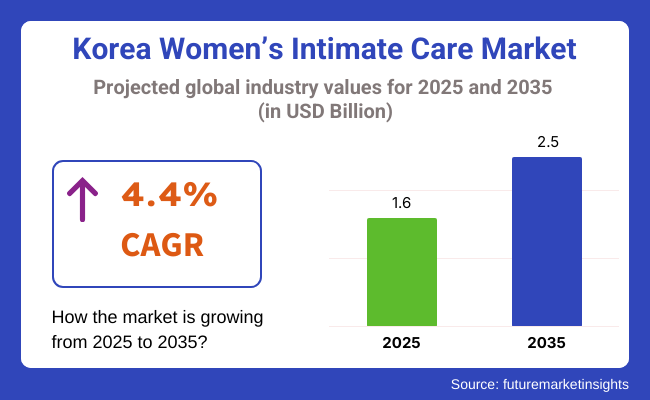

The Korea women’s intimate care market is poised to register a valuation of USD 1.6 billion in 2025. The industry is slated to grow at 4.4% CAGR from 2025 to 2035, witnessing USD 2.5 billion by 2035.

The expansion of the industry in Korea is fueled by an interplay of social, cultural, and demographic changes that are transforming consumer culture and wellness agendas. Among the key drivers is the growing transparency regarding women's health and self-care. Intimate hygiene has been a taboo topic in the past in most of Asia, including South Korea.

But with increasing awareness and a move toward destigmatizing women's health, more women are looking for products that are specifically meant to promote their intimate wellness. This encompasses cleansers, wipes, moisturizers, and pH-balancing solutions that address the sensitive areas. These changes are further underlined by a new generation of consumers who are better educated, health-oriented, and digitally enabled, with greater ease to get information and more access to higher standards in personal care.

The other factor is Korea's fast-aging population. As women get older, hormonal shifts-especially at menopause-can contribute to greater vaginal dryness, irritation, and discomfort. This demographic transition is driving consistent demand for intimate care products catering to comfort, hydration, and hygiene in advanced life stages. Furthermore, the increased popularity of preventive healthcare and holistic wellness is impacting buying behavior.

Korean consumers are increasingly appreciating preventive care versus reactive treatment, and intimate care is being merged into more comprehensive skincare and wellness regimens. Brands that market ingredients such as probiotics, natural extracts, and fragrance-free formulations are gaining popularity as a result of increased sensitivity to product safety and skin-friendliness.

Korea's well-developed beauty and personal care industry offers a fertile ground for innovation and product diversification. The industry is witnessing a trend towards premiumization, with consumers ready to pay for high-quality, dermatologist-tested formulations.

Social media and online platforms also have a crucial role to play in terms of product learning and discovery, and enabling women to make more informed decisions regarding intimate care. This intersection of education, aging populations, wellness trends, and access to digital media is driving consistent growth across Korea's industry for women's intimate care.

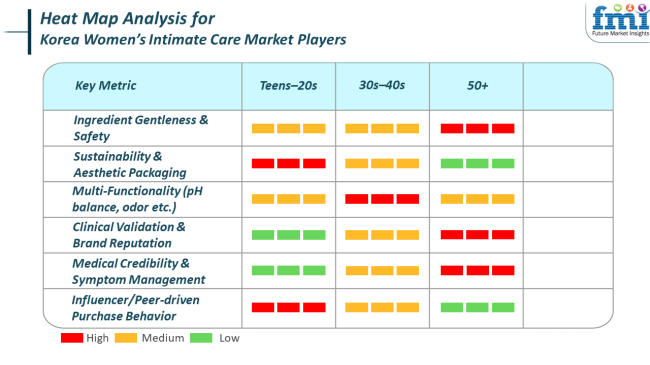

The Korean women's intimate care industry is experiencing divergent trends across generations, with different needs and consumption behaviors. In teens and young adults, there's a greater ease about personal care driven by digital media, peer and social influences, and wellness culture.

The younger generation favors natural, gentle ingredients and hypoallergenic product formulations, commonly seeking out safe, sustainable, and good-looking products. Their shopping choices are largely influenced by online reviews, influencer endorsements, and the transparency of a brand. Convenience and sustainable packaging also come into play, as young consumers are conscious of health as well as environmental concerns.

For women aged 30 years and above, intimate care is woven into general wellness and skincare routines. Individuals in their 30s and 40s like products that are multifunctional, balancing pH, moisturizing, and managing odor, and are willing to buy from established brands that have clinical validity. Women aged more than 50 prioritize comfort and managing health, particularly in managing symptoms related to menopause, such as dryness and irritation.

This age group tends to use medically approved, fragrance-free products and would rather shop through healthcare outlets or pharmacies. Across segments, however, there is a trend toward personalization that is evident, with education, safety, and overall well-being having a central role to play in the development of brand loyalty and product demand.

Between 2020 and 2024, the Korean women's intimate care industry underwent dramatic changes due to shifting consumer behavior, product formulation innovation, and the growth of digital influence. The COVID-19 pandemic hastened the need for personal care products as people became increasingly concerned with hygiene and wellness.

Consumers started to seek safe, effective, and multi-functional products that promoted overall well-being, rather than intimate hygiene. Also, a greater demand arose for products intended for sensitive skin and produced with natural or organic ingredients.

Improved e-commerce, social media channels, and platform accessibility enabled direct communication between companies and consumers, creating influencer marketing and expanded product availability. Companies responded with improved online presences, provisioning educational content, and aligning with trends such as sustainability, cruelty-free operation, and simplified packaging.

Looking ahead from 2025 to 2035, the industry will only grow more advanced with even greater emphasis on customized and integrative health solutions. Consumers will demand more products specific to their needs, whether that is the result of aging, hormonal fluctuations, or lifestyle considerations.

The aging demographic will fuel demand for intimate care solutions addressing issues such as vaginal dryness, discomfort, and sensitivity, especially among menopausal women. Moreover, product formulation technology will advance to create more advanced, clinically-supported products that combine probiotics, microbiome-dictated ingredients, and pH-adjusting solutions.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The COVID-19 pandemic increased the emphasis on personal hygiene, which boosted the demand for intimate care products. Consumers became more hygiene and safety conscious, and this triggered the growth in the industry. | In the future, the industry will experience increased demand for customized solutions that address specific health requirements of individuals, focusing on age-related problems, hormonal fluctuations, and lifestyle choices. |

| E-commerce websites and social media changed the way consumers had access to intimate care products, with digital platforms being utilized by brands for influencer marketing and direct customer interaction. | In the future, as technology improves, the products will aim at incorporating probiotics, microbiome-friendly components, and clinically-supported formulations that deliver advanced health advantages for intimate care. |

| Consumers became increasingly conscious of ingredient transparency and started preferring products with natural, organic, and hypoallergenic ingredients. Sensitive skin formulas became popular. | The focus will shift to products that balance and support the vaginal microbiome, using probiotics and ingredients that are meant to keep intimate health at a microbial level. |

| Sustainability emerged as a major driver of purchasing decisions, with consumers increasingly expecting environmentally friendly packaging, cruelty-free products, and ethical sourcing. | Sustainability will continue to be a top trend, with increased emphasis on minimizing environmental footprint, employing eco-friendly packaging, and ethical sourcing. Brands will have to demonstrate their commitment to these values through increased transparency. |

The industry, although under rapid growth and change, poses a number of risks that are likely to influence its course. Among the foremost risks is regulation, particularly because the industry for intimate care products is still on the rise.

South Korea boasts stringent regulation covering the formulation, labeling, and advertising of personal care products such as those meant for intimate cleanliness. Any modification in these regulations, especially with respect to product safety, ingredients, and advertising claims, may lead to disruptions. Firms that do not respond quickly to regulatory changes may encounter product launches held up, penalties, or the loss of reputation.

The second major risk is consumer education and trust. Although intimate care product awareness is increasing, there remains inadequate extensive education on how to use and the advantages of such products. If customers are not entirely aware of the necessity of the respective intimate care procedures, they might either not recognize value in the purchase of these items or resort to untested or harmful substitutes.

Secondly, the expanding industry may make it harder for companies to differentiate their product in an increasingly saturated industry, with various brands making similar promises. This saturation would result in aggressive competition based on price, driving down profitability and brand loyalty.

Intimate washes are among the highest-selling products, as customers have increasingly realized the necessity of proper hygiene for intimate areas. Designed to meet the demand for cleanliness with no harshness on sensitive skin, the product forms an integral part of Korean women's daily personal hygiene.

As women continue to learn about the advantages of pH-balanced washes to avoid irritation, discomfort, and bad odor, sales of intimate washes continue to soar. Many Korean brands sell these products with additional benefits like moisturizing or soothing properties, which are in line with the skincare culture that is deeply rooted in Korean beauty routines.

Moisturizers and creams designed specifically for intimate care have become popular, particularly because of increasing awareness about vaginal health and comfort. Products targeting issues such as dryness, irritation, and overall vaginal health are in great demand, especially among older women or those undergoing hormonal shifts.

As skincare is so deeply rooted in Korean culture, intimate creams and moisturizers are frequently formulated with natural ingredients such as aloe vera, probiotics, and hyaluronic acid, thereby appealing to consumers looking for gentle yet effective products. The growing emphasis on overall health and the avoidance of distress plays a large part in the success of these products.

The dominance of online retail is primarily because of the convenience, accessibility, and variety provided by online shopping. Korean consumers are extremely technologically advanced, and the country boasts one of the highest internet penetration rates in the world, which supports a strong e-commerce ecosystem. Digital platforms offer convenient access to a large array of intimate care products, facilitating comparison prices, reading reviews, and product information, enhancing confidence in purchase decisions.

Social media platforms, including Instagram and YouTube, also significantly influence consumer choice with influencers and brands actively marketing intimate care products. The convenience of having these products delivered to one's doorstep provides a sense of comfort and privacy, especially when buying personal care products.

Moreover, online buying tends to correspond with the growing emphasis on discretion and privacy. Since intimate care products are in some cases perceived as sensitive buys, numerous customers prefer the privacy of online shopping over in-store purchases. E-commerce sites also provide easy return policies and subscription options, so customers can use their products on a regular basis without the inconvenience of frequent visits to stores.

The Korean women's intimate care industry is very competitive, with local and foreign firms competing for a share in this emerging industry. Competitiveness is driven by innovation, quality, and competitiveness to meet the changing consumer demand for effective, high-quality, and functional products. Most brands aim to develop improved product formulations that meet the rising demand for convenience, wellness, and sustainability in intimate care. Some of the key players in the Korean women's intimate care industry are:

Procter & Gamble (P&G) is a global giant with a dominant position in the intimate care category, providing established brands such as Always and Tampax in Korea. P&G's success in the industry is due to its long history of providing high-quality, dependable products. With an emphasis on product innovation and consumer confidence, P&G continues to increase its industry share by meeting the increasing demand for personal hygiene and intimate care solutions.

Johnson & Johnson, under its popular Carefree and Neutrogena brands, dominates Korea's intimate care market. The company has a strong commitment to offering safe, dermatologically tested products that appeal to the Korean consumer, who is looking for skin-friendly formulations. Its wide distribution base, combined with its brand value, provides strong market presence across mass-market as well as premium segments.

Hindustan Unilever Limited has significant footprint in global personal care business and continues to pick up pace in Korea. Its Lux and Vanish lines, as well as its nascent intimate care brands, tap the company's strength in personal care, innovation, and sustainability. The emphasis of Unilever on ethical practice and sustainability resonates with Korean consumers' growing preference for eco-friendly, cruelty-free products.

Redcliffe Hygiene Private Limited and SANFE.IN are widening their reach in the intimate care segment through their product lines such as intimate washes, wipes, and sprays. Redcliffe Hygiene Private Limited and SANFE.IN target providing cost-effective, high-quality products designed to cater to the needs of Korean consumers looking for easy, safe, and effective intimate care products.

Joylux Inc. provides a specialty segment in the intimate care sector with its highly advanced technology-based products, for example, vaginal wellness devices. Joylux's emphasis on technology, especially the field of women's health and intimate wellness, makes it distinct, enabling the company to appeal to the rising demand for wellness-oriented intimate care products.

QUEEN V has become one of the top brands in Korea dedicated to natural and organic personal intimate care. Its commitment to well-being from within and environmental friendly products has earned it a very strong brand recognition in the marketplace, capturing the increasing base of health-focused and eco-sensitive buyers.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Procter & Gamble (P&G) | 18-22% |

| Johnson & Johnson | 15-18% |

| Hindustan Unilever Limited | 8-12% |

| Redcliffe Hygiene Private Limited | 5-7% |

| SANFE.IN | 3-5% |

| Joylux Inc. | 2-4% |

| QUEEN V | 2-4% |

| Other Key Players | 20-25% |

Key Company Insights

Market leader Procter & Gamble (P&G) has 18-22% market share, with its wide product line and popular brand presence in Korea. Johnson & Johnson comes in second, with a market share of 15-18%, as a result of its reputation in healthcare and dermatologically proven products. Hindustan Unilever, though relatively newer in this market, holds a market share of 8-12%, using its international reach and emphasis on sustainable products.

Smaller companies such as Redcliffe Hygiene and SANFE.IN are targeting niche markets with their emphasis on prices and convenience and grabbing 5-7% and 3-5% of the market, respectively. Joylux Inc. and QUEEN V, emphasizing health and environmentally friendly solutions, are expanding their share of the market in the health-conscious segment, and the rest of the market is dominated by other major local and foreign players.

With respect to product, the industry is classified into intimate washes, liners, oils, masks, moisturizers & creams, hair removal, gels, foams, exfoliate, mousses, mists, and sprays.

The industry is divided into 12-19 years, 20-25 years, 26-40 years, 41-50 years, and 51 and above.

The market is classified into women with children and women without children.

The market is bifurcated into online sales and offline sales.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 1.6 billion in 2025.

The industry is projected to witness USD 2.5 billion by 2035.

The industry is slated to grow at 4.4% CAGR during the study period.

Intimate wash products are widely used.

Leading companies include Korean Cosmetics Worldwide, Redcliffe Hygiene Private Limited, SANFE.IN, Joylux Inc., Hindustan Unilever Limited, Procter & Gamble, Johnson & Johnson, QUEEN V, ALYK, and Bodyform.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units Pack) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 21: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 22: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 23: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 24: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 25: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 27: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 29: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 30: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 31: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 32: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 33: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 35: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Jeju Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 37: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 38: Jeju Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 39: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 40: Jeju Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 41: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: Jeju Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Age Group, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by Age Group, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by User, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by User, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Units Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units Pack) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 33: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 34: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 36: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 37: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 38: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 39: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 40: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 41: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 42: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 55: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 56: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 57: North Jeolla Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 58: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 59: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 60: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 61: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 62: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 63: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 64: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 65: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 66: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 67: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 68: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 69: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 70: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 71: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 72: North Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 73: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 74: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 75: North Jeolla Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 76: North Jeolla Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 77: North Jeolla Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 78: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 80: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 81: South Jeolla Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 82: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 83: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 84: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 85: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 86: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 87: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 88: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 89: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 90: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 91: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 92: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 93: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 94: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 95: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: South Jeolla Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 97: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: South Jeolla Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 100: South Jeolla Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 101: South Jeolla Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 102: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 103: Jeju Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 104: Jeju Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 105: Jeju Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 106: Jeju Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 107: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 108: Jeju Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 109: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 110: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 111: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 112: Jeju Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 113: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 114: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 115: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 116: Jeju Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 117: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 118: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 119: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 120: Jeju Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 121: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 122: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 123: Jeju Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 124: Jeju Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 125: Jeju Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 126: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Product, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Age Group, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by User, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Age Group, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by Age Group, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Age Group, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Age Group, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by User, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by User, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by User, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by User, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Units Pack) Analysis by Sales Channel, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Product, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Age Group, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by User, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA