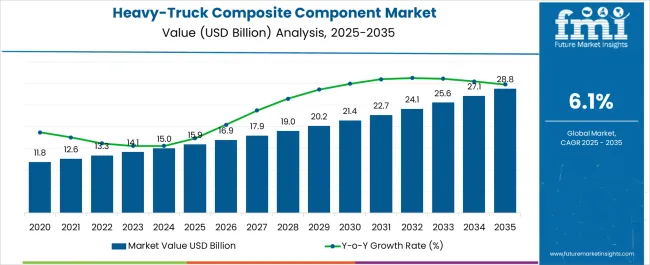

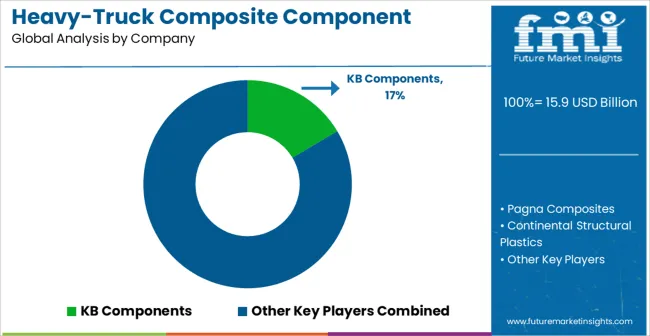

The Heavy-Truck Composite Component Market is estimated to be valued at USD 15.9 billion in 2025 and is projected to reach USD 28.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Heavy-Truck Composite Component Market Estimated Value in (2025 E) | USD 15.9 billion |

| Heavy-Truck Composite Component Market Forecast Value in (2035 F) | USD 28.8 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Heavy-Truck Composite Component market is experiencing substantial growth, driven by the increasing demand for lightweight, fuel-efficient, and durable truck components in both commercial and industrial sectors. Rising regulatory pressure to reduce emissions and improve fuel economy is accelerating the adoption of composite materials in heavy trucks. Advances in materials engineering, including fiberglass, carbon fiber, and other high-performance composites, are enabling manufacturers to replace conventional metal parts without compromising structural integrity.

The integration of lightweight components contributes to lower operational costs, enhanced payload capacity, and improved overall vehicle performance. Ongoing research in composite processing, cost optimization, and scalability is further supporting market expansion.

Fleet operators and manufacturers are increasingly seeking solutions that balance strength, durability, and weight reduction to meet environmental and economic objectives As technological innovations continue in material science and component design, the market is poised for sustained growth, with lightweight composite solutions expected to play a critical role in the next generation of heavy trucks.

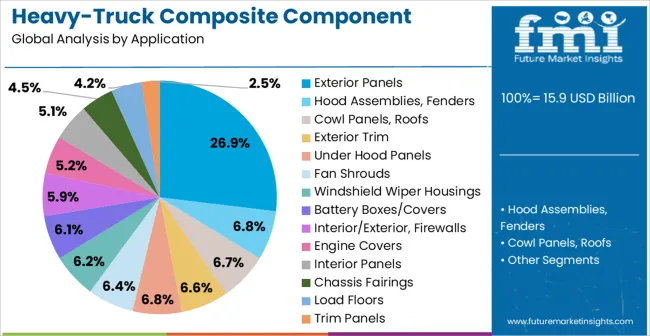

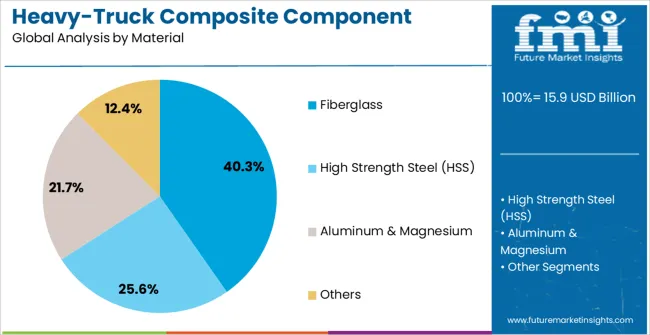

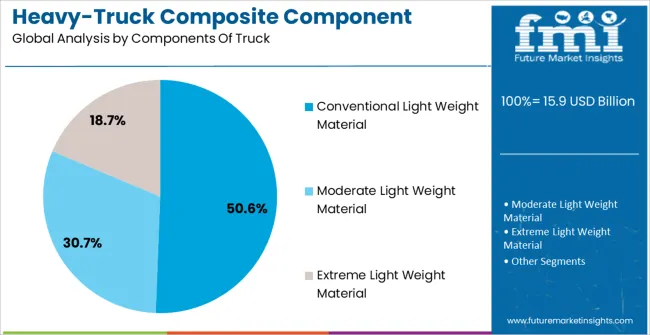

The heavy-truck composite component market is segmented by application, material, components of truck, and geographic regions. By application, heavy-truck composite component market is divided into Exterior Panels, Hood Assemblies, Fenders, Cowl Panels, Roofs, Exterior Trim, Under Hood Panels, Fan Shrouds, Windshield Wiper Housings, Battery Boxes/Covers, Interior/Exterior, Firewalls, Engine Covers, Interior Panels, Chassis Fairings, Load Floors, Trim Panels, and Others. In terms of material, heavy-truck composite component market is classified into Fiberglass, High Strength Steel (HSS), Aluminum & Magnesium, and Others. Based on components of truck, heavy-truck composite component market is segmented into Conventional Light Weight Material, Moderate Light Weight Material, and Extreme Light Weight Material. Regionally, the heavy-truck composite component industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The exterior panels application segment is projected to hold 26.9% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is being driven by the need for lightweight and durable panels that enhance fuel efficiency and reduce vehicle emissions. Composite materials allow for design flexibility, corrosion resistance, and improved impact performance, which are critical for heavy truck exteriors.

Adoption is being further supported by advancements in manufacturing processes such as molding and lamination, which enable consistent quality and scalability. The ability to integrate exterior panels with other truck systems and maintain structural integrity under operational stress strengthens their market position.

Increasing emphasis on regulatory compliance for emissions and weight reduction continues to drive preference for composite panels As manufacturers seek solutions that reduce operational costs while improving vehicle performance, exterior panels are expected to remain a key growth segment, supported by innovations in material composition and processing technologies.

The fiberglass material segment is anticipated to account for 40.3% of the market revenue in 2025, making it the leading material type. Its growth is driven by its combination of lightweight properties, high strength, durability, and cost-effectiveness compared to alternative composite materials. Fiberglass enables manufacturers to produce components that reduce overall vehicle weight, contributing to better fuel economy and compliance with environmental regulations.

The material also provides corrosion resistance and structural stability under heavy operational loads, which is critical for long-term vehicle performance. Advancements in fiberglass processing, such as optimized fiber alignment and resin formulation, have improved material reliability and scalability.

Widespread adoption is further supported by its compatibility with conventional manufacturing techniques and integration with other truck components As truck operators and manufacturers prioritize efficiency, sustainability, and operational cost reduction, fiberglass is expected to maintain its leading position in the composite materials market.

The conventional light weight material components segment is projected to hold 50.6% of the market revenue in 2025, establishing it as the leading component type. Its dominance is driven by the need for materials that offer a balance between weight reduction, strength, and cost-efficiency. Conventional lightweight materials, such as aluminum alloys and engineered polymers, provide adequate mechanical performance while contributing to improved fuel efficiency and payload optimization.

Their proven manufacturing processes, structural reliability, and compatibility with existing truck designs further enhance adoption. Continuous improvements in material formulations, durability, and corrosion resistance have reinforced their preference among manufacturers and fleet operators.

The growing focus on regulatory compliance for emission standards and operational efficiency is increasing demand for lightweight components As heavy trucks evolve to meet sustainability targets and performance requirements, conventional lightweight materials are expected to remain the most widely adopted component choice, supporting ongoing market growth.

For material overhaul, carriage and transport of bulk materials via heavy commercial vehicles, an able fabricated body is required to withstand heavy stress and abrasion exerted by the goods contained. To address this requirement, Heavy Commercial Vehicle OEMs have been fabricating the rear carriage via various types of composite materials ensuring durability under dynamic environments and load types.

Rapidly growing industrialization, technical advancement and increasing consumer desire for more comfort, safety, heavy trucks for transportation and significant emphasis on energy efficient vehicle has led to noteworthy advancement in the global heavy-truck composite component market. Fiber reinforce plastic or fiberglass is used as a composite material for manufacturing heavy truck components such as interior components, roof, battery boxes and engine cover.

Thermoset plastic resin is reinforced with glass fibers owning to fiber provides high strength, dimensional stability and heat resistance. Furthermore, some additive mix with fiber glass as a raw material product for provides color, surface finish and enhancing the properties such as withstanding and flame retardant.

Owning to increasing light weight trucks high speed steel is also replaced by another extreme light composite material. Moreover, lightweight competence will be a key differentiator especially for premium OEMs in the coming years. The intelligent use and marketing of lightweight design can have a significant effect on the brand and the overall attractiveness of premium OEMs it.

On the other hand, strength is the key requirement for steering, transmission. Interior parts, where light weight plastic is the predominant element today. As well, light weight plastic such as glass fiber is using for the windshield or screen as well for nonstructural body parts owing to its cost-weight ratio. Recently, BMW has started a project using carbon fiber for new electric vehicle, for reducing the weight of vehicle & enhance the driving dynamics.

Over the past few years, using of carbon fiber has gained significant attraction in the heavy-trucks composite component market owing to manufacturer are using one piece carbon fiber component instead of a four-piece metal parts, allowing for a 30 percent weight reduction and a 60 percent reduction in its tooling cost.

The future stance in the global heavy-truck composite component market is anticipated to remain optimistic & the market is anticipated to witness double digit CAGR growth over the forecast period.

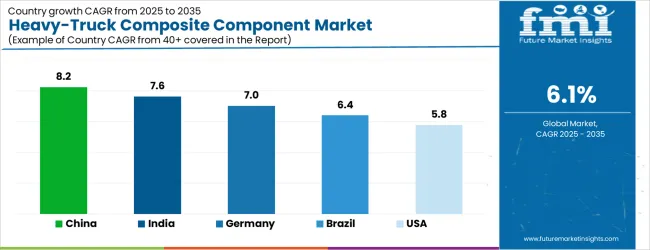

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The Heavy-Truck Composite Component Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Heavy-Truck Composite Component Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Heavy-Truck Composite Component Market is estimated to be valued at USD 5.8 billion in 2025 and is anticipated to reach a valuation of USD 5.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 797.8 million and USD 542.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.9 Billion |

| Application | Exterior Panels, Hood Assemblies, Fenders, Cowl Panels, Roofs, Exterior Trim, Under Hood Panels, Fan Shrouds, Windshield Wiper Housings, Battery Boxes/Covers, Interior/Exterior, Firewalls, Engine Covers, Interior Panels, Chassis Fairings, Load Floors, Trim Panels, and Others |

| Material | Fiberglass, High Strength Steel (HSS), Aluminum & Magnesium, and Others |

| Components Of Truck | Conventional Light Weight Material, Moderate Light Weight Material, and Extreme Light Weight Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | KB Components, Pagna Composites, Continental Structural Plastics, MW Industries, Bolwell Corporation, Creative Composites, Wabash National Corporation, Utility Trailer Manufacturing Company, and MFG Composite Systems Company |

The global heavy-truck composite component market is estimated to be valued at USD 15.9 billion in 2025.

The market size for the heavy-truck composite component market is projected to reach USD 28.8 billion by 2035.

The heavy-truck composite component market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in heavy-truck composite component market are exterior panels, hood assemblies, fenders, cowl panels, roofs, exterior trim, under hood panels, fan shrouds, windshield wiper housings, battery boxes/covers, interior/exterior, firewalls, engine covers, interior panels, chassis fairings, load floors, trim panels and others.

In terms of material, fiberglass segment to command 40.3% share in the heavy-truck composite component market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

Composite Pin Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Roller Market Size and Share Forecast Outlook 2025 to 2035

Composite Insulator Market Size and Share Forecast Outlook 2025 to 2035

Composite Paper Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Drums Market Size and Share Forecast Outlook 2025 to 2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Composite Cans Market Size and Share Forecast Outlook 2025 to 2035

Composite Film Market Size and Share Forecast Outlook 2025 to 2035

Composite Cardboard Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Composite Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Composite Tooling Market Outlook- Share, Growth and Forecast 2025 to 2035

Composite Cardboard Tubes Market from 2025 to 2035

Composite IBCs System Market from 2025 to 2035

Market Share Breakdown of Composite Paper Cans Manufacturers

Breaking Down Market Share in Composite Cardboard Tube Packaging

Key Players & Market Share in Composite Cylinder Production

Analyzing Composite Insulator Market Share & Industry Trends

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Composite AI Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA