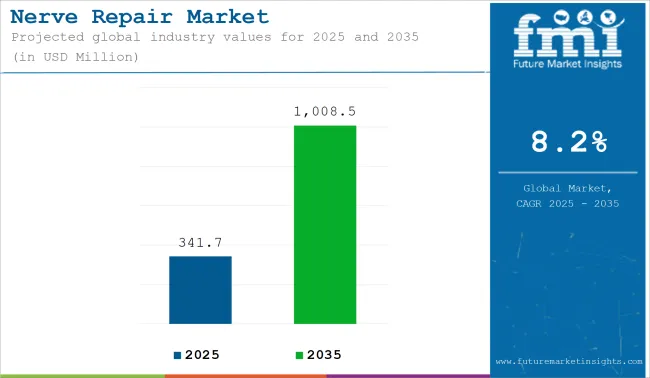

The global nerve repair market is estimated to be valued at USD 341.7 million in 2025 and is projected to reach USD 1,008.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 341.7 million |

| Industry Value (2035F) | USD 1,008.5 million |

| CAGR (202 to 2035) | 8.2% |

The nerve repair market has been experiencing notable expansion, driven by the rising incidence of nerve injuries associated with trauma, surgical procedures, and chronic conditions such as diabetes. A sustained increase in microsurgical interventions has been observed, as clinicians prioritize the restoration of sensory and motor function to improve long-term patient outcomes.

Regulatory approvals and commercialization of advanced biomaterials have contributed to wider availability of nerve repair solutions, ranging from allografts to synthetic conduits. Favourable reimbursement policies and dedicated funding for peripheral nerve injury treatments have encouraged adoption, particularly in developed markets.

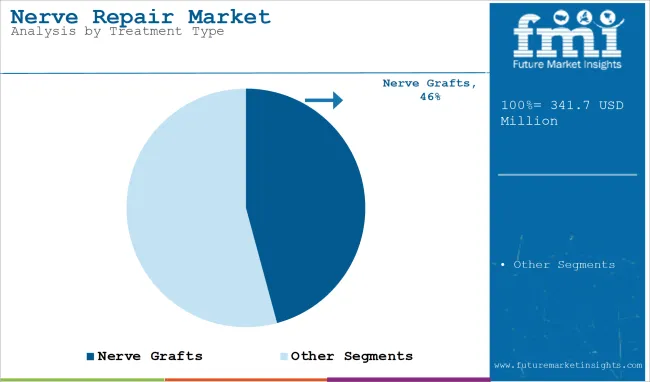

Nerve Grafts dominated with a revenue share of 45.8% in 2025 due to their established role in bridging nerve gaps and supporting axonal regeneration. Clinical preference has been influenced by the demonstrated ability of nerve grafts to provide a scaffold that facilitates organized regrowth of nerve fibers. Regulatory clearances for allograft and xenograft products have expanded the range of options available to surgeons, reducing reliance on autografts and associated donor site morbidity.

Advances in graft preservation techniques and processing methods have enhanced biocompatibility, further supporting procedural success rates. Procurement decisions have been shaped by the inclusion of nerve grafts in clinical guidelines for treating segmental defects and complex peripheral nerve injuries. Growth in microsurgical expertise and rising procedural volumes have also reinforced nerve graft adoption across tertiary care centers and specialized surgical units.

Epineural Nerve Repair holds a leading share of 66.9% which has been attributed to epineural nerve repair, reflecting its widespread acceptance as the preferred technique in a broad range of clinical scenarios. Adoption has been supported by the technique’s relative simplicity and the ability to achieve satisfactory alignment of nerve fascicles without extensive intraneural dissection. Procedural versatility has been acknowledged, allowing application in both acute traumatic injuries and delayed reconstructions.

Training programs and surgical guidelines have emphasized epineural suturing methods as foundational skills, contributing to consistency in clinical practice. Favorable outcomes have been reported in published clinical studies, reinforcing the perception of this technique as a dependable approach for tension-free nerve coaptation. These attributes have collectively sustained the dominance of epineural nerve repair within the nerve repair market.

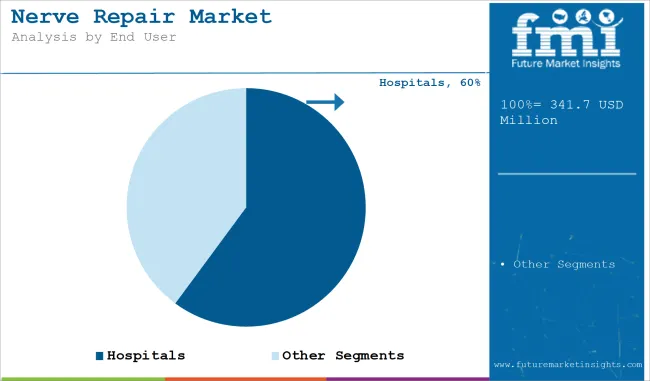

End User Analysis: Hospitals

Hospitals have accounted for 60.1% of market revenue, supported by their capacity to deliver comprehensive surgical care for nerve injuries and maintain multidisciplinary teams dedicated to reconstructive procedures. Adoption has been driven by investments in microsurgical infrastructure, including advanced operating microscopes and specialized instruments required for precise nerve coaptation. Training programs and fellowship opportunities have been expanded to build expertise among reconstructive surgeons and operating room staff.

Institutional protocols have been established to integrate nerve repair techniques into treatment pathways for trauma, oncology resections, and peripheral nerve compression syndromes. Reimbursement frameworks have been structured to support the high costs of nerve graft materials and operative time, incentivizing hospitals to prioritize these interventions in eligible patients. These factors have reinforced hospitals as the primary setting for nerve repair procedures and are expected to sustain their leadership in adoption over the forecast horizon..

Material Biocompatibility and Long-Term Stability as Key Challenges in Nerve Repair

The biocompatibility of synthetic and bioengineered materials produced for application in nerve grafts, wraps, and connectors is one of the biggest challenges of nerve repair. Understand that these biodegradable nerve conduits are on the rise, yet many of them report issues with inflammation, immune rejection, and differential degradation rates to nature. One of the remaining challenges is the extent to which such materials can support nerve regeneration and inhibit fibrosis, or scarring, from developing.

The long-term durability of nerve repair material will also be a focus for further research. Some nerve grafts that are engineered degenerate too rapidly prior to full nerve regeneration occurring, and others persist longer than they should, causing adverse conditions. With improvements in polymers and hydrogels and further research in their degradability, the industry continues to strive to develop materials that can mimic natural nerve structure, with the perfect balance of elasticity, conductivity, and degradation time.

BCIs as a Breakthrough Opportunity for Enhancing Neuroplasticity in Nerve Repair

The convergence of brain-computer interfaces (BCIs) with nerve repair technology is a revolutionary opportunity for the market. An essential feature of BCIs is their eventual capacity to promote neuroplasticity, or the inherent ability of the brain to self-remap and create new neural connections, by creating a connection between the brain and damaged nerves.

There is evidence that BCIs might improve functional recovery in individuals with acute peripheral nerve injuries, spinal cord injuries, or neurodegenerative conditions by decoding neural activity and modulation of the nerve circuits to which they are connected.

BCIs function as an integrated treatment strategy; hybrid therapy combines biological regeneration with bioengineering and real-time neural feedback, rather than simply biological regeneration that is typical of the traditional nerve repair paradigm. This facilitates the recovery of movement and sensation more quickly, even where total nerve regeneration is not feasible.

With increasing overlap between AI, robotics, and neuroscience, BCIs are poised to reimagine the nerve repair horizon. Firms investing in BCI-based rehabilitation technologies will be at a competitive advantage, tackling unmet neurorehabilitation needs and increasing treatment options for complex nerve injuries.

Market Outlook

The United States is dominating the overall nerve repair market because of the high incidence of peripheral nerve injury, well-developed healthcare infrastructure, and swift adoption of regenerative medicine in this region. Demand is being fueled by growth in surgical procedures involving nerve trauma, especially in the orthopedic, neurosurgical, and reconstructive spaces. The nation's leading biotech firms are also at the forefront of nerve grafts, conduits, allografts, and stem cell therapies.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.4% |

Market Outlook

In India, the market for nerve repair remains in its nascent stage due to growing access to microsurgical capabilities, growing trauma care facilities, and the expanding number of peripheral nerve injuries. While suturing remains the conventional modality for nerve repair, the growth of nerve repair conduits and regenerative medicine has demonstrated enormous potential, but in the context of private hospitals and tertiary care facilities, is gaining greater focus.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.7% |

Market Outlook

China's nerve repair market is booming, partly because of government investment in neurotrauma, and a high rate of orthopedic injuries and cranial nerve injuries, and rising access to procedures such as microsurgery. Back home, our biotech community is hard at work developing affordable nerve repair products, while demand for minimally invasive, tissue-friendly devices is rising among the city's healthcare providers.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 8.3% |

Market Outlook

Germany, being a top-ranking European market for nerve repair through the possession of an abundance of emphasis on neurological health, robust microsurgery capabilities and stringent government-funded work on the regeneration of nerves, is not thought to be the origin of this defect. Underpinned by highly developed neurosurgical facilities, the country has high utilization levels of a number of nerve conduits and artificial grafts across trauma and reconstructive surgeries.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 7.2% |

Market Outlook

Academic-medical network, increased applications of biomaterial-based conduits, and NHS-led peripheral nerve regeneration research are driving the expansion of the United Kingdom's nerve repair market. Nerve repair in chronic neuropathies and spinal cord injury is also on the horizon, with growing use of neurostimulation and tissue-engineered grafts.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6 .5% |

The nerve repair market has been characterized by the presence of specialized medical device companies and biotechnology firms investing in advanced graft materials and conduit technologies. Leading players have focused on expanding their product portfolios with FDA-cleared nerve allografts and bioresorbable conduits designed to improve regeneration and reduce surgical complexity.

Strategic collaborations have been established with academic institutions to validate clinical outcomes and develop next-generation solutions. Manufacturing capabilities have been strengthened to ensure consistent product quality and scalability. Product pipeline expansion and investments in biomaterials innovation are expected to remain key competitive strategies supporting sustained market leadership

Key Development:

Nerve Wrap, Nerve Protector, Nerve Connector and Nerve Graft

Epineural Nerve Repair, Perineural Nerve Repair and Fascicular Nerve Repair

Hospitals, Ambaatory Surgical Centers and wSpecialty Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for nerve repair market was USD 341.7 million in 2025.

The nerve repair market is expected to reach USD 1,008.5 million in 2035.

Growing focus on nerve repair in reconstructive and trauma surgeries is expanding market demand.

The top key players that drives the development of nerve repair market are Axogen Inc. Stryker Corporation, Synovis MCA (Baxter), Integra Lifesciences Holdings Corp, Polyganics B.V.

Nerve graft is expected to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Nerve Entrapment Syndrome Therapeutics Market Analysis & Forecast for 2025 to 2035

Nerve Locator Stimulator Market

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Vagus Nerve Stimulator Market Analysis – Growth & Industry Insights 2018-2026

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Hernia Repair Devices Market Insights - Trends & Forecast 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cartilage Repair Market Analysis - Size, Share & Forecast Outlook 2025 to 2035

Root Canal Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

Bone Defect Repair Materials Market Size and Share Forecast Outlook 2025 to 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Rib Fracture Repair Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA