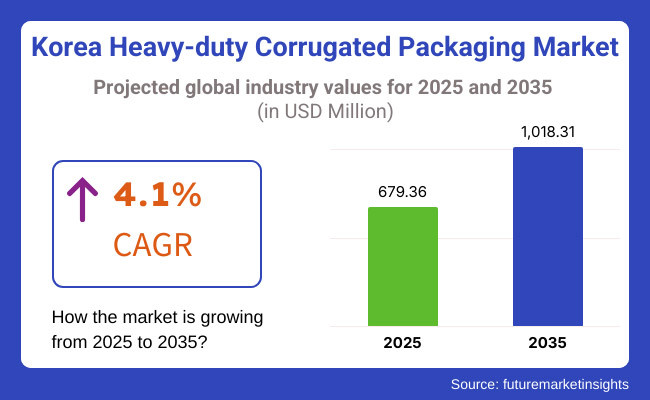

The total adoption of the heavy-duty corrugated packaging industry in Korea is estimated to be approx. USD 679.36 million in 2025. The industry is anticipated to grow at a steady CAGR of 4.1% in 2035 in the country, reaching an industry valuation of USD 1,018.31 million.

The heavy-duty corrugated packaging industry in Korea witnessed a consistent growth due to its demand across various sectors, including automotive, electronics and consumer goods. Heavy-duty corrugated packaging is renowned for its strength and capacity for heavy loads. It plays a crucial role in ensuring secure transportation and storage of heavy products.

As Korea continues to be a hub for manufacturing and export globally, the heavy-duty packaging industry has become increasingly important, mirroring trends in e-commerce, logistics, and environmentalism. Growth in the industry is also supplemented by the push towards green solutions and packaging technology innovations, placing Korea at the forefront of global heavy-duty corrugated packaging.

From 2020 to 2024, the Korean heavy-duty corrugated packaging industry witnessed consistent growth driven by the country's strong automotive and electronics manufacturing industries. The need for resilient packaging grew, and the use of double-wall packaging boxes gained significant traction, holding a large industry share in 2024.

During the forecast period between 2025 and 2035, the industry is expected to continue striving, with its revenue forecasts reaching substantial figures throughout the forecasted period. The growth of the industry is driven by several factors, including increasing demand for corrugated packaging in various end-use industries such as food and beverages, pharmaceuticals, consumer goods and electronics. However, several challenges, including fluctuations in raw materials and the need for sustainable packaging solutions, may impact the industry dynamics during this period.

The industry has also witnessed significant trends, including a shift towards eco-friendly packaging options and continuous innovations to meet evolving consumer and industry demands. The developments underscore the critical role of heavy-duty corrugated packaging in supporting Korea’s manufacturing and export-driven economy.

| Key Drivers | Key Restraints |

|---|---|

| Increasing Demand for Durable Packaging: The growth of industries such as automotive, electronics, and consumer goods has spurred the need for robust packaging solutions. Heavy-duty corrugated packaging provides enhanced strength and protection for high-value or fragile products, which drives demand. | Fluctuations in Raw Material Costs: The cost of raw materials like paper, wood, and other fibers can be volatile, affecting the overall pricing of corrugated packaging. This can lead to uncertainty for manufacturers and end-users, potentially limiting industry growth. |

| E-commerce Growth: The ongoing rise in e-commerce has led to a higher need for packaging solutions that ensure the safe transportation of goods. As more companies expand their online presence, the demand for heavy-duty corrugated packaging continues to rise. | Competition from Alternative Packaging Solutions: Alternative packaging materials, such as plastic and reusable packaging options, are gaining attention due to their perceived cost-effectiveness or performance benefits. This competition may limit the adoption of corrugated packaging, particularly in cost-sensitive sectors. |

| Environmental Concerns and Sustainability: There is an increasing push toward sustainable packaging due to growing environmental awareness. Heavy-duty corrugated packaging, being recyclable and eco-friendly, has benefited from these trends, driving growth. | Limited Availability of Raw Materials: A shortage in the supply of high-quality raw materials for corrugated packaging, such as specific types of paper or fibers, could impact production and limit the market’s growth potential. |

| Advancements in Packaging Technology: Innovations in corrugated packaging, such as improved strength-to-weight ratios, enhanced protection features, and automation in production, have expanded the capabilities of heavy-duty packaging, driving its industry acceptance. | Regulatory and Compliance Challenges: Different regulations related to the sourcing of materials, waste management, and carbon emissions could impose constraints on the heavy-duty packaging market. Adapting to these regulations could increase costs or slow down market growth. |

| Growth of the Manufacturing Sector: Korea's manufacturing strength, particularly in sectors like electronics, automobiles, and industrial machinery, continues to create a high demand for heavy-duty packaging. This trend contributes significantly to the market's expansion. | High Initial Investment for Manufacturers: While heavy-duty corrugated packaging offers many benefits, manufacturers may face high initial investments in machinery and production lines to meet the growing demand for customized solutions. This can act as a barrier to entry for smaller players. |

| Rise of Global Trade and Exports: As a major global exporter, Korea’s increasing trade activities demand efficient and protective packaging for various products. This has contributed to the robust demand for heavy-duty corrugated packaging in international shipping. | Lack of Consumer Awareness of Recyclability: Despite being eco-friendly, some consumers and industries may not fully realize the recyclable nature of corrugated packaging. This can impact the overall adoption of such materials, particularly in regions or sectors that are less environmentally conscious. |

| Customization of Packaging Solutions: The growing trend of customized packaging to meet specific product requirements has increased the adoption of heavy-duty corrugated packaging, as it allows for tailored protection and branding opportunities. | Economic Uncertainties: Economic downturns, such as recessions or trade disruptions, can impact the demand for heavy-duty corrugated packaging, especially in industries reliant on discretionary spending. Economic uncertainties can also disrupt supply chains and reduce production volumes. |

| Increased Focus on Supply Chain Optimization: With advancements in logistics and transportation, companies are looking for efficient and reliable packaging solutions that ensure the safe delivery of goods. Heavy-duty corrugated packaging fits well into this supply chain optimization trend, driving its demand. | Increased Pressure on Cost Management: While heavy-duty corrugated packaging offers durability and protection, the increased cost pressures, especially in industries with thin profit margins, could restrict its adoption, especially when compared to less expensive alternatives. |

| Driver | Impact |

|---|---|

| Increasing Demand for Durable Packaging | High |

| E-commerce Growth | High |

| Environmental Concerns and Sustainability | High |

| Advancements in Packaging Technology | Medium |

| Growth of the Manufacturing Sector | High |

| Rise of Global Trade and Exports | High |

| Customization of Packaging Solutions | Medium |

| Increased Focus on Supply Chain Optimization | Medium |

| Restraint | Impact |

|---|---|

| Fluctuations in Raw Material Costs | High |

| Competition from Alternative Packaging Solutions | Medium |

| Limited Availability of Raw Materials | Medium |

| Regulatory and Compliance Challenges | Medium |

| High Initial Investment for Manufacturers | Medium |

| Lack of Consumer Awareness of Recyclability | Low |

| Economic Uncertainties | Medium |

| Increased Pressure on Cost Management | High |

During the forecast period between 2025 and 2035, corrugated boxes will continue to dominate the heavy-duty packaging market. The demand of the market is driven by its versatility and cost-effectiveness. The robust nature of the product makes it an ideal choice for industries seeking secure, reliable packaging for a wide range of goods. The pallet boxes also witnessed an increased demand in the logistics and automotive sectors, where bulk items need to be transported safely.

Double and single cover boxes will become more popular to provide additional protection for delicate or high-value items. The usage of telescopic boxes will also increase in sectors requiring customized packaging solutions due to the flexible sizes and offering of enhanced protection.

Liquid bulk boxes will meet growing demand in sectors such as chemicals, food and beverages, enabling the safe transport of liquids and semi-liquids. Slotted boxes will continue to be a popular choice in the industry because of how efficient they are when packing and stacking. Niche sectors will explore other product varieties, such as octabins and high-performance totes, which supply appropriately specialized packaging solutions for larger goods.

The global demand for packaging solutions with a capacity of up to 100 lbs will remain stable in demand through the projected period between 2025 and 2035, especially in the food & beverages sector in which lightweight products are prevalent. However, packaging in the capacity range from 100 to 300 lbs will see good high growth as the range includes industries that need secure transportation such as chemicals, electronics, and pharmaceuticals.

Packaging solutions equipped to handle weights above 300 lbs will gain considerable traction, especially in automotive, heavy machinery and logistics sectors that cater to just-in-time (JIT) delivery, where deliveries predominantly comprise large and heavy, high-value products. These packaging solutions will be robust and meet the tough demands that come with transporting large, heavy products over long distances. Increased cargo shipments will spur trends in higher capacity packaging.

During the 2025 to 2035 forecast period, double-wall and triple-wall packaging will continue to witness rapid growth due to the need for enhanced protection and strength in packaging solutions. By providing a combination of firmness and low pricing, double-wall packaging is anticipated to be very popular in the sector, especially among industries that require greater padding and support for products while on the road.

As such, the demand for triple-wall packaging will grow in industries such as automotive and chemicals, in which greater strength and durability are required to safeguard heavier or more fragile products. Single-wall packaging will remain a cost-effective solution for lighter products and will exhibit stable demand for textiles and homecare industries.

As the demand for more durable and sustainable packaging continues to rise, manufacturers will continue to experiment with these board options to improve performance while still achieving sustainability objectives.

The food and beverage industry will continue to drive demand for heavy-duty corrugated packaging from 2025 to 2035, particularly for shipping bulk food, products and liquids. The chemical industry will also need strong packaging solutions, such as for hazardous or corrosive products, resulting in the increased use of heavy-duty boxes, liquid bulk boxes, and other specialized packaging formats.

On the consumer electronics front, there will be demand for durable packaging that is up to the task of handling the sensitive nature of the products, resulting in innovations in both packaging materials and designs. As consumers demand more sustainable options, cosmetics and personal care products will utilize eco-friendly packaging.

Healthcare packaging will still be important in preserving the integrity of products - especially for pharmaceuticals and medical devices where conditions are critical in avoiding contamination. The automotive industry would always be required to have high-performance packaging for their heavy parts and components, whereas textiles and glassware would need custom packaging to ensure safe transportation.

The Korean heavy-duty corrugated packaging Industry is anticipated to capture the market share of nearly 55% in 2025. Strict guidelines and quality requirements for packing valuable or delicate goods have increased the demand for double-walled, heavy-duty corrugated packaging in Korea. The popularity of triple-walled corrugated boxes is also growing rapidly in several manufacturing sectors of the country.

The heavy-duty corrugated packaging industry in South Gyeongsang is expected to grow steadily over the forecasted period between 2025 and 2035. The region’s strong manufacturing sectors, including automotive, electronics and shipbuilding, will continue to drive demand for durable packaging solutions.

In addition, increasing sustainability focus will encourage industries to turn towards greener packaging options. Infrastructure expansion and high export focus will be primary drivers for industry growth. However, issues like instability in raw material prices and disruption in global supply chains might hamper the market. Nevertheless, with developments in sustainable packaging, these issues may be counteracted, ensuring sustained industry stability.

The growing agricultural and industrial sectors in North Jeolla are expected to contribute to a steady expansion in the province’s heavy-duty corrugated packaging industry over the upcoming decade. With industries like food processing, heavy machinery manufacturing, and logistics growing in size, there is an increasing need for cost-effective, durable packaging solutions.

The region is known for its strategic location and proximity to major ports, enhancing export opportunities and boosting the demand for packaging in turn. A key factor affecting the market is technological advancement in packaging production coupled with spurring environmental regulations driving the adoption of innovative packaging design and materials.

There are also challenges looming, like the fluctuation of agricultural output and logistical disruptions that can reduce demand, but the focus on sustainability will most definitely bring sustainable packaging solutions to the forefront, overcoming several of these challenges.

The heavy-duty corrugated packaging industry for South Jeolla is anticipated to grow at a steady pace, owing to the marine and agriculture sector of the region, between 2025 and 2035. In addition, the increasing need for effective packaging solutions for agricultural exports, in particular in seafood and crop products, is anticipated to drive industry growth over the forecast period.

Considering how South Jeolla has a great emphasis on eco-friendly practices, it can cater to the global turn towards sustainability to assure a demand rise towards recyclable and biodegradable packaging solutions. Additionally, the region's unique strategic position as a port hub will continue to support export-driven packaging demand.

That said, risks to the industry may come in the form of uncertainty around agricultural production and delays in logistics. However, the increased attention to sustainable packaging and material innovation will alleviate such pains, developing a more robust industry.

The heavy-duty corrugated packaging industry in Jeju is expected to grow moderately between 2025 and 2035 due to Jeju's agricultural exports and tourism. Demand for packaging will be fueled by the need to prop up exports of agricultural products, from citrus fruits to seafood, along with the needs of the local retail industry targeting tourists. With the rising levels of tourism, retail products and souvenir packaging will grow as well.

But Jeju’s relatively smaller industrial base and its dependency on tourism make the island vulnerable to global economic shifts than other regions in the economy. However, the growing emphasis on sustainable packaging practices across the region will allow the industry to remain competitive in the face of these challenges. With local initiatives encouraging environmentally friendly packaging and a growing need to reduce environmental impact, sustainable packaging solutions will be a significant contributor to the growth of this industry.

The heavy-duty corrugated packaging industry in Korea is concentrated, with Tier 1 companies enjoying a dominant industry share of approximately 90%. The tier 1 companies include those that involve the major players dominating the majority of the market, rendering it less fragmented and more influenced by the strategies and innovations of the leading players.

Key players in the Korean heavy-duty corrugated packaging industry are Samjung Packaging, Iljin Group, and Hanil Paper Mfg. Co., Ltd. During 2024, there were important developments, including Samjung Packaging increasing production capacity to cope with the growing demand for environmental-friendly packaging solutions. Iljin Group also introduced advanced automation technology to increase operational efficiency and decrease environmental footprints in their packaging manufacturing operations.

Here are the key companies in the heavy-duty corrugated packaging industry in Korea:

E-commerce growth, a sustainability focus, and need for durable packaging.

Samjung Packaging, Iljin Group, Hanil Paper, and Dongbang Paper.

Eco-friendly materials and automation for efficiency.

Using recyclable materials and energy-efficient production methods.

Table 1: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Korea Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 4: Korea Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 5: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 6: Korea Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 7: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 8: Korea Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 9: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 10: Korea Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Board Type, 2019 to 2034

Table 44: Rest of Korea Industry Analysis and Outlook Volume (Units) Forecast by Board Type, 2019 to 2034

Table 45: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Rest of Korea Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 48: Rest of Korea Industry Analysis and Outlook Volume (Units) Forecast by Capacity, 2019 to 2034

Table 49: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 50: Rest of Korea Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Korea Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 2: Korea Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 3: Korea Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 4: Korea Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 5: Korea Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Korea Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 11: Korea Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 12: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 13: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 14: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 15: Korea Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 16: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 17: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 18: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 19: Korea Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 20: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 21: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 22: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 23: Korea Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 24: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Korea Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 27: Korea Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 28: Korea Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 29: Korea Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 30: Korea Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 127: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Board Type, 2024 to 2034

Figure 128: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 129: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Capacity, 2024 to 2034

Figure 130: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 131: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Board Type, 2019 to 2034

Figure 132: Rest of Korea Industry Analysis and Outlook Volume (Units) Analysis by Board Type, 2019 to 2034

Figure 133: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Board Type, 2024 to 2034

Figure 134: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Board Type, 2024 to 2034

Figure 135: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 136: Rest of Korea Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 137: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 138: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 139: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 140: Rest of Korea Industry Analysis and Outlook Volume (Units) Analysis by Capacity, 2019 to 2034

Figure 141: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 142: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 143: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 144: Rest of Korea Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 145: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 146: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 147: Rest of Korea Industry Analysis and Outlook Attractiveness by Board Type, 2024 to 2034

Figure 148: Rest of Korea Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 149: Rest of Korea Industry Analysis and Outlook Attractiveness by Capacity, 2024 to 2034

Figure 150: Rest of Korea Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA