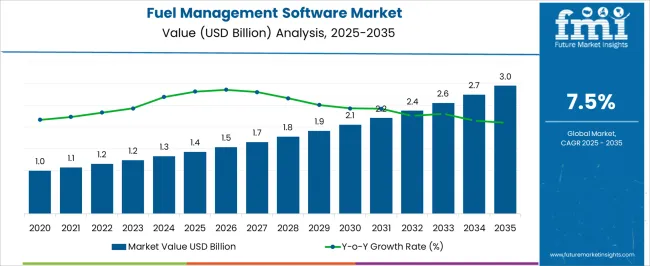

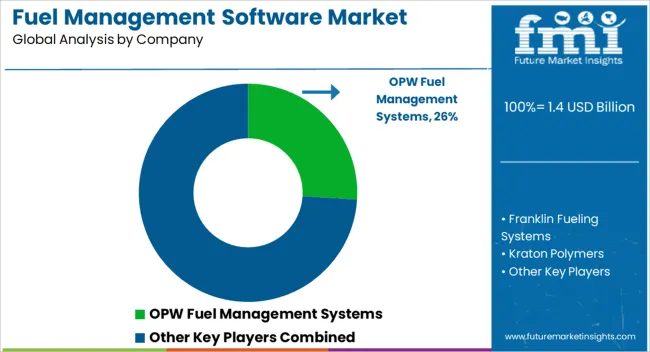

The Fuel Management Software Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Fuel Management Software Market Estimated Value in (2025 E) | USD 1.4 billion |

| Fuel Management Software Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Fuel Management Software market is being propelled by the increasing need for efficient fuel tracking, cost optimization, and regulatory compliance across various sectors. The current market scenario is shaped by rising fuel consumption, fluctuating fuel prices, and growing operational complexities in transportation, logistics, and defense. Businesses are increasingly adopting software-based solutions to monitor fuel usage, improve vehicle performance, and enhance safety protocols.

The future outlook for the market is driven by advancements in telematics, data analytics, and cloud-based platforms, which allow organizations to manage fuel resources more effectively. Growing pressure to reduce carbon emissions, comply with environmental regulations, and lower operational costs is expected to further support market growth.

Additionally, the integration of artificial intelligence and predictive analytics is enabling organizations to forecast fuel demand and detect anomalies With increasing digitization across industries and a focus on sustainable practices, fuel management solutions are anticipated to become critical tools for optimizing resource utilization and improving operational efficiency, paving the way for continued expansion in the coming years.

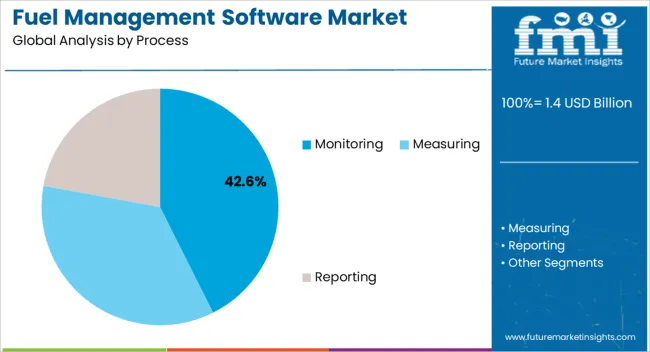

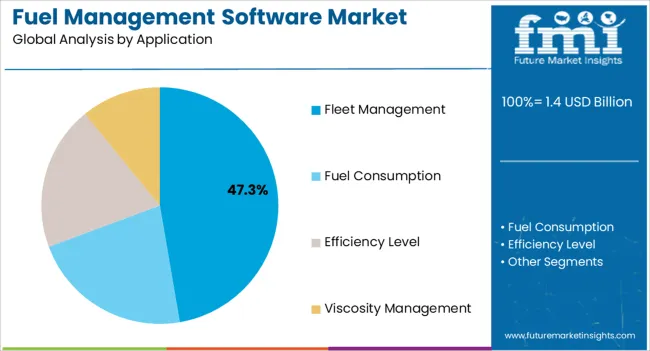

The fuel management software market is segmented by process, application, end user, and geographic regions. By process, fuel management software market is divided into Monitoring, Measuring, and Reporting. In terms of application, fuel management software market is classified into Fleet Management, Fuel Consumption, Efficiency Level, and Viscosity Management.

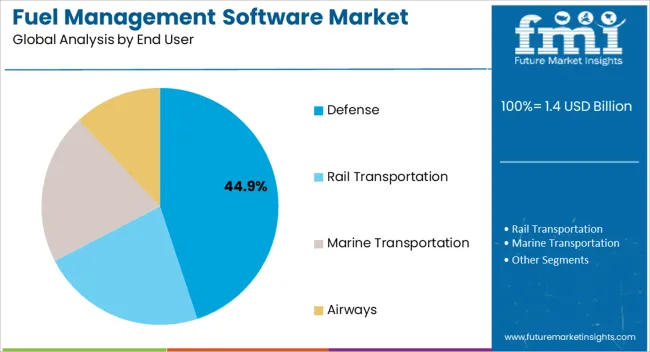

Based on end user, fuel management software market is segmented into Defense, Rail Transportation, Marine Transportation, and Airways. Regionally, the fuel management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The monitoring process segment is expected to account for 42.60% of the Fuel Management Software market revenue share in 2025, making it the leading segment. This position is attributed to the rising need for real-time tracking of fuel consumption across transportation and industrial fleets. Fuel monitoring is being prioritized due to its ability to deliver actionable insights on usage patterns, leakage detection, and inefficiencies that drive unnecessary costs.

The integration of sensors and automated data collection systems has made fuel monitoring more accurate and less labor-intensive, enabling organizations to detect fuel theft and optimize fuel usage. As regulatory frameworks regarding fuel reporting and emissions monitoring tighten, the adoption of monitoring solutions has been accelerated.

Furthermore, monitoring systems are being integrated with vehicle telematics and maintenance schedules, offering a holistic approach to fleet management The increasing complexity of supply chains and the growing adoption of connected devices are expected to further bolster the segment’s growth, making monitoring a critical component of fuel management strategies.

The fleet management application segment is projected to hold 47.30% of the Fuel Management Software market revenue share in 2025, emerging as the dominant application. This can be credited to the growing demand for optimized operations across logistics, transportation, and industrial fleets. Fuel tracking within fleet management is being driven by the need to reduce operating expenses, improve route planning, and enhance driver performance.

With increased investment in connected vehicle technologies and telematics platforms, fuel data is being used to improve fleet utilization and reduce downtime. Companies are also focusing on lowering carbon footprints, where software-enabled fuel tracking has become a key enabler.

The ability to provide dashboards, alerts, and predictive maintenance schedules is making fleet management applications more effective in addressing operational challenges As businesses continue to seek cost-saving measures and efficiency improvements, fleet management solutions are being integrated with broader enterprise management systems, resulting in higher adoption rates and sustained growth across industries.

The defense end user segment is anticipated to account for 44.90% of the Fuel Management Software market revenue share in 2025, establishing it as the largest end-use category. This is being driven by the operational and logistical demands unique to defense applications, where fuel management is critical for mission readiness, cost control, and compliance with strict safety protocols. Defense organizations are increasingly investing in advanced fuel monitoring solutions to track consumption across diverse fleets of aircraft, naval vessels, and ground vehicles.

Enhanced reporting capabilities are being leveraged to detect anomalies and prevent fuel pilferage, which is vital in high-security environments. Fuel management systems are also being integrated with maintenance planning and vehicle tracking to ensure operational efficiency during deployments.

The focus on energy conservation and long-range mission planning has further reinforced the adoption of sophisticated software solutions As military operations become more complex and fuel logistics play a pivotal role in strategic planning, the defense sector is expected to continue leading the demand for fuel management solutions due to its stringent operational requirements and emphasis on precision management.

Nowadays, marine, air, and rail transport are the best means of transportation and travelling. Every day, thousands of packages arrive at seaports and airports from countries all around the world. Fuel management software helps in maintaining, controlling, and monitoring fuel consumption and stock in various industries like rail, road, water, and air. Fuel management software plays a very important role by enabling long-range connectivity and the proper use of fuel, which helps in effectively measuring the fuel consumption. The Internet plays a crucial role in the fuel management software market by managing connectivity and ensuring better services. There are many industries, which use fuel management software, and the most common among them are construction and transport. Fuel management software has changed the way the world operates, especially when it comes to airplanes, ships, and other vehicles. There are many types of fuel management software, such as card-based fuel management software systems.

Fuel companies offer total fuel management software systems, in which they provide elements of a card-based system along with on-site fuel delivery and refuelling services. Fuel management software is combined with RFID technology, which helps in identifying equipment and ensuring automated fuel management.

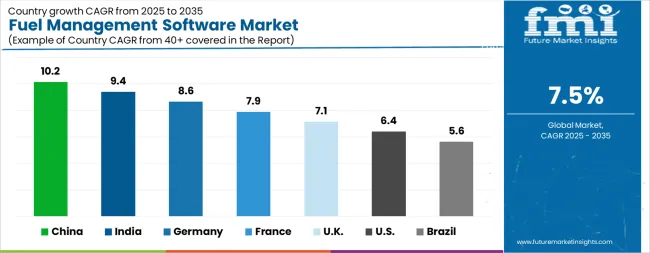

| Country | CAGR |

|---|---|

| China | 10.2% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The Fuel Management Software Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.2%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Fuel Management Software Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Fuel Management Software Market is estimated to be valued at USD 492.3 million in 2025 and is anticipated to reach a valuation of USD 914.9 million by 2035. Sales are projected to rise at a CAGR of 6.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 65.5 million and USD 40.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Process | Monitoring, Measuring, and Reporting |

| Application | Fleet Management, Fuel Consumption, Efficiency Level, and Viscosity Management |

| End User | Defense, Rail Transportation, Marine Transportation, and Airways |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OPW Fuel Management Systems, Franklin Fueling Systems, Kraton Polymers, Veeder-Root, Liquid Controls, GILBARCO VEEDER-ROOT, Dover Fueling Solutions, and Avery Weigh-Tronix |

The global fuel management software market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the fuel management software market is projected to reach USD 3.0 billion by 2035.

The fuel management software market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in fuel management software market are monitoring, measuring and reporting.

In terms of application, fleet management segment to command 47.3% share in the fuel management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA