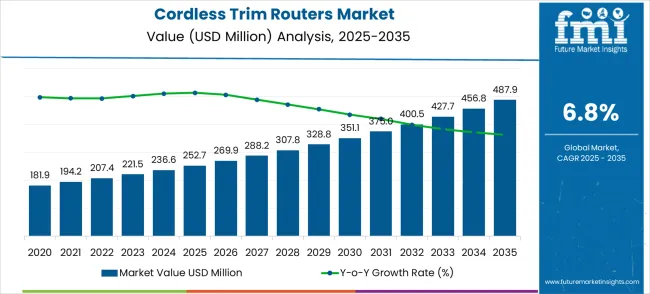

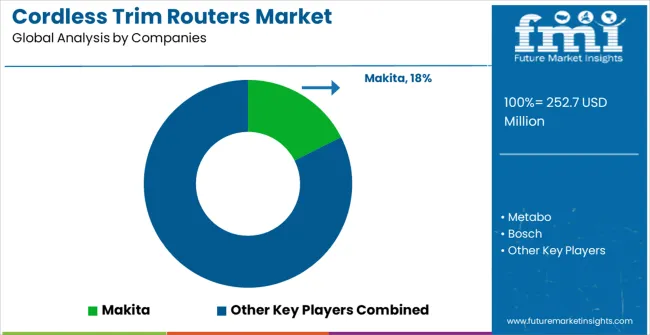

The cordless trim routers market is set to experience substantial growth, projected to rise from USD 252.7 million in 2025 to USD 487.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.8%. This steady upward trajectory is indicative of increasing consumer interest in portable, efficient power tools across various industries, particularly in the DIY and professional woodworking sectors. The trendline for the market, when visualized with a linear model, showcases consistent growth without extreme fluctuations, signaling steady adoption driven by improvements in battery technology and portability. As more consumers and businesses prioritize convenience and mobility, the demand for cordless alternatives to traditional routers is anticipated to grow in tandem. This market development is underpinned by the growing use of these tools in home renovation, furniture making, and construction applications, where space and power source limitations make cordless routers a practical solution.

The trendline for the cordless trim routers market can also be analyzed through an exponential lens, as the sector is expected to benefit from an expanding base of users and increased product availability. The relatively low cost and accessibility of cordless routers compared to their corded counterparts are key factors driving this demand, particularly as more consumers embrace home improvement and DIY projects. With the market expected to reach USD 487.9 million by 2035, it is evident that cordless routers are increasingly being integrated into both professional toolkits and personal use. Industries such as cabinetry, carpentry, and home improvement are poised to benefit from the rapid adoption of this tool due to its compactness, ease of use, and versatility. This sustained growth trend highlights how cordless trim routers are becoming a mainstay in power tool inventories, replacing traditional models for a wide range of applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 252.7 million |

| Forecast Value in (2035F) | USD 487.9 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The cordless trim routers market holds an estimated 2.4% share within the broader power tools market, where it plays a specialized role in precise edge trimming and detailing for various materials. Within the woodworking tools market, it captures a slightly higher share of 3.1%, serving as an essential tool for fine woodworking tasks, particularly in creating clean edges on wood. In the hand tools market, its presence is less significant, accounting for 1.9%, as other manual tools dominate this segment. However, in the cordless tools market, the cordless trim router makes up 4.7%, owing to its portability and ease of use in various environments. The home improvement tools market, encompassing DIY enthusiasts and professionals alike, contributes 3.6% to the market share. Combined, these parent markets showcase the growth of cordless trim routers, driven by increased demand for cordless, precision-oriented, and easy-to-use tools across various applications.

Market expansion is being supported by the rapid increase in home improvement and renovation projects worldwide and the corresponding need for portable woodworking tools that ensure project flexibility and workspace mobility. Modern woodworking operations rely on cordless tool convenience and battery-powered performance to ensure proper execution of routing tasks including edge trimming, decorative profiling, and precision cutting applications. Even minor project requirements can benefit from cordless tool mobility to maintain optimal work efficiency and project completion timelines.

The growing complexity of woodworking projects and increasing consumer preference for DIY activities are driving demand for professional-grade cordless tools from established manufacturers with appropriate performance capabilities and battery technologies. Home improvement retailers and professional contractors are increasingly emphasizing cordless tool advantages following project completion success and customer satisfaction metrics. Performance specifications and battery life requirements are establishing higher standards for cordless tools that require advanced motor technologies and trained technical support.

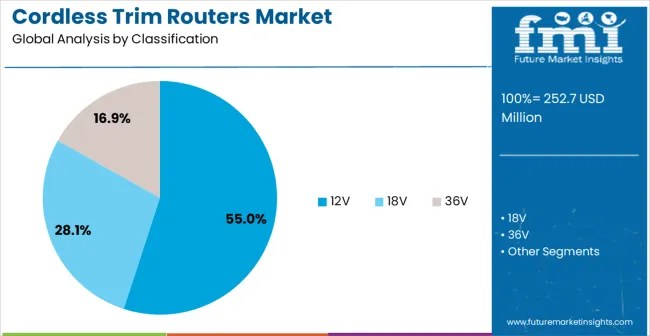

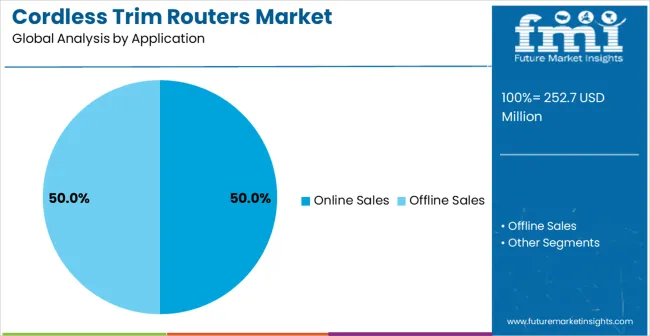

The 18V segment is expected to dominate the cordless trim routers market in 2025, capturing 55% of the share. Its success is driven by optimal power, battery life, and compatibility with professional and DIY applications. The online sales segment is set to capture 50% market share, boosted by e-commerce growth, convenience, competitive pricing, and online reviews.

The 18V power systems are expected to capture 55% of the cordless trim routers market in 2025, fueled by the widespread adoption of 18V battery platforms across both professional and consumer applications. These systems strike a perfect balance between power output and battery life, benefiting from established lithium-ion technologies and proven motor designs. The 18V platform's dominance is attributed to its versatility in handling a variety of routing applications, offering a combination of lightweight design and long battery runtime. It excels in precision edge work, decorative routing, and template-guided cutting tasks, which are common in woodworking. This makes it particularly ideal for projects requiring sustained operation and dependable results, supported by the extensive compatibility and tool options from various manufacturers.

The online sales segment is projected to account for 50% of the cordless trim routers market in 2025, maintaining a strong position. This significant market share is driven by the growing preference for convenient online shopping and easy access to a wide variety of cordless trim routers from leading brands. The ease of online purchasing, coupled with detailed product descriptions and reviews, has made online platforms the preferred choice for both professional and DIY users. Additionally, the rise in e-commerce platforms and targeted digital marketing efforts have further boosted online sales. The online segment is poised to continue its growth as consumers increasingly seek convenience and competitive pricing.

The cordless trim routers market is experiencing steady growth driven by the increasing adoption of portable, flexible tools in woodworking, construction, and DIY sectors. Demand is being fueled by the desire for lightweight, easy-to-use, and efficient tools for precision tasks. Opportunities are rising with the expansion of the home improvement sector and the growing trend of cordless power tools. However, challenges persist with battery life limitations, tool durability concerns, and competition from corded models, which often offer consistent performance for heavy-duty tasks.

The demand for cordless trim routers has been rising significantly due to the increasing need for portable, efficient, and versatile tools in woodworking applications. In opinion, hobbyists, DIY enthusiasts, and professionals in construction and cabinetry are increasingly turning to cordless trim routers for their ability to perform precision tasks without the constraints of power cords. These tools offer enhanced maneuverability and are perfect for intricate jobs, such as edge trimming, decorative routing, and pattern work. The demand for cordless models is also spurred by their convenience in job sites or workshops where mobility is key. With more professionals and DIY users opting for cordless solutions, the market for these routers is set to expand rapidly in the coming years.

Opportunities in the cordless trim routers market are expanding with the ongoing growth of the home improvement and DIY sector. In opinion, the rising trend of individuals taking on home renovation projects has created a surge in demand for compact, high-performance power tools like cordless routers. As consumers increasingly prefer cordless options for their convenience, ease of use, and improved safety features, the market for these tools is benefiting. Additionally, as the professional woodworking industry continues to embrace cordless power tools for their operational efficiency, the potential for market growth expands. With more homeowners and professionals alike seeking reliable, user-friendly tools for various tasks, cordless trim routers are well-positioned to capitalize on these opportunities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| United States | 6.5% |

| United Kingdom | 5.8% |

| Japan | 5.1% |

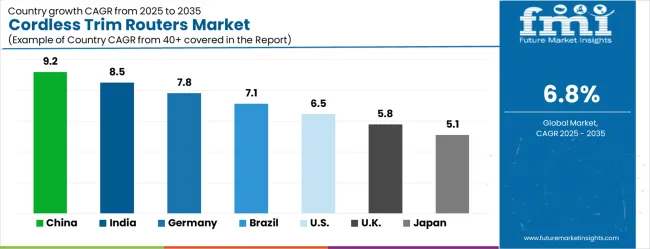

The cordless trim routers market is growing rapidly, with China leading at a 9.2% CAGR through 2035, driven by expanding furniture manufacturing, growing DIY culture, and increasing construction activities. India follows at 8.5%, supported by rising home improvement spending and increasing professional carpentry automation. Germany grows steadily at 7.8%, emphasizing precision tool manufacturing, quality standards, and advanced woodworking expertise. Brazil records 7.1%, integrating cordless tools into its expanding construction and furniture sectors. The United States shows growth at 6.5%, focusing on professional contractor adoption and DIY market expansion. The United Kingdom demonstrates growth at 5.8%, supported by home renovation trends and professional tool modernization. Japan maintains expansion at 5.1%, driven by precision manufacturing requirements and quality-focused tool adoption. Overall, China and India emerge as the leading drivers of global Cordless Trim Routers market expansion.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The cordless trim routers market in China is growing at a CAGR of 9.2%, driven by the rapid growth in construction and woodworking sectors. China’s expanding residential and commercial infrastructure, combined with the growing DIY culture, is accelerating the adoption of power tools like cordless trim routers. These tools are increasingly used in woodworking, cabinetry, and furniture making. Additionally, advancements in battery technology and demand for more portable, efficient power tools are contributing to China’s market leadership.

The cordless trim routers market in India is projected to grow at a CAGR of 8.5%, supported by rising construction activities, home improvement trends, and the growing popularity of woodworking. As the demand for precision tools in the construction and furniture industries increases, cordless trim routers are becoming more widely adopted. The surge in DIY projects and the growing number of small businesses in the furniture and cabinetry sectors are expected to further fuel market expansion in India.

The cordless trim routers market in Germany is expanding at a CAGR of 7.8%, driven by the country’s strong industrial base and focus on high-quality, precision tools. Germany’s advanced manufacturing and woodworking sectors are significantly contributing to the demand for cordless trim routers. The increasing popularity of compact, portable power tools for woodworking and DIY projects is pushing the adoption of these tools in both commercial and residential markets.

The cordless trim routers market in Brazil is projected to grow at a CAGR of 7.1%, fueled by the increasing demand for power tools in construction and woodworking sectors. As Brazil’s residential and commercial construction projects continue to rise, the need for precision tools like cordless trim routers is expanding. The market is further supported by the growing popularity of DIY activities, leading to higher demand for cordless, user-friendly power tools.

The cordless trim routers market in the United States is expected to grow at a CAGR of 6.5%, driven by the ongoing demand for portable power tools in various sectors, including construction, woodworking, and home improvement. The USA market continues to embrace cordless tools for their convenience, efficiency, and ease of use in professional and DIY projects. Technological improvements in battery life and charging systems further contribute to the growing adoption of cordless trim routers.

The cordless trim routers market in the United Kingdom is growing at a CAGR of 5.8%, driven by rising demand for compact and portable power tools. The UK market for cordless trim routers is benefiting from the growing trend of DIY home improvement projects, as well as increasing usage in commercial woodworking and cabinetry. The demand for more energy-efficient and durable power tools is expected to further accelerate market growth.

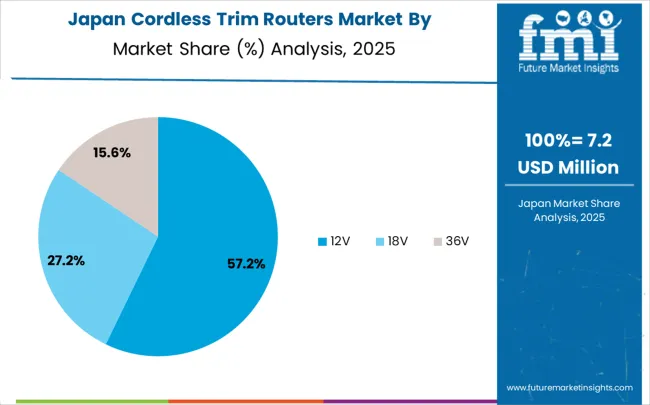

The cordless trim routers market in Japan is projected to grow at a CAGR of 5.1%, driven by the demand for high-precision tools in woodworking and furniture making. Japan’s focus on innovation and quality in manufacturing continues to support the adoption of advanced power tools, including cordless trim routers. The increasing popularity of DIY activities and home improvement in Japan is expected to further fuel market growth in the coming years.

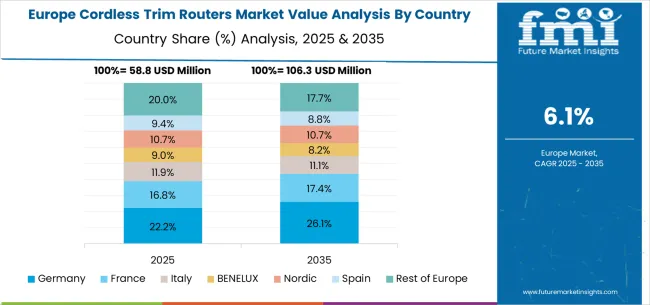

The cordless trim routers market in Europe is projected to grow from USD 58.8 million in 2025 to USD 106.3 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany will remain the leading market, rising from 22.2% in 2025 to 26.1% by 2035, driven by its advanced woodworking industry, high DIY adoption rates, and strong tool manufacturing base. France is forecast to hold 16.8% in 2025, growing to 17.4% by 2035, reflecting demand from carpentry, renovation, and woodworking applications. Italy will represent 11.9% in 2025, softening slightly to 11.1% by 2035, showing stable demand across professional and household markets.

The BENELUX region is projected to capture 10.7% in 2025, remaining steady at 10.7% by 2035, reflecting consistent industrial woodworking activity. The Nordic countries will contribute 9.4% in 2025, easing to 8.2% by 2035, reflecting slower growth despite strong DIY culture. Spain will account for 9.4% in 2025, softening to 8.8% by 2035, as demand stabilizes in home renovation activities. Meanwhile, the Rest of Europe will decline from 20.0% in 2025 to 17.7% by 2035, reflecting slower adoption in Eastern European and smaller woodworking markets.

The cordless trim routers market is defined by competition among established power tool manufacturers, specialty woodworking equipment companies, and emerging cordless technology providers. Companies are investing in advanced battery technologies, motor efficiency improvements, ergonomic design enhancements, and comprehensive tool ecosystems to deliver powerful, reliable, and user-friendly routing solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and brand presence.

Metabo offers high-performance cordless trim routers with a focus on professional applications, advanced battery technology, and German engineering excellence. Bosch provides comprehensive routing solutions integrated with established power tool platforms and innovative features. Stanley Black & Decker emphasizes broad market coverage, value positioning, and extensive distribution networks. Makita delivers professional-grade cordless tools with proven reliability and comprehensive battery ecosystems.

Skil focuses on consumer and DIY markets with user-friendly designs and competitive pricing. Festool offers premium routing solutions with advanced dust collection and precision features for professional applications. Hikoki, Triton, and WEN provide specialized routing capabilities with technical innovation and market-specific features. Trend, Silverline, Milwaukee, Einhell, Mafell, and Harbor Freight offer diverse routing solutions, competitive pricing, and regional market expertise across global and specialized market segments.

Cordless trim routers represent precision woodworking tools enabling fine edge work, laminate trimming, and decorative routing without the constraints of corded operation, with the global market valued at USD 252.7 million in 2025 and projected to reach USD 487.9 million by 2035, growing at a 6.8% CAGR. These battery-powered tools, available in 12V, 18V, and 36V configurations, combine portability with professional-grade performance for finish carpentry, cabinetmaking, and furniture restoration applications. Market growth is driven by increasing DIY woodworking popularity, professional demand for cordless convenience, advancing battery technology, and expanding applications in construction and renovation projects. However, scaling requires coordinated efforts across battery innovation, motor efficiency optimization, ergonomic design advancement, and comprehensive ecosystem development.

Advanced Manufacturing Support: Establish specialized manufacturing zones for power tool production with subsidized access to precision machining equipment, automated assembly systems, and battery integration facilities. Provide tax incentives for companies investing in brushless motor technology, lithium-ion battery production, and advanced polymer manufacturing.

Research and Development Funding: Finance national research institutes focusing on battery technology advancement, motor efficiency optimization, and power electronics integration specific to cordless power tools. Support university programs developing next-generation energy storage systems, wireless charging technologies, and smart tool connectivity features.

Skills Development Programs: Create technical training centers for power tool technicians, battery specialists, and precision manufacturing workers. Partner with vocational schools to establish certification programs covering cordless tool repair, battery management systems, and advanced manufacturing techniques.

Trade and Standards Facilitation: Harmonize international safety standards for cordless power tools while supporting domestic manufacturing capabilities. Negotiate favorable trade terms for critical battery materials including lithium, cobalt, and rare earth elements essential for motor magnets.

Innovation Ecosystem Development: Establish maker spaces and prototyping facilities enabling small manufacturers and startups to develop innovative cordless tool designs. Provide grants for companies developing breakthrough technologies in motor efficiency, battery chemistry, and ergonomic design.

Performance and Safety Standards: Develop comprehensive testing protocols for cordless trim router performance including cutting precision, battery runtime, vibration levels, and dust extraction efficiency. Establish safety certification programs ensuring electrical safety, ergonomic compliance, and electromagnetic compatibility.

Battery Standardization Initiatives: Promote platform compatibility standards enabling battery interchangeability across different tool brands and categories. Develop standardized charging protocols and battery management systems improving user convenience and reducing electronic waste.

Application Guidelines and Training: Create comprehensive guides for trim router selection, bit compatibility, and optimal cutting parameters for different materials including hardwoods, laminates, and composites. Develop certification programs for professional woodworkers and contractors on advanced routing techniques.

Sustainability Frameworks: Establish recycling programs for cordless tools and batteries, including take-back initiatives and material recovery systems. Develop lifecycle assessment methodologies evaluating environmental impact from manufacturing through end-of-life disposal.

Market Intelligence and Innovation Tracking: Provide regular analysis of technology trends, consumer preferences, and competitive landscape developments in the cordless power tool market. Track innovation patterns in battery technology, motor design, and smart tool connectivity features.

Advanced Battery Integration: Develop high-capacity lithium-ion battery systems with improved energy density, faster charging capabilities, and enhanced thermal management. Create intelligent battery management systems providing real-time performance feedback and predictive maintenance alerts.

Motor and Drive Technology: Invest in brushless motor technology optimizing power-to-weight ratios and extending tool lifespan. Develop electronic speed control systems providing variable speed operation and soft-start capabilities reducing material tear-out and improving precision.

Ergonomic Design Innovation: Create lightweight tool designs using advanced materials including carbon fiber reinforcements and magnesium alloy housings. Develop vibration dampening systems and ergonomic grip designs reducing operator fatigue during extended use.

Smart Tool Connectivity: Integrate IoT capabilities enabling tool performance monitoring, usage tracking, and maintenance scheduling through mobile applications. Develop connectivity features supporting inventory management and theft prevention for professional contractors.

Accessory and System Integration: Create comprehensive router bit systems optimized for cordless operation, including specialized bits for different materials and applications. Develop integrated dust collection systems and precision guide systems enhancing cutting accuracy and workspace cleanliness.

Omnichannel Sales Strategy: Develop integrated online and offline sales platforms providing comprehensive product demonstrations, technical specifications, and customer reviews. Create virtual reality showrooms enabling customers to experience tool operation and compare features before purchase.

Professional Services and Support: Establish service networks providing warranty support, repair services, and battery replacement programs. Develop trade-in programs enabling customers to upgrade to newer models while properly disposing of older equipment.

Education and Training Programs: Offer workshops and demonstrations on cordless trim router applications, safety procedures, and maintenance best practices. Create partnerships with woodworking schools and maker spaces providing hands-on training opportunities.

Inventory and Logistics Optimization: Implement demand forecasting systems optimizing inventory levels across different voltage platforms and accessory combinations. Develop efficient distribution networks ensuring product availability while minimizing carrying costs.

Customer Support Excellence: Provide comprehensive technical support including application guidance, troubleshooting assistance, and replacement parts availability. Develop customer loyalty programs rewarding repeat purchases and referrals.

Manufacturing Capacity Investment: Finance construction of advanced power tool manufacturing facilities incorporating automated assembly lines, precision testing equipment, and quality control systems. Structure investments with milestones tied to production efficiency, quality metrics, and market penetration targets.

Battery Technology Development: Back companies developing breakthrough battery technologies including solid-state systems, fast-charging capabilities, and sustainable chemistry alternatives. Support joint ventures between tool manufacturers and battery technology companies.

Market Expansion Financing: Fund expansion into emerging markets where DIY culture and professional woodworking are growing rapidly. Support establishment of regional service centers and distribution networks in key growth markets.

Innovation and R&D Investment: Finance research programs developing next-generation cordless tool technologies including artificial intelligence integration, predictive maintenance systems, and advanced materials applications. Support acquisition of innovative startups developing complementary technologies.

Ecosystem Development: Invest in companies developing comprehensive cordless tool platforms with interchangeable batteries, integrated accessories, and digital connectivity features. Support development of subscription models providing tool access and maintenance services for professional users.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 252.7 million |

| Power Type | 12V Systems, 18V Platforms, 36V High-Performance Models, and Specialty Voltage Configurations |

| Sales Channel | Online Sales Platforms, Offline Retail Stores, and Specialty Tool Distributors |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Metabo, Bosch, Stanley Black & Decker, Makita, Skil, Festool, Hikoki, Triton, WEN, Trend, Silverline, Milwaukee, Einhell, Mafell, Harbor Freight |

| Additional Attributes | Dollar sales by power type, sales channel, and application type, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging technology providers, buyer preferences for battery platforms versus tool performance, integration with digital tool management platforms and IoT connectivity, innovations in motor efficiency and battery optimization |

The global cordless trim routers market is estimated to be valued at USD 252.7 million in 2025.

The market size for the cordless trim routers market is projected to reach USD 487.9 million by 2035.

The cordless trim routers market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in cordless trim routers market are 12v, 18v and 36v.

In terms of application, online sales segment to command 50.0% share in the cordless trim routers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Sanders Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Cordless Garden Equipment Market

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brushless Cordless Band Files Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Trim Press Market Size and Share Forecast Outlook 2025 to 2035

Trimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Trimellitic Anhydride Market Size and Share Forecast Outlook 2025 to 2035

Trim Tabs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cetrimonium Bromide Market Trend Analysis Based on Purity, End-Use, and Region 2025-2035

Salatrim Market

Tris(trimethylsilyl)borate Market Size and Share Forecast Outlook 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

Cetyl Trimethyl Ammonium Chloride Market

Thread Trimming Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA