and deepwater applications.

The sand screens market is moderately consolidated, with a few global leaders accounting for a significant share of revenues. Companies such as SKF, Trelleborg, Freudenberg Sealing Technologies, Dana Holding, and Federal Mogul are competing based on advanced material engineering, corrosion resistance innovation, and expansion into offshore and unconventional drilling markets. Specialized players like Forum Energy Technologies and Delta Screens enhance competitive intensity with application-specific solutions and proprietary sand control designs.

Company strategies increasingly revolve around developing intelligent sand screens with IoT integration, expanding manufacturing capabilities in high-demand regions like North America and the Middle East, and forming strategic partnerships with oilfield service providers to broaden distribution networks. Firms are also prioritizing R&D investment in recyclable composites and shape-memory alloys to align with stringent environmental regulations while differentiating through long-life, high-performance screen technologies.

Recent Sand Screen Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 623.2 million |

| Projected Market Size (2035) | USD 1,052.6 million |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume in Units |

| By Type | Stand Alone, Remedial or Artificial Lift Protection |

| By Well Type | Land, Offshore |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and the Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, South Korea, Italy |

| Key Players | SKF, Trelleborg , Freudenberg Sealing Technologies, Dana Holding, Federal Mogul, Dichtungstechnik , Henniges Automotive, KACO GmbH + Co. KG, Forum Energy Technologies, Delta Screens |

| Additional Attributes | Dollar sales by value, segment share analysis by region, and country-wise analysis. |

With respect to type, it is classified into stand-alone and remedial or artificial lift protection.

In terms of well type, it is divided into land and offshore.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

The market size is valued at USD 623.2 million in 2025.

The market is forecasted to reach USD 1,052.6 million by 2035, reflecting a CAGR of 5.3%.

Stand-alone sand screens are expected to lead the market with approximately 65% market share in 2025.

Land-based wells are expected to hold around a 70% share of the market in 2025.

The USA is anticipated to be the fastest-growing market with a CAGR of 10.0% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sand Control Screens Market Growth - Trends & Forecast 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Maker Market Size and Share Forecast Outlook 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Containers Market Insights & Industry Analysis 2023-2033

Sand Control Tools Market

Sanding Sugar Market

Sander Market

Sandwich Preparation Refrigerators Market

Sandboxing Market

Sandbags Market

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Network Sandboxing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA