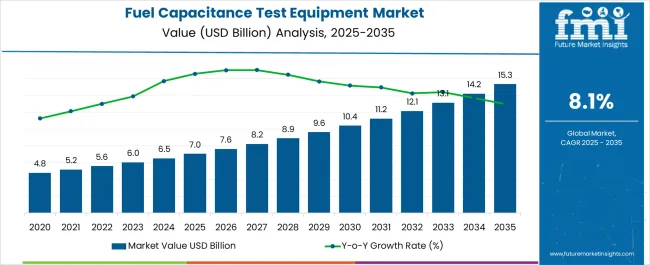

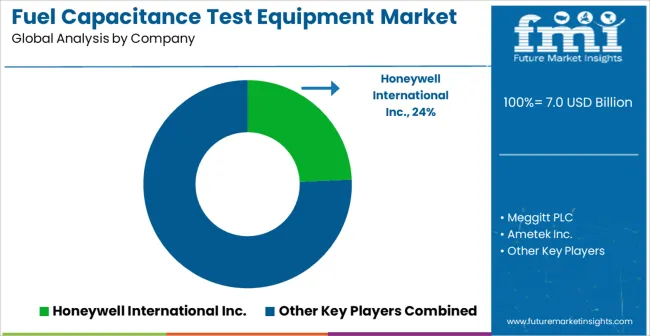

The Fuel Capacitance Test Equipment Market is estimated to be valued at USD 7.0 billion in 2025 and is projected to reach USD 15.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Fuel Capacitance Test Equipment Market Estimated Value in (2025 E) | USD 7.0 billion |

| Fuel Capacitance Test Equipment Market Forecast Value in (2035 F) | USD 15.3 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The Fuel Capacitance Test Equipment market is witnessing steady growth driven by the increasing demand for accurate and reliable fuel monitoring solutions across critical industries. The current scenario is shaped by stringent safety regulations, operational efficiency requirements, and the growing adoption of advanced diagnostic technologies in aviation and other sectors. The market is being propelled by investments in infrastructure and maintenance protocols that prioritize precision measurement and monitoring.

The future outlook is supported by developments in automated testing solutions that reduce human intervention and enhance test accuracy. Growing awareness about equipment safety and compliance requirements is further reinforcing demand for service-based models that offer flexibility and cost optimization.

As industries increasingly focus on predictive maintenance and equipment lifecycle management, the market is expected to benefit from ongoing technological innovations The adoption of rental service models is also expected to expand, as they allow users to access high-end equipment without significant upfront investment, thereby enabling broader accessibility and faster deployment.

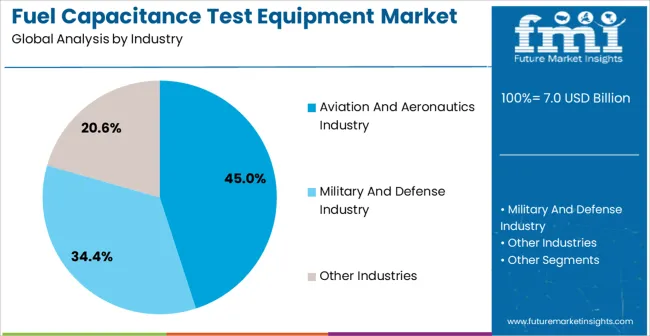

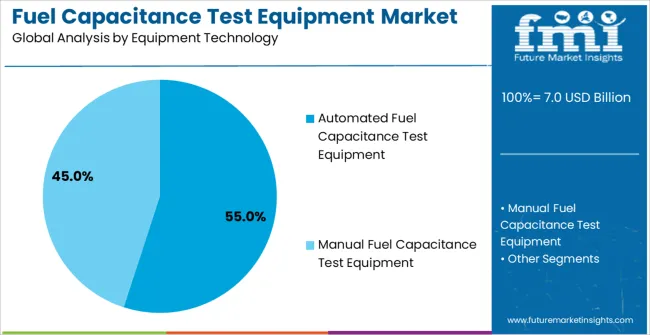

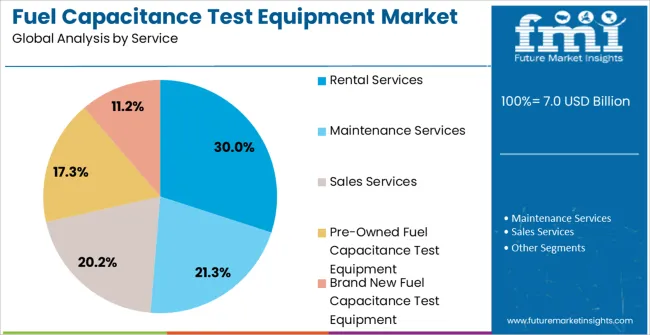

The fuel capacitance test equipment market is segmented by industry, equipment technology, service, and geographic regions. By industry, fuel capacitance test equipment market is divided into Aviation And Aeronautics Industry, Military And Defense Industry, and Other Industries. In terms of equipment technology, fuel capacitance test equipment market is classified into Automated Fuel Capacitance Test Equipment and Manual Fuel Capacitance Test Equipment. Based on service, fuel capacitance test equipment market is segmented into Rental Services, Maintenance Services, Sales Services, Pre-Owned Fuel Capacitance Test Equipment, and Brand New Fuel Capacitance Test Equipment. Regionally, the fuel capacitance test equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Aviation and Aeronautics Industry is projected to account for 45.00% of the Fuel Capacitance Test Equipment market revenue in 2025, making it the largest industry segment. This leadership is attributed to the critical need for highly precise and reliable fuel measurement systems in aerospace applications, where safety and performance are paramount.

The increasing complexity of aircraft systems, along with the stringent regulatory frameworks imposed by aviation authorities, has driven investment in advanced testing equipment. The adoption of fuel capacitance monitoring systems ensures compliance with safety protocols and improves fuel efficiency management.

Moreover, growing fleets and extended aircraft maintenance schedules have created a strong demand for advanced test solutions capable of delivering real-time diagnostics and reduced downtime As more aerospace companies seek cost-effective yet accurate testing solutions, this segment’s growth is expected to remain robust, supported by technological upgrades and increased operational requirements within the aviation ecosystem.

The Automated Fuel Capacitance Test Equipment segment is anticipated to hold 55.00% of the market share in 2025, positioning it as the leading equipment technology. The dominance of this segment is attributed to the rising need for precision and consistency in fuel capacitance measurements across various industries. Automated systems reduce reliance on manual intervention, improving both the accuracy of diagnostics and the speed at which tests can be conducted.

The increasing complexity of fuel systems, particularly in aerospace applications, has necessitated the deployment of automated testing solutions that ensure safety and compliance with stringent standards. Additionally, automated equipment enables integration with predictive maintenance frameworks, allowing early detection of anomalies and minimizing operational disruptions.

The demand for real-time data analytics and remote monitoring capabilities has further supported adoption As organizations seek solutions that enhance efficiency, reduce operational risk, and align with advanced maintenance strategies, the automated fuel capacitance test equipment segment is expected to witness sustained growth.

The Rental Services segment is expected to represent 30.00% of the market share in 2025, making it the most preferred service model within the Fuel Capacitance Test Equipment market. The growing popularity of rental solutions is being driven by the need for cost-effective access to sophisticated test equipment without large capital expenditure. Organizations operating in aerospace and other high-compliance sectors are increasingly opting for rental models that offer flexibility, scalability, and reduced maintenance overheads.

Rental services provide quick deployment options and the ability to upgrade testing capabilities as new technologies emerge. This model is particularly attractive for industries where test requirements fluctuate depending on operational schedules or project timelines.

Furthermore, the growing emphasis on operational efficiency and equipment lifecycle management has reinforced the adoption of rental models As companies focus on optimizing their maintenance budgets and enhancing access to advanced solutions, rental services are expected to play a key role in broadening market accessibility and driving growth across industries that rely on accurate fuel monitoring and safety compliance.

Fuel Capacitance Test Equipment Market Future Forecast

Unmanned aerial vehicles, commonly referred to as UAVs or drones, are increasingly being adopted for use in military, commercial, recreational, and other sectors. To deeply implement these aircraft, fuel monitoring systems are necessary, especially for long-endurance missions and the overall efficiency of missions.

Fuel capacitance test equipment allows for precise measurement and control of fuel content in UAVs and drones, which is fundamental to their functionality and durability. With the UAV industry setting phases for growth and diversification, the need for testing equipment for these aircraft rises and supports the industry’s growth.

Post-crisis, air travel demand especially from emerging economy groups of Asia Pacific and the Middle East is found to be on the rise. This is due to an increase in middle-class income and better supporting infrastructures. This growth leads to higher aircraft orders and higher requirements for sound maintenance practices. It is for this reason that this equipment has become invaluable in measuring and controlling fuel systems as these kinds of fleets continue to grow.

The increasing infrastructural base for air transportation and the increasing passenger commutations especially in the developing economies compel the demand for efficient and progressive fuel testing solutions. Thereby, helping the industry prosper.

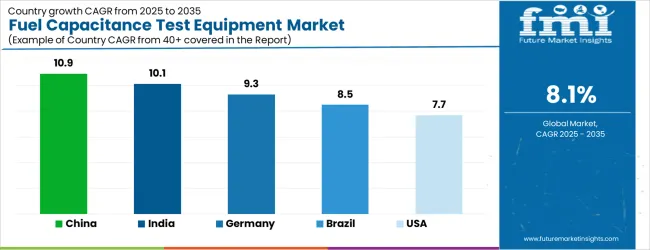

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| Brazil | 8.5% |

| USA | 7.7% |

| UK | 6.9% |

| Japan | 6.1% |

The Fuel Capacitance Test Equipment Market is expected to register a CAGR of 8.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.9%, followed by India at 10.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.1%, yet still underscores a broadly positive trajectory for the global Fuel Capacitance Test Equipment Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.3%. The USA Fuel Capacitance Test Equipment Market is estimated to be valued at USD 2.5 billion in 2025 and is anticipated to reach a valuation of USD 2.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 367.0 million and USD 198.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Industry | Aviation And Aeronautics Industry, Military And Defense Industry, and Other Industries |

| Equipment Technology | Automated Fuel Capacitance Test Equipment and Manual Fuel Capacitance Test Equipment |

| Service | Rental Services, Maintenance Services, Sales Services, Pre-Owned Fuel Capacitance Test Equipment, and Brand New Fuel Capacitance Test Equipment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., Meggitt PLC, Ametek Inc., General Electric Company (GE Aviation), Eaton Corporation plc, TE Connectivity Ltd., Kaman Corporation, Avtron Aerospace Inc., Laversab Inc., CiES Inc., Parker Hannifin Corporation, LORD Corporation, Prime Photonics, LC, Pacific Scientific Energetic Materials Company (PacSci EMC), and Aeroflex Inc. |

The global fuel capacitance test equipment market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the fuel capacitance test equipment market is projected to reach USD 15.3 billion by 2035.

The fuel capacitance test equipment market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in fuel capacitance test equipment market are aviation and aeronautics industry, military and defense industry and other industries.

In terms of equipment technology, automated fuel capacitance test equipment segment to command 55.0% share in the fuel capacitance test equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wi-Fi Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Oxy-Fuel Welding Equipment Market Growth – Trends & Forecast 2025 to 2035

Mortar Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA