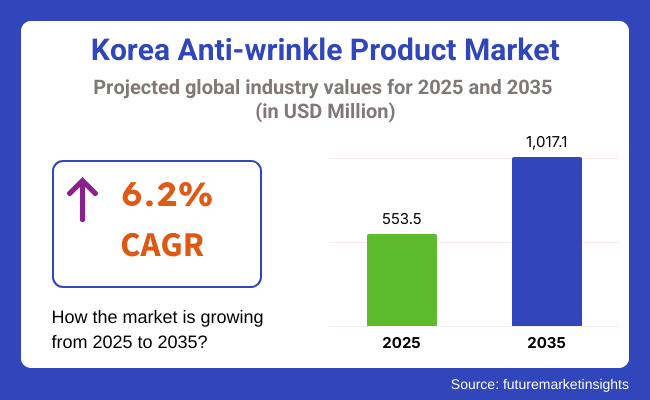

The Korea anti-wrinkle product market is poised to register a valuation of USD 553.5 million in 2025. The industry is slated to grow at 6.2% CAGR from 2025 to 2035, witnessing USD 1,017.1 million by 2035. The expansion of the market is primarily driven by the nation's well-established beauty culture, fast-aging population, and high consumer demand for preventive skincare.

South Korea has historically been a leader in skincare innovation and adoption, with consumers valuing highly maintaining a youthful and healthy look. Consequently, anti-aging and anti-wrinkle products specifically are not just aimed at aging populations but also more and more used by youth in their 20s and 30s as part of preventive skincare routines.

This reflects an increasing awareness that prevention is better than cure, and concurs with Korea's wider cultural focus on smooth skin and extended care. Additionally, South Korea has one of the world's fastest-aging populations. With over 20% of its population expected to be 65 years or older by the early 2030s, consumer demand for products that treat visible aging-such as fine lines, wrinkles, and loose skin-is likely to grow exponentially.

This population change fuels a large target market for anti-wrinkle creams, serums, and treatments. Furthermore, increasing income levels and awareness of health and wellness are driving customers to spend more on high-performance, science-formulated skincare products that deliver visible benefits.

Technological advancements are also vital to the growth of the market. South Korean consumers are extremely open to cutting-edge formulations that feature peptides, retinol, hyaluronic acid, and other proven actives.

Combined with the desire for multi-step skin care routines, products providing both anti-wrinkle and moisturizing, firming, or brightening functionality are in high demand. Finally, the power of media, K-pop, and online beauty influencers remains strong to compel women and men alike to pursue advanced anti-wrinkle products as a key component of their skin care routine.

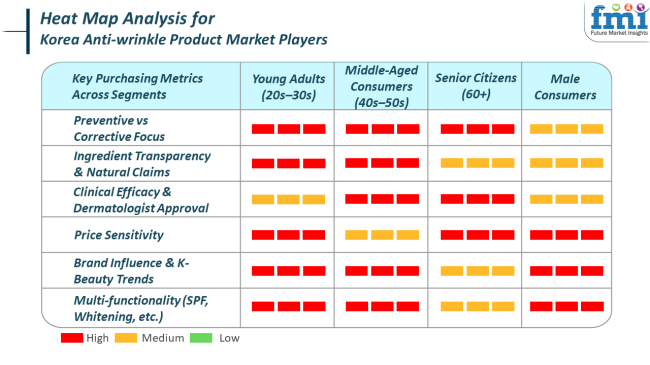

In South Korea, the market for anti-wrinkle products is influenced by unique trends in various end-use segments such as household consumers, dermatology and aesthetic clinics, and beauty salons. Among individual consumers, especially in urban regions, there is an increasing focus on preventive skincare, with individuals beginning their anti-aging regimen in their early to mid-20s.

Consumers value multi-functional products that offer wrinkle care along with benefits such as hydration, brightening, and UV protection. The power of social media reviews, social influencers, and perceivable outcomes are important drivers in buying behavior, with a liking for products with tried-and-tested active ingredients like peptides, retinol, and niacinamide.

Furthermore, the popularity of gender-neutral skincare and the growing number of male consumers demonstrate a change in social norms towards grooming and self-grooming. In the professional arena, dermatology clinics and beauty salons provide more focused needs, recommending medical-grade anti-wrinkle products for application in treatments.

Clinics concentrate on the scientific effectiveness and safety of the products, with regard to compatibility with other treatments such as injectables or lasers. Beauty salons also focus on products with instantaneous, visible results for after-treatment care, providing wrinkle-smoothing and firming properties to accompany in-salon treatments.

For both business segments, brand image, product effectiveness, and safety are important in deciding on purchases. Generally, for all end-use segments, the primary drivers of purchase decisions are product effectiveness, transparency of ingredients, and trust in brands, which are critical in fulfilling South Korea's beauty and health-oriented consumer expectations.

Between 2020 and 2024, the Korean anti-wrinkle market experienced dramatic changes primarily influenced by changing consumer behavior and advances in skincare technology. Preventive skincare emerged as a top trend, with young consumers initiating early anti-aging regimens, prioritizing long-term skin health over correction.

This transformation came alongside increased clean beauty, with consumers becoming increasingly concerned about clean and open labeling as well as environmentally friendly packaging. The proliferation of e-retailing and influencer marketing also intensified, as consumers made full use of the digital sphere to look for and research products and write reviews about them.

Further, there was increasing demand for products with multi-tasking features, combining wrinkle repair, moisturization, brightening, and sun protection. Over the next few years, stretching until 2025 to 2035, Korea's market for anti-wrinkle products is projected to develop further based on a range of significant trends.

First, tech integration will come into play on a more sophisticated level, where intelligent skincare technology and AI-assisted personalized offerings become more dominant. Consumers are going to opt for the products that promise personalized wrinkle care according to their individualized skin conditions, with companies capitalizing on data and artificial intelligence to develop personal skincare experiences.

Sustainability will see a further peak, with eco-friendly ingredients, packaging, and cruelty-free tests becoming more relevant. Additionally, the market will foresee increased diversification, as skincare for men grows into an ever-more emphasized sector as more and more men begin to pursue anti-aging measures.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| Period (2020 to 2024) | Period (2025 to 2035) |

|---|---|

| During this time, consumers, particularly younger consumers, were concentrated on preventive procedures. Skincare regimens were initiated earlier, with those in their 20s and 30s taking anti-wrinkle products as a proactive step, keeping an eye on long-term skin well-being. | During 2025 to 2035, the trend will be to more customized skincare. AI technology and intelligent devices will offer individualized anti-aging solutions, enabling consumers to get personalized suggestions based on their individual skin types and requirements, maximizing efficacy. |

| There was a major shift towards clean beauty, with consumers opting more for products with clear, natural ingredients and green packaging. This was inspired by the increase in concern over sustainability and chemical-free product formulation. | The movement towards sustainable packaging and sourcing will continue to grow. Brands will concentrate on minimizing their environment footprint, from biodegradable packaging to cruelty-free testing. Consumers will insist on transparency and more of a sustainable industry. |

| At this time, social media influencer and review influences on the purchase decision multiplied many times over. Consumers more and more leaned on digital as the means through which they discover, assess, and buy anti-wrinkle products. | Digital will remain core but the future will involve mixing in augmented reality (AR) and virtual try-ons within online shopping, with customers being able to view the effect of a product on their skin in real-time before making a purchase. This will further improve the online buying experience for anti-wrinkle products. |

| There was a significant need for multi-tasking skincare products that would blend anti-wrinkle features with other functionalities such as hydration, brightening, and UV protection. All-in-one products were sought after by consumers as a means to save time and streamline their skincare routines. | In 2025 to 2035, anti-wrinkle products will probably turn into products offering both preventive and corrective benefits. Products that combine active ingredients to offer long-term repair, prevention, and restoration will be prevalent, enabling consumers to see tangible results without requiring invasive treatments. |

The Korea anti-wrinkle product market is subject to a number of risks that may affect its growth path. The key risk is market saturation. Since the wrinkle care and anti-aging category gains popularity, especially among younger generations, the market is expected to face saturation from similar products, and it may result in cutthroat price competition and challenge for new or upcoming brands to establish themselves.

This would ultimately lower profitability for manufacturers and pose difficulties for brands that cannot differentiate themselves in an overcrowded marketplace. Furthermore, as more brands become available, consumer loyalty may be more difficult to secure, and price sensitivity could increase, putting further pressure on margins.

A further major risk is regulatory and safety issues. South Korea has very strict laws when it comes to cosmetics, and modifications to these regulations may affect the formulation, marketing, and sales of anti-wrinkle products.

Products with some active ingredients might become more scrutinized, particularly as consumers become increasingly health-conscious and look for products that meet their growing need for transparency and safety.

Creams and moisturizers are the best-selling anti-wrinkle products in Korea, as a result of their efficacy and convenience in integrating into every-day skincare routines. Korean consumers follow multi-step skincare regimens, and anti-wrinkle creams and moisturizers are an easy fit within these skincare routines.

These products are preferred for their capacity to dispense concentrated active ingredients, including peptides, retinol, and hyaluronic acid, that work directly on wrinkles and skin aging. The usage of moisturizing products is also encouraged by the harsh climate of the country, especially during cold winters. Thus, products that offer both hydration and anti-aging benefits are greatly preferred.

Cleansers are also a significant part of the market, but they are likely to be a more ancillary part of anti-wrinkle skincare routines. Cleansers made with anti-aging products clean the skin so that it's ready for the other anti-wrinkle solutions to be applied and absorbed efficiently.

Cleansers are not normally the main product used for achieving anti-wrinkle effects but are considered additional products to go alongside the core solution for preventing fine lines and wrinkles. Finally, although other products such as serums and masks are widely used, they are more specific in their targeting or are secondary to creams and moisturizers rather than being individual anti-aging treatments.

In Korea, e-retailers have become the major sales channel for anti-wrinkle products, primarily because of growing trust in online platforms for shopping and the convenience provided by them. Online shopping has increased dramatically, particularly with the emergence of local shopping giants like Coupang, Gmarket, and 11st, as well as international giants like Amazon and eBay.

South Korean consumers are highly technology-driven and prefer the ease of buying skincare products online, where they can conveniently compare prices, read reviews, and get easy access to a vast number of products from both domestic and global brands.

The direct-to-consumer sales from brands through their official websites also add to the development of e-retail, as it enables brands to have control over their marketing, offer exclusive offers, and communicate directly with customers. The popularity of social media influencers and beauty YouTubers in Korea has also further driven online sales, as more consumers seek these digital media for product recommendations and skin routines.

Online shopping not only offers greater accessibility to a vast range of anti-wrinkle products but also enables individualized shopping experiences through browsing behavior-based targeted ads and promotions, making online a preferred channel for skincare brands to engage their audience.

The Korean anti-wrinkle product market is held by the combination of local and international brands, each adding their own special capabilities to the increasing demand for high-quality, effective skincare products. The major international players L'Oréal S.A., Coty, Inc., and Kao Corporation introduce extensive research and development expertise, worldwide distribution channels, and high-end formulations into the market.

These brands typically launch new anti-wrinkle products that strike the high expectations of Korean consumers as well as the nation's quest for state-of-the-art skincare technologies. Their emphasis on next-generation anti-aging ingredients like peptides, hyaluronic acid, and retinol, in addition to aggressive advertising tactics, has made them well-established players in the anti-wrinkle product market.

Key Company Share Analysis

| Company Name | Estimated Industry Share (%) |

|---|---|

| L'Oréal S.A. | 10-15% |

| Coty, Inc. | 7-10% |

| Kao Corporation | 6-8% |

| Nature Republic | 5-7% |

| COSMAX INC. | 4-6% |

| Kolmar Korea | 4-6% |

| Clarins Group | 3-5% |

| KBL Cosmetics | 3-5% |

| Cosmecca Korea, Co. Ltd. | 3-5% |

| Black Bird Skincare | 2-4% |

| Lotus Herbals Limited | 2-4% |

| Clarins Group | 2-4% |

| Company Name | Key Offerings & Activities |

|---|---|

| L'Oréal S.A. | Has a comprehensive product line of anti-aging treatments, from prestige, targeted anti-wrinkle creams to specialty serums. |

| Coty, Inc. | Operates a core portfolio of anti-aging premium beauty products designed to reduce signs of fine lines and wrinkles. |

| Kao Corporation | Renowned for its anti-aging care line, Kao combines technology and natural components with the purpose to combat aging marks. |

| Nature Republic | Offers mass, natural-finished anti-wrinkle solutions with traditional Korean materials such as ginseng. |

| COSMAX INC. | Is concentrating on innovative formulae with the combination of scientific and natural ingredients suited to the Korean consumer. |

| Kolmar Korea | Experts at crafting customized anti-ag ing solutions utilizing local ingredients while emphasizing efficacy and quality. |

| Clarins Group | Famous for its high-quality skincare brands, Clarins markets anti-wrinkle products concentrated on rejuvenation and elasticity. |

| KBL Cosmetics | The popular local brand providing affordable but effective anti-wrinkle remedies. |

| Cosmecca Korea, Co. Ltd. | Creates anti-aging products with sophisticated Korean beauty formulations with the objectives of hydration and skin regeneration. |

| Black Bird Skincare | Provides specialist anti-wrinkle solutions with organic ingredients and gentle formulation. |

| Lotus Herbals Limited | Expertise lies in the blending of Ayurvedic ingredients with contemporary skincare technology to provide effective anti-wrinkle solutions. |

| Clarins Group | Operates with luxury, high-performance anti-wrinkle treatments with scientific research complemented by natural ingredients. |

The Korean market for anti-wrinkle products remains dynamic with local players and international players alike fueling its growth. Such players as L'Oréal S.A., Coty, Inc., and Kao Corporation use their international know-how to introduce premium, innovative anti-aging products, while local players like Nature Republic, COSMAX INC., and Kolmar Korea aim to combine age-old Korean beauty philosophies with contemporary skincare science.

This combination of global and local expertise provides consumers with a broad spectrum of anti-wrinkle products, ranging from high-end, high-performance lines to budget-friendly, every-day options. With the expansion of the market, sustainability, personalization, and technology-based skincare will keep defining the industry's future, keeping the market dynamic and highly competitive.

Firms that are able to successfully combine tradition with innovation, while addressing the growing need for both budget-friendly and high-end anti-aging products, will most assuredly continue to prosper in this changing arena.

In terms of product type, the industry is divided into creams & moisturizers, cleansers, and other products.

With respect to nature, the market is classified into natural/herbal, synthetic, and organic.

Based on end-user, the industry is segregated into men and women.

With respect to sales channel, the industry is divided into pharmacies, specialty outlets, supermarkets/hypermarkets, convenience stores, beauty stores, e-retailers, and others.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 553.5 million in 2025.

The industry is projected to witness USD 1,017.1 million by 2035.

The industry is slated to grow at 6.2% CAGR during the study period.

Moisturizers and creams are majorly used.

Leading companies include Nature Republic, COSMAX INC., Kolmar Korea, Cosmecca Korea, Co. Ltd., KBL Cosmetics, Black Bird Skincare, Lotus Herbals Limited, L'Oréal S.A., Kao Corporation, Coty, Inc., Colgate Palmolive Company, Clarins Group, and Biomod Concepts, Inc.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 20: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 22: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 24: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 26: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 28: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 30: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 32: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 34: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 36: Jeju Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 38: Jeju Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 40: Jeju Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 42: Jeju Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type , 2018 to 2033

Table 44: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type , 2018 to 2033

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature , 2018 to 2033

Table 46: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Nature , 2018 to 2033

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-User , 2018 to 2033

Table 48: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by End-User , 2018 to 2033

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 50: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel , 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 108: Jeju Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 112: Jeju Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 116: Jeju Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 120: Jeju Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type , 2023 to 2033

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature , 2023 to 2033

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by End-User , 2023 to 2033

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type , 2018 to 2033

Figure 132: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type , 2018 to 2033

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type , 2023 to 2033

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type , 2023 to 2033

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature , 2018 to 2033

Figure 136: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Nature , 2018 to 2033

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature , 2023 to 2033

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature , 2023 to 2033

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-User , 2018 to 2033

Figure 140: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by End-User , 2018 to 2033

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-User , 2023 to 2033

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-User , 2023 to 2033

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 144: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel , 2018 to 2033

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Product Type , 2023 to 2033

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Nature , 2023 to 2033

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by End-User , 2023 to 2033

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel , 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA