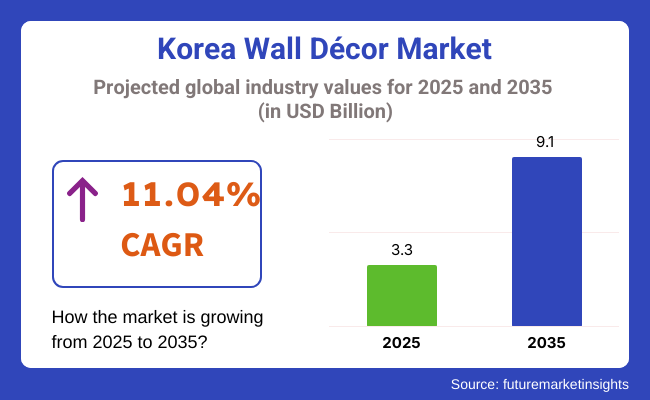

The Korea wall décor market is poised to register a valuation of USD 3.3 billion in 2025. The industry is slated to grow at 11.04% CAGR from 2025 to 2035, witnessing USD 9.1 billion by 2035. One of the main drivers of this market growth is the increasing trend of home renovation and interior decoration among South Korean consumers.

With rising disposable incomes and a growing interest in home beauty, more people are spending money on making their living spaces personalized and fashionable. The global interior design fashion, as well as the significant cultural significance of home décor in South Korea, has fueled demand for distinctive and creative wall décor solutions. Buyers are increasingly relying on wall art, decals, wallpapers, and other décor items as a means of expressing themselves, and therefore it is a leading category in the overall home décor market.

Another reason for the growth of the market is the development of urbanization and smaller living quarters in large cities such as Seoul. As living quarters grow smaller, there is an increased need for décor that maximizes space without sacrificing style.

Wall decor provides an ideal solution to this, as it can make an area look bigger and more vibrant without consuming precious floor space. Additionally, with more individuals working from home as a result of the flexibility initiated by remote work, many are investing in decorating their home workplaces, thus driving the demand for wall decor further.

Also, the use of e-commerce sites in South Korea has increased the accessibility of consumers to a vast array of wall décor products, both local and foreign designs. Online shopping has emerged as a convenient and accessible means for consumers to buy wall décor that fits their budget and style. With these driving forces, the Korean wall décor market is expected to continue its growth trend in the next few years.

The residential wall décor segment has witnessed a move towards personalization, with buyers increasingly opting for products that match their personal preferences. One trend in this segment is the trend towards minimalist designs, with buyers preferring understated and clean designs in neutral colors. Also, the increasing number of smaller living spaces as a result of urbanization has prompted the need for space-efficient wall décor solutions.

Peel-and-stick wall coverings, removable wall decals, and multi-purpose wall art are gaining popularity as they bring style without occupying space or necessitating permanent alterations. Environmentally friendly products are also becoming popular, as consumers are increasingly aware of sustainability, looking for products made from recycled materials or non-toxic paints.

Commercial environments such as offices, retail spaces, and public areas see wall décor now shifted towards the experience of the customer or employee as a whole. Large murals, branded graphics, and inspirational posters are increasingly being utilized by companies in keeping with their corporate culture.

There is also a trend towards wellness in the workplace, where companies are choosing soothing and nature-related wall decor to enhance productivity and make the workplace environment more pleasant. There is also the use of interactive wall decor like digital screens and projection mapping surfacing in upscale commercial venues, further improving the customer experience and interaction.

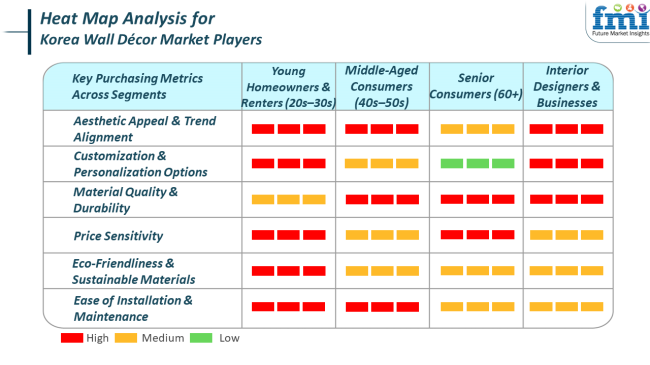

Although aesthetics are the prime driver across all segments, varying end-use markets prioritize durability, value for money, and customization based on their respective needs and priorities. As trends change, these buying parameters will also change based on consumer influence, technological developments, and environmental concerns.

Between 2020 and 2024, the wall decoration sector has seen tremendous changes, driven by various factors such as the COVID-19 pandemic, technological innovation, and changing tastes in consumers. Among the most significant changes during this time was the boom in home improvement activities. While numerous individuals spent most of their time at home following lockdowns and working from home setups, demand for home furnishings significantly increased, particularly those enabling the easy transformation of living spaces.

People looked for ways to personalize their homes, and demand surged for the sale of wall paintings, murals, and removable wall decals. Also, the demand for more flexible and mobile décor solutions grew, as peel-and-stick wallpapers and artwork rose to popularity because of their simplicity in installation and removal.

Looking ahead to the decade of 2025 to 2035, the wall decoration business is set to see more innovation and expansion fueled by changing consumer behavior, technological changes, and worldwide sustainability drives. Among the top trends likely to pick up in this space is the continuation of sustainability.

Customers will increasingly require more sustainable products, and companies will adapt by including sustainable materials like bamboo, recycled wood, and recycled plastics in their products. Also, non-toxic and biodegradable paints will be the norm for wall decor products, as customers increasingly look for health-oriented solutions.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| Period (2020 to 2024) | Period (2025 to 2035) |

|---|---|

| The COVID-19 crisis prompted a huge spike in home renovation, with customers staying indoors more, which translated into a high demand for wall decor products. Customers wanted to personalize and update their homes with hassle-free choices. | The future will witness greater focus on sustainable material and green production technologies as global concerns over the environment increase. Products with recycled content, eco-friendly paints, and energy-saving options will gain popularity. |

| Wall decor started using emerging technologies such as digital art screens and smart wall decor. Augmented reality, digital art, and interactive screens were introduced, enabling dynamic and customizable decor possibilities. | The use of wall decor integrated with smart home technology will be a dominant trend. Consumers will want products that integrate smoothly into their smart home environments, like wall-mounted digital screens controlled by smart devices and interactive wall decor. |

| There was an increase in the need for customized and personalized décor solutions, with increasing numbers of consumers choosing wall art that was representative of their individual tastes, like custom prints or family portraits. | Customization will continue with the development of digital printing and 3D wall art. Interactive and personalized designs will be extremely accessible, with consumers being able to create truly unique and personalized experiences for their environments. |

| As urbanization and compact spaces increased, removable decals and peel-and-stick wallpapers gained much popularity, as they were easily installed and could be changed, appealing to renters and those who need short-term solutions. | In the future, 3D wall art and interactive designs will gain more popularity, using advanced technology such as augmented reality and motion-sensitive features. This will allow for a more immersive and engaging customer experience. The convergence of wall décor and smart home technology will emerge as a major trend. |

The Korean wall decoration market holds both opportunities and challenges for investors and companies seeking to enter or expand in the sector. One of the key threats arises from shifting consumer trends, fueled by speedy lifestyle changes, minimalist fashions, and growing demands for customized and digital decoration solutions. Also, competition is mounting, with both local players and foreign brands competing to gain market share, which can squeeze margins and raise marketing and product innovation expenses.

Economic volatility should also be accounted for. South Korea's economy, though relatively stable, may be hit by fluctuations in consumer expenditure, inflation, or economic downturns, which can blunt discretionary spending such as home decor.

In addition, vulnerabilities within the supply chain, particularly in procuring raw materials or importing specialized items, may result in delays and costs-issues that became most apparent during worldwide disruptions such as the COVID-19 pandemic. Even regulatory risks are present, i.e., evolving import regulations, product safety regulations, and environmental regulatory requirements, which may affect production and sales.

There is also a subtle risk of cultural preferences in South Korea. The market prefers understated, clean designs with great affection for homegrown design themes. Non-local companies that do not adapt their offerings could find it difficult to gain share.

In addition, the ascendancy of e-commerce and social media as the principal sales and influence mechanisms puts additional pressure on having a robust digital presence, which could be capital-intensive. Lastly, intellectual property threats like copyright infringement and design copying are areas of concern, particularly for niche brands or creatives entering into the market place without strong protective legal frameworks.

In South Korea, wood is the most frequently employed base material in wall decoration rooted in the country's design aesthetics and cultural heritage. Such a choice is reflected in traditional architectural details as wooden pillars and sliding doors in hanok (traditional Korean homes) as well as contemporary interior design. The incorporation of wood provides coziness and an organic touch to interior spaces, following the principles of Korean minimalist style that concentrate on simplicity and unity with nature.

Furthermore, organic materials such as bamboo and rice paper are also common in Korean wall design. Bamboo is highly regarded for its eco-friendliness and visual beauty, being commonly integrated into different design components. Rice paper, used traditionally for writing and painting, is also used in wall coverings to provide lightness and refinement to rooms. These materials contribute not only to the aesthetic value of interiors but also to the cultural significance of natural materials in Korean design.

In South Korea, wall stickers are one of the most popular types of wall decor, representing a large portion of the market. They are popular because they are easy to use and versatile, making it possible for both homeowners and renters to customize their environments without damaging anything or making a permanent fixture.

This is particularly attractive in South Korea, where many residents occupy apartments that have standardized layouts. Wall stickers are simple to install and uninstall, so they are perfect for people who like to update their interior decor often or stay on top of seasonal design trends.

The other reason why wall stickers are used so commonly is that there are so many different designs available. From contemporary minimalist designs to fun or nature-based themes, the products suit many tastes.

This flexibility enables individuals to utilize personal creativity while compromising with trendy Korean interior design trends, which tend to focus on minimalism, balance, and tidy visual aspects. Wall stickers are also inexpensive, so they can reach a wide range of the population, such as students and young professionals who have limited financial resources for home decor.

The Korea wall décor market is dominated by a complex mix of local imagination and global inflow. The market has expanded massively as a result of growing urbanization, rising disposable incomes, and a changing cultural focus on unique and fashionable homes. Global design houses and local art-startups are molding consumer taste by providing a vast range of aesthetic options-ranging from classic motifs to modern, simple styles that trend with Korea's architectural and lifestyle preferences.

Global brands like Paragon Décor Inc., PTM Images, and Artissimo Designs feed the market with mass production, wide product varieties, and trendy collections. They provide Korea's needs for affordable but visually engaging interior accents. Conversely, Print Bakery and sustainable brands like Scandiamoss Inc. offer culturally relevant and environmentally friendly products, providing a competitive advantage with custom art prints and biophilic design concepts.

Key Company Share Analysis (Indicative Estimates)

| Company Name | Estimated Industry Share (%) |

|---|---|

| Print Bakery | 10-14% (local market leader) |

| Paragon Décor Inc. | 8-12% |

| PTM Images | 6-10% |

| Artissimo Designs | 5-8% |

| Lumas Gallery | 4-6% |

| Scandiamoss Inc. | 3-5% |

| Stratton Home Décor | 3-5% |

| Surya Inc. | 2-4% |

| Northern Oaks Décor Co | 2-4% |

| Green Front Furniture | 1-3% |

| Neiman Marcus | 1-3% |

| Company Name | Key Offerings & Activities |

|---|---|

| Lumas Gallery | Sells limited-edition photograph artworks and prints, targeting art collectors and modern home interior decorators looking for authentic, gallery-grade pieces. |

| Print Bakery | Korea's major art platform featuring collaborations with Korean artists to make affordable art prints, posters, and wall decoration, advocating for Korean cultural art aesthetics. |

| Northern Oaks Décor Co | Exports rustic and natural-themed wall decors, predominantly utilizing reclaimed woods and natural coatings that resonate with Korean green living design trends. |

| Stratton Home Décor | Offers a range of affordable home decor items such as metal wall sculptures, framed art, and mirrors, appealing to mass-market modern tastes. |

| Scandiamoss Inc. | Recognized for its distinctive preserved moss wall art, providing eco-friendly and sound-absorbing décor solutions for interiors with a Scandinavian-inspired look. |

| Paragon Décor Inc. | Designs and produces seasonal and trend-based wall décor products such as framed art, mirrors, and accessories, appealing to mid- to high-end interior markets. |

| PTM Images | Provides large canvas artwork, framed art prints, and photographic wall decor, addressing both retail chain and hospitality industry customers in search of volume and variety. |

| Artissimo Designs | Designs three-dimensional wall decor such as 3D flush mounts, metal art, and canvas décor with a focus on modern, bold designs. |

| Green Front Furniture | Provides combinations of classic and modern wall decor such as statement mirrors and pieces of art that are commonly used in complete interior furnishing solutions. |

| Surya Inc. | Offers a broad selection of home accents including wall art, mirrors, and textiles, with an emphasis on trend prediction and coordinated design collections. |

| Neiman Marcus | Offers carefully selected luxury wall decor, such as designer mirrors, framed art, and customized accent pieces, to Korea's top-end residential and retail customers. |

The market for Korea wall décor is to grow steadily on the back of growing consumer enthusiasm for interior décor, design inspirations fuelled by social media, and access to premium and affordable décor alike. Global companies continue to command strong bases on the back of their rich product portfolios and production capacities, as well as launching seasonal ranges and interior coordination offerings. Nevertheless, domestic players like Print Bakery are tapping into Korean cultural motifs and sentimentality, focusing on art as a way of life and a communal experience.

Personalization and sustainability are increasingly emerging as differentiators. Brands such as Scandiamoss Inc. are gaining popularity among environmentally conscious buyers by delivering biophilic and sustainable wall art solutions. At the same time, digital channels and direct-to-consumer models are aiding global as well as regional brands to better comprehend Korean purchasing behavior and trend changes.

In terms of base material, the industry is classified into fabric & textile, glass, metal, plastic, wood, and others.

With respect to end use, the industry is divided into educational institutes, hospitality industry, households, offices and showrooms, restaurants, salons and spas, spiritual institutes, and other end users.

Based on product type, the market is classified into frame works, hangings, metal works, mirror works, shelves, wall stickers, and other product types.

With respect to sales channel, the industry is divided into club stores, e-retailers, gift shoppe, hypermarket/supermarket, specialty store, and unorganized.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 3.3 billion in 2025.

The industry is projected to witness USD 9.1 billion by 2035.

The industry is slated to grow at 11.04% CAGR during the study period.

Wall stickers are majorly sold.

Leading companies include Lumas Gallery, Print Bakery, Northern Oaks Décor Co, Stratton Home Décor, Scandiamoss Inc., Paragon Décor Inc., PTM Images, Artissimo Designs, Green Front Furniture, Surya Inc., and Neiman Marcus.

Table 1: Industry Analysis and Outlook Value (US$ Mn) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Mn) Forecast by Base Material, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Mn) Forecast by End Use, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Mn) Forecast by Product Type, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Mn) Forecast by Sales Channel, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Forecast by Base Material, 2018 to 2033

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Forecast by End Use, 2018 to 2033

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Forecast by Product Type, 2018 to 2033

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Forecast by Sales Channel, 2018 to 2033

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by Base Material, 2018 to 2033

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by End Use, 2018 to 2033

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by Product Type, 2018 to 2033

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by Sales Channel, 2018 to 2033

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by Base Material, 2018 to 2033

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by End Use, 2018 to 2033

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by Product Type, 2018 to 2033

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Forecast by Sales Channel, 2018 to 2033

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 35: Jeju Industry Analysis and Outlook Value (US$ Mn) Forecast by Base Material, 2018 to 2033

Table 36: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 37: Jeju Industry Analysis and Outlook Value (US$ Mn) Forecast by End Use, 2018 to 2033

Table 38: Jeju Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Jeju Industry Analysis and Outlook Value (US$ Mn) Forecast by Product Type, 2018 to 2033

Table 40: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Jeju Industry Analysis and Outlook Value (US$ Mn) Forecast by Sales Channel, 2018 to 2033

Table 42: Jeju Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 43: Rest of Industry Analysis and Outlook Value (US$ Mn) Forecast by Base Material, 2018 to 2033

Table 44: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 45: Rest of Industry Analysis and Outlook Value (US$ Mn) Forecast by End Use, 2018 to 2033

Table 46: Rest of Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 47: Rest of Industry Analysis and Outlook Value (US$ Mn) Forecast by Product Type, 2018 to 2033

Table 48: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 49: Rest of Industry Analysis and Outlook Value (US$ Mn) Forecast by Sales Channel, 2018 to 2033

Table 50: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Mn) by Base Material, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Mn) by End Use, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Mn) by Product Type, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Mn) by Region, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Mn) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Mn) Analysis by Base Material, 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Mn) Analysis by End Use, 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Mn) Analysis by Product Type, 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) by Base Material, 2023 to 2033

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) by End Use, 2023 to 2033

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) by Product Type, 2023 to 2033

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Analysis by Base Material, 2018 to 2033

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Analysis by End Use, 2018 to 2033

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Analysis by Product Type, 2018 to 2033

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Mn) by Base Material, 2023 to 2033

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Mn) by End Use, 2023 to 2033

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Mn) by Product Type, 2023 to 2033

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by Base Material, 2018 to 2033

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by End Use, 2018 to 2033

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by Product Type, 2018 to 2033

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Mn) by Base Material, 2023 to 2033

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Mn) by End Use, 2023 to 2033

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Mn) by Product Type, 2023 to 2033

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by Base Material, 2018 to 2033

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by End Use, 2018 to 2033

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by Product Type, 2018 to 2033

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Mn) by Base Material, 2023 to 2033

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Mn) by End Use, 2023 to 2033

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Mn) by Product Type, 2023 to 2033

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Mn) Analysis by Base Material, 2018 to 2033

Figure 108: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Mn) Analysis by End Use, 2018 to 2033

Figure 112: Jeju Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Mn) Analysis by Product Type, 2018 to 2033

Figure 116: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 120: Jeju Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Mn) by Base Material, 2023 to 2033

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Mn) by End Use, 2023 to 2033

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Mn) by Product Type, 2023 to 2033

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Mn) Analysis by Base Material, 2018 to 2033

Figure 132: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Mn) Analysis by End Use, 2018 to 2033

Figure 136: Rest of Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Mn) Analysis by Product Type, 2018 to 2033

Figure 140: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 144: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wall Mounted Manifolds Market Size and Share Forecast Outlook 2025 to 2035

Wall Covering Product Market Forecast and Outlook 2025 to 2035

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Wallets & Little Cases Market Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Wall Art Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA