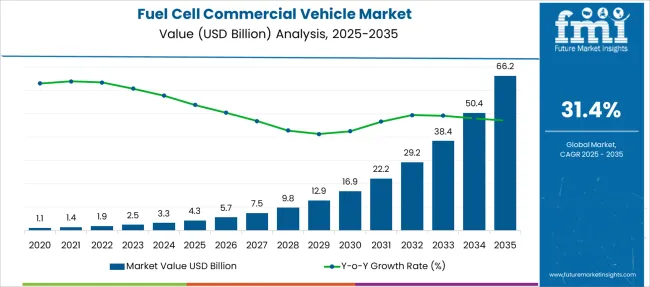

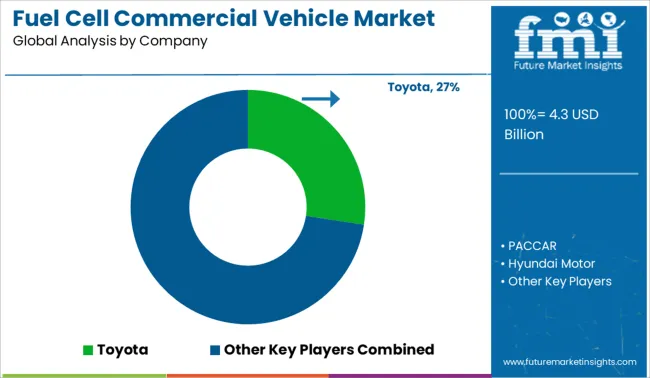

The Fuel Cell Commercial Vehicle Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 66.2 billion by 2035, registering a compound annual growth rate (CAGR) of 31.4% over the forecast period.

| Metric | Value |

|---|---|

| Fuel Cell Commercial Vehicle Market Estimated Value in (2025 E) | USD 4.3 billion |

| Fuel Cell Commercial Vehicle Market Forecast Value in (2035 F) | USD 66.2 billion |

| Forecast CAGR (2025 to 2035) | 31.4% |

The fuel cell commercial vehicle market is growing rapidly as the demand for clean and sustainable transportation solutions intensifies. Increasing environmental regulations and efforts to reduce greenhouse gas emissions have accelerated the adoption of zero-emission vehicles in logistics and urban transport. Advances in fuel cell technology have improved efficiency and reduced costs, making fuel cell vehicles more viable for commercial use.

The rising need for reliable long-range vehicles that can support daily operational demands without frequent refueling has further driven market growth. Expanding government incentives and infrastructure development for hydrogen refueling stations have created a more favorable environment for fuel cell adoption.

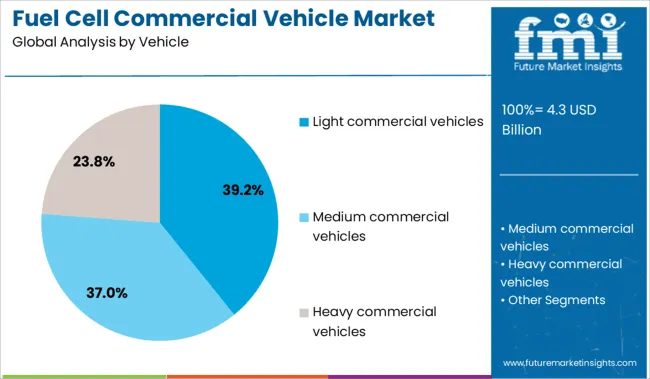

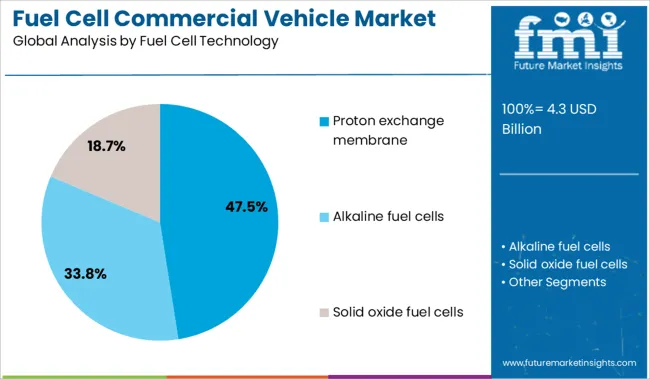

Increasing focus on reducing operational costs and enhancing vehicle uptime is also motivating fleet operators to invest in fuel cell technologies. Segment growth is anticipated to be led by light commercial vehicles, proton exchange membrane fuel cells, and long-range vehicle capabilities.

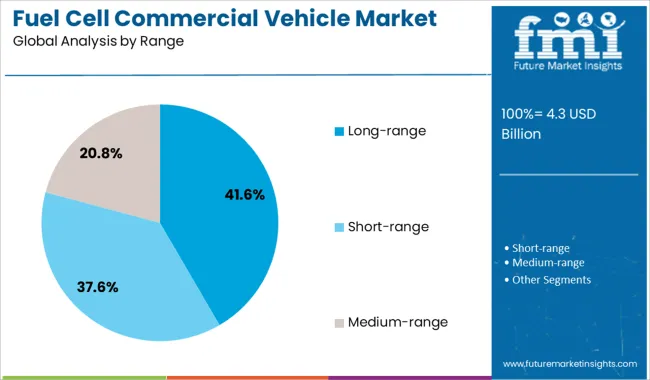

The fuel cell commercial vehicle market is segmented by vehicle, fuel cell technology, range, and end user and geographic regions. By vehicle of the fuel cell commercial vehicle market is divided into Light commercial vehicles, Medium commercial vehicles, and Heavy commercial vehicles. In terms of fuel cell technology of the fuel cell commercial vehicle market is classified into Proton exchange membrane, Alkaline fuel cells, and Solid oxide fuel cells. Based on range of the fuel cell commercial vehicle market is segmented into Long-range, Short-range, and Medium-range. By end user of the fuel cell commercial vehicle market is segmented into Logistics & transportation, Public transit, Construction and mining, and Others. Regionally, the fuel cell commercial vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The light commercial vehicles segment is expected to hold 39.2% of the fuel cell commercial vehicle market revenue in 2025, maintaining its position as the leading vehicle category. This segment’s growth has been driven by the suitability of light commercial vehicles for urban delivery and last-mile logistics, where zero emissions and maneuverability are critical. Fuel cell technology offers advantages such as fast refueling and longer range compared to battery electric alternatives, making these vehicles attractive to fleet operators.

The versatility of light commercial vehicles across various industries, including retail and courier services, has supported steady demand.

Additionally, their relatively lower upfront costs compared to heavier commercial vehicles make them a practical choice for early adopters seeking to reduce carbon footprints without compromising operational efficiency.

The proton exchange membrane fuel cell technology segment is projected to contribute 47.5% of the market revenue in 2025, establishing itself as the dominant fuel cell type. This technology is favored due to its high power density, quick start-up times, and ability to operate efficiently under varying load conditions. Proton exchange membrane fuel cells have been widely adopted in commercial vehicles because of their scalability and compatibility with existing vehicle platforms.

The technology’s proven reliability and performance in commercial applications have reinforced its market leadership. Furthermore, advancements in membrane materials and catalyst designs have improved durability and reduced costs, making this technology more attractive to manufacturers and fleet operators.

As efforts to enhance hydrogen production and distribution infrastructure continue, proton exchange membrane fuel cells are expected to sustain their leading role in the fuel cell commercial vehicle market.

The long-range segment is anticipated to hold 41.6% of the fuel cell commercial vehicle market revenue in 2025, making it the leading range category. Demand for long-range vehicles has been driven by the operational needs of commercial fleets requiring extended travel distances without frequent refueling. Fuel cell vehicles with long-range capabilities reduce downtime and improve route flexibility, which are critical factors for logistics and transport companies.

The ability to perform across varied terrains and weather conditions also enhances their appeal. Infrastructure development supporting hydrogen refueling networks is enabling more widespread adoption of long-range fuel cell vehicles.

Additionally, fleet operators have recognized the total cost of ownership benefits associated with vehicles capable of longer ranges. As the market continues to mature, the long-range segment is expected to maintain its dominance due to its alignment with commercial transportation requirements.

Demand for fuel cell commercial vehicles is expanding due to long-range, zero-emission fleet mandates across logistics and municipal sectors. Sales of hydrogen-powered trucks and buses are being driven by improvements in refueling infrastructure, OEM fuel cell system integration, and cost-down initiatives on compressed hydrogen storage.

Demand for fuel cell-powered long-haul trucks surged 34% in 2025, driven by clean transport legislation in the U.S., China, and Germany. Vehicles equipped with 350-bar dual hydrogen tanks achieved ranges over 600 km with payload capacities 12% higher than comparable BEVs. OEMs integrated 120 kW-class fuel cell stacks with dual e-axles, optimizing drivetrain energy use across gradients and highway loads. Fleet operators in South Korea and California reported a 27% reduction in downtime versus early BEV models, thanks to 10-minute average refueling cycles. Tier-1 suppliers improved stack durability to 25,000 hours, extending operational cycles and enhancing residual value for second-life vehicle leasing models.

Sales of fuel cell buses grew 41% YoY in 2025, as city authorities in the EU and Japan replaced diesel fleets to meet zero-emission zone mandates. Municipal tenders favored 8–12 m bus platforms with 90 kW-class fuel cell systems and regenerative braking, delivering 350–400 km range per fill. Noise levels below 70 dB during peak operation positioned hydrogen buses as preferred solutions for night routes and airport shuttles. China expanded its urban hydrogen bus networks by 24% across Tier 2 cities, aided by national fuel subsidy programs. Modular onboard storage designs enabled flexible seating layouts while improving tank replacement speed by 18%.

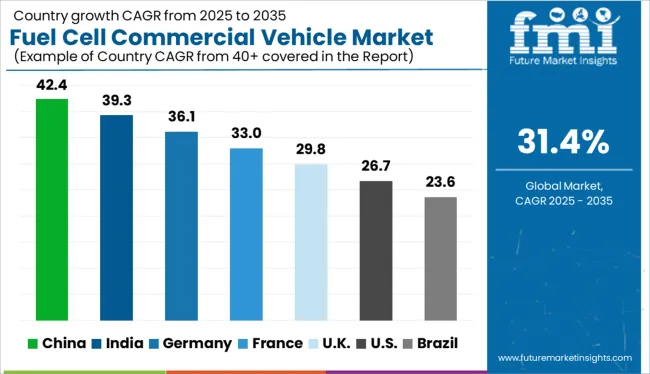

| Country | CAGR |

|---|---|

| China | 42.4% |

| India | 39.3% |

| Germany | 36.1% |

| France | 33.0% |

| UK | 29.8% |

| USA | 26.7% |

| Brazil | 23.6% |

The global market is forecast to expand at a strong CAGR of 31.4% from 2025 to 2035. China is leading growth with a CAGR of 42.4%, backed by state-led decarbonization targets and scaled domestic manufacturing of hydrogen-powered fleets. India follows with a CAGR of 39.3%, driven by clean mobility goals under FAME policies and rising investments in hydrogen refueling networks.

Germany, at 36.1%, reflects the OECD’s push for zero-emission transport across logistics and public fleets. The UK is advancing at 29.8%, supported by infrastructure rollouts and early adoption in municipal applications. The USA, while slightly below the global average at 26.7%, continues to invest in fuel cell trucks and buses across select states.

This growth spread underscores BRICS leadership in scaling volume and infrastructure, while OECD regions focus on regulatory alignment and commercial integration of hydrogen mobility. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s fuel cell commercial vehicle market is projected to surge at a CAGR of 42.4% between 2025 and 2035, driven by aggressive national decarbonization goals and substantial state subsidies for hydrogen infrastructure. During 2020-2024, adoption was limited to pilot fleets in select provinces such as Guangdong and Hebei. Over the coming decade, provincial rollout plans for hydrogen refueling stations and incentives for OEMs will accelerate mass production of fuel cell buses, logistics vans, and medium-duty trucks. Major domestic automakers are partnering with fuel cell system integrators to localize stack production and reduce vehicle costs.

India’s fuel cell commercial vehicle market is expected to grow at a CAGR of 39.3% from 2025 to 2035, supported by the National Green Hydrogen Mission and public-private fleet electrification pilots. Between 2020 and 2024, the market remained in its nascent stage, focused on R&D and limited demonstrations. Looking ahead, rising urban pollution and import dependency on fossil fuels are pushing policymakers to fund hydrogen-powered buses, especially for metro city routes. Indian OEMs and public transport operators are beginning trials with PEM (Proton Exchange Membrane) fuel cell buses supported by central government grants.

Germany’s fuel cell commercial vehicle market is projected to register a CAGR of 36.1% from 2025 to 2035, backed by strong regulatory support under the National Hydrogen Strategy and Europe’s Fit-for-55 package. From 2020 to 2024, early deployments focused on city buses and municipal fleets. The future phase will see scaling up of long-haul fuel cell trucks and logistics vans operating along trans-European corridors. German Tier 1 suppliers are investing in fuel cell powertrain R&D, while the country’s growing green hydrogen network is reducing refueling constraints for commercial fleet operators.

The United Kingdom’s fuel cell commercial vehicle market is forecast to grow at a CAGR of 29.8% during 2025-2035, spurred by decarbonization mandates in heavy transport and public fleet renewal programs. During 2020-2024, activity was limited to demonstration buses and last-mile delivery vehicle trials. Going forward, government-backed hydrogen hubs in Teesside and Aberdeen are providing infrastructure support for broader commercial fleet adoption. Local councils and logistics firms are beginning procurement of fuel cell trucks to comply with ultra-low emission zone (ULEZ) policies in major urban areas.

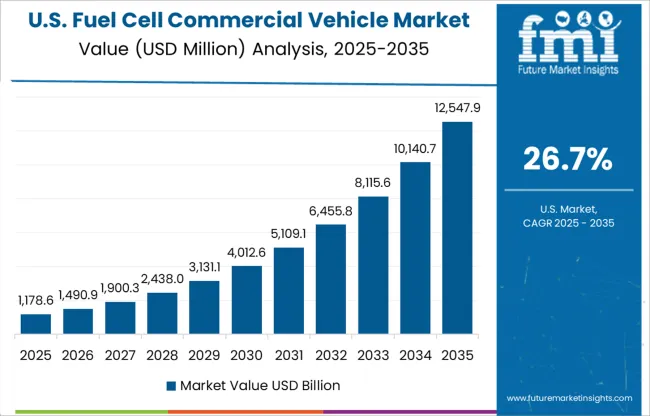

The United States fuel cell commercial vehicle market is expected to grow at a CAGR of 26.7% from 2025 to 2035, driven by federal infrastructure funding, clean energy mandates, and the California-led Hydrogen Fuel Cell Partnership. Between 2020 and 2024, FCEV deployments were centered on public transit fleets and pilot logistics trials. The next growth wave will come from class 8 trucks, school buses, and municipal service vehicles operating in hydrogen priority zones. OEMs and fleet operators are forming regional hydrogen ecosystems with shared fueling stations and stack supply chains.

Demand for fuel cell commercial vehicles in 2025 is being driven by decarbonization mandates and expanded hydrogen infrastructure across key economies. Toyota leads the global market with a significant share, propelled by its aggressive rollout of hydrogen-powered trucks and buses in Japan and North America. Hyundai Motor and Nikola are intensifying efforts in long-haul logistics, targeting fleet electrification with high-efficiency fuel cell systems. Sales of fuel cell trucks by PACCAR and Volvo are rising steadily in Europe, where emission targets are tightening rapidly. Scania and Foton Motor are scaling hydrogen mobility pilots across urban distribution fleets. Competition is intensifying as OEMs prioritize longer range, faster refueling, and TCO optimization over traditional battery electric alternatives in commercial vehicle segments.

In June 2024, Toyota unveiled a hydrogen-powered Hilux pickup truck prototype, demonstrating a 373-mile range. This initiative underscores Toyota's commitment to sustainable transportation solutions and showcases the potential of hydrogen fuel cell technology in light-duty vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Vehicle | Light commercial vehicles, Medium commercial vehicles, and Heavy commercial vehicles |

| Fuel Cell Technology | Proton exchange membrane, Alkaline fuel cells, and Solid oxide fuel cells |

| Range | Long-range, Short-range, and Medium-range |

| End User | Logistics & transportation, Public transit, Construction and mining, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota, PACCAR, Hyundai Motor, Scania, Volvo, Nicola, and Foton Motor |

| Additional Attributes | Dollar sales by fuel cell type and vehicle class, demand dynamics across logistics and public transportation sectors, regional trends in hydrogen infrastructure development, innovation in membrane electrode assemblies and system integration, environmental impact of hydrogen production and fuel cell disposal, and emerging use cases in long-haul trucking and urban transit fleets. |

The global fuel cell commercial vehicle market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the fuel cell commercial vehicle market is projected to reach USD 66.2 billion by 2035.

The fuel cell commercial vehicle market is expected to grow at a 31.4% CAGR between 2025 and 2035.

The key product types in fuel cell commercial vehicle market are light commercial vehicles, medium commercial vehicles and heavy commercial vehicles.

In terms of fuel cell technology, proton exchange membrane segment to command 47.5% share in the fuel cell commercial vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA