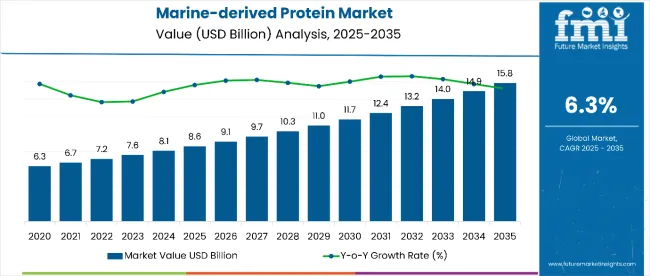

The marine-derived protein market is estimated to be valued at USD 8.6 billion in 2025 and is projected to reach USD 15.8 billion by 2035, registering a CAGR of 6.3% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 7.2 billion over the forecast period.

| Metric | Value |

|---|---|

| Marine-derived Protein Market Estimated Value (2025E) | USD 8.6 billion |

| Marine-derived Protein Market Forecast Value (2035F) | USD 15 .8 billion |

| Forecast CAGR (2025-2035) | 6.3% |

This reflects a 1.84 times growth at a compound annual growth rate of 6.3%. Market expansion will be supported by rising demand for sustainable protein alternatives, growing health awareness, and expanding applications across food, pharmaceutical, and skincare industries.

By 2030, the market is likely to reach USD 11.7 billion, accounting for USD 3.1 billion in incremental value over the first half of the period. The remaining USD 4.1 billion is expected during the second half, indicating a balanced yet steady growth pattern. The absolute dollar growth in the market between 2025 and 2035 is projected to be USD 10.37 billion.Product adoption is accelerating due to marine-derived proteins’ superior nutritional profile, functional properties, and diverse applications compared to conventional protein sources.

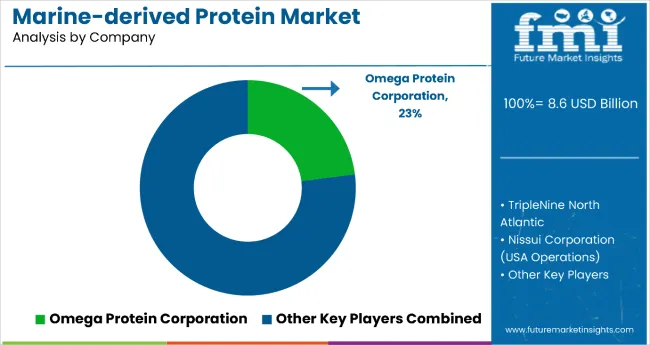

Companies such as Omega Protein Corporation, TripleNine North Atlantic, Nissui Corporation (USA Operations), Scanbio Marine Group, and Biomega AS are strengthening their competitive positions through investments in advanced extraction technologies and value-added protein formulations. Growth opportunities remain anchored in enzymatic hydrolysis (40% share), organic certifications, and sustainable marine resource utilization, which continue to drive adoption across end-user industries including food & beverages (31%), pharmaceuticals, and cosmetics & skincare.

The market holds 40% of the alternative protein market, driven by its high nutritional value, bioactive peptides, and superior digestibility compared to conventional proteins, making it attractive for health-conscious consumers. It accounts for around 31% of the food & beverage protein applications market, supported by its growing role in fortified foods, dietary supplements, and functional beverages.

The market contributes nearly 23% to the marine-based nutraceuticals segment, particularly for value-added products such as hydrolysates, isolates, and concentrates. It holds close to 40% of the protein hydrolysis technology applications market, where enzymatic hydrolysis ensures high-quality protein fractions with biofunctional properties. The share in the sustainable protein market reaches about 29%, reflecting its rising preference among industries seeking eco-friendly, traceable, and renewable protein sources.

The market is undergoing structural transformation, driven by rising demand for sustainable protein alternatives and expanding applications in food, pharmaceuticals, and cosmetics. Advanced extraction technologies such as enzymatic hydrolysis, supercritical fluid extraction, and high-pressure processing have enhanced protein quality, bioavailability, and functionality. Manufacturers are introducing specialized protein concentrates, isolates, and hydrolysates tailored for food fortification, skincare formulations, and dietary supplements, expanding their role beyond conventional marine protein applications

Marine-derived proteins are gaining traction due to their superior nutritional quality, bioactive compounds, and sustainable sourcing potential compared to conventional proteins. Fish, shellfish, algae, and marine invertebrates offer proteins rich in essential amino acids, peptides, and omega-3 fatty acids, making them highly attractive for health-conscious consumers and industries seeking functional protein solutions.

The market is expanding as food and beverage manufacturers increasingly adopt marine proteins for fortification in functional foods, supplements, and beverages. Rising demand for clean-label, natural, and eco-friendly ingredients supports adoption across global markets, particularly in regions with strong consumer focus on health and sustainability.

Additionally, government initiatives promoting sustainable marine resource utilization and stricter regulations on traditional protein sources are driving industries toward alternative proteins. With India, China, and Japan emerging as key growth countries and major companies like Omega Protein Corporation and Nissui Corporation investing in advanced processing and product innovation, the marine-derived protein market outlook remains highly favorable.

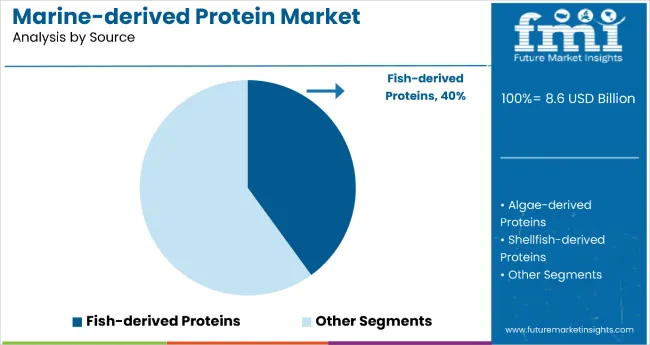

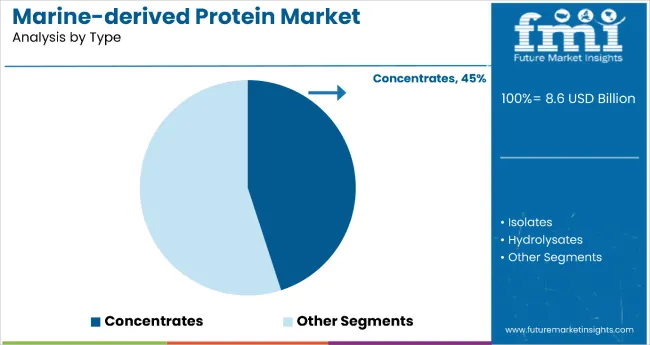

The market is segmented by source, type, end-user, extraction technique, and region. By source, the market is divided into fish-derived proteins, algae-derived proteins, shellfish-derived proteins, and marine invertebrate proteins. Based on type, the market is segmented into concentrates, isolates, hydrolysates.

In term of end-user, the market is categorized into food and beverage industry, pharmaceutical industry, cosmetics and skincare industry. By extraction technique, the market is divided into enzymatic hydrolysis, supercritical fluid extraction, high-pressure processing (HPP), ultrasound-assisted extraction, microwave-assisted extraction. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Fish-derived proteins account for 40% of the marine-derived protein market in 2025, making them the leading source segment, far ahead of algae, shellfish, and marine invertebrate proteins which remain more niche.Among all source segments, fish-derived proteins are the most lucrative in the marine-derived protein market for 2025. They are highly valued for their complete essential amino acid profile, high digestibility, and functional health benefitssuch as supporting muscle growth, heart health, and immune function.

Fish proteins' versatility enables their use in premium nutritional supplements, functional foods, cosmetics, and pharmaceuticals. This segment’s dominance is also powered by expanding aquaculture, advances in extraction and hydrolysis technology, and the widespread availability of fish by-products, making production cost-effective and sustainable.Additionally, growing regulatory support for sustainable fishing practices and circular economy approaches further enhances the fish-derived protein segment’s growth potential, ensuring a steady supply of raw materials and encouraging innovation across the value chain.

The protein concentrates segment is the most lucrative in the market, accounting for 45% of the total market share. Concentrates are highly preferred due to their cost-effectiveness, versatility, and ease of use across multiple applications, including food and beverages, dietary supplements, and animal feed. The rising demand for plant-based protein concentrates, such as soy, pea, and algae-derived options, is fueled by increasing health consciousness, vegan and flexitarian diet adoption, and a focus on functional foods.

In the food industry, concentrates enhance texture, protein content, and nutritional value in meat alternatives, dairy, and bakery products. North America and Europe dominate consumption, supported by established manufacturing infrastructure and strong consumer awareness. Overall, concentrates continue to lead the market, driven by affordability, functionality, and alignment with sustainable dietary trends.

From 2025 to 2035, food, beverage, and nutraceutical companies are increasingly adopting advanced formulation and processing technologies to enhance protein bioavailability, functional performance, and product stability. This trend positions marine protein suppliers offering high-purity, sustainably sourced proteins as key partners in supporting next-generation functional foods, dietary supplements, and specialized nutrition products.

Rising Health & Nutraceutical Innovation Drives Marine Protein Market Growth

The growing consumer focus on health, wellness, and protein-enriched diets has been identified as the primary catalyst for growth in the marine protein market. In 2024, innovative applications in functional beverages, protein bars, and alternative protein foods prompted manufacturers globally to incorporate marine-derived proteins into diverse formulations. By 2025, companies were expected to expand product portfolios with enhanced solubility, digestibility, and bioactive peptide content to meet rising demand for high-quality protein sources.

These developments indicate that consistent product innovation and health-driven consumer demand, rather than short-term trends, are fueling procurement cycles. Suppliers providing sustainably sourced, high-purity marine proteins with proven nutritional benefits are therefore well-positioned to capture sustained demand from food and supplement manufacturers.

Advanced Processing Integration Creates Market Expansion Opportunity

In 2024, manufacturers began integrating enzymatic hydrolysis, microfiltration, and other advanced extraction technologies with marine protein production to improve solubility, flavor profile, and functional performance in food and nutraceutical applications. By 2025, marine protein concentrates, isolates, and hydrolysates were increasingly incorporated into sports nutrition, functional beverages, and fortified foods, enabling superior nutritional quality and product appeal.

These implementations demonstrate that when advanced processing technologies are applied to marine-derived proteins, product functionality and consumer acceptance are significantly enhanced. Companies that adopt high-quality marine proteins with proven functional and nutritional benefits are being positioned to gain competitive advantage, offering superior protein-enriched products that meet health-conscious and sustainable consumption trends.

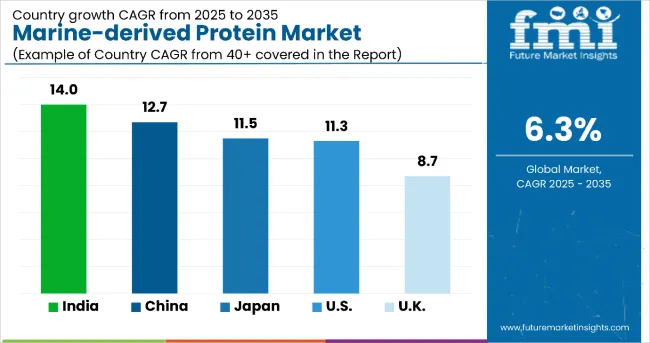

| Countries | CAGR (%) |

|---|---|

| India | 14% |

| China | 12.7% |

| Japan | 11.5% |

| United States | 11.3% |

| United Kingdom | 8.7% |

India leads the marine-derived protein market with the highest CAGR of 14%, driven by strong aquaculture growth and rising health awareness. China follows with a 12.7% CAGR, supported by its vast seafood processing capabilities and expanding middle-class demand for functional supplements. Japan’s market grows at 11.5%, focusing on premium proteins for clinical nutrition and aging populations. The USA shows an 11.3% CAGR, fueled by sports nutrition and clean-label protein trends. The UK has a steady growth of 8.7%, driven by sustainability and increasing functional food consumption. These growth rates highlight differing market dynamics and regional focuses globally.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Demand for marine-derived protein in India is expanding rapidly with a CAGR of 14%, propelled by rising health awareness and increased demand for functional and sustainable proteins. The country’s growing aquaculture and marine farming sectors provide a stable supply of raw materials, complemented by strong government support for sustainable fishery practices. Marine proteins are increasingly integrated into nutraceuticals, food, and pharmaceutical applications across urban and emerging markets.

Additionally, growing export potential strengthens India’s global market presence. Advancements in processing technologies and improved cold-chain logistics are enhancing product quality and distribution efficiency. With a large, cost-competitive labor force, India is poised to become a key player in the global marine protein industry. Consumer preference for natural and clean-label products further accelerates market expansion.

Revenue from marine-derived protein in China is experiencing robust growth with a CAGR of around 12.7%, driven by its extensive seafood processing infrastructure and rapidly growing domestic consumption. Significant investments in research and development have improved the extraction and purification technologies, bringing higher quality products to market.

The government’s emphasis on food safety and nutrition supports consumer confidence and product innovation. China dominates as a global exporter, supplying marine proteins worldwide. Urbanization, increasing incomes, and rising demand for health supplements contribute to accelerated consumption patterns. The middle class’s growing inclination toward functional and dietary supplements further fuels growth. Moreover, strengthening cold storage and logistics infrastructure facilitates broader market reach.

Sales of marine-derived protein in Japan are characterized by steady growth with a CAGR of about 11.5%, supported by high demand for premium hydrolysates used in clinical nutrition and sports supplements. The country’s aging population drives the need for easily digestible, bioactive proteins promoting wellness and longevity. Japan is a leader in marine protein R&D, continuously innovating with advanced extraction methods and functional formulations. Cultural preferences emphasize clean-label and high-quality products, strengthening demand for specialty marine proteins. Established supply chains and strong collaboration between industry and academia aid product development. Consumers increasingly favor products with proven health benefits, driving adoption in both medical and general food sectors.

The USA marine-derived protein market is growing with a CAGR of nearly 11.3%, fueled by health-conscious consumers and rising demand for sports nutrition and therapeutic foods. Greater awareness of sustainable and clean-label protein sources complements a robust regulatory environment ensuring high safety and quality standards. Market players invest heavily in innovation to deliver specialized marine protein formulations addressing lifestyle-related health concerns.

Expanding distribution channels including health stores and e-commerce platforms widen consumer reach. The growing prevalence of lifestyle diseases enhances the demand for functional proteins with anti-inflammatory and recovery benefits. Furthermore, increasing partnerships between marine biotech companies and food manufacturers provide growth opportunities. Producers are also focusing on transparency and traceability to boost consumer trust and loyalty.

Sales of marine-derived protein in the UK are steadily developing with a CAGR close to 8.7%, driven by increasing consumer focus on health, sustainability, and environmental consciousness. Functional foods and dietary supplements incorporating marine proteins are gaining traction amid a growing vegan and vegetative consumer base. Government policies promoting sustainable seafood harvesting and marine biotechnology innovation provide a supportive environment for market growth. Collaborative efforts between research institutions and industry players foster development of new marine protein applications in food and cosmetics sectors. The retail landscape evolves to offer greater availability of marine protein products through both physical and online stores. Consumers increasingly seek products with environmental credentials and proven health benefits.

The market is moderately consolidated, characterized by a mix of established global suppliers and specialized regional players with distinct extraction capabilities and application focuses. Key leaders such as Marine Biotech, Ocean Health Ingredients, and Croda International dominate the high-purity segment, delivering premium marine proteins for nutraceuticals, functional foods, and pharmaceutical uses. Their strength lies in advanced extraction and purification technologies as well as strong regulatory compliance frameworks that meet stringent quality standards.

Companies like Nuctech and Seagreens differentiate through tailored product offerings, including customized hydrolysates and isolates for targeted health benefits in sports nutrition and medical nutrition sectors. Large producers such as CP Ingredients and Seapeptides focus on scalable, cost-efficient production methods to satisfy the growing demand for food-grade and cosmetic applications of marine proteins.Regional players, including Indian Ocean Proteins and AquaMarine Solutions, leverage local marine resources and market knowledge to provide dependable supply chains and specialized formulations for domestic and regional markets.

High entry barriers persist due to technological complexities in protein isolation and hydrolysis, rigorous regulatory approval processes, and the requirement for consistent quality assurance across diverse applications. Competitive advantage increasingly hinges on extraction purity, bioactive efficacy validation, sustainability credentials, and compliance with global food and pharmaceutical regulations.

| Item | Details |

| Quantitative Units (2025) | USD 8.6 billion |

| Source | Fish -derived Proteins , S hellfish -derived Proteins , A lgae -derived Proteins , Marine Invertebrate Proteins |

| Type | Concentrates, Isolates, a nd Hydrolysates |

| End User | Food And Beverage Industry, Pharmaceutical Industry, a nd Cosmetics a nd Skincare Industry. |

| Extraction Technique | Enzymatic Hydrolysis, Supercritical Fluid Extraction, High-Pressure Processing (HPP), Ultrasound-Assisted Extraction, Microwave-Assisted Extraction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa , Australia and 40+ countries |

| Key Companies Profiled | CP Kelco , Omega Protein Corporation, Aroma NZ Ltd., Hofseth BioCare ASA, GC Rieber Oils, Scanbio Marine Group, Golden Omega, Marine Ingredients, Sea Run Holdings Inc., Arctic Nutrition AS, and CP Kelco |

| Additional Attributes | Growing health consciousness, sustainability focus, innovations in extraction & purification, increasing use in nutraceuticals, pharmaceuticals, cosmetics, functional foods |

The global marine-derived protein market is estimated to be valued at USD 8.6 billion in 2025.

The marine-derived protein market size is projected to reach USD 15.8 billion by 2035.

The marine-derived protein market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The concentrates segment is projected to lead the marine-derived protein market with 45% market share in 2025.

The fish-derived proteins segment is expected to account for 40% share of the marine-derived protein market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA