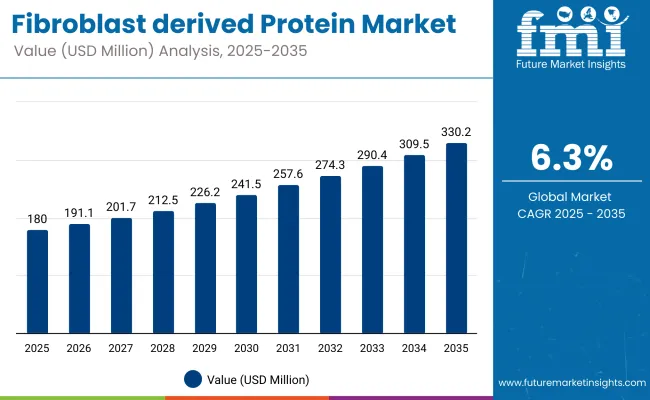

The Fibroblast-Derived Protein Market is expected to record a valuation of USD 180 million in 2025 and USD 330.2 million in 2035, with an increase of USD 150.25 million, representing an 83.47% rise over the decade. This expansion reflects a CAGR of 6.3%, indicating sustained adoption across medical, cosmetic, and regenerative applications.

Fibroblast-Derived Protein Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 180 million |

| Market Forecast Value in (2035F) | USD 330.2 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

During the first five-year period from 2025 to 2030, the market is projected to grow from USD 180 million to USD 241.49 million, adding USD 61.49 million, which accounts for 40.9% of the total decade growth. This phase is expected to witness steady integration into wound healing, anti-aging therapies, and advanced tissue engineering, supported by clinical validation and growing acceptance in high-value healthcare markets. Collagen-based proteins are likely to maintain the largest share during this phase, driven by their proven efficacy and wide therapeutic relevance.

From 2030 to 2035, the market is forecast to increase from USD 241.49 million to USD 330.2 million, contributing USD 88.76 million, or 59.1% of the total growth. This acceleration is anticipated to result from scaling production capacity, expanding into emerging healthcare hubs in South Asia & Pacific, and the adoption of GMP-certified recombinant production systems. Technological advancements in protein stability and delivery mechanisms are expected to enhance clinical outcomes, further broadening the addressable market.

By the end of the decade, the market is likely to exhibit deeper penetration in both developed and emerging regions, with North America (~30% share) and Europe (~28%) remaining core revenue centers, and Asia-Pacific emerging as a strategic growth engine.

From 2020 to 2024, the Fibroblast-Derived Protein Market expanded steadily from niche research applications to broader clinical and cosmetic integration, supported by advances in cell culture systems and recombinant protein technologies.

During this period, market leadership was held by companies with GMP-certified production capabilities, which collectively controlled the majority share by focusing on purity, scalability, and regulatory compliance. The revenue mix was dominated by collagen and elastin proteins for clinical and aesthetic use, while niche proteins such as fibronectin and laminin remained concentrated in specialized research and regenerative projects.

By 2025, demand is expected to reach USD 180 million, with adoption being strengthened by cross-sector usage in wound healing, anti-aging formulations, and regenerative scaffolds. Over the decade, the revenue composition is anticipated to shift toward advanced formulations, recombinant production methods, and region-specific therapeutic adaptations.

Market incumbents are projected to face competition from emerging biotech firms introducing next-generation delivery systems and AI-driven protein stability modeling. The competitive advantage is likely to be redefined by ecosystem integration, cross-disciplinary partnerships, and recurring B2B supply agreements rather than solely by protein sourcing or purity.

Growth in the Fibroblast-Derived Protein Market is being propelled by increasing clinical adoption in regenerative medicine, advanced wound care, and aesthetic dermatology. Scientific validation of fibroblast-derived proteins’ role in cell signaling, tissue regeneration, and collagen synthesis has been widely disseminated, leading to broader acceptance among healthcare providers. Demand is being strengthened by the rise of minimally invasive aesthetic procedures, where bioactive proteins are integrated into topical formulations and injectable solutions to enhance skin repair and elasticity.

The transition toward GMP-compliant recombinant production methods has improved scalability, consistency, and regulatory acceptance, further enabling commercialization. Research expansion in chronic wound management and anti-aging therapies has created a sustained pipeline of innovations, with collaborations between biotech firms and clinical networks accelerating market penetration. Over the forecast period, the convergence of biotechnology advancements, growing patient awareness, and diversified application areas is expected to keep market momentum strong and drive steady revenue expansion globally.

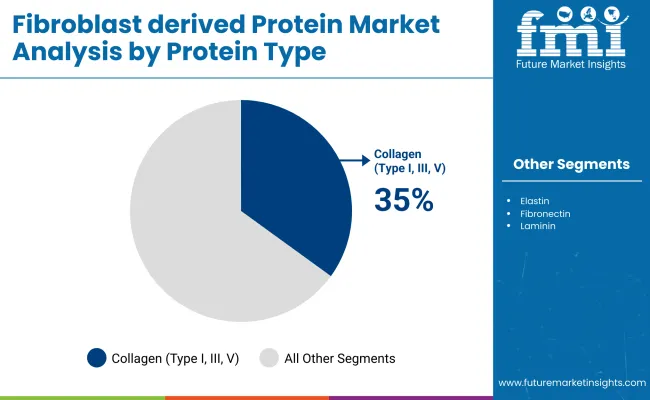

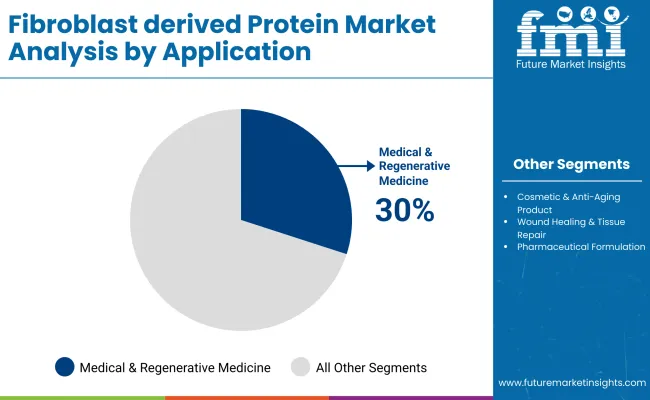

The Fibroblast-Derived Protein Market is segmented by protein type, application, and product form, each providing unique commercial opportunities and growth trajectories. Protein type segmentation captures the diversity of bioactive molecules including collagen, elastin, fibronectin, laminin, and proteoglycans & glycoproteins, each with distinct structural and therapeutic properties. Applications span medical & regenerative medicine, cosmetic & anti-aging products, wound healing & tissue repair, pharmaceutical formulations, and research & biotech, reflecting the market’s multidisciplinary reach.

Product form segmentation comprises purified protein extracts, recombinant protein solutions, lyophilized powders, and hydrogel & scaffold materials, catering to different delivery methods and end-use needs. This framework supports precise demand tracking, investment prioritization, and innovation targeting across clinical, cosmetic, and research domains.

Protein Type Segment Market Value Share, 2025

| Segment | Share (%) |

|---|---|

| Collagen (Type I, III, V) | 35 |

| Elastin | 15 |

| Fibronectin | 12 |

| Laminin | 10 |

| Proteoglycans & Glycoproteins | 28 |

| Segment | CAGR (2025 to 2035) |

|---|---|

| Collagen (Type I, III, V) | 9.00% |

| Elastin | 9.20% |

| Fibronectin | 9.40% |

| Laminin | 9.10% |

| Proteoglycans & Glycoproteins | 9.30% |

Collagen is expected to hold 35% of the market in 2025, retaining its lead due to its proven clinical benefits in tissue repair, skin health, and regenerative medicine. Adoption is supported by strong R&D pipelines and increasing integration into both advanced wound care and high-value cosmetic formulations. Technological advancements in recombinant collagen production are expected to enhance purity, scalability, and ethical sourcing.

Elastin and fibronectin are projected to post above-average CAGRs, reflecting their expanding role in niche regenerative and anti-aging applications. Proteoglycans & glycoproteins will continue to gain traction in bioactive scaffolds and combination therapies, ensuring a diverse revenue base for the segment.

Application Segment Market Value Share, 2025

| Segment | Share (%) |

|---|---|

| Medical & Regenerative Medicine | 30 |

| Cosmetic & Anti-Aging Products | 25 |

| Wound Healing & Tissue Repair | 20 |

| Pharmaceutical Formulations | 15 |

| Research & Biotech | 10 |

| Segment | CAGR (2025 to 2035) |

|---|---|

| Medical & Regenerative Medicine | 9.10% |

| Cosmetic & Anti-Aging Products | 9.30% |

| Wound Healing & Tissue Repair | 9.20% |

| Pharmaceutical Formulations | 8.90% |

| Research & Biotech | 9.00% |

Medical & regenerative medicine is projected to lead with 30% share in 2025, driven by the growing clinical validation of fibroblast-derived proteins in stem cell therapies, orthopedic repair, and chronic wound treatment. Cosmetic & anti-aging applications are forecast to post the fastest growth rate, leveraging increased consumer demand for science-backed topical and injectable solutions.

Wound healing & tissue repair will sustain robust adoption in both hospital and home care settings. Pharmaceutical formulations, while smaller in share, will benefit from targeted drug delivery innovations. Research & biotech will continue to serve as an innovation incubator, accelerating new therapeutic pathways.

Product Form Segment Market Value Share, 2025

| Segment | Share (%) |

|---|---|

| Purified Protein Extracts | 32 |

| Recombinant Protein Solutions | 25 |

| Lyophilized Powders | 23 |

| Hydrogel & Scaffold Materials | 20 |

| Segment | CAGR (2025 to 2035) |

|---|---|

| Purified Protein Extracts | 9.00% |

| Recombinant Protein Solutions | 9.40% |

| Lyophilized Powders | 9.20% |

| Hydrogel & Scaffold Materials | 9.30% |

Purified protein extracts are projected to dominate with 32% share in 2025, reflecting their broad adoption in both research-grade and therapeutic-grade applications. Stability, ease of formulation, and established regulatory pathways underpin their leadership. Recombinant protein solutions are forecast to achieve the highest CAGR, supported by ethical sourcing benefits and scalability in GMP-certified facilities.

Lyophilized powders will remain preferred for long-term storage and global distribution, particularly in emerging markets. Hydrogel & scaffold materials are expected to see sustained demand in regenerative medicine, where integration with fibroblast-derived proteins enhances tissue compatibility and healing efficiency.

Rising regulatory scrutiny and high production costs challenge fibroblast-derived protein adoption, even as demand accelerates in regenerative medicine, advanced wound care, and anti-aging therapeutics for evidence-backed, clinically validated bioactive solutions across diversified healthcare and cosmetic applications worldwide.

Expanding Clinical Applications in Regenerative Medicine

Adoption is being accelerated by increasing integration of fibroblast-derived proteins into regenerative medicine protocols, particularly in chronic wound management, orthopedic repair, and skin grafting. The ability of these proteins to stimulate cell proliferation, enhance extracellular matrix formation, and accelerate healing timelines has been widely documented in peer-reviewed studies. Healthcare systems are prioritizing therapies with strong clinical evidence and measurable patient outcomes, creating a favorable environment for advanced biologics.

Additionally, strategic collaborations between biotechnology companies, research institutions, and healthcare providers are enabling faster translation of laboratory innovations into market-ready products. This clinical credibility is further enhanced by GMP-compliant manufacturing, ensuring quality and safety. Over the forecast period, continued expansion of therapeutic use cases is expected to drive long-term demand and secure fibroblast-derived proteins a central role in next-generation regenerative solutions.

Transition Toward Recombinant Protein Production

A clear shift is underway toward recombinant production of fibroblast-derived proteins, driven by the need for scalable, ethically sourced, and highly consistent bioactive materials. Traditional extraction methods are increasingly being supplemented or replaced by recombinant platforms capable of producing proteins with controlled purity profiles and reduced batch variability. Advances in bioprocessing technology are lowering production costs while maintaining or enhancing functional performance.

This transition also aligns with tightening regulatory expectations for traceability and risk mitigation in biologics manufacturing. The ability to produce tailored protein variants through recombinant engineering is expected to open new therapeutic and cosmetic applications. Over the coming decade, recombinant production is anticipated to dominate supply chains, enabling broader market penetration and accelerating innovation cycles in fibroblast-derived protein applications.

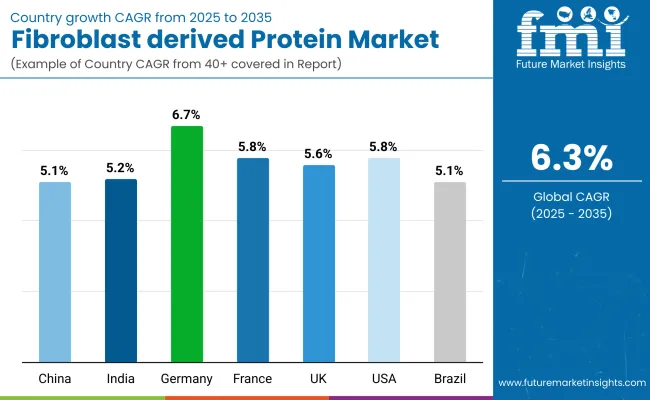

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.12% |

| India | 5.22% |

| Germany | 6.74% |

| France | 5.82% |

| UK | 5.68% |

| USA | 5.85% |

| Brazil | 5.12% |

The global Fibroblast-Derived Protein Market presents a varied growth landscape across leading countries, shaped by differences in healthcare infrastructure, research investment, and adoption readiness. Germany is projected to lead with a CAGR of 6.74%, supported by strong biotech manufacturing capabilities, robust clinical trial activity, and stringent regulatory quality standards.

The USA follows at 5.85% CAGR, driven by early adoption of advanced wound care and aesthetic biologics, alongside the presence of established GMP-certified production facilities. France (5.82%) and the UK (5.68%) are expected to sustain steady growth through innovation-led healthcare policies, rising demand for anti-aging treatments, and well-integrated hospital networks.

In Asia, India (5.22%) is forecast to grow rapidly due to the expansion of medical tourism, increased availability of regenerative therapies, and growing collaborations between private clinics and research bodies. China (5.12%) is anticipated to leverage its scaling biotechnology sector, integration of fibroblast-derived proteins in premium skincare, and localized production efficiencies.

In Latin America, Brazil (5.12%) is projected to expand through niche adoption in high-end healthcare facilities and gradual inclusion in specialized wound care protocols. Over the forecast period, these countries are expected to drive global market expansion, with recombinant protein technology acting as a key enabler for accessibility, cost control, and diversified applications.

| Year | USA |

|---|---|

| 2025 | 43.20 |

| 2026 | 45.7 |

| 2027 | 48.5 |

| 2028 | 51.3 |

| 2029 | 54.2 |

| 2030 | 57.7 |

| 2031 | 60.9 |

| 2032 | 64.8 |

| 2033 | 68.3 |

| 2034 | 71.9 |

| 2035 | 76.3 |

| Year | USA |

|---|---|

| 2025 | 6.69% |

| 2026 | 5.76% |

| 2027 | 6.17% |

| 2028 | 5.73% |

| 2029 | 5.74% |

| 2030 | 6.36% |

| 2031 | 5.63% |

| 2032 | 6.31% |

| 2033 | 5.43% |

| 2034 | 5.32% |

| 2035 | 6.09% |

The Fibroblast-Derived Protein Market in the USA is projected to expand at a CAGR of 5.9% from 2025 to 2035, driven by robust adoption in regenerative medicine, wound healing solutions, and premium aesthetic treatments. Increased investment in biotech R&D and advancements in recombinant protein manufacturing are expected to strengthen supply reliability and expand therapeutic use cases. Hospitals, specialty clinics, and research institutions are progressively integrating fibroblast-derived proteins into protocols for tissue repair and anti-aging treatments. Demand is being further supported by an aging population seeking non-invasive, evidence-backed interventions. Strategic collaborations between biotech companies and clinical networks are likely to accelerate product innovation and market penetration.

The Fibroblast-Derived Protein Market in the UK is projected to grow at a CAGR of 5.68% from 2025 to 2035, supported by a mature clinical research environment and high adoption in aesthetic dermatology. Increased integration into advanced wound healing therapies is anticipated, driven by NHS-supported innovation programs. Collaborations between biotech firms and academic institutions are expected to accelerate new product launches targeting anti-aging and tissue regeneration. Regulatory alignment with EU biologics standards will ensure product quality and market stability.

| Countries / Subregion | 2025 |

|---|---|

| UK | 19.94% |

| Germany | 20.72% |

| Italy | 10.11% |

| France | 13.77% |

| Spain | 11.50% |

| BENELUX | 6.49% |

| Nordic | 5.96% |

| Rest of Europe | 12% |

| Total | 100% |

| Countries / Subregion | 2035 |

|---|---|

| UK | 19.64% |

| Germany | 20.64% |

| Italy | 9.84% |

| France | 12.00% |

| Spain | 10.83% |

| BENELUX | 5.57% |

| Nordic | 5.66% |

| Rest of Europe | 16% |

| Total | 100% |

The Fibroblast-Derived Protein Market in India is forecast to expand at a CAGR of 5.22% during 2025-2035, driven by rising medical tourism, growing availability of specialty clinics, and lower production costs through regional manufacturing. Demand is being supported by adoption in orthopedic repair, chronic wound management, and premium skincare lines. Private healthcare providers are investing in advanced biologics to strengthen competitive positioning. Collaborations between local biotech firms and international research bodies are expected to boost technology transfer and expand product availability.

The Fibroblast-Derived Protein Market in China is projected to achieve a CAGR of 5.12% between 2025 and 2035, supported by strong government investment in biotechnology and growing demand for high-performance cosmetic formulations. Integration into premium skincare products and hospital-based regenerative therapies is rising steadily. Local manufacturing hubs are expanding capacity for GMP-compliant recombinant protein production, improving quality consistency. Partnerships with global biotech leaders are facilitating rapid technology adoption.

The Fibroblast-Derived Protein Market in Germany is expected to grow at a CAGR of 6.74%, the highest among major markets, fueled by strong R&D capabilities and advanced healthcare infrastructure. High adoption in regenerative orthopedics, chronic wound care, and medical aesthetics is anticipated. Regulatory stringency is ensuring consistent product standards, encouraging the adoption of recombinant production technologies. Germany’s role as a European biotech hub is expected to attract investments and foster cross-border partnerships.

| Japan Protein Type | 2025 Share% |

|---|---|

| Collagen (Type I, III, V) | 36% |

| Elastin | 14% |

| Fibronectin | 12% |

| Laminin | 10% |

| Proteoglycans & Glycoproteins | 28% |

| Total | 100% |

| Japan Protein Type | CAGR (2025 to 2035) |

|---|---|

| Collagen (Type I, III, V) | 8.90% |

| Elastin | 9.10% |

| Fibronectin | 9.30% |

| Laminin | 9.00% |

| Proteoglycans & Glycoproteins | 9.20% |

The Fibroblast-Derived Protein Market in Japan is projected at USD 22 million in 2025, with collagen contributing 36% of the market, followed by proteoglycans & glycoproteins at 28%. This structure reflects Japan’s strong emphasis on clinically validated collagen-based therapies in wound healing, regenerative medicine, and anti-aging treatments. Proteoglycans & glycoproteins hold a significant position due to their application in advanced tissue engineering and dermatological formulations. Elastin, fibronectin, and laminin together contribute over one-third of market revenue, supporting diverse clinical and cosmetic applications.

Rising demand is being driven by Japan’s aging population, which is increasing the need for regenerative and anti-aging solutions. Investments in recombinant protein production are enhancing scalability and ethical sourcing, aligning with domestic regulatory standards. Additionally, collaborations between Japanese research institutions and biotech firms are accelerating innovation in delivery systems and formulation stability. As the market evolves, a shift toward customized protein blends and precision-targeted therapies is expected to strengthen Japan’s position in the global market.

| South Korea Application | 2025 Share% |

|---|---|

| Medical & Regenerative Medicine | 31% |

| Cosmetic & Anti Aging Products | 26% |

| Wound Healing & Tissue Repair | 20% |

| Pharmaceutical Formulations | 14% |

| Research & Biotech | 9% |

| Total | 100% |

| South Korea Application | CAGR (2025 to 2035) |

|---|---|

| Medical & Regenerative Medicine | 9.00% |

| Cosmetic & Anti Aging Products | 9.20% |

| Wound Healing & Tissue Repair | 9.10% |

| Pharmaceutical Formulations | 8.80% |

| Research & Biotech | 8.90% |

The Fibroblast-Derived Protein Market in South Korea is projected at USD 15 million in 2025, with medical & regenerative medicine leading at 31% market share. This dominance reflects South Korea’s robust clinical infrastructure and emphasis on innovative regenerative therapies, supported by strong public and private investment.

Cosmetic & anti-aging products hold 26%, underpinned by the country’s global leadership in aesthetic dermatology and premium skincare exports. Wound healing & tissue repair applications, at 20%, benefit from advanced hospital care systems and early adoption of biologically active dressings. Pharmaceutical formulations and research & biotech segments, together accounting for 23%, are expected to expand steadily through academic collaborations and government-supported biotech initiatives.

Market momentum is anticipated to accelerate through the integration of fibroblast-derived proteins into combination therapies, alongside advances in recombinant protein production that ensure scalability, purity, and compliance with export markets. With strong domestic demand and significant global influence in cosmetic science, South Korea is expected to remain a critical hub for both innovation and commercialization in this sector.

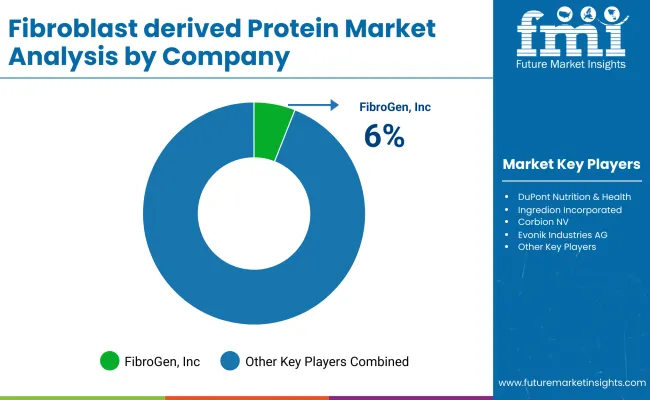

The market is characterized as moderately fragmented, with established biologics players, regenerative-medicine specialists, and cosmetic active suppliers competing across clinical, aesthetic, and research channels. Scale advantages are being realized where GMP-grade capacity, recombinant platforms, and validated QC assays are maintained.

Portfolio breadth across collagen, proteoglycans, and fibroblast-conditioned factors is being leveraged to secure multi-year supply agreements with clinics and OEM formulators. Downstream integration into hydrogels, scaffolds, and topical systems is being prioritized, while evidence generation and post-market surveillance are being expanded to support reimbursement and premium pricing.

Among the companies you listed, participation is considered relevant to fibroblast-derived or collagen/ECM-linked products and technologies: Sederma (Croda) in cosmetic bioactives; CollPlant in recombinant human collagen; Organovo in biofabrication enabling protein-rich tissues; Fibrocell Science and Histogen in fibroblast/growth-factor solutions; Collagen Solutions plc in medical-grade collagen; RepliCel, TissueGenesis, and Cytograft in cell-based/regenerative platforms; FibroGen in fibrosis biology and enabling assets.

Future competitiveness is expected to shift toward recombinant production, traceable cell-bank workflows, and co-development with device and dressings partners. Companies that align protein functionality with delivery systems (hydrogels, scaffolds, injectables) and digital evidence (RWD/RWE) are expected to outpace the field.

Key Developments in 2025

| Item | Value |

|---|---|

| Quantitative Units | USD 180 Million (2025) - USD 330.2 Million (2035) |

| Component | Protein Types: Collagen, Elastin, Fibronectin, Laminin, Proteoglycans & Glycoproteins |

| Application | Medical & Regenerative Medicine, Cosmetic & Anti-Aging Products, Wound Healing & Tissue Repair, Pharmaceutical Formulations, Research & Biotech |

| Product Form | Purified Protein Extracts, Recombinant Protein Solutions, Lyophilized Powders, Hydrogel & Scaffold Materials |

| End-use Industry | Hospitals & Clinics, Pharmaceutical Companies, Cosmetic & Personal Care Brands, Research Institutes, Biotechnology Firms |

| Regions Covered | North America, Europe, South Asia & Pacific, East Asia, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Thermo Fisher Scientific (PeproTech), Merck KGaA (Sigma-Aldrich), Bio- Techne (R&D Systems), Advanced BioMatrix, CollPlant Ltd., Histogen, Inc., Fibrocell Science, Inc., Organovo Holdings, Inc., Sederma (Croda Group), Collagen Solutions plc, Cytograft Tissue Engineering, TissueGenesis |

| Additional Attributes | Dollar sales by protein type and application, adoption trends in regenerative medicine and cosmetic dermatology, rising demand for recombinant proteins for scalability and purity, sector-specific growth in wound care and anti-aging, integration with hydrogel and scaffold technologies, regional trends influenced by regulatory approvals and aging demographics, innovations in protein stabilization, delivery systems, and biofabrication methods. |

The global Fibroblast-Derived Protein Market is estimated to be valued at USD 180 million in 2025.

The market size for the Fibroblast-Derived Protein Market is projected to reach USD 330.2 million by 2035.

The Fibroblast-Derived Protein Market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in the Fibroblast-Derived Protein Market are Collagen, Elastin, Fibronectin, Laminin, and Proteoglycans & Glycoproteins.

In terms of protein type, Collagen is expected to command 35% share in the Fibroblast-Derived Protein Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fibroblast Growth Factor Receptor (FGFR) Inhibitor Market - Growth & Forecast 2025 to 2035

Analysis and Growth Projections for Pine-derived Chemicals Market

Waste-derived Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Plant-Derived Hyaluronic Acid Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Derived Ceramide Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cocoa-Derived Peptides For Skin Repair Market Size and Share Forecast Outlook 2025 to 2035

Yeast-derived Collagen Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Global Plant-Derived Analgesics Market Outlook – Growth, Demand & Forecast 2025–2035

Plant Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Plasma-Derived Drugs Market

Insect-Derived Proteins in Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Marine Derived Proteins Market Size and Share Forecast Outlook 2025 to 2035

Marine-derived Protein Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Plasma-derived Protein Therapies Market

Coconut Derived Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Seaweed Derived Minerals Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA