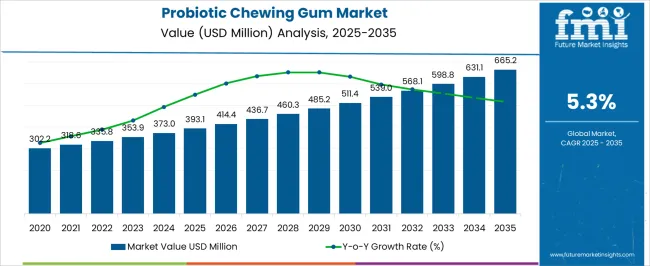

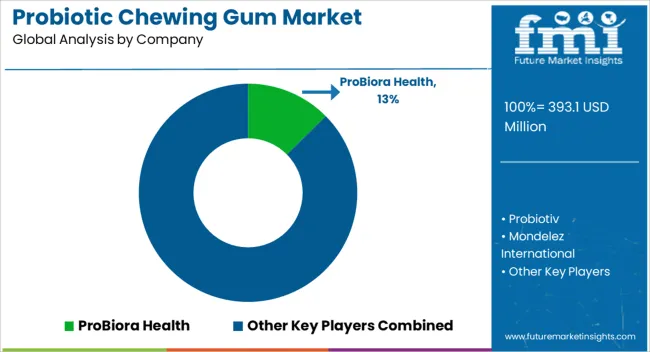

The Probiotic Chewing Gum Market is estimated to be valued at USD 393.1 million in 2025 and is projected to reach USD 665.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Probiotic Chewing Gum Market Estimated Value in (2025 E) | USD 393.1 million |

| Probiotic Chewing Gum Market Forecast Value in (2035 F) | USD 665.2 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The probiotic chewing gum market is expanding as consumers increasingly adopt functional confectionery products that combine convenience with health benefits. Rising awareness of gut health, oral care, and immune system support has strengthened demand for probiotic-infused gums.

Manufacturers are innovating with strain stability, extended shelf-life, and consumer-friendly formulations, enabling wider market penetration. Functional chewing gum provides an alternative to traditional supplement formats, catering to busy lifestyles and growing interest in on-the-go health solutions.

The market benefits from rising e-commerce adoption, premiumization trends, and the expanding influence of preventive healthcare awareness. With consumer preferences shifting toward non-invasive and enjoyable delivery formats for probiotics, the probiotic chewing gum market is positioned for steady growth across both developed and emerging regions.

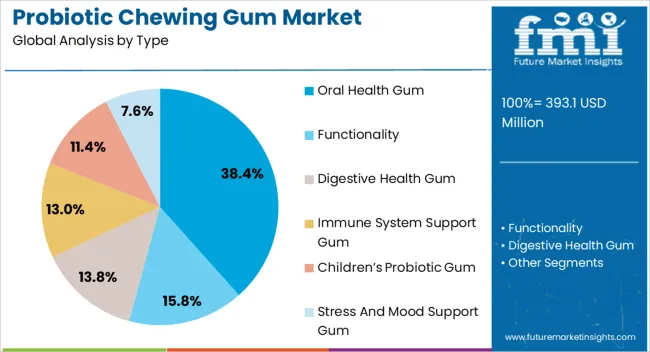

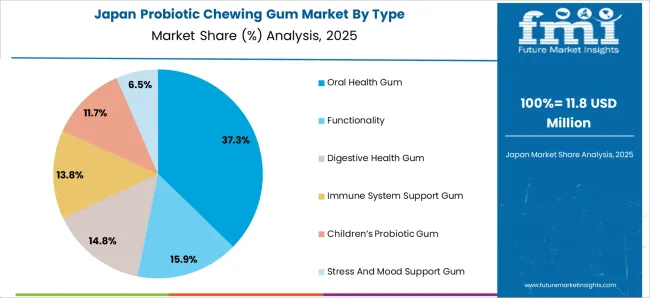

The oral health gum segment holds approximately 38.40% share in the type category, reflecting its leading role in the probiotic chewing gum market. This dominance is supported by increasing consumer interest in products that deliver dual benefits of oral hygiene and gut health.

Probiotics incorporated into oral health gums contribute to improved dental flora balance, reinforcing their appeal in preventive dental care. The segment benefits from cross-industry innovation, where dental health and functional nutrition converge.

With rising incidences of oral health issues and growing awareness of preventive care, oral health gum has established itself as a preferred format. Expanding product availability and increasing endorsements from dental professionals further reinforce the segment’s growth trajectory.

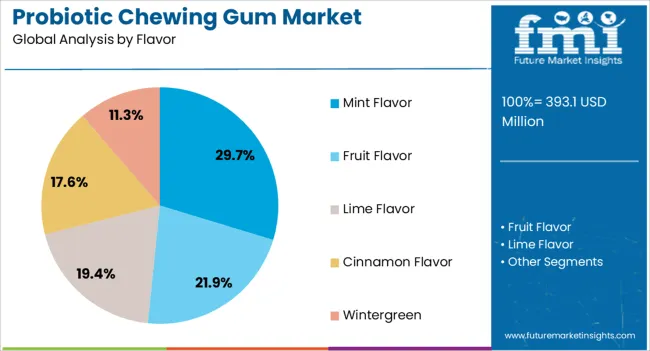

The mint flavor segment leads the flavor category with approximately 29.70% share, driven by consumer preference for refreshing and palate-cleansing options in chewing gum. Mint is widely accepted across demographics, providing familiarity and consistent demand.

Its compatibility with probiotic formulations ensures stability and broad consumer acceptance. The segment benefits from high repeat purchase rates and its positioning as a traditional flavor associated with freshness and oral care.

Manufacturers continue to expand offerings within the mint category, including sugar-free and natural variants, aligning with health-conscious trends. With strong consumer loyalty and universal appeal, mint flavor is expected to remain the leading segment in probiotic chewing gum formulations.

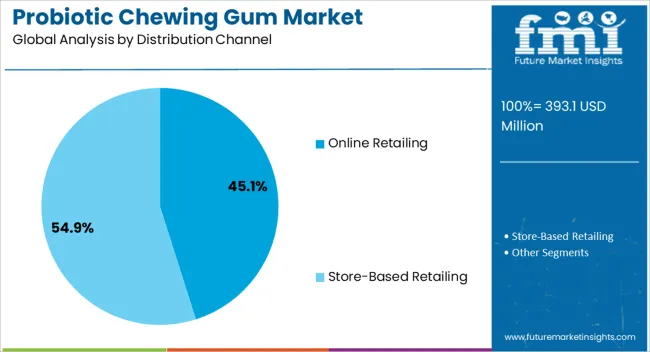

The online retailing segment dominates the distribution channel category, accounting for approximately 45.10% share. Its leadership is attributed to growing e-commerce penetration, convenience of direct-to-consumer channels, and the ability to offer a wider variety of specialized functional products.

Consumers are increasingly turning to online platforms to access probiotic chewing gums due to flexible purchasing options, subscription models, and attractive promotions. The segment benefits from the global expansion of digital marketplaces and health-focused e-commerce platforms.

With increasing smartphone usage, digital marketing initiatives, and personalized shopping experiences, online retailing is projected to sustain its leading role, further driving the global reach of probiotic chewing gum products.

The probiotic chewing gum market grew at a CAGR of 5.1% from 2020 to 2025. By 2035, the worldwide market for probiotic chewing gums is predicted to surge at 5.4% CAGR. Factors responsible for pushing probiotic chewing gum sales include:

Product Innovations and Health Awareness to be Key Trends in the Market

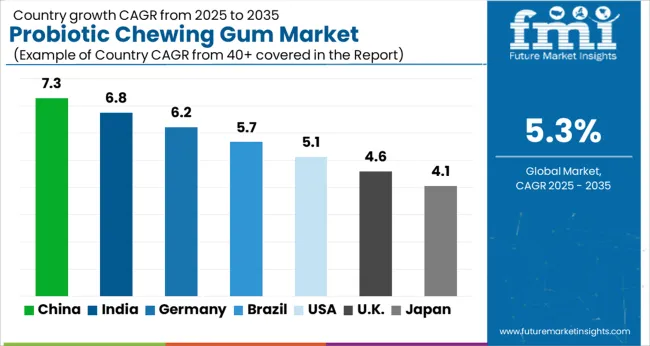

The table below shows the estimated growth rates of the top five countries. The United States, China, and Japan are set to record high CAGRs of 5.6%, 5.0%, and 6.1%, respectively, through 2035.

The United States is projected to surge at a CAGR of 5.6% through 2035. Emerging patterns in the market are as follows:

Sales of probiotic chewing gums are projected to increase in Germany at a CAGR of 3.4% through 2035. The factors driving the market growth are as follows:

The demand for probiotic chewing gums is increasing in China, with a projected CAGR of 5.0% through 2035. Emerging patterns in China’s market are as follows:

Japan is projected to rise at a 6.1% CAGR through 2035. The factors driving the market’s growth are as follows:

Australia's probiotic chewing gum market is expected to increase at 4.0% CAGR through 2035. The factors responsible for this growth are as follows:

The section below shows the digestive health gum segment dominating by functionality. It is predicted to hold a market share of 23% in 2025. Based on the distribution channel, the pharmacy segment is anticipated to generate a dominant share through 2025. It is set to hold a share of 21% in 2025.

| Segment | Market Share (2025) |

|---|---|

| Digestive Health Gum (Functionality) | 23% |

| Mint Flavor (Flavor) | 20% |

| Pharmacies (Distribution Channel) | 21% |

Based on functionality, demand for digestive health gums is expected to remain high, with a market share of around 23% in 2025. The following factors are projected to support demand:

Leading players are introducing novel products to meet consumer demand. They also employ tactics including partnerships, distribution agreements, mergers & acquisitions, collaborations, and advertising to gain a competitive edge in the market.

To meet the increasing demand, key players are introducing new sugar-free products onto the market. Companies are also releasing chewing gums in several flavors to capture a large market share.

For instance,

The global probiotic chewing gum market is estimated to be valued at USD 393.1 million in 2025.

The market size for the probiotic chewing gum market is projected to reach USD 665.2 million by 2035.

The probiotic chewing gum market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in probiotic chewing gum market are oral health gum, functionality, digestive health gum, immune system support gum, children’s probiotic gum and stress and mood support gum.

In terms of flavor, mint flavor segment to command 29.7% share in the probiotic chewing gum market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic for Men Market Analysis by Product, Sales Channel and Strain Type Through 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA