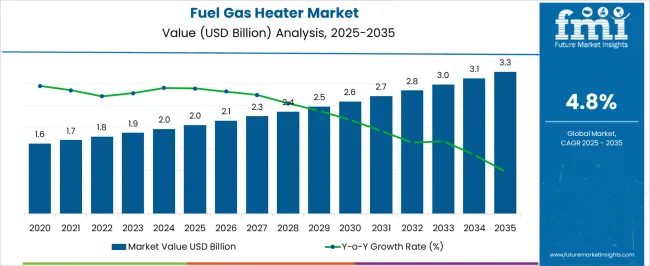

The Fuel Gas Heater Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Fuel Gas Heater Market Estimated Value in (2025 E) | USD 2.0 billion |

| Fuel Gas Heater Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The fuel gas heater market is expanding steadily, influenced by rising energy efficiency demands, growing urban housing needs, and advancements in heating technologies. Industry announcements and energy policy updates have emphasized the critical role of gas heaters in providing reliable, cost-effective, and environmentally compliant heating solutions.

Increasing natural gas availability and distribution infrastructure development have strengthened adoption in both developed and emerging economies. In residential and commercial sectors, rising consumer expectations for comfort and sustainable heating have stimulated demand for efficient gas-based systems.

Technological enhancements, such as improved burner designs and advanced heat exchangers, have supported higher energy conversion rates and reduced emissions. Additionally, government initiatives to phase out less efficient heating systems have encouraged the transition toward modern fuel gas heaters. Looking forward, market growth is expected to be sustained by expanding residential construction, ongoing replacement of outdated heating systems, and the integration of digital control systems enhancing user convenience and energy management.

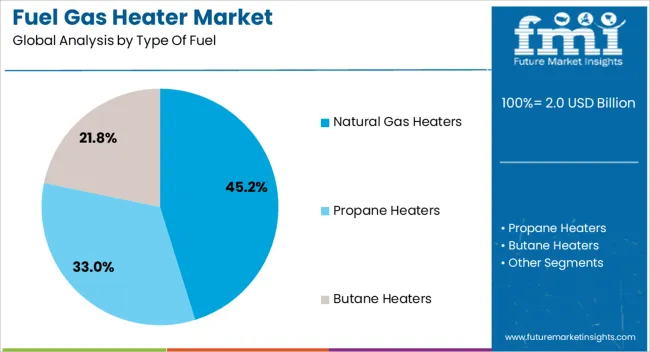

The Natural Gas Heaters segment is projected to hold 45.2% of the fuel gas heater market revenue in 2025, establishing itself as the dominant fuel type. Growth of this segment has been driven by the widespread availability of natural gas and its reputation as a cleaner-burning fossil fuel compared to coal or oil.

Utility expansions and pipeline infrastructure developments have improved access to natural gas, particularly in urban and suburban areas. Energy efficiency policies have favored natural gas appliances due to their lower emissions profile and ability to support sustainable energy targets.

Additionally, consumer preference has leaned toward natural gas heaters for their cost savings in regions with stable supply and pricing structures. Technological advances in gas combustion systems have further improved efficiency and safety standards, consolidating the position of natural gas heaters as the preferred choice in multiple heating applications.

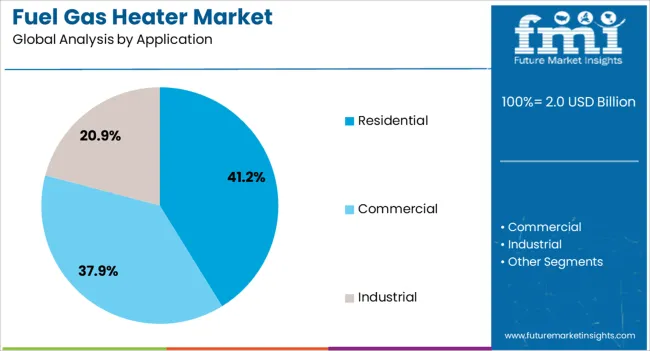

The Residential segment is anticipated to account for 41.2% of the fuel gas heater market revenue in 2025, maintaining its leading role across applications. Rising urbanization and expanding household formation have heightened the need for efficient and cost-effective heating systems.

Residential consumers have increasingly opted for gas heaters due to their quick heating performance, relatively lower running costs, and suitability for various housing formats. Energy efficiency regulations and incentives have encouraged homeowners to replace outdated systems with modern gas heaters, supporting growth in this segment.

Seasonal demand fluctuations, particularly in colder regions, have further strengthened residential adoption. Additionally, manufacturers have focused on compact designs and user-friendly controls, which align with consumer expectations for convenience and comfort. As residential energy demand continues to increase, this segment is expected to remain a cornerstone of the market.

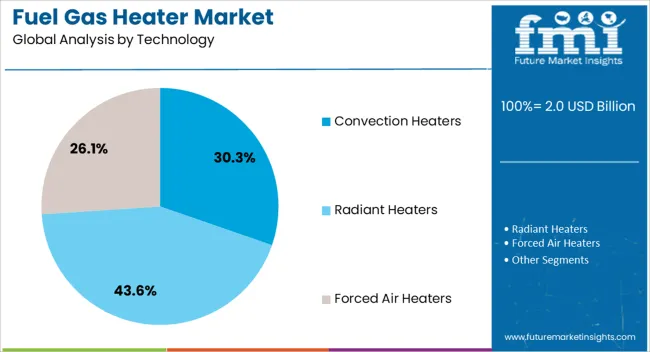

The Convection Heaters segment is forecasted to contribute 30.3% of the fuel gas heater market revenue in 2025, positioning itself as the leading technology type. This growth has been supported by the effectiveness of convection heaters in evenly distributing warm air, which has been valued for maintaining consistent indoor comfort.

Their ability to heat large spaces without producing excessive localized heat has made them highly suitable for both residential and commercial settings. Industry developments have introduced advanced convection designs with enhanced energy efficiency, safety features, and digital thermostatic controls, driving consumer preference.

Additionally, convection heaters have been adopted widely due to their relatively lower operational costs and long lifespan compared to alternative heating technologies. With growing emphasis on comfort heating and energy efficiency, the Convection Heaters segment is projected to retain its dominance, supported by continuous product innovation and broad consumer acceptance.

In a later section of this report, analysis of fuel source preferences and regional market dynamics in the fuel gas heating industry are also vividly discussed.

In the section below, find out emerging opportunities in the fuel gas heater market, instant water heater market, and electric water heater market. The comparative study is beneficial for players seeking expansion of their scope.

Core Market:

| Attributes | Fuel Gas Heater Industry |

|---|---|

| CAGR (2025 to 2035) | 4.80% |

| Growth Factor | Growing demand for fuel gas heaters in the residential sector |

| Opportunity | IoT connectivity and smart thermostat integration to increase opportunities for fuel gas heaters |

| Key Trends | Surging demand for hybrid heating solutions |

Instant Water Heater Market:

| Attributes | Instant Water Heater Market |

|---|---|

| CAGR (2025 to 2035) | 4.60% |

| Growth Factor | Increasing prominence of home energy management systems |

| Opportunity | Sustainability trends push the integration of renewable energy sources |

| Key Trends | Evolving consumer needs propose a heightened scope of hybrid water heaters |

Electric Water Heater Market:

| Attributes | Electric Water Heater Market |

|---|---|

| CAGR (2025 to 2035) | 5.2% |

| Growth Factor | Increasing demand for heaters to be used in the residential sector |

| Opportunity | Surging product launches by market players |

| Key Trends | Rising focus on sustainability to set the trends in the electric water heater market |

| Leading Type of Fuel | Natural Gas |

|---|---|

| Value Share (2025) | 45.20% |

Natural gas is excessively used in fuel gas heaters as it is less polluting and generates a lesser degree of greenhouse gases than its counterparts. Analysts at FMI have estimated that this gas is expected to account for 45.20% of the overall market share.

Alternatively, heaters powered by propane and butane are expected to garner consumer interest and increase take-up over the next decade. This shift in dynamics is expected to make natural gas lose its share in the future, which is comparatively less environmentally friendly.

| Leading Technology | Conventional Heaters |

|---|---|

| Value Share (2025) | 30.30% |

Conventional heaters continue to have a substantial grip in the fuel gas heater market. This segment is projected to offer a value share of 30.30% in the year 2025. The key factor that is still driving the growth of conventional heaters is the cost-savings people experience through the purchase of conventional heaters as opposed to other contemporary options.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| Canada | 5.40% |

| Spain | 5.10% |

| South Korea | 5.40% |

| Japan | 4.90% |

| Australia | 5.40% |

The market size of fuel gas heaters in Canada is becoming wider, stretching at a rate of 5.40% over the next ten years. The adoption rate of fuel gas heaters in Canada is higher than in the United States. The country is projected to observe an array of factors that induce market growth:

The growth rate of the fuel gas heater market in Spain is estimated at 5.10% CAGR over the forecast period. The growth of this market is compounding due to various factors, including:

The fuel gas heater industry in South Korea is thriving at a consistent 5.40% CAGR. Factors controlling the market dynamics in the country are as follows:

Japan is projected to witness a compounding growth rate of 4.90% for the next decade. Key factors fueling the market growth are as follows:

Australia’s fuel gas heater market is expected to expand at a CAGR of 5.40% over the next ten years. Key aspects that are compelling market growth are mentioned below:

Fuel gas heater companies are expanding their operations across geographies where growth potential seems to be higher. Players are taking extra measures to develop green and efficient heating systems for a sustainable future for the planet.

Going forward, players are expected to continue on their path of research and developmental activities to introduce breakthroughs in the market for advancement.

Industry participants are offering their products online as customers are attracted to the convenience of online platforms. By offering benefits like fast shipping and quality customer service, players are raising their product sales.

Events Shaping the Fuel Gas Heater Market

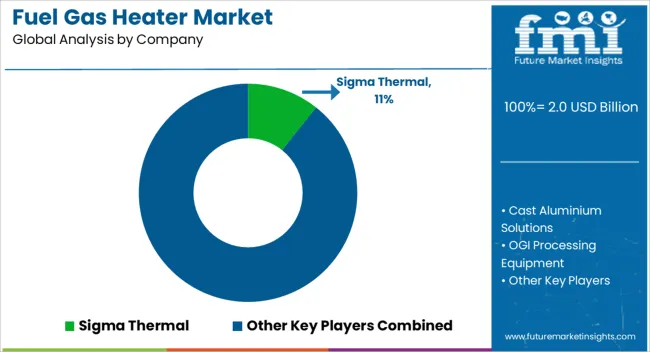

The global fuel gas heater market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the fuel gas heater market is projected to reach USD 3.3 billion by 2035.

The fuel gas heater market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in fuel gas heater market are natural gas heaters, propane heaters and butane heaters.

In terms of application, residential segment to command 41.2% share in the fuel gas heater market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Fuel Measuring Devices Market

Fuel Operated Heaters Market

Biofuel Testing Services Market Growth – Trends & Forecast 2018-2028

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA