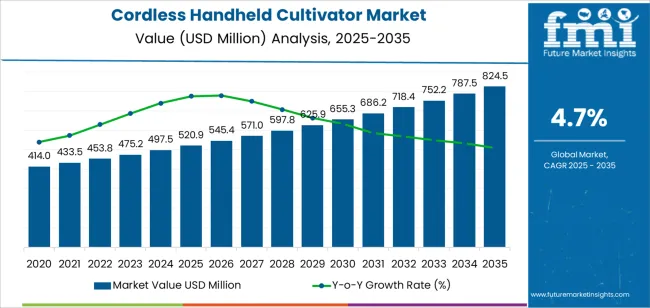

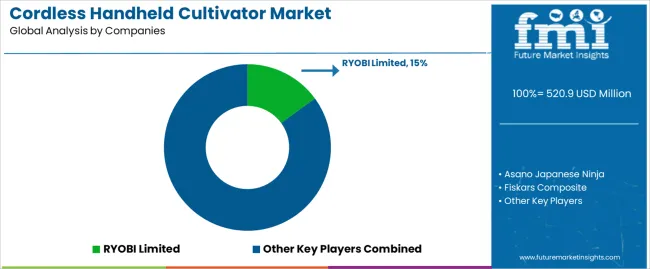

Valued at USD 520.9 million in 2025, the global cordless handheld cultivator market is anticipated to reach USD 824.5 million by 2035, reflecting a CAGR of 4.7% and generating an absolute dollar opportunity of USD 303.6 million during the forecast period. Rolling growth patterns indicate stable demand across residential gardening and small-scale cultivation segments, supported by the increasing shift toward battery-powered outdoor tools that balance performance with environmental efficiency.

Product development is focusing on improving energy density, reducing unit weight, and extending operational runtime. Modern cultivators now feature quick-swap batteries, brushless motors, and adjustable handles for greater usability and reduced fatigue during extended operation. Modular attachments that allow soil aeration, edging, and light tilling are also widening functional applications for both hobbyist and professional users.

Market expansion remains concentrated in North America and Western Europe, where established consumer bases favor low-maintenance, emission-free gardening solutions. Growth in Asia Pacific is accelerating through increased urban horticulture participation and rising adoption of compact electric equipment. Across the 2025–2035 assessment period, raw material sourcing, battery supply continuity, and manufacturing efficiency will remain essential to sustaining competitiveness and meeting consistent volume growth in the cordless handheld cultivator industry.

Between 2025 and 2030, the Cordless Handheld Cultivator Market is projected to grow from USD 520.9 million to USD 655.3 million, reflecting a 25.8% increase over five years. This period will be driven by the rising adoption of battery-powered gardening tools, fueled by consumer demand for eco-friendly and low-maintenance home gardening solutions. Advances in lithium-ion battery technology are extending runtime and improving torque performance, while ergonomic and lightweight designs enhance usability. Manufacturers are also integrating smart control systems and quick-charge capabilities, appealing to both residential users and professional landscapers seeking efficient and sustainable cultivation tools.

From 2030 to 2035, the market is forecast to increase from USD 655.3 million to USD 824.5 million, marking a 25.8% rise in the subsequent five-year span. This growth will be supported by expanding urban gardening initiatives, the growing popularity of smart agriculture tools, and government incentives for adopting electric-powered landscaping equipment. Product innovations emphasizing energy efficiency, modular attachments, and improved safety mechanisms will further strengthen market penetration. Strategic collaborations between battery manufacturers and agricultural equipment brands will foster technological refinement, enabling the development of next-generation cordless cultivators that combine durability, performance, and environmental responsibility.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 520.9 million |

| Market Forecast Value (2035) | USD 824.5 million |

| Forecast CAGR (2025–2035) | 4.7% |

The cordless handheld cultivator market is growing as consumers and landscaping professionals prioritize lightweight, battery-powered equipment that simplifies soil preparation and garden maintenance. These tools, equipped with rechargeable lithium-ion batteries, eliminate the constraints of corded systems and reduce dependence on gasoline engines. Improved motor efficiency and compact gearbox designs enable effective soil aeration and weed management in small plots, greenhouses, and urban gardens. Manufacturers develop ergonomic handles, variable-speed controls, and quick-change tines to improve user comfort and versatility. Rising adoption of eco-friendly garden tools and stricter emission regulations further encourage the transition toward cordless cultivator systems.

Expansion is also supported by advancements in battery chemistry that extend operating time while reducing charging cycles. The growth of home gardening, influenced by urban sustainability movements and increased recreational interest in food cultivation, drives consistent product demand. Distribution networks expand through e-commerce platforms, enabling smaller brands to compete alongside established power tool manufacturers. Product differentiation focuses on torque optimization, reduced vibration, and modular compatibility with other cordless tool systems. High initial prices and limited runtime under heavy-duty use remain adoption challenges in professional landscaping applications. Continuous innovation in compact motor design and energy management sustains long-term market growth across residential and light commercial segments.

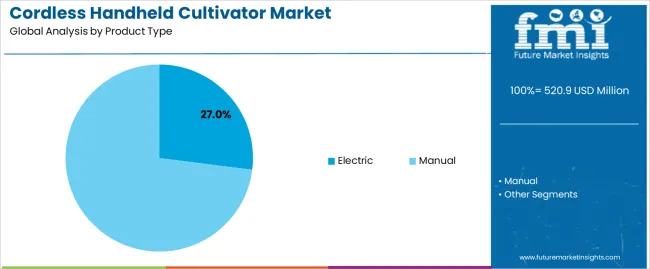

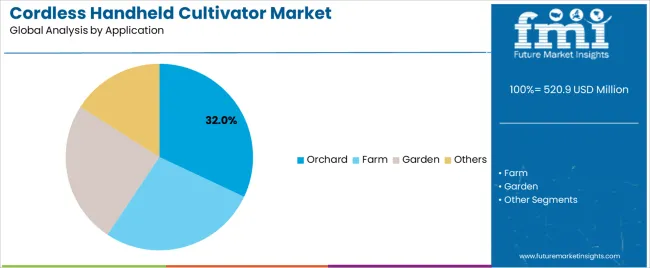

The cordless handheld cultivator market is segmented by product type, application, and region. By product type, the market is divided into electric and manual cultivators. Based on application, it is categorized into orchard, farm, garden, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions define the technology integration level, end-use diversity, and regional adoption patterns shaping product demand across agricultural and horticultural environments.

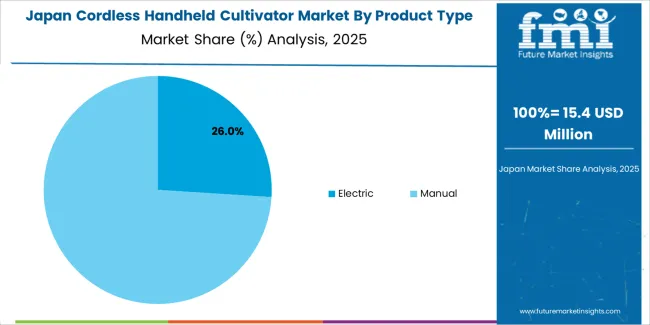

The electric segment accounts for approximately 27.0% of the global cordless handheld cultivator market in 2025, representing the leading product category. Its position reflects the growing preference for battery-powered and low-noise cultivation tools suitable for small-scale and specialized agricultural operations. Electric cultivators offer improved ease of use, consistent power output, and reduced manual effort compared with traditional manual systems. Their portability and low maintenance requirements make them well suited for both domestic and light agricultural applications.

The segment benefits from increased availability of lithium-ion battery technology, which supports longer operational cycles and faster recharging. Adoption is particularly strong among users prioritizing environmental sustainability and ergonomic handling. In addition, manufacturers continue refining motor efficiency and tool design to optimize torque distribution and soil penetration in variable soil conditions. Demand is expanding in regions emphasizing urban gardening and orchard maintenance, notably in Europe and East Asia. As labor efficiency and environmental standards influence equipment selection, electric cordless cultivators remain the preferred option for sustainable, low-emission tillage applications, maintaining their leadership in the overall product landscape.

The orchard segment represents about 32.0% of the total cordless handheld cultivator market in 2025, making it the largest application category. This dominance is attributed to the operational suitability of cordless cultivators for soil loosening and maintenance in confined or irregular orchard terrains. These tools are frequently used for surface tillage, weed removal, and aeration tasks between tree rows, where maneuverability and controlled soil disturbance are critical to protecting root systems.

The segment’s steady growth is supported by small and medium-scale orchard operations adopting lightweight mechanized tools to replace manual labor. Cordless electric cultivators are particularly valued for their precision handling, reduced vibration, and minimal noise output, enabling efficient use in fruit and nut production zones. Manufacturers target orchard applications with specialized attachments designed for root-friendly cultivation and variable depth control. Adoption is significant across East Asia and Southern Europe, where orchard farming is a key agricultural activity. As sustainability and labor optimization remain priorities in agricultural management, the orchard segment continues to lead overall market demand, supported by the expanding availability of efficient, battery-powered cultivation tools suitable for perennial crop environments.

The cordless handheld cultivator market is evolving as homeowners, hobby gardeners and light‐commercial users increasingly favour portable, battery‐powered tools for soil preparation, aeration and weeding. Demand for convenience, mobility and cleaner, cordless operation supports uptake. At the same time, adoption is restrained by battery cost, run-time limitations and competition from alternative tilling methods. A defining trend is integration of higher-capacity lithium‐ion batteries, ergonomic designs and modular attachments that expand functionality. As the gardening and small‐scale urban agriculture sectors grow, cordless cultivators are becoming a more appealing choice for flexible outdoor efforts.

Growth is being propelled by rising interest in home gardening, urban farming and landscaping tools that offer ease of use without power cords or petrol engines. Users value the portability and lower maintenance of battery-operated cultivators compared with gas-powered machines. Enhanced battery technology and improved motor efficiency have made handheld models more practical for small plots, raised beds and backyard gardens. The rise of e-commerce and DIY culture has further enabled access to these tools. Together, these factors raise the addressable market beyond traditional gardeners to a broader group of casual users seeking convenient soil cultivation.

A key restraint is the higher upfront cost of cordless handheld cultivators relative to traditional manual tools or corded electric alternatives. Battery packs and chargers add expense and may require replacement over the tool’s life. Battery runtime and power output still lag large‐scale petrol machines, reducing suitability for more demanding applications or larger areas. Additionally, availability of replacement batteries, performance degradation over time and perceived durability concerns may discourage buyers. In some regions, lack of awareness or price sensitivity also limits penetration, especially in lower-income or low-adoption markets.

The market is trending toward modular systems, better battery performance and smart features. Manufacturers are offering cordless cultivators with interchangeable battery systems across tool ranges, extending value for users. Ergonomic design improvements reduce fatigue and enhance usability for longer sessions. Integration of digital components like depth indicators, brushless motors and customizable attachments is expanding the tool’s versatility. Sustainability is increasingly a performance metric, with focus on longer battery life, recyclable materials and lower noise and emissions compared to petrol alternatives. Growth in emerging markets and expansion into rental and landscaping-service segments further widen growth potential.

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

| USA | 4.5% |

| UK | 4.0% |

| Japan | 3.5% |

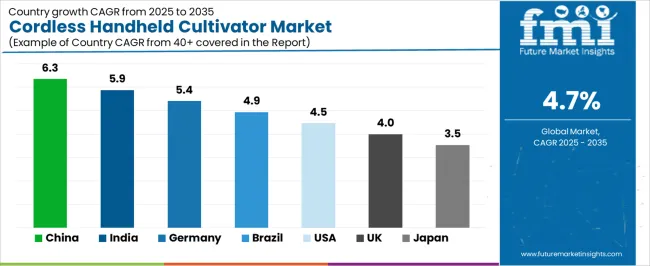

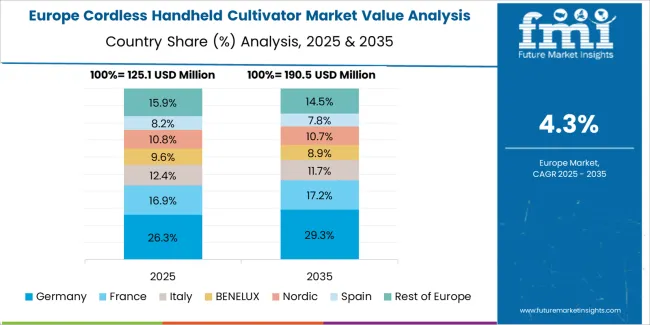

The Cordless Handheld Cultivator Market is expanding steadily worldwide, with China leading at a 6.3% CAGR through 2035, driven by agricultural modernization, adoption of battery-powered equipment, and rapid growth in sustainable farming practices. India follows at 5.9%, supported by government-backed mechanization initiatives, rising small-scale farming efficiency, and increased accessibility to affordable cordless tools. Germany grows at 5.4%, benefiting from precision engineering and high adoption in urban and smart gardening applications. Brazil records 4.9%, reflecting agricultural diversification and mechanized cultivation growth. The USA, at 4.5%, maintains consistent progress with innovation in compact garden equipment, while the UK (4.0%) and Japan (3.5%) focus on ergonomic design, eco-friendly technology, and expanding applications in home and commercial horticulture.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

In China, revenue from cordless handheld cultivators is projected to grow at a CAGR of 6.3% through 2035, supported by rising agricultural mechanization and widespread small-scale farming operations. Expanding rural electrification and government subsidies for modern farming equipment are increasing adoption rates. Local manufacturers are producing lightweight and energy-efficient models suitable for intensive horticultural use. The transition toward battery-operated cultivation tools aligns with environmental policies aimed at reducing emissions from traditional fuel-powered machinery.

India is witnessing consistent market growth for cordless handheld cultivators, advancing at a CAGR of 5.9%, driven by modernization of rural equipment and rising adoption among small and marginal farmers. Agricultural programs promoting sustainable cultivation practices are encouraging the use of compact, battery-powered tools. Domestic manufacturers are developing ergonomic designs suited for vegetable, orchard, and floriculture applications. Increasing availability through local cooperatives and agro-retail outlets ensures wider accessibility across regional farming communities.

Across Germany, the cordless handheld cultivator market is advancing at a CAGR of 5.4%, supported by precision engineering, strong consumer interest in home gardening, and environmentally conscious farming. Manufacturers emphasize design quality, motor efficiency, and operational safety to align with European performance standards. Demand for low-maintenance, cordless systems continues to rise among small-scale horticultural users. Integration of lithium-ion batteries and intelligent power management systems ensures higher efficiency and extended operational life.

Brazil is observing a steady increase in the cordless handheld cultivator market, projected to grow at a CAGR of 4.9%, driven by modernization in agricultural practices and growth in smallholder farming. Government-backed programs supporting rural equipment financing promote adoption of battery-powered cultivators. Local distributors collaborate with international suppliers to introduce robust and affordable models suited to tropical conditions. Expanding horticulture and floriculture industries provide new application opportunities for cordless cultivation tools.

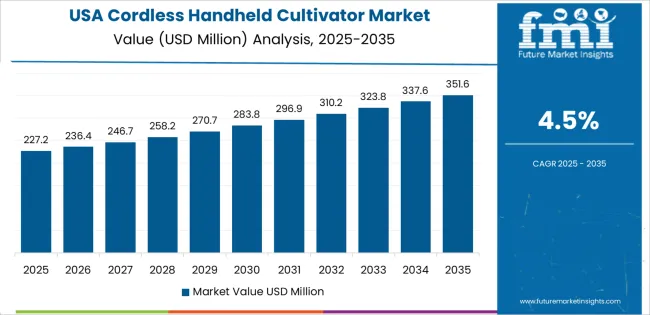

In the United States, the cordless handheld cultivator market is increasing at a CAGR of 4.5%, supported by growing preference for sustainable gardening tools and residential landscaping applications. Manufacturers focus on integrating high-torque brushless motors and advanced battery systems to enhance operational time. The popularity of electric yard equipment among hobbyists and professional landscapers continues to fuel steady demand. Product innovation centered on safety features and noise reduction aligns with evolving consumer expectations.

Across the United Kingdom, the cordless handheld cultivator market is advancing at a CAGR of 4.0%, supported by the country’s growing focus on sustainability and home-based gardening. Increasing adoption among small farms and private gardens sustains steady market utilization. Manufacturers emphasize ergonomics, reduced vibration, and easy battery interchangeability. Integration of recyclable materials and low-carbon production methods enhances environmental performance while maintaining consistent consumer demand for efficient cordless equipment.

Japan is growing steadily in the cordless handheld cultivator market, with revenue expected to increase at a CAGR of 3.5% through 2035. Domestic manufacturers focus on compact and lightweight cultivator designs suitable for precision horticulture and greenhouse use. Ongoing technological innovation in electric motor efficiency and battery management continues to enhance usability. The increasing shift toward eco-friendly gardening tools and urban agriculture supports stable, long-term market performance within both residential and professional segments.

The global cordless handheld cultivator market exhibits fragmented competition, with manufacturers focusing on ergonomic design, battery efficiency, and lightweight construction. RYOBI Limited leads the market through its extensive cordless power tool ecosystem and continued investment in lithium-ion battery technology. Asano Japanese Ninja and Fiskars Composite maintain strong reputations for durable, precision-designed hand tools suited for small-scale and residential gardening. Green Reaper and Radius Garden Ergonomic compete by emphasizing user comfort and soil penetration efficiency in compact cultivator models. Wolf-Garten Small Cultiweeder and Yard Butler deliver mid-range solutions integrating interchangeable attachments and corrosion-resistant materials to enhance operational lifespan and usability.

Corona, Garden Weasel, and Seymour contribute broad product diversity through established hand tool manufacturing expertise and dependable performance in home gardening applications. Edward Tools focuses on affordability and ergonomic handle design for improved user control. Sun Joe maintains a solid presence in powered garden equipment, integrating cordless cultivator systems into its consumer-focused lineup emphasizing ease of maintenance and accessibility. Competition across this segment is driven by power efficiency, material resilience, and operational comfort. Strategic differentiation increasingly depends on battery innovation, torque optimization, and sustainable manufacturing practices, while long-term growth aligns with expanding interest in home gardening and compact mechanized cultivation tools.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Product Classification) | Electric, Manual |

| Application | Orchard, Farm, Garden, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | RYOBI Limited, Asano Japanese Ninja, Fiskars Composite, Green Reaper, Radius Garden Ergonomic, Wolf-Garten Small Cultiweeder, Yard Butler, Corona, Garden Weasel, Seymour, Edward Tools, Sun Joe |

| Additional Attributes | Dollar sales by product type and application; regional adoption trends across residential, commercial, and orchard applications; battery chemistry and energy management innovations; modular attachment systems and torque optimization; ergonomic design trends; sustainability performance (noise, emission, recyclability); e-commerce and distribution analysis; pricing comparison with manual and corded alternatives. |

The global cordless handheld cultivator market is estimated to be valued at USD 520.9 million in 2025.

The market size for the cordless handheld cultivator market is projected to reach USD 824.5 million by 2035.

The cordless handheld cultivator market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in cordless handheld cultivator market are electric and manual.

In terms of application, orchard segment to command 32.0% share in the cordless handheld cultivator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Cordless Sanders Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Cordless Garden Equipment Market

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brushless Cordless Band Files Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cordless Fillet Weld Grinder in UK Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA