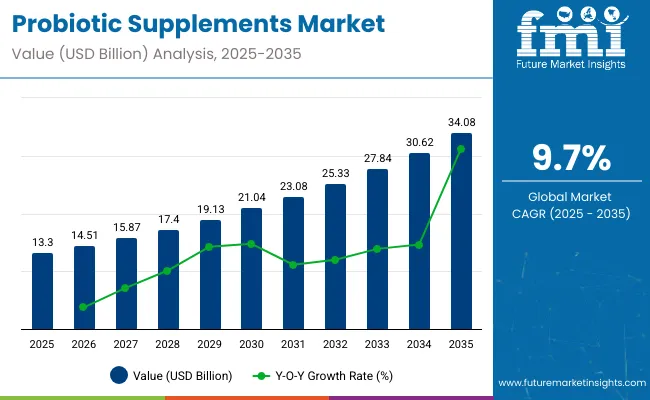

The probiotic supplements market is expected to grow from USD 13.30 billion in 2025 to USD 34.08 billion by 2035, at a CAGR of 9.7%. This growth is driven by increasing awareness of gut health, immunity, and the gut-brain axis, along with the rise in digestive disorders and a shift toward preventive healthcare. Regulatory approvals from bodies like the USA FDA and EFSA have enhanced consumer confidence.

Per capita spending on probiotic supplements reflects growing global interest in gut health, immunity, and overall wellness. This market segment is influenced by demographic factors, healthcare infrastructure, and consumer education. Developed regions typically show higher spending, driven by strong health awareness and availability of diverse probiotic products. Meanwhile, emerging markets, although currently lower in spending, are rapidly expanding as urbanization and lifestyle changes increase demand for digestive health solutions.

The trade scenario of the probiotic supplements market is shaped by increasing global demand for digestive health products and expanding cross-border supply chains. Key exporting countries are those with advanced nutraceutical industries and strong manufacturing capabilities, while major importing regions are driven by rising consumer awareness and growing health-focused populations. Trade flows are also influenced by regulatory standards, quality certifications, and the need for cold chain logistics to preserve probiotic viability.

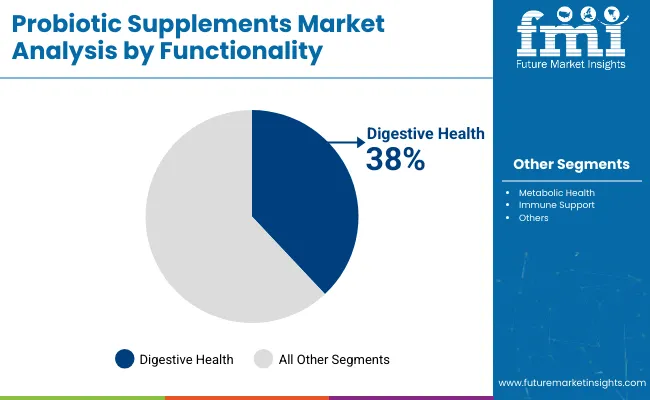

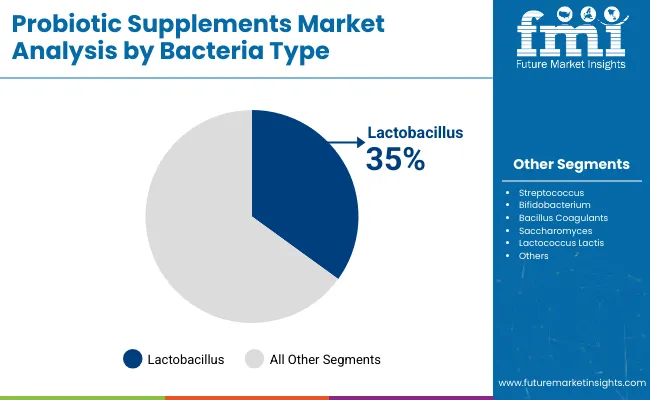

The probiotic supplements market is projected to grow at a strong CAGR of 9.7%, reaching USD 34.08 billion by 2035. Digestive health will be the key driver, capturing 38% of the market share by 2025. Lactobacillus strains, known for their digestive benefits, lead the bacteria type segment with a 35% share.

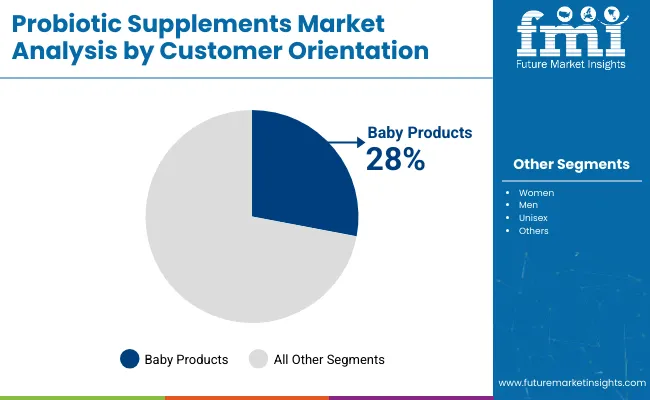

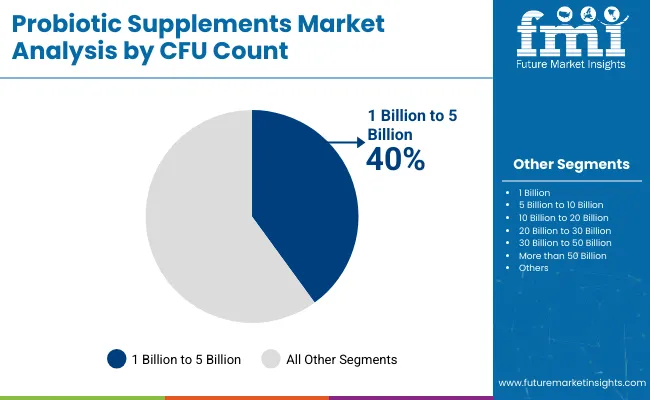

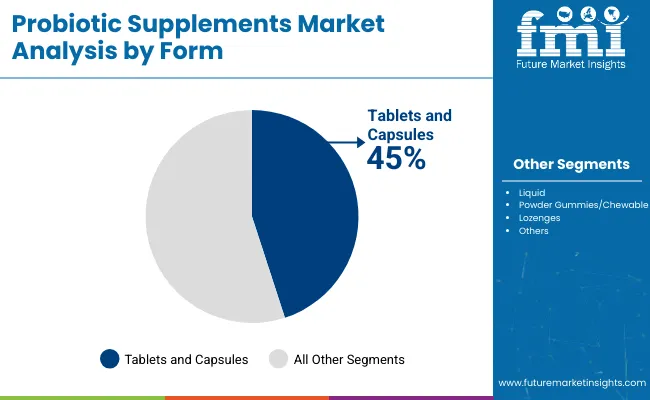

Baby-specific probiotic products are gaining popularity, expected to account for 28% of the market. The 1-5 billion CFU range will dominate, holding a 40% market share. Tablets and capsules are the preferred forms, representing 45% of the market. India is anticipated to be the fastest-growing market due to rising awareness and affordable products.

In 2024, Nestlé Health Science CEO Greg Behar emphasized the company’s investment in synbiotic formulations combining probiotics and prebiotics for digestive and immune health. ADM expanded its microbiome innovation center in Valencia to advance postbiotic product pipelines.

In 2025, Chr. Hansen launched a transparency platform for verifying strain origin, CFU count, and clinical backing via QR codes. Consumer Lab’s 2024 review highlighted BioGaia and Culturelle for their consistent potency. The International Probiotics Association (IPA) projects that shelf-stable and targeted-release capsules will account for nearly 50% of sales by 2035, with emerging applications in weight management and mental wellness.

Digestive health will dominate the functionality segment with a 38% market share, while lactobacillus will lead the bacteria type segment with a 35% share. Baby products will capture 28% of the customer orientation segment by 2025.

Digestive health continues to lead the probiotic supplements market, holding a 38% market share by 2025.

Lactobacillus is expected to capture 35% of the market share in the bacteria type segment by 2025.

Baby products are expected to hold a 28% market share in the customer orientation segment by 2025.

Probiotic supplements with a CFU count between 1 billion and 5 billion will capture 40% of the market share by 2025.

Tablets and capsules are expected to dominate the form segment, holding 45% of the market share by 2025.

The global probiotic supplements market is experiencing steady growth, driven by the increasing awareness of gut health and digestive well-being, as well as the growing adoption of probiotics in daily wellness routines. However, the market also faces challenges related to regulatory hurdles and competition from alternative health supplements.

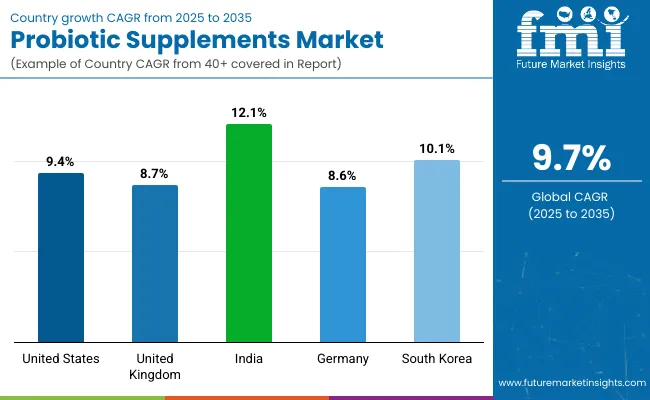

The probiotic supplements market is experiencing substantial growth, driven by increasing awareness of digestive health, immune support, and overall wellness. Leading countries in the formulation, distribution, and consumption of probiotic supplements include the United States, United Kingdom, India, Germany, and South Korea.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 9.4% |

| United Kingdom | 8.7% |

| India | 12.1% |

| Germany | 8.6% |

| South Korea | 10.1% |

The USA probiotic supplements market is expected to expand at a CAGR of 9.4% from 2025 to 2035. Major brands like Garden of Life, Culturelle, and Activia are at the forefront of market development, offering a variety of probiotic formulations targeting different health benefits.

The UK probiotic supplements market is expected to grow at a CAGR of 8.7% during the forecast period. Major brands like Yakult and Bio-K+ are expanding their product lines to cater to diverse consumer needs, particularly in the digestive health segment.

India's probiotic supplements market is forecast to grow at an impressive CAGR of 12.1%. Brands like Dabur and The Himalaya Drug Company are tapping into the health-conscious population with affordable and culturally relevant probiotic products.

The German probiotic supplements market is projected to expand at a CAGR of 8.6% from 2025 to 2035. Germany is a significant player in the European market, with strong demand for high-quality probiotic supplements.

South Korea's probiotic supplements market is expected to grow at a CAGR of 10.1%, driven by the increasing popularity of health-conscious lifestyles. Brands like LG Household & Health Care are leading the charge with high-quality probiotics designed to target specific health benefits.

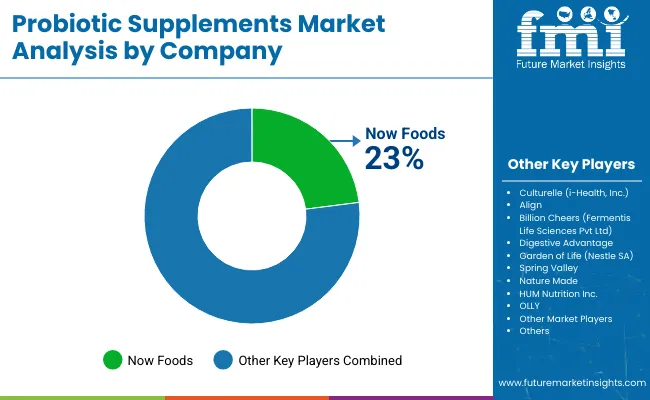

The probiotic supplements market is diverse, with Tier 1 players like Culturelle (i-Health, Inc.), Align, and Garden of Life (Nestle SA) leading through strong brand recognition, extensive product lines, and substantial R&D investment. These companies prioritize product innovation and clinical research, offering specialized probiotic formulations for digestive health. Tier 2 players like Billion Cheers (Fermentis Life Sciences Pvt Ltd) and Spring Valley focus on affordability and regional expansion, often incorporating organic ingredients to appeal to health-conscious consumers.

Tier 3 companies, such as Now Foods, Nature Made, and OLLY, target niche markets with specialized products like mood balance and skin health, leveraging digital marketing strategies. Entry barriers are moderate due to regulatory hurdles, large-scale manufacturing, and strong brand loyalty from top players. Market fragmentation is evident, but consolidation is increasing as larger firms acquire smaller competitors to expand their product offerings and market reach.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 13.30 billion |

| Projected Market Size (2035) | USD 34.08 billion |

| CAGR (2025 to 2035) | 9.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Functionality Segments Analyzed | Digestive Health, Metabolic Health, Immune Support, Others |

| Customer Orientation Segments Analyzed | Baby, Women, Men, Unisex |

| Bacteria Types Analyzed | Lactobacillus, Streptococcus, Bifidobacterium, Bacillus coagulants, Saccharomyces, Lactococcus lactis |

| CFU Count Segments Analyzed | Less than 1 Billion, 1 Billion to 5 Billion, 5 Billion to 10 Billion, 10 Billion to 20 Billion, 20 Billion to 30 Billion, 30 Billion to 50 Billion, More than 50 Billion |

| Form Types Analyzed | Tablets/Pills, Capsules, Liquid, Powder, Gummies/Chewable, Lozenges, Others (Gels, Soft Gels) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players Influencing the Market | Culturelle (i-Health, Inc.), Align, Billion Cheers (Fermentis Life Sciences Pvt Ltd), Digestive Advantage, Garden of Life (Nestle SA), Spring Valley, Now Foods, Nature Made, HUM Nutrition Inc., OLLY, Other Market Players |

| Additional Attributes | Dollar sales growth by functionality (digestive/immune), regional demand trends, competitive landscape, CFU count preference, form type preference, consumer behavior, sustainability, and innovation in probiotic supplements |

Digestive Health, Metabolic Health, Immune Support, Others.

Baby, Women, Men, Unisex.

Lactobacillus, Streptococcus, Bifidobacterium, Bacillus coagulants, Saccharomyces, Lactococcus lactis.

Less than 1 Billion, 1 Billion to 5 Billion, 5 Billion to 10 Billion, 10 Billion to 20 Billion, 20 Billion to 30 Billion, 30 Billion to 50 Billion, More than 50 Billion.

Tablets/Pills, Capsules, Liquid, Powder, Gummies/Chewable, Lozenges, Others (Gels, Soft Gels).

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global probiotic supplements market is expected to reach USD 13.50 billion in 2025.

By 2035, the probiotic supplements market is projected to grow to USD 34.08 billion.

The market is expected to grow at a CAGR of 9.7% from 2025 to 2035.

Digestive health will dominate the customer orientation segment, holding a 38% market share.

India is projected to be the fastest-growing country, with a CAGR of 12.1%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

UK Probiotic Supplements Market Report – Size, Share & Outlook 2025-2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025-2035

Postnatal Probiotic Supplements Market Size and Share Forecast Outlook 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Demand for Probiotic Supplements in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA