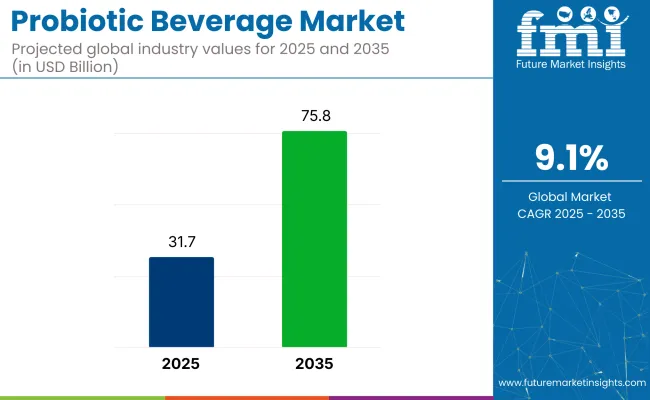

The probiotic beverage market is expected to expand from USD 31.7 billion in 2025 to USD 75.8 billion by 2035, reflecting a CAGR of 9.1%. The industry growth is driven by the increasing demand for functional beverages that offer health benefits such as improved digestion and enhanced immunity.

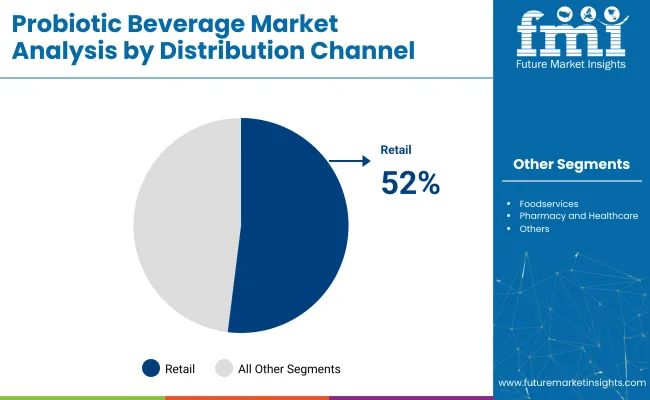

The industry’s expansion is fueled by the growing popularity of kombucha, kefir, and other probiotic-infused drinks. Consumer interest in health and wellness, particularly among adults aged 31-50, is driving the industry forward, with retail channels accounting for the largest share of the distribution network. The increasing availability of these products through various distribution channels, including retail, online, and foodservice outlets, is expected to further boost industry growth.

The Economic Times article, "A billion-dollar idea born out of gut feeling," discusses the rise of Poppi, a prebiotic soda brand, which was born from the founders' desire to create a healthier alternative to traditional sodas. The brand’s focus on gut health and its use of apple cider vinegar as a key ingredient resonated with health-conscious consumers.

Poppi’s unique positioning in the functional beverage space has led to its rapid growth, attracting significant investment. In 2025, PepsiCo announced its acquisition of Poppi, further solidifying the brand's success in the burgeoning industry.

The industry holds a growing but specialized share within its parent markets. In the functional beverages market, it accounts for approximately 5-7%, driven by the increasing demand for beverages offering health benefits like improved digestion and immunity. Within the health and wellness market, the share is around 3-5%, as probiotic drinks are consumed for their overall health benefits.

In the dairy products market, probiotic drinks represent about 2-4%, as many of these drinks are dairy-based, like yogurt and kefir. In the fermented food and beverage market, their share is approximately 10-12%, as probiotic drinks are a popular category of fermented products. In the natural and organic products market, the share is around 3-5%, with organic probiotic drinks appealing to health-conscious consumers.

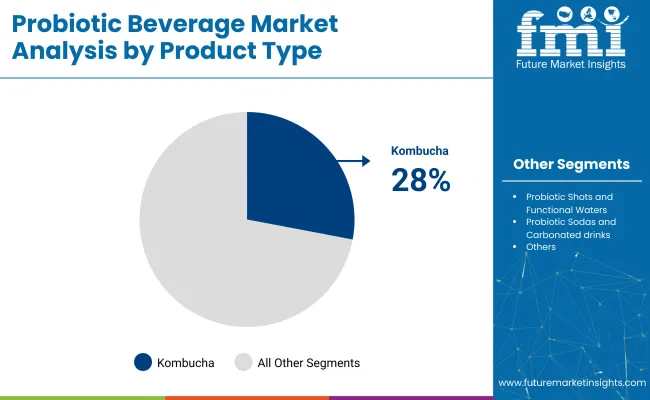

The industry is segmented by product type, including kombucha, kefir, and probiotic shots. Distribution occurs through retail channels, online platforms, and foodservice. Consumer demographics range from children to older adults, with the largest demand from adults (31-50).

Kombucha is projected to dominate the industry, capturing an estimated 28% share in 2025. This fermented tea drink is increasingly popular due to its health benefits, such as aiding digestion, boosting immunity, and providing natural energy. Kombucha’s appeal is further enhanced by its wide variety of flavors and alcohol content variations, catering to a broad consumer base.

The global rise in demand for functional beverages, particularly among health-conscious consumers, drives kombucha’s growth. Leading companies like GT's Living Foods and Health-Ade Kombucha are expanding their product offerings to include flavored, alcohol-free, and sugar-reduced versions, ensuring kombucha’s continued industry leadership.

Retail channels are projected to capture 52% of the industry distribution in 2025. Supermarkets, hypermarkets, and health food stores remain key contributors by offering easy access to a broad range of probiotic drinks, including kombucha and kefir. Convenience stores and specialty beverage retailers also play an increasing role as consumers seek healthier, on-the-go drink alternatives.

The growing awareness of the health benefits of probiotics, coupled with the expansion of product offerings in retail channels, will drive significant growth. Major players like Danone S.A. and Yakult Honsha Co., Ltd. continue to invest in expanding product availability to meet rising consumer demand.

Adults aged 31-50 are expected to represent the largest consumer group for probiotic drinks, capturing 40% of the industry share in 2025. This demographic is increasingly focused on health and wellness, particularly digestive health, driving the demand for probiotic drinks.

Adults in this age group are more likely to incorporate probiotics into their daily routines for benefits such as improved gut health, immune support, and overall well-being. Companies are catering to this demographic by developing low-sugar options, enhanced functionality, and convenient packaging. The growing demand from health-conscious adults is expected to significantly influence the industry’s growth.

The industry is driven by the increasing demand for health-focused drinks, particularly kombucha and kefir. However, challenges such as production complexities, high costs, and regulatory hurdles may limit industry growth, necessitating innovations and cost-effective solutions.

Growing Consumer Interest in Health and Wellness Driving Industry Expansion

The industry is expanding due to rising consumer interest in health and wellness. As people become more health-conscious, there is an increased demand for functional beverages that support digestion, immunity, and overall well-being.

Drinks like kombucha, kefir, and functional waters are gaining popularity as healthier, natural alternatives to sugary beverages. The growing understanding of the gut-brain connection and the benefits of probiotics for both mental and physical health are further propelling industry growth.

Challenges in Production and Regulatory Barriers Limiting Industry Growth

Despite strong demand, the industry faces significant challenges, including difficulties in production and regulatory barriers. Maintaining the viability and effectiveness of probiotic strains in beverages is complex and costly, which can drive up production expenses.

Additionally, the regulatory environment for functional foods and beverages varies by region, and obtaining product approvals can be time-consuming and expensive. These factors create obstacles, particularly for new entrants trying to innovate and compete in this rapidly evolving industry.

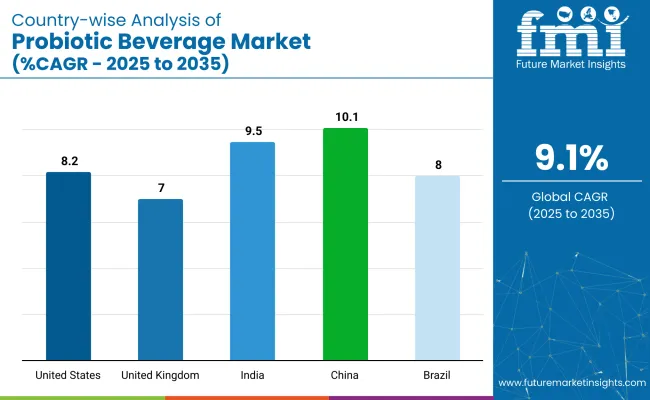

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.2% |

| United Kingdom | 7% |

| China | 10.1% |

| India | 9.5% |

| Brazil | 8% |

The industry demand is projected to rise at a 9.1% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, China leads at 10.1%, followed by India at 9.5%, and the United States at 8.2%, while Brazil posts 8% and the United Kingdom records 7%.

These rates translate to a growth premium of +11% for China, +4% for India, and -10% for the United Kingdom versus the baseline, while the United States and Brazil show more moderate growth. Divergence reflects local catalysts: growing demand for health-conscious beverages and increasing awareness of gut health in China and India, as well as a more established probiotic beverage market in the United States and Brazil, while the United Kingdom lags slightly due to industry saturation.

The industry in the United States is set to record a CAGR of 8.2% through 2035. Expansion has been propelled by consumer focus on gut health and immunity, fueling adoption of kombucha, kefir, and concentrated probiotic shots across supermarkets, convenience stores, and direct-to-consumer channels.

Leading brands such as KeVita (PepsiCo) and Health-Ade Kombucha have broadened lineups with tropical and low-sugar variants, while functional claims tied to digestive balance resonate with wellness-minded shoppers. E-commerce bundles and subscription services have increased household penetration, and retail planograms now dedicate prominent end-caps to refrigerated probiotic drinks.

Sales of probiotic drinks in the United Kingdom are projected to grow at a CAGR of 7% through 2035. Rising interest in functional drinks that support digestive wellness is evident in the growing shelf space for kombucha, kefir, and probiotic water.

Brands such as Poppi and Biotiful Dairy emphasize clean labels, reduced sugar, and live-culture counts that fit HFSS-compliant positioning. Online grocery platforms and click-and-collect services have widened distribution beyond metropolitan hubs. Retail promotions centered on gut-health education align with NHS nutrition messaging, encouraging trial across the 31- to 50-year age bracket.

Demand for probiotic drinks in China is estimated to grow at a CAGR of 10.1% through 2035. Heightened awareness of digestive wellness and immunity has driven uptake of kombucha, yogurt-based drinks, and probiotic waters across hypermarkets and specialty health stores. Urban consumers favor convenience packs with on-label culture counts, while rural penetration rises via e-commerce flash sales.

Nestlé and GT’s Living Foods are ramping localized production to meet volume spikes, and domestic startups launch tea-infused probiotic tonics tailored to regional taste profiles. Cold-chain expansion ensures consistent quality during long-haul distribution.

Growing at a CAGR of 9.5%, the industry India is being propelled by expanding urban wellness culture and rising disposable income. Kombucha, kefir, and yogurt drinks fortified with live cultures are gaining shelf presence in modern trade and specialty stores.

Danone and Yakult have introduced region-specific flavors, while local craft brewers offer small-batch kombucha with indigenous fruits such as jamun and kokum. Health-influencer campaigns on social media educate consumers about digestive benefits, bolstering trial rates. Government nutrition drives that highlight gut health further normalize daily probiotic intake across middle-class households.

The industry in Brazil is forecasted to grow at a CAGR of 8% through 2035. Urban consumers are shifting away from sugar-laden soft drinks toward functional beverages that support digestive and immune health. Kombucha and kefir brands spotlight antioxidant-rich Amazonian fruits such as açaí and cupuaçu, aligning with regional taste preferences.

Nestlé and Yakult have expanded chilled-chain distribution to secondary cities, while local startups utilize direct-to-consumer models for niche flavors. Retailers allocate refrigerator space to probiotic drinks positioned as better-for-you alternatives, and fitness centers stock grab-and-go probiotic shots post-workout.

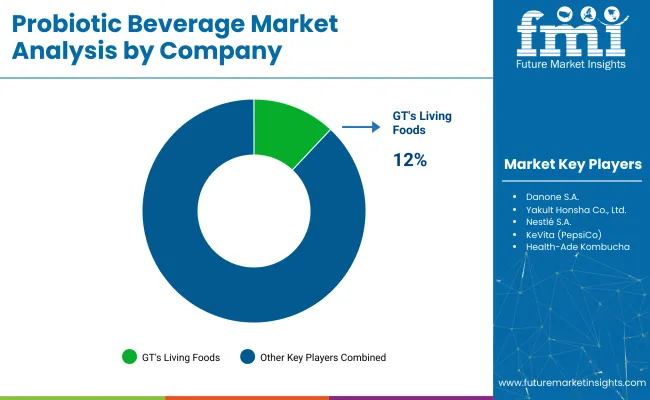

Leading Company - GT's Living Foods Industry Share - 12%

The global industry is characterized by dominant players, key players, and emerging players. Dominant players such as GT's Living Foods, Danone S.A., and Yakult Honsha Co., Ltd. lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across health-conscious consumers.

Key players including Nestlé S.A., KeVita (PepsiCo), and Health-Ade Kombucha offer specialized probiotic drinks catering to specific applications and regional industries. Emerging players, such as Lifeway Foods, Inc., Culture Pop, and Poppi, focus on innovative flavors and formulations, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 31.7 billion |

| Projected Industry Size (2035) | USD 75.8 billion |

| CAGR (2025 to 2035) | 9.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Type Segmentation | Kombucha (Flavor Segmentation and Alcohol content variations), Kefir (Dairy-based kefir, Plant-based kefir, Flavored vs. plain variants), Probiotic shots and functional waters (Concentrated probiotic shots, Probiotic-enhanced waters, Electrolyte-probiotic combinations), Drinking yogurt and dairy-based beverages (Traditional drinking yogurt, Greek yogurt drinks, Low-fat and non-fat variants), Plant-based probiotic beverages (Fruit and vegetable-based, Nut and seed-based, Grain-based fermented drinks), Probiotic sodas and carbonated drinks (Prebiotic sodas, Low-sugar variants, Natural flavor profiles) |

| Distribution Channel Segmentation | Retail Channels (Supermarkets and Hypermarkets, Health food stores, Convenience stores, Specialty beverage retailers), Online Retail (E-commerce platforms, Direct-to-consumer sales, Subscription-based models), Foodservice (Restaurants and cafes, Health and wellness centers, Corporate cafeterias), Pharmacy and Healthcare Channels (Traditional pharmacies, Health clinics, Nutritionist recommendations) |

| Consumer Demographics Segmentation | Children (0-12), Teenagers & Young Adults (13-30), Adults (31-50), Older Adults (51+) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | GT's Living Foods, Danone S.A., Yakult Honsha Co., Ltd., Nestlé S.A., KeVita (PepsiCo), Health-Ade Kombucha, Lifeway Foods, Inc., Culture Pop, Poppi, Biotiful Dairy, Karma Probiotic Water, Chr. Hansen Holding A/S, DuPont Nutrition & Biosciences, BioGaia AB, Lallemand Inc. |

| Additional Attributes | Dollar sales by product type, distribution channel, and consumer demographics, increasing consumer demand for health-conscious drinks, growing preference for plant-based and dairy-free probiotic drink s, rising awareness about gut health, expanding distribution channels through e-commerce and retail, regional adoption trends and regulatory impacts on probiotic drink formulations. |

The industry is segmented into kombucha(flavor segmentation and alcohol content variations), kefir(dairy-based kefir, plant-based kefir, flavored vs. plain variants), probiotic shots and functional waters (concentrated probiotic shots, probiotic-enhanced waters, electrolyte-probiotic combinations), drinking yogurt and dairy-based beverages (traditional drinking yogurt, greek yogurt drinks, low-fat and non-fat variants), plant-based probiotic beverages (fruit and vegetable-based, nut and seed-based, grain-based fermented drinks), and probiotic sodas and carbonated drinks (prebiotic sodas, low-sugar variants, natural flavor profiles).

The industry is segmented into retail channels (supermarkets and hypermarkets, health food stores, convenience stores, and specialty beverage retailers), online retail (e-commerce platforms, direct-to-consumer sales, subscription-based models), foodservice(restaurants and cafes, health and wellness centers, corporate cafeterias), and pharmacy and healthcare channels(traditional pharmacies, health clinics, nutritionist recommendations).

The industry is segmented into children(0-12), teenagers & young adults (13-30), adults (31-50), and older adults (51+).

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Middle East and Africa (MEA).

The industry is projected to reach USD 31.7 billion in 2025.

The industry is expected to grow to USD 75.8 billion by 2035.

Kombucha is the leading product type, holding a 28% share in the industry.

China has the highest CAGR in the industry at 10.1%.

GT's Living Foods is the leading company in the industry, with an industry share of 12%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA