The heart pump device market is experiencing significant expansion, driven by the rising prevalence of heart failure, technological advancements in mechanical circulatory support systems, and growing acceptance of minimally invasive cardiac procedures. Increased awareness among patients and healthcare professionals regarding the benefits of ventricular assist devices has improved treatment adoption rates.

The market is also benefiting from enhanced biocompatibility, longer device lifespan, and improved patient mobility. Aging populations and growing healthcare infrastructure investments are further contributing to market growth.

Future outlook remains strong as continuous innovation and clinical research expand applications beyond end-stage heart failure. With supportive reimbursement frameworks in several regions, the heart pump device market is set to sustain long-term growth.

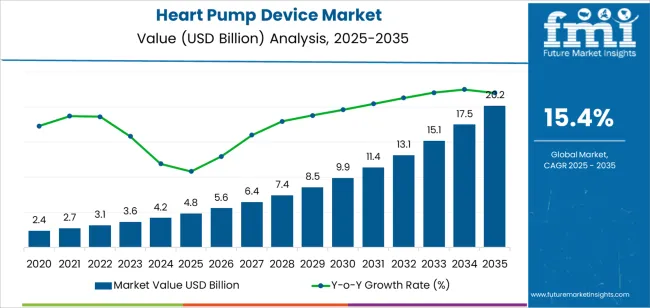

| Metric | Value |

|---|---|

| Heart Pump Device Market Estimated Value in (2025 E) | USD 4.8 billion |

| Heart Pump Device Market Forecast Value in (2035 F) | USD 20.2 billion |

| Forecast CAGR (2025 to 2035) | 15.4% |

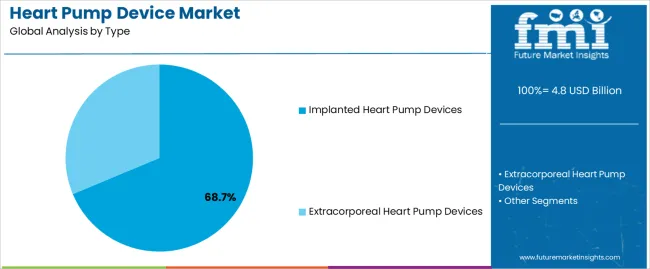

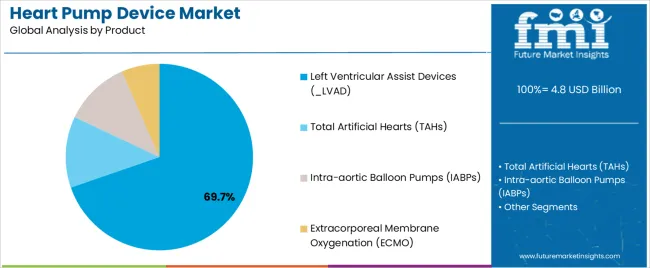

The market is segmented by Type, Product, and End Use and region. By Type, the market is divided into Implanted Heart Pump Devices and Extracorporeal Heart Pump Devices. In terms of Product, the market is classified into Left Ventricular Assist Devices (_LVAD), Total Artificial Hearts (TAHs), Intra-aortic Balloon Pumps (IABPs), and Extracorporeal Membrane Oxygenation (ECMO). Based on End Use, the market is segmented into Hospitals, Cardiac Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The implanted heart pump devices segment leads the type category with approximately 68.7% share, reflecting its critical role in long-term cardiac support. These devices are preferred for patients with advanced heart failure requiring durable assistance to maintain circulatory function.

Miniaturization of implantable systems and improvements in durability have enhanced patient quality of life. The segment’s growth is reinforced by increasing clinical success rates and reduced post-surgical complications.

Hospitals and specialized cardiac centers are expanding their adoption of implanted solutions due to better patient outcomes. With ongoing development of fully implantable systems, this segment is expected to retain its leading position throughout the forecast period.

The LVAD segment holds approximately 69.7% share of the product category, attributed to its proven efficacy in managing left ventricular dysfunction in end-stage heart failure patients. LVADs serve as both bridge-to-transplant and destination therapy solutions, offering sustained circulatory support.

Continuous advancements in pump design, battery efficiency, and remote monitoring have significantly reduced complication rates. Increasing clinical evidence demonstrating survival and quality-of-life improvements is encouraging broader physician adoption.

As demand for long-term cardiac support rises, the LVAD segment is anticipated to maintain its dominant market position.

The hospitals segment represents approximately 83.4% share of the end use category, underscoring their central role in device implantation and postoperative management. Hospitals provide the specialized surgical expertise and monitoring infrastructure necessary for advanced cardiac interventions.

The segment benefits from increasing numbers of dedicated cardiac care units and multidisciplinary treatment programs. Favorable reimbursement policies and availability of skilled healthcare professionals further drive adoption.

With ongoing expansion of tertiary care facilities and rising demand for life-saving interventions, hospitals are expected to remain the primary end users of heart pump devices over the forecast horizon.

The global heart pump device sales grew at a CAGR of 24.0% from 2020 to 2025. The growth of heart pump devices from 2020 to 2025 can be attributed to a convergence of factors:

By 2035, the market for heart pump devices is expected to rise at 20.4% CAGR.

The table below shows the estimated growth rates of the top five countries. South Korea, the United Kingdom, and China are set to record high CAGRs of 22.2%, 21.5%, and 21.7%, respectively, through 2035.

| Countries | Projected CAGR (2035) |

|---|---|

| United States | 20.7% |

| United Kingdom | 21.5% |

| China | 21.7% |

| South Korea | 22.2% |

| Japan | 18.6% |

The table below explains the heart pump device market size of the top five countries for 2035. Among them, the United States is anticipated to remain at the forefront by reaching a valuation of USD 20.2 billion. Japan is expected to reach around USD 2.3 billion by 2035, less than China's USD 4.3 billion.

| Countries | Market Values |

|---|---|

| United States | USD 20.2 billion |

| United Kingdom | USD 1 billion |

| China | USD 4.3 billion |

| South Korea | USD 1.5 billion |

| Japan | USD 2.3 billion |

The United States heart pump device industry is poised to exhibit a CAGR of 20.7% during the assessment period. By 2035, the United States market is expected to reach USD 20.2 billion. The key factors supporting the market growth are:

Heart pump device demand in China is anticipated to rise at a steady CAGR of 21.7% during the forecast period. This is attributable to a combination of factors, including:

Japan's heart pump device market is expected to reach a valuation of around USD 2.3 billion by 2035. Top factors supporting the market expansion in the country include:

The demand for heart pump devices is increasing in the United Kingdom, with a projected CAGR of 21.5% through 2035. Emerging patterns in the United Kingdom market are as follows:

The heart pump device market is projected to increase in South Korea at a CAGR of 22.2% through 2035. The factors driving the market growth are as follows:

The section below shows the implanted heart pump devices segment dominating by type. The segment is predicted to surge at a 20.0% CAGR through 2035. Based on the product, the ventricular assist devices (VADs) segment is anticipated to generate a dominant share through 2025. It is expected to rise at a CAGR of 19.6% through 2035.

| Segment | CAGR (2035) |

|---|---|

| Implanted Heart Pump Devices [Type] | 20.0% |

| Ventricular Assist Devices (VADs) [Product] | 19.6% |

Based on type, the demand for implanted heart pump devices is expected to remain high during the evaluation period.

Based on the product, ventricular assist devices (VADs) are expected to surge at a CAGR of 19.6% through 2035.

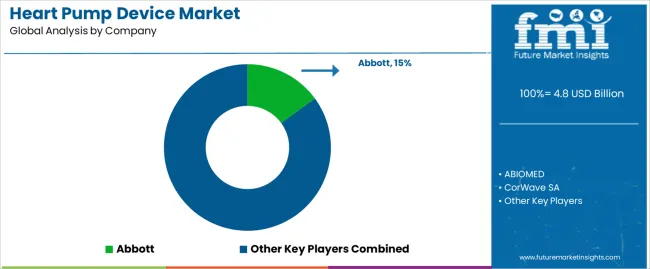

Collaborations between medical device companies, research institutions, and healthcare providers are becoming increasingly common. These partnerships facilitate the exchange of knowledge and resources, accelerating the development and adoption of innovative heart pump devices.

Key firms are pursuing strategic initiatives to optimize their market domination, such as acquisitions, mergers, and collaborations. They are introducing cutting-edge products at competitive rates.

For instance

The global heart pump device market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the heart pump device market is projected to reach USD 20.2 billion by 2035.

The heart pump device market is expected to grow at a 15.4% CAGR between 2025 and 2035.

The key product types in heart pump device market are implanted heart pump devices and extracorporeal heart pump devices.

In terms of product, left ventricular assist devices (_lvad) segment to command 69.7% share in the heart pump device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

APAC Heart Health Functional Food Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Monitor and Sensor Market

Heart Failure Testing Market

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Mobile Heart Monitoring Market

Nitinol Heart Valve Frames Market Analysis Size and Share Forecast Outlook 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Pulmonary Heart Valve Replacement Market Size and Share Forecast Outlook 2025 to 2035

Rheumatic-Heart Disease Management Market Analysis - Innovations & Outlook 2025 to 2035

Pediatric Heart Valve Repair and Replacement Analysis by Product, Induction, End Users and Region-2025 to 2035

Prosthetic Heart Valve Market is segmented by product & end user from 2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Transcatheter Heart Valve Replacement Market Analysis - Trends & Forecast 2025 to 2035

Total Artificial Heart Market

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Pump Jack Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA