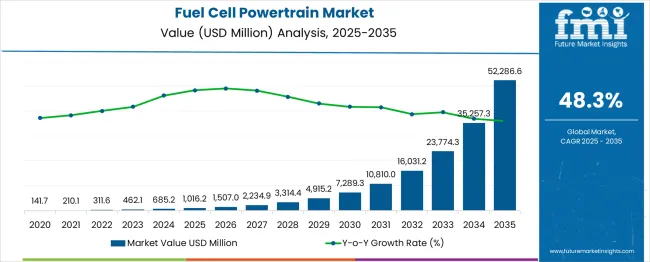

The fuel cell powertrain market is projected to reach 1,016.2 USD million in 2025 and is anticipated to surge to 52,286.6 USD million by 2035, registering a CAGR of 48% over the forecast period. Year-on-year (YoY) growth analysis indicates that the market will experience exponential expansion, with early years showing moderate increments as technology adoption begins among niche automotive manufacturers and commercial fleets exploring hydrogen-powered solutions.

During the initial phase, the YoY gains are driven by pilot projects, government incentives for zero-emission vehicles, and the gradual scaling of hydrogen infrastructure, providing a strong foundation for subsequent growth.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,016.2 million |

| Forecast Value in (2035F) | USD 52,286.6 million |

| Forecast CAGR (2025 to 2035) | 48.3% |

The fuel cell powertrain market is shaped by several interconnected parent markets that collectively define its growth trajectory and adoption. The automotive sector contributes the largest share at 50%, driven by the increasing adoption of fuel cell electric vehicles (FCEVs) in countries like Japan, South Korea, and China. The hydrogen infrastructure segment holds 20%, supported by the expansion of hydrogen refueling stations and government incentives promoting clean energy adoption. The commercial vehicles and buses segment accounts for 15%, as fleet operators seek zero-emission alternatives to reduce operational costs and meet environmental regulations. The stationary power systems segment contributes 10%, leveraging fuel cell technology for reliable, clean energy generation in industrial and remote applications. The research and development segment adds 5%, with ongoing investments aimed at improving fuel cell efficiency, reducing costs, and accelerating commercialization.

These parent markets drive strong dollar sales and significant market share growth, with automotive and hydrogen infrastructure together representing over 70% of total demand. The sector’s future trajectory is expected to strengthen with technological advancements, supportive government policies, and growing investments in hydrogen supply chains. Adoption is anticipated to accelerate in emerging regions where industrialization, clean energy initiatives, and urban mobility solutions fuel demand for fuel cell powertrains.

Modern fleet operators and logistics companies are increasingly focused on mobility options that can deliver long-range capabilities without compromising payload capacity or operational flexibility. Fuel cell powertrains' proven ability to provide extended driving range with rapid refueling makes them a preferred solution for heavy-duty transportation applications.

The growing focus on hydrogen economy development and infrastructure investments is driving demand for fuel cell powertrains across multiple transportation segments. Government incentives, subsidies, and regulatory mandates for zero-emission vehicles are creating favorable market conditions for fuel cell adoption. The rising influence of corporate steady commitments and environmental regulations is also contributing to increased technology adoption across commercial vehicle fleets and logistics operations.

The market is segmented by component outlook, product outlook, application outlook, end user outlook, and region. By component outlook, the market is divided into fuel cell module (stack + BoP), hydrogen storage system, electric drive unit (EDU), and power electronics & control. Based on product outlook, the market is categorized into fuel cell electric powertrain, fuel cell stack, and fuel cell system. In terms of application outlook, the market is segmented into commercial trucks & buses, material handling, and passenger vehicles.

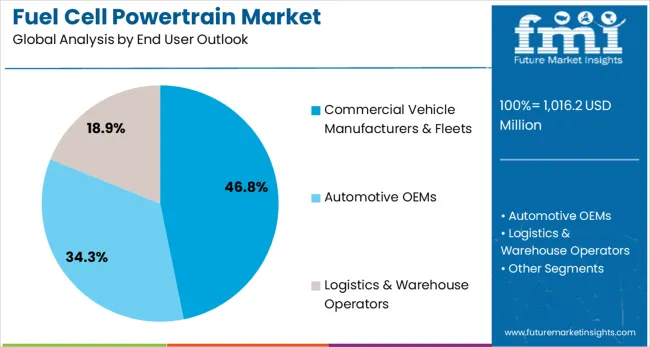

By end user outlook, the market is classified into commercial vehicle manufacturers & fleets, automotive OEMs, and logistics & warehouse operators. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

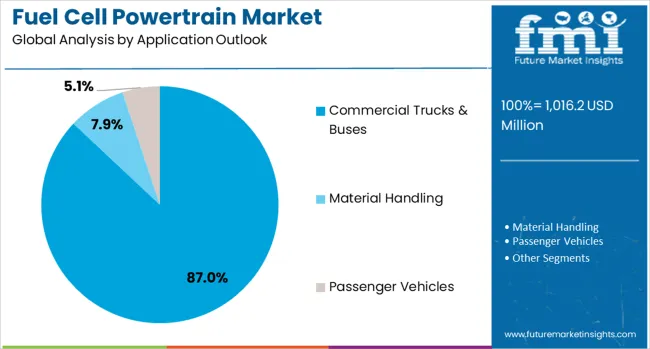

The commercial trucks & buses application is projected to account for 87% of the fuel cell powertrain market in 2025, reaffirming its position as the category's dominant application segment. Fleet operators and transportation companies increasingly understand the advantages of fuel cell technology for heavy-duty applications, including extended driving range, rapid refueling capabilities, and high payload capacity maintenance. Fuel cell powertrains' superior performance characteristics directly address the operational requirements of commercial vehicle applications.

This segment forms the foundation of market growth, as it represents the most suitable application for fuel cell technology's unique benefits. Government policies supporting zero-emission commercial vehicles and ongoing infrastructure development continue to strengthen adoption in this segment. With increasing pressure to decarbonize freight transportation and logistics operations, commercial trucks & buses align with both regulatory requirements and operational efficiency goals. The segment's broad appeal across different fleet applications ensures dominance, making it the central growth driver of fuel cell powertrain market expansion.

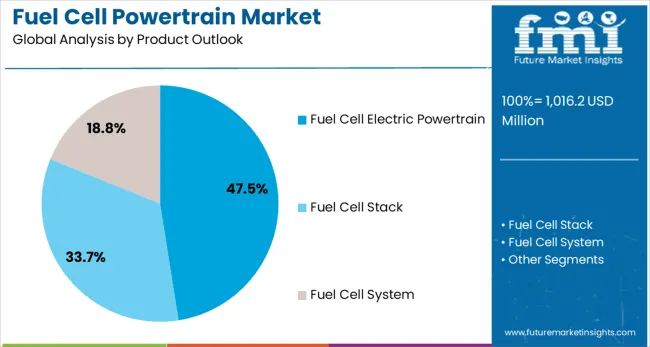

Fuel cell electric powertrain is projected to represent 48% of fuel cell powertrain market demand in 2025, underscoring its role as the preferred complete solution for zero-emission vehicle applications. Fleet operators and vehicle manufacturers gravitate toward integrated powertrain systems for their comprehensive approach to fuel cell vehicle development, including seamless integration of all powertrain components and optimized system performance. Positioned as complete mobility solutions, fuel cell electric powertrains offer both operational efficiency and simplified vehicle integration processes.

The segment is supported by the growing trend toward turnkey solutions in commercial vehicle electrification, where integrated powertrains play a central role in vehicle development strategies. Manufacturers are increasingly combining fuel cell powertrains with advanced control systems, energy management technologies, and vehicle integration services, enhancing appeal and justifying comprehensive solution positioning. As fleet operators prioritize operational reliability and system integration, fuel cell electric powertrains will continue to dominate market demand, reinforcing their position as complete zero-emission mobility solutions.

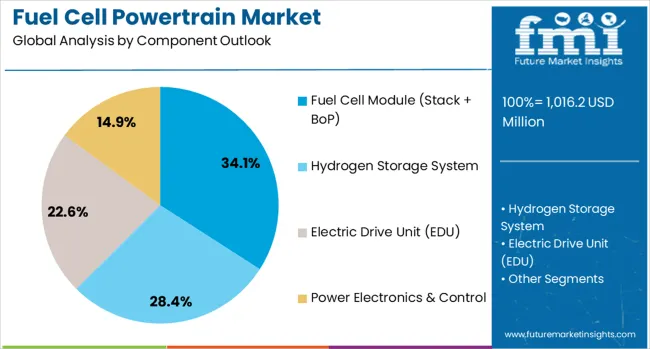

The fuel cell module (stack + BoP) component is forecasted to contribute 34% of the fuel cell powertrain market in 2025, reflecting the critical role of core fuel cell technology in powertrain system development. Vehicle manufacturers and system integrators increasingly focus on advanced fuel cell modules that combine stack technology with balance of plant components for optimal performance and reliability. This integration approach aligns with the industry trend toward comprehensive fuel cell solutions that deliver consistent power output and operational durability.

The segment benefits from ongoing technological advancements in fuel cell stack design, materials science, and system integration technologies. Advanced fuel cell modules provide the foundation for powertrain system performance, making them essential components for successful fuel cell vehicle deployment. With continued focus on technology advancement and cost reduction initiatives, fuel cell modules serve as critical differentiators in powertrain system development, making them fundamental drivers of market growth and technological progression.

The commercial vehicle manufacturers & fleets end user segment is forecasted to contribute 47% of the fuel cell powertrain market in 2025, expanding the growing adoption of fuel cell technology in commercial transportation applications. Fleet operators and vehicle manufacturers are increasingly focused on zero-emission solutions that can deliver operational efficiency, regulatory compliance, and environmental friendliness. This alignment with commercial transportation decarbonization goals positions fuel cell powertrains as essential technology for fleet modernization initiatives.

The segment also benefits from strong government support for commercial vehicle electrification and expanding hydrogen infrastructure development. Fleet adoption provides credibility and validation for fuel cell technology, encouraging broader market acceptance and technology advancement. With heightened focus on total cost of ownership optimization and operational efficiency improvement, commercial vehicle manufacturers & fleets serve as key technology adopters, making them critical drivers of market expansion and technology commercialization in the fuel cell powertrain category.

The fuel cell powertrain market is advancing rapidly due to increasing government support for hydrogen mobility initiatives and growing demand for zero-emission commercial transportation solutions. The market faces challenges, including hydrogen infrastructure limitations, high initial technology costs, and competition from battery electric alternatives. Innovation in fuel cell efficiency, cost reduction technologies, and infrastructure development continue to influence market expansion and commercial adoption patterns.

The growing development of hydrogen refuelling infrastructure is enabling broader adoption of fuel cell vehicles across commercial transportation applications. Government investments and private sector initiatives are establishing comprehensive hydrogen supply chains, including production, distribution, and refuelling capabilities. Strategic partnerships between energy companies, technology providers, and vehicle manufacturers are accelerating infrastructure deployment, particularly in high-traffic commercial vehicle corridors and logistics hubs.

Rising interest in low-emission commercial fleets and passenger vehicles is driving fuel cell powertrain adoption. Logistics and transport operators are exploring hydrogen fuel cell buses, trucks, and delivery vehicles to reduce operating costs and comply with emission regulations. Passenger vehicle manufacturers are introducing fuel cell models to appeal to environmentally conscious consumers seeking alternative mobility options. The trend toward electrification of fleets and urban public transport is creating a strong demand base, particularly in Europe, North America, and the Asia-Pacific.

| Country | CAGR (2025-2035) |

|---|---|

| China | 65.2% |

| India | 60.4% |

| Germany | 55.5% |

| France | 50.7% |

| UK | 45.9% |

| USA | 41.1% |

| Brazil | 36.2% |

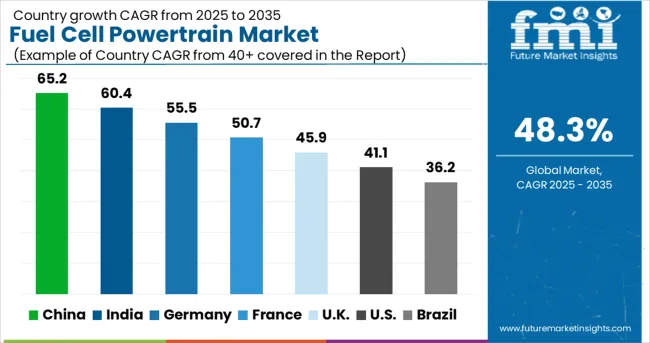

The global fuel cell powertrain market is projected to grow at a CAGR of 48% between 2025 and 2035. China leads this expansion with a 65.2% CAGR, driven by strong government support for clean mobility, increasing adoption of hydrogen fuel cell vehicles, and expansion of hydrogen refueling infrastructure. India follows at 60.4%, supported by rising investments in alternative fuel technologies, growing automotive electrification, and policy initiatives promoting fuel cell adoption.

Germany shows growth at 55.5%, emphasizing automotive innovation, R&D in hydrogen-powered vehicles, and integration of fuel cell systems in commercial fleets. France records 50.7%, fueled by the expansion of green mobility programs and the industrial adoption of fuel cell solutions. The UK is experiencing growth of 45.9%, with a focus on deploying hydrogen vehicles and developing infrastructure. The USA stands at 41.1%, reflecting increased investments in fuel cell technology, fleet electrification initiatives, and industrial partnerships driving market growth.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

The fuel cell powertrain market in China is projected to grow at a CAGR of 65.2% from 2025 to 2035, driven by government incentives, strong investment in hydrogen infrastructure, and rising demand for zero-emission commercial vehicles. Leading automotive manufacturers are launching fuel cell buses, trucks, and passenger vehicles to meet urban emission reduction targets. Collaborations between local OEMs and international technology providers are accelerating R&D in fuel cell stack efficiency, durability, and cost reduction. Expansion of hydrogen refueling stations in metropolitan and industrial regions is further supporting adoption. Public-private partnerships are promoting large-scale deployments in logistics, public transportation, and heavy-duty fleets. The market is also witnessing growth in fuel cell components, including membranes, bipolar plates, and balance-of-plant systems, boosting domestic manufacturing capacity.

The fuel cell powertrain market in India is expected to grow at a CAGR of 60.4% from 2025 to 2035, driven by increasing focus on clean energy transportation, emission reduction policies, and investments in hydrogen fuel infrastructure. Government-backed programs are promoting demonstration projects for fuel cell buses, trucks, and industrial vehicles. Domestic OEMs are partnering with international players to develop efficient fuel cell stacks and powertrain systems suitable for Indian conditions. Pilot projects in urban public transport and logistics sectors are paving the way for broader adoption. Investments in hydrogen production, storage, and refueling infrastructure are being scaled up, while research institutions are advancing next-generation membrane electrode assemblies and high-performance bipolar plates. Consumer awareness and fleet operator interest in zero-emission solutions are gradually increasing adoption across metropolitan regions.

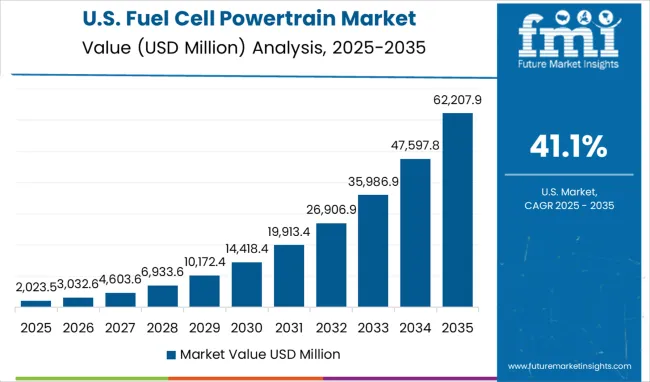

Demand for fuel cell powertrains in the USA is projected to grow at a CAGR of 41.1%, supported by federal and state government support for hydrogen mobility initiatives and significant private sector investments in fuel cell technology development. American companies are leading innovation in advanced fuel cell systems, hydrogen infrastructure development, and commercial vehicle applications. The market is characterized by strong collaboration between technology providers, automotive manufacturers, and fleet operators. Federal funding programs and state-level zero-emission vehicle mandates are driving accelerated adoption of fuel cell powertrains throughout commercial transportation and logistics applications across multiple regions. Advanced research and development capabilities in fuel cell technology, materials science, and system integration are supporting next-generation powertrain solutions that deliver enhanced performance and cost-effectiveness for commercial vehicle applications.

Revenue from fuel cell powertrains in Germany is projected to grow at a CAGR of 55.5% through 2035, driven by the country's leadership in automotive engineering, comprehensive hydrogen economy strategy, and strong commitment to transportation decarbonization. German automotive manufacturers and technology companies are developing advanced fuel cell powertrain solutions that combine engineering excellence with innovative hydrogen technologies for commercial vehicle applications. Ongoing investments in hydrogen infrastructure development and fuel cell manufacturing capabilities are supporting comprehensive technology deployment across commercial transportation and logistics operations throughout the country and broader European region. Collaboration between automotive manufacturers, research institutions, and technology providers is enhancing product innovation and reinforcing Germany's position as a leader in advanced fuel cell powertrain development and commercialization.

The fuel cell powertrain market in the United Kingdom is projected to grow at a CAGR of 45.9% from 2025 to 2035, supported by increasing investments in hydrogen infrastructure and public transport electrification. UK OEMs and fleet operators are piloting FCEVs in buses, trucks, and utility vehicles. Collaborative initiatives with research institutions and technology providers are advancing fuel cell stacks, membranes, and balance-of-plant systems. The government is providing incentives for hydrogen production, refueling stations, and adoption of zero-emission fleets. Integration of fuel cell powertrains into logistics and municipal transport is improving operational efficiency. Growing awareness of emission reduction targets is motivating fleet operators to adopt hydrogen-based solutions, while pilot programs demonstrate real-world reliability and long-range capabilities.

The fuel cell powertrain market in France is anticipated to grow at a CAGR of 50.7% from 2025 to 2035, driven by government policies supporting hydrogen mobility, public transport electrification, and industrial applications. French OEMs and suppliers are focusing on FCEVs for buses, delivery trucks, and urban logistics. Expansion of hydrogen production plants and refueling stations is enhancing accessibility and reliability for commercial fleets. Research partnerships with universities and technology startups are advancing membrane electrode assemblies, bipolar plates, and thermal management systems. Strategic collaborations with European OEMs and hydrogen associations are facilitating large-scale adoption. Urban fleet operators and logistics companies are gradually integrating fuel cell powertrains into daily operations, demonstrating operational cost savings and environmental benefits.

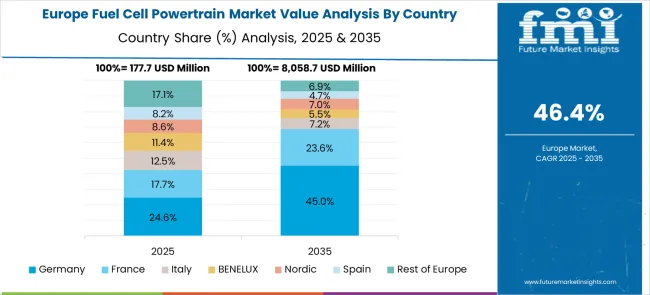

The fuel cell powertrain market in Europe demonstrates strong development across major economies with Germany showing exceptional presence through its leadership in hydrogen technology development and comprehensive support for fuel cell mobility initiatives, supported by automotive manufacturers and technology companies leveraging advanced engineering capabilities to develop efficient fuel cell powertrain solutions that address commercial transportation decarbonization requirements and regulatory compliance objectives.

France represents a significant market driven by its commitment to hydrogen economy development and strategic investments in clean mobility infrastructure, with companies and research institutions pioneering advanced fuel cell technologies that combine French automotive expertise with innovative hydrogen solutions for enhanced commercial vehicle performance and environmental benefits.

The UK exhibits considerable growth through its focus on zero-emission transportation policies and strategic hydrogen roadmap implementation, with manufacturers and fleet operators leading the adoption of fuel cell powertrain solutions and comprehensive deployment strategies for commercial vehicle applications. Germany and France show expanding leadership in fuel cell technology development, particularly in advanced powertrain solutions targeting heavy-duty transportation and logistics applications. Other European countries contribute through their commitment to EU decarbonization goals and expanding investments in hydrogen infrastructure development, while Eastern Europe and Nordic regions display growing potential driven by increasing awareness of hydrogen mobility benefits and expanding access to fuel cell technologies across diverse commercial transportation segments.

Companies are investing in advanced fuel cell technologies, hydrogen infrastructure partnerships, strategic collaborations, and comprehensive powertrain solutions to deliver efficient, reliable, and cost-effective zero-emission transportation systems. Technology development, system integration capabilities, and market positioning are central to strengthening product portfolios and expanding market presence.

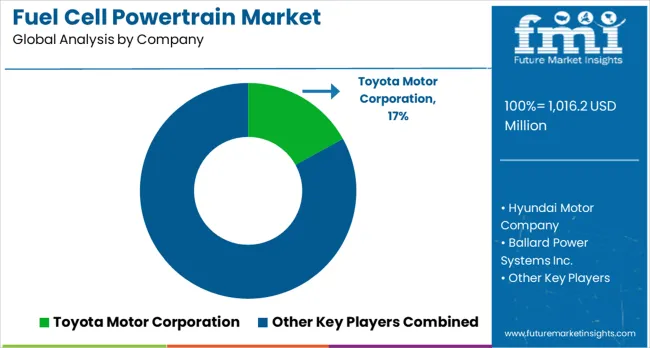

Toyota Motor Corporation, Japan-based, leads the market with 17% global value share, offering proven fuel cell powertrain solutions with extensive commercial vehicle applications and comprehensive hydrogen mobility expertise. Hyundai Motor Company provides advanced fuel cell systems with a focus on commercial transportation and strategic infrastructure partnerships. Ballard Power Systems delivers specialized fuel cell technologies with a focus on heavy-duty applications and system integration capabilities. Plug Power Inc. focuses on comprehensive hydrogen solutions that combine fuel cell powertrains with infrastructure development and operational support services.

Cummins Inc., operating globally, provides integrated powertrain solutions across multiple zero-emission technologies and commercial vehicle applications. Symbio, a joint venture between Faurecia and Michelin, emphasizes innovative fuel cell system development with a focus on automotive integration and performance optimization. Bosch Hydrogen Powertrain Systems offers comprehensive system solutions with advanced engineering capabilities and global manufacturing presence. AVL List GmbH provides specialized development and testing services with a focus on powertrain optimization and performance validation. Horizon Fuel Cell Technologies and Sinosynergy Hydrogen Energy Technology represent emerging players with a focus on advanced fuel cell technologies and comprehensive powertrain solutions for commercial vehicle applications and hydrogen mobility initiatives.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,016.2 million |

| Component Outlook | Fuel Cell Module (Stack + BoP), Hydrogen Storage System, Electric Drive Unit (EDU), Power Electronics & Control |

| Product Outlook | Fuel Cell Electric Powertrain, Fuel Cell Stack, Fuel Cell System |

| Application Outlook | Commercial Trucks & Buses, Material Handling, Passenger Vehicles |

| End User Outlook | Commercial Vehicle Manufacturers & Fleets, Automotive OEMs, Logistics & Warehouse Operators |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Toyota Motor Corporation, Hyundai Motor Company, Ballard Power Systems, Plug Power Inc., Cummins Inc., Symbio, Bosch Hydrogen Powertrain Systems, AVL List GmbH, Horizon Fuel Cell Technologies, and Sinosynergy Hydrogen Energy Technology |

| Additional Attributes | Dollar sales by fuel cell type and power output capacity, regional demand trends, competitive landscape, buyer preferences for system integration versus component solutions, integration with hydrogen infrastructure development, innovations in durability enhancement, cost reduction technologies, and manufacturing practices |

The global fuel cell powertrain market is estimated to be valued at USD 1,016.2 million in 2025.

The market size for the fuel cell powertrain market is projected to reach USD 52,286.6 million by 2035.

The fuel cell powertrain market is expected to grow at a 48.3% CAGR between 2025 and 2035.

The key product types in fuel cell powertrain market are fuel cell module (stack + bop), hydrogen storage system, electric drive unit (edu) and power electronics & control.

In terms of product outlook, fuel cell electric powertrain segment to command 47.5% share in the fuel cell powertrain market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA