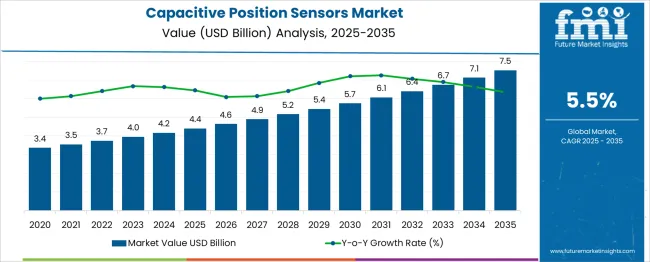

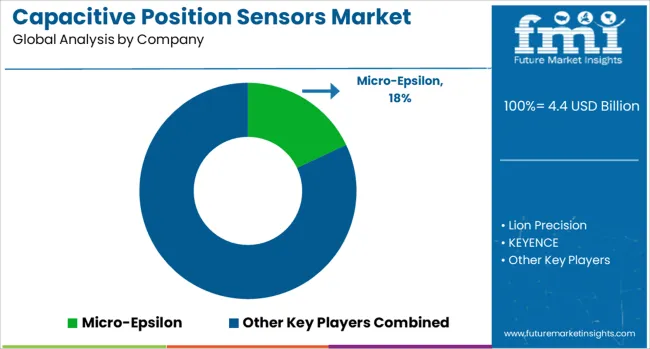

The Capacitive Position Sensors Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. From 2025 to 2030, the market is projected to grow from USD 4.4 billion to about USD 5.4 billion, driven primarily by rising adoption in automation, robotics, and manufacturing systems where accurate position feedback is essential for process control and efficiency.

During this period, many industries are replacing older sensing technologies with capacitive sensors due to their enhanced reliability and accuracy, further supporting consistent market growth. In addition, steady investments in upgrading existing machinery in sectors such as automotive and electronics contribute to expanding demand. Moving into the latter half of the decade, from 2030 to 2035, the market’s growth momentum accelerates, with the value rising from approximately USD 5.4 billion to USD 7.5 billion.

This acceleration results from expanding applications in sectors like aerospace, medical devices, and consumer electronics, which require increasingly precise and compact sensing solutions. Increasing industrial activity worldwide, combined with recurring replacement cycles for installed sensors, sustains demand. By 2035, capacitive position sensors will be firmly embedded as essential components across a wide range of industries, underpinning steady growth and broad adoption.

| Metric | Value |

|---|---|

| Capacitive Position Sensors Market Estimated Value in (2025 E) | USD 4.4 billion |

| Capacitive Position Sensors Market Forecast Value in (2035 F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The capacitive position sensors market is experiencing accelerated growth driven by the rising demand for precision measurement in industrial automation, aerospace, and consumer electronics. As industries prioritize non-mechanical, low-maintenance systems for high-accuracy positioning, capacitive technologies are being adopted for their ability to measure displacement and position with superior reliability. Increasing integration of automation systems in manufacturing environments has necessitated sensors that can deliver consistent output even in high-vibration or harsh environments.

Advancements in semiconductor miniaturization, along with the expansion of smart factories and electric vehicles, have further expanded the scope of capacitive sensing technology. The non-contact nature and high sensitivity of these sensors make them ideal for applications requiring long-term operational stability.

As regulatory standards become stricter and performance demands grow, the market is being supported by continuous R&D investments and strong demand from sectors requiring real-time position monitoring. With expanding use cases in both industrial and consumer environments, the capacitive position sensors market is positioned for long-term, sustained growth..

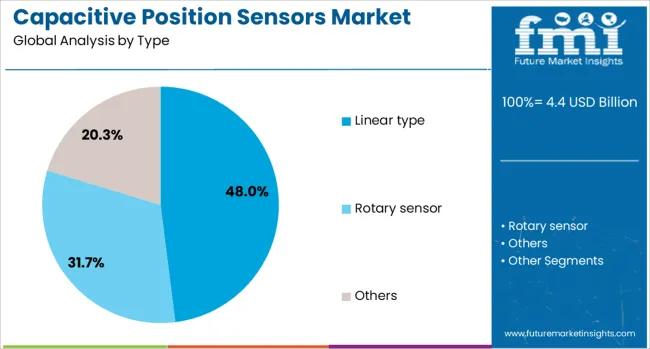

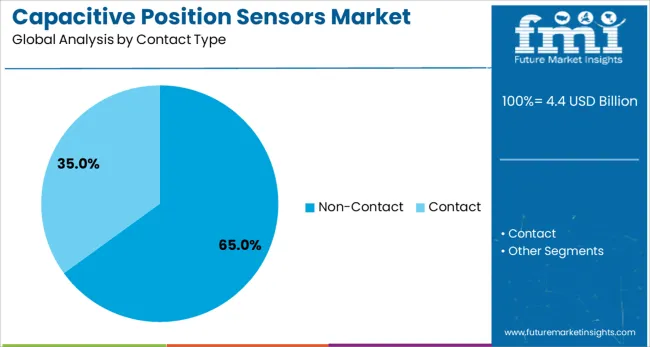

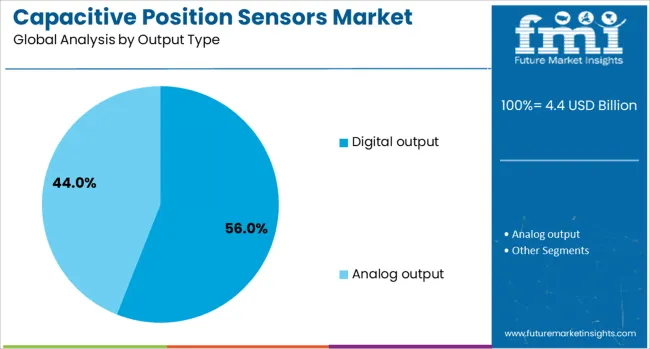

The capacitive position sensors market is segmented by type, contact type, output type, application, end-use, and geographic regions. The capacitive position sensors market is divided into Linear type, Rotary sensor, and others. In terms of contact type, the capacitive position sensors market is classified into Non-Contact and Contact. Based on the output type, the capacitive position sensors market is segmented into Digital output and analog output. The capacitive position sensors market is segmented into Machine tools, Robotics, Motion systems, Material handling, Test equipment, and others. The end-use of the capacitive position sensors market is segmented into Manufacturing, Automotive, Aerospace, Packaging, Healthcare, Electronics, and others. Regionally, the capacitive position sensors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The linear type segment is projected to hold 48% of the capacitive position sensors market revenue share in 2025, making it the leading category within the type segment. This dominance has been driven by the segment’s suitability for applications requiring precise linear displacement measurement. Linear capacitive sensors have been widely adopted in automation and industrial control systems due to their ability to maintain high sensitivity and resolution across longer sensing ranges.

Their reliability in measuring direct linear motion without mechanical wear has made them highly preferred in both static and dynamic industrial applications. The demand for compact, lightweight solutions in robotics and material handling equipment has also reinforced the preference for linear types.

Additionally, these sensors can be easily integrated with control systems and calibrated for real-time feedback, which improves operational accuracy and efficiency. As industries seek high-precision, contactless measurement tools to support production quality and process automation, the linear type continues to dominate the segment..

The non-contact segment is expected to account for 65% of the capacitive position sensors market revenue share in 2025, establishing its leadership in the contact type segment. The increasing reliance on durable, low-maintenance sensing technologies has accelerated the adoption of non-contact sensors across various industrial and scientific applications. These sensors have been favored for their ability to operate without physical interaction, reducing wear and enhancing lifecycle longevity.

Non-contact capacitive sensors offer greater immunity to environmental disturbances such as dust, humidity, and temperature fluctuations, which enhances their effectiveness in critical and sensitive applications. Their usage has expanded in areas like semiconductor manufacturing, automation systems, and precision metrology, where contamination and downtime must be minimized.

Furthermore, the integration of non-contact sensors with advanced control systems allows for real-time data acquisition and dynamic performance monitoring. Their superior accuracy, minimal drift, and consistent performance over time have reinforced their position as the preferred contact type in high-demand sectors..

The digital output segment is anticipated to capture 56% of the capacitive position sensors market revenue share in 2025, making it the leading segment within output type. Growth in this segment has been supported by the increasing need for real-time data processing and compatibility with digital control systems. Digital output capacitive sensors provide direct, noise-immune signals that facilitate accurate and fast communication with automation and monitoring platforms.

Their ease of integration into programmable logic controllers, industrial IoT systems, and embedded electronics has enhanced their attractiveness for modern applications. The digital format also enables advanced diagnostics, remote calibration, and seamless data logging, which are essential in quality-critical environments.

As industries transition toward smarter production lines and predictive maintenance, digital output sensors are being increasingly favored for their reliability, consistency, and adaptability. The ability to process and transmit precise measurements with minimal latency continues to drive their widespread adoption in various commercial and industrial applications..

The capacitive position sensors market is expanding as demand grows for precise, reliable, and non-contact position measurement across industries like automotive, consumer electronics, and industrial automation. These sensors offer high sensitivity, durability, and resistance to environmental factors, making them preferred for complex applications. While the market faces challenges related to cost and electromagnetic interference, advancements in miniaturization and integration with smart systems are driving adoption. Increasing automation and smart device proliferation worldwide support sustained market growth.

Capacitive position sensors are increasingly integrated into industrial automation systems to provide accurate, contactless position detection critical for robotics, assembly lines, and quality control processes. Their ability to operate in harsh environments with dust, moisture, or vibration gives them an edge over other sensor types. In the automotive sector, these sensors are used in throttle position sensing, pedal position detection, and gear shift systems, where precision and reliability are vital for safety and performance. The expanding use of electric vehicles and advanced driver assistance systems further drives demand. Manufacturers offering sensors that can withstand temperature extremes and electromagnetic interference gain traction. The growing emphasis on precision manufacturing and real-time monitoring also supports the adoption of capacitive position sensors as industries move toward smarter, more automated processes.

Although capacitive position sensors provide many advantages, their relatively higher cost compared to alternative sensor technologies limits adoption in price-sensitive applications. The complexity of design and calibration can add to manufacturing expenses. Moreover, these sensors can be susceptible to electromagnetic interference from nearby electronic components or machinery, potentially affecting measurement accuracy. This limitation requires additional shielding or filtering, increasing system complexity and cost. In applications with high electromagnetic noise, such as heavy industrial environments, alternative sensor types may sometimes be preferred. Manufacturers are investing in research to develop improved sensor architectures and signal processing techniques that reduce interference effects. Cost reduction efforts through scalable production and material optimization are also crucial. Overcoming these challenges is key to expanding the use of capacitive position sensors in broader industrial and consumer markets.

Technological advancements in miniaturizing capacitive position sensors open new opportunities for integration into compact electronic devices and wearable technology. Smaller sensors with enhanced sensitivity can be embedded in smartphones, tablets, and medical devices, enabling precise touchless control and improved user interfaces. Integration with Internet of Things platforms and wireless communication protocols facilitates real-time monitoring and remote diagnostics in industrial equipment and consumer electronics. The growing trend of smart manufacturing and Industry 4.0 adoption creates demand for sensors that can communicate with central control systems and support predictive maintenance. Additionally, the rise of robotics and automation in healthcare, agriculture, and logistics requires compact, reliable sensors capable of precise motion tracking. Companies that innovate in sensor miniaturization and smart integration are positioned to capitalize on expanding applications across diverse sectors.

Compliance with international safety and performance standards is critical for capacitive position sensors, especially in sectors like automotive, aerospace, and medical devices. Meeting rigorous certification requirements adds complexity to sensor design and testing processes but is essential for gaining market acceptance. Variations in regulatory requirements across regions can pose challenges for manufacturers seeking global market penetration. Standards related to electromagnetic compatibility and environmental resilience require sensors to demonstrate consistent performance under diverse operating conditions. Aligning product development with evolving regulations ensures long-term reliability and safety, which are crucial for customer trust. Industry efforts to harmonize testing protocols and performance metrics can reduce barriers to entry and facilitate wider adoption. Companies investing in quality management systems and certification processes gain competitive advantages by delivering compliant, high-performance sensors that meet the demands of regulated markets.

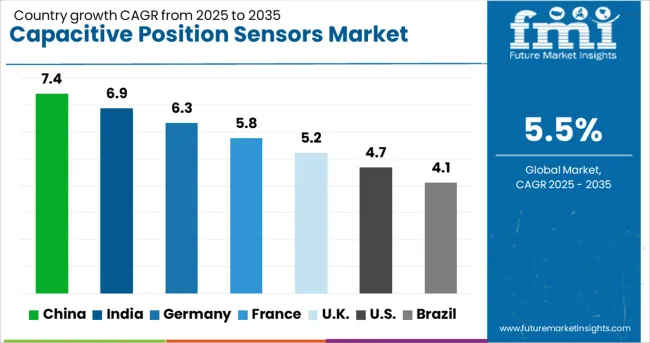

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global portable cannabis vaporizer market is expanding at a CAGR of 14.7%, driven by increasing legalization, consumer preference for smokeless consumption, and innovations in vaporizer technology. China leads with 19.8% growth, supported by its dominance in electronics manufacturing and growing export of vaporizer components. India follows at 18.4%, driven by rising consumer interest, evolving regulatory conversations, and expansion in wellness-based cannabis applications. Germany reports 16.9% growth, reflecting its strong medical cannabis framework and preference for controlled, high-quality devices. The United Kingdom shows consistent growth at 14.0%, influenced by wellness trends and a maturing consumer base. The United States, growing at 12.5%, remains a key player, shaped by regulatory shifts, brand competition, and product innovation. Market dynamics are influenced by battery efficiency, dosage control, material safety, and regional legalization policies. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is experiencing a 7.4% CAGR in the capacitive position sensors market, driven by rapid industrial automation and the growth of smart manufacturing. The increasing adoption of Industry 4.0 technologies across automotive, electronics, and robotics sectors is fueling demand for precise and reliable position sensing solutions. Chinese manufacturers are investing heavily in research and development to improve sensor accuracy, miniaturization, and integration capabilities. The expansion of electric vehicle production and renewable energy projects also supports market growth. Collaborations between sensor producers and system integrators are enabling customized solutions tailored for complex automation needs. Government initiatives encouraging smart factories and digitization further accelerate adoption. Growing applications in consumer electronics, such as smartphones and wearables, provide an additional growth avenue for capacitive sensors. Overall, China is rapidly positioning itself as a key hub for both production and consumption of capacitive position sensors in Asia.

India is recording a 6.9% CAGR in the capacitive position sensors market, supported by expanding industrial sectors and rising automation across manufacturing units. The automotive industry’s shift towards electric vehicles and advanced driver-assistance systems is a major driver of sensor demand. Increasing government focus on “Make in India” and digitalization has spurred investments in smart factory solutions where capacitive sensors play a critical role. Local manufacturers are beginning to develop cost-effective capacitive sensors suitable for harsh environmental conditions typical in India. Growing use in robotics, packaging, and consumer electronics further contributes to market expansion. Furthermore, the rising adoption of Industry 4.0 frameworks among medium and large enterprises is increasing demand for reliable and accurate position sensing technologies. Initiatives to boost electronics manufacturing ecosystems are expected to strengthen the supply chain for capacitive sensors.

Germany is witnessing a 6.3% CAGR in the capacitive position sensors market, driven by its strong industrial base and leadership in automotive and machinery sectors. The country’s focus on Industry 4.0, automation, and smart manufacturing is stimulating demand for precise position sensing technologies. Capacitive sensors are increasingly used in robotics, production line monitoring, and quality control applications. Manufacturers emphasize compliance with high-quality standards, durability, and sensor miniaturization to meet demanding industrial environments. The automotive sector’s transition to electric and autonomous vehicles further fuels sensor adoption. Additionally, Germany’s renewable energy sector leverages capacitive sensors for turbine and system monitoring. Integration of sensors into IoT-enabled industrial equipment allows for real-time data collection and predictive maintenance, which is a key trend in the market. The country’s emphasis on sustainability and technological innovation supports ongoing market growth.

The United Kingdom is registering a 5.2% CAGR in the capacitive position sensors market, supported by growing automation in manufacturing, aerospace, and healthcare sectors. The demand for non-contact, highly accurate position measurement solutions is rising due to increasing adoption of robotics and advanced machinery. UK manufacturers prioritize sensor reliability and durability in diverse operating environments. The aerospace industry’s need for precise control systems and quality assurance drives capacitive sensor use. Healthcare equipment manufacturers are also integrating these sensors to improve device functionality and patient safety. Government support for technology innovation and Industry 4.0 adoption is fostering market growth. Additionally, collaborations between research institutions and sensor producers are driving innovation in sensor materials and designs. The expanding renewable energy sector also contributes to market demand through applications in turbine control and energy monitoring.

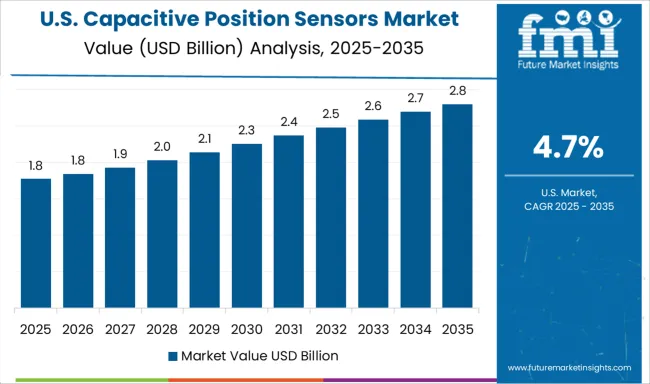

The United States is posting a 4.7% CAGR in the capacitive position sensors market, driven by advancements in automation, aerospace, and consumer electronics industries. Growing investments in robotics and smart manufacturing facilities fuel demand for accurate, contactless position sensors. The automotive industry’s push toward electric and autonomous vehicles boosts adoption of capacitive sensors for precise positioning and safety functions. Consumer electronics companies integrate capacitive sensors in devices like smartphones and tablets, expanding market opportunities. The USA government’s focus on advanced manufacturing and innovation supports research in sensor technologies. Emphasis on miniaturization, low power consumption, and wireless connectivity are key product development trends. Additionally, the medical devices sector is increasing use of capacitive sensors for equipment requiring accurate positional feedback. The overall focus on Industry 4.0 and IoT adoption sustains steady market growth.

The capacitive position sensors market is growing steadily, driven by the need for precise, non-contact position measurement in various industrial sectors. These sensors detect the position or displacement of objects without physical contact, offering high accuracy and durability, which makes them crucial for applications in automation, robotics, semiconductor manufacturing, and quality control.

Key players in this market include Micro-Epsilon, which is recognized for its high-precision capacitive sensors designed to perform reliably even in harsh industrial environments. Lion Precision focuses on delivering ultra-precise sensors tailored for specialized applications such as electronics and thin film manufacturing. KEYENCE offers a wide range of capacitive sensors known for fast response times and easy integration into automated production lines, enhancing operational efficiency.

KAMAN provides sensors designed specifically for demanding aerospace and defense applications, ensuring robustness and reliability. Balluff specializes in versatile capacitive sensors that offer excellent repeatability, making them suitable for factory automation and process control. OMRON is another important player, providing sensors with advanced signal processing capabilities that improve detection stability and reduce false triggers. Pepperl+Fuchs integrates capacitive sensing technology with intelligent interfaces, facilitating smooth communication within industrial systems and contributing to smarter manufacturing environments.

As industries increasingly adopt automated and precise manufacturing processes, the demand for capacitive position sensors continues to rise. These sensors help reduce maintenance costs and downtime by eliminating physical wear, and their non-contact nature allows for measurement in delicate or small-scale applications. Overall, the market growth is fueled by the expanding use of capacitive sensors across diverse industries aiming for better accuracy, reliability, and efficiency in position sensing.

On June 3, 2025, UltraSense Systems launched the CapForce™ Edge, the first fully integrated capacitive and piezo force-sensing controller. It features 24 capacitive and 8 force-sensing channels with EMI mitigation, enhancing smart touch interfaces for automotive, consumer, industrial, and robotics sectors. On June 25, 2025, EBE sensors + motion introduced the TCRC capacitive touch sensors, designed to operate reliably in harsh conditions such as water, oil, and ice. Built on proprietary corTEC® technology, these sensors target industrial, medical, and household applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Type | Linear type, Rotary sensor, and Others |

| Contact Type | Non-Contact and Contact |

| Output Type | Digital output and Analog output |

| Application | Machine tools, Robotics, Motion systems, Material handling, Test equipment, and Others |

| End-use | Manufacturing, Automotive, Aerospace, Packaging, Healthcare, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Micro-Epsilon, Lion Precision, KEYENCE, KAMAN, Balluff, OMRON, and Pepperl+Fuchs |

| Additional Attributes | Dollar sales vary by sensor type, including linear, rotary, and other capacitive position sensors; by output type, such as digital and analog outputs; by region, dominated by Asia‑Pacific and strong North American growth. Growth is driven by precision positioning in industrial automation, semiconductor metrology, and IoT integration. |

The global capacitive position sensors market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the capacitive position sensors market is projected to reach USD 7.5 billion by 2035.

The capacitive position sensors market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in capacitive position sensors market are linear type, rotary sensor and others.

In terms of contact type, non-contact segment to command 65.0% share in the capacitive position sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Position Servo System Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Capacitive Proximity Sensor Market Trends - Growth & Forecast 2025 to 2035

Capacitive Touchscreen Market Insights – Growth & Forecast through 2034

Repositionable Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Repositionable Labels Manufacturers

Repositioning and Offloading Market – Trends & Forecast 2024 to 2034

Repositioning & Offloading Devices Market – Demand & Forecast 2024 to 2034

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

Predisposition Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA