The global hernia repair devices market is expected to grow at a robust pace, driven by rising incidences of hernia cases, increasing preference for minimally invasive surgeries, and ongoing advancements in surgical mesh materials and fixation technologies. Hernias are among the most common surgical conditions worldwide, and as awareness of the benefits of timely intervention grows, more patients are seeking effective and durable solutions.

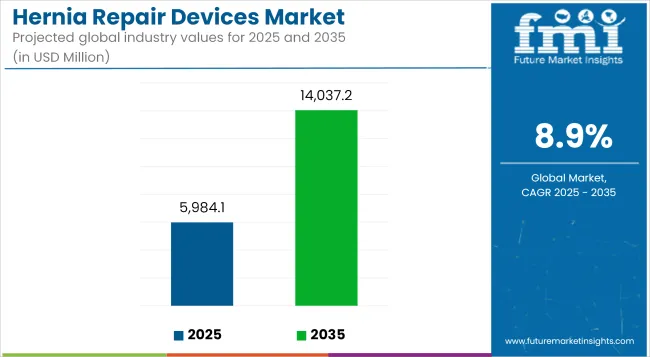

In 2025, the global hernia repair devices market is estimated to be valued at approximately USD 5,984.1 Million. By 2035, it is projected to grow to around USD 14,037.2 Million, reflecting a compound annual growth rate (CAGR) of 8.9%.

Hernia repair devices, which include surgical meshes, tacks, and fixation instruments, have seen continuous improvements in design and functionality, leading to better patient outcomes and shorter recovery times. With the growing adoption of robotic-assisted and laparoscopic procedures, alongside the availability of innovative materials such as absorbable and composite meshes, the market is poised for significant expansion through 2035.

North America has been one of the leading hernia repair device market, attributed to the high prevalence of hernia conditions, advanced healthcare infrastructure and high adoption of innovative surgical techniques. The growing patient population in the United States and the rising availability of robotic-assisted surgical systems contribute massively to the demand from this geography.

The other important market opportunity is represented by Europe, a region with increasing awareness regarding minimally invasive procedures, government support for healthcare malpractices and a sound medical devices industry. The countries in leading position for advanced hernia repair devices and materials adoption include Germany, United Kingdom, and France.

Hernia repair devices market at present time has grown fastest in the Asia pacific region due to the rising cases of hernia, increase in healthcare expenditure and availability of modern medical technologies. Regions, such as China, Japan, and India are witnessing a surge in demand for advanced surgical meshes and laparoscopic instruments, leading to more patients seeking minimally invasive options.

Challenges

Mesh Complications, Regulatory Scrutiny, and Reimbursement Limitations

Regulatory restrictions on mesh use and growing concerns about long-term mesh-related complications, such as chronic pain, infection, mesh erosion, and adhesion formation, pose some of the major challenges in the Hernia Repair Devices Market as they have resulted in significant legal liabilities and patient apprehensions.

Safety issues have led to a broad regulatory response from agencies including the FDA, EMA, and other regional health authorities due to increased demands for post-market surveillance, clinical data transparency, and material biocompatibility re-evaluation.

Inconsistent reimbursement across various countries and payers can also serve as a barrier to advanced laparoscopic or robotic-assisted hernia repair, particularly in cost-sensitive healthcare settings. Also, minimal invasive techniques require highly skilled surgeons that limits adoption in rural or under developed regions.

Opportunities

Technological Innovation, Minimally Invasive Procedures, and Aging Population Demand

Despite these hurdlesevolution of light weight, absorbable, and 3D pure anatomical mesh in hernia is ensuring better post-surgery outcomes as well as better comfort for the patient. In addition, growth of laparoscopic and robotic-assisted surgeries allow to faster recoveries, less complication, and shorter hospital stays, making elective hernia repairs more appealing.

A key macro trend behind a strong market demand is the increasing elderly population since the global growth of age-related abdominal wall weakness, obesity and post-surgical hernia increases. Moreover, increasing healthcare expenditure, particularly in emerging economies, and AI-based surgical navigation system is leading to higher precision hernia repair across the world.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA 510(k), CE mark, and MDR guidelines for mesh implants and surgical tools. |

| Consumer Trends | Demand for faster recovery, fewer complications, and minimally invasive options. |

| Industry Adoption | High adoption of synthetic and composite meshes in open and laparoscopic surgeries. |

| Supply Chain and Sourcing | Sourcing of polypropylene, polyester, and composite mesh materials from regulated vendors. |

| Market Competition | Dominated by Medtronic, B. Braun, BD, W. L. Gore & Associates, and Ethicon. |

| Market Growth Drivers | Boosted by rising hernia incidence, improved surgical outcomes, and supportive reimbursement (in developed markets). |

| Sustainability and Environmental Impact | Limited focus on eco-friendly surgical packaging or reusable instruments. |

| Integration of Smart Technologies | Early use of laparoscopic cameras, surgical staplers, and imaging tools. |

| Advancements in Repair Techniques | Use of open, laparoscopic, and hybrid hernia repair approaches. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of AI-powered post-market surveillance, bioresorbable mesh labeling standards, and global quality mandates. |

| Consumer Trends | Growth in personalized surgical planning, robotic-guided hernia repairs, and AI-assisted diagnostics. |

| Industry Adoption | Expansion into robotic-assisted procedures, 3D-printed anatomical meshes, and absorbable biomaterials. |

| Supply Chain and Sourcing | Shift toward biopolymer-based mesh sourcing, regenerative scaffold materials, and AI-optimized inventory management. |

| Market Competition | Entry of biotech-driven mesh startups, robotic surgery innovators, and AI-integrated surgical tech providers. |

| Market Growth Drivers | Accelerated by aging demographics, robotic surgery expansion, and patient-centric procedural innovations. |

| Sustainability and Environmental Impact | Adoption of green OR protocols, recyclable surgical instruments, and bio-based implant materials. |

| Integration of Smart Technologies | Evolution toward robot-assisted systems, AI-enhanced surgical navigation, and real-time risk prediction models. |

| Advancements in Repair Techniques | Development of personalized mesh placement, AI-driven robotic closure, and regenerative hernia repair scaffolds. |

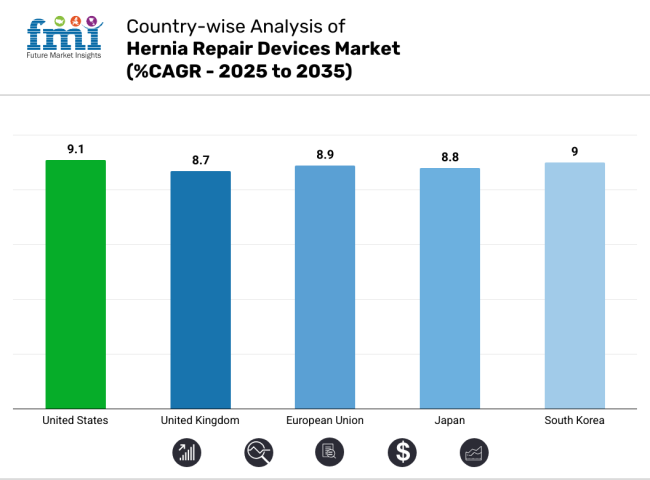

USA hernia repair devices market is propelling at a startling rate due to high prevalence of hernia diseases, growing adoption of laparoscopic surgeries and growing usage of advanced mesh materials and fixation systems. Moreover, conducive reimbursement policies coupled with the presence of key players in the medical device industry are both driving the adoption of innovative surgical treatment alternatives such as laparoscopic and robotic-assisted hernia repair procedures.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.1% |

Growing number of elective hernia repair surgery in the UK, increasing used of absorbable and composite meshes are the major growth driver for Hernia Repair Devices market in the UK. The combination of ERPs is taking hold, providing quicker patient outcomes, and, in turn, driving device adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.7% |

The hernia repair devices market in the rest of Europe is growing steadily due to the aging population, rising incidence of abdominal wall hernias, as well as increasing penetration and access to laparoscopic and robotic surgeries throughout the European Union. The market for lightweight anti-adhesion meshes with self-fixating devices is also being supported by investments in surgical innovation and regulatory support in the domain of advanced biomaterials.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.9% |

The Japanese hernia repair devices market is moderately growing, due to its rising demand for minimally invasive procedures among an aging population, high adoption of tension-free mesh repairs, and continuous upgrading of hospital infrastructure. Innovation in the production of advanced biosynthetic mesh materials at the local level also impacts adoption trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.8% |

Laparoscopic hernia repair devices have gained immense popularity in South Korean hospitals and clinics, which, along with rising healthcare investments in the nation, increasing number of laparoscopic hernia repair procedures, and favorable reimbursement frameworks for laparoscopic hernia repair treatment options, are driving the growth of South Korea hernia repair devices market. The market is also accelerating because of the rise of outsourced procedures and the globalization of robotic-assisted systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.0% |

Growing prevalence of hernias, increasing surgical inventions, number of minimally operative procedures have focused market participants on the back and developments for hernia repair devices market are expected to further by aiding in hernia repair.

Driven by both patients and healthcare providers who are eager for faster recovery, shorter hospitalization and lower rate of complications, the company has seen a rapid growth in demand for next-generation meshes and fixation systems. Advances in synthetic biomaterials, robotic support, and absorbable fixation devices are changing the surgical environment. This market is segmented by Product (Hernia Mesh, Fixation Devices) and Procedure (Open Surgery, Laparoscopic Surgery, Robotic Surgery).

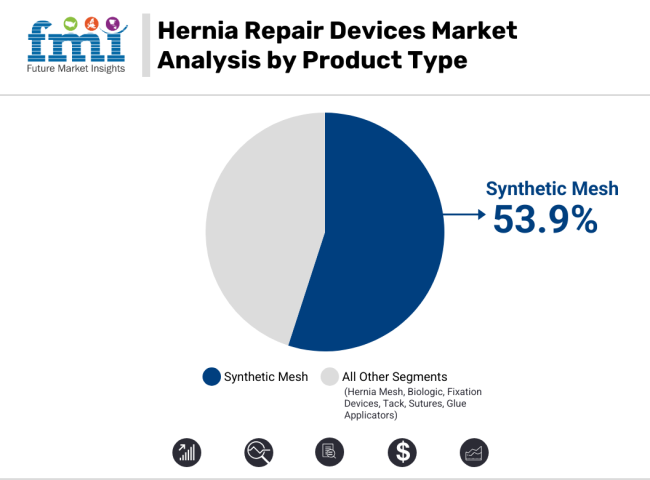

The market for synthetic hernia mesh is the most dominant product segment, expected to reach a share of 53.9% of the global market by the end of 2025. The synthetic types are usually polypropylene or polyester and are commonly used because they are durable, cost-effective, and can be effectively used for inguinal and ventral hernia repair. These meshes are highly supportive, reducing recurrence rates and showing excellent outcomes for open or laparoscopic approaches.

Synthetic mesh further dominates because of its index of compatibility with different types of surgical techniques and its availability in different patterns (lightweight, heavyweight, coated, uncoated). Although biologic meshes have advantages in complex and contaminated cases, in general surgery settings in both convergence and advanced healthcare markets, synthetic options remain dominant in both volume and cost-effectiveness.

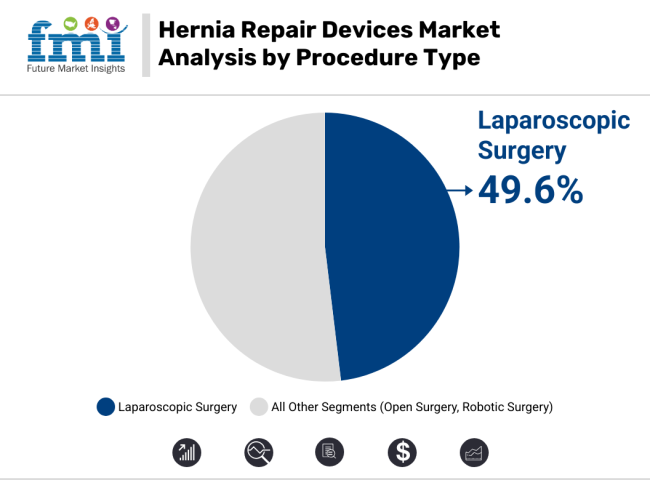

On the basis of procedure type, laparoscopic surgery is leading the hernia repair procedures segment owing to its estimated 49.6% market share in 2025. The widespread use of the minimally invasive approach is explained by a lower postoperative pain, smaller incision, shorter recovery, and a lower risk of infection. Inguinal (groin), incisional, and ventral hernias are most commonly repaired using laparoscopic techniques, particularly when surgical skill and availability to complex instrumentation increases worldwide.

Compared to its open predecessors, laparoscopic pneumonectomies’ allow for increased views of the surgical field and reduce complication rates, as well as allowing for concurrent bilateral hernia repairs in one setting. It has also emerged as the standard of care for numerous elective hernia surgeries, particularly in urban hospitals or ambulatory surgery centers.

As this way of performing surgeries witnesses additional investments of healthcare systems in training as well as laparoscopic infrastructure, this segment is projected to expand even further with the backing of improved reimbursement frameworks in addition to robust clinical outcomes.

The marketplace for hernia repair gadgets is anticipated to witness sustained expansion as an end result of growing variety of hernia restore procedures, acceptance of minimally invasive surgical procedures, and rising availability of advanced meshes and robotic-assisted tools. Biologic & Composite Mesh Technology, AI-Integrated Surgical System, Self-Fixation Devices, Tissue Closure Devices.

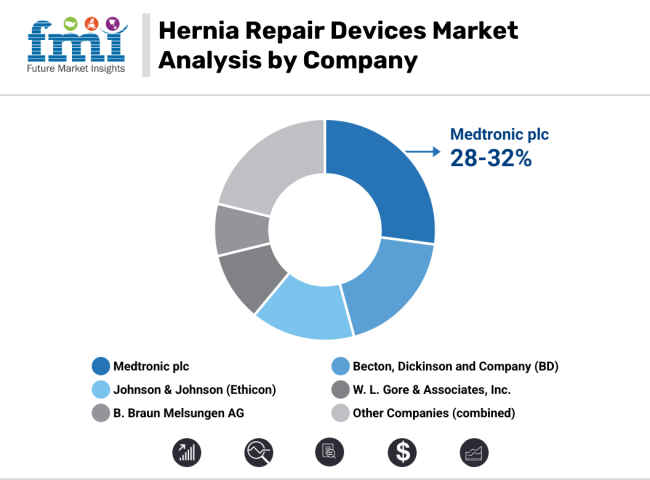

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | In 2024 , launched its ProGrip™ Laparoscopic Self-Fixating Mesh with improved microgrip technology. In January 2025 , rolled out AI-guided visualization integration with its hernia repair robotic platform for enhanced precision. |

| BD (Becton, Dickinson and Company) | In 2024 , released the Phasix™ ST Mesh in additional global markets, with resorbable barrier coating. In February 2025 , began clinical trials on a next-gen hybrid mesh combining biologic and synthetic components. |

| Ethicon (Johnson & Johnson) | In 2024 , introduced Physiomesh™ Open Flexible Composite Mesh to support complex abdominal wall reconstructions. In January 2025 , integrated digital surgical tracking with its mesh portfolio in select robotic-assisted hernia repairs. |

| W. L. Gore & Associates, Inc. | In 2024 , expanded its GORE® SYNECOR Preperitoneal Biomaterial range. In February 2025 , launched GORE® Performance Mesh with enhanced tissue integration and optimized pore design. |

| B. Braun Melsungen AG | In 2024 , launched DynaMesh® IPOM for laparoscopic incisional hernia repairs. In March 2025 , added self-anchoring mesh fixation technology to its minimally invasive toolkit. |

Key Company Insights

Medtronic plc (28-32%)

Medtronic leads the global hernia repair devices market, offering a broad range of synthetic, composite, and self-fixating meshes. The company is also investing in robotic-assisted platforms and AI-enhanced surgical navigation for laparoscopy.

BD (18-22%)

BD is strengthening its presence with recordable mesh solutions and biocompatible materials designed to reduce post-op complications. The Phasix™ line is a flagship offering across multiple hernia types.

Ethicon (14-18%)

A major innovator in open and laparoscopic hernia repair, Ethicon combines surgeon-centric mesh systems with integrated digital surgery tools from the Johnson & Johnson MedTech ecosystem.

W. L. Gore & Associates (8-12%)

Gore focuses on composite mesh biomaterials with a strong reputation for soft-tissue compatibility. The company continues to improve tissue ingrowth, handling, and flexibility of its offerings.

B. Braun Melsungen AG (6-9%)

B. Braun is gaining market share with DynaMesh® solutions, widely used in minimally invasive and laparoscopic settings. The company emphasizes long-term mesh stability and patient comfort.

Other Key Players (20-25% Combined)

The overall market size for the hernia repair devices market was USD 5,984.1 Million in 2025.

The hernia repair devices market is expected to reach USD 14,037.2 Million in 2035.

Growth is driven by the increasing prevalence of hernia cases globally, advancements in minimally invasive and laparoscopic procedures, rising adoption of biologic and composite mesh materials, and the growing aging population susceptible to abdominal wall weakness.

The top 5 countries driving the development of the hernia repair devices market are the USA, Germany, China, Japan, and India.

Synthetic Hernia Mesh and Laparoscopic Surgery are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Procedure, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Hernia Type , 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Procedure, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Hernia Type , 2017 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Procedure, 2017 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Hernia Type , 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Procedure, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Hernia Type , 2017 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 21: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Asia Pacific Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 23: Asia Pacific Market Value (US$ Million) Forecast by Procedure, 2017 to 2033

Table 24: Asia Pacific Market Value (US$ Million) Forecast by Hernia Type , 2017 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 26: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 27: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 28: Middle East and Africa Market Value (US$ Million) Forecast by Procedure, 2017 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Hernia Type , 2017 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Procedure, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Hernia Type , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Procedure, 2017 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Procedure, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Procedure, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Hernia Type , 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Hernia Type , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Hernia Type , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Procedure, 2023 to 2033

Figure 23: Global Market Attractiveness by Hernia Type , 2023 to 2033

Figure 24: Global Market Attractiveness by End Use, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Procedure, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Hernia Type , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Procedure, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Procedure, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Procedure, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Hernia Type , 2017 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Hernia Type , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Hernia Type , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 46: North America Market Attractiveness by Product, 2023 to 2033

Figure 47: North America Market Attractiveness by Procedure, 2023 to 2033

Figure 48: North America Market Attractiveness by Hernia Type , 2023 to 2033

Figure 49: North America Market Attractiveness by End Use, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Procedure, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Hernia Type , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Procedure, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Procedure, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Procedure, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Hernia Type , 2017 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Hernia Type , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Hernia Type , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Procedure, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Hernia Type , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Procedure, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Hernia Type , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Procedure, 2017 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Procedure, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Procedure, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Hernia Type , 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Hernia Type , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Hernia Type , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Product, 2023 to 2033

Figure 97: Europe Market Attractiveness by Procedure, 2023 to 2033

Figure 98: Europe Market Attractiveness by Hernia Type , 2023 to 2033

Figure 99: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: Asia Pacific Market Value (US$ Million) by Procedure, 2023 to 2033

Figure 103: Asia Pacific Market Value (US$ Million) by Hernia Type , 2023 to 2033

Figure 104: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 110: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 111: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 112: Asia Pacific Market Value (US$ Million) Analysis by Procedure, 2017 to 2033

Figure 113: Asia Pacific Market Value Share (%) and BPS Analysis by Procedure, 2023 to 2033

Figure 114: Asia Pacific Market Y-o-Y Growth (%) Projections by Procedure, 2023 to 2033

Figure 115: Asia Pacific Market Value (US$ Million) Analysis by Hernia Type , 2017 to 2033

Figure 116: Asia Pacific Market Value Share (%) and BPS Analysis by Hernia Type , 2023 to 2033

Figure 117: Asia Pacific Market Y-o-Y Growth (%) Projections by Hernia Type , 2023 to 2033

Figure 118: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 119: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 121: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 122: Asia Pacific Market Attractiveness by Procedure, 2023 to 2033

Figure 123: Asia Pacific Market Attractiveness by Hernia Type , 2023 to 2033

Figure 124: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 125: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 126: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Procedure, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Hernia Type , 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by Procedure, 2017 to 2033

Figure 138: Middle East and Africa Market Value Share (%) and BPS Analysis by Procedure, 2023 to 2033

Figure 139: Middle East and Africa Market Y-o-Y Growth (%) Projections by Procedure, 2023 to 2033

Figure 140: Middle East and Africa Market Value (US$ Million) Analysis by Hernia Type , 2017 to 2033

Figure 141: Middle East and Africa Market Value Share (%) and BPS Analysis by Hernia Type , 2023 to 2033

Figure 142: Middle East and Africa Market Y-o-Y Growth (%) Projections by Hernia Type , 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 144: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 147: Middle East and Africa Market Attractiveness by Procedure, 2023 to 2033

Figure 148: Middle East and Africa Market Attractiveness by Hernia Type , 2023 to 2033

Figure 149: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 150: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hernia Protection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hernia Mesh Devices Market Size and Share Forecast Outlook 2025 to 2035

Ventral Hernia Treatment Market Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ship Repair and Maintenance Service Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Wall Repair Roller Paint Market Size and Share Forecast Outlook 2025 to 2035

Tire Repair Patch Market Analysis By Type, Application, and Region Through 2035

Nerve Repair Market Growth - Trends, Demand & Innovations 2025 to 2035

Global On-Demand Repair Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cartilage Repair Market Analysis - Size, Share & Forecast Outlook 2025 to 2035

Foundation Repair Services Market Outlook from 2025 to 2035

Automotive Repair & Maintenance Services Market Growth - Trends & Forecast 2025 to 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Rib Fracture Repair Systems Market Size and Share Forecast Outlook 2025 to 2035

Motor Winding Repair Service Market Growth - Trends & Forecast 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Repair & Reconstruction Devices Market – Growth & Trends 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA