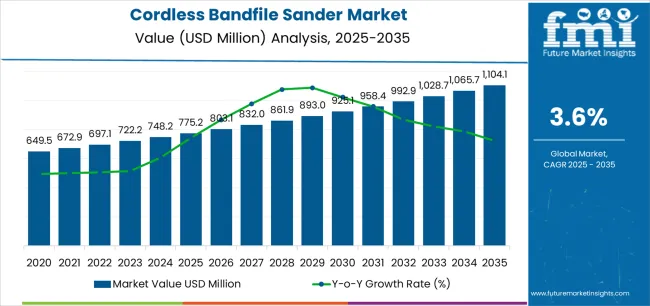

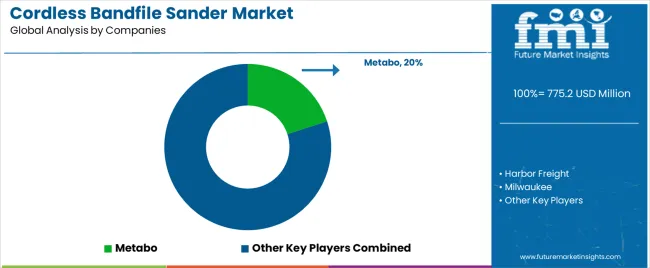

The global cordless bandfile sander market is on track to reach USD 1,104.1 million by 2035, up from USD 775.2 million in 2025, growing at a 3.6 % CAGR. Demand rises as users shift toward cordless mobility, improved battery ecosystems, and compact sanding tools suited for construction, woodworking, metal fabrication, and professional maintenance work. The category blends traditional belt-style sanding with modern battery, brushless motor, and ergonomic technologies, creating tools that deliver portability, precision, and safer use in restricted or multi-site environments. Professional users drive adoption due to runtime improvements, dust-control add-ons, and compatibility with existing workshop batteries, while industrial facilities use cordless bandfile sanders for weld prep, seam finishing, and mobile surface work where cords reduce productivity.

The cordless bandfile sander market adds roughly USD 107 million between 2025 and 2030, supported by stronger cordless preference and better battery performance. Between 2030 and 2035, another USD 221.8 million is added as advanced connectivity features, tool monitoring, and wider adoption in emerging economies improve upgrade cycles. Asia Pacific, Europe, and North America remain the strongest regions, with China, India, and Germany showing the fastest country-level growth. Online sales are gaining momentum due to easier comparison shopping and broader access to cordless tool ecosystems. Supply-chain pressures from lithium-ion cells, abrasives, cobalt, nickel, and global logistics continue to constrain. Competition is shaped by Metabo, Milwaukee, DeWalt, Harbor Freight, Hilti, Einhell, Snap-on, Makita, WEN, Jet Tools, Erbauer, and Bosch, each strengthening its position through battery platforms, runtime enhancement, and ergonomic tool design.

Market expansion stems from evolving user preferences toward mobility, ergonomics and integration with battery ecosystems. Professional woodworkers and metal‑fabricators drive significant demand for cordless bandfile sanders that combine high runtime, dust extraction capability and compatibility with workshop battery systems. Construction and renovation applications favour tools that offer cordless convenience while maintaining industrial grade performance, particularly on scaffolding, elevated platforms and multi‑site deployments.

Industrial and manufacturing applications represent a growing market segment where cordless bandfile sanders serve specialized fabrication, finishing and maintenance purposes. Metal‑fabrication shops utilise these sanders in weld‑preparation and seam finishing where corded constraints limit productivity. Wood‑furniture manufacturers adopt cordless versions for flexible finishing lines and mobile workstations. Regional adoption patterns reflect mature tool markets combined with growing professional tool usage in emerging economies. North America and Europe lead in cordless professional tool penetration, supported by established brands and battery ecosystems. Asia Pacific is gaining traction thanks to rising woodworking, renovation and construction activity, and increased uptake of professional cordless tools. Supply‑chain dynamics involve complexities in battery cell supply, motor manufacturing, abrasive belt sourcing, and global logistics. Price volatility in battery raw materials (e.g., cobalt, nickel) and abrasives influences product cost and profitability across the value chain.

Between 2025 and 2030, the market is projected to expand from USD 775.2 million to approximately USD 882.3 million (assuming uniform CAGR), resulting in a value increase of about USD 107.1 million, which represents ~32.6 % of the total forecast growth for the decade. This phase of development will be shaped by rising demand for cordless adoption, advancing battery runtimes, product innovation in cordless band‑type sanders, and expanding integration within professional tool ecosystems.

From 2030 to 2035, the market is forecast to grow from approximately USD 882.3 million to USD 1,104.1 million, adding about USD 221.8 million, which constitutes ~67.4 % of the overall ten‑year expansion. This period is expected to be characterized by the maturation of cordless bandfile sanders across professional segments, increased replacement cycles, advanced connectivity (e.g., belt wear sensors, battery monitoring), and deeper market penetration in emerging economies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 775.2 million |

| Market Forecast Value (2035) | USD 1,104.1 million |

| Forecast CAGR (2025-2035) | 3.6% |

The cordless bandfile sander market is experiencing growth driven by the increasing demand for portable and efficient power tools in industries such as construction, automotive, and woodworking. Cordless bandfile sanders offer the flexibility and convenience of a wireless design, enabling users to perform sanding tasks in locations without easy access to electrical outlets. This portability and ease of use make them particularly attractive for on-site and fieldwork applications.

As the construction and automotive sectors continue to expand globally, the need for efficient sanding solutions is rising. Cordless bandfile sanders provide a combination of precision and mobility, allowing professionals to quickly and effectively smooth surfaces in a variety of materials, including wood, metal, and plastic. Furthermore, the rise in DIY (do-it-yourself) culture and hobbyist woodworking is also contributing to increased demand for these tools among non-professional users.

Technological advancements in battery life and motor efficiency are also enhancing the performance and appeal of cordless bandfile sanders. Challenges such as higher upfront costs compared to corded alternatives and the need for battery replacements may limit market penetration in more cost-sensitive regions or industries.

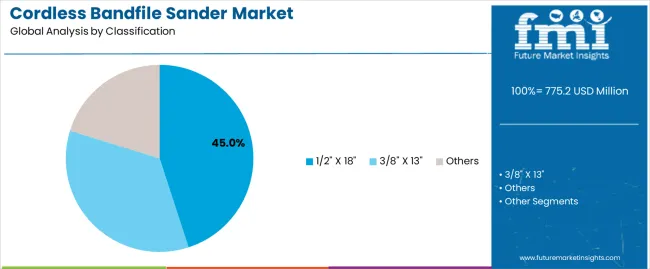

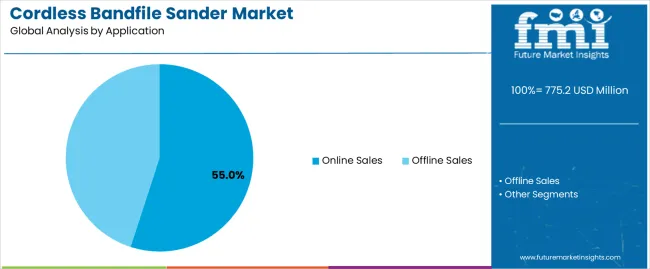

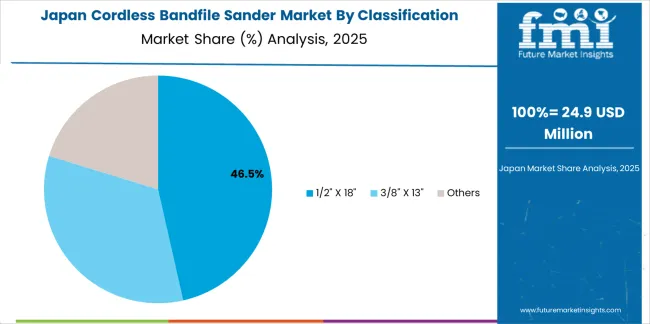

The market is classified by size, application, and region. By size, the market is divided into 1/2" X 18", 3/8" X 13", and Others, with 1/2" X 18" leading the market. Based on application, the market is categorized into Online Sales and Offline Sales, with Online Sales accounting for the largest share. Regionally, the market is divided into Asia Pacific, Europe, North America, and other regions.

The 1/2" X 18" size segment leads the market for cordless bandfile sanders, accounting for 45% of the market share. This size is popular due to its versatility and performance in various sanding applications. The 1/2" X 18" bandfile sander provides an ideal balance between power and control, making it suitable for both professional and DIY use. It is widely used for tasks that require precise sanding, such as woodworking, metalworking, and surface preparation, which drives its demand.

The ease of use and ability to reach tight spaces with this size make it a preferred choice for many users. As industries like construction, automotive, and home improvement continue to grow, the demand for versatile tools like the 1/2" X 18" cordless bandfile sander is expected to rise. The growth of e-commerce platforms and the increasing preference for portable, easy-to-use tools further contribute to the expansion of this segment. As users prioritize convenience and efficiency, the 1/2" X 18" sander remains a dominant choice in the market.

The Online Sales segment holds a significant share of the cordless bandfile sander market, accounting for 55% of the market share. The growth of online shopping is a major driver of this trend, as consumers increasingly prefer the convenience of purchasing tools and equipment online. E-commerce platforms allow buyers to easily compare products, read reviews, and find competitive prices, which has made online sales the preferred method for purchasing cordless sanders.

The rise of online marketplaces and specialized retail websites has made it easier for consumers to access a variety of cordless bandfile sanders, including different sizes and models. The ability to have tools delivered directly to one's doorstep has increased the attractiveness of online sales for both professional contractors and DIY enthusiasts. As consumers continue to prioritize convenience, fast delivery, and competitive pricing, the Online Sales segment is expected to continue to dominate, driving the market’s growth in the coming years.

The market is primarily driven by the increasing demand for portable, flexible tools in construction, metal fabrication, and maintenance sectors. The shift toward cordless tools for improved mobility and efficiency is a key growth factor. Emerging trends include advancements in battery technology, ergonomic designs, and dust‑control features. Market growth is constrained by the higher cost of cordless tools and challenges in battery runtime.

What are the Drivers of Growth in the Cordless Bandfile Sander Market?

The growth of the cordless bandfile sander market is driven by the rising demand for portable finishing tools in industries like construction and metalworking. The need for mobility and flexibility at job sites is a key factor, as cordless tools eliminate the hassle of cords and improve safety. Additionally, the increasing adoption of battery‑powered tool ecosystems with many users preferring to use the same battery for multiple tools supports the growth of cordless sanders. Enhanced battery life and improvements in brushless motors are making cordless tools more capable of handling heavy workloads, further driving adoption. The trend toward ergonomically designed tools also plays a significant role in growth, as users seek tools that are comfortable and easy to use for extended periods. Furthermore, as cordless bandfile sanders become more specialized for precision tasks like contour sanding, edge finishing, and tight spaces, their market reach expands beyond basic applications, adding to overall demand.

How are Emerging Trends Shaping the Cordless Bandfile Sander Market?

Emerging trends in the cordless bandfile sander market include a focus on battery platform integration, where manufacturers are aligning their products with broader cordless tool ecosystems, allowing users to use the same batteries for a variety of tools. Innovations in ergonomics are making the tools lighter, more balanced, and comfortable for prolonged use. Dust control systems and LED lighting on tools are becoming standard to improve job site efficiency and cleanliness. Additionally, advancements in belt change mechanisms are making it easier for users to switch between different sanding belts, reducing downtime. The trend of increased power and runtime due to brushless motors and high‑capacity batteries are enabling cordless bandfile sanders to perform similarly to corded tools, making them viable for more demanding applications. As users increasingly demand tools that combine portability with power, the market is responding with multi‑functionality and tool versatility, expanding the utility of cordless bandfile sanders across various industries.

What are the Restraints Affecting the Cordless Bandfile Sander Market?

Despite growth in the cordless bandfile sander market, there are several challenges. Higher initial costs are one of the main barriers, as cordless tools, particularly those with advanced battery systems and brushless motors, tend to be more expensive than their corded counterparts. Battery life and runtime limitations are additional constraints, as users may find cordless sanders unsuitable for longer, high‑intensity tasks if the battery is not capable of sustaining performance. The specialized nature of bandfile sanders, being suited primarily for precise and niche sanding tasks, also limits the size of the market compared to more general sanding tools. Furthermore, issues with battery compatibility and concerns about long‑term battery degradation may discourage potential customers. Lastly, while cordless tools are increasingly powerful, some users may still prefer corded models for tasks that demand continuous power, creating a challenge for widespread adoption in heavy‑duty applications.

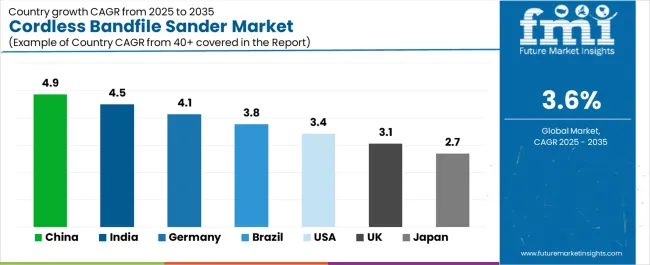

| Country | CAGR (%) |

|---|---|

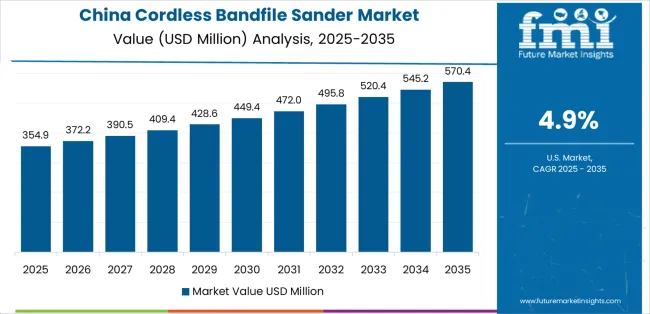

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| Brazil | 3.8% |

| USA | 3.4% |

| UK | 3.1% |

| Japan | 2.7% |

The global cordless bandfile sander market is growing steadily, with China leading at a 4.9% CAGR, driven by strong industrial demand and the rise of cordless power tools. India follows with a 4.5% CAGR, fueled by increasing digitalization and infrastructure growth. Germany grows at 4.1%, supported by its industrial sector's need for precision tools. Brazil’s market is expanding at 3.8%, driven by the growing construction and manufacturing industries. The USA shows a 3.4% CAGR, while the UK and Japan grow at 3.1% and 2.7%, respectively, due to increasing DIY trends and demand for portable tools.

China leads the cordless bandfile sander market with a 4.9% CAGR, driven by the country’s strong manufacturing base and growing demand for power tools across various sectors. As one of the largest producers and consumers of industrial products, China’s robust construction, automotive, and home improvement sectors fuel the demand for high-quality, efficient sanding tools. The increasing adoption of cordless power tools, which offer greater mobility and convenience, is driving market growth. China’s growing DIY culture and expanding e-commerce platforms have made such products more accessible to a wide range of consumers. The country’s focus on innovation and the expansion of its industrial sector ensures a steady demand for cordless bandfile sanders. As the Chinese economy continues to evolve and industrial activities expand, the cordless bandfile sander market is expected to maintain strong growth.

India is experiencing steady growth in the cordless bandfile sander market, with a 4.5% CAGR, driven by increasing industrial activities, infrastructure development, and the rise of DIY culture. The country’s booming construction and automotive sectors are key drivers of this demand, as sanding tools are essential for surface finishing and material preparation. Additionally, the growing awareness of power tools in the DIY and home improvement markets has led to an increase in cordless bandfile sander sales. The availability of affordable power tools, coupled with India’s expanding middle class and rising disposable incomes, further boosts market growth. As India continues to modernize its industries and infrastructure, the demand for cordless power tools, including sanders, is expected to grow at a steady pace. The rise of e-commerce also makes it easier for consumers to access these products, contributing to the market’s expansion.

Germany is witnessing steady growth in the cordless bandfile sander market, with a 4.1% CAGR, driven by the country’s advanced manufacturing sector and focus on precision tools. As Europe’s largest economy, Germany has a strong demand for high-quality, reliable power tools, especially in industries like automotive, construction, and furniture manufacturing. The growing trend towards cordless power tools, which offer portability and ease of use, further supports the market’s growth. Germany’s emphasis on innovation and the development of energy-efficient, eco-friendly tools ensures that the demand for advanced sanding solutions remains high. The country’s strong e-commerce platforms also play a role in expanding the market by making these tools more accessible to both professionals and hobbyists. As Germany continues to lead in industrial automation and precision manufacturing, the demand for cordless bandfile sanders is expected to remain strong.

Brazil is experiencing moderate growth in the cordless bandfile sander market, with a 3.8% CAGR, driven by increased industrial activities and the growing demand for power tools in the construction, automotive, and home improvement sectors. The rising popularity of DIY projects and the increasing availability of cordless power tools in Brazil’s retail and e-commerce markets are contributing to the market’s growth. As Brazil continues to develop its infrastructure, there is an increasing demand for tools that provide efficiency and convenience. Additionally, Brazil’s expanding manufacturing sector, which requires high-performance sanding tools for a variety of applications, further boosts the demand for cordless bandfile sanders. With the rise of online shopping platforms, Brazilian consumers are also gaining better access to these products, driving the growth of the market. As the economy recovers and industrial demand increases, Brazil’s cordless bandfile sander market is expected to continue expanding steadily.

The USA is witnessing steady growth in the cordless bandfile sander market, with a 3.4% CAGR, influenced by the demand for power tools in both professional and DIY markets. The rise of home improvement projects and the growing popularity of cordless tools for convenience and mobility are key drivers in the USA market. The increasing demand for sanding tools in industries like automotive, construction, and woodworking, combined with the expansion of DIY activities, is also contributing to the growth. Additionally, the USA market benefits from a mature e-commerce sector, making power tools more accessible to a broader range of consumers. As technology advances and cordless power tools continue to improve in terms of performance and battery life, the market for cordless bandfile sanders is expected to continue its growth in the USA, driven by both professional and recreational users.

The UK is experiencing moderate growth in the cordless bandfile sander market, with a 3.1% CAGR, driven by increasing demand for power tools in both professional and home improvement sectors. The growing popularity of DIY culture, along with a focus on convenience and portability, has led to a rise in the adoption of cordless power tools, including sanders. The UK’s strong construction and automotive sectors, which require precise and efficient sanding tools, also contribute to market growth. As the e-commerce market continues to expand, more consumers in the UK are gaining access to high-quality cordless bandfile sanders. The shift towards cordless power tools, with their improved battery life and ease of use, is expected to continue supporting the market’s growth. As the demand for professional-grade tools and home improvement solutions rises, the cordless bandfile sander market in the UK is projected to grow steadily.

Japan is witnessing steady growth in the cordless bandfile sander market, with a 2.7% CAGR, driven by its strong manufacturing sector and the increasing adoption of cordless power tools. The country’s demand for precision tools, particularly in industries like automotive, construction, and electronics, is pushing the need for high-quality sanding solutions. The rise of DIY culture and the growing popularity of home improvement projects in Japan are contributing to the market’s growth. As Japan focuses on automation and technological advancements in manufacturing, the demand for efficient and portable tools like cordless sanders continues to rise. The country’s strong e-commerce platforms also make it easier for consumers to access these tools. Despite the relatively mature market, the shift towards cordless power tools with enhanced battery life and performance is expected to support steady growth in the cordless bandfile sander market in Japan.

The cordless bandfile sander market is competitive, with several well-established brands offering a range of products designed to meet the needs of both professional and DIY users. Metabo leads the market with a 20% share, known for its high-performance tools and commitment to innovation in power tools. Metabo's focus on quality, durability, and advanced technology in its cordless bandfile sanders gives it a strong edge in both professional and industrial applications.

Other key players in the market include Harbor Freight, Milwaukee, and DeWalt, each of which has a significant market presence. Harbor Freight competes by offering affordable options that appeal to budget-conscious consumers, while Milwaukee is known for its premium tools, delivering high power and efficiency, often targeting professionals in construction and industrial sectors. DeWalt continues to be a major contender with its reliable and durable sanders, known for their long battery life and ergonomically designed products.

Brands like Hilti, Einhell, and Snap-on focus on offering high-quality tools that are both efficient and durable, appealing to professionals in the construction and automotive industries. Makita, WEN, and Jet Tools provide solid competition with their high-performing yet budget-friendly options. Erbauer and Bosch round out the competition, with Bosch being recognized for its innovation and quality, offering tools that cater to both high-end and entry-level users.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | 1/2″ × 18″, 3/8″ × 13″, Others |

| Application | Online Sales, Offline Sales |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Metabo, Harbor Freight, Milwaukee, DeWalt, Hilti, Einhell, Snap-on, Makita, WEN, Jet Tools, Erbauer, Bosch |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, technological advancements in cordless bandfile sanders, integration with power tools and DIY applications. |

The global cordless bandfile sander market is estimated to be valued at USD 775.2 million in 2025.

The market size for the cordless bandfile sander market is projected to reach USD 1,104.1 million by 2035.

The cordless bandfile sander market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in cordless bandfile sander market are 1/2" x 18", 3/8" x 13" and others.

In terms of application, online sales segment to command 55.0% share in the cordless bandfile sander market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Cordless Garden Equipment Market

Cordless Sanders Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brushless Cordless Band Files Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cordless Fillet Weld Grinder in UK Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Sander Market

File Sander Market Size and Share Forecast Outlook 2025 to 2035

Angle Sander Market Size and Share Forecast Outlook 2025 to 2035

Belt File Sander Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA