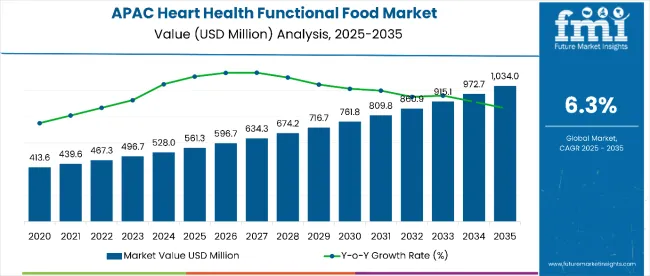

The APAC heart health functional food market is estimated to be valued at USD 561.3 million in 2025 and is projected to reach USD 1,034.0 million by 2035, registering a CAGR of 6.3% over the forecast period. The market is projected to record an absolute dollar increase of USD 472.7 million during this period, equivalent to 1.84-times growth.

| Metric | Value |

|---|---|

| APAC Heart Health Functional Food Market Estimated Value (2025E) | USD 561.3 million |

| APAC Heart Health Functional Food Market Forecast Value (2035F) | USD 1,034.0 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

Growth is expected to be driven by increasing health awareness, rising cardiovascular risks, and a shift toward preventive dietary habits among the region’s aging population.

By 2030, the market is likely to reach approximately USD 739.5 million, accounting for an incremental value gain of USD 178.2 million during the first half of the forecast period. The remaining USD 294.5 million is expected in the latter half, indicating a progressively accelerating growth trend supported by innovation in product formats, ingredient fortification, and expansion of retail distribution.

Countries such as China, India, and Japan are poised to lead in regional consumption, with China ranking highest on the market development index at 7.4. Key players including Kellogg’s, Nestlé, and General Mills are advancing product portfolios with clean-label claims, low-cholesterol ingredients, and heart-health positioning. Strategic emphasis on personalized nutrition, clinically backed efficacy, and regulatory-compliant health claims is expected to strengthen long-term market resilience and consumer trust.

The market holds approximately 1.2% of the overall APAC functional food market, driven by growing consumer awareness of cardiovascular health and lifestyle-related disease prevention. It accounts for around 9% of the region's fortified food segment, supported by the increasing integration of heart-beneficial nutrients like omega-3s, plant sterols, and dietary fiber.

The market contributes nearly 6% to the overall health and wellness food category, particularly in urban centers with higher spending power and older populations. It accounts for close to 10% of the breakfast food innovation segment, where heart health claims are becoming a key differentiator. Its share in the clean-label functional food segment reaches about 13%, indicating strong consumer preference for transparent, natural, and clinically supported product formulations.

The market is undergoing structural transformation driven by increased demand for preventive nutrition, regulatory support for health claims, and rising incidence of cardiovascular diseases across emerging Asian economies. Advances in functional ingredient technology and bioavailability enhancement are enabling more effective formulations targeting heart health. Manufacturers are launching tailored product lines such as cholesterol-lowering cereals, heart-healthy dairy, and functional edible oils.

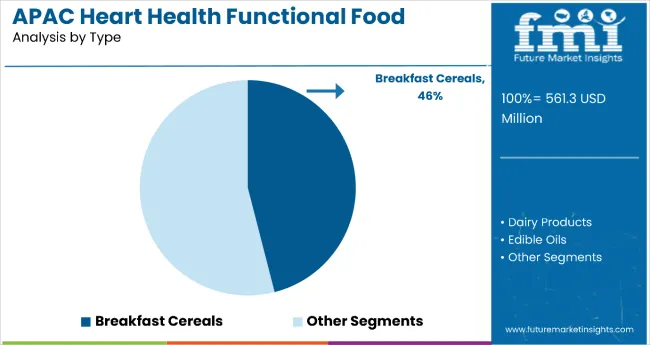

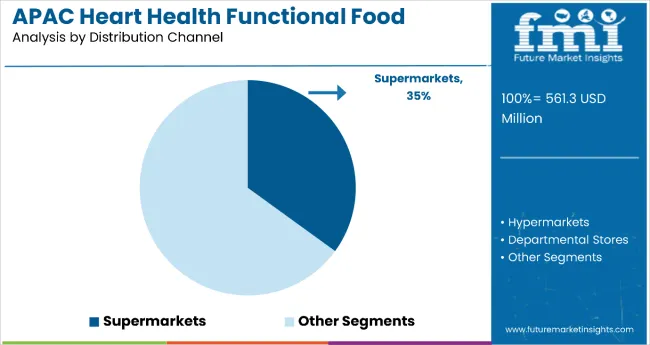

The market is segmented by type, distribution channel, and country. By type, it is divided into breakfast cereals, dairy products, edible oils, nutritional bars, and others such as juices, supplements, spreads, and fortified snacks. By distribution channel, it is classified into hypermarkets, supermarkets, departmental stores, and grocery/retailers. By country, the market includes India, China, Japan, Singapore, Indonesia, Thailand, and Malaysia.

The breakfast cereals segment holds a dominant 46% market share in 2025, driven by widespread consumer acceptance, convenience, and strong positioning as a heart-healthy, fiber-rich meal choice. Fortification with beta-glucan, plant sterols, and whole grains enables these products to support cholesterol reduction, blood pressure management, and overall cardiovascular health.

In fast-paced urban APAC markets such as China, India, and Japan, breakfast cereals provide a practical solution for health-conscious consumers seeking functional benefits without sacrificing taste or preparation time. Leading players including Kellogg’s, Nestlé, and PepsiCo (Quaker) are investing in localized innovations, clean-label formulations, and targeted health claims to reinforce competitive advantage. With a large consumer base, high repeat purchase rates, and innovation-led growth, breakfast cereals are expected to maintain their leading position through 2035.

Supermarkets dominate the distribution landscape with a 35% market share in 2025, supported by strong urban penetration, a growing middle-class population, and the ability to offer a diverse range of heart-health-focused functional foods in one location. In APAC countries such as China, India, and Singapore, supermarkets dedicate shelf space to health and wellness products, ensuring easy access to fortified cereals, dairy items, and nutritional snacks with cardiovascular benefits.

Transparent labeling, promotional campaigns, and in-store nutrition guidance enhance consumer trust. The expansion of domestic supermarket chains, alongside growth by international retailers, is increasing product visibility and accessibility. With their infrastructure, merchandising strength, and broad reach, supermarkets remain a strategic priority for manufacturers targeting heart-health-conscious consumers in APAC.

Growth is being supported by rising health awareness, increasing prevalence of cardiovascular diseases, and growing demand for preventive dietary solutions across the region. Consumers are seeking convenient, functional food products that support heart health, particularly those fortified with omega-3s, plant sterols, dietary fiber, and antioxidants. This trend is amplified by a shift toward clean-label, low-cholesterol, and clinically supported food options.

Government initiatives and regulatory support for health-enhancing food claims are encouraging manufacturers to innovate in this space. Rapid population aging and the rise of lifestyle-related health issues in countries like China, India, and Japan are accelerating adoption. Modern trade channels such as supermarkets and hypermarkets are expanding access to fortified functional foods.

As food companies prioritize nutritional value, label transparency, and disease prevention, the heart health functional food segment is expected to gain wider traction. The market is likely to benefit from continued investments in R&D, strategic partnerships, and growing consumer trust in scientifically backed functional nutrition.

In 2024, the APAC heart health functional food market experienced strong growth, driven by rising incidences of cardiovascular diseases, hypertension, and cholesterol-related disorders across urban populations. Consumption of heart-friendly cereals, dairy products, and edible oils fortified with omega-3 fatty acids and plant sterols increased notably, supported by growing consumer preference for preventive nutrition.

By 2025, demand for clinically validated functional foods gained momentum as consumers actively sought dietary alternatives that deliver measurable cardiovascular benefits. Governments across the region implemented regulatory frameworks promoting nutrient fortification, while food manufacturers advanced product innovation with targeted health claims aligned to public health objectives. Strategic marketing and product positioning reinforced consumer trust, accelerating functional food penetration in metro markets.

Regulatory Support and Preventive Health Campaigns Drive Functional Food Uptake

Regional authorities in APAC are actively promoting functional nutrition to address escalating healthcare costs associated with cardiovascular conditions. In 2024, multiple countries introduced dietary guidelines recommending the inclusion of heart-health nutrients in everyday diets. By 2025, leading food manufacturers had adapted labeling and formulation practices to align with official recommendations, boosting market credibility.

Public health campaigns in China, India, and Japan have normalized the integration of fortified foods into daily consumption habits, fostering consistent adoption among health-conscious consumers. Innovations in formulation, taste, and packaging continue to make heart-health-positioned products more accessible, supporting sustained market expansion.

Price Sensitivity and Awareness Gaps Limit Broader Market Penetration

Despite robust demand in urban centers, market growth remains restrained in semi-urban and rural areas due to high product pricing and limited awareness of functional food benefits. Premium SKUs often fall outside the affordability range for lower-income segments, slowing adoption beyond metro markets.

A lack of targeted nutrition education in non-urban areas reduces perceived value, preventing wider acceptance. Without cost-optimized product offerings and localized awareness initiatives, penetration into price-sensitive and less-informed consumer segments will remain gradual. These constraints underscore the importance of balancing innovation with affordability to capture the full market potential across the APAC region.

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.8% |

| Japan | 6.2% |

| Singapore | 5.8% |

| Thailand | 5.3% |

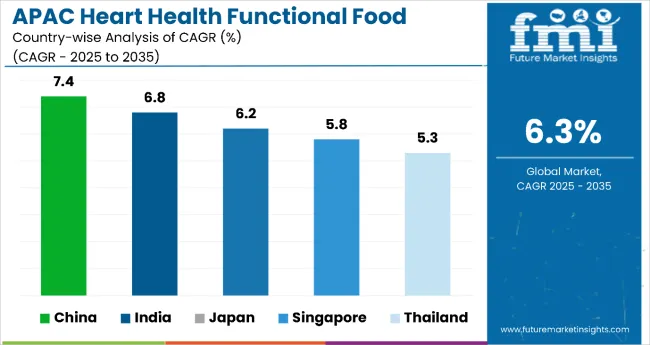

In the APAC heart health functional food market, China leads with the highest projected CAGR of 7.4% from 2025 to 2035, driven by a large aging population and rapid adoption of preventive nutrition. India follows closely with a CAGR of 6.8%, fueled by increasing cardiovascular issues and growing popularity of fortified cereals and oils.

Japan maintains steady growth at a 6.2% CAGR, supported by regulatory frameworks like FOSHU and a culture of scientifically backed dietary solutions. Singapore is projected to expand at a 5.8% CAGR, thanks to its affluent, health-conscious population and strong government-backed labeling initiatives. Thailand, while growing slightly slower at a 5.3% CAGR, shows strong momentum due to rising demand for functional snacking and heart-healthy beverages, especially among younger consumers.

Heart health functional food market in China is projected to grow at a CAGR of 7.4% from 2025 to 2035, making it the most dominant market in the APAC heart health functional food landscape. With the world’s largest aging population and rising rates of cardiovascular diseases, the demand for functional food products is growing exponentially.

Middle-class consumers are increasingly adopting heart-health-focused cereals, dairy drinks, and fortified oils. Government health programs are actively promoting preventive nutrition, while major local players are integrating traditional Chinese ingredients like red yeast rice and green tea extract into functional formats. E-commerce giants are enabling deeper market penetration through personalized health bundles and subscription models.

India heart health functional food revenue is expected to register a CAGR of 6.8% from 2025 to 2035, making it one of the fastest-growing markets in the region. Rapid urbanization, sedentary lifestyles, and increasing cholesterol-related health issues are pushing Indian consumers toward heart-healthy food alternatives. Breakfast cereals fortified with oats, plant sterols, and millets are gaining significant traction, especially among millennials and Gen Z.

Edible oils infused with omega-3 and natural antioxidants are also rising in popularity. Government campaigns such as Fit India and Ayushman Bharat have indirectly encouraged healthier food choices. Indian manufacturers are innovating with Ayurvedic herbs, while MNCs are localizing global formulations to match cultural preferences. Tier-1 cities are leading adoption, but tier-2 cities are emerging as high-potential markets with growing awareness and retail access.

Heart health functional food market in Japan is forecasted to grow at a CAGR of 6.2% during the forecast period, backed by a long-standing culture of health maintenance and functional food use. Consumers prioritize dietary solutions that are both convenient and scientifically backed.

Dairy-based drinks, probiotic yogurts, and soy-based products lead the segment due to their cholesterol-lowering properties and high trust among aging consumers. Japan’s regulatory framework (FOSHU - Foods for Specified Health Uses) supports clearly labeled, clinically tested functional foods. Companies are investing heavily in R&D to create customized solutions for cardiovascular health.

Sales of heart health functional food in Singapore are estimated to expand at a CAGR of 5.8% between 2025 and 2035, driven by an affluent, health-aware population and government initiatives promoting dietary health. The market is characterized by premium clean-label product offerings, particularly in nutritional bars, fortified cereals, and dairy alternatives.

Regulatory policies like the Healthier Choice Symbol encourage consumption of heart-friendly products. Singapore also acts as a testing ground for global brands before regional rollout, due to its advanced logistics and diverse consumer base. With a strong retail infrastructure and rising interest in personalized nutrition, companies are using AI-driven platforms and health tech to tailor offerings to individual cardiovascular health needs.

Revenue from heart health functional food in Thailand is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by growing cardiovascular disease prevalence and an expanding urban consumer base. Functional snacking, particularly nutritional bars and heart-healthy beverages, is becoming increasingly popular, especially among younger demographics. Government initiatives promoting heart health and healthy eating are raising public awareness. Global and regional brands are tapping into Thailand’s modern trade sector to roll out cholesterol-lowering and low-sodium products. Additionally, Thailand’s rising medical tourism industry is enhancing demand for wellness-oriented dietary products. Functional food visibility in convenience stores and supermarkets is growing as consumers become more label-conscious and willing to pay premium prices for trusted health claims.

The market is moderately fragmented, featuring a combination of global food giants, regional manufacturers, and specialized wellness brands. Kellogg’s and Nestlé dominate the premium breakfast and dairy segments, leveraging strong brand equity, well-established retail networks, and a portfolio of heart-health-positioned products with clinically validated claims. Their strategic edge lies in large-scale R&D infrastructure, regulatory compliance capabilities, and consistent product quality across APAC markets.

General Mills and PepsiCo (Quaker) differentiate by focusing on clean-label formulations, whole grain enrichment, and cholesterol-lowering ingredient fortification, appealing to urban and health-conscious demographics. Meanwhile, Post Holdings has established a competitive niche in functional snacking with targeted product lines for cardiovascular support.

Barriers to entry remain high, due to complex regulatory frameworks, need for clinical validation of health claims, and consumer trust dynamics. Competitiveness is increasingly determined by certified health benefits, ingredient traceability, regional taste adaptation, and collaboration with nutrition science bodies.

Key Developments in APAC Heart Health Functional Food Market

Manufacturers are actively investing in functional ingredient innovation, such as microencapsulation for nutrient bioavailability and plant-based alternatives for dairy and cereals. Global firms are forming partnerships with local distributors and health institutions to deepen market penetration and build clinical credibility.

Region-wide rollouts of clean-label, low-sodium, and cholesterol-lowering product lines are accelerating, supported by enhanced labeling policies and wellness campaigns. Companies are also adopting AI-driven personalization, enabling tailored dietary solutions based on consumer health profiles. Enhanced focus on clinical trials, food safety certifications, and regional compliance standards is shaping product development pipelines and go-to-market strategies across the APAC region.

| Item | Value |

|---|---|

| Quantitative Units | USD 561.3 Million |

| Product Type | Breakfast Cereals, Dairy Products, Edible Oils, Nutritional Bars, Others (Juices, Supplements, Spreads, etc.) |

| Distribution Channel | Hypermarkets, Supermarkets, Departmental Stores, Grocery/Retailers |

| Regions Covered | Asia-Pacific |

| Countries Covered | China, India, Japan, Singapore, Indonesia, Thailand, Malaysia |

| Key Companies Profiled | Nestlé S.A., The Kellogg Company, Marico Ltd., Raisio plc, Associated British Foods, Kalbe Farma Tbk, Bagrry’s India Ltd., PepsiCo Inc., Ruchi Soya Industries Ltd., ConAgra Foods Inc. |

| Additional Attributes | Dollar sales by product type and distribution channel, consumer shift toward clean-label and fortified foods, growing prevalence of heart disease, urbanization-driven demand, and supportive government initiatives |

The global APAC heart health functional food market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the APAC heart health functional food market is projected to reach USD 1.2 billion by 2035.

The APAC heart health functional food market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in APAC heart health functional food market are breakfast cereals, dAIry products, edible oils, nutritional bars and others (functional bEVerages, spreads, supplements).

In terms of distribution channel, supermarkets segment to command 41.8% share in the APAC heart health functional food market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Heart Beat Sensor Market Size and Share Forecast Outlook 2025 to 2035

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Heart Beat Monitor and Sensor Market

Heart Failure Testing Market

Mobile Heart Monitoring Market

Nitinol Heart Valve Frames Market Analysis Size and Share Forecast Outlook 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Pulmonary Heart Valve Replacement Market Size and Share Forecast Outlook 2025 to 2035

Rheumatic-Heart Disease Management Market Analysis - Innovations & Outlook 2025 to 2035

Pediatric Heart Valve Repair and Replacement Analysis by Product, Induction, End Users and Region-2025 to 2035

Structural Heart Devices Market Size and Share Forecast Outlook 2025 to 2035

Prosthetic Heart Valve Market is segmented by product & end user from 2025 to 2035

Transcatheter Heart Valve Replacement Market Analysis - Trends & Forecast 2025 to 2035

Total Artificial Heart Market

Radiation-Free Fetal Heart Rate Monitor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA