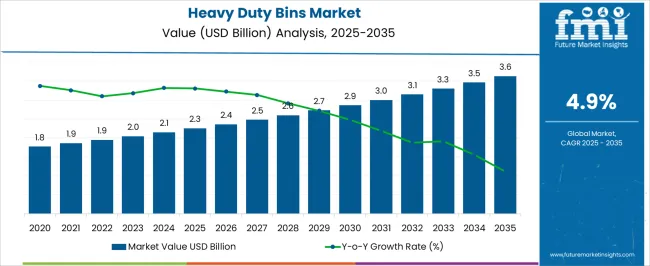

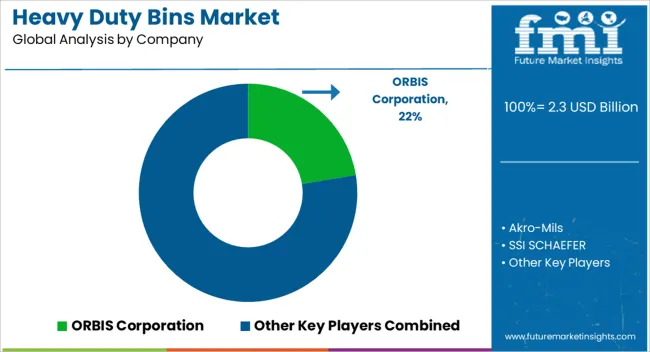

The Heavy Duty Bins Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Heavy Duty Bins Market Estimated Value in (2025 E) | USD 2.3 billion |

| Heavy Duty Bins Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The Heavy Duty Bins market is witnessing steady growth driven by the increasing emphasis on efficient waste management and industrial storage solutions. Rising urbanization, growing industrial activity, and the expansion of commercial sectors have heightened the demand for durable, long-lasting, and high-capacity bins.

Technological advancements in material processing and molding have allowed the production of bins that are resistant to impact, harsh weather, and chemical exposure, further enhancing their appeal. Additionally, regulatory requirements for proper waste disposal and recycling have prompted industries and municipalities to adopt standardized, high-capacity waste storage solutions.

As sustainability and environmental compliance become central to operations, heavy duty bins are increasingly recognized as critical infrastructure for both waste collection and material handling The market outlook remains positive, with opportunities arising from smart waste management initiatives, increasing industrial automation, and the need for cost-efficient storage and transport solutions, all of which support long-term market expansion.

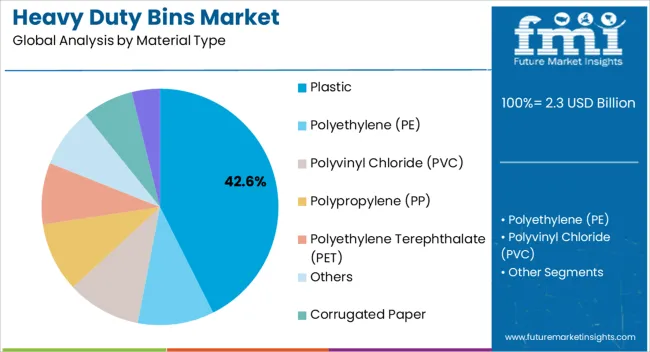

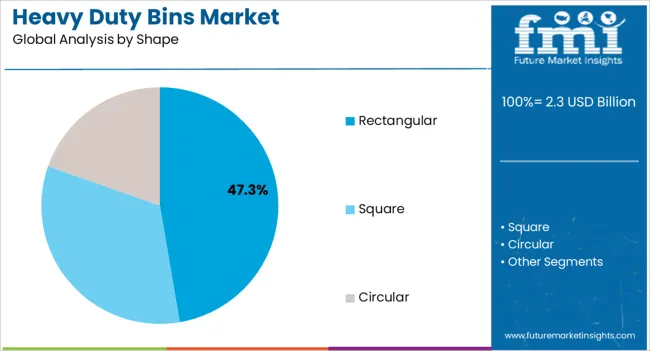

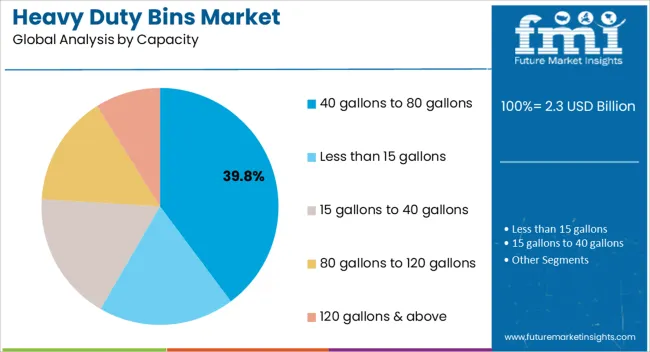

The heavy duty bins market is segmented by material type, shape, capacity, product type, end use industry, and geographic regions. By material type, heavy duty bins market is divided into Plastic, Polyethylene (PE), Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene Terephthalate (PET), Others, Corrugated Paper, and Steel. In terms of shape, heavy duty bins market is classified into Rectangular, Square, and Circular. Based on capacity, heavy duty bins market is segmented into 40 gallons to 80 gallons, Less than 15 gallons, 15 gallons to 40 gallons, 80 gallons to 120 gallons, and 120 gallons & above. By product type, heavy duty bins market is segmented into Stackable, Collapsible, and Nestable. By end use industry, heavy duty bins market is segmented into Logistics and Transportation, Building & Construction, Chemicals & Fertilizers, Food & Beverage, Home Care & Personal Care, E – Commerce, and Other End Use. Regionally, the heavy duty bins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material segment is expected to hold 42.60% of the Heavy Duty Bins market revenue share in 2025, making it the leading material type. Growth in this segment has been driven by the lightweight yet durable nature of plastic, which facilitates easier handling, transportation, and installation compared with metal or composite alternatives. Plastic bins are highly resistant to corrosion, chemicals, and UV exposure, making them ideal for both indoor and outdoor applications.

Cost-effectiveness and the ability to mold plastic into diverse shapes and sizes have also contributed to its dominance. Adoption has been accelerated in industrial, commercial, and municipal sectors seeking bins that can withstand repeated use and rough handling.

The segment’s performance is further supported by improvements in recycled and high-density plastics, allowing for sustainable production while maintaining strength and longevity As industries continue to prioritize low-maintenance, long-lasting, and eco-friendly storage solutions, plastic heavy duty bins are expected to remain the top material choice.

The rectangular shape segment is projected to hold 47.30% of the Heavy Duty Bins market revenue share in 2025, emerging as the most preferred bin shape. Its popularity has been influenced by space optimization and stackability, which allow for efficient storage in warehouses, factories, and commercial establishments. Rectangular bins facilitate better utilization of floor area and simplify logistics during transport or loading operations.

Additionally, the shape accommodates various compartmentalization designs, which are advantageous for segregating waste or materials in industrial and municipal applications. Robustness and uniformity in structure enhance durability, particularly when bins are subjected to heavy loads or frequent handling.

The segment’s growth has been further supported by industry preference for standardized containers that integrate seamlessly with existing storage systems and waste management processes Given the focus on operational efficiency and organized storage solutions, rectangular heavy duty bins are expected to maintain their leadership in the market.

The capacity segment of 40 gallons to 80 gallons is anticipated to account for 39.80% of the Heavy Duty Bins market revenue share in 2025, establishing it as the leading capacity range. This preference is being driven by its suitability for both commercial and industrial applications, where bins need to accommodate substantial volumes without becoming difficult to maneuver.

The range offers an optimal balance between storage efficiency and portability, allowing for easier handling by personnel and compatibility with standard collection vehicles. Adoption has been influenced by operational needs for regular waste disposal cycles, compliance with storage regulations, and the requirement for high-throughput material handling.

The capacity also supports integration with automated waste collection systems and stackable storage solutions, further enhancing utility With industries and municipalities increasingly seeking flexible, durable, and appropriately sized containers, heavy duty bins within the 40 to 80 gallons range are projected to retain their dominant position in the market.

Industrial bulk packaging have seen a tremendous growth in recent few years due to increase in logistics and transportation industry across the globe. One such type of industrial bulk packaging can be done by using heavy duty bins. Heavy duty bins are designed for saving storing industrial and household products which may get damage during transit.

Mostly heavy duty bins are commonly made up of plastic such as polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polyethylene terephthalate (PET). Moreover, it is observe that due to environmental issue heavy duty bins made from steel and corrugated paper are getting traction. Heavy duty bins are available with several formats such as nestable, stackable and collapsible which helps in reducing the space for storing empty bins. All these above factors have created growth opportunities for heavy duty bins market during the forecast period.

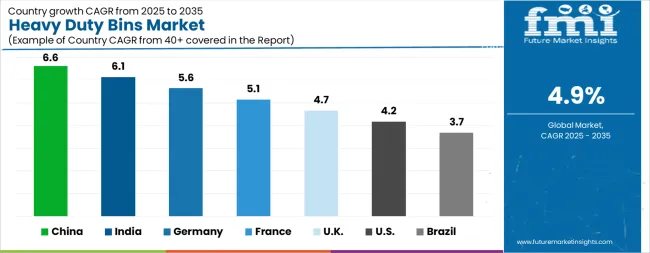

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The Heavy Duty Bins Market is expected to register a CAGR of 4.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.6%, followed by India at 6.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.7%, yet still underscores a broadly positive trajectory for the global Heavy Duty Bins Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.6%. The USA Heavy Duty Bins Market is estimated to be valued at USD 792.5 million in 2025 and is anticipated to reach a valuation of USD 1.2 billion by 2035. Sales are projected to rise at a CAGR of 4.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 109.5 million and USD 60.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Material Type | Plastic, Polyethylene (PE), Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene Terephthalate (PET), Others, Corrugated Paper, and Steel |

| Shape | Rectangular, Square, and Circular |

| Capacity | 40 gallons to 80 gallons, Less than 15 gallons, 15 gallons to 40 gallons, 80 gallons to 120 gallons, and 120 gallons & above |

| Product Type | Stackable, Collapsible, and Nestable |

| End Use Industry | Logistics and Transportation, Building & Construction, Chemicals & Fertilizers, Food & Beverage, Home Care & Personal Care, E – Commerce, and Other End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ORBIS Corporation, Akro-Mils, SSI SCHAEFER, Schoeller Allibert, Sterilite Corporation, Rubbermaid Commercial Products, ULINE, and Reliance Industries Limited |

The global heavy duty bins market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the heavy duty bins market is projected to reach USD 3.6 billion by 2035.

The heavy duty bins market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in heavy duty bins market are plastic, polyethylene (pe), polyvinyl chloride (pvc), polypropylene (pp), polyethylene terephthalate (pet), others, corrugated paper and steel.

In terms of shape, rectangular segment to command 47.3% share in the heavy duty bins market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-Duty Pallet Warehouse Racking Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pallet Rack Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pump Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Heavy-Duty Hydrogen Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Pick Up Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Vehicle Rental Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Engine Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Trucks Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Heavy Duty Vacuum Bottle Market Trends – Growth & Demand 2025 to 2035

Heavy Duty Band Sealer Machine Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of the Heavy Duty Corrugated Packaging Market

Heavy Duty Bag and Sack Market from 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Korea Heavy-Duty Corrugated Packaging Industry Analysis by Product Type, Board Type, Capacity, End-Use Verticals and Region: A Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA