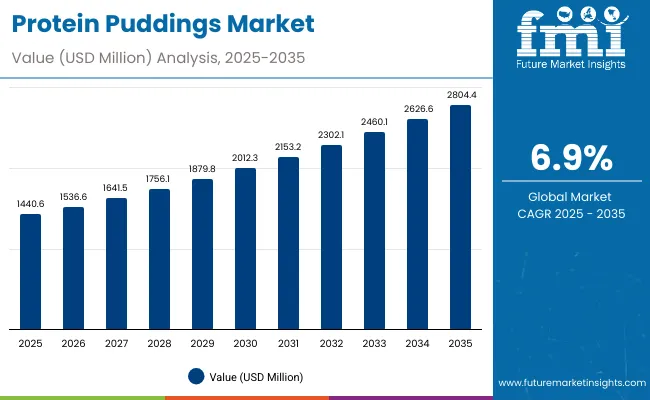

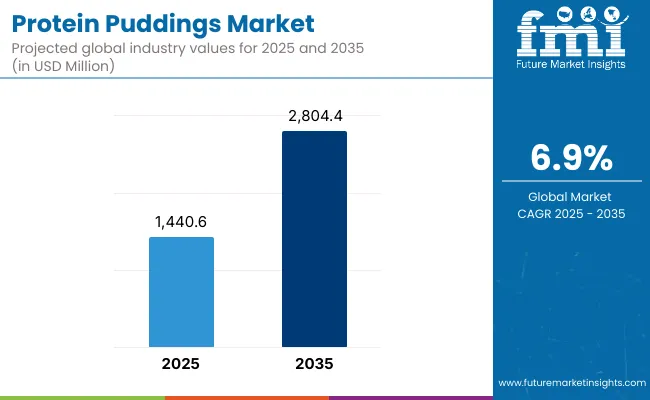

The Protein Puddings Market is projected to be valued at USD 1,440.6 million in 2025 and is forecasted to reach USD 2,804.4 million by 2035. This growth represents an increase of USD 1,363.8 million over the decade, translating to a nearly 2X expansion and a compound annual growth rate (CAGR) of 6.9%. A steady climb in high-protein functional foods particularly within the dairy and plant-based pudding space is anticipated to fuel this trajectory.

Protein Puddings Market Key Takeaways

| Metric | Value |

|---|---|

| Protein Puddings Estimated Value in (2025E) | USD 1,440.6 million |

| Protein Puddings Forecast Value in (2035F) | USD 2,804.4 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

Between 2025 and 2030, the market is expected to rise from USD 1,440.6 million to approximately USD 2,012.3 million, marking an addition of USD 571.7 million, or 42% of the total decade-long growth. During this initial phase, early-stage innovation in protein fortification, combined with premium product positioning, is expected to shape consumer uptake. Higher demand across North America and Europe is likely to be observed as sports nutrition and wellness segments continue to converge with indulgent formats.

In the subsequent period from 2030 to 2035, a sharper growth curve is forecasted, with the market increasing from USD 2,012.3 million to USD 2,804.4 million, adding USD 792.1 million, which constitutes 58% of total growth. This acceleration is expected to be driven by widespread mainstreaming of protein puddings into meal replacement routines and the incorporation of hybrid animal-plant protein systems. Regional expansion, clean-label innovation, and digital retail channels are projected to further elevate value capture across the latter half of the forecast window.

From 2020 to 2024, the Protein Puddings Market experienced sustained momentum as high-protein, low-sugar indulgent foods gained broader acceptance among fitness-focused, weight-conscious, and aging consumers. During this phase, the competitive landscape was dominated by established dairy players, who accounted for over 60% of market revenue, leveraging their processing capabilities and distribution networks. Product innovation during this period was focused on dairy-based RTE cups, with clean-label claims and digestive wellness enhancements serving as differentiators. Plant-based and hybrid formulations remained in nascent stages, contributing less than 15% of total sales.

By 2025, demand is projected to reach USD 1,440.6 million, with consumer expectations shifting toward personalization, functional fortification (e.g., probiotics, fiber), and digital engagement. Over the next decade, value migration is expected toward plant-forward, on-the-go, and direct-to-consumer (DTC) models. Legacy brands are now pivoting to retain relevance through flavor diversification, packaging innovation, and e-commerce integration. Meanwhile, digitally native brands with agile formulation cycles and strong influencer marketing presence are capturing share. The basis of competitive advantage is moving from distribution scale alone to product experience, functional utility, and brand trust. Recurring revenue via subscriptions, loyalty programs, and personalized wellness bundling is expected to define the next wave of market leadership.

Significant growth in the Protein Puddings Market has been driven by a convergence of health-conscious consumer behavior, functional snacking trends, and protein fortification innovation. A shift toward high-protein, low-sugar indulgent foods has been widely observed, as consumers increasingly seek balanced nutrition without compromising on taste or convenience. This demand has been reinforced by the expansion of fitness lifestyles, weight management routines, and aging populations seeking muscle maintenance and satiety-enhancing diets.

Enhanced accessibility through supermarkets, online retail, and direct-to-consumer platforms has been strategically leveraged to expand reach across both urban and rural demographics. Technological advancements in formulation science have allowed for improved texture, taste masking, and protein blending-particularly in ready-to-eat and refrigerated pudding formats. Blended proteins and plant-based alternatives are also being adopted to cater to vegan, lactose-intolerant, and allergen-sensitive consumers.

Retailers and manufacturers have responded by investing in clean-label, low-carb, and functional SKUs, which are being actively positioned as meal replacements, post-workout snacks, or healthy desserts. Flavor diversification and convenience packaging formats are being employed to stimulate trial and repeat purchases. As regulatory clarity and consumer education improve, sustained market growth is expected to be supported by innovation pipelines, global expansion strategies, and cross-category hybridization with nutraceuticals and sports nutrition products.

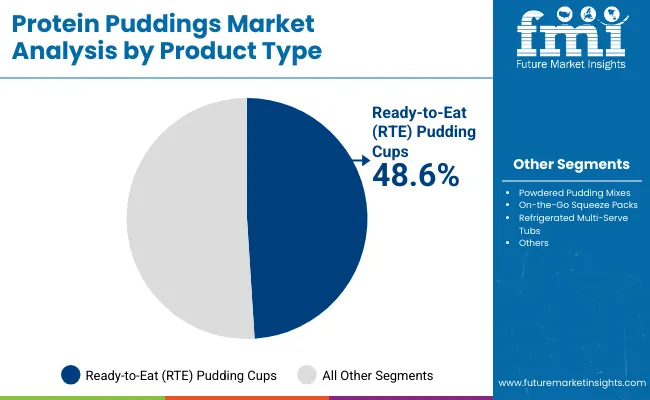

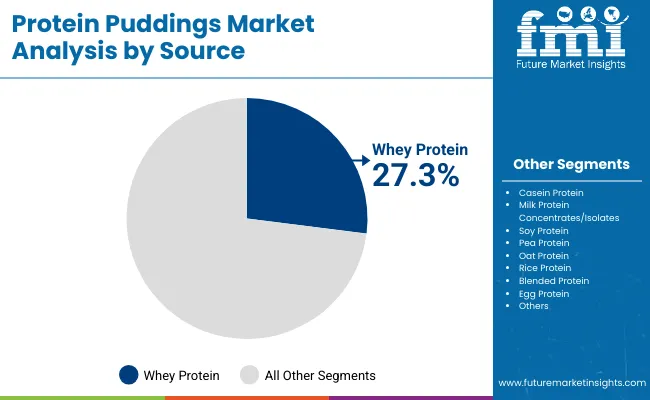

The Protein Puddings Market has been segmented based on product type, source, end user, flavor, distribution channel, and region. Among these, product type, source, and end user have emerged as foundational dimensions shaping market growth and innovation. Product segmentation has reflected the varying consumption preferences for convenience, indulgence, and dietary compliance, with ready-to-eat formats continuing to dominate shelves and innovation pipelines. On the basis of Source, a diverse range of dairy and plant-based proteins has been deployed to cater to shifting consumer dietary patterns. Meanwhile, the End User segment has demonstrated strong performance as personalized nutrition and sports-based formulations have been aligned with specific consumer demographics. These segments have been closely analyzed to understand current dominance and future potential, as demand continues to diversify across performance-driven, lifestyle-oriented, and health-critical consumer groups.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Ready-to-Eat (RTE) Pudding Cups | 48.6% |

| Powdered Pudding Mixes | 21.7% |

Ready-to-Eat (RTE) Pudding Cups are projected to account for 48.6% of the Protein Puddings Market in 2025, maintaining their dominance due to convenience and mass appeal. Strong adoption has been observed among active and health-conscious consumers, particularly those seeking protein-rich snacks that require no preparation. The segment’s expansion has been supported by advances in packaging, extended shelf stability, and clean-label ingredient integration. As manufacturers continue to enhance flavor and texture profiles while maintaining nutritional claims, sustained demand is expected. The rise of subscription-based DTC models and increased placement in supermarkets and gyms has further reinforced segment penetration. Given evolving consumer lifestyles and the demand for functional indulgence, RTE Pudding Cups are likely to remain the anchor format of the market.

| Source | 2025 Share% |

|---|---|

| Whey Protein | 27.3% |

| Casein Protein | 14.6% |

| Milk Protein Concentrates/Isolates | 13.9% |

Whey Protein is expected to hold the highest share at 27.3% in 2025, attributed to its superior digestibility, amino acid profile, and widespread consumer trust. Long favored in sports and clinical nutrition, whey-based formulations have been extended into indulgent protein snacks such as puddings. The segment’s performance has been driven by its compatibility with dairy bases, favorable texture outcomes, and recognized efficacy in muscle recovery. While plant-based alternatives are gaining ground, whey continues to serve as the protein of choice for high-performance products. Innovations in filtration and flavor masking have further enhanced its versatility. Continued dominance is likely as mainstream consumers prioritize scientifically backed protein sources, although hybrid blends and clean-label plant options may gradually dilute its share over time.

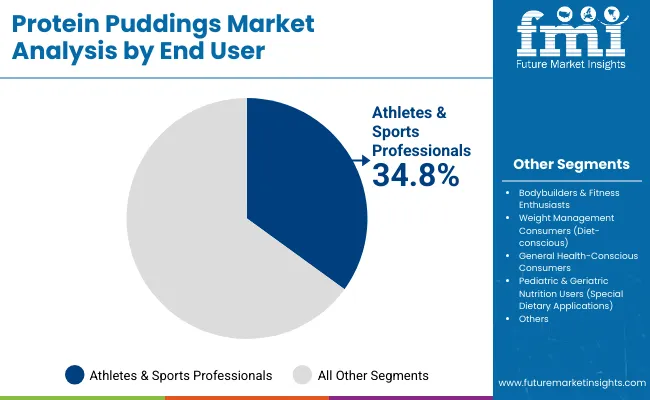

| End User | 2025 Share% |

|---|---|

| Athletes & Sports Professionals | 34.8% |

| Bodybuilders & Fitness Enthusiasts | 25.8% |

| Weight Management Consumers (diet-conscious) | 18.3% |

Athletes and Sports Professionals are projected to represent 34.8% of the market in 2025, establishing themselves as the largest consumer base. Performance-driven nutritional needs have fueled consistent uptake of protein puddings as a post-exercise recovery snack or muscle support supplement. This segment has benefited from targeted marketing, clinical claims, and placement within fitness retail environments. On-the-go formats such as RTE cups and squeeze packs have been optimized for convenience post-training, while high-protein, low-carb formulations have been prioritized. As performance nutrition becomes increasingly mainstream, the boundaries between athlete-focused and lifestyle segments are expected to blur. However, product lines tailored specifically for this group are anticipated to retain a premium positioning, with new ingredient integrations and clinical endorsements driving continued engagement.

While demand continues to accelerate across health, wellness, and sports nutrition segments, challenges around taste masking, protein stability, and clean-label claims have been observed. Still, the market is being shaped by the growing integration of functional foods into daily routines and the rise of hybrid protein formats tailored to evolving dietary preferences.

Functional Snacking Becoming a Core Consumer Behavior

The incorporation of protein-enriched puddings into daily eating patterns has been accelerated by growing demand for functional snacking. These products are no longer being positioned solely as post-workout options but are now being consumed across breakfast, midday, and evening snacking occasions. The rise of time-compressed lifestyles, combined with higher consumer awareness around satiety and muscle maintenance, has fueled this trend. Health-aware consumers are actively seeking portable, nutritionally dense snacks that align with their macronutrient goals. As indulgence and nutrition converge, protein puddings have been embraced as a bridge category that satisfies both emotional and dietary needs. Continued investment in product formats and retail placements is expected to amplify functional snacking as a key market driver.

Blended and Alternative Protein Sources Gaining Momentum

A shift toward diversified protein sourcing has been observed, with blended dairy-plant formulations and egg or rice protein alternatives being explored. This trend has been catalyzed by growing interest in allergen-free, vegan, and sustainable protein sources. Blended protein systems have been utilized to improve texture, flavor neutrality, and cost-efficiency, while appealing to flexitarian consumers. As label scrutiny intensifies, manufacturers are expected to innovate with combinations that balance efficacy, taste, and digestibility.

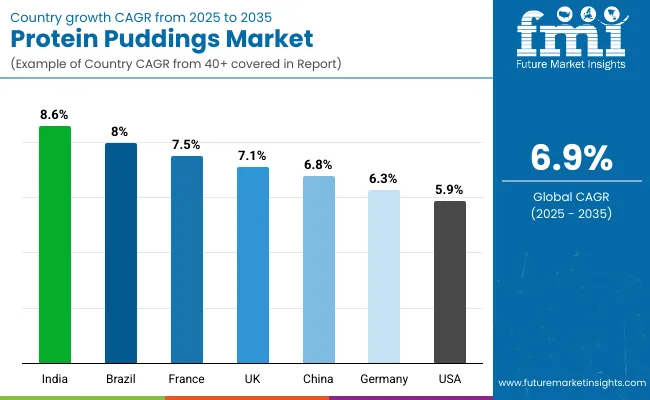

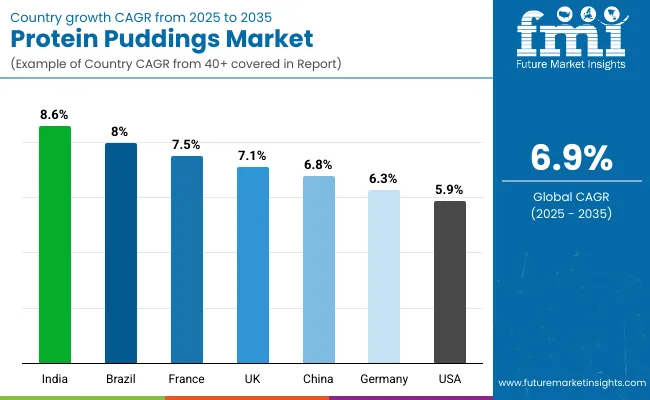

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.8% |

| India | 8.6% |

| Germany | 6.3% |

| France | 7.5% |

| UK | 7.1% |

| USA | 5.9% |

| Brazil | 8.0% |

The global Protein Puddings Market has been shaped by significant cross-country differences in health awareness, nutritional infrastructure, and sports nutrition adoption. Accelerated expansion has been observed across emerging economies, where the fusion of convenience and protein fortification is being embraced across demographics. Asia-Pacific has been identified as the most dynamic region, with India expected to grow at 8.6% CAGR, fueled by rising health consciousness, an expanding fitness ecosystem, and increased availability of protein-enriched dairy and plant-based products. In China, growth at 6.8% CAGR is being driven by a shift in consumer dietary patterns, urbanization-led snacking behavior, and domestic innovations in functional foods targeting younger consumers.

In Europe, consistent growth is being supported by high product awareness, structured retail penetration, and evolving regulatory support for protein claims. France (7.5%), the UK (7.1%), and Germany (6.3%) are forecasted to maintain upward trajectories, driven by clean-label demand, rising flexitarianism, and premiumization of protein puddings within grocery and pharmacy channels.

In Brazil, an 8.0% CAGR is expected as middle-class consumers increasingly adopt protein-rich formats for weight management and fitness. Meanwhile, the USA will grow at 5.9% CAGR, supported by strong DTC brands and clinical positioning of protein puddings, though growth will remain moderate due to market maturity and saturation in sports nutrition SKUs.

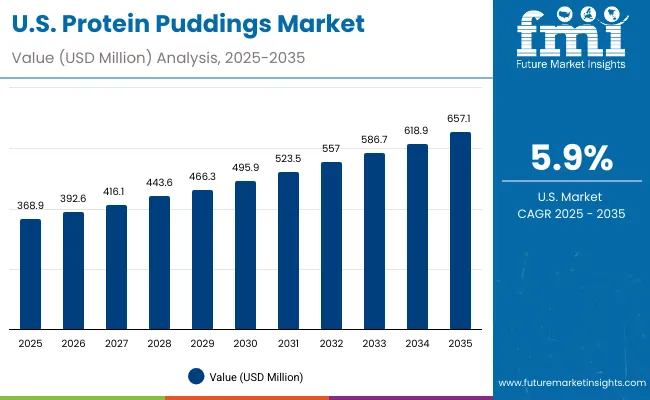

| Year | USA Protein Puddings Market (USD Million) |

|---|---|

| 2025 | 368.9 |

| 2026 | 392.6 |

| 2027 | 416.1 |

| 2028 | 443.6 |

| 2029 | 466.3 |

| 2030 | 495.9 |

| 2031 | 523.5 |

| 2032 | 557.0 |

| 2033 | 586.7 |

| 2034 | 618.9 |

| 2035 | 657.1 |

The Protein Puddings Market in the United States is projected to grow at a CAGR of 5.9% from 2025 to 2035. Growth has been propelled by rising consumer emphasis on high-protein, low-sugar snacking solutions that align with weight management, muscle recovery, and active lifestyle goals. Ready-to-eat formats have been embraced across fitness, convenience retail, and clinical nutrition settings, especially within metropolitan regions.

Clinical and wellness-driven innovation has been prioritized by domestic brands, with protein puddings increasingly positioned as meal replacements and functional desserts. Demand has also been supported by the integration of dairy and plant-based hybrid proteins to cater to a broader health-aware population, including lactose-intolerant and flexitarian consumers.

E-commerce and DTC platforms have been actively utilized to promote subscriptions, limited editions, and influencer-led product launches. Clean-label claims, satiety benefits, and indulgent flavors have been leveraged to attract both performance-focused and mainstream audiences.

The Protein Puddings Market in the UK is projected to register a CAGR of 7.1% between 2025 and 2035, supported by the mainstreaming of functional snacks in both retail and gym-affiliated channels. Growth has been driven by strong consumer alignment with high-protein, low-sugar formats that fit clean-label and weight management trends. Ready-to-eat pudding cups and on-the-go formats have been increasingly adopted as alternatives to traditional dairy desserts and bars. Hybrid protein formulations particularly those combining dairy with plant-based proteins have gained acceptance among flexitarian consumers. Strong distribution via supermarkets, health stores, and online DTC models has been observed, while subscription models continue to gain traction among repeat buyers.

The Protein Puddings Market in China is anticipated to expand at a CAGR of 6.8% between 2025 and 2035, driven by the convergence of functional food trends, digital retail penetration, and modern snacking behavior. Rising awareness of muscle health, especially among urban youth and middle-aged populations, has led to increasing experimentation with high-protein desserts. The market has benefited from the integration of protein puddings into fitness regimens, particularly among gym-goers and social media-influenced consumers. Domestic players have actively launched pudding products that align with national taste preferences and clean-label demands. Premium packaging, probiotic fortification, and celebrity endorsements have been used to drive differentiation.

In India, the Protein Puddings Market is forecasted to grow at a robust CAGR of 8.6% from 2025 to 2035, making it one of the fastest-growing national markets. Rapid urbanization, rising disposable incomes, and a fitness-focused millennial demographic have contributed to increased awareness of protein-rich functional foods. Growth has been further catalyzed by the entry of both domestic startups and multinational nutrition brands offering regionally tailored flavors and plant-forward formulations. Localized branding, affordability, and positioning around energy and satiety have allowed protein puddings to gain traction even outside Tier 1 cities. Online platforms, including wellness-focused e-commerce sites, have been actively utilized for first-time consumer acquisition.

| Country | 2025 |

|---|---|

| UK | 21.4% |

| Germany | 27.6% |

| Italy | 10.8% |

| France | 16.9% |

| Spain | 9.7% |

| BENELUX | 5.9% |

| Nordic | 4.2% |

| Rest of Europe | 3.5% |

| Country | 2035 |

|---|---|

| UK | 19.9% |

| Germany | 26.1% |

| Italy | 11.4% |

| France | 15.7% |

| Spain | 10.9% |

| BENELUX | 5.7% |

| Nordic | 5.0% |

| Rest of Europe | 5.3% |

Germany’s Protein Puddings Market is forecasted to grow at a CAGR of 6.8% through 2035, underpinned by strong demand for clean-label, high-protein snacks with indulgent appeal. Consumers have shown a preference for dairy-based pudding formats fortified with whey, casein, or milk protein isolates. Increased gym participation and active lifestyle trends have supported market penetration across younger and aging demographics alike. The segment has benefited from premium placement in supermarkets, organic chains, and pharmacy health aisles. Innovation in functional claims such as satiety, digestive health, and low-carb content has strengthened product appeal. Flavor diversification, including mocha, berry, and exotic seasonal options, is also being embraced.

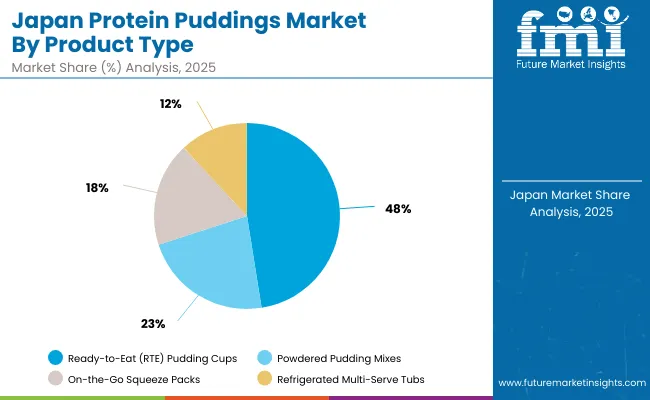

| Product Type | Market Value Share, 2025 |

|---|---|

| Ready-to-Eat (RTE) Pudding Cups | 47.5% |

| Powdered Pudding Mixes | 22.5% |

| On-the-Go Squeeze Packs | 18.1% |

| Refrigerated Multi-Serve Tubs | 11.9% |

The Protein Puddings Market in Japan is projected to reach a valuation of USD 86.8 million by 2025. Among product formats, Ready-to-Eat (RTE) Pudding Cups are expected to dominate with 47.5% share, while Powdered Pudding Mixes hold 22.5%, and On-the-Go Squeeze Packs follow at 18.1%. Although traditional convenience formats continue to lead, a gradual transition toward portable and customizable options such as squeeze packs and powdered mixes is being observed. This shift reflects changing consumer expectations around portion control, mobility, and personalization.

Market growth is being underpinned by Japan’s increasing preference for functional indulgence, where high-protein snacks are perceived as healthier dessert alternatives. The rise of clinical wellness, coupled with demand for low-sugar and lactose-free formulations, has encouraged innovation in plant-protein variants and hybrid formats. As population aging accelerates, protein puddings are also being used to support nutritional supplementation for senior demographics.

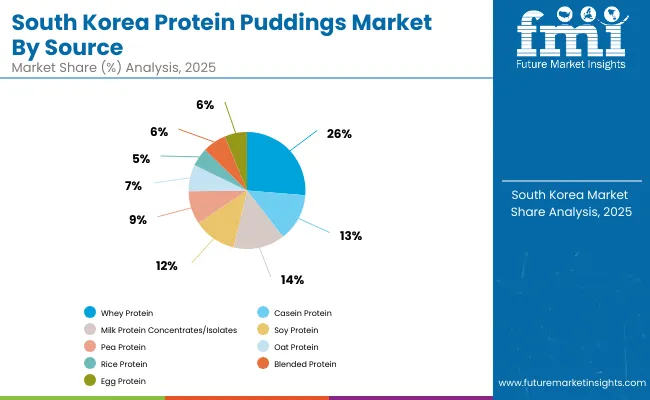

| Source | Market Value Share, 2025 |

|---|---|

| Whey Protein | 26.3% |

| Casein Protein | 13.2% |

| Milk Protein Concentrates/Isolates | 14.2% |

| Soy Protein | 11.9% |

| Pea Protein | 9.2% |

| Oat Protein | 7.4% |

| Rice Protein | 5.1% |

| Blended Protein | 6.5% |

| Egg Protein | 6.2% |

The Protein Puddings Market in South Korea is projected to expand steadily through 2035, driven by growing nutritional awareness, increased fitness engagement, and a heightened preference for functional yet indulgent food formats. In 2025, Whey Protein is expected to lead with a 26.3% market share, while plant-based alternatives such as Oat, Pea, and Rice Proteins are forecasted to gain traction due to rising lactose intolerance and clean-label demand.

Blended Proteins, holding 6.5% of the market in 2025, are poised for the fastest growth, as Korean consumers increasingly seek balanced nutrition that combines the efficacy of dairy with the digestibility of plant-based options. Innovation in protein delivery such as pudding-based formats tailored for skin health, weight management, and recovery is expected to be prioritized by both domestic and global brands entering the Korean wellness space.

High digital literacy and strong e-commerce infrastructure are being leveraged to personalize protein product offerings through direct-to-consumer platforms, K-beauty wellness crossovers, and KOL-driven campaigns.

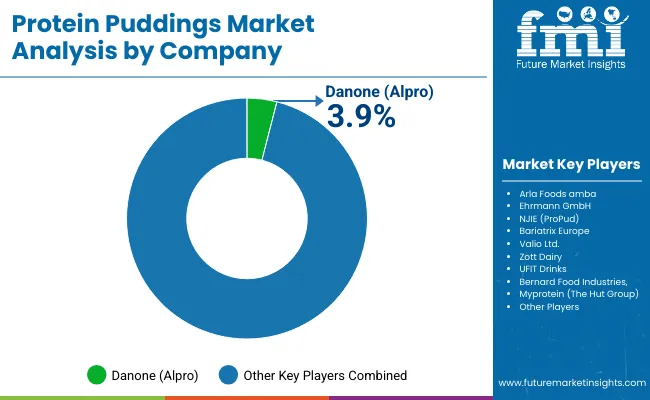

| Company | Global Value Share 2025 |

|---|---|

| Danone (Alpro) | 3.9% |

| Others | 96.1% |

The Protein Puddings Market is moderately consolidated, with established dairy companies, performance nutrition brands, and functional food innovators competing across health, wellness, and sports nutrition segments. Global dairy leaders such as Arla Foods amba, Danone (Alpro), and Valio Ltd. are expected to retain dominant positions, backed by robust dairy sourcing, cold chain infrastructure, and long-standing consumer trust. These companies have emphasized high-protein innovations through clean-label, lactose-free, and functional pudding lines, often cross-leveraging their expertise in yogurt, beverages, and fortified dairy categories.

Mid-sized health and performance brands like Ehrmann GmbH, NJIE (ProPud), and UFIT Drinks have been positioned as agile innovators, targeting fitness-conscious consumers with ready-to-eat formats, advanced protein blends, and influencer-driven marketing. Their products have been increasingly placed in gym kiosks, convenience stores, and DTC platforms, offering both taste appeal and macro-alignment.

Niche-focused players such as Bariatrix Europe, Myprotein (The Hut Group), and Bernard Food Industries have carved out space through clinical nutrition SKUs, private label partnerships, and e-commerce-first strategies. These brands often cater to protein-specific dietary needs like weight loss, diabetic nutrition, or senior care.

Competitive differentiation is being driven by ingredient transparency, functional fortification (e.g., probiotics, fiber), and format diversification. The shift toward subscription-based models, plant-dairy hybrids, and sustainability narratives is expected to intensify over the forecast period.

Key Developments in Protein Puddings Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,440.6 million |

| Product Type | Ready-to-Eat (RTE) Pudding Cups, Powdered Pudding Mixes, On-the-Go Squeeze Packs, Refrigerated Multi-Serve Tubs |

| Source | Whey Protein, Casein Protein, Milk Protein Concentrates/Isolates, Soy Protein, Pea Protein, Oat Protein, Rice Protein, Blended Protein, Egg Protein |

| Flavor | Chocolate, Vanilla, Strawberry, Banana, Blueberry, Mango, Mocha/Coffee, Caramel, Cookies & Cream, Exotic/Seasonal Flavors (e.g., Pumpkin Spice, Matcha, Coconut) |

| End User | Athletes & Sports Professionals, Bodybuilders & Fitness Enthusiasts, Weight Management Consumers, General Health-Conscious Consumers, Pediatric & Geriatric Nutrition Users |

| Distribution Channel | Supermarkets, Hypermarkets, Convenience Stores, Specialty Nutrition & Health Stores, Pharmacies/Drugstores, Online Retail, Fitness & Gym Outlets, Direct-to-Consumer (DTC) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arla Foods amba, Ehrmann GmbH, NJIE (ProPud), Bariatrix Europe, Valio Ltd., Zott Dairy, UFIT Drinks, Bernard Food Industries, Myprotein (The Hut Group), Danone (Alpro) |

| Additional Attributes | Dollar sales by source type, product form, and end user; demand trends in weight management and active nutrition; growing adoption of plant-based and blended protein systems; retail innovations (shelf-stable, chilled, and DTC formats); cross-functional benefits (satiety, energy, gut health); regional flavor development strategies; and integration with fitness and lifestyle branding campaigns. |

The global Protein Puddings is estimated to be valued at USD 1,440.6 million in 2025.

The market size for the Protein Puddings is projected to reach USD 2,804.4 million by 2035.

The Protein Puddings is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in the Protein Puddings Market are Ready-to-Eat (RTE) Pudding Cups, Powdered Pudding Mixes, On-the-Go Squeeze Packs, and Refrigerated Multi-Serve Tubs.

In terms of product type, the Ready-to-Eat (RTE) Pudding Cups segment is expected to command the highest share at 48.6% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Analysis and Growth Projections for Protein Hydrolysate Ingredient Market

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Protein Water Market Analysis by Product Type, Flavour, Packaging Type, Source and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA