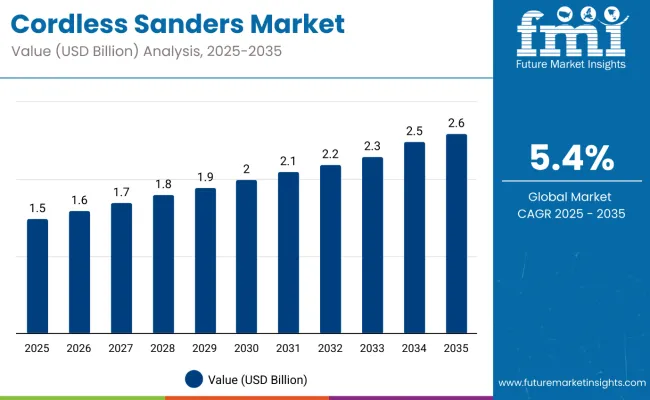

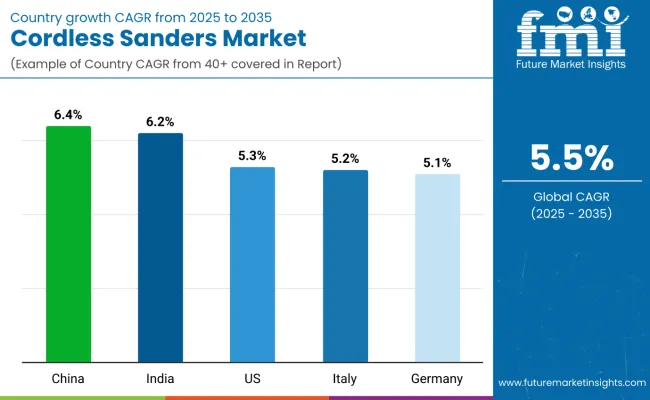

The global cordless sanders market is projected to reach a value of USD 2.6 billion by 2035, rising from USD 1.5 billion in 2025. This represents an absolute growth of USD 1.1 billion over the forecast period, translating to a 73.3% increase in value. The market is expected to grow at a CAGR of 5.4%, with the total size expanding nearly 1.73X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Size (2035F) | USD 2.6 billion |

| CAGR (2025-2035) | 5.4% |

From 2025 to 2030, the market is projected to rise from USD 1.5 billion to USD 2.0 billion, led by increased adoption of brushless motor tools, compact form factors, and battery pack innovations. Residential DIY trends, furniture refurbishing, and cordless flexibility in confined spaces are encouraging user migration from corded to cordless formats.

Between 2030 and 2035, the market is forecast to grow from USD 2.0 billion to USD 2.6 billion, adding another USD 0.6 billion. Growth during this period is likely to stem from new product launches with smart battery systems, ergonomic design improvements, and expanded use across commercial vehicle body shops, woodcraft SMEs, and specialty metal finishing contractors.

Between 2020 and 2025, the cordless sanders market expanded steadily from USD 1.2 billion to USD 1.5 billion, reflecting a value addition of USD 300 million and an annualized growth rate of approximately 4.6%. This period marked the gradual shift of sanding applications from corded and pneumatic systems to battery-powered tools across residential, commercial, and light-industrial sectors.

The COVID-19 pandemic temporarily disrupted the supply of lithium-ion cells and power tool components during 2020 and early 2021. However, pent-up demand from home improvement projects and the rapid growth of online tool retail helped stabilize volumes. DIY professionals and contractors increasingly adopted cordless sanders for interior wood finishing, drywall work, and painted surface preparation, encouraged by compact tool designs and reduced setup times.

Manufacturers responded with enhanced offerings that included variable speed controls, dust extraction systems, and high-efficiency motors. The steady decline in battery prices and improvements in charging efficiency supported broader product penetration across developed markets in North America, Europe, and Japan.

The growth of the cordless sanders market is being propelled by a confluence of user-centric design improvements, enhanced battery performance, and rising demand for flexible power tools across consumer and professional segments. End users are increasingly prioritizing maneuverability, reduced setup time, and safe operation attributes where cordless sanders offer significant advantages over their corded counterparts.

The widespread availability of lithium-ion batteries with faster charging times, longer runtimes, and higher energy densities has removed major performance limitations, enabling users to execute prolonged sanding tasks without frequent recharging. Manufacturers are investing in brushless motor technology and ergonomic tool housings, making cordless sanders more appealing for use in cabinetry, furniture making, auto refinishing, and construction.

The DIY culture, reinforced by increased home renovation activities and digital tool-buying platforms, has led to a surge in consumer adoption of cordless tools. Parallelly, construction contractors and renovation professionals are integrating cordless sanders into standard toolkits to improve on-site productivity and reduce dependency on external power sources.

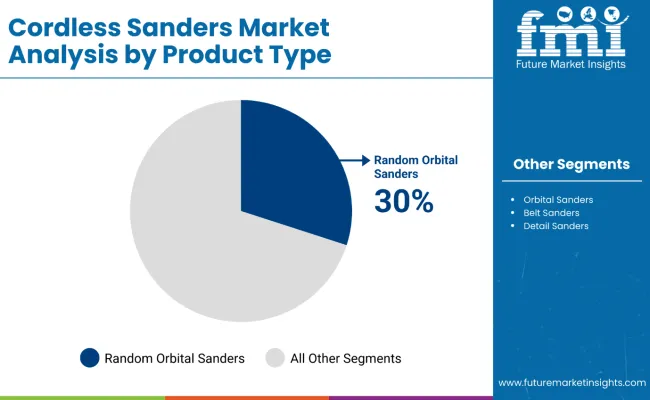

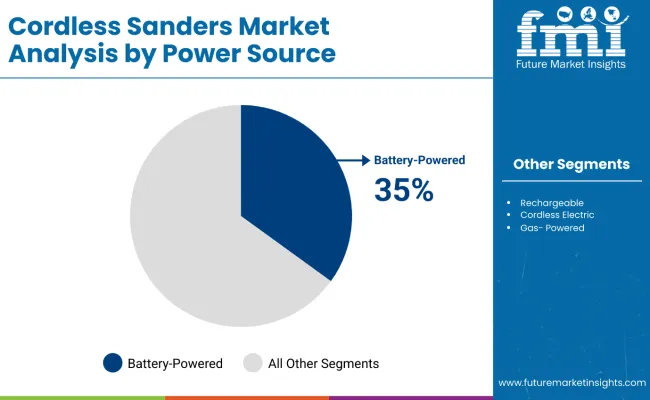

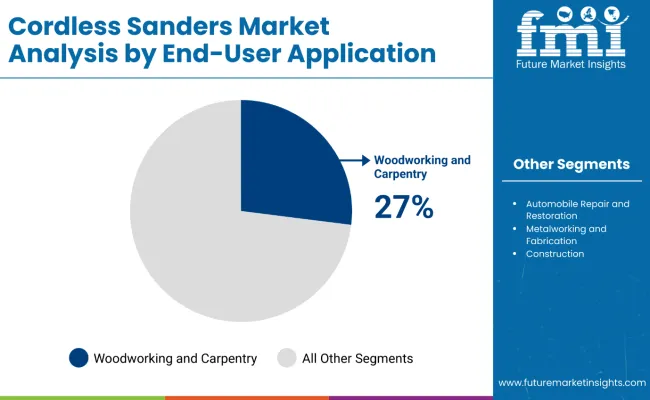

The cordless sander market is segmented by product type into orbital, random orbital, belt, detail, and spindle sanders, reflecting varying use-cases from coarse sanding to intricate detailing. Power source segmentation includes battery-powered, rechargeable, cordless electric, and gas-powered options, each supporting distinct runtime and torque requirements. End-user applications span professional contractors, woodworking and carpentry, automobile restoration, metal fabrication, construction, and DIY users, reflecting a wide application footprint across industries and user expertise levels.

Random orbital sanders are projected to account for 30% of global demand in 2025 and are expected to grow at a CAGR of 5.9% through 2035. Their ability to deliver a swirl-free finish makes them ideal for both professional and hobbyist users. The segment benefits from increasing demand in surface preparation, particularly in furniture making, cabinetry, and auto refinishing. Enhanced motor design, dust collection systems, and variable speed control features are being adopted widely. Manufacturers are also offering compact, ergonomic designs to reduce operator fatigue, supporting increased uptake in fine finishing tasks.

Battery-powered sanders are estimated to command 35% of the global market in 2025 and are forecast to expand at a CAGR of 6.1% over the next decade. Their growing popularity is attributed to the convenience of cable-free operation, enhanced runtime, and portability. Integration of lithium-ion batteries has significantly improved performance and operational time. Contractors and professional users increasingly favor these models for their ability to deliver consistent torque and maneuverability in jobsite conditions. Universal battery platforms across tool ecosystems are further encouraging wider adoption.

Woodworking and carpentry are expected to represent 27% of market share in 2025, growing at a CAGR of 6.0% through 2035. These applications involve sanding of furniture, cabinetry, trim, and wood panels where cordless mobility improves workflow and reduces downtime. Demand is supported by growth in renovation and interior woodwork activities. High-precision models with low vibration and dust control are being adopted by craftsmen and small-scale manufacturers. Increasing DIY activity in developed regions is also contributing to the consistent demand in this segment.

The cordless sanders market is witnessing consistent expansion due to increasing product innovation, battery advancements, and changing consumer preferences favoring mobility and ease of use. However, growth is tempered by limitations in continuous usage time and higher upfront costs compared to corded tools. Industry players are navigating challenges around heat generation, torque delivery, and application-specific power needs while ensuring product durability across diverse end-user segments.

Lithium-Ion Battery Optimization Drives Long-Term Adoption

The integration of high-capacity lithium-ion batteries into cordless sanders is enabling longer runtime, consistent torque, and faster charging factors that are significantly improving user experience across both DIY and professional use cases. Battery packs with smart management systems are gaining traction in premium models, supporting sustained demand in compact job sites and renovation projects.

DIY and Home Renovation Culture Influencing Market Expansion

A growing preference for self-service home improvement, fueled by online tutorials and e-commerce availability, is contributing to the increasing sales of cordless sanders among homeowners. Lightweight models with variable speed settings and dust collection features are appealing to consumers seeking professional-grade results without outsourcing.

Tool Integration and Modular Compatibility Enhance Commercial Usage

Contractors are opting for cordless sander models that integrate seamlessly into modular battery platforms shared across tool ecosystems. This trend is being reinforced by power tool manufacturers offering cross-compatible battery packs for drills, grinders, and sanders, reducing inventory complexity and total ownership costs for professionals.

| Countries | 2025 Share |

|---|---|

| Germany | 30% |

| UK | 18% |

| France | 15% |

| Italy | 10% |

| Spain | 8% |

| BENELUX | 7% |

| Russia | 4% |

| Rest of Europe | 8% |

| Countries | 2035 Share |

|---|---|

| Germany | 28% |

| UK | 17% |

| France | 16% |

| Italy | 11% |

| Spain | 9% |

| BENELUX | 8% |

| Russia | 3% |

| Rest of Europe | 8% |

The European cordless sanders market is expected to grow from USD 293.3 million in 2025 to USD 482.3 million by 2035, reflecting a CAGR of 5.1%. Germany will continue to lead the regional market with a projected 28% share in 2035, driven by high adoption of battery-powered hand tools in the professional woodworking and furniture segments. The United Kingdom is estimated to hold 17% share, supported by strong DIY uptake and e-commerce-based distribution.

France is forecast to slightly increase its share to 16%, backed by state-backed energy-efficient home renovation programs. Italy and Spain are expected to see moderate growth from 10% and 8% in 2025 to 11% and 9% by 2035 respectively, with rising penetration in residential refurbishing and artisan workshops. BENELUX countries will improve their regional share to 8%, while Russia’s share is set to decline to 3% due to trade and import constraints.

China is expected to lead growth in the cordless sanders market between 2025 and 2035. The expansion of domestic tool manufacturers, combined with strong retail and e-commerce penetration, is driving high product visibility across urban and semi-urban clusters. Local players are introducing low-cost cordless models targeting furniture and renovation professionals.

India is poised for rapid adoption of cordless sanders, supported by MSME growth, infrastructure investments, and availability of compact power tools across offline and online platforms. Construction contractors and small-scale furniture makers are transitioning to battery-powered sanding solutions due to inconsistent power supply in several regions.

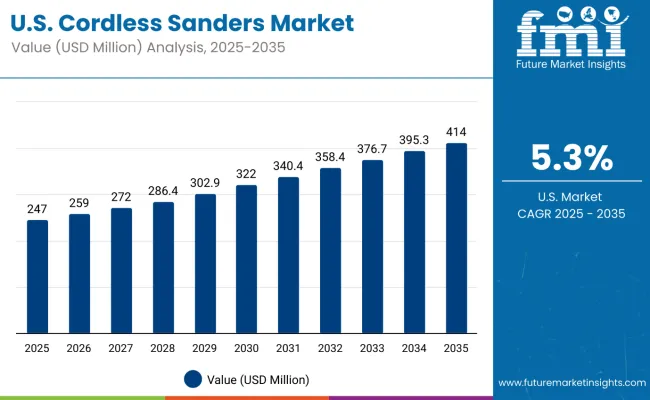

The USA cordless sanders market continues to grow steadily, driven by a well-established consumer base, frequent DIY renovations, and commercial contractor upgrades. Innovation in brushless motor designs and universal battery compatibility is helping increase replacement cycles. Retail promotions and bundled tool kits are contributing to volume sales.

Italy represents a moderately growing market driven by construction SMEs, traditional carpentry businesses, and home restoration services. Users seek cordless sanders for precision work, noise-sensitive environments, and off-grid operations. Local demand is shifting from corded to compact battery-powered variants, especially in woodwork-heavy regions.

Germany remains one of the most advanced markets for cordless sanders, driven by precision engineering demand, active renovation cycles, and robust retail channels. Professional woodworkers and manufacturing technicians increasingly favor cordless systems with interchangeable batteries. Integration with smart diagnostics is also gaining traction in B2B sales.

In Japan, battery-powered sanders account for 65% of the cordless sander market in 2025, driven by high portability needs in home improvement, modular furniture assembly, and electronics casing applications. The demand for rechargeable sanders, which hold a 20% share, is also growing among semi-professional users in small workshops and residential renovation setups. Cordless electric sanders, while limited to 10%, find favor in constrained indoor spaces that benefit from low-noise operations. Gas-powered sanders, with just 5% share, are primarily used in niche industrial restoration projects where consistent high-torque output is essential.

South Korea's cordless sander market is characterized by a balanced application profile. Professional contractors form the largest segment at 30%, using sanders for finishing tasks in interior and exterior worksites. Woodworking and carpentry applications command 20% share, with high-end sanders used in precision wood shaping. The automobile repair and restoration segment holds 15%, leveraging compact sanders for body refinishing. Construction accounts for another 15%, followed by metalworking and fabrication (10%) and DIY enthusiasts (10%), who are increasingly adopting cordless tools through e-commerce and lifestyle retail.

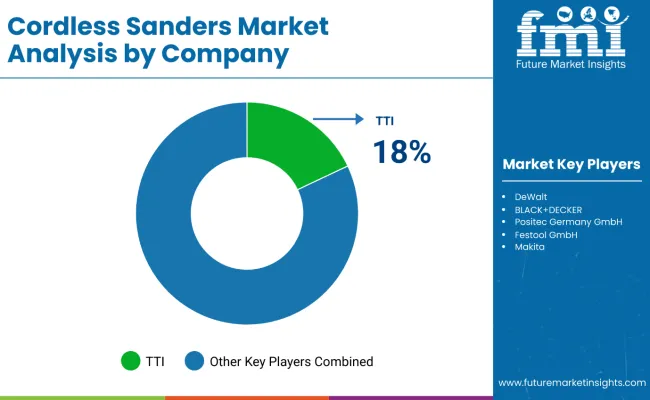

Competition in the cordless sanders market is being driven by the introduction of feature-rich, high-performance tools. New launches are focusing on enhancing jobsite efficiency, user comfort, and precision through innovations such as integrated LED lighting, variable speed control, and multi-mode sanding capabilities.

Cordless designs are being optimized to match or surpass corded performance, targeting professionals in woodworking, automotive body shops, and remodeling sectors. Manufacturers are emphasizing ergonomics, portability, and versatility to differentiate offerings, while continual improvements in battery technology and power management are enabling longer runtimes and consistent output.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion (2025) |

| By Product Type | Orbital Sanders, Random Orbital Sanders, Belt Sanders, Detail Sanders, Spindle Sanders |

| By Power Source | Battery-powered Sanders, Rechargeable Sanders, Cordless Electric Sanders, Gas-powered Sanders |

| By End-User Application | Professional Contractors, Woodworking and Carpentry, Automobile Repair and Restoration, Metalworking and Fabrication, Construction, DIY Enthusiasts |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, South Korea |

| Key Companies Profiled | Makita Corporation, Stanley Black & Decker, Bosch Power Tools, Techtronic Industries Co. Ltd. (TTI), Festool GmbH, Hilti Group, Metabo, Positec Group, Ryobi Tools, WORX |

The global Cordless Sanders Market is expected to reach a value of USD 1.5 billion in 2025, driven by the increasing shift toward cordless, high-efficiency sanding tools in both professional and DIY settings.

The market is forecast to reach approximately USD 2.6 billion by 2035, supported by advances in battery technology, dust management, and ergonomic tool design.

The Cordless Sanders Market is projected to grow at a CAGR of 5.4% between 2025 and 2035, with demand rising steadily across woodworking, construction, and automotive applications.

Random Orbital Sanders are expected to lead the market in 2025 due to their versatility, high surface coverage, and smoother finish quality across multiple materials.

Leading players include Makita, Bosch, Stanley Black & Decker, TTI (Milwaukee), Festool, and Hilti, all focusing on lithium-powered platforms, brushless motors, and smart tool integration for professional and consumer use.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Cordless Garden Equipment Market

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brushless Cordless Band Files Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cordless Fillet Weld Grinder in UK Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Sander Market

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Belt File Sander Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA