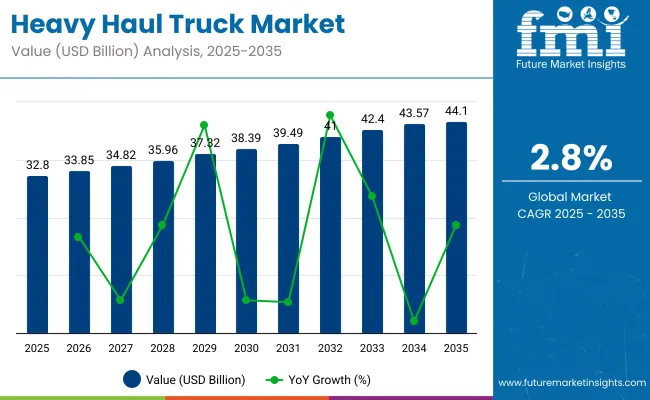

The heavy haul truck market is projected to reach USD 32.8 billion in 2025, supported by a CAGR of 2.8%. By 2035, the market is expected to be valued at approximately USD 43.5 billion, reflecting consistent demand for transporting oversized and overweight loads in sectors such as mining, construction, and energy projects.

Year-on-year growth shows a steady trajectory, with 2024 gains driven by resumed infrastructure activity, higher mining output, and investments in renewable energy installations that require heavy transport equipment. In 2025, growth momentum is expected to remain slightly stronger than the prior year, aided by expanding cross-border industrial trade and resource exploration in remote regions.

North America is projected to maintain stable growth through fleet replacements and rising demand from mining operations. Asia Pacific markets are expected to expand due to industrial growth in emerging economies and ongoing road network upgrades. European demand is likely to benefit from operational efficiency targets and adoption of emission reduction technologies, spurring purchases of advanced models. The integration of telematics, safety systems, and fuel-efficient powertrains is expected to improve operational value, supporting incremental yearly gains. While YoY growth remains moderate, the market's core role in logistics and infrastructure keeps it resilient through changing economic conditions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 32.8 billion |

| Industry Value (2035F) | USD 43.5 billion |

| CAGR (2025 to 2035) | 2.8% |

The heavy haul truck market is a specialized segment within the heavy duty trucks and heavy commercial vehicles markets. Based on industry assessments, heavy haul trucks account for roughly 8-10% of the global heavy duty trucks market and about 6-8% of the overall heavy commercial vehicles market.

The share reflects their niche role in transporting oversized and overweight loads across mining, construction, and energy sectors. Growth is influenced by large-scale infrastructure projects, expansion of mining operations, and technological upgrades aimed at improving load capacity, fuel efficiency, and regulatory compliance across high-demand regions.

Manufacturers are focusing on advanced electrification programs, with battery-electric and hybrid heavy haul models entering pilot operations to meet stricter emission norms. Autonomous driving technologies are being deployed in mining and port logistics to improve operational safety and reduce downtime.

Key players are introducing modular truck platforms with interchangeable components to lower lifecycle costs and speed up custom configuration for specific industries. Digital fleet monitoring systems with predictive maintenance features are becoming standard, helping operators optimize utilization. Strategies also include expanding production in emerging markets and partnering with energy providers to establish charging and hydrogen refueling infrastructure

Growth in construction activities and mining output is supporting demand for heavy haul trucks with higher load capacity and operational efficiency. Use in transporting oversized and heavy materials is increasing in infrastructure projects and extraction sites. Rising interest in advanced load management technologies is also contributing to market expansion.

Challenges arise from high operational expenses and adherence to strict emission norms. Opportunities are emerging through electric and automated vehicle development. Integration of telematics, predictive maintenance tools, and modular truck designs is influencing purchase decisions across key industries.

Large-scale construction programs and mining operations are creating the need for heavy haul trucks with greater durability and payload capacity. Road, bridge, and industrial development require the movement of heavy equipment and raw materials that cannot be transported by standard vehicles.

Mining operations for coal, iron ore, and other minerals rely on trucks capable of handling demanding terrain and continuous usage. Engine efficiency improvements and strong chassis designs enable faster completion of work with reduced operational downtime. Public and private sector investment in long-term infrastructure projects is ensuring consistent demand for heavy-duty transport vehicles.

Operating a heavy haul truck fleet involves substantial expenses related to fuel consumption, spare parts, and regular servicing. Meeting strict emission regulations requires costly upgrades to engines and exhaust systems, adding to the initial investment. Drivers must undergo specialized training, further increasing costs for fleet operators.

Fuel price fluctuations directly affect operating budgets, while continuous heavy load transport accelerates mechanical wear. Repair needs and unplanned downtime impact productivity, making such vehicles less accessible for smaller logistics and transport companies with limited financial resources. This combination of high costs and compliance obligations can slow adoption.

Manufacturers are focusing on electric truck models to help reduce fuel dependency and align with emission reduction targets. Automated driving systems are being designed to enhance safety and improve operating efficiency by reducing reliance on manual driving. In industries such as mining and construction, these technologies allow for round-the-clock operation without fatigue-related interruptions.

Advances in charging infrastructure, energy storage systems, and AI navigation are increasing the feasibility of deploying such vehicles. Strategic collaborations between vehicle makers and technology providers are expected to expand the range of applications for heavy haul trucks in the future.

Fleet managers are adopting telematics systems for real-time vehicle tracking, performance analysis, and maintenance scheduling. This data-driven approach supports improved route planning and helps reduce fuel waste. Demand is growing for trucks with modular designs that can be adapted to different load requirements through adjustable chassis and trailer configurations.

Cloud-connected fleet management tools allow operators to monitor performance remotely and respond quickly to mechanical issues. Hybrid and alternative powertrain developments are being tested to meet operational needs while reducing fuel use. These trends reflect a shift toward more adaptable and efficient heavy transport solutions.

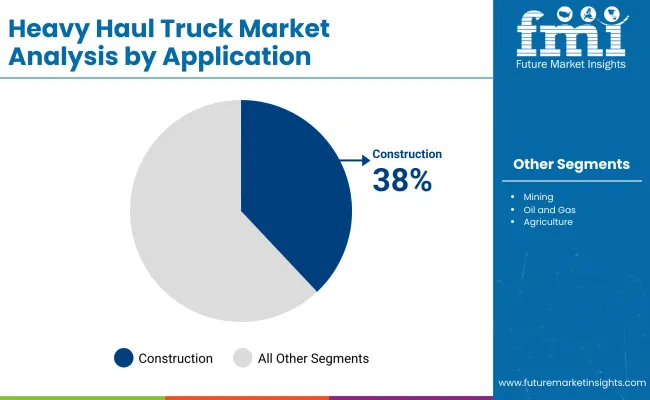

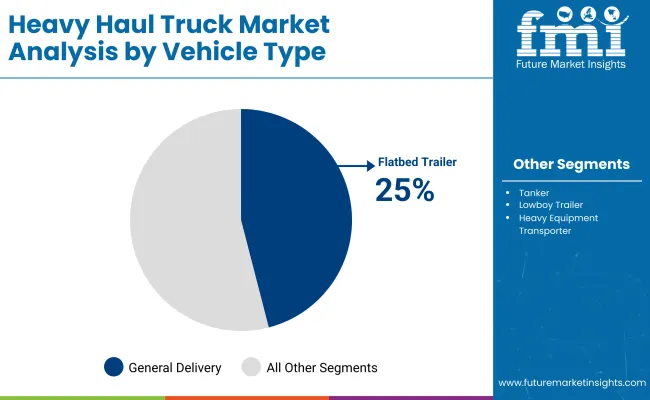

The heavy haul truck market in 2025 is driven by strong demand in construction, flatbed trailers, internal combustion engines, and above 50-ton load capacities, which collectively hold over 60% of the total market share. Construction leads the application category with 38%, supported by ongoing infrastructure expansion. Flatbed trailers dominate vehicle type demand at 25% due to their adaptability for irregular loads. Internal combustion engines retain a commanding 60% share, benefiting from established fueling networks and operational reliability.

Construction holds a 38% market share within applications, supported by large-scale projects in transportation infrastructure, commercial facilities, and industrial plants. Heavy haul trucks play a key role in moving oversized equipment, prefabricated structures, and building materials to sites with high precision. Leading manufacturers such as Caterpillar, Komatsu, and Liebherr supply vehicles built with reinforced chassis, multiple axle configurations, and advanced suspension systems to meet the sector’s demands. Growth is also fueled by synchronized project planning and rising investment in both urban redevelopment and rural connectivity.

Flatbed trailers lead the vehicle type category with 25% share due to their unmatched versatility in carrying oversized and irregularly shaped loads. These trailers are widely used for wind turbine blades, large industrial machinery, and agricultural equipment. Companies such as Fontaine Trailer, Trail King Industries, and K-Line Trailers invest in lightweight, high-strength materials to enhance load capacity without compromising fuel efficiency.

The open-deck design allows for easy loading from multiple angles, reducing turnaround times and increasing operational efficiency for fleet operators. Flatbeds are favored for their adaptability across sectors, making them an investment priority for haulers handling varied freight profiles.

Internal combustion engines command 60% share in the propulsion category, maintaining their position as the most practical and cost-effective option for heavy-duty applications. Manufacturers such as Volvo Trucks, Kenworth, and Mack Trucks offer diesel engines with high torque outputs, long service lives, and efficient fuel consumption rates.

These engines excel in remote regions and extreme climates where alternative fuel infrastructure is limited or unavailable. They remain the preferred choice for long-distance, high-load operations in industries like mining, construction, and oil transport. Investment in cleaner combustion technology further supports their continued relevance, even as electric and hybrid models expand market presence.

The above 50-ton capacity segment holds 38% market share, making it the leading category for high-volume, heavy-duty transport needs. It serves industries such as mining, oil, and large construction projects that require fewer trips to move massive loads, thereby reducing operational costs and timelines.

Companies like Hitachi Construction Machinery, Terex, and BelAZ design trucks with reinforced suspension, high-torque engines, and advanced braking systems to handle extreme payloads in challenging terrains. Demand is concentrated in resource-rich regions where hauling efficiency directly impacts profitability. This category’s dominance is expected to continue as global energy and mining operations scale up their logistics requirements.

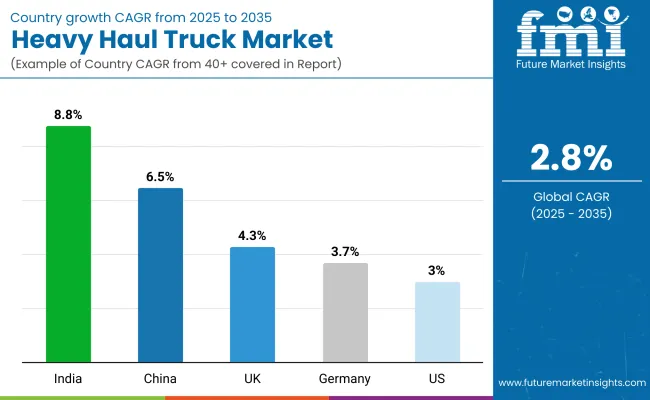

The market is projected to grow at a CAGR of 2.8% from 2025 to 2035. India is expected to lead with a CAGR of 8.8%, followed by China at 6.5% and the United Kingdom at 4.3%. Germany is forecast at 3.7%, while the United States is projected at 3.0%. India’s growth surpasses the global average by +214%, with China at +132% and the United Kingdom at +54%. Germany records a +32% premium, while the United States maintains a modest +7% difference.

Growth trajectories are being influenced by industrial expansion and resource extraction in BRICS economies, sustained infrastructure renewal in OECD markets, and logistics network upgrades across emerging trade hubs. ASEAN member states, while not leading in percentage growth, are expected to follow a similar upward pattern as cross-border freight demand intensifies, creating distinct opportunities across both advanced and developing economies.

The global heavy haul truck market is projected to expand at a CAGR of 2.8%, supported by increasing demand for higher payload efficiency in project logistics. Manufacturers are developing reinforced chassis and higher torque powertrains to minimize trip frequency and maintain uptime in long distance and off highway operations. Fleet buyers are shifting toward modular trailer systems that accommodate multiple cargo types, while telematics integration enables predictive maintenance to reduce downtime. Aftermarket support networks are expanding into remote areas, shortening service lead times. Financing models tied to operational schedules allow mid-size operators to upgrade fleets without heavy upfront investment, creating a shift toward integrated product and service solutions.

The United States heavy haul truck market is forecast to grow at a CAGR of 3.0%, driven by bulk commodity routes and long distance energy logistics. Operators rely on high torque low speed engines, reinforced drivetrains, and auxiliary braking to manage sustained heavy loads. Seasonal fluctuations in demand encourage the use of lease based procurement and lifecycle service agreements. Mobile service fleets now cover more remote haul routes, lowering average recovery times. Compliance requirements on oversize movements have led to wider use of multi axle trailer configurations and route optimization software to improve delivery timelines.

The United Kingdom market is expected to expand at a CAGR of 4.3%, supported by abnormal load transport and port to inland movements. Operators favour low axle load tractors and compact chassis to meet bridge and road restrictions. Modular multi axle trailers are used extensively to distribute mass effectively. Route surveys and close authority coordination are standard to minimized disruption for large component deliveries. Specialist lifting and coupling systems reduce handling times at transfer points, improving delivery efficiency.

The heavy haul market in China is projected to grow at a CAGR of 6.5%, driven by large scale industrial relocations, port expansions, and mining projects. Operators use high output diesel engines, heavy duty transmissions, and reinforced chassis to sustain continuous heavy loads. Domestic OEMs provide customized low bed trailers for oversized industrial cargo, while inland distribution hubs ensure part availability. OEM logistics partnerships are speeding up delivery to key ports and industrial sites, aligning with project schedules.

The heavy haul truck industry in India is anticipated to grow at a CAGR of 8.8%, fueled by infrastructure, mining, and construction projects. Operatorspriorities high power tractors with extendable low bed trailers for varied road conditions and axle load compliance. Domestic trailer manufacturers produce modular extendable platforms for long industrial components. Financing tied to project cash flows helps smaller operators access high capacity vehicles. Planned maintenance is increasingly aligned with permit windows to avoid unnecessary downtime.

The demand of heavy haul in Germany is expected to grow at a CAGR of 3.7%, with strong demand for precision transport of industrial machinery and infrastructure modules. High performance tractors feature advanced braking and electronically controlled suspensions for stability. Steering axle trailers and modular coupling systems allow better maneuverability in constrained spaces. Data-driven fleet scheduling reduces idle time, and cooperation with authorities shortens permitting cycles for key industrial routes.

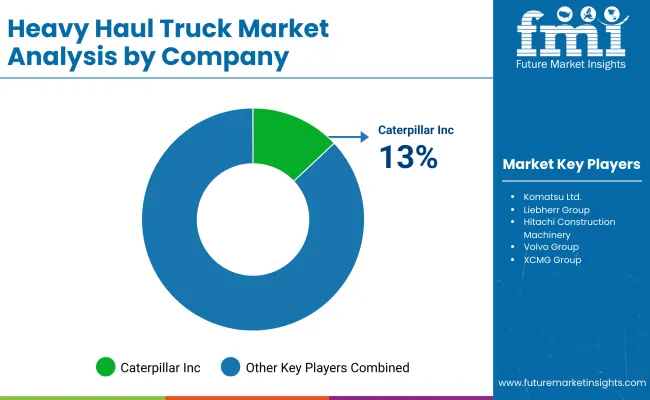

The heavy haul truck market is driven by established global players and emerging manufacturers adopting diverse strategies to strengthen their market presence. Caterpillar Inc. continues to roll out upgraded models with higher payload capacity and autonomous haulage capabilities, while Komatsu Ltd. focuses on electric-drive systems and partnerships with mining operators for fleet trials.

Liebherr Group invests in R&D to enhance durability in harsh mining conditions, recently expanding its T 284 range, and Hitachi Construction Machinery aligns its truck designs with compatible excavators for integrated site performance. Volvo Group develops operator-centric features and collaborates with contractors for field testing, whereas XCMG Group targets export growth through distributor agreements in Africa and Latin America with reinforced large-tonnage trucks.

BelAZ concentrates on ultra-class haul trucks exceeding 400-ton payloads, supported by testing in extreme climates, while Scania AB upgrades engine torque for demanding loads and introduces training programs for operators. Terex Trucks refines transmission systems for better fuel efficiency and expands its dealer network across high-demand regions, and SANY Group strengthens its export capabilities with localized component production and high-load capacity product launches. Emerging regional players in India, Indonesia, and South America compete with cost-effective, adaptable models, using localized manufacturing and modular designs to meet diverse operational needs.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 32.8 billion |

| Projected Market Size (2035) | USD 43.5 billion |

| CAGR (2025 to 2035) | 2.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value, units for volume where applicable |

| Application Segments | Construction, Mining, Oil and Gas, Agriculture, Logging |

| Vehicle Types | Flatbed Trailers, Tankers, Lowboy Trailers, Heavy Equipment Transporters, Custom Trailers |

| Engine Types | Internal Combustion Engine, Electric, Hybrid, Natural Gas, Hydrogen Fuel Cell |

| Load Capacity Segments | Up to 15 Tons, 15-30 Tons, 30-50 Tons, Above 50 Tons |

| Geographic Coverage | North America, Europe notable, South America, Asia Pacific, Middle East & Africa |

| Countries Analyzed | United States, Canada, Germany, France, Brazil, Mexico, China, India, Australia, South Africa, Saudi Arabia |

| Key Companies | Caterpillar Inc., Komatsu Ltd., Liebherr Group, Hitachi Construction Machinery, Volvo Group, XCMG Group, BelAZ, Scania AB, Terex Trucks, SANY Group |

| Additional Insights | Mining and construction remain the highest revenue contributors, electric and hydrogen fuel cell adoption is expected to increase in response to emissions regulations, above 50-ton segment is favored in mining-heavy regions, Asia Pacific shows strong growth from infrastructure expansion |

The market is projected to reach USD 43.5 billion by 2035.

The market is expected to grow at a CAGR of 2.8% during the period.

Construction leads with a 38% share in 2025.

Flatbed trailers account for 25% of the market in 2025.

Komatsu Ltd. introduced a hydrogen-powered haul truck prototype in April 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Bins Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Cordless Tools Market Analysis Size and Share Forecast Outlook 2025 to 2035

Heavy Lifting Equipment Market Size and Share Forecast Outlook 2025 to 2035

Heavy Commercial Vehicle Eps Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Heavy Oil Cracking Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Heavy Wall Bottles Market Size, Share & Forecast 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Heavy Duty Band Sealer Machine Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of the Heavy Duty Corrugated Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA