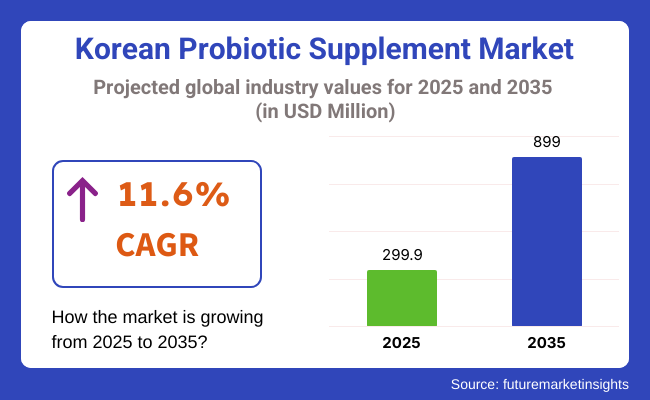

In 2025, the probiotic supplement market in Korea is anticipated to be valued at USD 299.9 million, and it is expected to grow at an 11.6% CAGR from 2025 to 2035. The probiotic supplement industry in Korea is likely to reach USD 899 million by 2035. Rising health awareness and the well-embedded culture of functional nutrition in the country have fueled growth.

With its cultural base and influence, South Korea is setting the health-and-beauty trend, thus providing the necessary breeding ground for probiotic supplement acceptance. Consumers increasingly want products that support digestion, immunity, and skin health, a trend closely linked to the general "K-wellness" movement that emphasizes balance, longevity, and holistic vitality. The rising enthusiast interest in microbiome research and the gut-skin connection has further extended demand across various demographic gaps.

Advanced biotechnology is being used in Korea to produce probiotic and strain-specific products for irritable bowel symptoms, fatigue, and even mood regulation. There is a trend toward customization, where advanced formulations are among the most desired offerings in store for the tech-savvy, health-conscious consumer.

The ever-growing trend of retail expansion through pharmacy chains, health and wellness outlets, and digital platforms has contributed to making them more accessible. Online channels influence product differentiation prominently through influencer-led content and consumer education initiatives that stress clinical proof and functional benefits.

Regulation and strategic collaborations with research institutes and health professionals will enable the South Korean probiotic supplement industry to maintain growth. Multifunctional products that touch beauty, cognition, and preventive medicine are going to be the key to sustaining competitiveness and creative offerings in an ever-changing industry.

Probiotic supplements in Korea will be dominated by capsules with a 26.2% industry share, followed by gummies/chewables with 21.5% in 2025.

Being easy to use and carry, allowing for precise dosage, and having a long shelf-life seem to be the reasons for the popularity of capsules among health-conscious consumers. In fact, when consumed regularly, it is very convenient and has multiple benefits, such as improving digestion and boosting immunity.

Some of the big names in this space are CJ CheilJedang's "Celltrion" probiotic capsules and Chong Kun Dang Bio's capsules with Lactobacillus GG. Both of these companies focus on formulations that utilize clinically documented high-potency probiotic strains and target adults looking for effective modes of delivery for gut health and immunity.

Gummy and chewable formulations accounted for 21.5% of the industry and have so much room to grow. Rising preference for gummy/chewable forms has been attributed to flavor appeal, ease of use, and the combination of probiotics, tasty flavor, and provision of benefits.

Popular brands such as Pulmuone "Feelgood" probiotics gummies are just among the few that come up with gummy-style probiotics. At the same time, Maeil Dairies introduces "Yogurt Probiotic Chewables," encapsulating Lactobacillus and Streptococcus strains with flavor enhancers like blueberry and strawberry. They target convenience and fun rather than providing entertaining yet useful ways of improving gut well-being.

Young generations and busy professionals increasingly prefer them. The Pro Bite line is gummy probiotics from Korea's leading health company, Amore pacific, aimed not only at children but also at adults who find the traditional capsules cumbersome. These gummy probiotics have carved a niche for themselves as an engaging and flexible option for people of all ages.

In 2025, capsulated forms will be dominant in the Korean probiotics supplementation industry, with a 26.2% industry share, followed by gummies or chewables, with 21.5%.

Capsules remain the most used form as they appeal to the convenience of use, exact dosage, shelf life, and so on, therefore making probiotic consumption a simple, trusted option. Similar to adults, most of the products seek only a specific requirement directed toward digestive health and immunity.

CJ Cheil Jedang is also known for its "high-potency-line" associated with the "Celltrion" probiotic capsules, followed by Chong Kun Dang Bio, which also provides the Lactobacillus GG formulation to the industry. These brands prove the scientific basis for their efficacy and accurately point out the way probiotics are integrated into everyday health routines.

Chewable and gummy products show strong momentum and will represent some 21.5% of the industry in 2025. Their popularity is largely due to sweetness, easy handling, and convenience, particularly for young adults and children.

The products offer the benefits of Lactobacilli and Streptococci in a tasty, fun format, such as Pulmuone's ''Feelgood'' probiotic gummies and Maeil Dairies' ''Yogurt Probiotic Chewables.'' These products are being marketed increasingly to busy professionals and families looking for a convenient and enjoyable way to support gut health. With flavors like strawberry and blueberry, they have found an expanding loyal industry across a wide demographic.

Probiotic supplements, which are involved in preventive health management, are in high demand in South Korea. The usage of probiotics is emerging on the beauty horizon among the active urban youth in lives where probiotics are not only for gut health but to support beauty, relieve stress, and enhance immunity. It is increasingly enabled by smart digital health technologies in the wearable field, recommending probiotics according to a person's lifestyle. It identifies specific needs and makes individual formulations complementary to the personalizing aspect of this trend.

South Koreans are well-informed and intelligent consumers and attach great importance to scientific credibility, localized product development, and clean labeling, among the top criteria, including residue ingredient sources and clinical proof of effectiveness, in influencing brand loyalty and repurchase decisions.

From 2020 to 2024, the industry experienced huge growth because of growing consumer demand for digestive health, immunity, and overall wellness. There was a major movement towards younger consumers, particularly millennials and Gen Z, who took probiotic supplements not just for digestive well-being but also for skin health and immune system wellness.

The product diversified with capsules, powders, and beverages, which are very accepted because they meet tastes and lifestyle needs. The platform medium increased enormously for probiotic selling, and users wanted to purchase in online form due to convenience and ease.

With the path towards 2025 to 2035, the trend will shift in favor of more functional probiotics. These specific supplements will cater to personal health requirements, including weight control, brain activity, and mental well-being. Increasing demand for gummies and other convenient delivery forms of supplements will propel innovation, with tailor-made probiotic products being increasingly utilized. Regulatory systems will also continue to fuel growth, with the safety and performance of the product assured while being in line with the increasing focus on clean-label, sustainable products.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Younger generations, primarily millennials and Gen Z, are looking for immunity and GI health | Larger consumer base, such as the elderly, looking for specific health outcomes (e.g., cognitive function, weight maintenance) |

| Capsules, powders, and drinks were trending. | Increased demand for probiotics being utilized in gummies and foods for functio purposesn |

| Wellness, immunity, and gut health | Functional probiotics addressing specific diseases |

| E-commerce and health food store growth | Increased presence in the mass industry channel retail, as pharmacies too increased in stature |

| Government backing for health and wellness products | Further regulation with a focus on product openness and sustainability |

The industry is rapidly growing; nevertheless, it is facing an inherent danger of saturation. An influx of domestic and foreign players has led to fierce competition, with many products making similar health claims. If no clear differentiation can be made or a scientific basis cannot be provided, the brands themselves may find it difficult to hold consumer interest.

Another challenge is regulatory ambiguity. While functional foods are fairly well regulated in South Korea, inconsistent enforcement and fluctuating criteria for product classification can engender uncertainty around product claims and advertising, impacting brand compliance and consumer trust.

The strain viability and shelf-life are operational threats. Since live probiotic cultures are extremely sensitive to environmental conditions, ensuring their efficacy right up to the point of distribution remains a logistical priority. If the potency is not maintained right at the end-consumption point, it would provoke distrust in the brand and limit repeat purchases in this discerning industry.

The industry is growing robustly and durably with the combined influence of cultural eating habits, increasing consumer health consciousness and a mature functional food sector. Probiotics are well-known and embraced in South Korean culture, not only because of the long history of fermented foods intake like kimchi, doenjang, and makgeolli. This cultural comfort has set a strong precedent for probiotic supplement incorporation into everyday health regimens, particularly as consumers look for convenient, science-based solutions to support digestive and immune health.

The South Korean industry is characterized by high consumer literacy around health and wellness, which is evident in the demand for specific and personalized probiotic products. Probiotic supplements formulated for healthy outcomes are now being supplied by manufacturers, such as skin care, women's health, metabolic support, mental wellness and recovery from post-antibiotics. Technological advancements in strain generation and encapsulation technologies are also taking center stage, with emphasis on guaranteeing stability, targeted delivery and synergy between multiple strains.

Mobile shopping platforms and digital retail have increased the visibility, accessibility, and use of probiotic supplements among younger groups. Influencer marketing campaigns and online health forums are driving brand choice and regular use.

Moreover, the clear regulatory channels set out by the South Korean government for healthy functional foods, including probiotics, have helped ensure consumer confidence and product quality. As South Korea's population ages, disposable income rises, and the country's domestic healthcare industry becomes extremely competitive, its probiotic supplement industry is primed to keep its momentum going as an industry leader in the overall health and wellness sector.

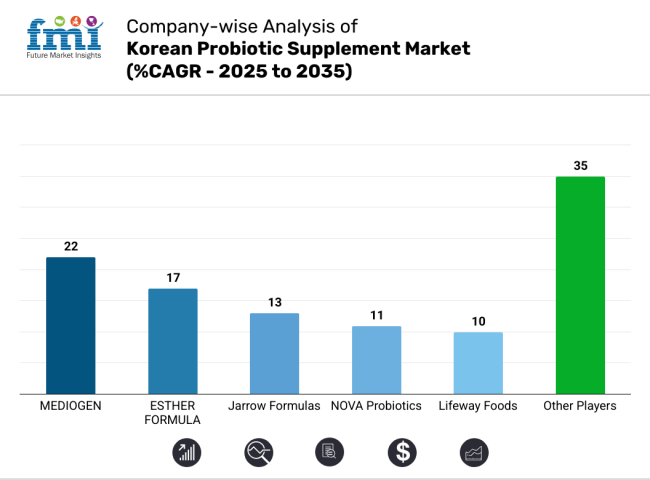

The Korean probiotic supplement industry is witnessing dynamic expansion, with a surge in demand for targeted, clinically backed formulations. MEDIOGEN has emerged as a key player, leveraging its extensive research partnerships and product customization capabilities to capture significant traction. ESTHER FORMULA has continued to innovate with advanced delivery systems that improve probiotic survival rates, solidifying its premium positioning in the Korean wellness sector.

Jarrow Formulas, with its strong global reputation, has increased its Korea-focused product lines, adapting formulations to local dietary needs and regulatory standards. Similarly, NOVA Probiotics has expanded its footprint by emphasizing hypoallergenic and vegan probiotic ranges, appealing to Korea’s rapidly growing health-conscious demographic.

Lifeway Foods continues to strengthen its position by promoting kefir-based probiotics through strategic partnerships with local distributors. Notably, Natural Factors and Pharma Care Laboratories have prioritized evidence-based claims, ensuring higher trust among Korean consumers seeking transparent labeling and proven benefits.

Meanwhile, companies such as Church & Dwight and Total Nutrition are focusing on online and D2C (direct-to-consumer) channels to capture Korea’s digitally savvy consumer base. The landscape is becoming increasingly competitive, with innovation, regulatory compliance, and localized strategies emerging as key differentiators. Companies investing in clinical substantiation and premium product positioning are poised to outperform in the evolving Korean probiotic supplement industry.

Market Share Analysis by Company

Key Success Factors Driving the Probiotic Supplement Industry in Korea

The Korean probiotic supplement industry is led by MEDIOGEN, which holds an estimated industry share of 18-22%. This has become the product of the company's R&D competence in conjunction with the universities involved in the next-generation strain developments. It further emerges as a player in Korea's relatively sophisticated health and wellness segment by specializing in customized formulations for digestive health and immunity enhancement.

The ESTHER FORMULA claims an approximate industry share of about 14-17% based on its reputation for pharmaceutical-grade supplements and early adoption of acid-resistant capsule technologies for maximum probiotic viability.

Jarrow Formulas made its mark with about 10-13% of the industry share due to Korea-specific modifications to the global bestsellers and the collaboration with local health retailers. NOVA Probiotics has roughly 8-11%, relying on its specialization with allergen-free and vegan probiotics that have a huge appeal with the growing plant-based consumer base of Korea.

On the other hand, Lifeway Foods holds 7-10% of the Korean industry by marketing its kefir-centered probiotic nutrition with the help of educational campaigns and greater availability in retail places. In Korea's increasingly sophisticated probiotic marketplace, brand trust, clinical backing, and cultural relevance have become the competitive edge for defining a large fraction of the players involved.

By bacteria, the industry is segmented into lactobacillus, streptococcus, and bifid bacterium.

By form, the industry is categorized into tablet, capsules, liquid, powder premixes, gummies/chewable, lozenges, and liquid & gels.

By function, the industry is divided into immunity & digestive health, urogenital health, vaginal health, urinary tract infections, pregnancy, and weight management.

By distribution channel, the industry is segmented into hypermarket/supermarket, specialty stores, e-commerce, and pharmacy stores.

By end user, the industry is categorized into women, seniors, and kids.

By province, the industry spans South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 299.9 million in 2025.

The industry is projected to grow to USD 899 million by 2035.

The industry is expected to grow at a CAGR of approximately 11.6% during the forecast period.

Capsules represent a key segment in the industry.

Key players include MEDIOGEN, ESTHER FORMULA, Jarrow Formulas, NOVA Probiotics, Lifeway Foods, Natural Factors, PharmaCare Laboratories, Total Nutrition, Church & Dwight, and Goerlich Pharma.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 24: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 27: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 28: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 29: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 34: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 35: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 37: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 38: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 39: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 43: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 44: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 45: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 47: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 48: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 49: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 51: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 52: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Bacteria, 2018 to 2033

Table 54: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Bacteria, 2018 to 2033

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Function, 2018 to 2033

Table 58: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Function, 2018 to 2033

Table 59: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Distribution Channel, 2018 to 2033

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 62: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End User, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 9: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 12: Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 16: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 17: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 19: Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 20: Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 21: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 22: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 23: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 25: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 26: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 27: Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 28: Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 29: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 30: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 31: Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 32: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 33: Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 34: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 35: Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 37: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 38: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 40: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 41: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 42: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 43: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 44: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 45: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 46: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 47: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 48: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 49: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 50: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 51: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 52: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 53: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 54: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 56: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 57: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 58: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 59: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 60: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 61: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 62: South Gyeongsang Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 63: South Gyeongsang Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 64: South Gyeongsang Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 65: South Gyeongsang Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 66: South Gyeongsang Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 68: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 69: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 70: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 72: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 73: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 74: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 75: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 76: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 77: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 78: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 79: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 80: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 81: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 82: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 83: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 84: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 86: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 89: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 90: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 91: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 92: North Jeolla Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 93: North Jeolla Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 94: North Jeolla Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 95: North Jeolla Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: North Jeolla Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 97: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 98: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 99: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 100: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 101: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 102: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 103: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 104: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 105: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 106: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 107: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 108: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 109: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 110: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 111: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 112: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 113: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 114: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 116: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 117: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 118: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 120: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 121: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 122: South Jeolla Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 123: South Jeolla Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 124: South Jeolla Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 125: South Jeolla Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 126: South Jeolla Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 127: Jeju Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 128: Jeju Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 129: Jeju Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 130: Jeju Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 131: Jeju Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 132: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 133: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 134: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 135: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 136: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 137: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 138: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 139: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 140: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 141: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 142: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 143: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 144: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 145: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 146: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 147: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 148: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 149: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 150: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 151: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 152: Jeju Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 153: Jeju Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 154: Jeju Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 155: Jeju Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 156: Jeju Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 157: Rest of Industry Analysis and Outlook Value (US$ Million) by Bacteria, 2023 to 2033

Figure 158: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) by Function, 2023 to 2033

Figure 160: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 161: Rest of Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 162: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Bacteria, 2018 to 2033

Figure 163: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Bacteria, 2018 to 2033

Figure 164: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Bacteria, 2023 to 2033

Figure 165: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Bacteria, 2023 to 2033

Figure 166: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 167: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 168: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 169: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 170: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 171: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Function, 2018 to 2033

Figure 172: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 173: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 174: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 175: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Distribution Channel, 2018 to 2033

Figure 176: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 177: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 178: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 179: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End User, 2018 to 2033

Figure 180: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 181: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 182: Rest of Industry Analysis and Outlook Attractiveness by Bacteria, 2023 to 2033

Figure 183: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 184: Rest of Industry Analysis and Outlook Attractiveness by Function, 2023 to 2033

Figure 185: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 186: Rest of Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Korea Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Korea Anti-wrinkle Product Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA