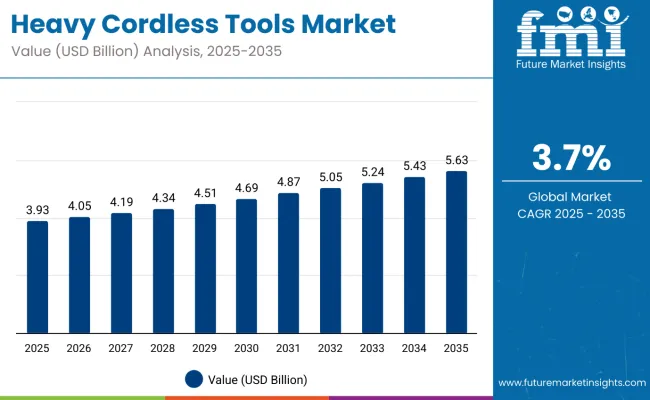

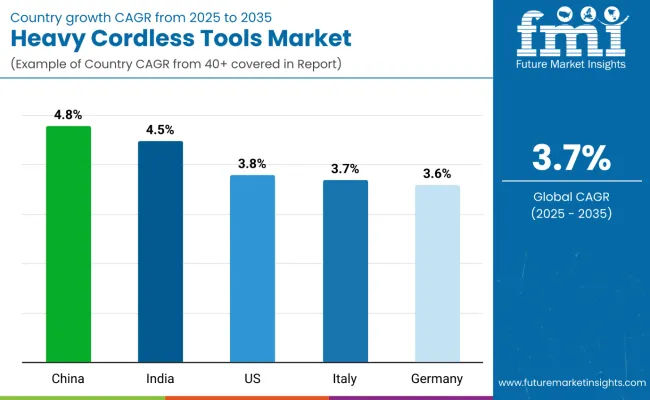

The global heavy cordless tools market is projected to increase from USD 3.93 billion in 2025 to approximately USD 5.63 billion by 2035, reflecting an absolute gain of USD 1.7 billion or 43.3% over the decade. This growth translates to a 1.43X expansion of the market between 2025 and 2035, at a compound annual growth rate (CAGR) of 3.7%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.93 billion |

| Industry Size (2035F) | USD 5.63 billion |

| CAGR (2025 to 2035) | 3.7% |

Between 2025 and 2030, the market is set to grow from USD 3.93 billion to USD 4.69 billion, contributing USD 760 million to overall expansion. Growth in this phase is expected to be driven by widespread industrial adoption of cordless rotary hammers, impact wrenches, and demolition tools across construction, energy, and infrastructure sectors. The phasing out of air-powered tools in safety-critical environments is accelerating cordless adoption due to ease of use, enhanced mobility, and lower maintenance needs.

From 2030 to 2035, the market is projected to expand from USD 4.69 billion to USD 5.63 billion, adding another USD 940 million in value. This period is anticipated to benefit from advances in high-capacity lithium-ion battery platforms, integration of sensor-based control features, and rising use of brushless motors for heavy-duty cutting, grinding, and drilling operations. Efforts to decarbonize power tools and reduce compressor noise levels in urban job sites will further elevate demand for battery-operated heavy tools among contractors, shipyards, and prefabrication units globally.

Between 2020 and 2025, the global heavy cordless tools market expanded from USD 3.39 billion to USD 3.93 billion, reflecting a cumulative increase of USD 540 million, or 15.9% in total value. This growth was achieved at a compound annual growth rate (CAGR) of approximately 3.0% during the period.

The upward trend was primarily supported by rising industrial preference for mobile, powerful tools in sectors such as construction, oil & gas, and shipbuilding, where traditional pneumatic and corded tools posed safety and logistical challenges. The post-COVID economic rebound in 2021 and 2022 led to increased infrastructure spending in North America, China, and Southeast Asia, creating demand for high-torque, cordless solutions that reduce setup time and offer operational flexibility.

Several manufacturers introduced heavy-duty cordless grinders, impact wrenches, and breakers with enhanced battery capacities, better ergonomic handling, and brushless motor platforms. Innovations around power tool digitalization also gained traction during this period, with connectivity modules being integrated for jobsite data logging, tool tracking, and user safety diagnostics. Brands such as DEWALT, Hilti, and Makita strengthened their offerings for heavy applications by launching modular battery systems supporting multiple tools under a unified energy platform.

Retrofitting projects and urban construction compliance with noise and emission norms further accelerated demand for cordless formats, especially in areas with restricted generator or compressor use.

The heavy cordless tools market is expanding steadily as industries prioritize mobility, operator safety, and operational efficiency in high-torque applications. These tools eliminate the limitations of corded and pneumatic systems, offering greater maneuverability in elevated, confined, or hazardous environments while reducing accident risks linked to cables and hoses.

Growth is being fueled by the rising scale of construction, infrastructure, and utility projects in developing economies, where job sites are increasingly adopting cordless systems to comply with evolving safety and environmental mandates. Governments and contractors are favoring electric tools to reduce emissions and noise, especially in enclosed or urban settings.

Advancements in high-capacity lithium-ion batteries have extended tool runtimes and decreased charging times, improving productivity in demanding operations. Manufacturers are supporting these shifts through shared battery ecosystems that enable multiple heavy-duty toolssuch as grinders, rotary hammers, and torque wrenches which are easy to operate on a single battery platform, optimizing inventory and workflow.

Smart connectivity features embedded in modern cordless tools are enabling predictive maintenance, usage monitoring, and real-time diagnostics. These capabilities support safer operations and reduce long-term costs, making cordless solutions more attractive for industrial users across sectors such as shipbuilding, rail infrastructure, and high-rise construction.

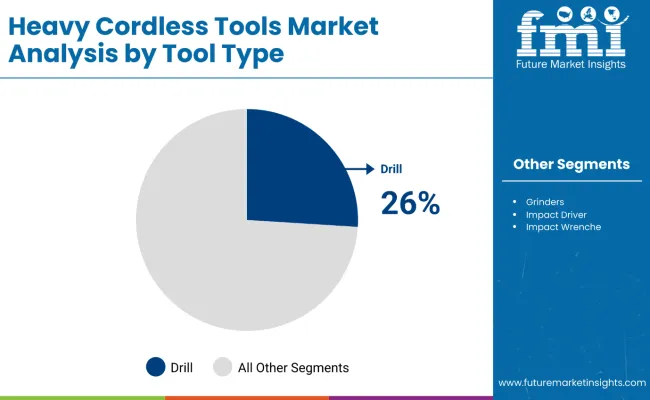

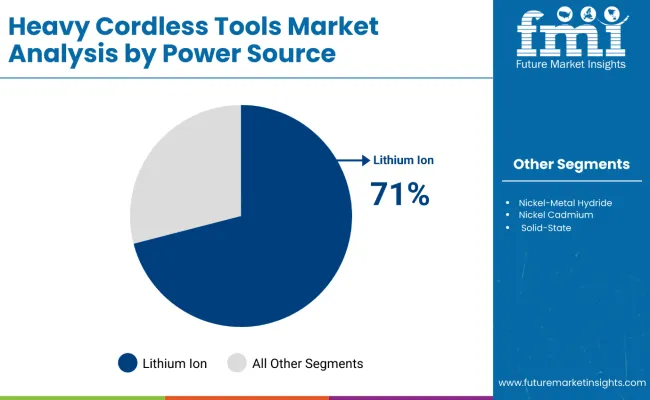

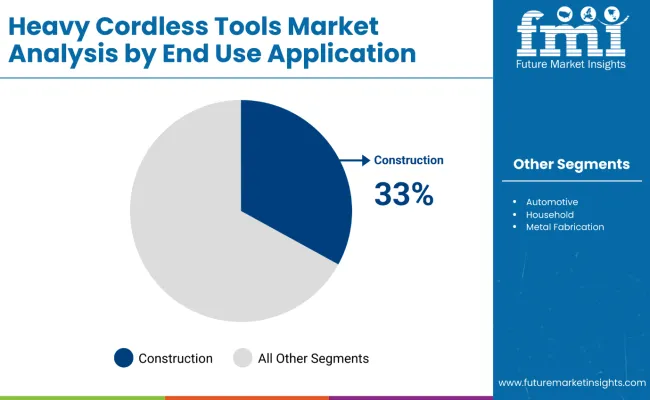

The market is segmented by tool type into drills, grinders, impact drivers, impact wrenches, rotary tools, sanders, and saws, reflecting varied operational roles across industries. Power source classification includes lithium-ion, nickel-metal hydride, nickel-cadmium, solid-state, and other battery technologies, highlighting advancements in energy storage and discharge efficiency. End-use applications span construction, automotive, household, metal fabrication, woodworking, and aerospace, indicating widespread deployment across both heavy industrial and precision-oriented environments. Each segment reflects differing torque requirements, runtime needs, and mobility advantages depending on application complexity and worksite conditions.

Drills are projected to account for 26% of the heavy cordless tools market in 2025 and are expected to grow at a CAGR of 3.6% through 2035. Their versatility in boring, fastening, and assembly operations across residential and industrial settings has contributed to continued adoption. Cordless drills equipped with torque control, brushless motors, and high-capacity lithium-ion batteries have enabled usage in heavy-duty construction and automotive repair environments. Modular attachments and ergonomic designs have further extended their relevance in confined and overhead job sites.

Lithium-ion battery systems are estimated to represent 71% of the total power source segment in 2025 and are projected to expand at a CAGR of 3.9% over the forecast period. Their lightweight structure, high energy density, and fast recharge capabilities make them ideal for use in cordless power-intensive tools. Manufacturers have increasingly standardized battery platforms across product families, facilitating swappable energy packs and reducing downtime. Advancements in thermal protection, intelligent charge controllers, and longer lifecycle have reinforced their market leadership in heavy-duty environments.

The construction industry is anticipated to generate 33% of the total demand for heavy cordless tools in 2025, advancing at a CAGR of 3.8% through 2035. Battery-powered drills, impact wrenches, and saws are extensively used in framing, rebar cutting, anchoring, and overhead installations. The shift toward modular building techniques and increased adoption of prefabrication have accelerated the need for portable, durable, and maintenance-free cordless tools on job sites. Rising safety norms and efforts to minimize trip hazards from corded tools have further supported the transition to cordless formats.

Demand for Safer, Mobile Alternatives is Driving Transition

Industries are increasingly replacing corded and pneumatic equipment with cordless tools to eliminate mobility restrictions and reduce safety risks. The absence of power cords or air lines lowers the chance of slips, trips, and falls, particularly in crowded or elevated work zones. Heavy cordless tools are gaining traction on construction sites, in rail maintenance, and in energy infrastructure projects where portability is critical. Workers benefit from reduced fatigue and simplified setup, which contributes to higher productivity and fewer operational delays.

High-Performance Battery Systems are Reinforcing Market Growth

Battery innovation remains a key enabler for market expansion. Newer lithium-ion packs offer higher energy density and greater thermal stability, allowing cordless variants of heavy-duty tools like impact wrenches and demolition hammers to match corded power levels. Manufacturers are introducing multi-voltage platforms and smart battery management systems to enhance performance and extend product lifespan. These advances are appealing to fleet managers seeking to minimize downtime, maintenance frequency, and replacement costs across tool inventories.

Connectivity Features are Enhancing Maintenance and Safety

The integration of wireless communication modules in cordless tools is enabling real-time diagnostics, tool tracking, and usage analytics. Connected systems provide data on vibration levels, battery cycles, and error codes, which helps in proactively managing wear and complying with jobsite safety audits. This is particularly useful in sectors like oil & gas and heavy manufacturing, where machine failure can pose environmental and human risks. Bluetooth-enabled tools and mobile app support are also improving user training and remote monitoring capabilities.

The Europe heavy cordless tools market is expected to grow from USD 824.5 million in 2025 to USD 1,185.7 million by 2035, reflecting a CAGR of 3.7%. Germany is anticipated to maintain its lead through the decade, accounting for 30% of the regional market by 2035. The country’s dominance is driven by its industrial manufacturing sector, robust construction activities, and growing emphasis on electrified and portable tooling in assembly lines and infrastructure projects.

The United Kingdom is forecast to represent 17% of the market by 2035, supported by construction modernization programs and the rapid electrification of power tools across government infrastructure projects. France, projected to account for 16% of the market, is witnessing steady adoption of battery-powered tools in energy and transportation sectors, particularly rail and metro upgrades.

Italy and Spain are showing gradual increases in market share, reflecting rising equipment adoption by contractors and SMEs. Meanwhile, the BENELUX region continues to grow due to cross-border tool sharing models and industrial logistics hubs prioritizing safety-driven upgrades.

| Country | Share (2025) |

|---|---|

| Germany | 32% |

| UK | 18% |

| France | 15% |

| Italy | 10% |

| Spain | 8% |

| BENELUX | 7% |

| Russia | 4% |

| Rest of Europe | 6% |

| Country | Share (2035) |

|---|---|

| Germany | 30% |

| UK | 17% |

| France | 16% |

| Italy | 11% |

| Spain | 9% |

| BENELUX | 8% |

| Russia | 3% |

| Rest of Europe | 6% |

China is projected to witness the fastest growth in the heavy cordless tools market through 2035, with a CAGR of 4.8%. Accelerated investment in advanced manufacturing zones, infrastructure upgradation, and smart construction technologies is strengthening demand for portable high-torque tools across China’s industrial belt. Policy initiatives targeting electrification of equipment in government-funded projects are supporting deeper adoption of heavy-duty cordless variants.

India’s heavy cordless tools market is set to grow at a CAGR of 4.5% between 2025 and 2035. The growth trajectory is supported by large-scale highway and metro rail expansion, alongside electrification of tools in mid-size construction companies and repair services. Small contractors and urban infrastructure firms are shifting toward battery-powered tools for mobility, safety, and performance gains.

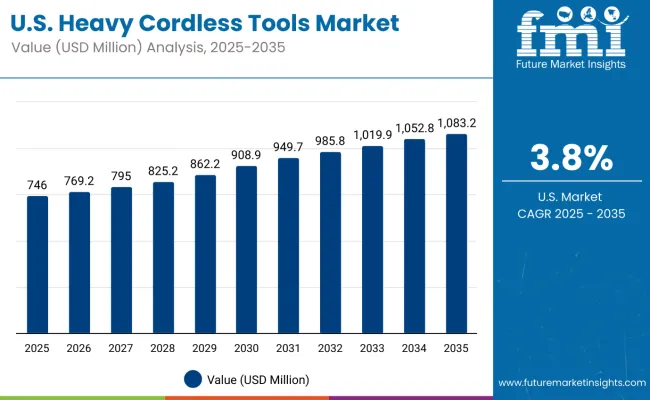

The USA market is expected to grow at a CAGR of 3.8%, supported by demand from commercial contractors, energy infrastructure firms, and manufacturing maintenance teams. The push for safety compliance, mobility, and environmental standards is prompting companies to adopt low-noise, emission-free cordless alternatives.

Italy’s market is set to expand at a CAGR of 3.7%, driven by renovation activities and increased use of cordless tools in facility management, heritage site restoration, and public utility projects. Demand is also rising from packaging and food processing firms modernizing tool systems.

Germany, with a projected CAGR of 3.6%, maintains a large installed base of heavy cordless tools across automotive, aerospace, and renewable energy industries. The aftermarket is robust, with a high focus on replacement purchases and modular tool upgrades.

In Japan, lithium-ion battery-powered tools are estimated to account for 70% of heavy cordless tool sales by 2035. This dominance is driven by the country's strong inclination toward precision engineering, compact modular designs, and rapid charging technologies. As manufacturing plants across automotive, electronics, and aerospace sectors adopt cordless operations, lithium-ion platforms are gaining a significant lead.

In South Korea, construction (30%) and automotive (25%) sectors are projected to be the two leading end-user industries for heavy cordless tools. These segments are actively transitioning to advanced, battery-operated tools for use in confined spaces and safety-sensitive environments. The push for automated assembly lines in automotive manufacturing and infrastructure upgradation in urban areas are key demand drivers.

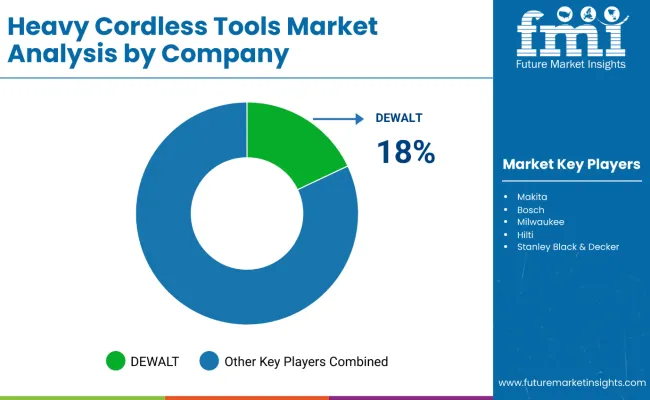

Competition in the heavy cordless tools market is intensifying as players focus on expanding high-performance, jobsite-ready offerings. New product launches emphasize enhanced battery platforms, higher power output, and durability to meet the demands of construction, industrial, and woodworking applications. Manufacturers are targeting heavy-duty segments with specialized toolkits and accessories that improve efficiency and versatility on-site. The integration of advanced cordless technology, including extended runtime and robust motor performance, is becoming a key differentiator, driving market rivalry.

| Attribute | Details |

|---|---|

| Base Year | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Unit | Value (USD Billion) |

| Report Coverage | Market Size, Y-o-Y Growth, 10-Year Forecast, Regional Trends, Competitive Landscape |

| By Tool Type | Drills, Grinders, Impact Drivers, Impact Wrenches, Rotary Tools, Sanders, Saws |

| By Power Source | Lithium Ion, Nickel-Metal Hydride, Nickel Cadmium, Solid-State, Others |

| By End Use Application | Automotive, Construction, Household, Metal Fabrication, Woodworking, Aerospace |

| Region Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, MEA |

The market is projected to reach a valuation of USD 5.63 billion by 2035, up from USD 3.93 billion in 2025.

Drills and impact drivers are expected to collectively dominate the tool type segment due to high usage across industrial and construction applications.

Lithium-ion batteries offer longer runtime, lighter weight, and faster charging, making them the preferred choice for professional-grade cordless tools.

Rapid infrastructure development, modular construction trends, and demand for flexible, high-torque cordless tools are driving growth in this segment.

East Asia, particularly China and India, is projected to experience the fastest growth due to rapid industrialization and increasing adoption of cordless tools in manufacturing and construction sectors.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cordless Multi Rotary Tools Market Size and Share Forecast Outlook 2025 to 2035

Cordless Handheld Cultivator Market Size and Share Forecast Outlook 2025 to 2035

Cordless Bandfile Sander Market Size and Share Forecast Outlook 2025 to 2035

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Cordless Fillet Weld Grinder Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Cordless Pop Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Cordless Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Cordless Wood Planer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Cordless Trim Routers Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA