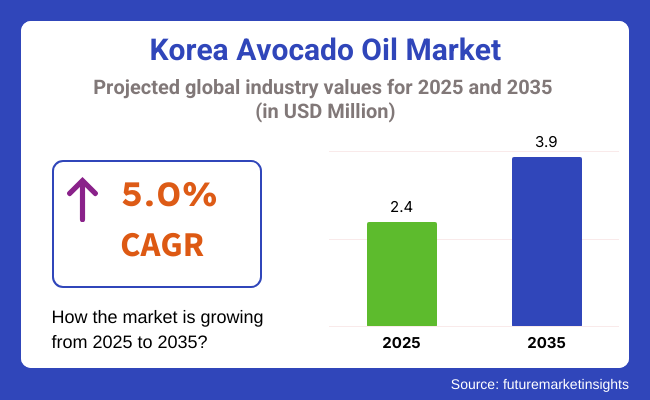

The Korea avocado oil market is poised to register a valuation of USD 2.4 million in 2025. The industry is slated to grow at 5.0% CAGR from 2025 to 2035, witnessing USD 3.9 million by 2035. The industry is witnessing impressive growth, supported by a convergence of health-oriented consumerism, changing dietary patterns, and heightened awareness of the nutritional values linked with the product.

While Korean consumers take greater control over their well-being, there has been an impressive shift toward adopting functional and natural ingredients as part of day-to-day diets. The product, rich in monounsaturated fats, antioxidants, and vitamins E and K, is becoming popular as a healthier alternative to traditional cooking oils like canola or soybean oil.

Its perceived health benefits for the heart and anti-inflammatory value are finding good alignment with the emerging trend for foods that promote preventive health and wellness. Another principal driver is increasing Western-influenced dietary and culinary patterns in Korea. With global cuisines increasingly being incorporated into Korean cuisine, foods such as avocado oil-hitherto perceived as niche-are now receiving mainstream popularity.

Cooking-at-home trends, enabled by the COVID-19 pandemic, have further helped popularize the product. Consumers are seeking out new ingredients that are healthy and versatile, and the neutral flavor and high smoke point of the product make it a go-to choice for stir-frying, baking, and salad dressings.

In addition, its clean-label appeal and "superfood" status are resonating very strongly with younger consumers, who value transparency, sustainability, and health benefits in their food choices. Aside from food applications, the multifunctionality of the product in the cosmetics and personal care industries contributes to its industry demand.

Its moisturizing and anti-aging capabilities have contributed to greater use in skincare and haircare products, further driving demand. As Korean lifestyle trends remain focused on health, natural living, and holistic wellness, the industry is poised for long-term growth. Ongoing consumer education and retail growth will most likely support this upward trend in the next few years.

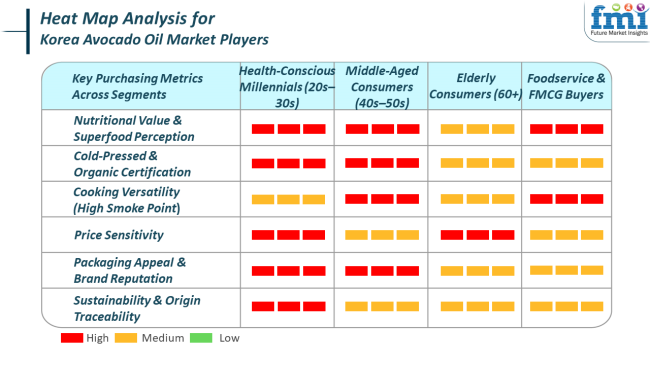

The Korean industry is seeing dynamic growth in a range of end-use segments, each shaped by distinct consumer trends and shopping priorities. In the foodservice segment, health-oriented consumers are substituting traditional oils with avocado oil because of its high smoke point, subtle taste, and rich nutritional content, including heart-healthy fats and antioxidants.

Shopping choices are based on attributes such as organic certification, cold-pressed processing, clean-label status, and convenient packaging. Home cooking trends, meal kit growth, and increased demand for functional foods have also fueled demand further.

At the same time, in the foodservice and HORECA category, restaurants and cafes are including the product in health-oriented menus, where bulk supply, uniform quality, and thermal stability for professional use are of top concern.

Within the cosmetics and personal care category, increasing demand for natural and eco-friendly beauty products has positioned the product as a preferred ingredient in skin and hair care products due to its moisturizing and anti-aging capabilities.

Ingredient purity, organic sources, lack of additives, and sensitivity to skin are priorities with consumers in this category. In dietary supplements, the product appears in soft gels and enhanced products, with buying criteria focusing on omega levels, absorption rates, clear labeling, and third-party certification.

From 2020 to 2024, Korea's industry went through a significant shift, led mainly by increased health consciousness, the growth of plant-based living, and altered consumer behavior due to the COVID-19 pandemic. Throughout this time, the product transitioned from being an imported, niche product to a more mainstream pantry and personal care product.

The pandemic led to a surge in home cooking and at-home beauty treatments, driving the adoption of functional and natural ingredients such as avocado oil. More imports arrived on the industry, with a greater range of cold-pressed, extra virgin, and organic oils available.

Retailers increased product ranges, both in-store and online, and consumer education on healthy fats and clean-label products gained momentum. In the beauty industry, the product was a hit in K-beauty products with its repairing and moisturizing properties, which complemented increasing demand for mild, plant-based ingredients.

During the forecast period, the Korean industry will continue to grow steadily with sustained momentum from wellness, sustainability, and functional food trends. With increasingly selective consumers, demand is likely to be redirected towards certified organic, ethically sourced, and multifunctional oils.

Cold-press extraction technology and eco-friendly agricultural methods can also improve product quality and supply. Avocado oil in the food sector will most probably be a driving force behind functional snack development, clean-label ready meals, and plant-based substitutes, whereas in personal care, it can possibly find more application in green, minimalist skincare and haircare products.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The product picked up steam as consumers started focusing on health and wellness, particularly post-COVID-19, with growing interest in natural and immune-strengthening ingredients. | The product will become a household name in kitchens and skincare regimens, accepted by all demographics for its health and multi-functional benefits. |

| The majority of avocado oil products were imported, with limited local presence and greater price sensitivity. The product range was limited and targeted premium consumers. | Import source expansion and possible local alliances will create a wider range of products, including affordable, organic, and value-added ones. |

| Skincare companies gradually began incorporating the product for its hydrating and anti-inflammatory properties, especially in clean and niche beauty categories. | The product is likely to be a ubiquitous base ingredient in sustainable Korean beauty brands, fitting minimalist and natural skin care trends. |

| Many were still discovering the benefits of the product, where marketing centered around awareness and inherent nutritional benefits. | Consumers will look for proven claims like cold-pressed, non-GMO, ethically sourced, and multifunctional across cooking and personal care. |

The Korean industry, though recording steady growth and rising consumer demand, is not without danger. Among the key concerns is supply chain vulnerability to imports. Avocados are not grown locally in Korea in significant quantities, hence the industry remains very much dependent on imports from nations like Mexico, Peru, and Kenya.

This subjects the industry to possible threats from global avocado price volatility, trade barriers, seasonal disruptions, and geopolitical tensions. Any supply chain disruption can have a direct impact on product availability and retail prices, possibly curbing consumer demand. Another significant risk factor is consumer price sensitivity.

The product remains a premium and is usually pricier compared to more familiar cooking oils like soybean or canola oil. While an awareness of the health benefits thereof is growing, the wider penetration of the general industry may be constrained by perceiving it to be a niche or luxury good. Economic deceleration or inflationary factors could cause shifting consumer demand away from more premium products towards value-for-money solutions, affecting projected growth.

Extra virgin avocado oil is most commonly sold and sought after in the Korean industry, mainly because of its superior quality, health benefits, and alignment with the trend for consumer demand for healthy products. Extra virgin avocado oil is cold-pressed from the ripe avocado pulp without applying heat or chemicals, which helps maintain its natural nutrients, intense green color, and mild buttery taste.

Such characteristics strongly appeal to Korean consumers, who are becoming more inclined toward functional, natural, and clean-label food offerings. This oil's high monounsaturated fat content, antioxidants, and vitamins also place it very well in the midst of Korea's wellness trend and home cooking movement.

The success of this oil is also largely dependent on its versatility. Korean consumers utilize it for a wide range of applications, from salad dressings and pan cooking to skincare regimes, owing to its high smoke point and skin-protecting capabilities.

Health-oriented shoppers, especially in metropolitan cities such as Seoul and Busan, are inclined towards imported, organic-branded extra virgin oils that come advertised with labels like non-GMO, cold-pressed, and free of additives.

Organic oil is more readily available and in demand in Korea than its conventional equivalent, owing to the nation's heightened health awareness and rising demand for clean-label, chemical-free products. Korean consumers, especially in urban areas and among younger consumers, are increasingly food- and skincare-savvy, with a high priority on natural origin, non-GMO status, and ethical sourcing.

Organic oil sits easily with such a philosophy since it is cultivated and processed free of synthetic pesticides, fertilizers, or chemical solvents. Korean consumers tend to link the term "organic" with greater product quality, tougher production conditions, and generally improved health effects.

Some Korean organic oils are imported from countries recognized for environmentally friendly avocado cultivation-e.g., Mexico, New Zealand, or Chile-and carry internationally accepted labels (e.g., USDA Organic, EU Organic), reassuring consumers about their quality.

The Korean industry is becoming more competitive as global players and niche brands compete to extend their reach. Expansion is being fueled by increased consumer demand for health, wellness, and clean-label products, particularly those that are functional and nutritional.

With the product growing in popularity as a cooking, personal care, and functional food ingredient, manufacturers are investing in innovation, sustainability, and customized offerings to meet the changing needs of the Korean industry. Whereas premium and organic segments head demand, differentiation through products and industry positioning through strategies are fundamental in winning over consumers' confidence and industry shares.

AVO F&C commands the Korean industry by having robust channels of distribution as well as maintaining concentration on top-shelf quality health-oriented offerings. The business produces versatile cold-pressed oils fit for food or cosmetic purposes, thus rendering itself a front runner in its niche.

Crofts Ltd. introduces high-quality oils to Korea with a focus on clean, organic production. Their transparency and cold-press reputation has them serving a devoted following among Korean buyers concerned with health and the environment.

H&K Co., Ltd., a Korean company, is engaged in localized branding and packaging innovations with a focus on providing oils that are consistent with Korean taste and lifestyle preferences. Its industry responsiveness enables it to serve niche retail and online niches.

Nobel Foods provides top-grade oils, both for foodservice and retail markets in Korea. They are famous for their heat stability and taste-balanced oils, perfect for professional chefs and health-oriented home cooks alike.

Spectrum Organics Products, LLC offers a robust organic line to Korea, with a focus on USDA-certified oils. They are in great demand in health food stores and online channels, backed by brand loyalty among organic consumers.

Bella Vado Inc. has developed a niche position in Korea's beauty and personal care industry with the sale of oils popular for skin and hair care benefits. Their extra virgin, ecologically sourced products are appreciated as rich in natural nutrients.

The Village Press has taken hold in Korea with its high-end extra virgin oils, sold on both culinary and ethical grounds. Its oils are particularly favored by gourmet food lovers and high-end retailers. La Tourangelle, Inc. resonates with Korea's health-aware consumers with artisanal-style oils packaged in sophisticated presentation. The company's focus on culinary innovation and quality has won it a following in health-aware homes.

Proteco Gold Pty Ltd., with its reputation for top-grade Australian oils, enters the Korean industry with products full of purity and nutritional value. Their oils are marketed as green-friendly, non-GMO, and suitable for multipurpose application.

Sesajal S.A. de C.V. specializes in mass-scale, sustainable production of oils and ships to Korea with a value-oriented portfolio. Their purified oils are suitable for foodservice providers seeking affordable, health-oriented options.

Grupo Industrial Batellero offers cold-pressed and refined oils customized for bulk demand. Its distribution in Korea is expanding, particularly in B2B and food processing industries where price point and reliability are priorities.

Grove Avocado Oil is known in Korea for its bright, cold-pressed oils. The company promotes its oils as wellness-focused, appealing to younger generations with interests in holistic wellness and clean food.

Cibaria International provides varied avocado oil presentations available for the Korean industry, with a focus on bulk availability and customizable private labelling. Their adaptability accommodates both retail and industrial customers.

Olivado USA is a dominant force in the premium segment, recognized for its organic and fair-trade accredited oils. The sustainable aspect of the brand and its quality offerings resonate very well with the Korean consumer looking for traceable and ethical products.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| AVO F&C | 18-22% |

| Crofts Ltd. | 14-18% |

| H&K Co., Ltd. | 12-15% |

| Nobel Foods | 8-11% |

| Spectrum Organics Products, LLC | 6-9% |

| Bella Vado Inc. | 5-7% |

| The Village Press | 4-6% |

| La Tourangelle, Inc. | 3-5% |

| Proteco Gold Pty Ltd. | 2-4% |

| Sesajal S.A. de C.V. | 2-4% |

| Grupo Industrial Batellero | 1-2% |

| Grove Avocado Oil | 1-2% |

| Cibaria International | 1-2% |

| Olivado USA | 1-2% |

| Other Key Players (Combined) | 10-12% |

AVO F&C dominates the Korea avocado oil market with an estimated 18-22% industry share, thanks to a strong local presence, product versatility, and distribution across food and personal care channels.

Crofts Ltd. enjoys a 14-18% share, bolstered by its organic product range and focus on clean sourcing. The brand has established high trust among Korean consumers with a health and transparency focus.

H&K Co., Ltd. holds a 12-15% industry share by utilizing its familiarity with the local industry to provide custom avocado oil solutions with branding and packaging, engendering high industry interaction.

Nobel Foods has 8-11% industry share by providing stable, high-quality avocado oils for the culinary retail industry and foodservice industry, establishing itself as a stable supplier.

Spectrum Organics Products, LLC holds a 6-9% position with its certified organic products and extensive retail coverage. Its oils are highly acceptable to Korea's increasing health-oriented consumer industry.

Bella Vado Inc. enjoys 5-7% industry share, particularly in the beauty and wellness arena. Its oil for skin use is prized for its purity and natural virtues.

The Village Press, La Tourangelle, and Proteco Gold Pty Ltd. together hold a substantial niche providing high-end, artisanal, and environmentally friendly avocado oils suitable for specialty and gourmet markets.

The other brands, such as Sesajal S.A. de C.V., Grupo Industrial Batellero, and Olivado USA, make up a rising proportion of imports catering to retail and industrial markets with mixed emphasis on sustainability, price sensitivity, and scalability.

In terms of product type, the industry is divided into extra virgin oil, virgin oil, and refined.

Based on variety, the market is classified into hass, fuerte, zutano, bacon, lamb hass, gwen, and others.

In terms of nature, the market is bifurcated into organic and conventional.

With respect to end use, the industry is divided into personal care and cosmetics, food and beverage processing, functional food and dietary supplements, fooservice, and retail.

Based on distribution channel, the industry is divided into direct sales and indirect sales.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 2.4 million in 2025.

The industry is projected to witness USD 3.9 million by 2035.

The industry is slated to grow at 5.0% CAGR during the study period.

Extra virgin avocado oil is widely used.

Leading companies include AVO F&C, Crofts Ltd., H&K Co., Ltd., Nobel Foods, Spectrum Organics Products, LLC, Bella Vado Inc., The Village Press, La Tourangelle, Inc., Proteco Gold Pty Ltd., Sesajal S.A. de C.V., Grupo Industrial Batellero, Grove Avocado Oil, Cibaria International, and Olivado USA.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Litres) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: North Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 26: North Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 27: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: North Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 29: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: North Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: North Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 35: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 36: South Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 37: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 38: South Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 39: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: South Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 41: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: South Jeolla Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 43: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Jeju Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 45: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 46: Jeju Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 47: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 48: Jeju Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 49: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Jeju Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 51: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 52: Jeju Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 56: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 58: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 59: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 62: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Volume (Litres) Analysis by Region, 2018 to 2033

Figure 9: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 16: Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 17: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 18: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 19: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 20: Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 21: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 22: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 23: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 24: Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 25: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 26: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 27: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 28: Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 29: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 30: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 31: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 32: Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 33: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 34: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 35: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 37: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 40: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 41: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 42: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 43: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 44: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 45: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 46: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 47: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 48: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 49: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 50: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 51: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 52: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 53: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 54: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 56: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 59: South Gyeongsang Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 60: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 61: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 62: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 63: South Gyeongsang Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 64: South Gyeongsang Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 65: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 66: South Gyeongsang Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 68: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 69: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 70: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 72: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 73: North Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 74: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 75: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 76: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 77: North Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 78: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 79: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 80: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 81: North Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 82: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 83: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 84: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: North Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 86: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 89: North Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 90: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 91: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 92: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 93: North Jeolla Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 94: North Jeolla Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 95: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 96: North Jeolla Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 97: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 99: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 100: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 101: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 102: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 103: South Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 104: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 105: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 106: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 107: South Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 108: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 109: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 110: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 111: South Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 112: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 113: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 114: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 115: South Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 116: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 119: South Jeolla Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 120: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 121: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 122: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 123: South Jeolla Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 124: South Jeolla Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 125: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 126: South Jeolla Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 127: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Jeju Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 129: Jeju Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 130: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 131: Jeju Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 132: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 133: Jeju Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 134: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 135: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 136: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 137: Jeju Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 138: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 139: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 140: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 141: Jeju Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 142: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 143: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 144: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 145: Jeju Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 146: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 147: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 148: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 149: Jeju Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 150: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 151: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 152: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 153: Jeju Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 154: Jeju Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 155: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 156: Jeju Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 157: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 158: Rest of Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 160: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 161: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 162: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 163: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 164: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 165: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 166: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 167: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 168: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 169: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 170: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 171: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 172: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 173: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 174: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 175: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 176: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 177: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 178: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 179: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 180: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 181: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 182: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 183: Rest of Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 184: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 185: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 186: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA