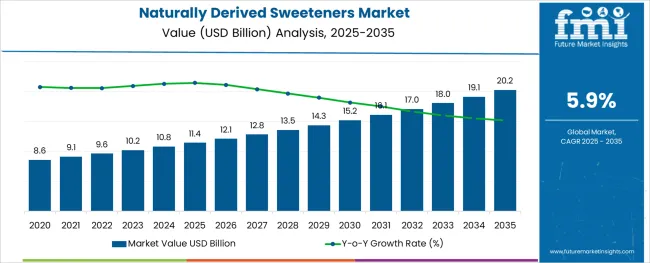

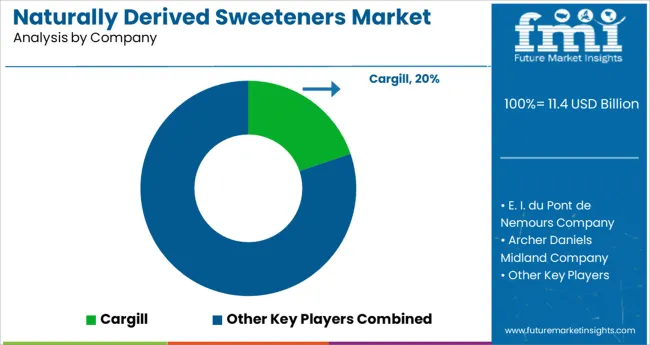

The Naturally Derived Sweeteners Market is estimated to be valued at USD 11.4 billion in 2025 and is projected to reach USD 20.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The naturally derived sweeteners market is expanding rapidly as consumer demand shifts toward healthier alternatives to synthetic sugars. Growing health awareness and concerns about obesity and diabetes have led many consumers to seek natural sweetening options. Product innovations and the availability of a variety of natural sweeteners have broadened market appeal across food and beverage industries.

Rising preference for clean-label ingredients has encouraged manufacturers to incorporate organic and plant-based sweeteners into their formulations. The expansion of organic food markets and increasing adoption of natural ingredients in processed foods have further accelerated growth. Retail penetration and e-commerce growth have improved product accessibility, supporting wider consumer adoption.

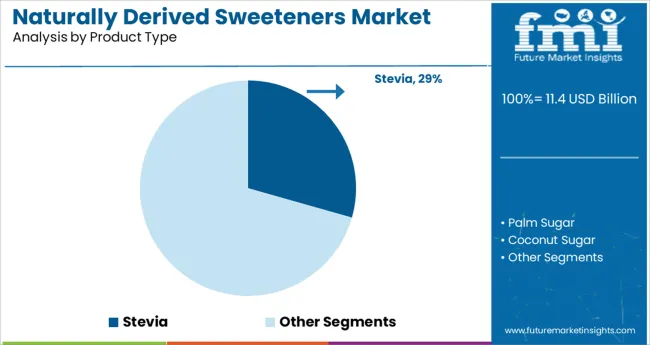

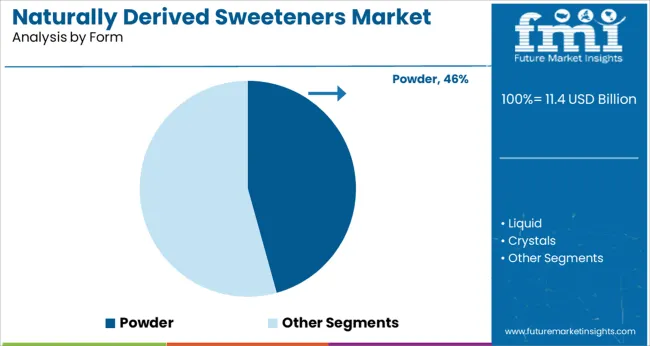

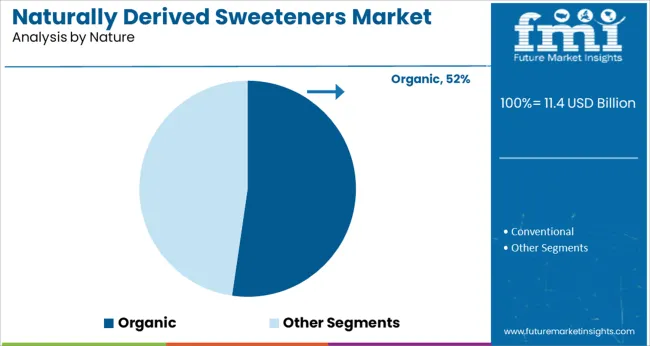

Future growth is expected to be driven by continuous innovation in formulation technologies and increasing consumer focus on sustainable and organic products. Segmental leadership is anticipated from Stevia in product type, Powder in form, and Organic in nature.

The market is segmented by Product Type, Form, Nature, End Use, and Sales Channel and region. By Product Type, the market is divided into Stevia, Palm Sugar, Coconut Sugar, Honey, Maple Syrup, Monk Fruit Sugar, Agave Syrup, Lucuma Fruit Sugar, Molasses, and Natural Sweetener Blends. In terms of Form, the market is classified into Powder, Liquid, and Crystals. Based on Nature, the market is segmented into Organic and Conventional. By End Use, the market is divided into Food, Beverages, Personal Care, Pharmaceuticals, and Tabletop Sweetener.

By Sales Channel, the market is segmented into Offline Sales Channel and Online Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Stevia is expected to hold 29.4% of the naturally derived sweeteners market revenue in 2025. Its growth is supported by its strong sweetness profile with negligible calories and a natural origin that appeals to health-conscious consumers. Stevia has been incorporated widely in beverages, dairy products, and tabletop sweeteners due to its ability to deliver sweetness without affecting blood sugar levels.

The versatility of Stevia in both liquid and powder formulations makes it adaptable for various applications. Additionally, Stevia’s natural source and regulatory approvals in many regions have accelerated its adoption.

Consumer demand for low-calorie and plant-based sweeteners is expected to keep Stevia at the forefront of the market.

The Powder form segment is projected to contribute 45.7% of the market revenue in 2025. Powdered sweeteners have gained popularity due to their ease of use in food processing and formulation consistency. They allow precise control over sweetness intensity and are preferred in bakery, confectionery, and beverage industries.

The stability and longer shelf life of powders compared to liquid forms make them attractive for manufacturers. Furthermore, powdered sweeteners facilitate blending with other ingredients, enabling innovative product development.

As manufacturers seek versatile and easy-to-handle sweetener options, the Powder segment is expected to maintain its market dominance.

The Organic segment is expected to hold 52.3% of the naturally derived sweeteners market revenue in 2025, establishing it as the leading nature category. Consumer preference for organic products has surged due to perceived health benefits and environmental concerns. Organic sweeteners are favored for being free from synthetic pesticides and fertilizers, aligning with clean-label trends.

The organic certification has become a key purchase driver for many consumers, especially in developed markets. Additionally, increasing organic farming practices and certifications have expanded the availability of organic sweeteners.

As the demand for organic ingredients grows across food and beverage sectors, the Organic segment is positioned for sustained growth.

As people become more aware of healthcare options, they are becoming more cognizant of their dietary needs. As a result, customers are moving their preferences toward healthy and natural goods when it comes to food and beverage consumption, supporting the growth of the Naturally Derived Sweeteners Market.

Because of the rising prevalence of diabetes and obesity among consumers around the world, there is a significant increase in demand for low-calorie and sugar-free products, which is expected to boost the growth of the Naturally Derived Sweeteners Market.

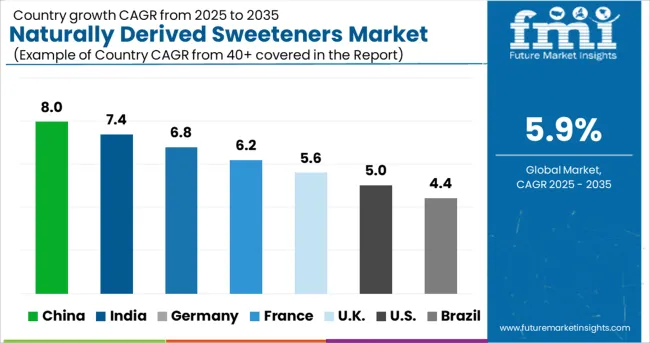

In 2024, East Asia had the largest market share, accounting for 37.8% of the total. Growing demand for stevia products, high availability of raw materials, and increased investment by big corporations are all contributing to this segments’ growth.

The market is being driven by the increased use of low-calorie and sugar-free goods among the diabetic population in the region. Due to reasons such as increased health awareness among consumers and increasing demands for natural sweeteners in beverages and food as well as pharmaceuticals, East Asia is expected to be the fastest

Due to a rising shift in consumer preference toward natural sugar and increased demand for new products from customers, the Food and Beverage industry held the highest share in 2024. The market is developing due to an increase in demand for natural goods in food and beverages as a result of rising health consciousness among consumers.

Because of the growing demand for natural goods in pharmaceuticals and increased research & development efforts, the pharmaceuticals segment is expected to be the fastest expanding category. Natural sweeteners are in high demand in pharmaceuticals due to their non-toxic nature.

Because of the increased demand for low-calorie foods, the stevia category had the biggest share in 2024. Stevia is made up of eleven main steviol glycosides and does not add carbs or calories to the foods or beverages to which it is added. The diabetic population's rising demand for stevia products is propelling the industry forward.

During the projection period 2025 to 2035, coconut sugar is expected to be the fastest expanding category, with a CAGR of 6.4%. This is due to reasons including rising demand for natural goods and increased knowledge of the health advantages of coconut products.

Businesses in the naturally derived sweeteners industry are increasingly more engaged with beginning tactics such as focused marketing, CSR initiatives, and other strategies in order to increase their global significance.

A notable tendency that can be seen across the board is that these businesses are now attempting to handle a certain business-related activity in a nation with favourable legislation so that they are able to save expenses while still employing industry experts at important points in their operations.

Authorities in growing nations such as India, China, Taiwan, and Indonesia, among others, are pursuing policies to entice foreign investors into their manufacturing sectors by cutting trade taxes and levies in order to create more employment.

According to the market research E. I. du Pont de Nemours Company, Archer Daniels Midland Company, Merisant Company, Tate & Lyle PLC, Cargill, Madhava Natural Sweeteners, PureCircle Limited, Herboveda India Pvt. Ltd.

GLG Lifetech Corporation Wisdom Natural Brands (SweetLeaf Stevia), are among the key players in the naturally derived sweeteners market.

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 9.6 Billion |

| Market Forecast Value in 2035 | USD 17 Billion |

| Global Growth Rate | 5.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | MT for Volume and billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania and Middle East and Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, others. |

| Key Market Segments Covered | Nature, From, Product, End Use, and Region |

| Key Companies Profiled | E. I. du Pont de Nemours Company; Archer Daniels Midland Company; Merisant Company; Tate & Lyle PLC; Cargill; Madhava Natural Sweeteners; PureCircle Limited; Herboveda India Pvt. Ltd.; GLG Lifetech Corporation; Wisdom Natural Brands (SweetLeaf Stevia) |

| Pricing | Available upon Request |

The global naturally derived sweeteners market is estimated to be valued at USD 11.4 billion in 2025.

It is projected to reach USD 20.2 billion by 2035.

The market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types are stevia, palm sugar, coconut sugar, honey, maple syrup, monk fruit sugar, agave syrup, lucuma fruit sugar, molasses and natural sweetener blends.

powder segment is expected to dominate with a 45.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Naturally Cultured Beverages Market

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Pine-derived Chemicals Market

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Insect-Derived Proteins in Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine-derived Protein Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Plasma-Derived Drugs Market

Plasma-derived Protein Therapies Market

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA