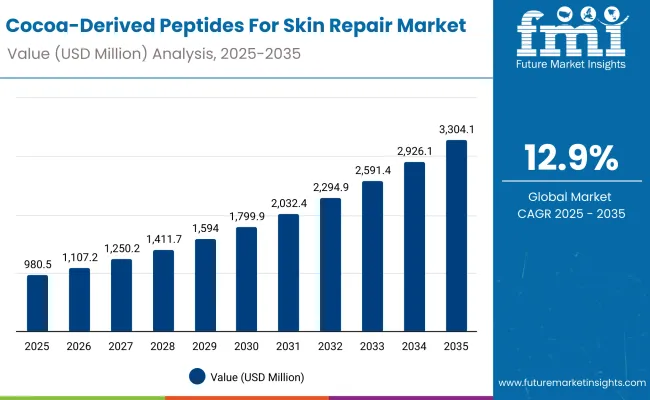

A valuation of USD 980.5 million has been projected for the Cocoa-Derived Peptides for Skin Repair Market in 2025, which is expected to escalate to USD 3,304.1 million by 2035. This surge reflects an addition of over USD 2,323 million during the decade, translating into a CAGR of 12.9%. The market is thus forecasted to achieve a 3.3X growth within the ten-year horizon.

Cocoa-Derived Peptides For Skin Repair Market Key Takeaways

| Metric | Value |

|---|---|

| Cocoa-Derived Peptides For Skin Repair Market Estimated Value in (2025E) | USD 980.5 million |

| Cocoa-Derived Peptides For Skin Repair Market Forecast Value In (2035f) | USD 3,304.1 million |

| Forecast CAGR (2025 to 2035) | 12.9% |

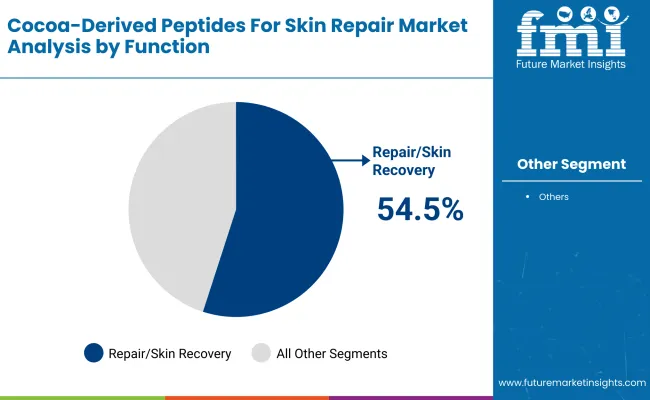

Between 2025 and 2030, growth from USD 980.5 million to USD 1,799.9 million is anticipated, representing nearly USD 819 million in incremental revenue and accounting for more than one-third of the decade’s expansion. This period is likely to be characterized by steady adoption of cocoa-derived actives in repair-focused formulations, particularly as consumer preferences lean toward barrier protection and functional healing solutions. Repair and skin recovery will dominate the functional landscape, accounting for 54.5% of value in 2025 with USD 534.3 million.

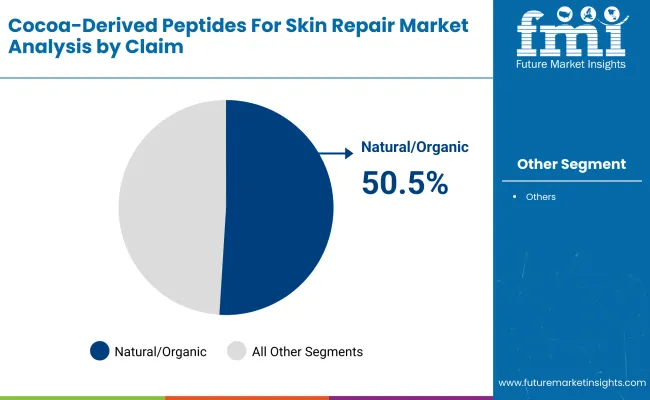

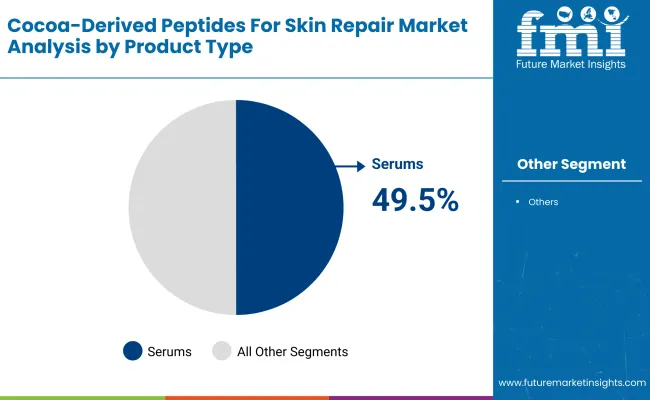

From 2030 to 2035, acceleration is expected, as the market advances from USD 1,799.9 million to USD 3,304.1 million, contributing nearly USD 1,504 million, or two-thirds of overall growth. This momentum will be fueled by clean-label demand, sustainability-driven claims, and expanded penetration in clinical skincare. Natural and organic claims are set to capture 50.5% share in 2025, equivalent to USD 494.9 million, positioning them as a key driver of consumer trust. Within product formats, serums are forecasted to contribute 49.5% share, valued at USD 484.8 million, consolidating their role as the preferred channel for concentrated peptide delivery.

From 2020 to 2024, the Cocoa-Derived Peptides for Skin Repair Market transitioned from niche adoption to broader consumer recognition, supported by rising demand for natural actives in functional skincare. During this period, competitive positioning was shaped by bioactive ingredient developers that emphasized peptide efficacy, stability, and sustainability credentials. Companies with advanced extraction capabilities and clinical validation frameworks commanded stronger influence, while smaller players differentiated through customization and clean-label claims.

By 2025, demand is expected to reach USD 980.5 million, and expansion is anticipated to be accelerated by the integration of bioavailability technologies, encapsulation systems, and e-commerce distribution platforms. The revenue mix is projected to shift further toward natural/organic positioning and dermatologist-tested formulations. Competitive advantage is expected to move beyond ingredient sourcing alone toward ecosystem strength, partnerships with skincare brands, and the ability to demonstrate clinical performance and transparency.

Growth of the Cocoa-Derived Peptides for Skin Repair Market is being propelled by a combination of scientific innovation and consumer-driven demand for natural actives. Increasing recognition of cocoa-derived peptides for their efficacy in repair, barrier restoration, and anti-inflammatory properties has been influencing product adoption. A rising preference for natural and organic formulations has reinforced the role of these peptides, with clean-label positioning and dermatologist-tested claims adding further credibility.

Expansion of functional skincare routines is being supported by higher consumer awareness of skin barrier health, where peptides are being integrated for accelerated recovery and long-term firmness. Advances in extraction and formulation science are enabling greater bioavailability, ensuring more effective results and sustained consumer trust.

Market growth is also being stimulated by widening application in premium serums, which offer targeted delivery and higher concentrations. Over the coming decade, momentum is expected to be sustained as clinical skincare and sustainable beauty trends converge, reinforcing demand across global markets.

The Cocoa-Derived Peptides for Skin Repair Market has been segmented across key dimensions of function, claim, and product type, each providing insight into evolving consumer priorities and formulation strategies. Growth is being influenced by rising awareness of barrier repair, increased demand for natural and organic skincare, and strong acceptance of concentrated delivery formats.

Functional performance is being highlighted by the dominance of repair and recovery, while clean-label claims continue to drive trust and adoption among conscious consumers. Product type segmentation underscores the balance between serums and broader skincare formats, with both contributing significantly to overall demand. As innovation accelerates, these segments are expected to define the trajectory of adoption and long-term expansion in global markets.

| Segment | Market Value Share, 2025 |

|---|---|

| Repair/skin recovery | 54.5% |

| Others | 45.5% |

The function segment is being led by repair and skin recovery, which is expected to account for 54.5% share in 2025, valued at USD 534.3 million. This dominance is being reinforced by the growing importance of skin barrier restoration and accelerated healing in consumer skincare priorities. The segment’s growth is being supported by rising demand for multifunctional solutions that address post-inflammatory concerns and environmental stress.

Adoption is being further shaped by clinical evidence linking peptides with faster recovery cycles and improved skin resilience. As skincare innovation advances, repair and recovery are projected to remain the primary focus, consolidating their position as the backbone of functional formulations in this market.

| Segment | Market Value Share, 2025 |

|---|---|

| Natural/organic | 50.5% |

| Others | 49.5% |

Natural and organic claims are anticipated to dominate with 50.5% share in 2025, representing USD 494.9 million. This leadership is being driven by heightened consumer preference for clean-label products and increasing reliance on transparent ingredient sourcing. Dermatologist-tested and eco-conscious attributes are reinforcing the trustworthiness of cocoa-derived peptides, positioning natural claims at the forefront of market adoption.

Strong alignment with sustainability initiatives and regulatory encouragement for safer cosmetic ingredients are also expected to accelerate this trajectory. As global awareness of ethical beauty rises, natural and organic positioning is forecasted to remain the decisive factor shaping consumer purchasing behavior, ensuring sustained growth for peptide-based skincare products across regions.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 49.5% |

| Others | 50.5% |

The product type segment is being evenly distributed, with “others” leading at 50.5% share, valued at USD 495.2 million, while serums follow closely at 49.5%. Despite this narrow margin, serums are increasingly being preferred for targeted delivery of cocoa peptides, benefiting from high concentration and deeper penetration.

The growth of “others,” which includes lotions and masks, is being supported by consumer demand for versatile daily-use formats that ensure continuous repair support. This balance highlights the adaptability of cocoa peptides across multiple skincare applications. As innovation expands, serums are projected to steadily strengthen their role, though diverse product forms will continue to appeal to consumers seeking multifunctional and accessible solutions.

Complexities in peptide formulation and scalability of natural bioactive sourcing continue to influence adoption, even as opportunities emerge through advanced delivery systems and regulatory acceptance of functional actives for clinical skincare, clean-label innovation, and high-performance recovery solutions.

Advancement in Bioavailability Engineering

Market expansion is being supported by advances in bioavailability engineering, where cocoa-derived peptides are increasingly optimized through encapsulation technologies and nanocarriers. These systems are ensuring deeper dermal penetration, stability against oxidation, and improved release kinetics. Such innovations are expected to transform consumer trust by enabling visible, long-lasting results in skin repair.

The convergence of biotechnology and dermatology is further enhancing positioning, allowing peptides to be differentiated as clinically robust actives rather than niche natural extracts. As beauty-tech ecosystems expand, partnerships between ingredient developers and cosmetic formulators are anticipated to accelerate, reinforcing the segment’s role in functional skincare markets across regions.

Supply Chain Fragility in Cocoa-Derived Actives

Sourcing fragility has been identified as a critical restraint, with dependence on cocoa cultivation exposing the market to agricultural volatility, climate variability, and sustainability scrutiny. Inconsistent yields and fluctuating raw material quality challenge scalability, creating uncertainties for manufacturers reliant on consistent peptide fractions. Furthermore, pressures from global sustainability frameworks are compelling companies to trace and verify supply chains, raising operational costs. Limited standardization in extraction protocols compounds the restraint, as varying peptide concentrations influence efficacy outcomes.

While advancements in fermentation-based alternatives are being pursued, widespread adoption remains constrained by high investment needs. Overcoming this restraint will require resilient sourcing models, transparent certification, and greater integration of sustainable farming practices into the cocoa-derived peptide ecosystem.

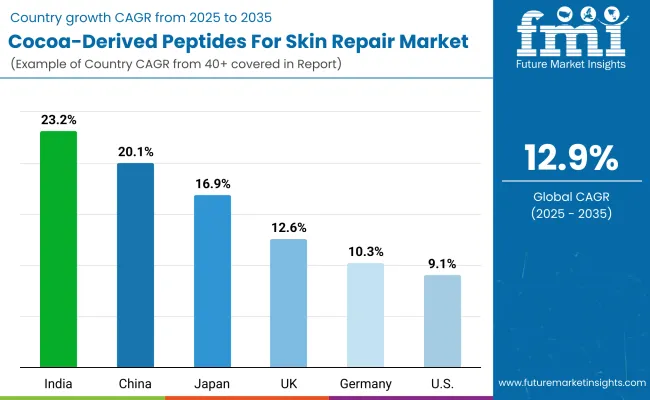

| Country | CAGR |

|---|---|

| China | 20.1% |

| USA | 9.1% |

| India | 23.2% |

| UK | 12.6% |

| Germany | 10.3% |

| Japan | 16.9% |

The global Cocoa-Derived Peptides for Skin Repair Market demonstrates clear variations in country-level growth trajectories, shaped by consumer awareness, regulatory environments, and innovation ecosystems. Asia is expected to emerge as the strongest growth engine, with India projected to expand at a CAGR of 23.2% and China at 20.1% during 2025 to 2035. India’s momentum is being influenced by rapid adoption of bioactive ingredients in skincare, supported by a younger consumer base and increasing investments in cosmeceutical production. In China, acceleration is being driven by advanced R&D initiatives, strong e-commerce penetration, and government-backed emphasis on sustainable beauty products.

Japan is forecasted to maintain robust growth at 16.9%, reinforced by premium skincare demand and a mature consumer base that values clinically validated natural ingredients. Europe remains steady, with Germany (10.3%) and the UK (12.6%) benefitting from strict regulatory frameworks, sustainability-driven standards, and consistent investments in high-quality formulations.

North America shows a more moderate pace, with the USA expected to grow at 9.1%, reflecting a mature skincare market but with opportunities centered on dermatologist-tested and clean-label positioning. Together, these countries are projected to set the direction of innovation, creating a competitive yet opportunity-rich landscape for cocoa-derived peptide adoption.

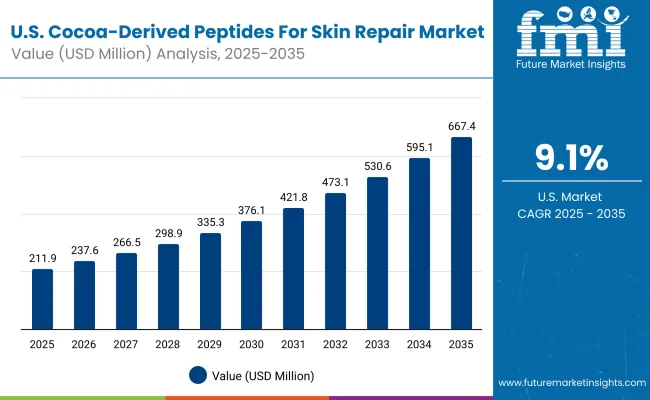

| Year | USA Cocoa-Derived Peptides For Skin Repair Market (USD Million) |

|---|---|

| 2025 | 211.92 |

| 2026 | 237.68 |

| 2027 | 266.58 |

| 2028 | 298.99 |

| 2029 | 335.34 |

| 2030 | 376.11 |

| 2031 | 421.83 |

| 2032 | 473.11 |

| 2033 | 530.63 |

| 2034 | 595.14 |

| 2035 | 667.49 |

The Cocoa-Derived Peptides for Skin Repair Market in the United States is projected to grow at a CAGR of 11.8% from 2025 to 2035, rising from USD 211.92 million to USD 667.49 million. Expansion is expected to be supported by increasing consumer focus on dermatologist-approved, natural skincare products and the accelerated adoption of bioactive actives with clinically validated performance. The influence of the clean-label movement is shaping purchasing behavior, as sustainable and transparent formulations gain traction across retail and professional skincare settings.

Growth is anticipated to be reinforced by strong uptake of concentrated delivery formats such as serums, combined with rapid scaling of digital retail platforms. Collaborations between global ingredient leaders and USA skincare brands are forecasted to widen product access while strengthening credibility of efficacy claims.

The Cocoa-Derived Peptides for Skin Repair Market in the UK is forecasted to grow at a CAGR of 12.6% from 2025 to 2035, supported by strong consumer preference for premium, natural skincare formulations. Growth is expected to be shaped by the country’s established dermatology sector, which has been increasingly integrating bioactive ingredients into clinical skincare practices.

Stringent regulatory standards are reinforcing trust in peptide-based formulations, particularly those positioned as sustainable and clean-label. Digital retail penetration is projected to expand peptide accessibility, catering to both premium and mass-market consumers.

The Cocoa-Derived Peptides for Skin Repair Market in India is projected to expand at a CAGR of 23.2% during 2025 to 2035, making it the fastest-growing global market. Rising consumer demand for advanced skincare, combined with a younger demographic base, is creating fertile ground for adoption of natural bioactives.

Increased investment in cosmeceutical production and distribution is expected to broaden accessibility, while e-commerce platforms continue to amplify consumer awareness. The influence of clean beauty and transparency trends is further accelerating the acceptance of peptide-based repair solutions.

The Cocoa-Derived Peptides for Skin Repair Market in China is anticipated to grow at a CAGR of 20.1% from 2025 to 2035, driven by advanced innovation ecosystems and strong consumer demand for functional skincare. Regulatory encouragement for natural bioactive adoption is reinforcing confidence, while premium skincare is gaining significant traction across urban populations.

With e-commerce playing a dominant role, accessibility to repair-focused formulations is being expanded at scale. Investments in biotechnology are expected to further optimize peptide extraction and stability, ensuring sustained adoption across the decade.

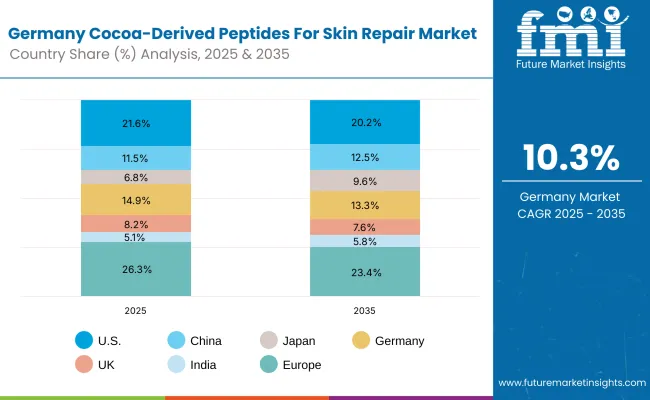

| Country | 2025 |

|---|---|

| USA | 21.6% |

| China | 11.5% |

| Japan | 6.8% |

| Germany | 14.9% |

| UK | 8.2% |

| India | 5.1% |

| Country | 2035 |

|---|---|

| USA | 20.2% |

| China | 12.5% |

| Japan | 9.6% |

| Germany | 13.3% |

| UK | 7.6% |

| India | 5.8% |

The Cocoa-Derived Peptides for Skin Repair Market in Germany is expected to grow at a CAGR of 10.3% from 2025 to 2035, supported by the country’s advanced regulatory frameworks and established skincare sector. High consumer awareness of barrier health and recovery solutions is reinforcing peptide adoption, particularly within dermatologist-tested and clinical formulations. Sustainability and traceability are being emphasized, aligning with Germany’s strong environmental and ethical standards. Distribution through pharmacies and specialty skincare channels is expected to dominate, ensuring access to trusted peptide-based solutions.

Growth Outlook for Cocoa-Derived Peptides For Skin Repair Market in USA

| Segment | Market Value Share, 2025 |

|---|---|

| Natural/organic | 50.5% |

| Others | 49.5% |

The Cocoa-Derived Peptides for Skin Repair Market in the United States is projected at USD 211.92 million in 2025. Natural and organic claims contribute 50.5% of the market, equating to USD 107.0 million, while other claims account for 49.5%, valued at USD 104.9 million. This slight dominance of natural and organic claims highlights a transition toward transparent formulations and clean-label positioning, which are increasingly prioritized by USA consumers. Such growth reflects the strong influence of sustainability, safety, and dermatology-backed trust, ensuring wider acceptance across premium and mass-market channels.

The rising prominence of natural claims is expected to create opportunities for innovation in extraction techniques, formulation stability, and clinical validation. As consumer demand for authenticity deepens, partnerships between ingredient developers and skincare brands are likely to strengthen the positioning of natural cocoa-derived peptides as high-value actives.

| Segment | Market Value Share, 2025 |

|---|---|

| Repair/skin recovery | 54.5% |

| Others | 45.5% |

The Cocoa-Derived Peptides for Skin Repair Market in China is projected at USD 113.05 million in 2025. Repair and skin recovery accounts for 54.5% of the market, valued at USD 61.7 million, while other functional claims represent 45.5%, contributing USD 51.4 million. This dominance of the repair function reflects the rising influence of dermatology-inspired skincare in China, where consumers increasingly prioritize barrier health, rapid healing, and anti-inflammatory support.

Strong growth is expected to be driven by the integration of bioactive peptides in both premium and mass-market skincare, supported by advanced R&D ecosystems. With government-backed emphasis on sustainable beauty and innovation, peptide formulations with verified clinical efficacy are anticipated to achieve faster adoption. Continued investment in encapsulation and nanotechnology is expected to improve bioavailability, reinforcing consumer trust in repair-focused skincare.

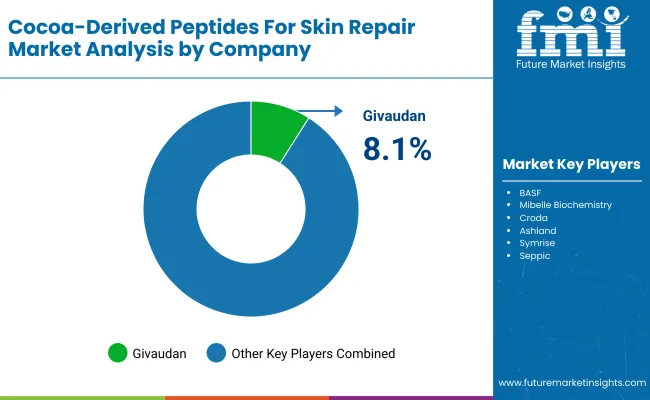

| Company | Global Value Share 2025 |

|---|---|

| Givaudan | 8.1% |

| Others | 91.9% |

The Cocoa-Derived Peptides for Skin Repair Market is moderately fragmented, with global leaders, specialty bioactive innovators, and regionally focused suppliers competing to strengthen their market presence. Givaudan is projected to lead with a global value share of 8.1% in 2025, supported by its diversified peptide portfolio and advanced delivery technologies that enhance efficacy in repair-focused skincare. Its leadership is expected to be reinforced by sustained R&D investments, clean-label positioning, and partnerships with premium skincare brands.

Mid-sized players such as BASF, Mibelle Biochemistry, and Croda are actively innovating with functional peptide fractions, focusing on bioavailability improvements, natural sourcing, and dermatologist-tested claims. These companies are expected to accelerate adoption through cosmeceutical collaborations and sustainability-driven initiatives. Ashland, Symrise, Seppic, and Provital are projected to contribute to specialized innovations, emphasizing encapsulation technologies and formulation stability. CLR Berlin and Lucas Meyer Cosmetics are carving their niche in high-performance and clinical skincare segments, offering customized peptide solutions aligned with dermatologist-backed claims.

Competitive differentiation is shifting toward integrated innovation models, where bioactive efficacy is combined with transparency, sustainability, and digital engagement. Companies that align peptides with functional claims, consumer trust, and regional preferences are expected to secure stronger footholds in this evolving market.

Key Developments in Cocoa-Derived Peptides For Skin Repair Market

| Item | Value |

|---|---|

| Quantitative | USD 980.5 million (2025); USD 3,304.1 million (2035); CAGR 12.9% (2025 to 2035) |

| Function | Repair/skin recovery: 54.5% (USD 534.3 million, 2025); Others: 45.5% (USD 445.68 million, 2025) |

| Claim | Natural/organic: 50.5% (USD 494.9 million, 2025); Others: 49.5% (USD 485.30 million, 2025) |

| Product Type | Serums: 49.5% (USD 484.8 million, 2025); Others: 50.5% (USD 495.20 million, 2025) |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | Givaudan; BASF; Mibelle Biochemistry; Croda; Ashland; Symrise; Seppic; Provital; CLR Berlin; Lucas Meyer Cosmetics |

| Competitive Share (Global) | Givaudan: 8.1% value share (2025); Others: 91.9% (2025) |

| Additional Attributes | Country growth: India 23.2% CAGR (2025 to 2035); China 20.1% CAGR; Japan 16.9% CAGR; UK 12.6% CAGR; Germany 10.3% CAGR; USA 9.1% CAGR. USA market trajectory: USD 211.92 million (2025) → USD 667.49 million (2035). China function split (2025): Repair/skin recovery 54.5% (USD 61.7 million); Others 45.5% (USD 51.38 million). Demand drivers: dermatologist-tested, clean-label positioning, bioavailability/encapsulation advances, e-commerce distribution. Use-case emphasis: barrier repair, post-inflammatory recovery, and anti-aging firmness benefits. |

The global Cocoa-Derived Peptides for Skin Repair Market is estimated to be valued at USD 980.5 million in 2025.

The market size for the Cocoa-Derived Peptides for Skin Repair Market is projected to reach USD 3,304.1 million by 2035.

The Cocoa-Derived Peptides for Skin Repair Market is expected to grow at a CAGR of 12.9% between 2025 and 2035.

The key product types in the Cocoa-Derived Peptides for Skin Repair Market are serums and others, with both contributing almost equal shares in 2025.

In terms of function, the repair/skin recovery segment is expected to command 54.5% share in the Cocoa-Derived Peptides for Skin Repair Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tuna Peptides Market – Growth, Demand & Functional Benefits

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Lupine Peptides Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Peptides Test Market Size and Share Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Antimicrobial Peptides Market

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Nerve Repair Market Growth - Trends, Demand & Innovations 2025 to 2035

Hernia Repair Devices Market Insights - Trends & Forecast 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cartilage Repair Market Analysis - Size, Share & Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA