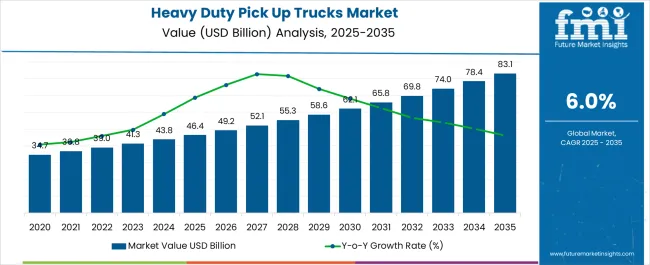

The Heavy Duty Pick Up Trucks Market is estimated to be valued at USD 46.4 billion in 2025 and is projected to reach USD 83.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Based on the analysis, growth trajectory shows a cost structure dominated by raw materials, powertrain components, advanced electronics, and R&D investments. Steel and high-strength alloys remain the primary material contributors, supporting chassis rigidity and payload capacity, while aluminum and composites gradually influence cost allocation in pursuit of weight optimization and fuel efficiency.

Powertrain systems, including diesel engines and hybrid drivetrains, represent a substantial share of production expenditure, particularly with regulatory compliance driving cleaner emissions technologies. The value chain begins with suppliers of metals, engine parts, and electronic modules, followed by OEMs responsible for integration, assembly, and quality assurance. Manufacturing costs encompass labor, tooling, and automation, with scale efficiencies emerging at high production volumes. Downstream distribution involves dealer networks, fleet partnerships, and digital sales channels, which increasingly influence pricing strategies and market reach.

Aftersales services, including maintenance, spare parts, and warranty programs, provide additional revenue streams, shaping overall value capture. Investments in advanced safety features, infotainment systems, and telematics drive both material and R&D costs, yet enhance product differentiation and long-term profitability. By 2035, while conventional heavy-duty models retain cost efficiency, the integration of electrification and smart technologies will reshape the value chain, shifting expenditure patterns and improving lifecycle value for manufacturers and end users.

| Metric | Value |

|---|---|

| Heavy Duty Pick Up Trucks Market Estimated Value in (2025 E) | USD 46.4 billion |

| Heavy Duty Pick Up Trucks Market Forecast Value in (2035 F) | USD 83.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The heavy duty pick up trucks market is experiencing robust momentum driven by rising demand across construction, agriculture, logistics, and municipal service sectors. These vehicles are increasingly favored for their superior payload capacity, engine durability, and off-road performance.

Technological advancements in powertrain systems, towing assistance, and driver safety features have expanded their functional versatility. Fleet operators are showing a clear preference for trucks that combine power with efficiency and low maintenance overhead.

Additionally, infrastructure development initiatives and expanding utility service networks are contributing to higher vehicle procurement rates in both urban and rural regions. As original equipment manufacturers continue to invest in comfort upgrades and hybridization potential, the market is poised for continued growth across commercial and individual ownership segments.

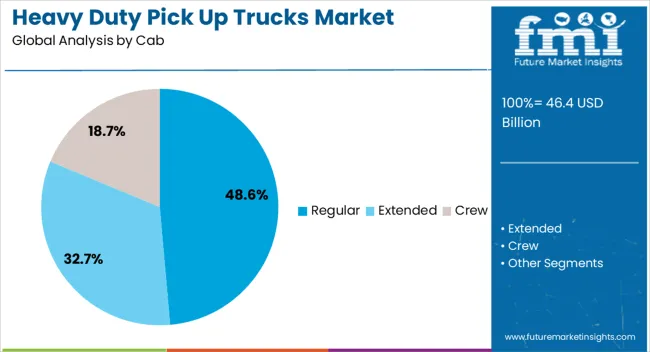

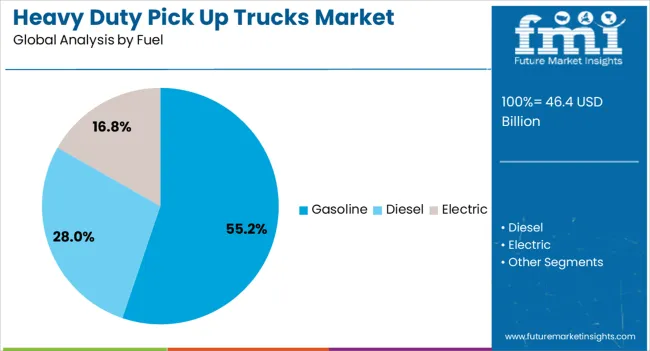

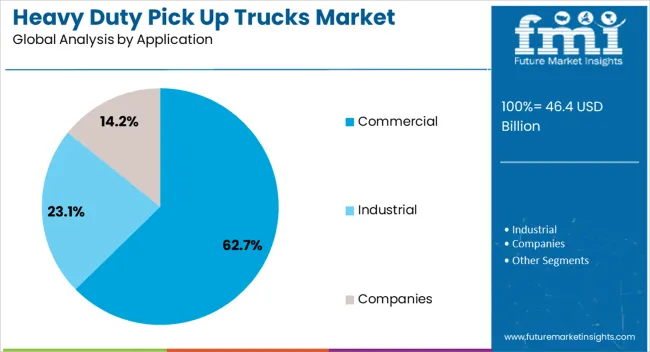

The heavy duty pick up trucks market is segmented by cab, fuel, application, and geographic regions. By cab, the heavy duty pick up trucks market is divided into Regular, Extended, and Crew. In terms of fuel, the heavy-duty pickup trucks market is classified into Gasoline, Diesel, and Electric. Based on application, the heavy duty pick up trucks market is segmented into Commercial, Industrial, and Companies. Regionally, the heavy duty pick up trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The regular cab configuration is projected to account for 48.60% of total market revenue by 2025 within the cab category, making it the dominant format. Its widespread use in heavy-duty applications stems from its simple structural design, lower cost of acquisition, and larger bed space, which maximizes cargo utility.

Fleet buyers and commercial users have consistently preferred this configuration for its optimal balance between payload efficiency and operational cost. Regular cab trucks are particularly well-suited for industries prioritizing functionality over passenger capacity, such as mining, maintenance, and agricultural transport.

This segment continues to lead due to its durability, straightforward maintenance, and cargo centric utility.

The gasoline fuel segment is expected to represent 55.20% of the total market revenue by 2025 within the fuel category, positioning it as the leading powertrain choice. Gasoline powered heavy duty pick up trucks are favored for their lower upfront cost, widespread fuel availability, and ease of maintenance.

For light commercial duty cycles and municipal operations where shorter driving ranges are typical, gasoline engines provide a cost-effective and efficient solution. Continued innovations in fuel injection and engine management systems have also improved fuel efficiency and emissions performance, further enhancing appeal.

As rural and suburban fleets prioritize lower purchase costs and immediate availability, gasoline powered trucks maintain dominance in the heavy duty segment.

The commercial application segment is projected to hold 62.70% of overall market revenue by 2025 under the application category, making it the largest and fastest-growing end-use area. This leadership is being driven by consistent demand from utility services, infrastructure development, freight handling, and mobile operations across construction and agriculture.

Heavy duty pick up trucks serve as essential assets in field logistics, job site mobility, and equipment transport. Businesses value their ability to traverse difficult terrain, haul significant loads, and perform reliably under tough conditions.

With expanding industrial activity and rising last-mile service demand, commercial operators are increasingly turning to these vehicles for fleet modernization and capacity enhancement. The segment’s dominance is reinforced by its integral role in daily operations across multiple high-value sectors.

The market has been defined by a combination of industrial, agricultural, and commercial applications along with lifestyle-driven demand in developed economies. These vehicles have been engineered for towing, hauling, and operating in demanding terrains where durability and strength are essential. Automakers have focused on powertrain efficiency, advanced safety systems, and alternative fuel adoption to strengthen competitiveness. Demand has been influenced by infrastructure development projects, resource-based industries, and rising consumer preference for high-performance multipurpose vehicles.

The demand for heavy duty pick-up trucks has been supported by their broad utility across construction, mining, agriculture, and logistics sectors. These vehicles have been widely used for transporting heavy equipment, raw materials, and operational staff in challenging environments. Their load-bearing capacity and off-road performance have made them integral for industries requiring robust mobility solutions. Expansion in oil and gas exploration activities, infrastructure construction projects, and farm mechanization have reinforced their market presence. Their durability has ensured long replacement cycles, which has favored fleet operators aiming to minimize downtime. With industries seeking higher efficiency in transportation and logistics, heavy duty pick-up trucks have remained critical assets. Their multipurpose applications across diverse industries have continued to be a key driver of growth in both developed and emerging markets.

The shift toward cleaner mobility solutions have strongly influenced the heavy duty pick-up trucks market. Automakers have invested in electric and hybrid models to reduce reliance on conventional fuel. Battery-powered heavy duty trucks have been designed with advanced torque delivery to support towing and payload performance comparable to diesel counterparts. Hydrogen fuel cell integration has also been explored for long-haul applications, offering extended range and fast refueling benefits. Regulatory frameworks focusing on emission reduction and green incentives have accelerated adoption. Although challenges related to charging infrastructure and battery weight persist, continuous technological progress has been observed. Fleet operators have increasingly evaluated hybrid solutions as a bridge toward full electrification. The adoption of alternative powertrains has redefined product innovation, making sustainability a central element of long-term competition in the trucks industry.

The market has been shaped by growing integration of safety and digital technologies. Advanced driver assistance systems including lane departure warning, blind spot monitoring, adaptive cruise control, and automated braking have been increasingly incorporated. Telematics has allowed fleet managers to track vehicle efficiency, driver performance, and predictive maintenance needs in real time. Connectivity upgrades have also enhanced user experience through smart infotainment systems and integration with mobile devices. Such improvements have raised consumer expectations for comfort and reliability, even in utility-focused vehicles. The evolution of technology has positioned heavy duty pick-up trucks not just as workhorses but as intelligent mobility solutions. With regulatory emphasis on road safety and consumer demand for premium features, the adoption of advanced technology has been one of the strongest factors influencing market expansion.

The growth of the market has been reinforced by expanding construction and infrastructure development activities globally. These vehicles have been essential in transporting raw materials, machinery, and labor to project sites. Governments investing heavily in road, bridge, and energy projects have indirectly created consistent demand for such trucks. Their capability to operate in rough terrains and carry heavy loads has made them indispensable in these sectors. The agricultural sector has also supported adoption, particularly in regions where farm mechanization and transportation efficiency have been prioritized. Seasonal demand spikes in agriculture, coupled with steady industrial requirements, have maintained strong utilization. As infrastructure spending continues across developed and emerging economies, heavy duty pick-up trucks are expected to remain a backbone of project logistics and industrial mobility solutions worldwide.

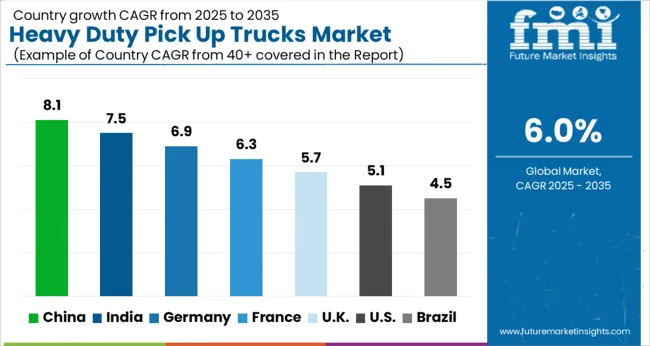

The market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by increasing demand in construction, logistics, and commercial sectors. China leads with an 8.1% CAGR, expanding through large-scale manufacturing and adoption in infrastructure and transport projects. India follows at 7.5%, strengthening its market via rising fleet purchases and industrial applications. Germany progresses at 6.9%, supported by engineering expertise and integration of advanced powertrain technologies. The UK, at 5.7%, experiences growth through niche fleet adoption and utility-focused upgrades. The USA, at 5.1%, maintains steady demand backed by commercial usage and emerging electric heavy-duty pickups. This report covers 40+ countries, with the top markets highlighted here for reference.

China is expected to record a CAGR of 8.1% in the market from 2025 to 2035. Expansion in construction, mining, and logistics industries is driving adoption, alongside government incentives for commercial and industrial vehicles. Domestic manufacturers are investing in advanced engine technologies and durable chassis designs to meet industrial requirements. The shift toward hybrid and electric heavy duty pickups is accelerating due to environmental regulations and rising fuel efficiency expectations. Increased demand for multipurpose utility vehicles in rural and industrial regions is strengthening market growth.

India is anticipated to grow at a CAGR of 7.5%, supported by industrial expansion, infrastructure projects, and agricultural logistics. Heavy duty pickups are increasingly preferred for transporting construction materials and farm products efficiently. Global automakers are entering India with upgraded models, while domestic manufacturers are emphasizing rugged, fuel-efficient vehicles. Rising fleet modernization initiatives and government incentives for clean fuel vehicles are further supporting market adoption.

Germany is projected to expand at a CAGR of 6.9%, driven by industrial logistics, construction, and agriculture. Consumer interest in lifestyle and leisure heavy duty pickups is also contributing to market growth. Manufacturers are investing in electrified engines and advanced connectivity features to comply with EU emission norms. Strong dealer networks and aftersales services are reinforcing adoption across both commercial and private segments.

The United Kingdom is expected to witness a CAGR of 5.7%, supported by construction, logistics, and rural transportation demand. Adoption is also rising for recreational and lifestyle uses. Manufacturers are focusing on lightweight materials, hybrid powertrains, and enhanced safety features to meet emission and regulatory standards. Increasing interest in connected vehicle technologies is likely to accelerate market growth.

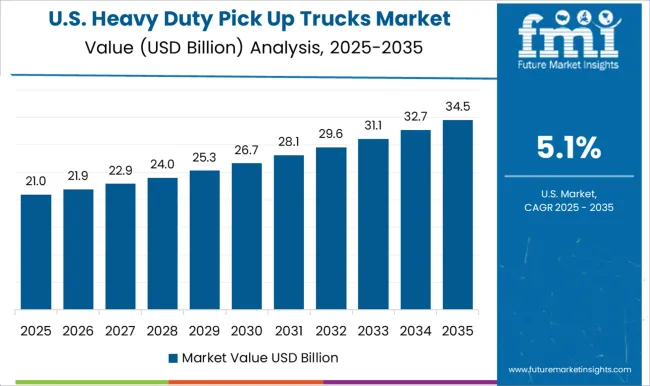

The United States is anticipated to grow at a CAGR of 5.1%, with strong demand from construction, oil and gas, and logistics sectors. Heavy duty pickups continue to dominate commercial and light truck segments due to durability and versatility. Investments in electric pickups, advanced telematics, and safety features are reshaping market competitiveness. Fleet renewal programs and government incentives for clean energy vehicles are further supporting growth.

General Motors has secured a strong position through its Chevrolet Silverado HD and GMC Sierra HD models, which are widely recognized for their high towing capacity and durability under demanding conditions. Ram Trucks continues to appeal to commercial and recreational users with its Power Wagon and 2500/3500 series, offering powerful engines and advanced safety and convenience features.

Toyota Motor Corporation has built a loyal customer base with its Tundra and Land Cruiser pickups, known for longevity, off-road capability, and consistent performance. Nissan and Mitsubishi Motors complement this segment by providing trucks that combine robust engineering with practical functionality for professional and industrial use. Other players are increasingly influencing regional markets and niche segments. Honda has ventured into the heavy-duty space with trucks emphasizing reliability and urban adaptability. Isuzu, a pioneer in commercial-grade vehicles, continues to provide trucks optimized for industrial applications.

Volkswagen and Great Wall Motors have introduced models with modern designs, fuel-efficient engines, and enhanced technological features, targeting emerging markets and younger buyers. Across the market, manufacturers are strategically integrating electrification, driver-assist technologies, and telematics to differentiate offerings, strengthen brand presence, and capture growing demand for high-performance, heavy-duty pickup trucks globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 46.4 Billion |

| Cab | Regular, Extended, and Crew |

| Fuel | Gasoline, Diesel, and Electric |

| Application | Commercial, Industrial, and Companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Motors, Great Wall Motors, Honda, Isuzu, Mitsubishi Motors, Nissan, Ram Trucks, Toyota Motor Corporation, and Volkswagen |

| Additional Attributes | Dollar sales by vehicle type and drivetrain, demand dynamics across fleet and personal use, regional trends in emerging truck markets, innovation in engine performance and safety features, environmental impact of emissions, and emerging use cases in logistics and off-road applications. |

The global heavy duty pick up trucks market is estimated to be valued at USD 46.4 billion in 2025.

The market size for the heavy duty pick up trucks market is projected to reach USD 83.1 billion by 2035.

The heavy duty pick up trucks market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in heavy duty pick up trucks market are regular, extended and crew.

In terms of fuel, gasoline segment to command 55.2% share in the heavy duty pick up trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Haul Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Heavy Duty Band Sealer Machine Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA