The APAC solar micro inverters industry is valued at USD 537.4 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 6.1% and reach USD 972.1 million by 2035.

Growth is set to accelerate as countries across Asia Pacific expand their solar energy infrastructure and favor distributed generation systems. Micro inverters are gaining prominence due to their panel-level optimization, real-time monitoring capabilities, and enhanced energy efficiency, particularly in urban and semi-urban rooftop projects.

The outlook remains strong, supported by national-level renewable energy goals and increased investments in modular solar installations. The ongoing electrification of remote areas across Southeast Asia and the Pacific Islands is also creating long-term demand. As residential and small commercial projects demand higher energy yields and safer architectures, micro inverters are positioned to become the preferred technology over traditional string inverters.

In 2024, regional adoption surged due to favorable government policies that supported rooftop solar expansion. Multiple domestic manufacturers launched new micro inverter models tailored to APAC climatic conditions. Additionally, pilot programs in rural electrification incorporated micro inverters, marking a shift in deployment patterns across developing economies. These trends solidified the foundation for the upcoming decade of expansion.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 537.4 million |

| Industry Value (2035F) | USD 972.1 million |

| CAGR (2025 to 2035) | 6.1% |

The APAC solar micro inverters industry is on a steady upward trajectory, driven by the region's aggressive shift toward decentralized and rooftop solar energy systems. Improved energy efficiency, safety, and real-time performance monitoring make micro inverters a preferred choice over traditional systems, especially in space-constrained urban settings. Residential and small commercial users stand to benefit most, while legacy inverter manufacturers may face declining demand if they fail to innovate.

The single-phase micro inverter sub-segment is projected to witness the fastest growth across types, registering a CAGR of 18.9% between 2025 and 2035, supported by the rapid adoption of solar energy in residential settings. Single-phase inverters are preferred due to their compatibility with low-power household electrical networks, affordability, and ease of integration with rooftop solar panels.

These features make them a popular choice for homeowners seeking to reduce utility bills and switch to sustainable energy. In contrast, the three-phase micro inverter segment, while growing steadily, caters to commercial and small industrial applications requiring higher power output and robust system reliability.

These inverters are deployed in medium to large solar arrays and are valued for their efficiency in grid-tied installations. Nonetheless, the increasing electrification of homes and governmental support for decentralized solar power initiatives are expected to solidify single-phase inverters as the dominant segment in terms of growth and unit volume over the next decade.

The residential segment is set to emerge as the fastest-growing application in the solar micro inverter industry, anticipated to grow at a CAGR of 9% from 2025 to 2035, driven by rising homeowner awareness of solar benefits and growing electricity costs. Residential users are increasingly installing rooftop solar panels paired with micro inverters to ensure module-level optimization, improved safety, and real-time energy tracking.

Government subsidies, net metering policies, and the push for sustainable living are reinforcing this trend. Meanwhile, the commercial segment is also showing strong growth, as businesses adopt solar systems to cut operational expenses and meet ESG targets. Micro inverters in this segment improve system uptime and energy harvest, making them an attractive investment.

The PV power plant sub-segment, although slower in comparison, remains relevant for distributed generation projects and hybrid grid setups. The shift toward decentralized energy generation places residential micro inverter applications at the forefront of future industry expansion.

The hardware sub-segment is expected to dominate in terms of value and volume, posting a CAGR of 8% over the 2025 to 2035 forecast period. Hardware includes the core micro inverter units that convert DC electricity from solar panels into grid-compatible AC power. Increasing demand for more efficient, reliable, and cost-effective inverter systems is fueling this segment.

Innovations such as integrated monitoring features, improved cooling systems, and modularity are further enhancing the attractiveness of hardware offerings. However, the software and services sub-segment is gaining momentum, primarily due to the growing need for smart monitoring, predictive maintenance, and performance analytics.

These services optimize energy production, extend product lifespans, and lower operational costs. Although currently smaller in size, software integration is quickly becoming a key differentiator among manufacturers, especially as solar users seek real-time insights into energy usage. Both segments are expected to play complementary roles in maximizing system efficiency and reliability, driving industry consolidation.

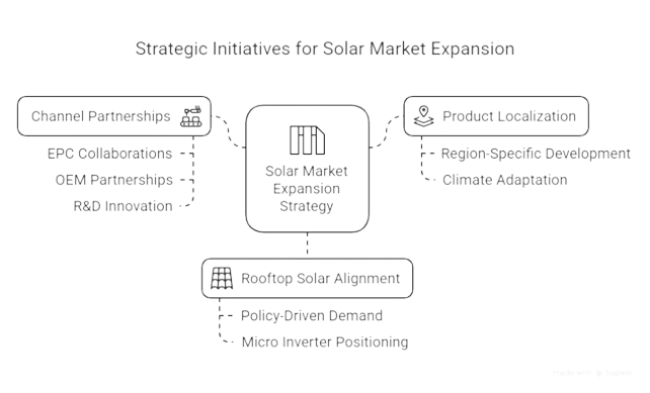

Accelerate Product Localization and Customization

Invest in region-specific product development to cater to the unique grid structures, rooftop constraints, and climate variations across APAC countries, especially in Southeast Asia and India.

Align with Rooftop Solar Incentives and Urban Energy Trends

Realign marketing and distribution strategies to match policy-driven demand surges in urban solar deployments and position micro inverters as an energy-efficient, safe, and scalable solution.

Strengthen Channel Partnerships and R&D Innovation

Expand technical collaborations with solar EPC firms and OEMs while increasing R&D funding focused on AI-based monitoring systems and thermal resilience to boost differentiation and long-term adoption.

| Risk | Probability - Impact |

|---|---|

| Regulatory delays in subsidy disbursement | Medium - High |

| Cost pressure from domestic competitors | High - Medium |

| Supply chain disruption of critical ICs | Medium - High |

| Priority | Immediate Action |

|---|---|

| Evaluate rural industry penetration models | Run feasibility study for decentralized microgrid deployments in tier-2 zones |

| Adapt to evolving policy frameworks | Set up regulatory task force for APAC rooftop subsidy alignment |

| Expand regional capacity partnerships | Initiate OEM engagement in Vietnam and Indonesia for local assembly deals |

To stay ahead of the curve in APAC’s rapidly evolving solar energy landscape, leadership must pivot toward hyper-localized product strategies and collaborative distribution models. With policy-backed rooftop solar demand accelerating and micro inverters emerging as the technology of choice, this intelligence signals a clear roadmap: invest in scalable, efficient, and region-optimized innovations.

Strengthening regional partnerships and preempting component supply risks will be crucial to secure long-term relevance and industry share. This shift not only enhances competitiveness but also aligns the organization with the next decade of distributed energy growth.

Estimated Industry Share: ~35-40%

Enphase Energy remains a dominant force in the Asia Pacific solar micro inverter industry. The company has consistently expanded its footprint through strategic partnerships and by providing innovative products, making it a preferred choice for residential and commercial solar installations.

Enphase's industry leadership is attributed to its advanced micro inverter technology, which offers high efficiency and improved energy output. In 2024, Enphase reinforced its industry share by strengthening its distribution network across key industries, particularly in Australia, Japan, and India. The company’s ability to deliver reliable and high-performance solutions has helped it maintain a significant edge in the competitive landscape.

Estimated Industry Share: ~15-20%

APsystems has made substantial inroads in the Asia Pacific region with its dual-module micro inverter technology, offering cost-effective and scalable solutions for residential and commercial solar installations. The company’s innovative approach and competitive pricing strategy have enabled it to secure a growing industry share.

In 2024, APsystems introduced new models designed to optimize energy yield and reduce installation costs, which positioned it favorably within the industry. Additionally, its expanding footprint in emerging industries like India and Southeast Asia has contributed significantly to its growing influence.

Estimated Industry Share: ~10-15%

SMA Solar Technology has maintained a solid presence in the Asia Pacific solar micro inverter industry by offering modular solutions that cater to a broad range of applications. The company is known for its focus on quality, energy efficiency, and long-term performance. In 2024, SMA Solar expanded its product line to include advanced inverters with enhanced flexibility, allowing for customized solutions across residential and commercial sectors. Their strategic emphasis on improving energy storage capabilities further boosted their position within the industry, appealing to customers seeking comprehensive solar solutions.

Key Developments in 2024

Enphase Energy, Inc.In 2024, Enphase Energy made notable strides by expanding its product offerings and increasing its industry share across the Asia Pacific region. The company introduced new models of its micro inverters that focus on enhancing solar energy efficiency and providing greater scalability for residential and commercial applications. Enphase also worked on strengthening its distribution channels and forming strategic partnerships with regional installers to further boost its presence in emerging industries, particularly in Japan and India.

AP systems AP systems launched a new generation of dual-module micro inverters in 2024, aimed at optimizing energy yield and reducing the cost of installation. This move addressed the growing demand for efficient and scalable solar energy solutions, particularly in residential and commercial sectors. The company also focused on improving product reliability and energy output, which helped AP systems increase its competitive advantage and industry share in the Asia Pacific region.

SMA Solar Technology AGSMA Solar Technology introduced new modular micro inverters in 2024 designed for residential and commercial applications. These inverters provide enhanced flexibility and better integration with solar energy storage systems. In response to industry trends, SMA Solar also expanded its capabilities in providing customized solutions for both small-scale and large-scale solar installations, significantly contributing to its growth in the Asia Pacific industry.

The Asia Pacific Solar Micro Inverters Industry is segmented into Single Phase and Three Phase.

The sector is segmented into Residential, Commercial, and PV Power Plant.

The industry is segmented into Hardware and Software & Services.

The industry is studied across China, India, Japan, ASEAN, and Oceania.

Advances in surgical techniques and the increasing prevalence of bariatric surgeries are driving the demand for precise and specialized retractors in surgeries.

Adjustable retractors provide greater flexibility, ensuring a better fit for various patient anatomies, which enhances the overall efficiency and safety of surgeries.

North America holds the largest share due to an aging population and a high number of bariatric surgeries being performed in the region.

The industry is projected to reach USD 230.5 million by 2035, experiencing a compound annual growth rate (CAGR) of 6.8%.

Companies are adapting by launching region-specific products and forging local partnerships to cater to the unique surgical needs of these regions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

APAC Wiper Blade Industry Size and Share Forecast Outlook 2025 to 2035

APAC Waste Heat Recovery Systems Market Size and Share Forecast Outlook 2025 to 2035

APAC Fluoroelastomer Market Size and Share Forecast Outlook 2025 to 2035

APAC Commercial Glazing System Market Size and Share Forecast Outlook 2025 to 2035

APAC Automotive Telematics Market Growth - Trends & Forecast 2025 to 2035

APAC Biocomposites Market Growth - Trends & Forecast 2025 to 2035

APAC Savory Ingredients Market Analysis – Trends & Forecast 2016-2026

Capacitance Meter Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Capacitive Touchscreen Market Insights – Growth & Forecast through 2034

Capacitor Kits Market

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ultracapacitors Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Supercapacitors Market Report - Trends & Industry Outlook through 2034

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA