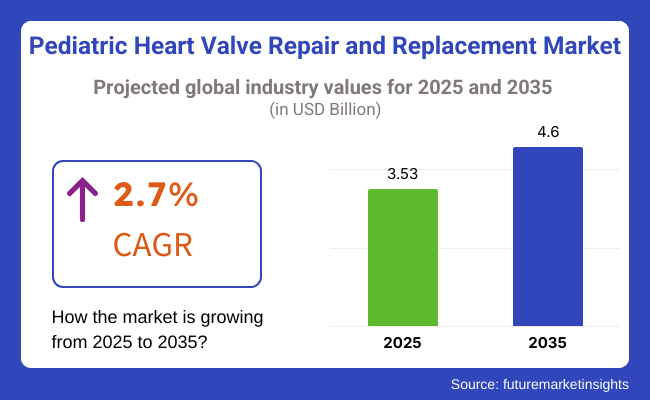

Between 2025 to 2035, the global pediatric heart valve repair and replacement market is anticipated to record a 3x rise in terms of volume, owing to growing congenital heart defects (CHD), advances in valve repair technologies as well as evolving pediatric cardiovascular care.

There are well known frameworks to treat heart valve catheterization for congenital stenosis and regurgitation in children. The increase in child metabolism data and development of bioprosthetic and mechanical valve solutions tailored to children in response to the ongoing evolution of clinical demand means that there are increasingly diverse treatment options available.

Technologies such as tissue-engineered heart valves, transcatheter valve replacement (TVR) and techniques for minimally-invasive surgery are revolutionizing pediatric cardiac care. Moreover, the rising investments in healthcare, government programs, and training of pediatric cardiac surgeons would further benefit the industry.

Nevertheless, pediatric heart valve medication potential, along with concerns about high procedural costs and challenges in the complexity of repeat surgeries due to child growth are expected to limit market growth.

North America is most likely to hold a dominant share of the sector in the forthcoming years. The major reason for this is the country’s well-established and advanced healthcare infrastructure, high focus to congenital heart disease and the country’s significant investment in pediatric cardiac research.

Top hospitals and research centers are working on new heart valves solutions and better surgical outcomes with innovation. Moreover, the increasing reimbursement policies by the government as well as the declining cost of healthcare services are ensuring easy access to the pediatric heart valve procedures.

Strong partnerships between medical device manufacturers and research universities in the region are also accelerating the development of revolutionary heart valve technologies in the region. Though providing these advantages, the high cost of treatments poses a barrier for certain patient population, though some diversity in healthcare access based on population groups may minimize sector penetration.

Europe is expected to withstand the sector over the forecast period, with the help of a growing awareness on congenital heart diseases, better pediatric cardiovascular programs, and development of minimum invasive surgeries of heart valves. Countries such as Germany, France, and the UK are investing significantly in pediatric cardiac research resulting in next-generation valve technology.

Moreover, the European healthcare policies primarily focus on early diagnosis and quick preventive measures giving rise to increased demand in the industry by providing remarkable patient outcomes. With the help of AI-driven diagnostic tools and the advantage of 3D printing of heart valves, are opening the new doors of treatment facilities.

However, on the other hand, the rigid regulations related to medical devices, including as CE marking prerequisites may present as an emerging hurdle in the industry growth and deployment of innovative approaches.

North America is anticipated to dominate the global pediatric cardiac surgery industry owing to advanced healthcare facilities, rising awareness about congenital conditions, and high surgical volume. Countries like China, India, and Japan are also converting their networks to provide pediatric cardiac care and government initiatives are giving organizations to help promote diagnosis and treatment at a young age.

And the growth of specialized pediatric cardiac centers and expanded training programs for cardiac surgeons is helping patients get the treatment they need. Moreover, international partnerships and foreign investments are contributing to delivering medical innovation and making high-quality heart valve repair and replacement products more accessible.

Nonetheless, issues like healthcare access in rural regions, high costs for complex medical processes, and disparity in regulatory structures could limit industry growth. Campaigns to raise awareness, as well as efforts by non-governmental organizations (NGOs) to provide surgeries for free or at reduced costs, are essential to tackling these problems.

Challenges

Lack of Pediatric-specific Valve Solutions: One of the key obstacles to the growth of pediatric heart valve repair and replacement industry is the absence of solutions specific to the pediatric aging population. Unlike adult patients, children need valves that can grow with them, making approaches to long-term treatment complicated.

High procedural costs and the necessity of repeat interventions as children grow up further complicate treatment plans. Regulatory Issues Related to Pediatric Medical Device Approvals: One of the challenges faced in the industry is the regulatory challenges in interpreting the data and developing the protocol for pediatric populations.

The prolonged and expensive approvals for medical technologies create a hindrance to quickly provide new technologies to patients, delaying their access to new and better solutions. In some areas, an insufficient number of specialized pediatric cardiac surgeons also hampers industry growth since the expertise for complicated heart valve repair is limited to larger metropolitan hospitals and large specialty centers.

Opportunities

Technological advancements in the development of tissue engineered and bioresorbable heart valves are expected to offer high growth opportunities in the industry. The recent innovations in transforming valves into personalized/3D-printed heart valves may play a crucial role in addressing the scalability issue among pediatric patients, ultimately enhancing years of life saved, and improving outcomes in general.

Other key contributors that are escalating the industry growth features the significant investment in pediatric cardiac research alongside initiatives that are focused towards enhancing access to specialized care, universally. Increasing government initiatives for early screening programs and neonatal cardiac care are additionally fostering industry growth.

The increasing collaboration of philanthropic organizations and non-profit entities in undertaking and funding pediatric cardiac surgeries is making these life-saving surgeries available to the larger population in underdeveloped economies, undoubtedly creating a industry for the players to explore in the emerging economies.

The Future of Pediatric Cardiac Surgery: 3D Printed Patient-Specific Heart Valves The increasingly individualized heart valve designs, tailored to a child's unique anatomy, are making treatment more accurate, minimizing complications and improving survival.

AI in Cardiac Imaging and Diagnosis: Integration of AI into early diagnosis and surgical planning for pediatric heart valve disorders improves the quality of precision and treatment. The advance generation AI-driven analytics are allowing clinicians to detect congenital heart defects and taking rapid personalized strategies, to improve long-term prognosis for pediatric patients.

In the preceding years, the patient positioning system domain have been experiencing a stable growth, establishing a good hold onto the increased number of surgeries, need for accurate imaging, and developments in the robotic procedures.

Now as we move forward to 2025 to 2035, the industry landscape will be completely driven by further developments focusing majorly on patient-specific customization, and enhanced integration with robotic surgical platforms.

The rigid regulatory frameworks will ensure patient security and sustainability concerns may escalate the incorporation of sustainable material that are environmental oriented as well. The growth of telemedicine and remote patient monitoring device will affect product development in the homecare and outpatient settings as well.

Comparison Table

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Safety and compliance mandates for hospital-based positioning systems. |

| Technological Advancements | Robotic-assisted positioning and ergonomic system expansion |

| Consumer Demand | Surgically and diagnostic processes with substantial accuracy. |

| Market Growth Drivers | Increasing surgical volumes, heightened patient comfort features, and growing investments in healthcare. |

| Sustainability | Few sustainable materials and energy-efficient manufacturing. |

| Supply Chain Dynamics | Disruptions from global raw-material shortages and production constraints. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stronger global regulations centered on patient safety, data integration, and interoperability. |

| Technological Advancements | Automation driven by AI, real-time monitoring & fluid imaging-guided positioning solutions. |

| Consumer Demand | This involves greater demand for positioning solutions that are personalized, adaptable, and compatible with homecare. |

| Market Growth Drivers | Robotic platform integration; better positioning through AI; product expansion for homecare. |

| Sustainability | More on eco-friendly materials, recyclable components, and energy-efficient designs. |

| Supply Chain Dynamics | Localized manufacturing and diversified sourcing for better supply chain resilience. |

Market Outlook

The United States pediatric heart valve repair and replacement domain is expected to grow at a moderate growth rate over the forecast period, as the sector is being driven by the increasing cases of congenital heart defects CHDs, and technological advancement in the medical field. In the USA, approximately 40,000 infants are born with congenital heart defects (CHDs) every year requiring specialized cardiac intervention.

Various products are on the industry here, namely mechanical, bioprosthetic valves and transcatheter aortic valve implantation (TAVI) devices. The focus on early diagnosis and intervention, as well as supportive healthcare policies, are major factors contributing to the growth of the industry. Meanwhile, demanding regulatory requirements and high procedural costs may hamper growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| United States | 3.5% |

Market Outlook

The German pediatric heart valve repair and replacement industry is driven by a well-established healthcare infrastructure and a strong emphasis on innovative medical technologies. They have a well-developed system of specialized pediatric cardiac centers that treat across the spectrum of care. Different types of valve, including mechanical and bioprosthetic valves, are available for patients on the industry. But high procedures and devices cost and stringent regulatory frameworks may hamper the industry growth.

Industry Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.8% |

Market Outlook

For decades, the market for pediatric heart valve repair and replacement in China has been driven by a population base and healthcare investments. The increase in the incidence of congenital heart disease calls for specialized cardiac care services Pediatric Cardiac Therapeutics device Industry Segment Insights: In 2022, the growth of the Pediatric Cardiac Therapeutics industry was mainly driven by the increasing adoptions of the industry segments, such as the increasing demand for the Pediatric Cardiac Therapeutics products, time spent on the products, premium price(high price of products), and customized product offer.

In addition, industry growth may be hampered by healthcare access gaps between urban and rural areas and low awareness.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| China | 4.2% |

Market Outlook

High birth rate and growing awareness of congenital heart disease will be the key factors driving the industry. On the basis of service type, the global cardiac care services market can be segmented into acute care services, chronic care services, recuperative care services, diagnostic care services, and on-site preventive care services.

Industrial development is further reinforced by various government efforts to enhance healthcare availability and reduce costs, as well as the rise of specialized cardiac centers. Limitations like lack of resources and healthcare for rural population might affect growth.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| India | 5.0% |

Market Outlook

The incidence of congenital heart disease creates a need for specific cardiac facilities. Both public and private healthcare providers, surgical interventions, and advanced medical devices are included in the market. Economic inequality and regional disparities in healthcare access could hinder the growth expansion of industry.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.5% |

Heart Valve Repair: Leading the Segment in Minimally Invasive SolutionsAmong the various key applications of the pediatric heart valves, heart valve repair is dominating the segment due to its benefits over the complete valve replacement. Surgical strategies are designed to maintain the function of the native valve wherever possible, minimizing the risk of complications and lifelong anticoagulation therapy.

In fact, this is especially important for children bearing cardiac devices, as their hearts are still in development. New advances in minimally invasive approaches, including annulus- and valve-plasty, resulted in improved outcomes among children with congenital valve defects.

Rising awareness, as well as increasing availability of pediatric cardiac care centers specializing in valve repair, further boost the demand for this segment. Efforts to engineer valve scaffolds with tissue-engineering techniques similar to those in hit-use for blood vessels, as well as the introduction of bioresorbable materials, should improve the durability and efficacy of repair procedures.

Transcatheter Aortic Valve Implantation (TAVI): New Horizons in Pediatric Cardiology While mostly used in adult patients, transcatheter aortic valve implantation (TAVI) usage is an emerging topic in pediatric cardiology, particularly those who are of high surgical risk and not considered candidates for traditional open-heart surgery.

TAVI is minimally invasive and results in shorter recovery times and fewer surgical complications, so it represents an appealing option for congenital valve pathology treatment. Advancements in valve design and smaller catheter sizes and more flexible delivery systems have since broadened the potential for valve-in-valve TAVI, particularly in young patients. The market for these novel interventions is expected to experience significant growth, as ongoing clinical trials assess long-term safety and efficacy of TAVI in the pediatric population.

Congenital Heart Defects: Leading Cause of Pediatric Valve Procedures Congenital heart defects (CHDs) are the most frequent indication for repair and replacement of pediatric heart valves. Common congenital heart defects (CHDs)-abnormalities of the heart and great vessels, such as valve stenosis, regurgitation, or malformed valve structures-often necessitate early corrective intervention for optimal cardiac function and development.

Progress toward early diagnosis (fetal echocardiography; 3D imaging) and its associated improvements in treatment planning and outcomes for future affected infants and children have been instrumental in this regard. Other factors driving industry growth include, increased investment into pediatric cardiac centers, and development of patient specific valve devices made for children.

The continuously rising focus on personalized medicine and regenerative therapies for the treatment of coronary heart diseases (CHD) is anticipated to provide an impetus to the innovation in this segment.

Atresia: Complex Valve Reconstruction Techniques in High Demand Atresia is a congenital condition that causes the total absence of an opening of a heart valve, and it requires complex surgical interventions to be corrected. Restoring normal flow depends on multi-stage procedures such as valve repair or valve replacement, due to the severity of this condition. As such, pediatric patients with atresia often receive staged surgeries, including Fontan, which emphasizes the critical importance of advanced valve solutions.

This industry is witnessing demand for heart valves durable and adaptable solutions due to increase in congenital atresia cases and improvements in neonatal cardiac surgery. Allowing ongoing research with bioengineered heart valves that grow with pediatric patients would open up positive opportunities for the sector growth in the future.

The global pediatric heart valve repair and replacement sector is expected to expand as the path of least resistance by virtue of technological innovation, enhanced awareness pertaining to congenital heart disease conditions, and surge in demand for minimally invasive treatment alternatives.

There is a steady growth in the pediatric heart valve repair and replacement segment owing to the rising congenital heart diseases (CHD), growing advancements in minimally invasive surgical techniques, and the recent improvements in bioprosthetic valve durability.

Major manufacturers of medical devices are investing their resources in R&D activities to improve the performance and durability of pediatric heart valves, along with a keen focus on regulatory approvals and clinical studies. The industry features technological advancements, specialty treatment solutions, and collaborations in between healthcare providers and industry participants.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Edwards Lifesciences | 18-22% |

| Medtronic plc | 15-18% |

| Abbott Laboratories | 10-12% |

| Boston Scientific Corporation | 8-10% |

| Other Companies (combined) | 38-49% |

| Company Name | Key Offerings/Activities |

|---|---|

| Edwards Lifesciences | Develops innovative bioprosthetic and mechanical pediatric heart valves with extended durability. |

| Medtronic plc | Specializes in minimally invasive heart valve repair and transcatheter valve technologies. |

| Abbott Laboratories | Focuses on congenital heart disease treatments and tissue-engineered valve solutions. |

| Boston Scientific Corporation | Advances transcatheter valve replacement systems and cutting-edge surgical innovations. |

Key Company Insights

Edwards Lifesciences (18-22%)

LEADERSHIP IN PEDIATRIC HEART VALVE MARKET Our pioneering bioprosthetic and mechanical valve solutions position Edwards Lifesciences as the leader in the pediatric heart valve industry. The company invests heavily in next-generation technologies and clinical studies to enhance patient outcomes.

Medtronic plc (15-18%)

With a focus on minimally invasive repair and replacement, Medtronic is advancing children's heart surgery and cardiovascular care. Its transcatheter valve innovations continue to make inroads in international industrys.

Abbott Laboratories (10-12%)

SynCardia has revolutionized mechanical CHD treatment with the world's first approved, fully implantable artificial heart. It partners with some of research institutions to foster innovation in pediatric cardiology.

Boston Scientific Corporation (8-10%)

Boston Scientific: One of the Companies to Watch in the Pediatric Heart Valve SpaceBoston Scientific is advancing transcatheter and hybrid heart valve replacement approaches to give children better outcomes.

Several other medical device manufacturers contribute significantly to the pediatric heart valve repair and replacement industry through technological innovations and specialized treatment solutions. Notable players include:

As demand for pediatric heart valve repair and replacement continues to rise, companies are prioritizing innovation, regulatory approvals, and strategic collaborations to expand their industry reach and enhance patient care.

Congenital heart defects like aortic stenosis, pulmonary valve stenosis, and mitral valve regurgitation often require intervention.

Innovations include tissue-engineered valves, transcatheter valve replacement, and growth-adaptive bioengineered solutions.

Limited availability of pediatric-sized valves, risk of reoperations as children grow, and high procedural costs are key challenges.

North America and Europe lead due to advanced healthcare infrastructure, while Asia-Pacific is emerging due to rising awareness and healthcare investments.

Table 1: Global Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 2: Global Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 3: Global Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Table 4: Global Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Region

Table 5: North America Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Country

Table 6: North America Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 7: Latin America Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 8: Latin America Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 9: Latin America Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Table 10: East Asia Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Country

Table 11: East Asia Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 12: East Asia Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 13: East Asia Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Table 14: South Asia and Pacific Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Country

Table 15: South Asia and Pacific Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 16: South Asia and Pacific Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 17: South Asia and Pacific Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Table 18: Western Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Country

Table 19: Western Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 20: Western Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 21: Western Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Table 22: Eastern Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Country

Table 23: Eastern Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 24: Eastern Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 25: Eastern Europe Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Table 26: Middle East and Africa Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Country

Table 27: Middle East and Africa Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Product

Table 28: Middle East and Africa Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By Application

Table 29: Middle East and Africa Market Size (US$ million) Analysis 2019 to 2023 and Forecast 2024 to 2034, By End User

Figure 1: Global Market Share, By Product, 2024 (E)

Figure 2: Global Market Share, By Application, 2024 (E)

Figure 3: Global Market Share, By End User, 2024 (E)

Figure 4: Global Market Share, By Region, 2024 (E)

Figure 5: Global Market Value Analysis (US$ million), 2019 to 2023

Figure 6: Global Market Value Forecast (US$ million), 2024 to 2034

Figure 7: Global Market Absolute Market Absolute $ Opportunity, 2024 to 2034

Figure 8: Global Market Share Analysis (%), By Product, 2024 (E) to 2034 (F)

Figure 9: Global Market Y-o-Y Analysis (%), By Product, 2024 to 2034

Figure 10: Global Market Attractiveness Analysis by Product, 2024 to 2034

Figure 11: Global Market Share Analysis (%), By Application, 2024 (E) to 2034 (F)

Figure 12: Global Market Y-o-Y Analysis (%), By Application, 2024 to 2034

Figure 13: Global Market Attractiveness Analysis by Application, 2024 to 2034

Figure 14: Global Market Share Analysis (%), By End User, 2024 (E) to 2034 (F)

Figure 15: Global Market Y-o-Y Analysis (%), By End User, 2024 to 2034

Figure 16: Global Market Attractiveness Analysis by End User, 2024 to 2034

Figure 17: Global Market Share Analysis (%), By Region, 2024 (E) to 2034 (F)

Figure 18: Global Market Y-o-Y Analysis (%), By Region, 2024 to 2034

Figure 19: Global Market Attractiveness Analysis by Region, 2024 to 2034

Figure 20: North America Market Share, By Product, 2024 (E)

Figure 21: North America Market Share, By Application, 2024 (E)

Figure 22: North America Market Share, By End User, 2024 (E)

Figure 23: North America Market Share, By Country, 2024 (E)

Figure 24: North America Market Value (US$ million) Analysis 2019 to 2023

Figure 25: North America Market Value (US$ million) Analysis 2024 to 2034

Figure 26: North America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 27: North America Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 28: North America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 29: North America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 30: United States Market Share Analysis (%) By Product, 2023 to 2034

Figure 31: United States Market Share Analysis (%) By Application, 2023 to 2034

Figure 32: United States Market Share Analysis (%) By End User, 2023 to 2034

Figure 33: Canada Market Share Analysis (%) By Product, 2023 to 2034

Figure 34: Canada Market Share Analysis (%) By Application, 2023 to 2034

Figure 35: Canada Market Share Analysis (%) By End User, 2023 to 2034

Figure 36: Mexico Market Share Analysis (%) By Product, 2023 to 2034

Figure 37: Mexico Market Share Analysis (%) By Application, 2023 to 2034

Figure 38: Mexico Market Share Analysis (%) By End User, 2023 to 2034

Figure 39: Latin America Market Share, By Product, 2024 (E)

Figure 40: Latin America Market Share, By Application, 2024 (E)

Figure 41: Latin America Market Share, By End User, 2024 (E)

Figure 42: Latin America Market Share, By Country, 2024 (E)

Figure 43: Latin America Market Value (US$ million) Analysis 2019 to 2023

Figure 44: Latin America Market Value (US$ million) Analysis 2024 to 2034

Figure 45: Latin America Market Attractiveness Analysis by Product, 2024 to 2034

Figure 46: Latin America Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 47: Latin America Market Attractiveness Analysis by End User, 2024 to 2034

Figure 48: Latin America Market Attractiveness Analysis by Country, 2024 to 2034

Figure 49: Brazil Market Share Analysis (%) By Product, 2023 to 2034

Figure 50: Brazil Market Share Analysis (%) By Application, 2023 to 2034

Figure 51: Brazil Market Share Analysis (%) By End User, 2023 to 2034

Figure 52: Chile Market Share Analysis (%) By Product, 2023 to 2034

Figure 53: Chile Market Share Analysis (%) By Application, 2023 to 2034

Figure 54: Chile Market Share Analysis (%) By End User, 2023 to 2034

Figure 55: East Asia Market Share, By Product, 2024 (E)

Figure 56: East Asia Market Share, By Application, 2024 (E)

Figure 57: East Asia Market Share, By End User, 2024 (E)

Figure 58: East Asia Market Share, By Country, 2024 (E)

Figure 59: East Asia Market Value (US$ million) Analysis 2019 to 2023

Figure 60: East Asia Market Value (US$ million) Analysis 2024 to 2034

Figure 61: East Asia Market Attractiveness Analysis by Product, 2024 to 2034

Figure 62: East Asia Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 63: East Asia Market Attractiveness Analysis by End User, 2024 to 2034

Figure 64: East Asia Market Attractiveness Analysis by Country, 2024 to 2034

Figure 65: China Market Share Analysis (%) By Product, 2023 to 2034

Figure 66: China Market Share Analysis (%) By Application, 2023 to 2034

Figure 67: China Market Share Analysis (%) By End User, 2023 to 2034

Figure 68: Japan Market Share Analysis (%) By Product, 2023 to 2034

Figure 69: Japan Market Share Analysis (%) By Application, 2023 to 2034

Figure 70: Japan Market Share Analysis (%) By End User, 2023 to 2034

Figure 71: South Korea Market Share Analysis (%) By Product, 2023 to 2034

Figure 72: South Korea Market Share Analysis (%) By Application, 2023 to 2034

Figure 73: South Korea Market Share Analysis (%) By End User, 2023 to 2034

Figure 74: South Asia and Pacific Market Share, By Product, 2024 (E)

Figure 75: South Asia and Pacific Market Share, By Application, 2024 (E)

Figure 76: South Asia and Pacific Market Share, By End User, 2024 (E)

Figure 77: South Asia and Pacific Market Share, By Country, 2024 (E)

Figure 78: South Asia and Pacific Market Value (US$ million) Analysis 2019 to 2023

Figure 79: South Asia and Pacific Market Value (US$ million) Analysis 2024 to 2034

Figure 80: South Asia and Pacific Market Attractiveness Analysis by Product, 2024 to 2034

Figure 81: South Asia and Pacific Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 82: South Asia and Pacific Market Attractiveness Analysis by End User, 2024 to 2034

Figure 83: South Asia and Pacific Market Attractiveness Analysis by Country, 2024 to 2034

Figure 84: India Market Share Analysis (%) By Product, 2023 to 2034

Figure 85: India Market Share Analysis (%) By Application, 2023 to 2034

Figure 86: India Market Share Analysis (%) By End User, 2023 to 2034

Figure 87: Association of Southeast Asian Nations Countries Market Share Analysis (%) By Product, 2023 to 2034

Figure 88: Association of Southeast Asian Nations Countries Market Share Analysis (%) By Application, 2023 to 2034

Figure 89: Association of Southeast Asian Nations Countries Market Share Analysis (%) By End User, 2023 to 2034

Figure 90: Australia and New Zealand Market Share Analysis (%) By Product, 2023 to 2034

Figure 91: Australia and New Zealand Market Share Analysis (%) By Application, 2023 to 2034

Figure 92: Australia and New Zealand Market Share Analysis (%) By End User, 2023 to 2034

Figure 93: Western Europe Market Share, By Product, 2024 (E)

Figure 94: Western Europe Market Share, By Application, 2024 (E)

Figure 95: Western Europe Market Share, By End User, 2024 (E)

Figure 96: Western Europe Market Share, By Country, 2024 (E)

Figure 97: Western Europe Market Value (US$ million) Analysis 2019 to 2023

Figure 98: Western Europe Market Value (US$ million) Analysis 2024 to 2034

Figure 99: Western Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 100: Western Europe Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 101: Western Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 102: Western Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 103: Germany Market Share Analysis (%) By Product, 2023 to 2034

Figure 104: Germany Market Share Analysis (%) By Application, 2023 to 2034

Figure 105: Germany Market Share Analysis (%) By End User, 2023 to 2034

Figure 106: Italy Market Share Analysis (%) By Product, 2023 to 2034

Figure 107: Italy Market Share Analysis (%) By Application, 2023 to 2034

Figure 108: Italy Market Share Analysis (%) By End User, 2023 to 2034

Figure 109: France Market Share Analysis (%) By Product, 2023 to 2034

Figure 110: France Market Share Analysis (%) By Application, 2023 to 2034

Figure 111: France Market Share Analysis (%) By End User, 2023 to 2034

Figure 112: United Kingdom Market Share Analysis (%) By Product, 2023 to 2034

Figure 113: United Kingdom Market Share Analysis (%) By Application, 2023 to 2034

Figure 114: United Kingdom Market Share Analysis (%) By End User, 2023 to 2034

Figure 115: Spain Market Share Analysis (%) By Product, 2023 to 2034

Figure 116: Spain Market Share Analysis (%) By Application, 2023 to 2034

Figure 117: Spain Market Share Analysis (%) By End User, 2023 to 2034

Figure 118: BENELUX Market Share Analysis (%) By Product, 2023 to 2034

Figure 119: BENELUX Market Share Analysis (%) By Application, 2023 to 2034

Figure 120: BENELUX Market Share Analysis (%) By End User, 2023 to 2034

Figure 121: Nordic Countries Market Share Analysis (%) By Product, 2023 to 2034

Figure 122: Nordic Countries Market Share Analysis (%) By Application, 2023 to 2034

Figure 123: Nordic Countries Market Share Analysis (%) By End User, 2023 to 2034

Figure 124: Eastern Europe Market Share, By Product, 2024 (E)

Figure 125: Eastern Europe Market Share, By Application, 2024 (E)

Figure 126: Eastern Europe Market Share, By End User, 2024 (E)

Figure 127: Eastern Europe Market Share, By Country, 2024 (E)

Figure 128: Eastern Europe Market Value (US$ million) Analysis 2019 to 2023

Figure 129: Eastern Europe Market Value (US$ million) Analysis 2024 to 2034

Figure 130: Eastern Europe Market Attractiveness Analysis by Product, 2024 to 2034

Figure 131: Eastern Europe Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 132: Eastern Europe Market Attractiveness Analysis by End User, 2024 to 2034

Figure 133: Eastern Europe Market Attractiveness Analysis by Country, 2024 to 2034

Figure 134: Russia Market Share Analysis (%) By Product, 2023 to 2034

Figure 135: Russia Market Share Analysis (%) By Application, 2023 to 2034

Figure 136: Russia Market Share Analysis (%) By End User, 2023 to 2034

Figure 137: Hungary Market Share Analysis (%) By Product, 2023 to 2034

Figure 138: Hungary Market Share Analysis (%) By Application, 2023 to 2034

Figure 139: Hungary Market Share Analysis (%) By End User, 2023 to 2034

Figure 140: Poland Market Share Analysis (%) By Product, 2023 to 2034

Figure 141: Poland Market Share Analysis (%) By Application, 2023 to 2034

Figure 142: Poland Market Share Analysis (%) By End User, 2023 to 2034

Figure 143: Middle East and Africa Market Share, By Product, 2024 (E)

Figure 144: Middle East and Africa Market Share, By Application, 2024 (E)

Figure 145: Middle East and Africa Market Share, By End User, 2024 (E)

Figure 146: Middle East and Africa Market Share, By Country, 2024 (E)

Figure 147: Middle East and Africa Market Value (US$ million) Analysis 2019 to 2023

Figure 148: Middle East and Africa Market Value (US$ million) Analysis 2024 to 2034

Figure 149: Middle East and Africa Market Attractiveness Analysis by Product, 2024 to 2034

Figure 150: Middle East and Africa Market Attractiveness Analysis by Technology, 2024 to 2034

Figure 151: Middle East and Africa Market Attractiveness Analysis by End User, 2024 to 2034

Figure 152: Middle East and Africa Market Attractiveness Analysis by Country, 2024 to 2034

Figure 153: Saudi Arabia Market Share Analysis (%) By Product, 2023 to 2034

Figure 154: Saudi Arabia Market Share Analysis (%) By Application, 2023 to 2034

Figure 155: Saudi Arabia Market Share Analysis (%) By End User, 2023 to 2034

Figure 156: Türkiye Market Share Analysis (%) By Product, 2023 to 2034

Figure 157: Türkiye Market Share Analysis (%) By Application, 2023 to 2034

Figure 158: Türkiye Market Share Analysis (%) By End User, 2023 to 2034

Figure 159: South Africa Market Share Analysis (%) By Product, 2023 to 2034

Figure 160: South Africa Market Share Analysis (%) By Application, 2023 to 2034

Figure 161: South Africa Market Share Analysis (%) By End User, 2023 to 2034

Figure 162: Other African Union Market Share Analysis (%) By Product, 2023 to 2034

Figure 163: Other African Union Market Share Analysis (%) By Application, 2023 to 2034

Figure 164: Other African Union Market Share Analysis (%) By End User, 2023 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pediatric Measuring Devices Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Dental Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pediatric Tube Feeding Market Analysis by Formula Type, Feeding Method, Form, Specific Needs, Dietary Preference, Age, Distribution Channel and Region Through 2035

Pediatric Home Healthcare Market - Growth & Demand Trends 2025 to 2035

Pediatric Obesity Management Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast for 2025 to 2035

Pediatric Nutrition Market – Growth, Demand & Child Health Trends

Global Pediatric Diabetes Therapeutic Market Analysis – Size, Share & Forecast 2024-2034

Global Pediatric Clinical Trial Market Analysis – Size, Share & Forecast 2024-2034

Pediatric Vitrectomy Market

Pediatric Nasal Cannula Market

Adult and Pediatric Hemoconcentrators Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Heart Failure Testing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA